The accounting cycle gives your firm a clear process: record transactions, post to the ledger, make adjustments, prepare reports, and close the books. When followed correctly, it keeps everything in order, enabling your team to stay organized, avoid errors, and complete client work on time.

But in practice, many firms struggle to manage the cycle smoothly. Workflows break down, and team members end up chasing missing documents, clarifying vague transactions, and redoing work that should have been done right the first time.

According to the Financial Cents 2025 Workflow Report, 55.5% of firms struggle with workflow inefficiencies, which negatively impact work-life balance, lead to missed deadlines, and affect revenue.

In this guide, we explain the full accounting cycle, and show you how to manage it better with automation.

What is the Accounting Cycle?

The accounting cycle is the structured process accountants follow to record, organize, and report a business’s financial transactions for a specific period. It begins when a transaction occurs and ends when the period’s financial statements are prepared and the books are closed.

This process isn’t a one-time task; it repeats every reporting period, whether that’s monthly, quarterly, or annually. For example, you might run the accounting cycle every month to prepare management reports, then again at year-end to create annual statements for tax filing.

Following the cycle ensures that all transactions are captured, accounts are reconciled, adjustments are made, and reports are accurate and ready for decision-making or compliance purposes. It also standardizes your workflow so nothing is missed and deadlines are met. For instance, if you know reconciliations always happen before preparing a trial balance, you can avoid the back-and-forth that happens when those steps are done out of order.

Why the Accounting Cycle Matters

A well-managed accounting cycle is very important for the following reasons:

Ensures Accurate and Compliant Financial Reporting

Accurate financial reporting starts with recording every transaction, classifying it correctly, and making all necessary adjustments before preparing statements. The accounting cycle gives you a clear process to follow, helping your team complete each step in the right order and on time. This reduces the risk of errors, missed entries, or reporting items in the wrong period.

By following the cycle consistently, your firm can help clients meet compliance requirements for tax filings, audits, and accounting standards and avoid penalties.

Enables Better Client Advisory and Decision-Making

When the accounting cycle is completed accurately, the resulting financial statements reflect the true financial position of your client’s business. This gives both you reliable data to evaluate performance, identify trends, and make informed decisions.

Without up-to-date and accurate reports, clients risk making key decisions like cutting costs, investing in growth, or managing cash flow based on incomplete or outdated information, which can lead to poor outcomes.

Helps Identify Errors Early in the Process

The cycle includes key checkpoints like preparing the unadjusted and adjusted trial balances that help you catch errors early. By reviewing accounts at these stages, you can spot and fix issues before they affect financial reports. This reduces the risk of larger problems later on and cuts down on time spent correcting mistakes during month-end or year-end close.

Helps To Prevent Fraud

Following the accounting cycle consistently improves transparency and accountability in your client’s financial records. Regular reviews, reconciliations, and adjustments make it harder for unauthorized transactions or misstatements to slip through unnoticed. It also supports proper segregation of duties so no one person handles a transaction from start to finish further reducing the risk of fraud.

Great for Audit Preparation

Completing the accounting cycle each reporting period keeps financial data, reconciliations, and supporting documents organized and up to date. This makes audit preparation faster, builds auditor confidence, and reduces the risk of adjustments or delays. Firms that follow a consistent process often experience smoother audits with fewer disruptions to their regular workflow.

Steps in the Accounting Cycle

The accounting cycle follows a clear order, so each task builds on the one before it. Here’s what each step involves.

Step 1: Identify and Analyze Transactions

This is where the cycle begins. Start by identifying every transaction that affects your client’s finances, like sales, expenses, bank transfers, payroll, or loan payments. Then analyze each one to decide how to categorize and record it.

At this stage, it’s common to encounter transactions that aren’t clearly categorized, especially if clients provide incomplete descriptions or forward bank feeds without context. Leaving these as uncategorized transactions can cause reporting errors, delay reconciliations, and impact tax deductions. That’s why it’s best to address them immediately.

Financial Cents’ Month End Close tool can help you quickly review, categorize, and clear these transactions so they’re accurate before moving to the next step.

Step 2: Journalize Transactions

Once you’ve analyzed the transactions, record them in the journal using the double-entry method. For every transaction, make sure you include the date, debit and credit amounts, account names, and a short description.

Consistent, accurate journalizing ensures that transactions are documented in chronological order and ready for posting to the ledger. It also provides an audit trail for anyone reviewing the books later.

Step 3: Post to the Ledger

Next, transfer your journal entries into the general ledger, organizing each entry by account (e.g, cash, revenue, expenses). The ledger groups similar transactions together and gives you an up-to-date view of each account’s balance.

Keep your ledger clean and consistent. A well-maintained ledger helps you spot issues faster and makes trial balances and reconciliations much easier to manage. Here’s a good general ledger template if you need one.

Step 4: Prepare an Unadjusted Trial Balance

At this stage, list all accounts from the ledger along with their balances to confirm that total debits equal total credits. This internal check helps you catch data entry issues like missing amounts or reversed entries before moving forward.

If the trial balance doesn’t match, go back to your ledger and fix the errors now to avoid bigger problems later.

Step 5: Journalize and Post Adjusting Entries

Record adjusting entries for any income or expenses that haven’t been captured yet but apply to the current period. These might include accrued income, unpaid bills, depreciation, or prepaid expenses.

Accurate adjustments ensure the period’s financial results reflect the actual economic activity, not just cash movements.

Once recorded, post these adjustments to the ledger just like you did with the original journal entries. This keeps the books accurate and in line with accrual accounting standards.

Step 6: Prepare an Adjusted Trial Balance

After posting adjustments, prepare a second trial balance to confirm that total debits still equal total credits. The adjusted trial balance gives you the accurate account balances you need to prepare financial statements. If anything still looks off, make corrections before continuing.

Step 7: Prepare Financial Statements

With accurate account balances, prepare the financial statements for the period, typically the income statement, balance sheet, and cash flow statement.

These reports show how the business performed during the period. Use them for advisory conversations, compliance, and decision-making. If you followed the earlier steps in the cycle correctly, the reports should be accurate and ready to share with clients, stakeholders, or auditors.

Step 8: Journalize and Post Closing Entries

Finally, close out temporary accounts like revenue and expenses by moving their balances into retained earnings (or the owner’s equity account).

Record these closing entries in the journal, post them to the ledger, and confirm that all income and expense accounts reset to zero, ready for the next cycle.

The Accounting Cycle in Practice: Manual vs. Software

While the steps in the accounting cycle haven’t changed, the way firms complete them has evolved. Some firms still rely on manual methods, others use spreadsheets, and many have transitioned to full accounting software. Each approach comes with different levels of efficiency and risk.

Manual System

Traditionally, accountants completed the entire cycle by hand, writing transactions into physical journals, posting to ledgers, and calculating trial balances on paper. But this method was time-consuming and left a lot of room for error. A single mistake in posting or totaling accounts could throw off the entire cycle, requiring hours to trace and correct.

Manual systems also lacked safeguards for data integrity, made collaboration difficult, and increased the risk of losing or misplacing records.

Spreadsheets

Spreadsheets, like Excel and Google Sheets, improved on manual systems by handling calculations automatically. With the right formulas, you can streamline parts of the cycle, especially when preparing trial balances or financial statements.

However, accounting spreadsheets still require significant manual data entry, and they don’t eliminate the risk of human error. Typos, broken formulas, version control issues, and lack of real-time visibility can all slow down the process and lead to inaccurate reporting.

It’s why almost half of the 27.7% of firms that still manage workflows in spreadsheets feel dissatisfied and actively search for a better solution, according to our report.

Accounting Software

Unlike spreadsheets, which still require a degree of manual work, modern tools like QuickBooks, Xero, and others automate almost the entire process. Once you enter a transaction, the software can automatically journalize it, post it to the correct ledger accounts, update balances, and even generate trial balances and financial statements.

This automation reduces repetitive work, improves accuracy, and saves time across the cycle. But here’s the catch: software only works as well as the data and setup behind it.

If you don’t understand the accounting cycle itself, you’re more likely to miscode transactions or miss necessary adjustments.

Best Practices for a Smooth Accounting Cycle

Keep Documentation Organized and Digitized

If your team still relies on paper documents or scattered email threads, you’re more likely to miss key details when recording or adjusting transactions. Use cloud storage or a client portal that integrates with your workflow system to store and centralize all documents.

This makes it easier to retrieve information during reconciliations, adjustments, audits, or client requests.

Reconcile Bank and Credit Accounts Regularly

Build reconciliation into your weekly or biweekly process. It helps you catch missing, duplicated, or incorrect transactions before they affect your trial balance or reports. Regular reconciliation also strengthens fraud prevention by making unauthorized activity easier to detect.

Set Recurring Reminders for Each Step in the Cycle

Set up recurring tasks or calendar reminders for each part of the cycle, from identifying transactions and posting journal entries to preparing trial balances and closing the books. This ensures nothing falls through the cracks, especially when managing multiple clients or busy periods like month-end and year-end.

You can use workflow tools to automate these reminders and assign responsibility so everyone stays on track.

Use Templates and Checklists

Create reusable templates and checklists for your team. This standardizes the accounting cycle process, making your team more efficient and reducing errors. Instead of guessing what’s next or relying on memory, your team can follow a clear sequence that covers all required tasks for each reporting period.

Standardizing Your Cycle Process With Workflows

Without a standardized process for managing the accounting cycle, things can quickly fall through the cracks. Tasks get completed out of order, deadlines are missed, and team members use different methods for data entry or reconciliation. This leads to inconsistent work quality, delayed reporting, and more time spent fixing preventable errors. These inefficiencies affect your reputation and create stress for your team.

The solution? Accounting workflows.

An accounting workflow is a predefined set of steps your team follows to complete a specific accounting process, like month-end close, reconciliations, or year-end reporting. It shows what needs to be done, who’s responsible, and when it’s due. “A good workflow is a structured sequence of steps that efficiently guides tasks from start to finish,” says Dawn Brolin, CPA, CFE.

This workflow ensures that your team performs every step in the correct order, every time.

As Kellie Parks, Business Consultant and Bookkeeper, says,

You can't scale if you're not doing good work. You can't do good work if you don't make your way through the process. And you can't do it efficiently if you're going to do it out of order."

When you use workflows to manage the accounting cycle, you:

- Reduce miscommunication and redundant work across the team

- Create consistency in how work is done, regardless of who’s assigned

- Improve visibility into task progress, status, and bottlenecks

- Make it easier to maintain quality as your client base grows

How to Implement Workflows for Your Accounting Cycle

1. Map Current Process

Start by documenting how your team currently handles each step in the accounting cycle, for example, how transactions are gathered, when journal entries are made, and how reports are finalized. This gives you a clear view of what’s working and where there are gaps.

2. Identify Bottlenecks/Inefficiencies

Next, look for slowdowns or pain points. Are client documents always late? Are reconciliations constantly being pushed back? Do team members complete steps out of order? This is where you uncover the root cause of missed deadlines, errors, or duplicated effort.

3. Create Optimize Workflows or Use Templates

With those insights, build a step-by-step workflow for how the accounting cycle should run in your firm. You don’t have to start from scratch; you can use our pre-built accounting workflow templates. These are built by real accounting, bookkeeping, and tax professionals.

Whether you’re managing monthly close, reconciliations, or year-end reporting, these templates give you a structured starting point you can customize for your team. Choose from over 200 templates in our template library.

4. Leverage Workflow Automation

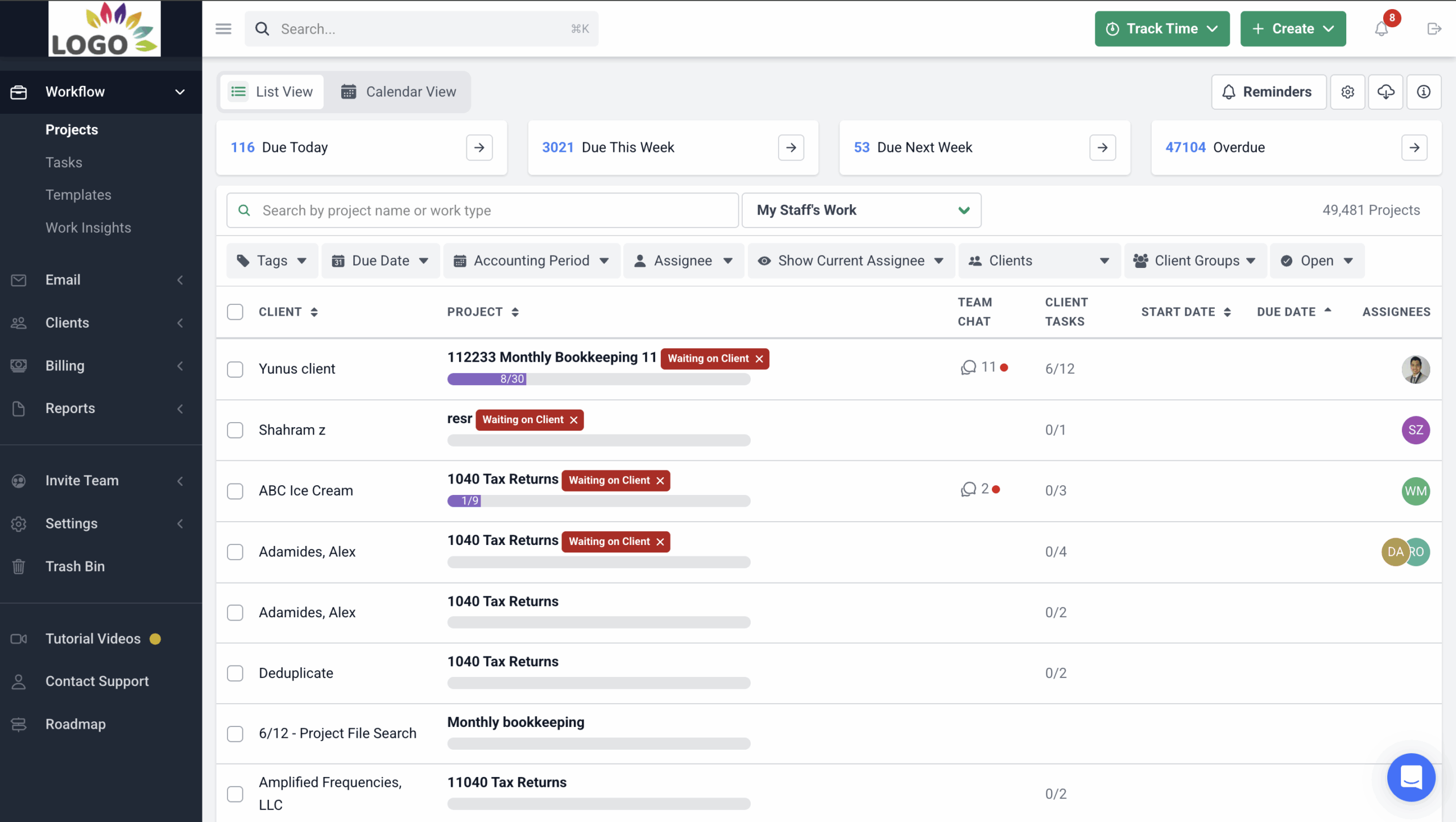

Once your workflows are in place, automation helps keep them running without constant manual follow-ups. With the right tool like Financial Cents, you can:

- Set recurring tasks for each reporting period

- Automatically assign tasks to team members

- Send reminders for upcoming or overdue work

- Trigger client requests at the right stage of the workflow

This keeps your accounting cycle on track, even as your client base grows.

5. Train Your Team

Walk your team through each step, explain the “why” behind the process, and set expectations for using the workflow consistently. The more comfortable your team is with the system, the more reliable your output will be.

6. Monitor & Improve

Once your workflows are in use, track how they’re performing. Are deadlines still being missed? Are certain steps always delayed? Use your workflow dashboard to identify trends and continuously refine the process. As your firm evolves, your workflows should evolve too.

Manage Processes in Your Firm with Practice Management Software

It’s important to manage the accounting cycle properly if you want to deliver accurate work, meet deadlines, and grow your firm efficiently. Each step in the cycle builds on the last, so when tasks are missed, delayed, or done out of order, it affects the entire process from reconciliations to final reporting.

The more clients you serve, the harder it becomes to stay on top of every step without a system in place. That’s where Financial Cents can help.

With our software, you can:

- Track the status of client work through a clear workflow dashboard

- Create step-by-step workflows for tasks like monthly close and reconciliations

- Assign tasks and collaborate with your team

- Automate recurring projects so you don’t have to create them from scratch every time

- Send automatic client reminders and collect documents faster

- Use a secure client portal to communicate with clients

It helps you stay organized, improve your process, and make sure every client’s accounting cycle is completed accurately and on time.

Want to improve your accounting cycle workflow and serve clients better?