I started my firm using spreadsheets and a tickler file. The spreadsheets had dates for when payroll needed to be run or when liabilities needed to be paid. That was what I did for about three years. It worked okay when it was only me, but when I had other people joining me, it really didn't work at all."

Shannon Ballman Theis, Founder of Payroll RestorationProject management challenges feel more insurmountable when you think you’re alone. But you’re never alone in whatever workflow issue you’re struggling with.

Most, if not all, accounting firm owners currently using Financial Cents subscribed to the tool because they were drowning in tasks and information spread across spreadsheets, email threads, and sticky notes.

These manual project management systems (which are usually sufficient early on) create bottlenecks and increase administrative work pretty quickly.

They disrupt communication, increase manual data entry, and prevent anyone from tracking project status in real time, which causes missed deadlines and unmet client expectations.

Things do not have to get any worse than they currently are for you to realize that:

- Balancing deadlines, ensuring accountability, and enhancing collaboration is more than half the work of running an accounting firm.

- As long as they use a software solution designed for the way accounting teams work, they’ll continue to expend their time putting out fires, instead of tending a garden (growing their firm).

In this guide, we will show you how accounting project management software simplifies accounting workflows, lightens team workloads, and makes meeting evolving client and regulatory demands much easier.

Financial Cents, our accounting project management software, helps us to organize the firm. Everyone just knows what to do right away."

Mark Abraham, Founder, Oscar Abraham CPAThe Challenges of Managing Accounting Projects Without Software

1. Missed client deadlines

When due dates, work resources, and client information are stored in spreadsheets, calendars, and sticky notes, it’s hard to have the complete picture.

If you remember that a client needs the financial report by Thursday, you don’t know that after several email follow-ups and calls that were not answered, your team is still waiting for the client to send the files that were due two weeks ago.

Scenarios like this are the reasons for several missed deadlines in accounting firms. Interestingly, the client will think you’re too slow and unprofessional.

2. Difficulty tracking who’s working on what

When there’s no system to centralize project information in one place, firm owners and managers could assign the same task to:

- Multiple team members (which will create duplicate efforts and result in wasted resources), or;

- No one at all (which denies them the right to hold anyone accountable, causing tasks to slip through the cracks).

3. Wasting time with emails and spreadsheets

Emails and spreadsheets are supposed to help your team focus on client service, but since they are not built for full-on project management, you’re going to spend more time and effort coordinating projects, team members, and client information as your team grows.

For example, you’ll need some time to understand which version of your spreadsheet is current, which email thread has the latest update you need, and all of which takes up your billable hours.

4. Limited visibility for firm owners

Managing accounting projects without software deprives you of the ability to see where team members are:

- Spending their time (to reduce your team’s non-billable work.

- Struggling (to enable you to assign resources effectively and improve your workflow processes.

- Lagging (to manage workflows and capacity for timely client deliverables).

Calling and emailing to ask your team members for this data is not only time-consuming, but it’s also unreliable.

Interestingly, generic project management software is not any better. Here’s Sarah’s experience:

There was no way to see my team’s workload in Asana. We couldn't see which team member had what amount of work on them.

Asana didn’t have a set place where you can store or access clients’ contact information, login details, and passwords. We had Excel sheets and local drives that had all the login information. It was like you're going to three different places to do things.""

5. Inconsistent Client Experience

When work is done across multiple platforms, workflow processes will be far from uniform, and that makes client results as different as the number of people who did their work.

One employee may know they should provide timely client updates, while another may not think it’s so necessary. It’s also easy for team members to skip a step in an accounting procedure if they’re unsure how it is done in your firm.

In that case, the quality of client experience will depend on the team member who happens to serve them each time, making it harder for your firm to impress new clients and retain old ones.

6. Poor team collaboration

When team members don’t have a clear space to share files, updates, or feedback, collaboration suffers, workflows slow down, and accurate client service becomes left to chance.

This gives different team members a different set of information, which can invalidate the hard work your team members might be putting into a project.

What Is Project Management Software for Accounting Firms?

Project management software for accounting firms is an app that helps an accounting firm manage client deliverables by creating, assigning, and tracking the status of client work across multiple engagements.

They also automate repetitive actions to reduce the manual and administrative work that makes accounting firms unproductive and inefficient.

While every project management software helps teams plan and execute projects efficiently, their industry focus determines how useful they are in different professional settings.

Generic project management tools are designed to serve project management needs across multiple industries. They view projects as a group of tasks that have defined beginnings and ends, which is why milestone tracking is a fundamental consideration in these tools.

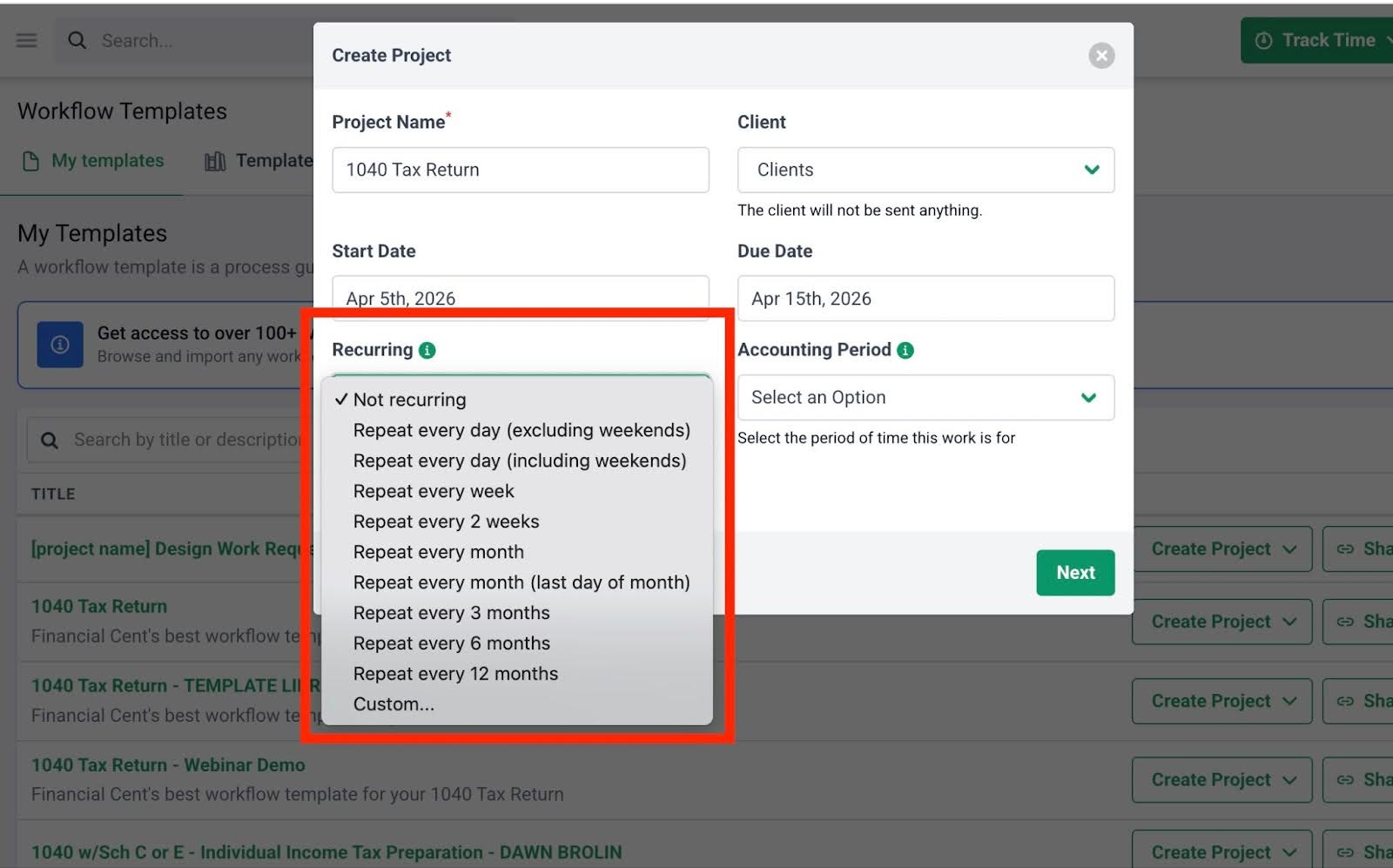

On the other hand, accounting work is cyclical, recurring, and relationship-driven. Recurring client services are broadly the same, which is why automations like the recurring work feature are primary for accounting project management software.

Key Benefits of Project Management Software for Accounting Firms

Going from manual systems to accounting firm management software, like Financial Cents, enables you to enjoy:

-

Centralized task and project tracking

Project management software provides a single dashboard to track all of a firm’s tasks. You wouldn’t have to constantly jump between spreadsheets, email threads, and sticky notes to understand where your projects stand.

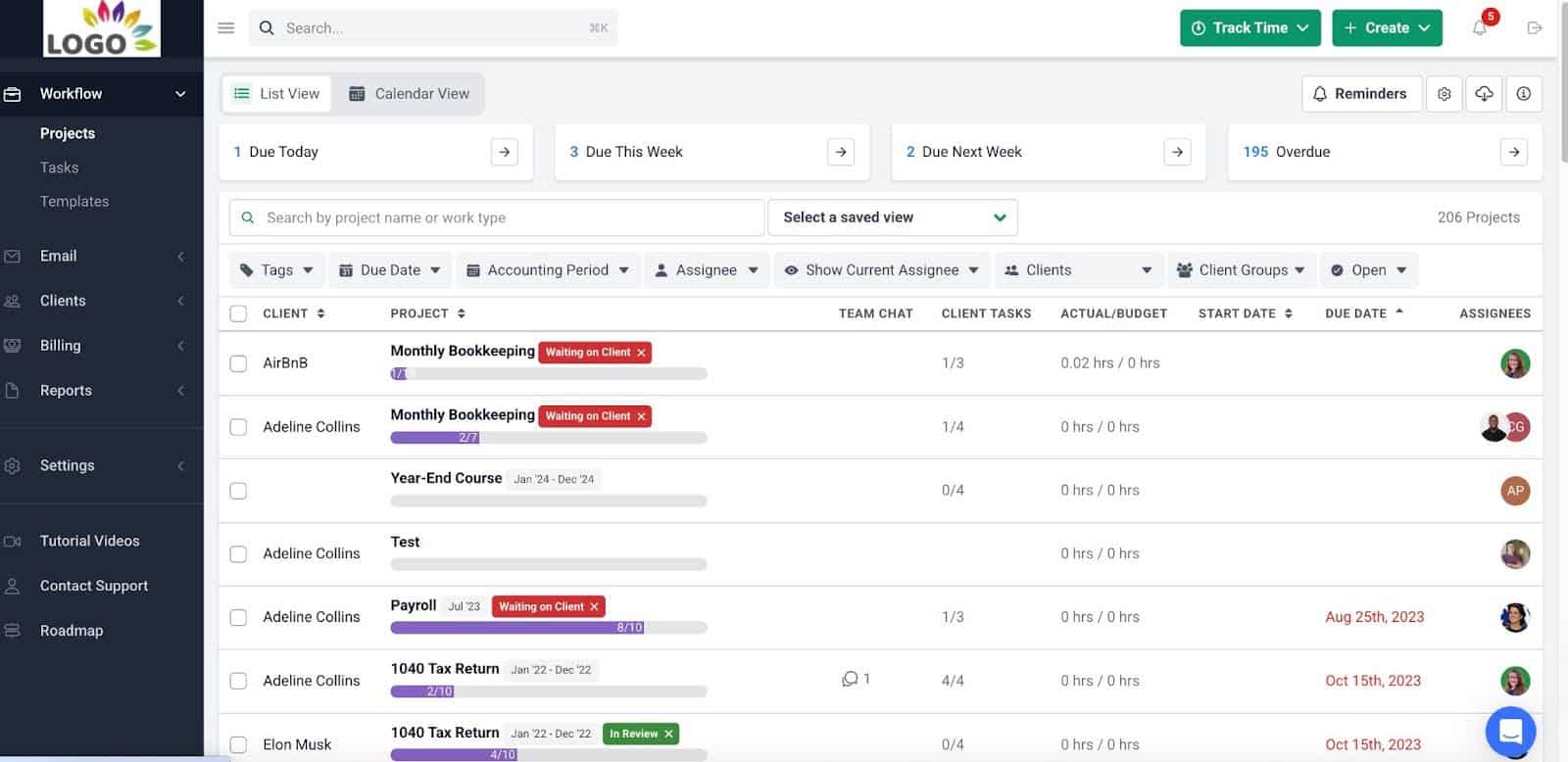

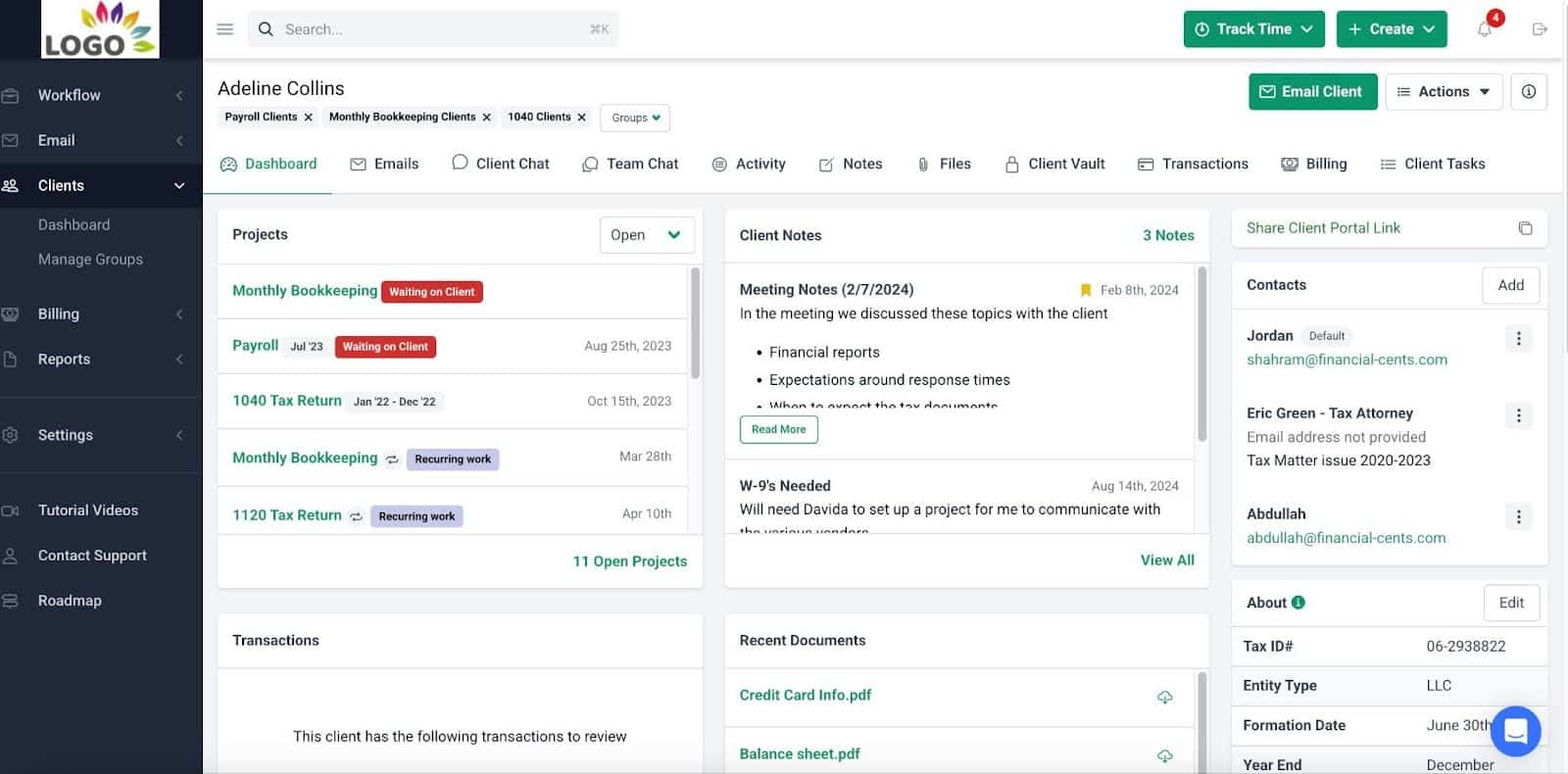

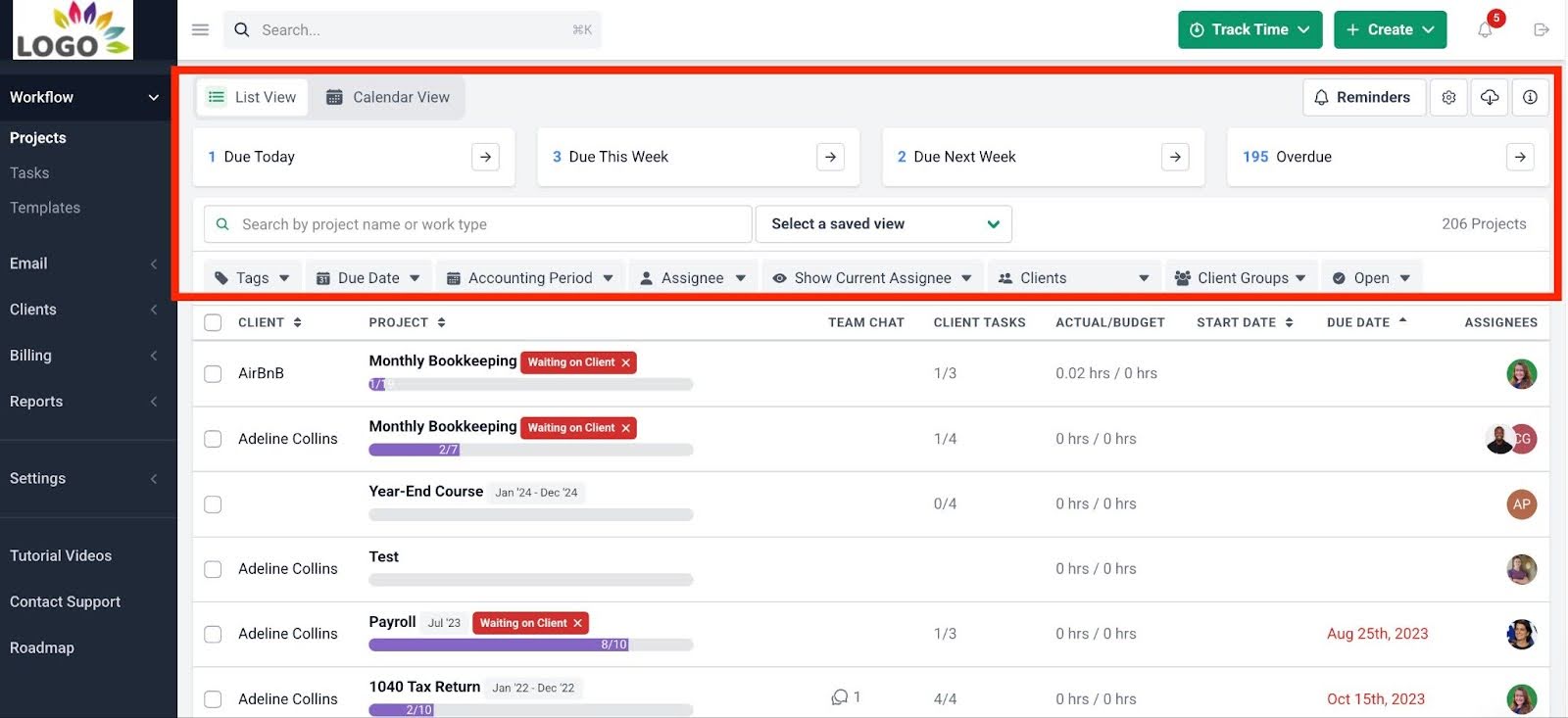

In Financial Cents, the workflow dashboard displays each client engagement as a project with its tasks, assignees, due dates, and progress reports. This enables you to identify the projects that need urgent attention.

In this dashboard, the firm is currently handling monthly bookkeeping for Adeline Collins and Airbnb, 1040 Tax Returns for Adeline Collins and Elon Musk, and a Payroll project for Adeline Collins (which is waiting on the client to send necessary files and info).

This means that if you do monthly bookkeeping, taxes, and payroll for a client, Financial Cents presents these engagements as separate projects that shape the relationship with that client. This enables you to monitor progress and meet individual deliverables, keeping the overall client experience memorable.

-

Visibility into team workload and progress

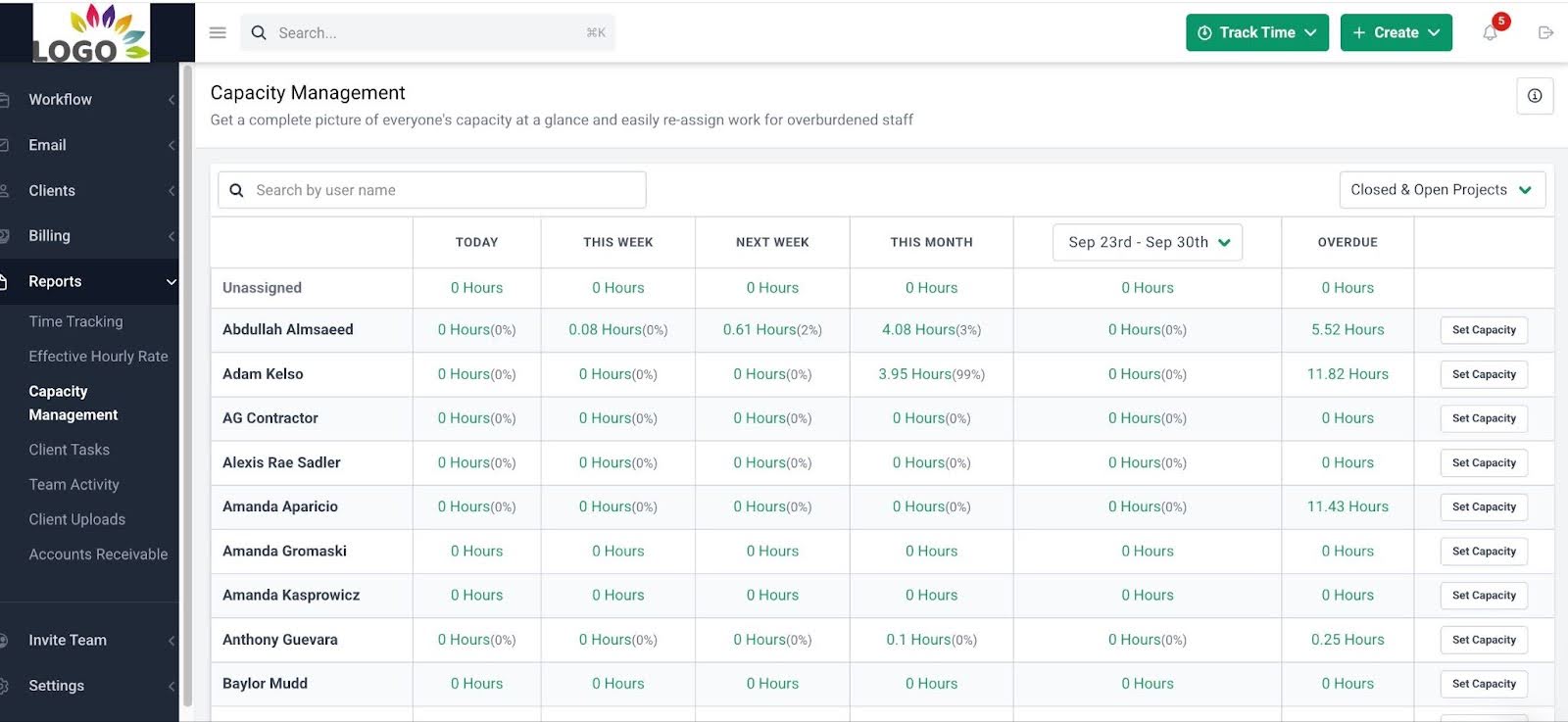

As a firm owner or manager, Financial Cents gives you visibility into your staff’s work to see the work that might be behind schedule.

The capacity management report shows all the work assigned to your team members, making it easier to balance workload and maintain peak performance.

The Workload View displays your team members’ tasks that are Due Today, This Week, and Next Week. This also enables you to assign tasks intelligently and prevent burnout.

-

Improved deadline management

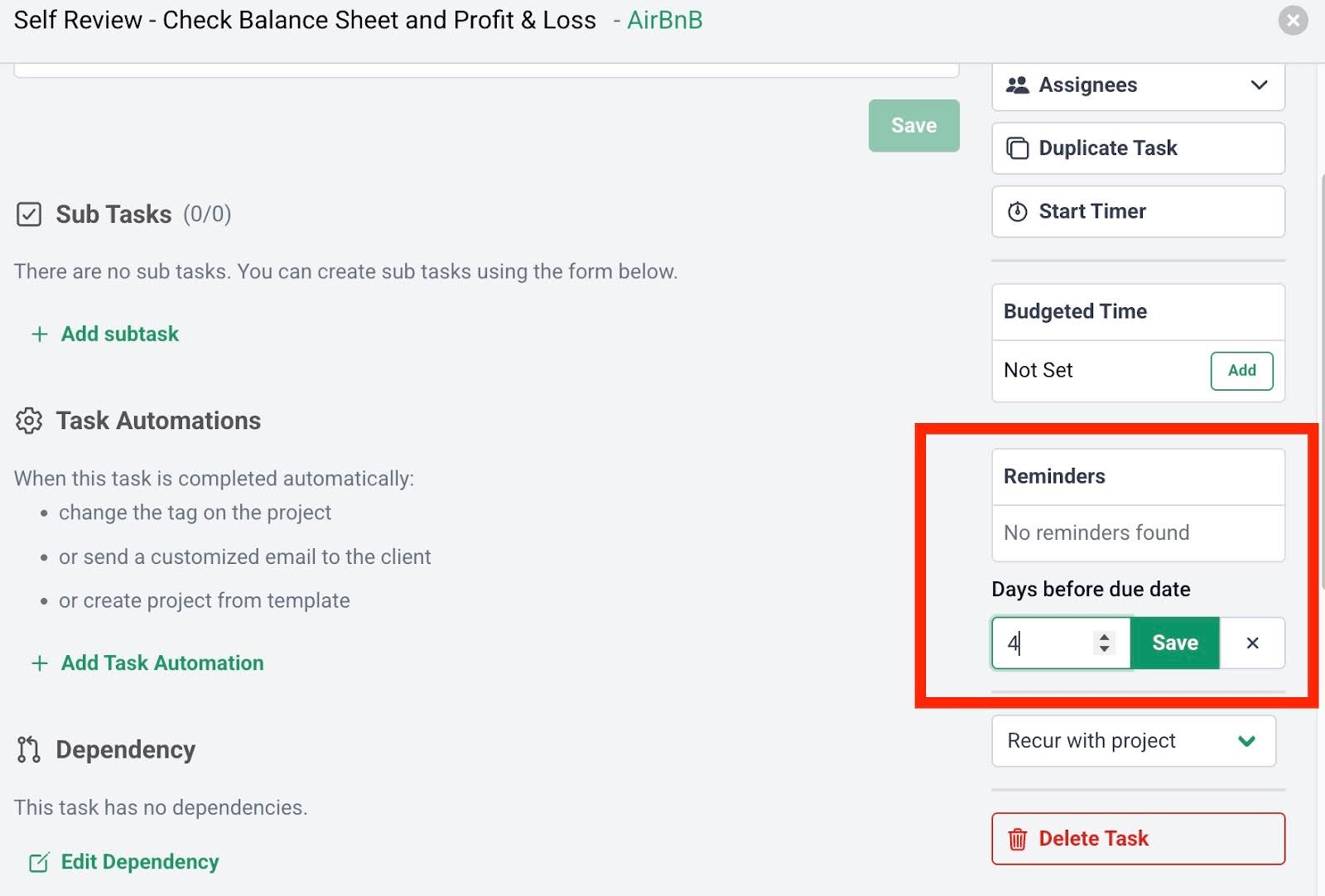

Every project in your project management software has due dates that enable your team to prioritize tasks to ensure no deadline takes you by surprise or slips through the cracks.

Financial Cents takes this a step further with the Due Date Reminder feature. It notifies accounting teams about tasks that are approaching their deadlines. This enables firm owners, managers, and staff to adjust their workload and prioritize the most urgent projects.

-

Standardized workflows across clients

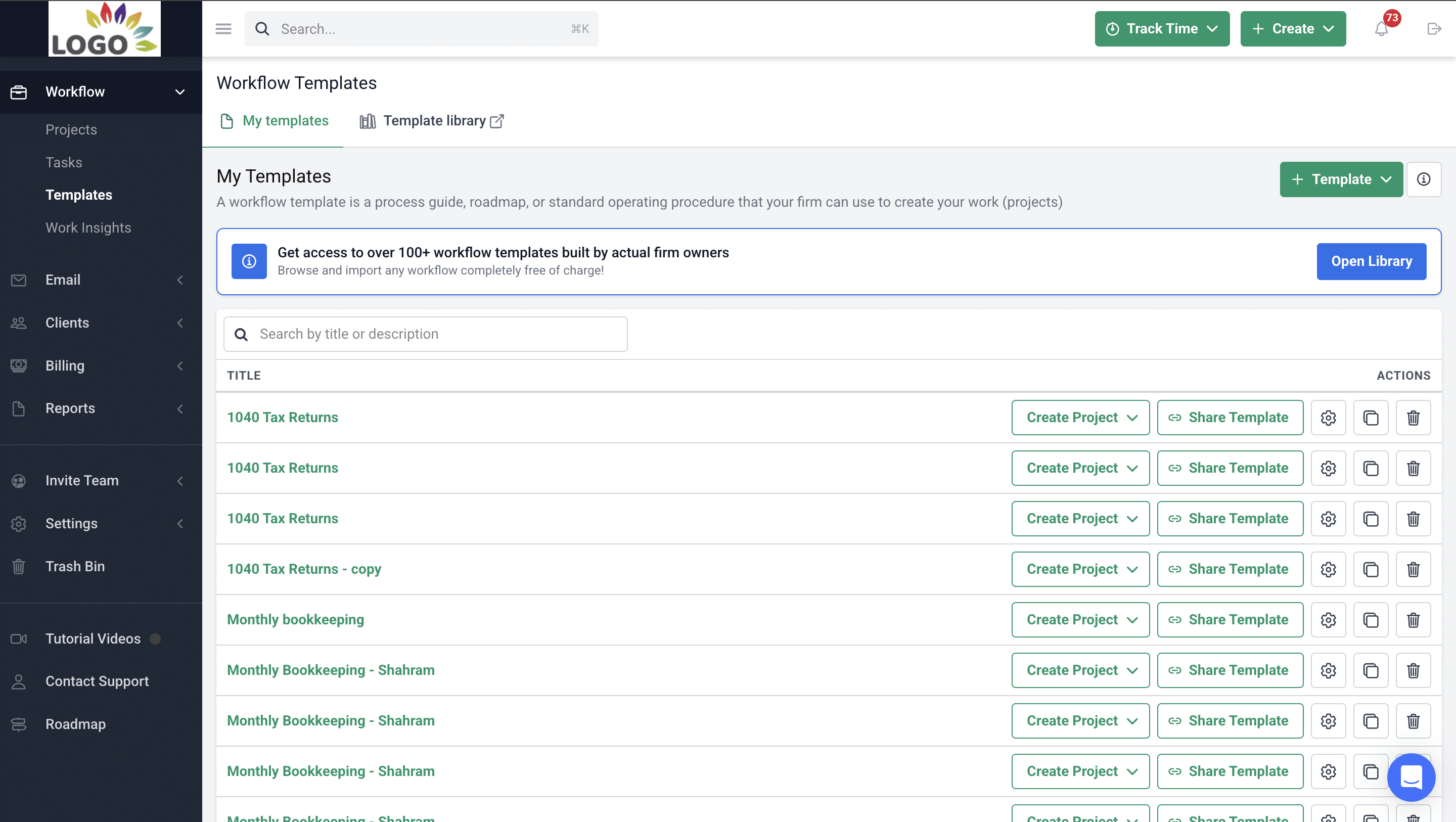

Every notable accounting project management software should enable you to create workflow templates that standardize your team’s accounting procedures.

These templates ensure that all team members follow the same steps, while clients receive consistent service quality.

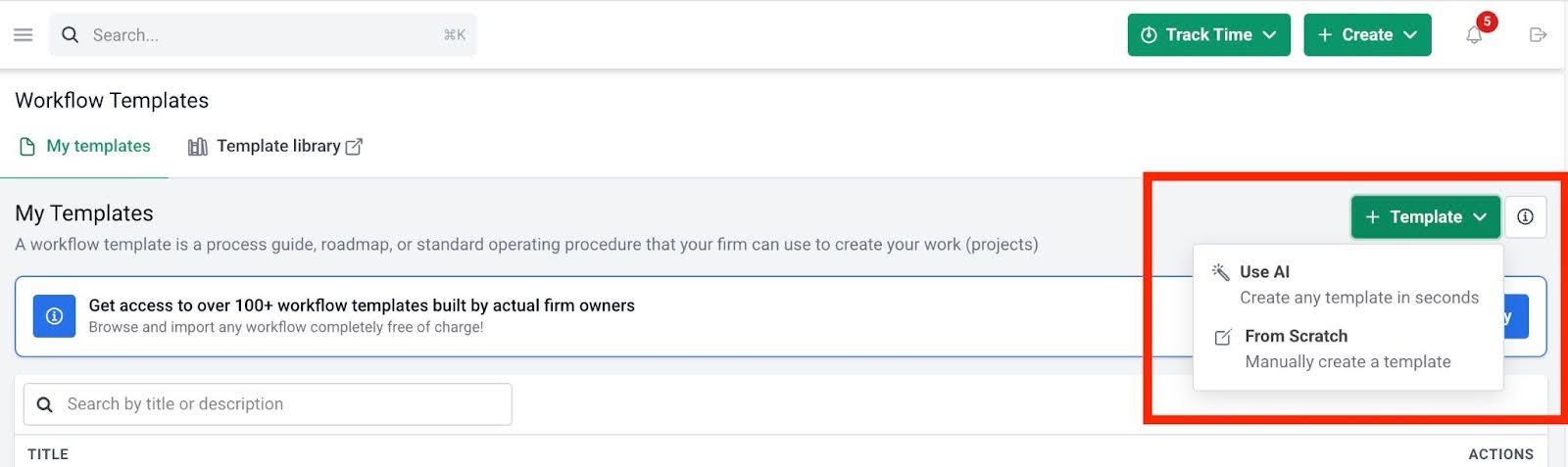

In Financial Cents, you have not one, not two, but three different ways to create your workflow templates.

One, Financial Cents provides pre-built workflow templates that capture 60+ accounting processes. All you need to do is download these and customize them to suit your firm’s unique preferences.

Second, Financial Cents enables you to document your processes from scratch or using AI and save them as templates for subsequent use.

-

Better collaboration and communication

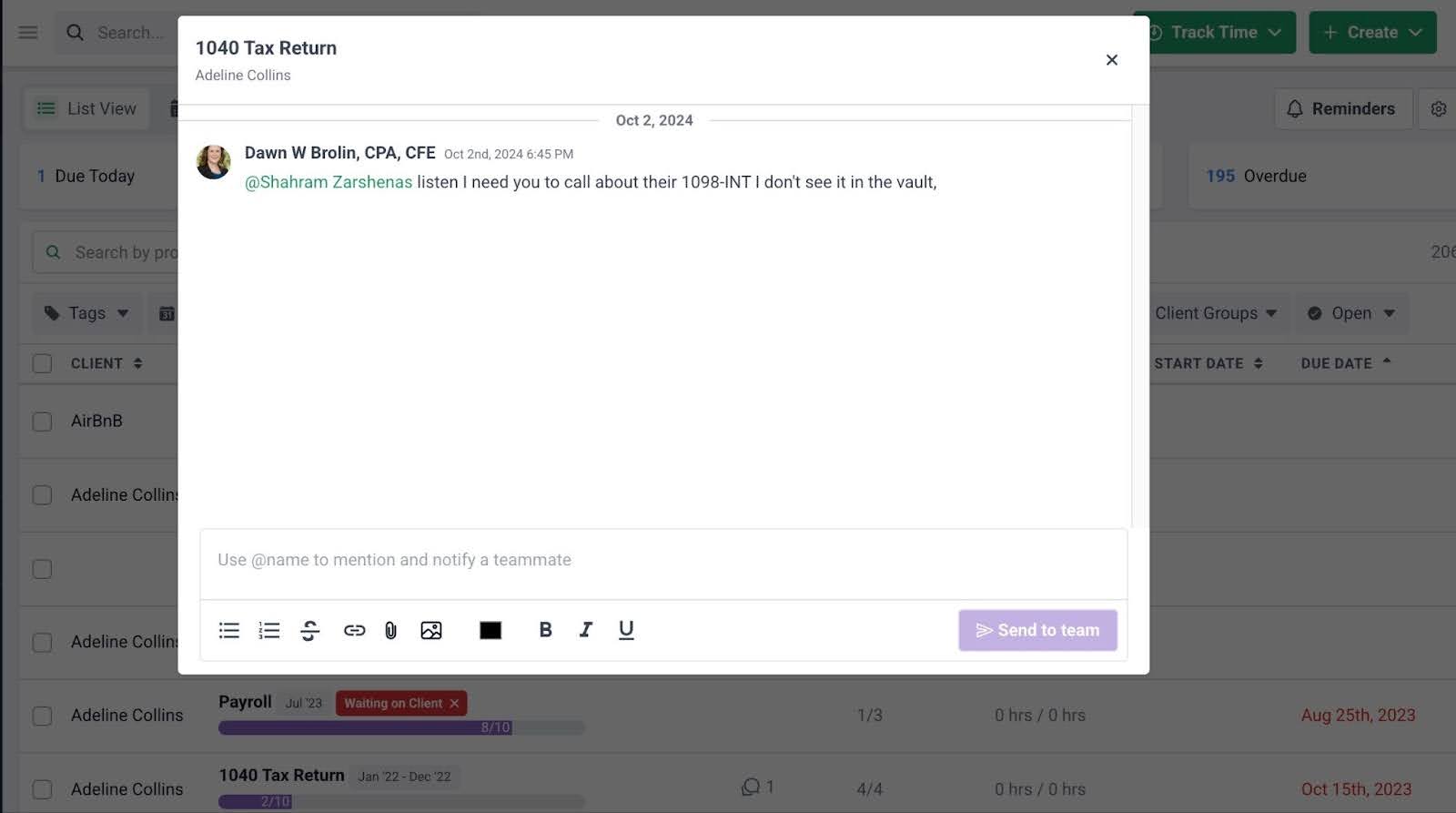

Financial Cents centralizes team communication and collaboration inside the project and client profile to enable accounting teams to discuss projects with the right context.

The Team Chat section of each client engagement shows the comments team members have left for their teammates. They can also mention team members to pull their attention more quickly.

Thirdly, the Financial Cents templates library is a community of accounting firm owners sharing their best workflow templates. This gives you access to workflow templates (currently 100+) that were created by other accounting firm owners like you.

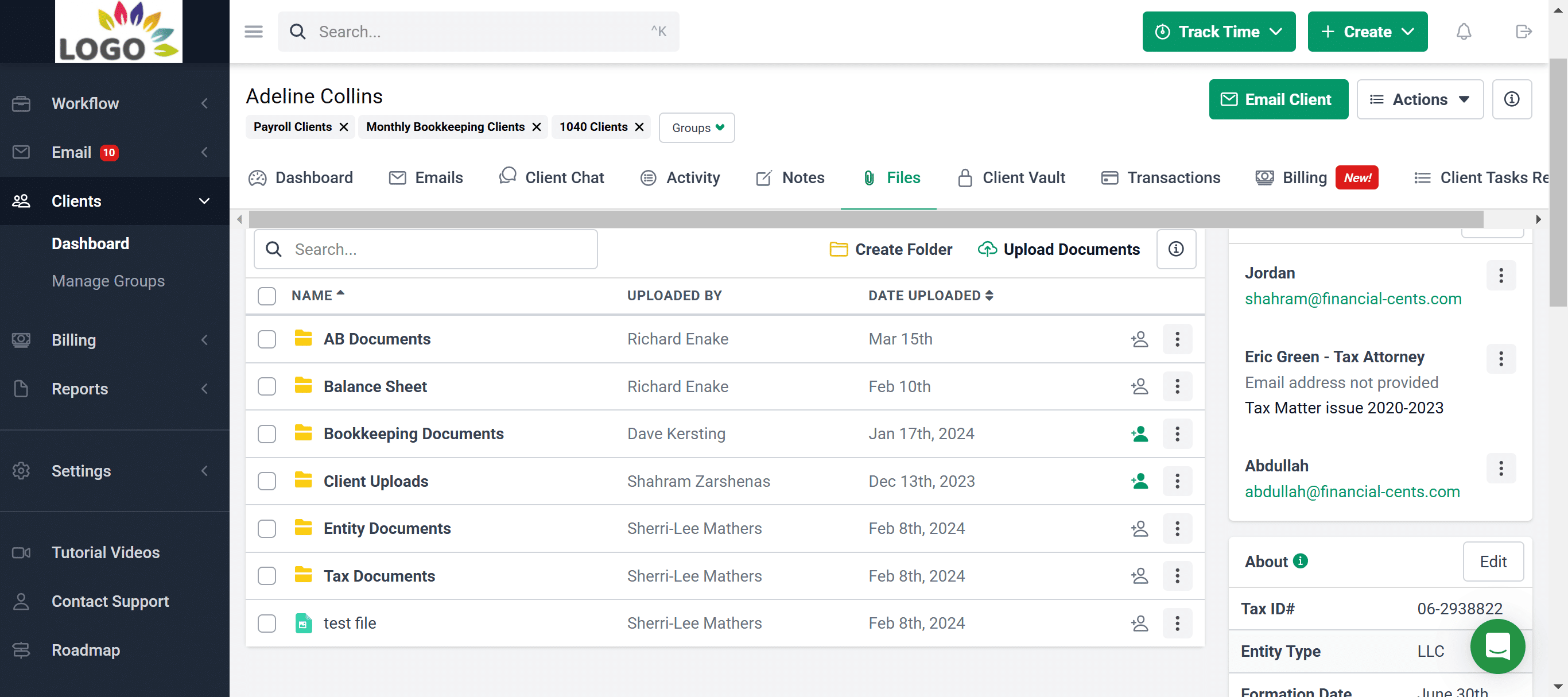

The client profile in Financial Cents also contains important information about the client that helps service delivery. For example, the client notes feature enables team members to record information that might help other team members to complete their tasks more accurately.

These will save your team members the distraction of scrolling through email chains and making phone calls that prevent them from deep, focused work.

Essential Features to Look for in an Accounting Project Management Software

You’re likely dealing with generic project management software if you don’t find the following features in a project management software, which means that the volume of your manual labor will increase as your firm grows:

1. Workflow management & automation

This feature minimizes the manual work that accounting teams repeat frequently. Accounting project management tools are designed to identify and automate these steps and patterns.

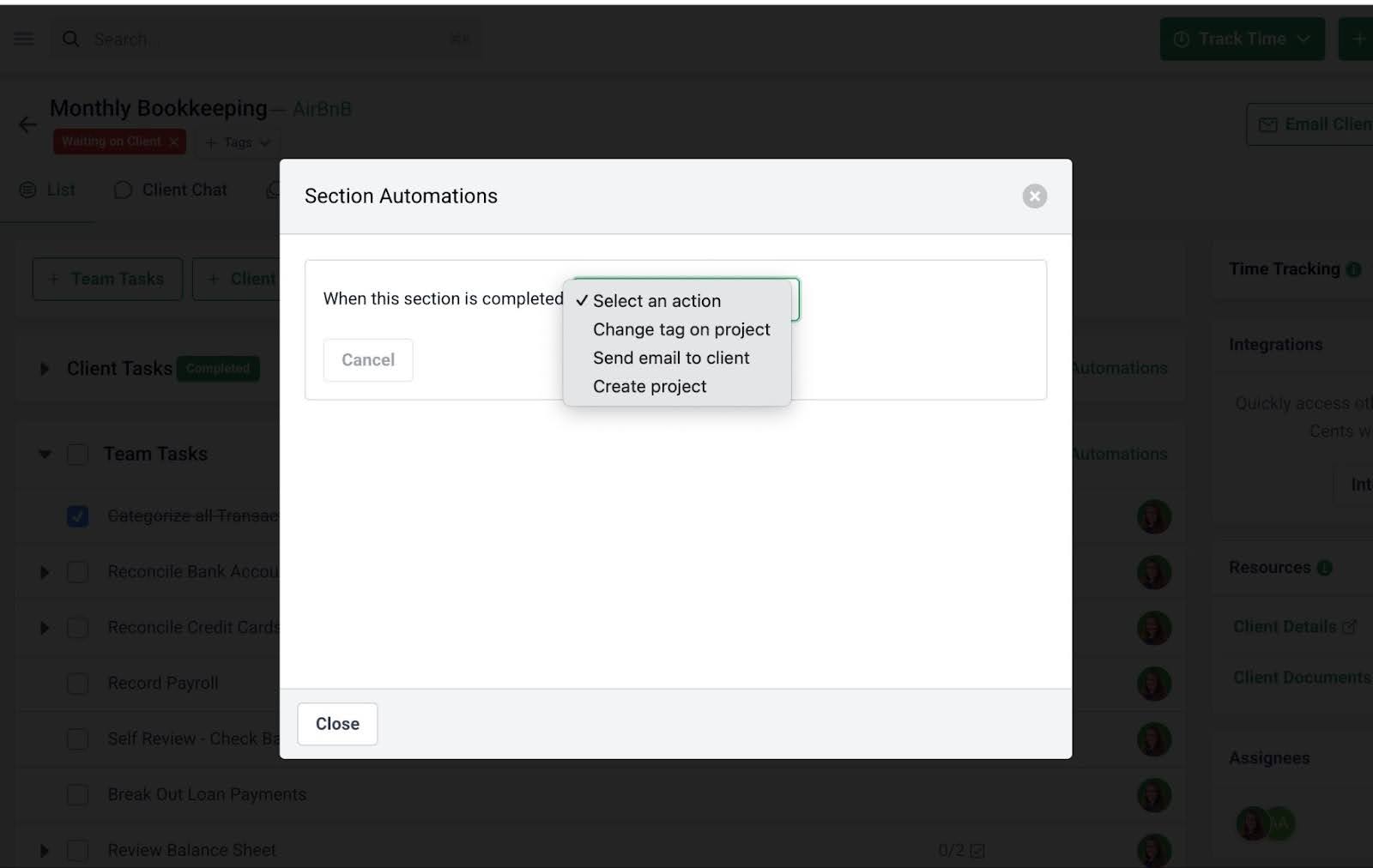

In Financial Cents, your team can automatically recreate your regular projects to save the time and effort of creating them from scratch every week, month, or year.

With the workflow automation feature, your team can send client updates and change project status without human effort.

2. Project tracking and deadline management

The top accounting project management software solutions understand that client and compliance deadlines are not optional.

Project management software for accounting firms display the tasks that are due by when.

This visibility is critical to planning resources and meeting client deadlines.

3. Accounting Project & Workflow Template

The workflow templates feature enables accounting firm owners to improve firmwide efficiency by making their workflow expertise accessible to everyone in the firm.

Otherwise, firm owners and managers will store their standard operating procedures in their heads, which will deny their firms the opportunity to standardize client services, prevent confusion, and make the client experience more consistent.

4. Document and file sharing

What is project management software without the ability to exchange financial documents with your clients?

Accounting project management solutions provide secure client portals that enable accounting teams to share sensitive financial documents without security worries.

Beyond the security of clients’ financial information, the document and file-sharing feature also makes necessary documents available to your team members in the same place they do their work. This saves them the stress of searching through email inboxes and external document management software.

5. Time and billing

Time tracking is a necessity for every accounting firm, regardless of its preferred billing system. It enables you to record the time spent on work so you can separate billable from non-billable time.

This information helps you to manage your time more effectively to improve revenues.

Having the time tracking feature in the same tool as the billing feature makes it easier to link the time spent on work to revenues without leaving your project management software, which saves you time and money spent on multiple tools.

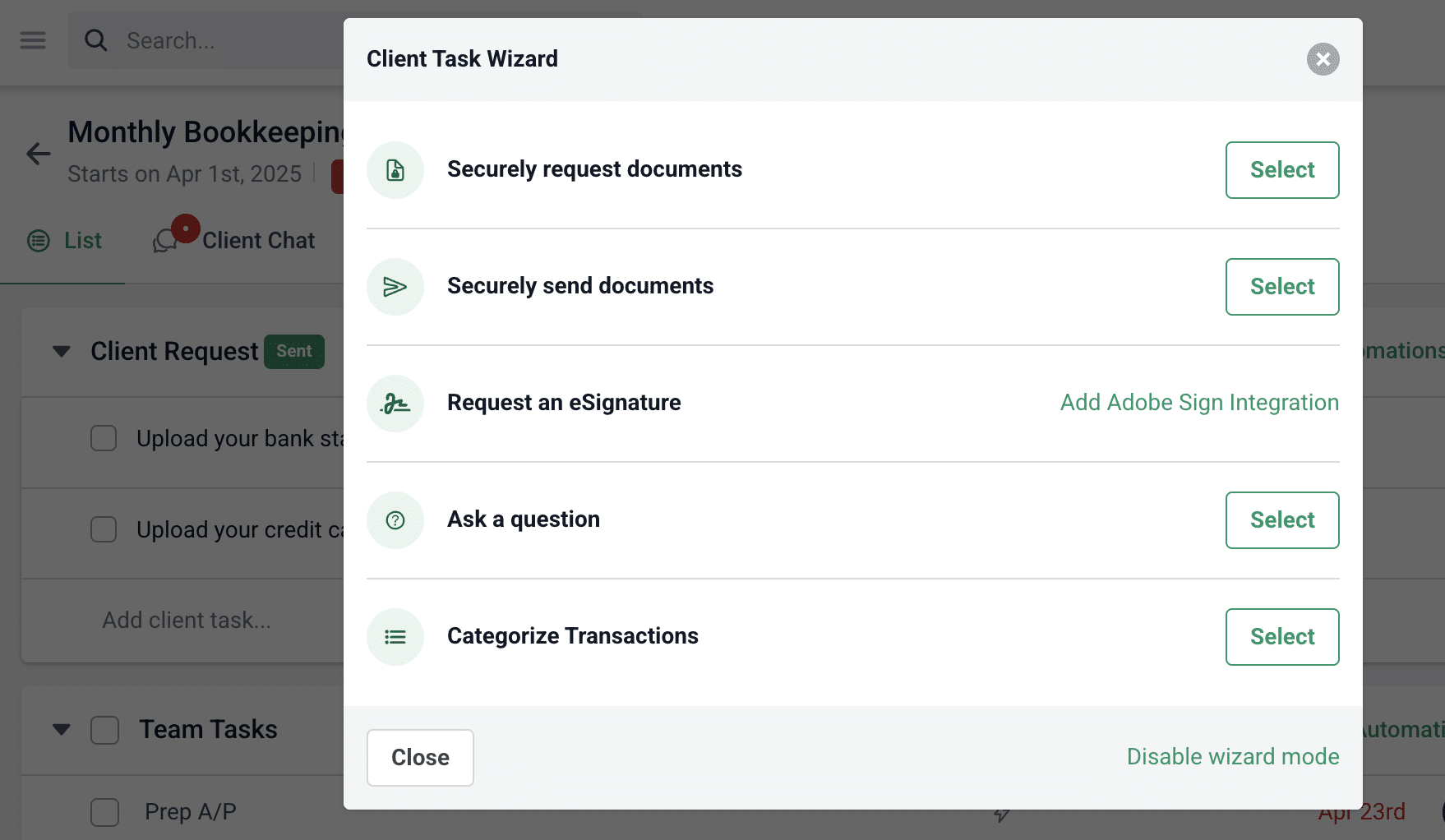

6. Client Task Management

Few things are more disappointing for an accounting team than settling down to complete a project only to find that they cannot because the client hasn’t sent the information they need to move forward.

This is why the ability to request client information is critical in your project management software.

Yet, sending a single client request is often not enough to get their responses. That’s why top solutions like Financial Cents include a reminder feature. The client task reminder automatically notifies clients about your requests until they grant them.

If you’d like to understand in detail the essential features you need in an accounting project management software to get maximum ROI, read our article on the must-have features of an accounting project management

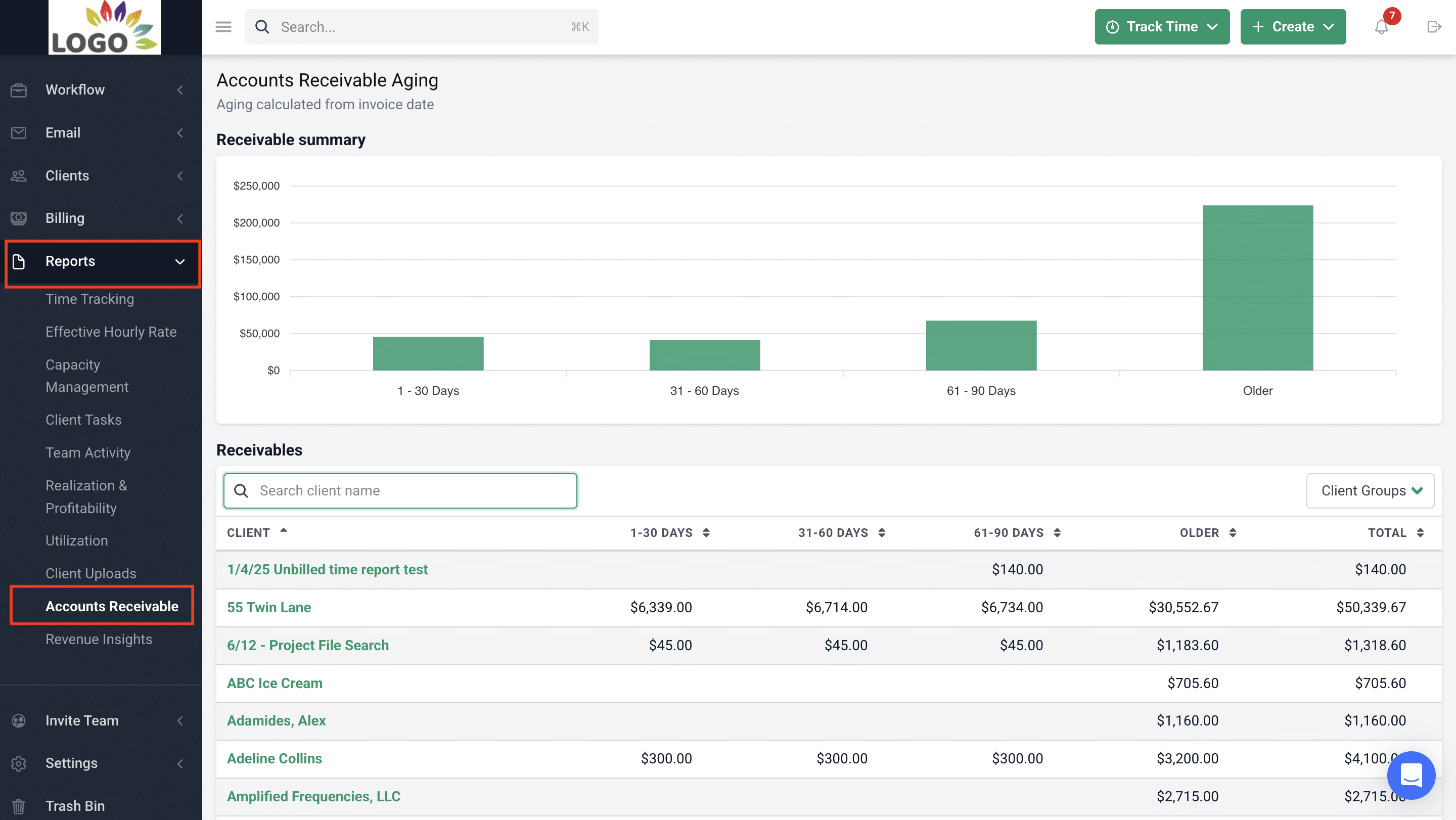

7. Reporting

This feature is necessary for the insights it provides for firm owners to manage their capacity, productivity, and profitability.

With a project management tool like Financial Cents, you can view both high-level and granular information to tie project data directly with financial outcomes.

It provides the data you need to run your firm proactively, instead of merely showing you what has already happened. This helps you refine your workflows and plan your workloads to eliminate friction.

Recommended Guide:

How Project Management Software Improves Client Service

Although your clients won’t care about your internal processes, efficient internal processes improve the quality and consistency of your client service, and that’s where accounting project management software, like Financial Cents, comes in handy to ensure:

I. Faster turnaround and fewer errors

Every feature in the accounting project management software is carefully designed to reduce confusion and the mental load of managing projects. That way, accountants will deliver more work and make fewer mistakes.

For example, workflow templates eliminate the time and energy your team members spend figuring out how to go about a client’s work. This frees them up to spend their time and energy doing the actual work while reducing the likelihood of missing key steps.

Similarly, client tasks and reminders ensure your team receives the files and information they need to do their work when needed, and the workflow dashboard centralizes project information to enable faster decision-making.

II. Increased transparency with deadlines and deliverables

Asana wasn't designed for the bookkeeping or tax industry. For example, it was super complicated to get the due dates to populate, so I was having to go in and do a lot of work to change these due dates manually."

In Financial Cents, it's much easier to adjust due dates if tasks don't get completed on the original due dates. You only have to move one date, and then all others will populate based on when the task is marked off."

Accounting clients are happier when they don’t have to call or send emails before knowing the status of their projects.

That is why accounting project management software provides firms with real-time progress reports on their tasks, which enables them to update their clients as often as needed.

With a tool like Financial Cents, you’ll also have the client-facing project status that enables you to make the status of certain projects visible to your clients inside the client portal.

This enables your clients to understand the progress made on their work without having to call or send emails, which improves client trust.

It also shows clients when their delay in sending necessary information is holding an engagement back and keeps your team on their toes, knowing that the client is watching.

III. Ability to scale and handle more clients without losing control

Most accounting firm owners think of growth in terms of hiring more staff to take on more clients, but it doesn’t have to be so.

Project management software helps you to track and organize the many moving parts of your accounting firm so that your team can have enough time to serve more clients. That means you won’t necessarily need to hire more staff as you add more clients.

Why Accounting Firms Should Choose Industry-Specific Tools

Accounting industry-specific tools like project management software are crucial because financial information is so sensitive and compliance requirements so strict that forcing a tool built for several other industries will result in unnecessary waste of time, mental energy, and growth opportunities.

Asana wasn't designed for the bookkeeping or tax industry. For example, it was super complicated to get the due dates to populate, so I was having to go in and do a lot of work to change these due dates manually."

In Financial Cents, it's much easier to adjust due dates if tasks don't get completed on the original due dates. You only have to move one date, and then all others will populate based on when the task is marked off."

Accounting clients are happier when they don’t have to call or send emails before knowing the status of their projects.

That is why accounting project management software provides firms with real-time progress reports on their tasks, which enables them to update their clients as often as needed.

With a tool like Financial Cents, you’ll also have the client-facing project status that enables you to make the status of certain projects visible to your clients inside the client portal.

This enables your clients to understand the progress made on their work without having to call or send emails, which improves client trust.

It also shows clients when their delay in sending necessary information is holding an engagement back and keeps your team on their toes, knowing that the client is watching.

-

Ability to scale and handle more clients without losing control

Most accounting firm owners think of growth in terms of hiring more staff to take on more clients, but it doesn’t have to be so.

Project management software helps you to track and organize the many moving parts of your accounting firm so that your team can have enough time to serve more clients. That means you won’t necessarily need to hire more staff as you add more clients.

Why Accounting Firms Should Choose Industry-Specific Tools

Accounting industry-specific tools like project management software are crucial because financial information is so sensitive and compliance requirements so strict that forcing a tool built for several other industries will result in unnecessary waste of time, mental energy, and growth opportunities.

We had to create a new Trello board for the monthly project every month. It took so long to do that, and it created more room for error. We found out Trello wasn't robust enough and didn't have the automation we (accounting firms) were looking for."

Sarah Landrum, Office Manager, Ascension CPAThe difference between a generic tool and the accounting industry-specific project management software begins with the mindset behind its development, which determines its features and roadmap.

A generic project management software treats all projects in the same way. That is why their features are expected to be one-size-fits-all for all industries.

They require accounting firms to manually recreate projects every month for each of their monthly engagements, resulting in a waste of time and resources that leaves your team with little time and mental energy to do the actual work.

But industry-specific tools like Financial Cents understand that accounting workflows are unique and follow specialized procedures. Their features are built by people who understand the reality of accounting engagements, tax season requirements, and the interdependence of team and client tasks.

In terms of integration with relevant third-party apps, generic project management tools integrate with tools that may not be relevant to the accountants. But project management tools for accounting firms integrate only with accounting project-critical tools.

For example, Financial Cents integrates with tax and general ledger software to enable a seamless flow of data between the apps in your tech stack, reducing manual data entry and information silos.

Financial Cents: A Project Management Software that Amplifies Your Team’s Expertise

Time is the most important factor in project management. Technically, it can’t be created or destroyed.

It can only be spent well or not, and your choice of a project management system inevitably makes that distinction for your firm.

When you rely on project management tools that demand manual inputs at every stage of your projects, you’re always one client, team member, or tax season away from losing your best staff and clients.

That is why accounting firm owners, like Sarah Landrum, Mark Abraham, and Stelle Anderson, prefer project management tools (like Financial Cents) that serve the accounting industry exclusively.

Financial Cents was built for accounting, bookkeeping, and tax firms that are ready to stop fighting their tools, explaining why they are always running behind, and wondering where their time is going.

Its features include:

- Workflow management feature: Provides complete visibility into what’s happening across every engagement in real time.

- Accounting CRM: Everything you need to nurture client relationships in one place – the client profile.

- Time tracking: Automatically captures your billable hours while you’re doing the work.

- Email Integration: Pulls client emails into your accounting workflows to improve visibility and responsiveness.

- Billing and Payments: Ensures you get paid what you’re worth and on time.

- Reporting: Real-time insights for managing workflows, team workload, and client profitability.

- Etc.

With all these manual efforts out of the way, accounting teams can spend more time applying their expertise to clients’ financial situations.

If you’re ready to start doing the work that generates revenue, instead of working on what to work on, click here to start your 14-day free trial of Financial Cents today.