We’ve found that 51.4% of accounting firm owners had a disorganized onboarding process before implementing an accounting client onboarding software, and 55.2% of those who implemented one have turned their onboarding process into an efficient and memorable one for their team and clients.

I knew I needed a client onboarding software when I couldn't standardize the onboarding process for new clients. Our inconsistent process produced inconsistent client experiences."

Accounting firm ownerUnlike this firm owner, many firm owners are struggling to decide whether to use an onboarding tool because they’d rather endure the pains and inefficiencies of their current processes than make the bold, but necessary, decision. Others are not sure which one to use, considering the complexity of some software solutions.

That is why we have selected ten (10) accounting client onboarding software solutions that are not just easy to use, but will improve your current processes, no matter how efficient they seem.

What is a Client Onboarding Software for Accountants?

An accounting client onboarding software is a tool that simplifies the collection, organization, and management of client information to set them up in your accounting systems.

By automating manual tasks and centralizing communication, client onboarding software saves you time, minimizes errors, and builds trust with clients from the start of the relationship.

Otherwise, accounting teams will rely on manual systems and scattered email threads to collect personal and financial information, send engagement letters, secure e-signatures, set up payment details, and add clients to their workflow systems, which creates administrative bottlenecks, increases error rates, and endangers the client experience.

Features to Look out for in a Client Onboarding Tool for Your Firm

-

Client Portal

A good client portal does three things, among others: (i) makes it easy for clients to share files and information with your team, (ii) secures clients’ files and information, and (iii) centralizes clients’ files and information to enable your team to find them quickly.

Beyond the onboarding phase, the client portal provides clients with a central location to view their documents and collaborate with your team, which improves client collaboration and satisfaction.

-

Proposals and Engagement Letters

The best client onboarding software solutions allow you to generate and send proposals and engagement letters to save time, enable consistency, and ensure legal compliance.

This feature comes with an E-signature solution that saves your clients the stress of downloading and printing documents to sign engagement letters. They will be able to open and sign the document on their mobile devices from anywhere, helping you close clients faster.

-

Relevant Integrations (such as QuickBooks Online, Ignition, Anchor, Adobe E-signature, Zapier, etc.)

You’ll be the luckiest person in the world if you find a client onboarding tool that solves all your accounting needs at all times.

But you wouldn’t need that impossible amount of luck if your onboarding solution integrates with other relevant apps in your tech stack.

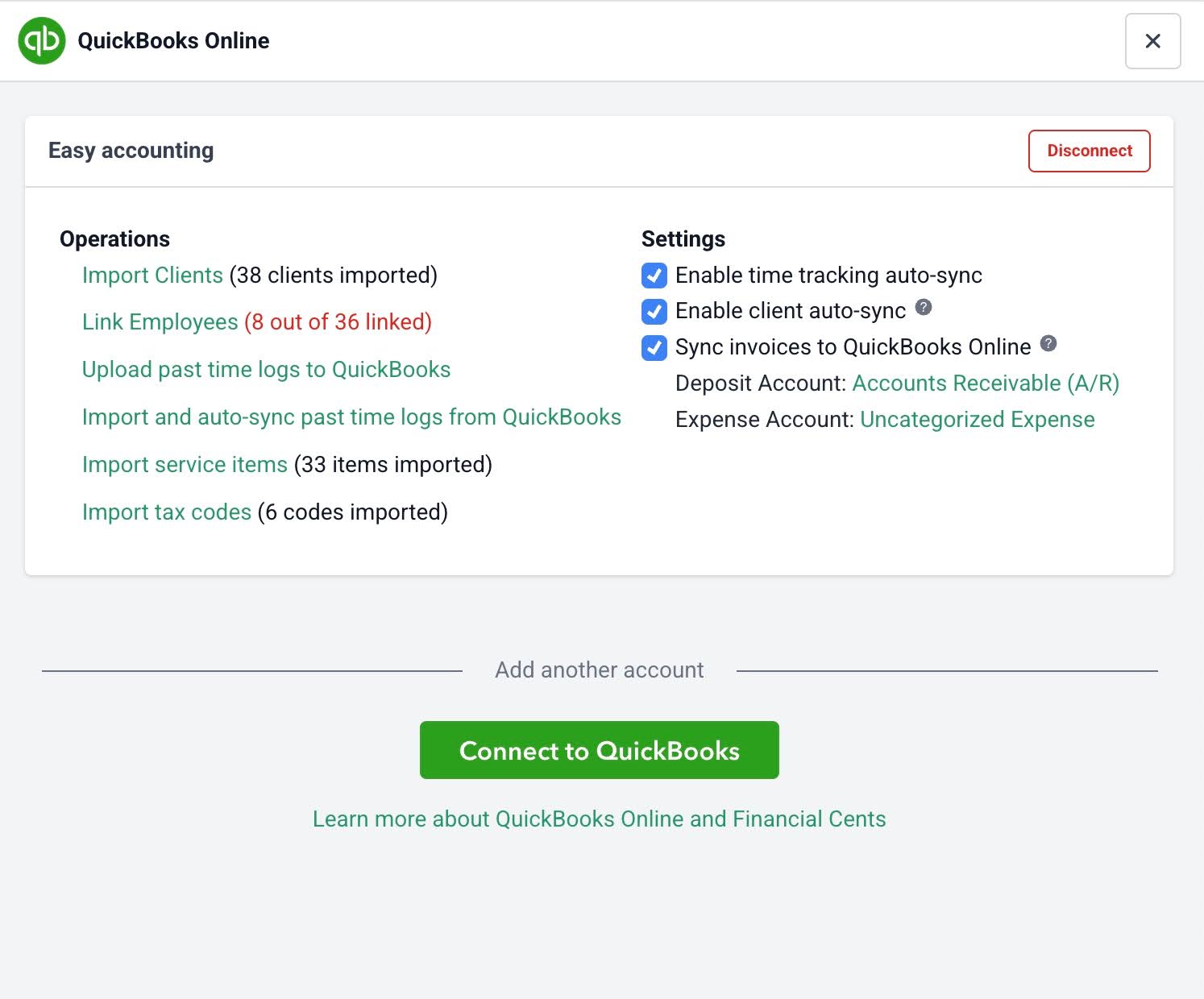

For example, Financial Cents integrates with QuickBooks Online to automatically take client data from your client onboarding tool into your accounting software, preventing double data entry and human errors.

-

Ease of use

A client onboarding tool can’t deliver results when your team or clients cannot complete the necessary tasks, and your team (worse still, your clients) can’t use it if they don’t understand how it works.

That is where ease of use provides a major benefit. The best client onboarding software solutions are intuitive and require minimal training for users to start getting value from them.

Your clients, especially those in low-tech industries like construction, need a simple tool they can navigate without stress, to provide all the information you need to deliver results as soon as possible.

-

Automation

Client onboarding software automates time-consuming and error-prone tasks, like document requests, automated welcome emails, and reminders for incomplete tasks.

When done manually, these tasks can take hours of work each week, which will be a waste of your human resources.

Automation also ensures that no step or information is forgotten, saving you the embarrassment of realizing too late or delivering inaccurate work (due to inadequate client information).

-

Onboarding Kits (Checklist Templates, Content Hub, YouTube Tutorials, Podcasts)

No matter how good your client onboarding process currently is, it can always get better. But you never know what you’re getting wrong until you find the right resources (like templates and tutorials) that show how the program is designed to run and how other people are achieving the results you want to see in your firm.

For example, checklist templates document the tasks (steps) needed to complete a client onboarding project, which standardize your client onboarding workflows to deliver excellence at scale.

-

Security

With the sensitivity of the information that accounting firms handle, the client onboarding software must be able to protect the movement of information between your firm and clients.

Top accounting client onboarding tools have various security protocols that prevent unauthorized access to client information. These include data encryption, multi-factor authentication, and compliance with standards like ISO 27001, SOC 2, and GDPR.

-

Client Dashboard

The client dashboard helps your team understand the status of client onboarding tasks, which prevents onboarding delays.

This shows you, the firm owner, upcoming client onboarding tasks and who’s responsible for what, improving team cohesion and coordination.

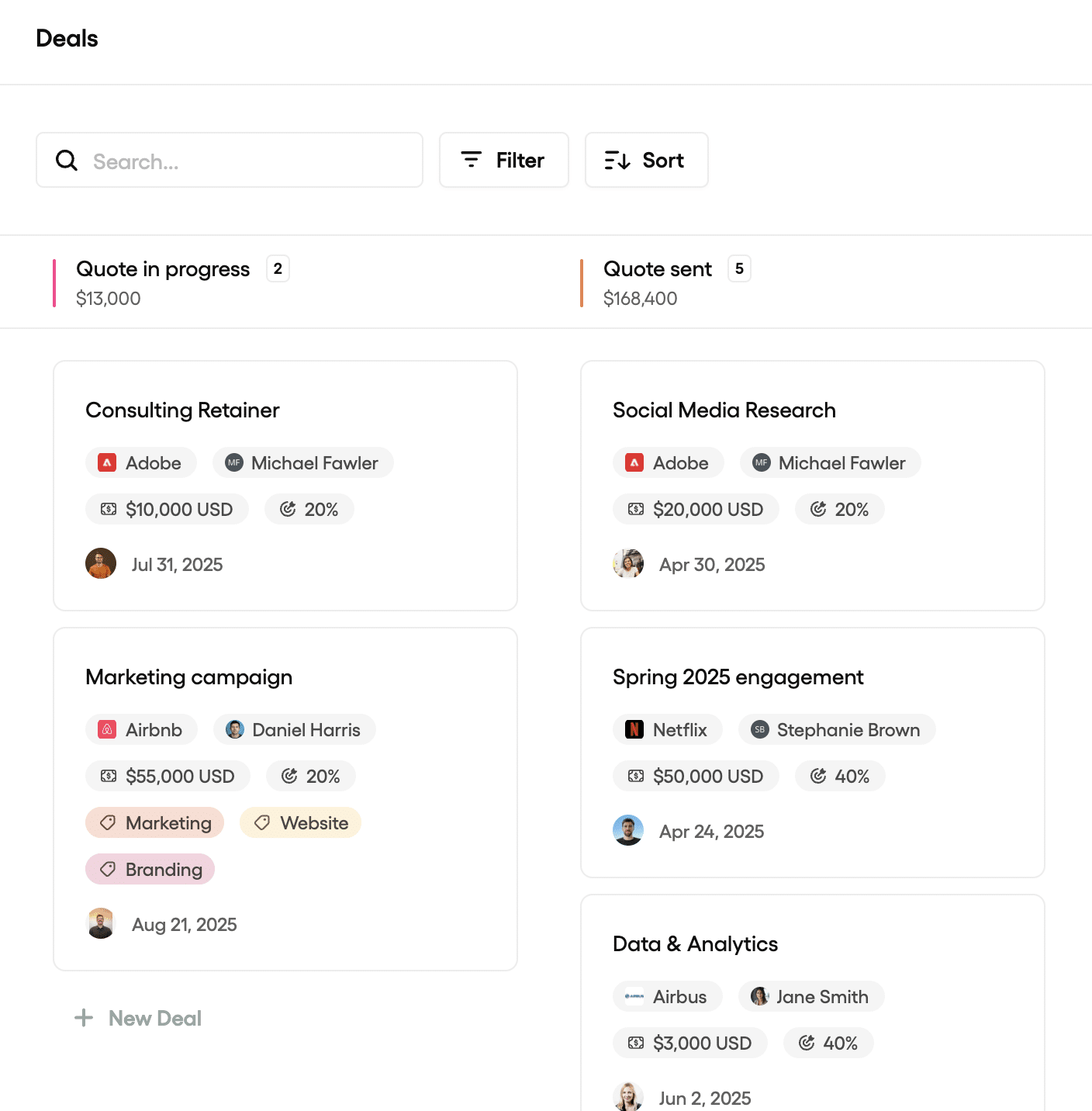

The 10 Top Accounting Client Onboarding Tools for a Smooth Client Onboarding Experience

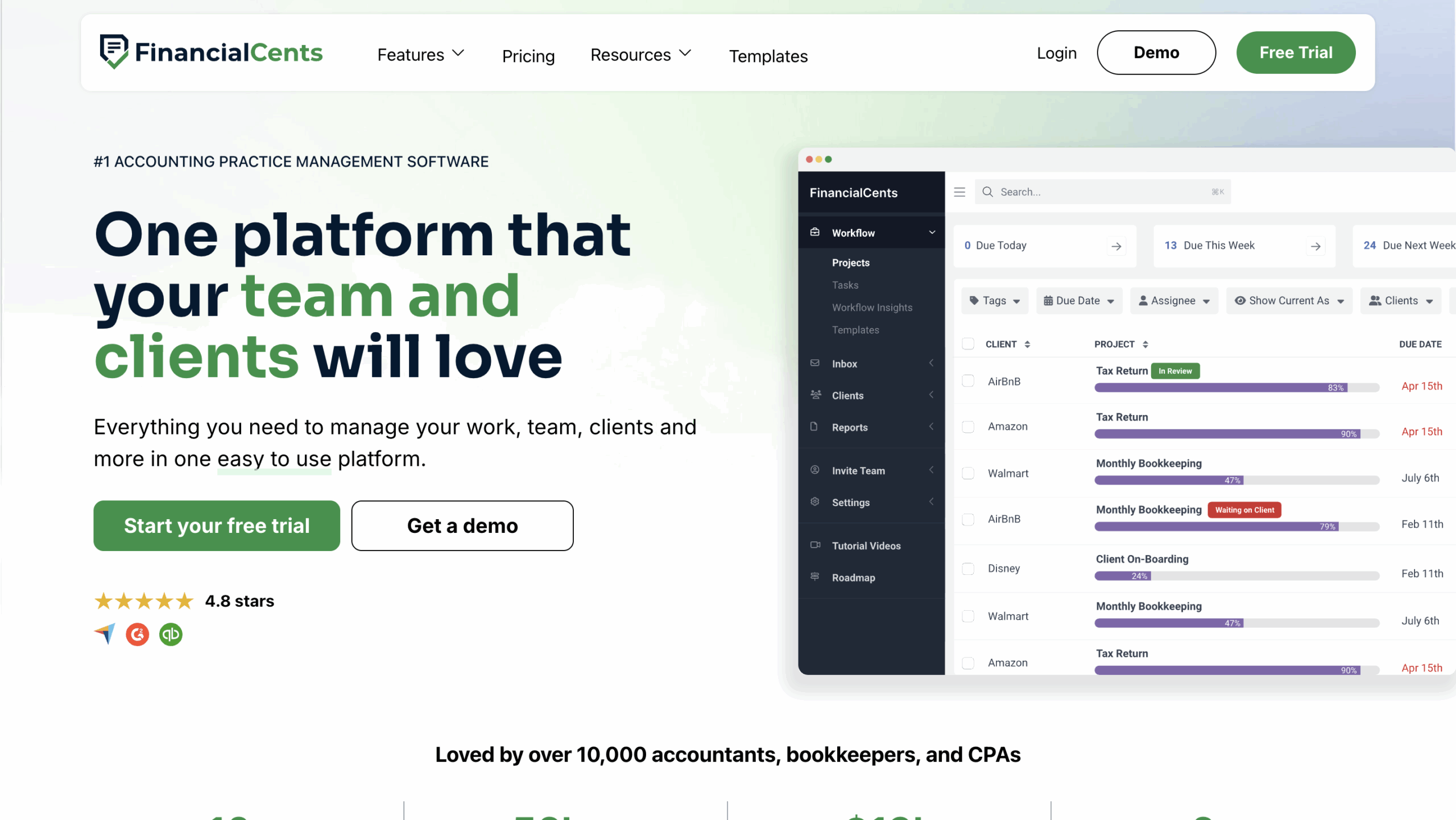

Financial Cents is an all-in-one practice management software that provides everything accounting firms need to manage their clients across the board (from conversion to service delivery and payment collection).

Its client onboarding features enable you to collect client files and information, communicate with clients, set them up in your tech stack, and create and deliver their work.

Here are Financial Cents’ client onboarding features and what they mean:

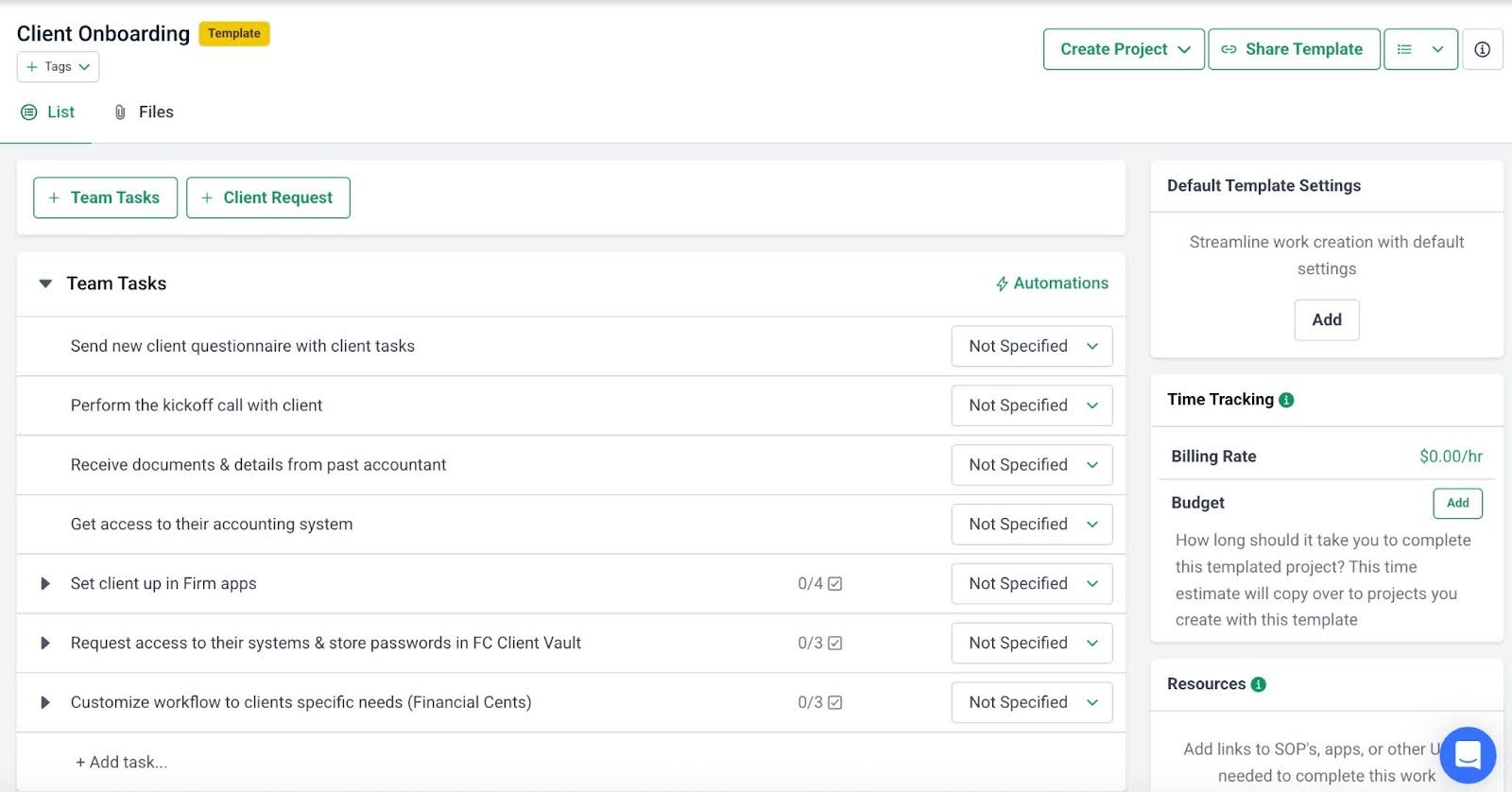

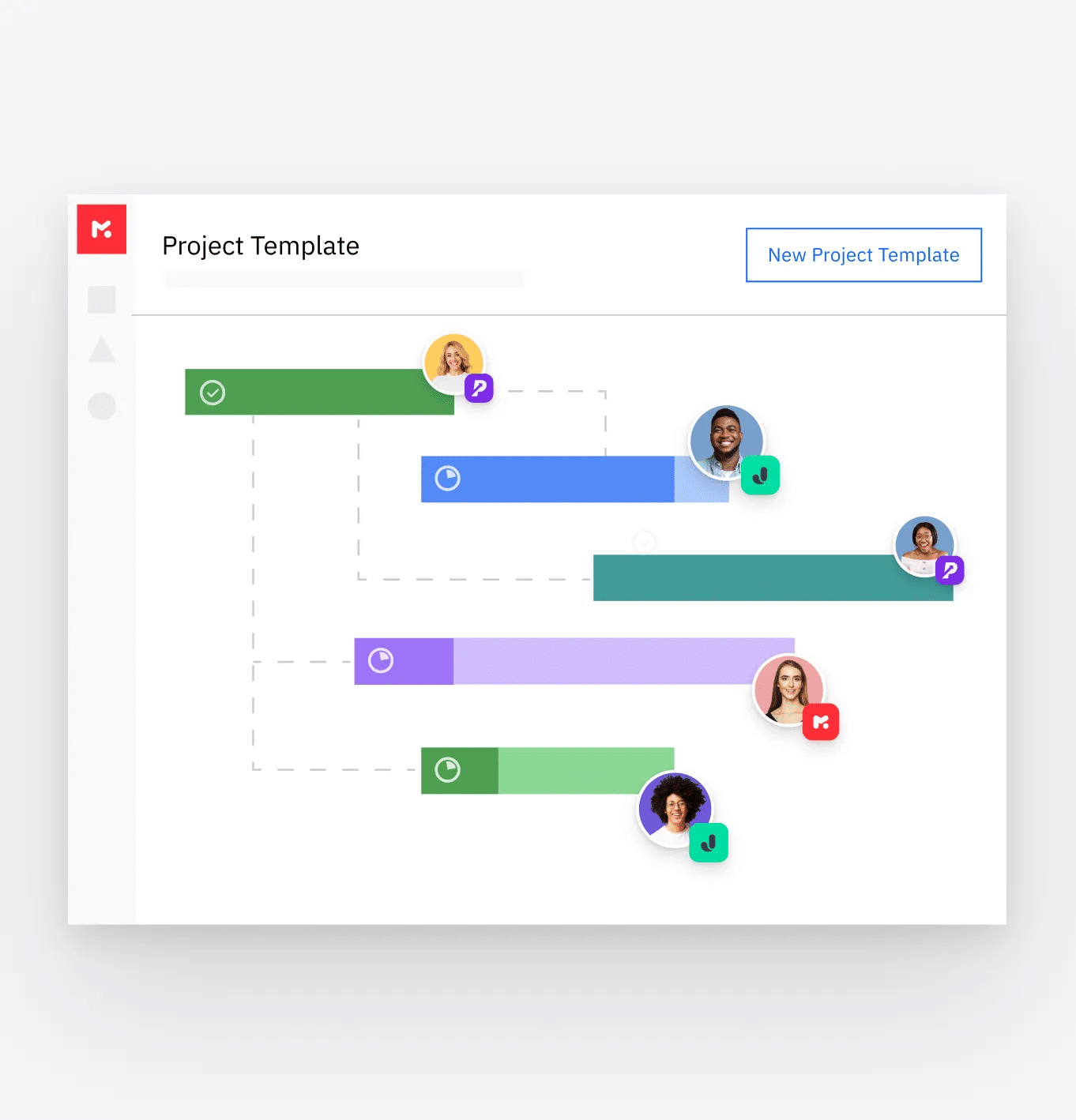

- Onboarding Checklist Templates: Financial Cents’ client onboarding templates can be customized to fit your specific onboarding process, making it easier, faster, and more efficient for your team members to onboard clients.

- Bulk Import Clients from QuickBooks: Enables you to reduce manual data entry and the likelihood of errors by importing your clients in QBO directly into Financial Cents within seconds. This automatically creates client profiles (including their email, phone number, address, and notes) in Financial Cents.

You only need to do this once, as subsequent additions or edits to client information in QBO or Financial Cents will be reflected in the other tool.

- Import Clients (in Bulk) using a CSV File: Another way to quickly add your clients in bulk from any software to Financial Cents. It involves exporting your files to a CSV file and then uploading the file to Financial Cents.

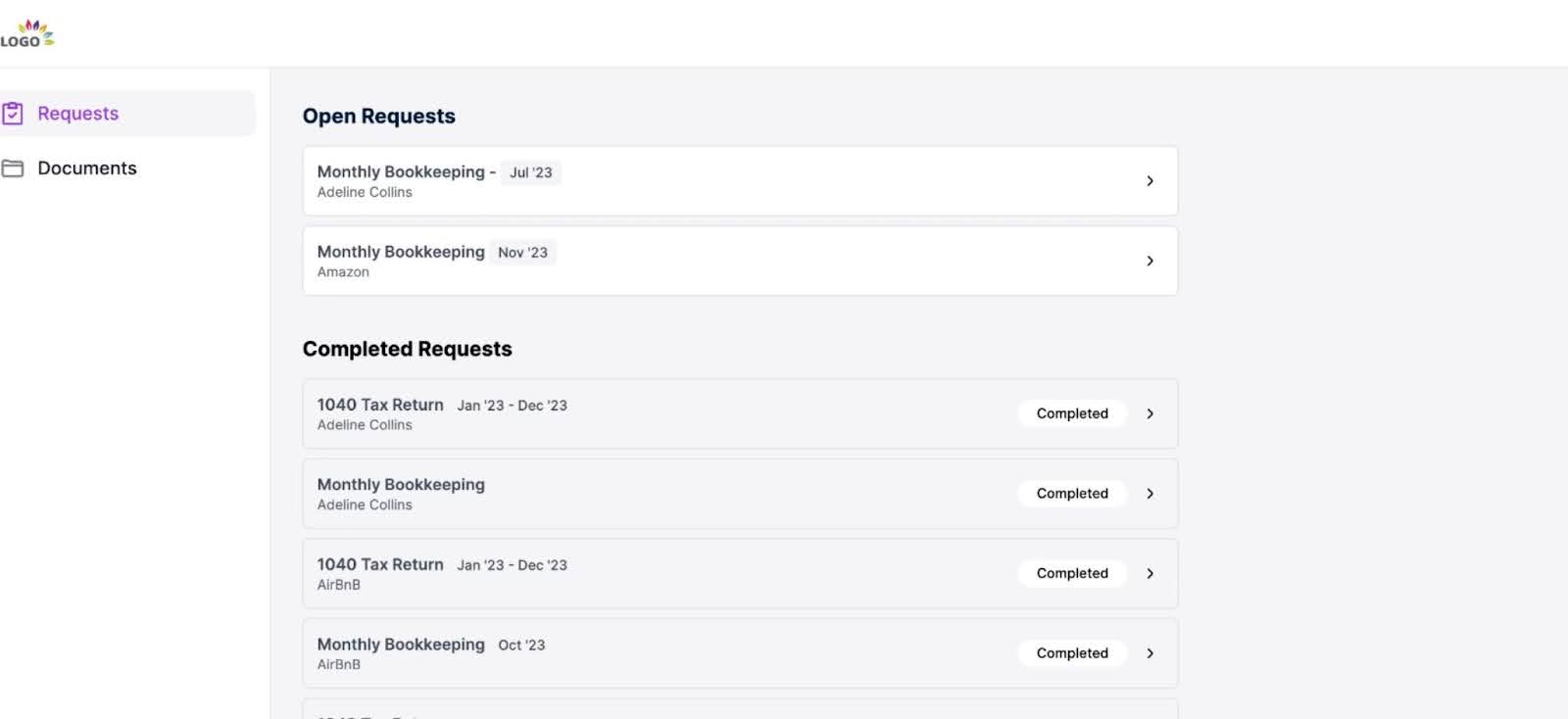

- Client Portal: The Financial Cents client portal provides one location for clients to access their document requests, shared documents, and reports.

The portal is divided into:

-

- Client Tasks & Requests: Shows your requests for documents, e-signatures, or other information necessary to complete the client onboarding process.

- Client Chat: Allows your team and clients to discuss requests and projects. It organizes your client conversations into topics, specifies the team members and the client’s employees who can access the conversations, and enables you to search across the conversations.

Note: The Financial Cents client portal doesn’t require clients to create or manage passwords. Instead, it uses magic link technology to secure the portal, which allows clients to access it without a password.

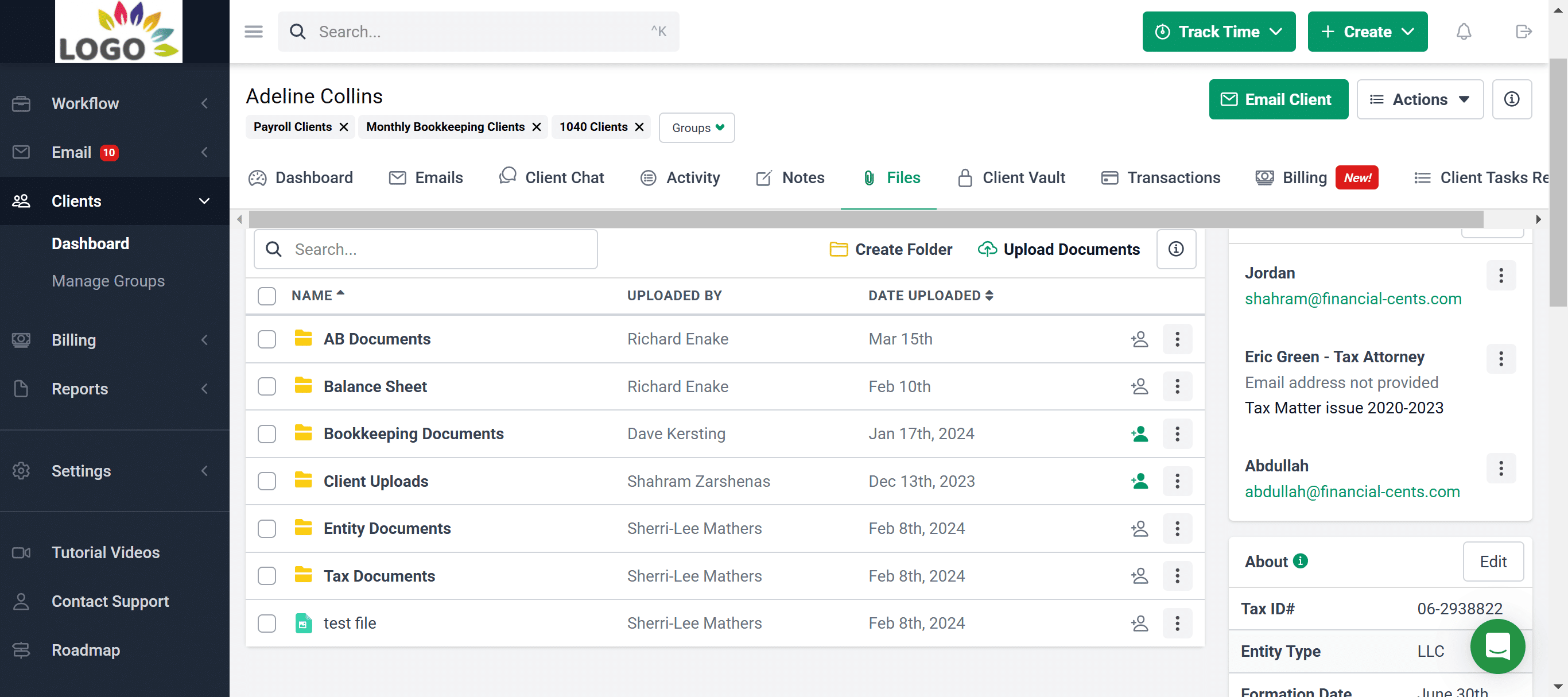

- Document Management System: The Financial Cents Document Management System (DMS) enables you to collect and store client information on the client’s profile, making it easier for your team to access.

Financial Cents document management features include:

-

- DMS integrations: allow you to reroute documents from Financial Cents into third-party DMS tools.

- Folder-sharing: You can share files and folders for clients to access in the client portal.

- Document organization: groups files into more manageable categories for easy retrieval.

- Workflow Management and Automation: Beyond the client onboarding workflow, Financial Cents’ accounting workflow management feature enables firms to assign tasks, manage dependencies, and turn client emails into tasks they can track on the workflow dashboard.

The workflow dashboard shows every project (and its basic information like assignee, client, due date, etc.). It also has a Team Chat feature that centralizes team collaboration to ensure excellent client service.

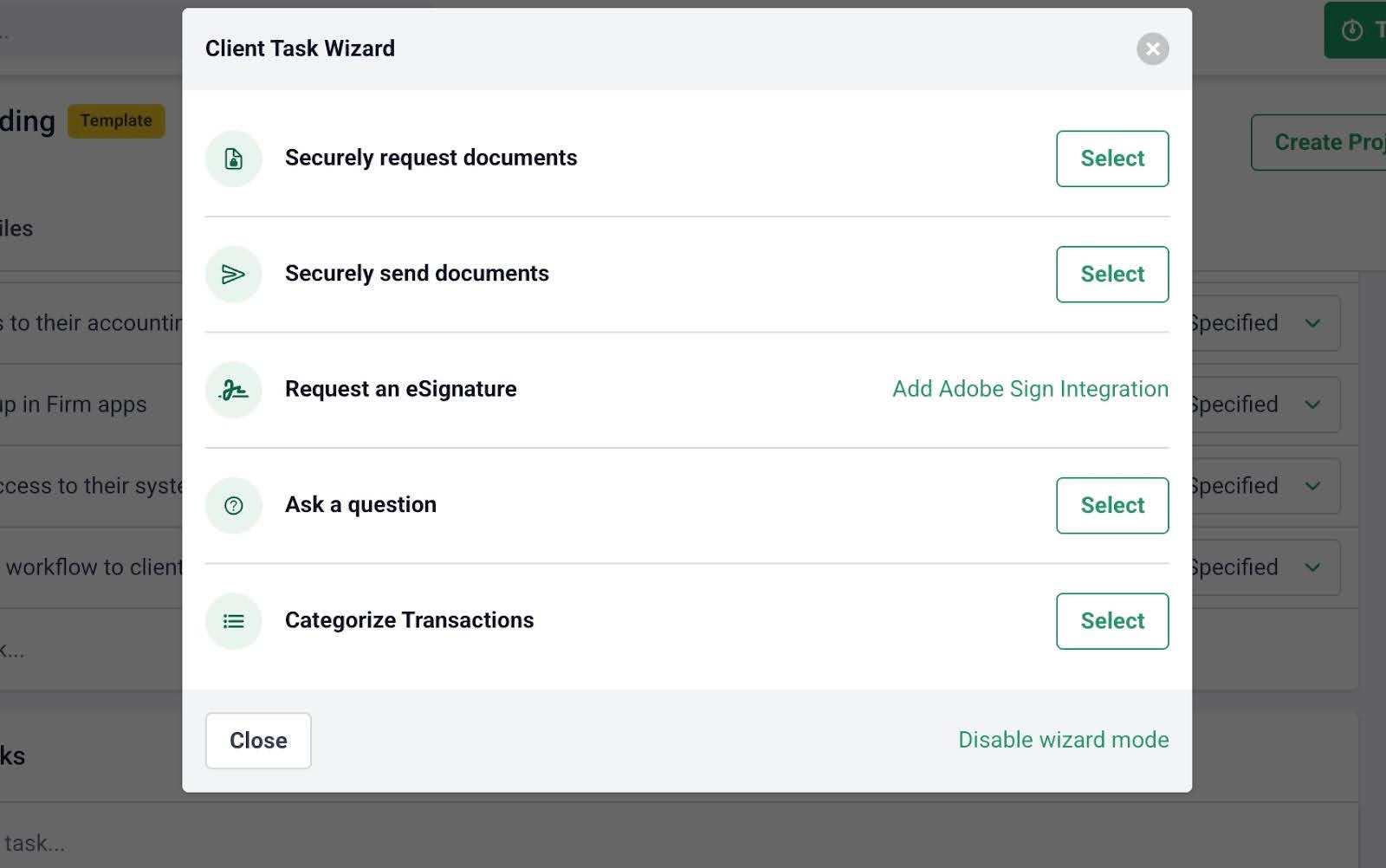

- Adobe E-signature: Financial Cents’ integration with Adobe Sign saves you and your clients the manual work of requesting and signing documents, enabling your clients to sign your proposals, tax returns, and any other documents for clients to sign online.

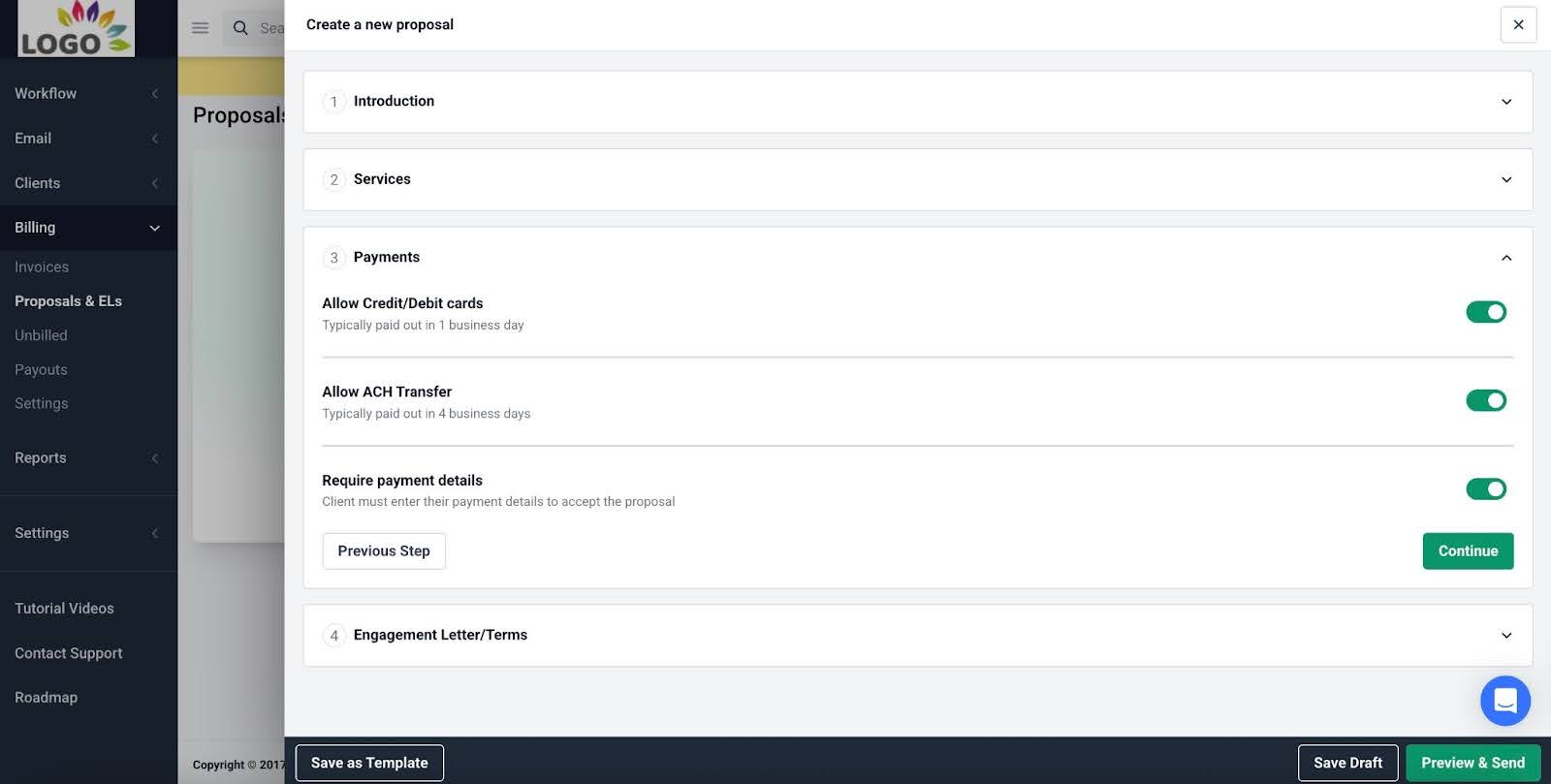

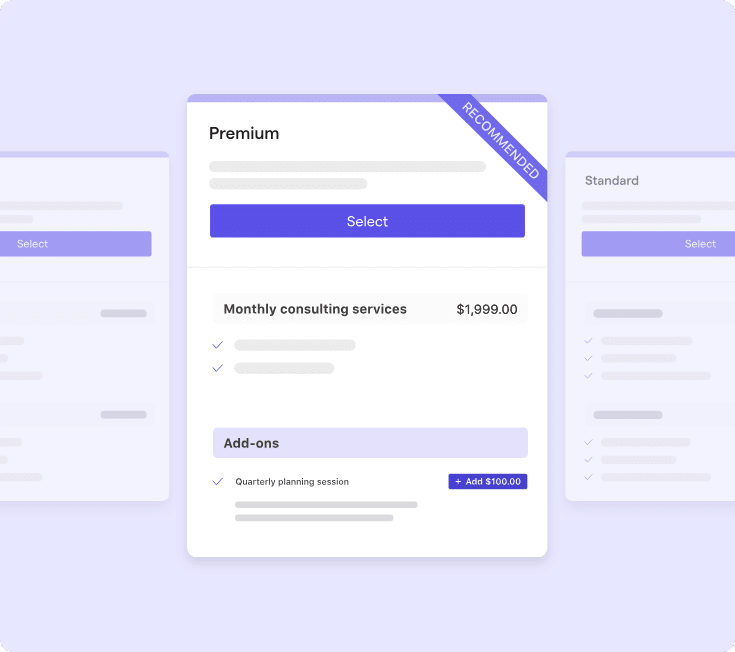

- Proposal and Engagement Letters: The modern proposal and engagement letter solution streamlines and automates client onboarding and billing.

It allows you to:

-

- Send professional proposals & engagement letters.

- Outline and scope your services.

- Collect payment information upfront from the client.

- Let clients electronically sign and agree to your terms.

- Auto-generate and activate invoicing once they sign the proposal.

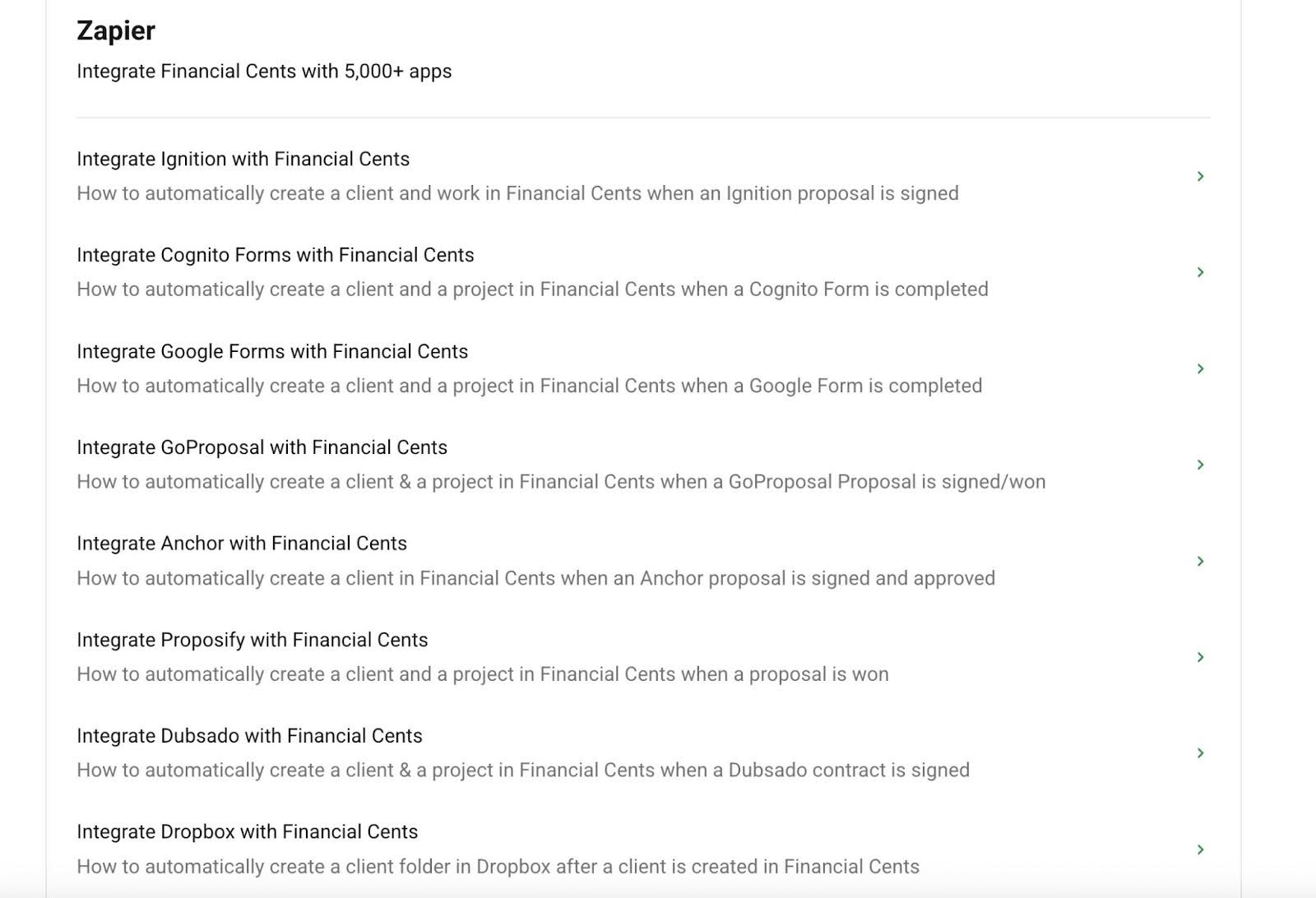

- Access to 5,000+ Other Apps: Financial Cents integration with Zapier enables you to choose from over 5,000 other apps to optimize your client onboarding and service delivery. This includes integrations with Xero, 17hats, Cognito Forms, Google Forms, and Dropbox, among others.

Pros

|

Cons

|

Pricing

- Solo: $19/month per user (Billed annually)

- Team: $49/month per user (Billed annually)

- Scale: $69/month per user (Billed annually)

- Enterprise: Custom

2. Zapier

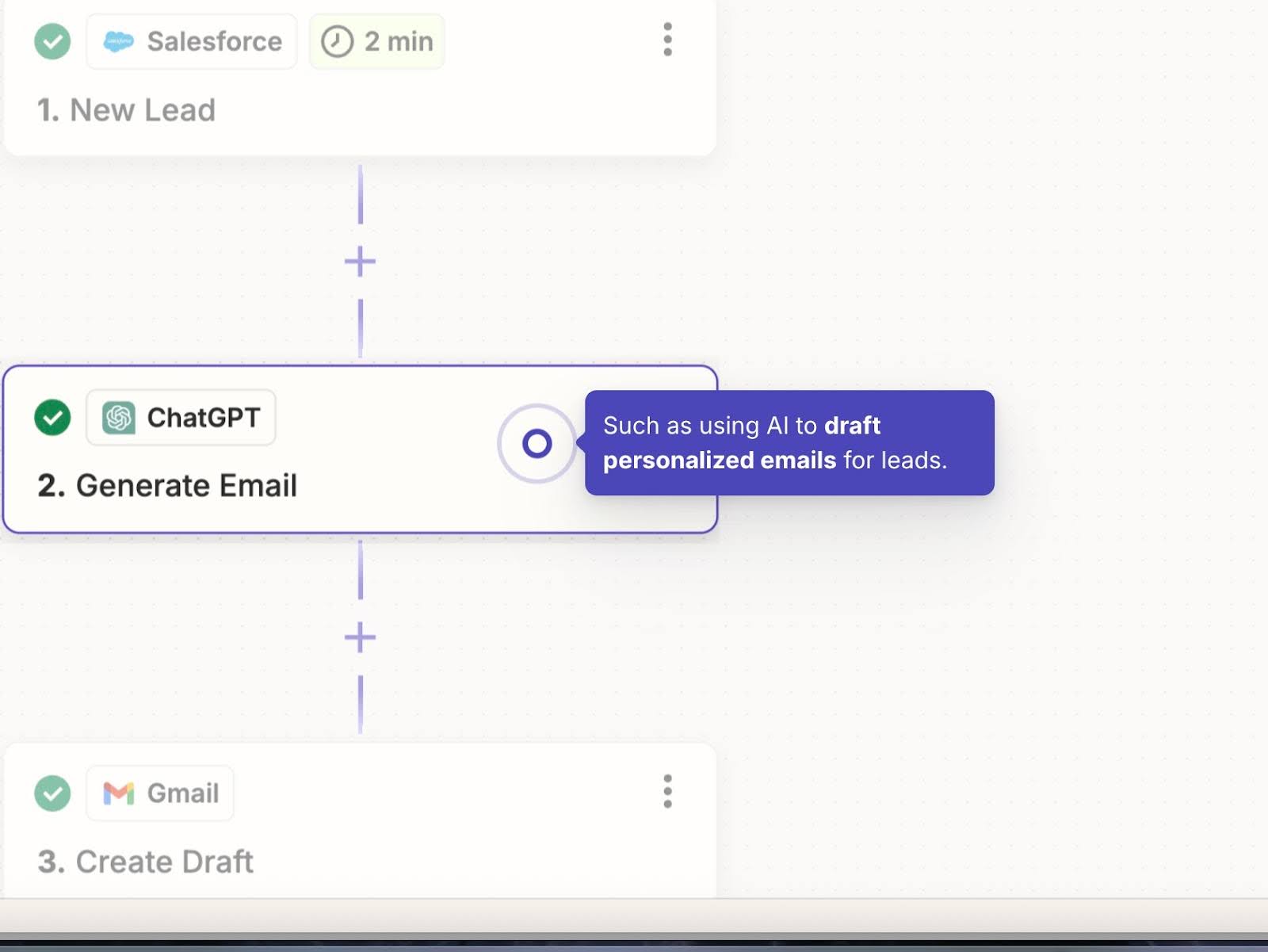

Zapier’s AI orchestration platform automates the accounting client onboarding process by streamlining onboarding tasks and freeing your team to focus on what they do best.

It connects multiple apps to enable a single event (the trigger) to produce a sequence of actions, such as creating a client’s profile in your workflow management software and creating a document folder for the client in your document management software.

Here are Zapier’s client onboarding features and what they do:

- Automatic data entry: Zapier automatically creates a contact in your accounting software when a new client signs an engagement letter in Adobe Sign.

- Triggering workflows: Creates a task list for a client in Financial Cents when a client fills out an onboarding form in, for example, Typeform.

- Centralized communication: Sends a welcome email to clients (via Gmail or Outlook) when clients sign up for your service.

- Update to multiple tools: Zapier pushes your client’s details to your practice management software or dedicated CRM tool.

Pros

|

Cons

|

Pricing

- Free: $0

- Pro: $19.99/month (Billed annually)

- Team: $69/month (Billed annually)

- Enterprise: Contact Sales

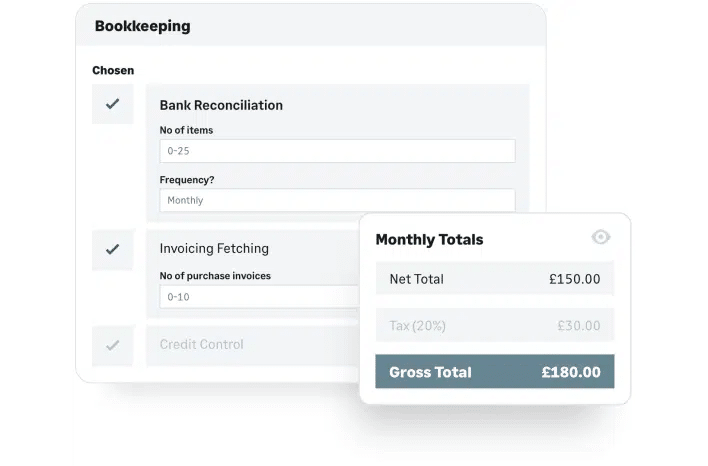

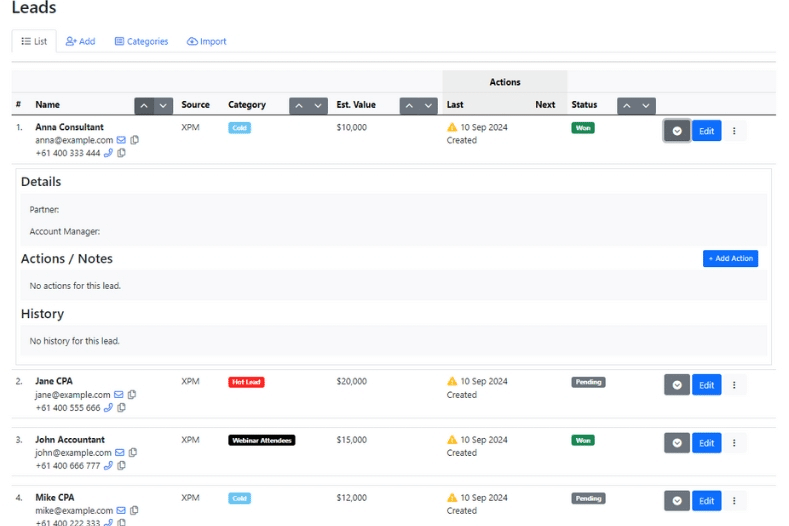

4. Ignition

Ignition is a proposal software that helps service-based businesses, like accounting firms, convert leads into paying clients by automating the lead capture, client proposals, and payment processes.

Thanks to its integration with Financial Cents, you won’t only close deals faster, but you can also create projects and assign tasks to team members once clients accept your proposal. This speeds up your onboarding workflows and improves client experience.

Here are Ignition’s client onboarding features and what they do:

- Deals pipeline: Allows you to view, manage, and automate your sales pipeline.

- Proposals: Branded online proposals that are quick to prepare and easy for clients to sign.

- Automatic invoicing and collections: Automatically invoices your clients to increase your likelihood of getting paid on time.

- Billing: Centralizes your client billing in one place, making it easier to manage payment challenges.

- Branded forms: Online forms that ease data collection and enable you to qualify prospects effectively.

- Integration with Accounting Practice Management: Ignition integrates directly with Financial Cents to streamline your client onboarding, project creation, and ongoing service delivery.

- Intuitive business dashboard: Provides visibility into your data (sales pipeline, upcoming client payments, and projected revenue) to make the business more profitable.

Pros

|

Cons

|

Pricing

- Solo: $39/month

- Core: $99/month

- Pro: $229/month

- Enterprise: Custom pricing

4. GoProposal

GoProposal makes it easy for accounting firms to align expectations early with a user-friendly interface that can be populated while you’re still in the meeting with the client.

Its consistent pricing system provides an easy-to-read menu of accountancy services that your clients can choose from to help them understand the costs from the beginning.

Here are GoProposal’s client onboarding features and what they do:

- Proposal Templates: Professional proposals that match your accounting niche and make it easier and faster to sign while in the meeting.

- Line items: Configures accounting services and prices for each client’s unique needs by breaking down services and associated costs.

- Integrations: Integrates with accounting software solutions to create a seamless and efficient experience for you, your client, and your team.

- Contract Hub: Centralizes all clients’ proposals, anti-money laundering and historical contact information in one place to enable your team to personalize client service.

- Pricing and Services: Enhances flexibility with pricing calculations on line items that increase service pricing in bulk.

Pros

|

Cons

|

Pricing

- Solo: £70 per month

- Basic: £100 per month

- Standard: £140 per month

- Premium: £225 per month

5. Uniify

Uniify simplifies client information gathering to meet KYC, KYB, and credit assessment requirements, saving time and improving client experiences.

It also provides compliance checks and data integration tools to improve operational efficiency and customer satisfaction.

Here are Uniify’s client onboarding features and what they do:

- Unlimited workflows: Build onboarding flows to convert new customers and personalize their onboarding journey.

- Multiple integrations: Integrate Uniify with other accounting apps to create consistent onboarding experiences using a no-code feature.

- Dynamic redirects: Send clients to a website (where necessary) based on their response to your form questions.

- E-mail invites: Share personalized onboarding workflows with your new clients to move them along in the process.

- Basic form elements: Capture diverse client data by adding input fields, expansive text areas, and dynamic HTML fields to your forms.

- File uploads: Uniify’s multi-file upload fields give your clients flexibility with file uploads.

Pros

|

Cons

|

Pricing

Custom pricing based on:

- Number of clients onboarded annually.

- Features required (e.g., advanced compliance checks, AML add-ons, or additional integrations).

- Firm size and complexity of onboarding workflows.

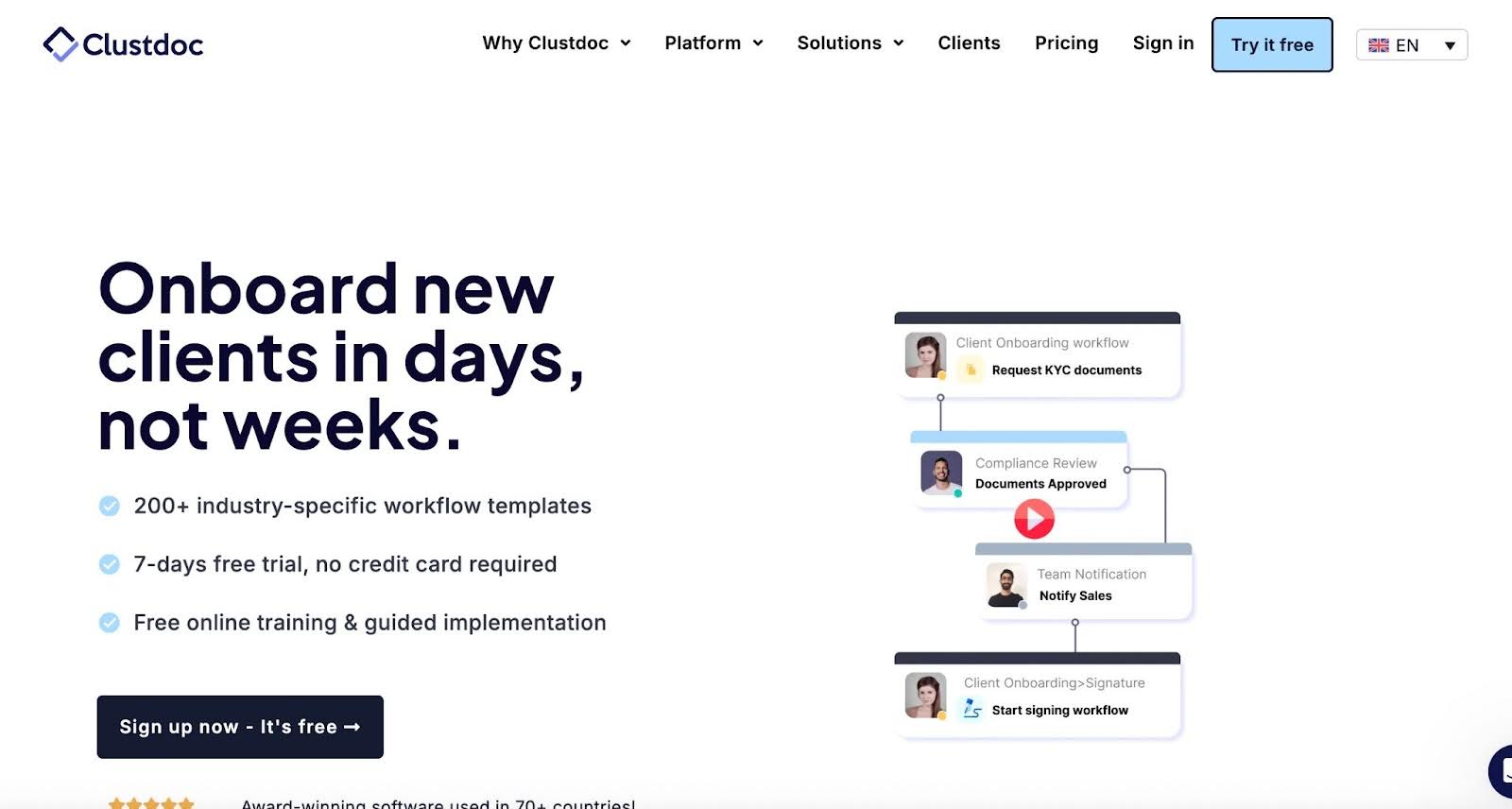

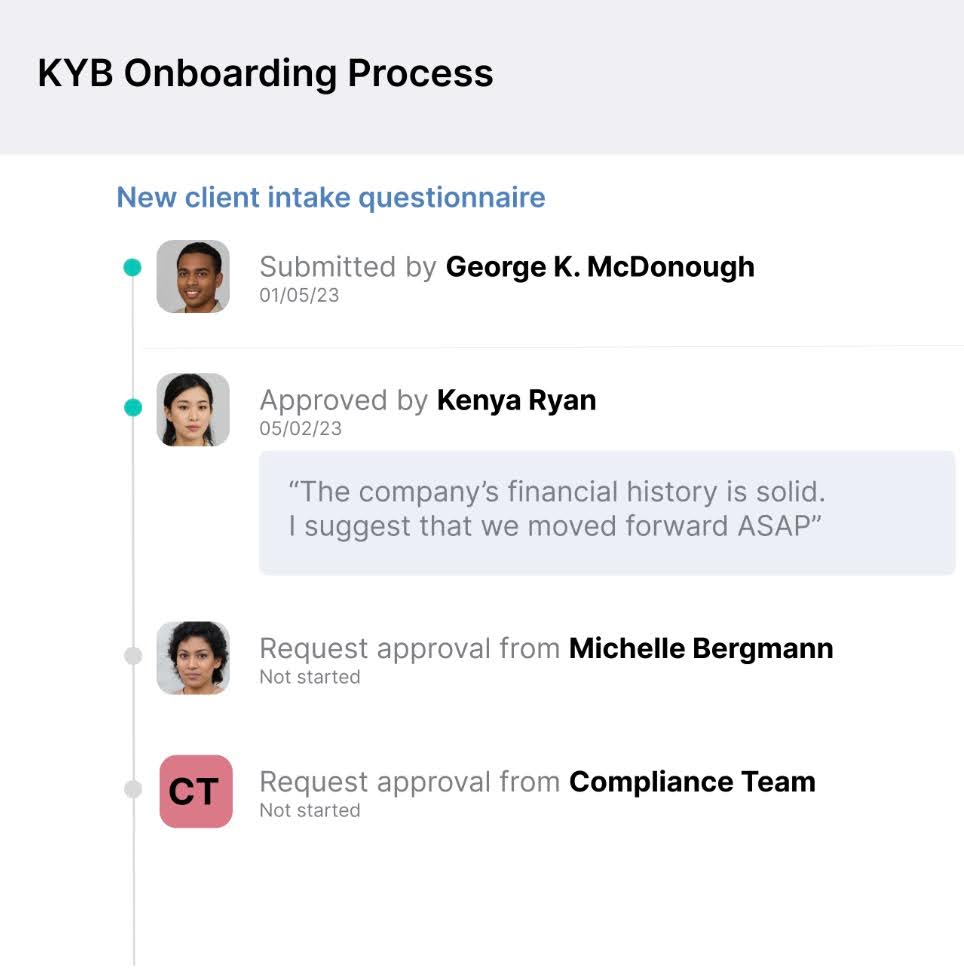

6. Clustdoc

Clustdoc is a client onboarding and document collection software that enables accounting firms to complete the process in days, instead of weeks.

Its 200+ workflow templates make it easier for these businesses to deliver a consistent and professional onboarding experience.

Here are Clustdoc’s client onboarding features and what they do:

- Data Capture: Collects new clients’ key information using embedded forms.

- Document Collection: Dynamically request client files, based on the client’s profile, context, or situation.

- E-signature: Enables clients to sign multiple documents sequentially based on preceding onboarding steps.

- Approvals: Centralize internal approvals to keep everyone on the same page.

- Shared Inbox: Brings all client onboarding-related interactions into a single place to enable your team to handle all client communication from one inbox.

- Client Portal: Allows clients to access, share, and complete onboarding documents or tasks with you and your team.

Pros

|

Cons

|

Pricing

- Pro: $190/month

- Expert: On quote

- Ultimate: On quote

7. Rocketlane

Rocketlane is a client onboarding software that helps onboarding and professional services firms collaborate with customers.

By giving you detailed insights into the progress of your onboarding projects, it empowers your team to deliver excellent client onboarding consistently.

Here are Rocketlane’s client onboarding features and what they do:

- Project Forms: Creates and embeds forms directly into projects to collect structured information from your clients.

- Onboarding templates: Reusable workflows that standardize your onboarding processes.

- Files: A central location for storing and sharing information with clients.

- Conversations: Project or task-related discussion threads that prevent information silos.

- Shared client portal: Branded portal that allows clients to view progress, tasks, and timelines.

- Real-Time co-editing: Enables teams and clients to collaborate on documents in Rocketlane.

Pros

|

Cons

|

Pricing

- Essential: $19/month per team member (billed annually)

- Standard: $49/month per team member (billed annually)

- Premium: $69/month per team member (billed annually)

- Enterprise: $99/month per team member (billed annually)

8. Seamlss

Seamlss is an Australian client identity verification and engagement tool that helps service providers get client onboarding right in compliance with the ATO.

Its suite of features helps accounting firms collect and verify clients, obtain digital signatures on engagement letters, and securely store client data in a way that saves time and resources.

Here are Seamlss’s client onboarding features and what they do:

- Secure identity verification: A bank-level, encrypted, and two-factor authenticated system that verifies clients’ identities securely and reliably.

- Xero Practice Manager Integration: Integrates with Xero Practice Manager to improve your workflows and reduce human errors.

- Customizable engagement templates: Templates that enable firms to personalize their engagement letters to improve client experience.

- Bulk identity checks: Bulk importer feature that performs multiple client identity checks at the same time.

Pros

|

Cons

|

Pricing

- Essential: $50/Month (AUD)

- Power: $75/Month (AUD)

- Premium: $100/Month (AUD)

9. Bonsai

Bonsai centralizes client information to help your team add them to relevant systems from the beginning through project delivery.

Its features enable you to close more deals, collaborate, and provide a consistent client experience.

Here are Bonsai’s client onboarding features and what they do:

- Unified client management: Organizes lead and client information in color-coded fields that you can filter to find information faster.

- Sales pipeline: Displays your sales process with customizable pipeline stages.

- Automations: Automated workflows that trigger actions like document reminders.

- Documents: Contracts, proposals, and agreements that are pre-filled with the client’s data to ease documentation.

- Client portal: Allows clients to view their documents and communication through a branded portal experience.

Pros

|

Cons

|

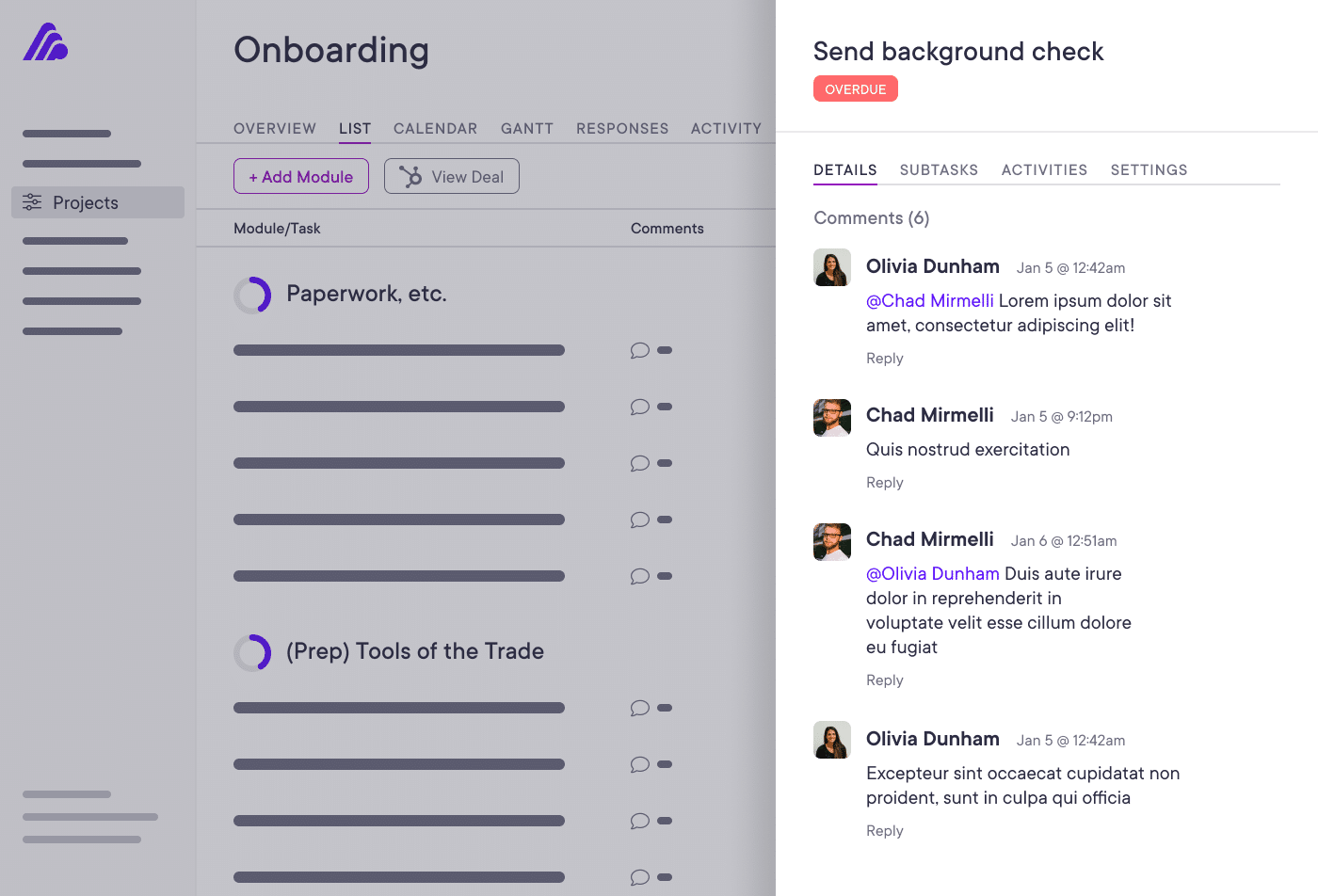

10. OnRamp

OnRamp’s client onboarding solution provides workflows, scalable playbooks, and real-time automation that reduce your client’s time to value.

It balances a simple and intuitive client experience with the project management and reporting tools your team needs to be more productive.

Here are OnRamp’s client onboarding features and what they do:

- Personalized client portals: customizable portals that dynamically guide every client project from start to finish.

- Insights & progress trackers: Provide visibility into workflows to increase successes and eliminate blockers, and improve time-to-value.

- Automated sales-to-CS handoffs: Auto-creates projects for new clients in your CRM to ease client hand-off.

- Reusable projects & playbooks: Enables you to customize your playbooks for each client’s unique service needs.

- Triggered follow-ups: Automated reminders and notifications that keep everyone informed and accountable for their tasks

Pros

|

Cons

|

Pricing

Custom pricing based on:

- Number of Playbooks

- Number of Customer Accounts

- User Types

How to Choose the Right Tool for Your Firm

If you want to avoid the mistakes that make many firm owners miss out on the benefits of a client onboarding software, do the following even after getting a suitable tool:

-

Match features to your workflow and team size

Client onboarding looks different for firms depending on the services they offer and their workflow setup.

For example, a CPA firm’s client onboarding process should have more tasks requiring automation and integration with third-party tools than a strictly payroll processing firm.

That is why your choice of a client onboarding tool has to be informed by the level of alignment between the tool’s features and your specific workflow needs.

Otherwise, you’ll waste more time and energy creating workarounds that never work or paying for features that you don’t need.

-

Consider ease of setup and adoption

A complex setup process delays software adoption and time-to-value.

Ensure your client onboarding software has an intuitive interface, easy-to-understand training materials, and responsive customer support, so your team can start using it immediately.

That is why we’ll never get tired of recommending demos and free trials. They give your team an inside peek at what to expect in a client onboarding software before you commit your money and time to it.

-

Look for integrations with your current tools

Effective integration interconnects your tech stack to prevent workflow delays, eliminate information silos, and speed up onboarding success.

Your client onboarding tool should either connect with the other apps in your tech stack natively or through Zapier, which allows you to leverage thousands of other mission-critical apps.

-

Evaluate client-facing experience to be sure your clients find it easy to use

It is easy to forget the client’s experience when choosing apps, but the client onboarding tool (especially the client portal) should be easy for clients to use for communication, E-signature, and uploads, etc.

Otherwise, you might not have many clients to onboard in the first place because they’ll be unable to share the files and information you need to set them up for satisfactory client service.

Three Tips for Streamlining Client Onboarding for Accounting Firms

If you are implementing a client portal software, think about your client’s industry. Don't buy a tool with all the bells and whistles, but it's super complicated to use.

If you're serving an industry like construction, where tech skills aren't incredibly high, and people aren't naturally tech-savvy, try to find a solution that matches your client and their team."

-

Prioritize scalability

You shouldn’t have to overhaul your tech stack as your firm grows to a certain point, which is what will happen if you don’t prioritize scalable client onboarding software over those that are only good for your current stage.

Your client onboarding software should be able to handle the onboarding process involving multiple clients and team members without overshooting your budget for features you currently don’t need.

We wanted a software solution that could scale with us. I like Financial Cents because it targets the accounting industry. It provides the structure that enables scalability.""

Stacey Feldman, CPA, Chief Operating Officer at Full Send FinanceTips for streamlining client onboarding for accounting firms

Sometimes, successful client onboarding requires more than simply getting the best tool for your firm. You also need the right systems to make the most out of it.

These practices will help you make your client onboarding a lot more effective:

I. Use Pre-Built Templates and Checklists

Workflow templates standardize the client onboarding process (and other related tasks like proposals, engagement letters). It also saves your time and ensures consistent client experiences.

To maximize them, document and save your standard operating procedures for your client onboarding tasks in your practice management software. With a tool like Financial Cents, you don’t have to do this from scratch.

You’ll get pre-built templates for your client onboarding (and other accounting) processes that you can customize and make your own.

II. Use Onboarding Questionnaires to Know Your New Client Better

Client Onboarding questionnaires help you understand your new client’s needs, goals, and preferences more deeply.

For example, asking how their previous accountant addressed their challenges can help you understand what can be done differently. This can keep you from deploying the tactics that might have failed.

You can find engaging questions to ask your new clients in our free client questionnaire template.

Client onboarding questionnaires help you understand the context you need to tailor your services to your new clients.

III. Automate Routine Tasks

Tasks like the creation and sending of welcome emails, document requests, and task notifications do not need to be done manually.

Automating these tasks enables your staff to focus on aspects of the onboarding process that need a human touch.

Use Financial Cents’ automated reminders to follow up on missing documents and the workflow automation feature to auto-update clients on progress.

IV. Centralize Document Collection with a Client Portal

The client portal not only makes client collaboration easier; it also centralizes all your documents, organizing them in one place.

This shows your team members what the client has provided and what is left. That way, they don’t have to make the same request multiple times.

With the Client Chat in the Financial Cents client portal, your clients can also ask questions to gain clarity.

When they are done uploading the files, Financial Cents will organize these documents in the client’s profile and the relevant projects for quick access.

V. Test and Refine the Process

You not only need to update your client onboarding workflow, but you also need to always be on the lookout for better ways to do it.

One way to do that is by asking clients for feedback on your processes. Another way is to visit the Financial Cents templates library as often as you can.

The templates library is a community of firm owners who are sharing their most efficient accounting workflow processes to help each other succeed.

Turn New Clients into Raving Fans with a Seamless Onboarding Process

According to IBIS World, there are over 85,000 accounting firms in the U.S. The numbers may be different in the U.K., Canada, and other countries, but one thing is sure: there are thousands upon thousands of other accounting firms your new clients could be using right now, but they chose you.

An efficient client onboarding process is your first step towards repaying that trust in your brand, while also improving your chances of referrals.

Satisfactory client service (which begins at onboarding) is your surest source of referrals. That is because business owners are more likely to ask their friends and network for recommendations for accounting firm owners.

Accounting firm owners chose Financial Cents because it not only simplifies their onboarding process but also empowers them to deliver client services that satisfy their clients and build quality client relationships.

Financial Cents enables me to set up templates for projects. This helps me set my new clients up when I’m bringing them on. Doing this with those templates helps me see what they might have missed."

Phil McTaggart, Founder SALAS Inc.Make your client onboarding easier, more modern, and professional today. Start with our 14-day Free Trial.

Excellent article!