You cleaned up their books, categorized every expense, reconciled accounts, and maybe even chased down a few missing receipts. Now it’s time to get paid.

But if your invoice doesn’t clearly show what was done, how much it costs, and when payment is due, clients may delay payment or come back with questions, slowing down collections and affecting your cash flow.

A well-organized invoice reflects the same attention to detail you bring to your client work. It shows that your processes are solid, and it helps you avoid unnecessary follow-ups so you can stay focused on actual client work.

In this guide, we’ll walk you through how to create a professional bookkeeping invoice and give you a free Excel and Google Sheets template to get started. Prefer a faster, automated process? We’ll also show you how to streamline billing with Financial Cents.

Why You Need a Professional Bookkeeping Invoice

Before we get into how to create your invoice, let’s talk about why it actually matters. A well-designed invoice has so many benefits:

1. Builds Trust with Clients

A professional, well-structured invoice shows that you’re organized, transparent, and take your work seriously. It answers key questions before they even need to ask:

- What work is this invoice for?

- How much do I owe?

- When is payment due?

- How do I pay?

- Who do I contact if I have questions?

When clients don’t have to follow up or second-guess your invoice, they’re more confident in your services and more likely to continue working with you long-term.

2. Reduces Disputes

No one enjoys going back and forth with a client about what was billed, why it was billed, or whether it was included in the agreed scope. But that’s exactly what happens when invoices are vague or missing key details. Clients are more likely to push back, delay payment, or hit you with follow-up questions like, “Was this part of our agreement?”

A professional invoice prevents all that. It clearly states what work was done, when it was delivered, how much each service costs, and the payment terms. That way, clients don’t have to guess, and you’re not stuck justifying your pricing or scope after the fact.

For example, instead of writing “Bookkeeping services – $900,” list exactly what you did, like reconciliations, transaction categorization, and financial reporting. It gives clients clarity, sets expectations, and helps keep payments on track with less friction.

3. Ensures Clear Documentation and Recordkeeping

Your invoices are part of both your firm’s and your client’s official financial records. Each one serves as a documented summary of the services delivered, how much was charged, and the terms agreed to. And having all of that clearly laid out saves you time down the line.

Well-structured invoices make it easier to track revenue by service, client, or time period, which is especially useful when reviewing profitability or identifying where to focus your efforts. They also make audits, reconciliation, and preparing financial statements faster and less stressful.

4. Makes End-of-Month and Tax Season Easier

When it’s time to close the books at the end of the month or prep for tax season, your invoices become some of the most valuable records you have. A clear, well-documented invoice makes it easy to see what was billed, when it was billed, and what services were delivered, without relying on memory or digging through emails to figure it out.

Invoices with service dates, detailed descriptions, and totals help you quickly calculate monthly income and confirm completed work. And when tax season rolls around, those same invoices provide a reliable paper trail to report earnings, answer questions, and prepare financial statements accurately. No scrambling, no guesswork—everything’s already documented.

Professional invoices help you stay organized, save time, and reduce stress when reporting, reconciling, or filing taxes.

5. Get Paid Faster and Improve Cash Flow

The clearer your invoice, the quicker your clients can review, approve, and pay. And when payments come in faster, your cash flow improves. You’re not left chasing down payments or wondering if you’ll have enough to cover expenses. You have the funds to pay your team, invest in tools, or just breathe a little easier.

It might seem like a small thing, but a well-crafted invoice can make a real difference in how quickly you get paid, and how smoothly your business runs as a result.

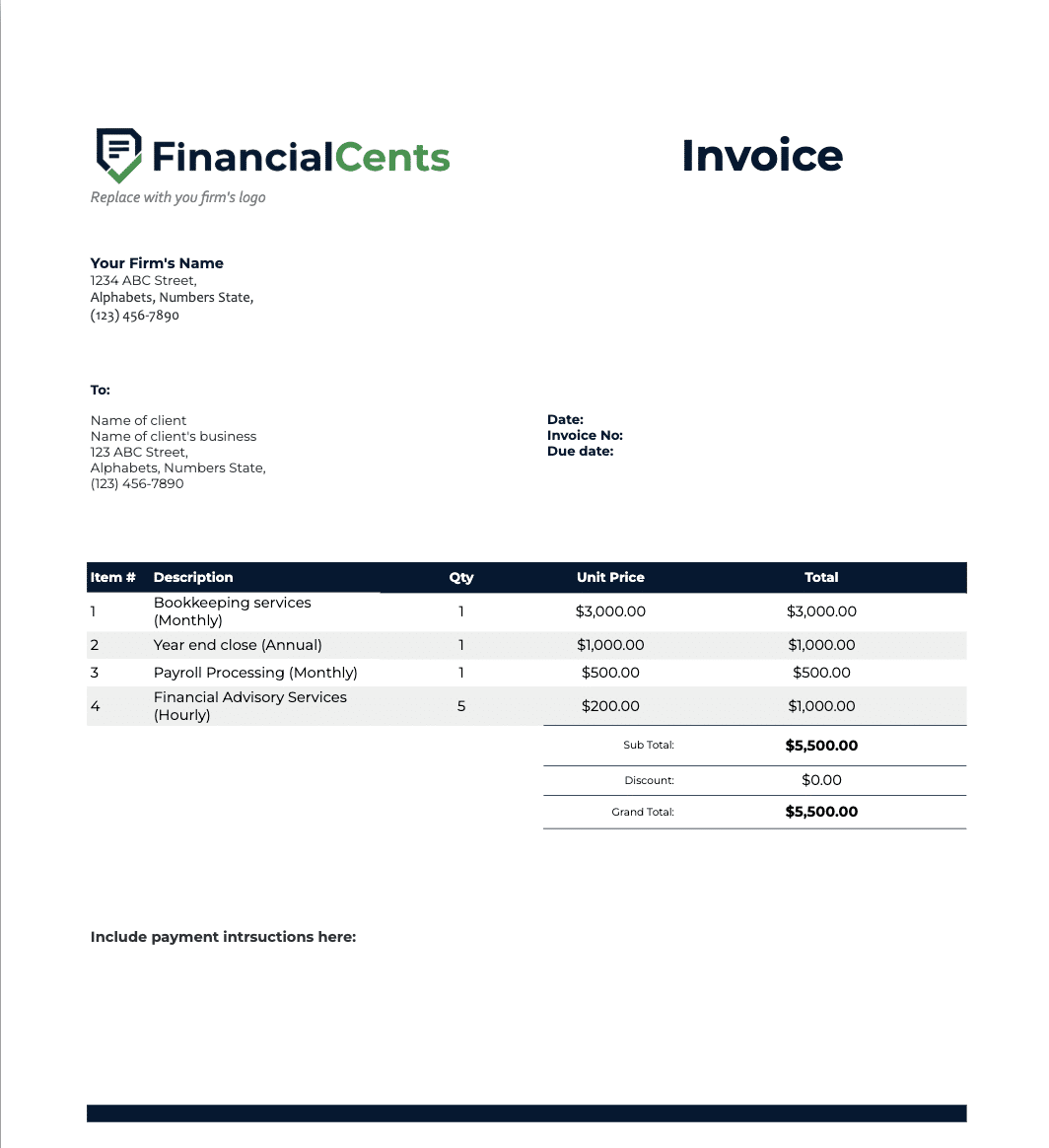

What You Should Include in Your Bookkeeping Invoice

Now that you know why having a professional invoice matters, let’s break down what actually needs to be on it.

Your Logo and Business Information

Start with your firm’s name, logo, and contact details (email, phone number, and address). This adds credibility and helps clients recognize the invoice instantly. A logo isn’t mandatory, but it makes your invoice look polished and official.

Client Name and Address

Include your client’s name or business name and billing address. This helps you keep records straight and adds a layer of personalization and clarity, especially if you work with multiple departments or contacts at the same company.

Invoice Number and Date

Every invoice should have a unique number and an issue date. This makes tracking easier, prevents confusion, and is essential for proper recordkeeping. For instance, if a client ever asks about “that $800 invoice from March,” you’ll be able to easily find it with the invoice number or date.

Description of Services

Add a specific description of the services you rendered. Remember, the more detailed you are, the fewer questions you’ll get and the faster you’ll get paid.

Hourly Rate or Flat Fee

Make it clear how you’re charging: hourly or fixed. If hourly, list the number of hours and the rate. If it’s a flat fee, just state the total. Either way, transparency is key.

Subtotals, Taxes, and Total

Break down any line items, apply taxes (if applicable), and clearly state the grand total. Clients shouldn’t have to do math to figure out what they owe.

Payment Terms and Due Date

Spell out when payment is due. Net 15? Net 30? Due on receipt? Whatever it is, include it upfront so there’s no confusion. This sets expectations and helps you follow up if payment is late.

Payment Methods

List how clients can pay you: bank transfer, PayPal, credit card, auto-debit, etc. The easier you make it, the faster you’ll get paid. If you accept multiple options, mention them all so clients can choose what works for them.

Notes Section (Optional, but Helpful)

Use this space for any extras, like:

- A quick thank-you note

- A reminder about your late fee policy

- A note about what’s coming next (“This covers April; May’s invoice will go out on the 31st.”)

It adds a personal touch and helps you communicate without needing a separate email.

Download Your Free Bookkeeping Invoice Template (in Excel & Google Sheets)

Bookkeeping Invoice Template

Bookkeeping Invoicing Best Practices

Having a well-designed invoice is step one. But to keep cash flow healthy and clients happy, how you manage the invoicing process matters just as much. Here are some simple but important best practices to follow:

Be Consistent With Numbering and Due Dates

Your invoices should follow a consistent numbering system (e.g., #1001, #1002, #1003) so you can easily track them. Stick to standard due terms like Net 15 or Net 30, and apply them across all clients unless you’ve agreed otherwise. Consistency helps you stay organized and makes your invoicing process easier to manage month after month.

Always Include a Clear Breakdown of Services

Never assume your client remembers what they’re being billed for. Spell out the services provided, when they were done, and how they’re priced (hourly or flat). This avoids back-and-forth and shows that you’re transparent and detail-oriented.

Send Invoices on Time

Delaying your invoice delays your payment. Set a recurring time to send invoices, whether that’s the last day of the month or immediately after work is completed. The sooner your client receives it, the faster they can process it.

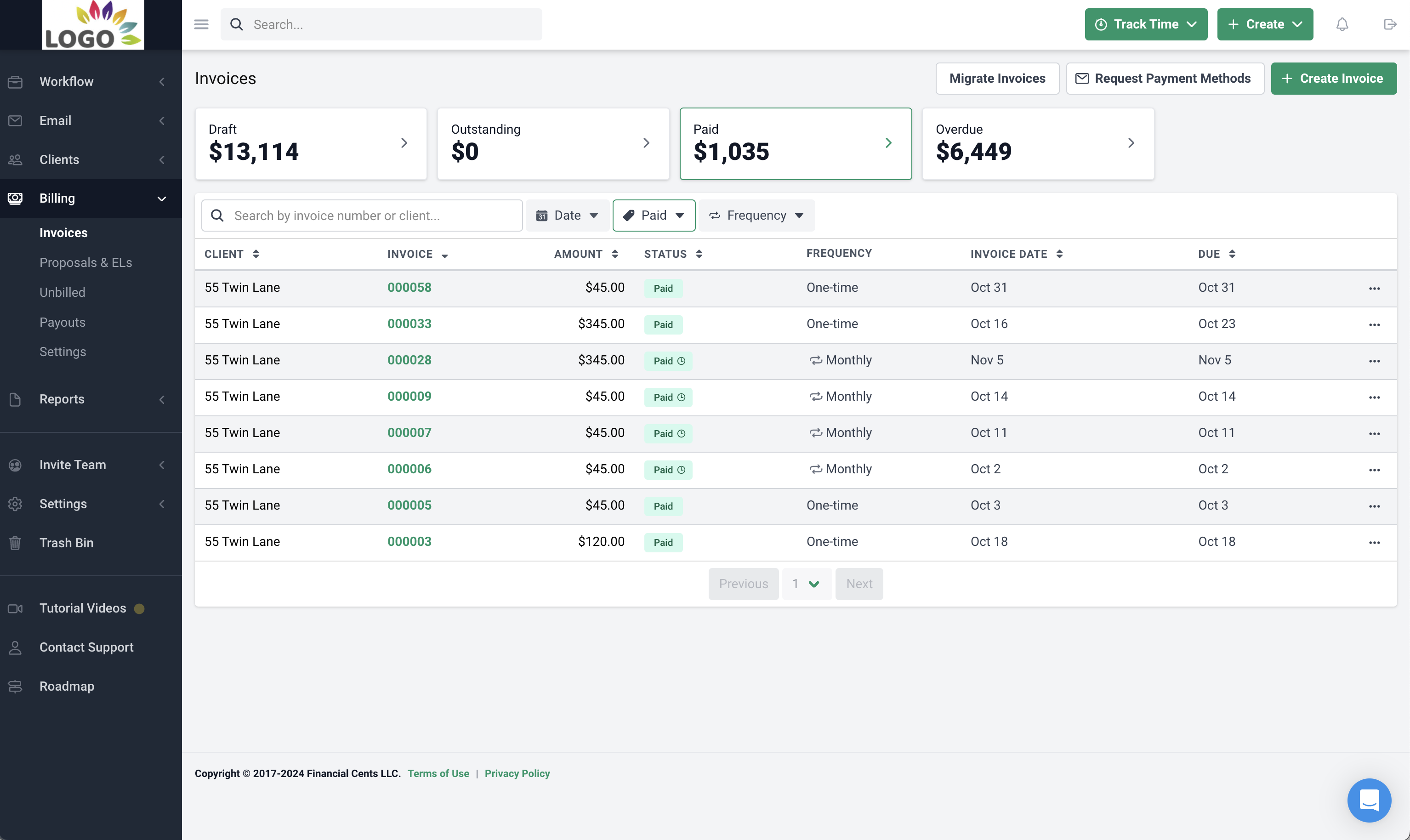

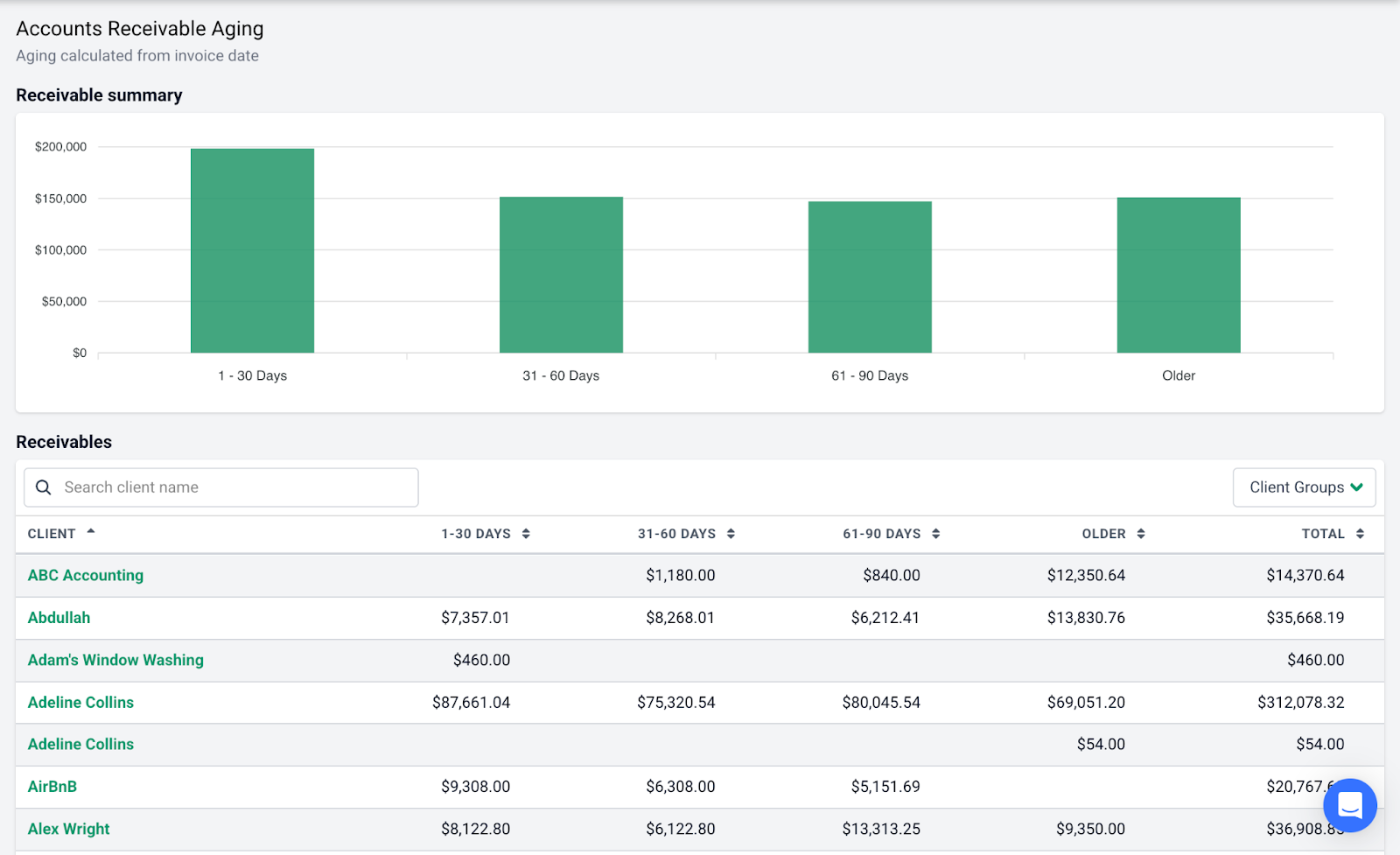

Track Payments

Track all your invoices to know what’s been paid and what’s still outstanding. You can do this manually with an accounts receivable template or invoicing and accounting billing tools like Financial Cents to log and monitor payments and tracking your receivables aging. Either way, knowing your receivables at a glance saves time and prevents things from slipping through the cracks.

Follow Up on Overdue Payments Professionally

If a payment is late, follow up with a polite reminder. Sometimes clients simply forget or miss the email. A short message like, “Just a quick reminder that Invoice #1043 is past due, please let me know if there’s any issues or you need me to resend it,” can go a long way. If you have a late fee policy, include it in your original invoice and mention it again when following up.

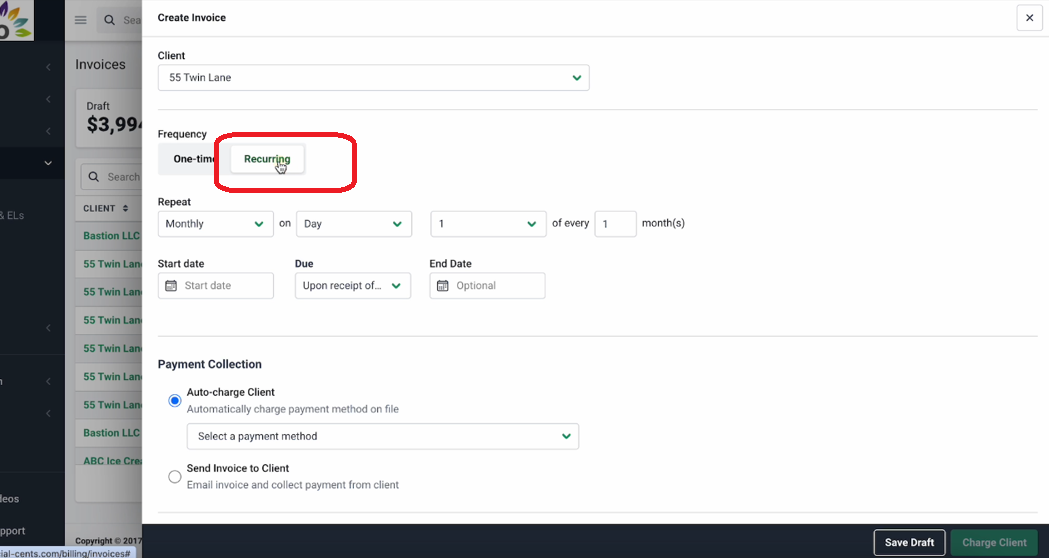

Automate Billing Invoicing with Financial Cents

Creating and sending invoices manually works fine until your client list grows and you’re buried in administrative work. That’s where Financial Cents’ billing feature comes in. It helps you automate your entire billing process so you can spend less time chasing payments and more time focusing on client work.

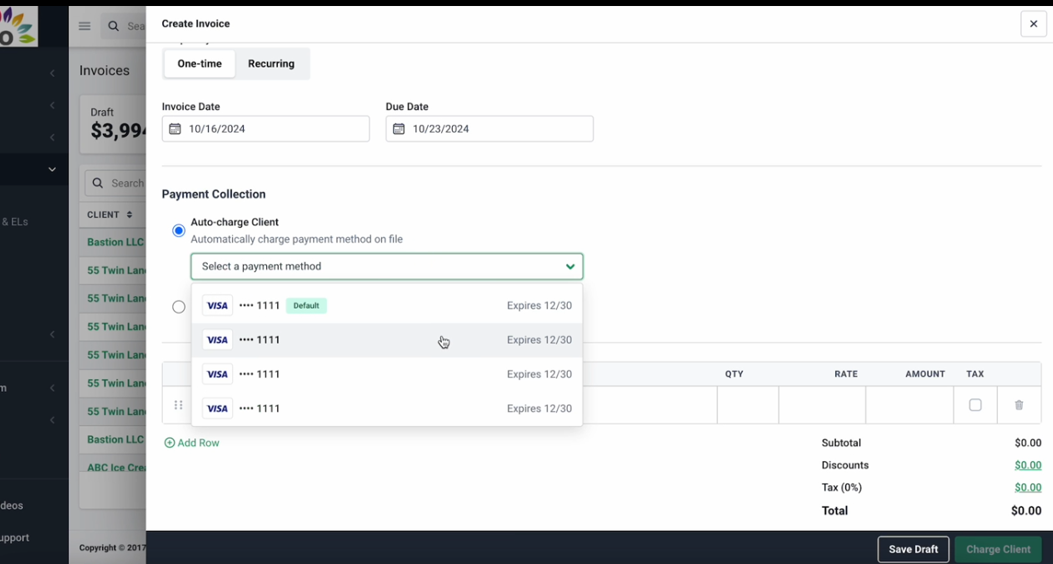

Here’s what you can do with it:

- Create and Send Professional Invoices (Fast): Generate branded, professional invoices in just a few clicks. You can add your logo, choose the services provided, enter your rates, and set payment terms. You can also send them directly from Financial Cents, so no exporting or jumping between tools.

- Set Up Recurring Invoices and Auto-Charge Clients: If you charge clients the same amount each month for ongoing work (like monthly bookkeeping), you can automate the entire process. Just set up recurring invoices and schedule them to go out at regular intervals. No need to manually recreate them every time.

See it in action:

Then set automated reminders for your desired intervals:

You can also enable auto-charging (with client authorization) via ACH or credit card. Financial Cents will securely store your client’s payment information, automatically charge them on the scheduled date, and send them an invoice once the payment is processed.

- Track Payments and Stay on Top of A/R: Financial Cents gives you real-time visibility into who has paid, who hasn’t, and how much is overdue. Everything is organized in one place, so you’re not guessing or scrolling through emails and bank records.

The Accounts Receivable aging report also provides you with a comprehensive view of all your outstanding invoices, how much you are being owed and the duration.

- Send Proposals and Engagement Letters (and Turn Them Into Invoices): You can also create proposals and bookkeeping engagement letters directly in Financial Cents. Once a client accepts and signs, you can instantly turn that accepted bookkeeping proposal into an invoice, saving you time and avoiding mistakes. Everything stays connected from onboarding to payment.

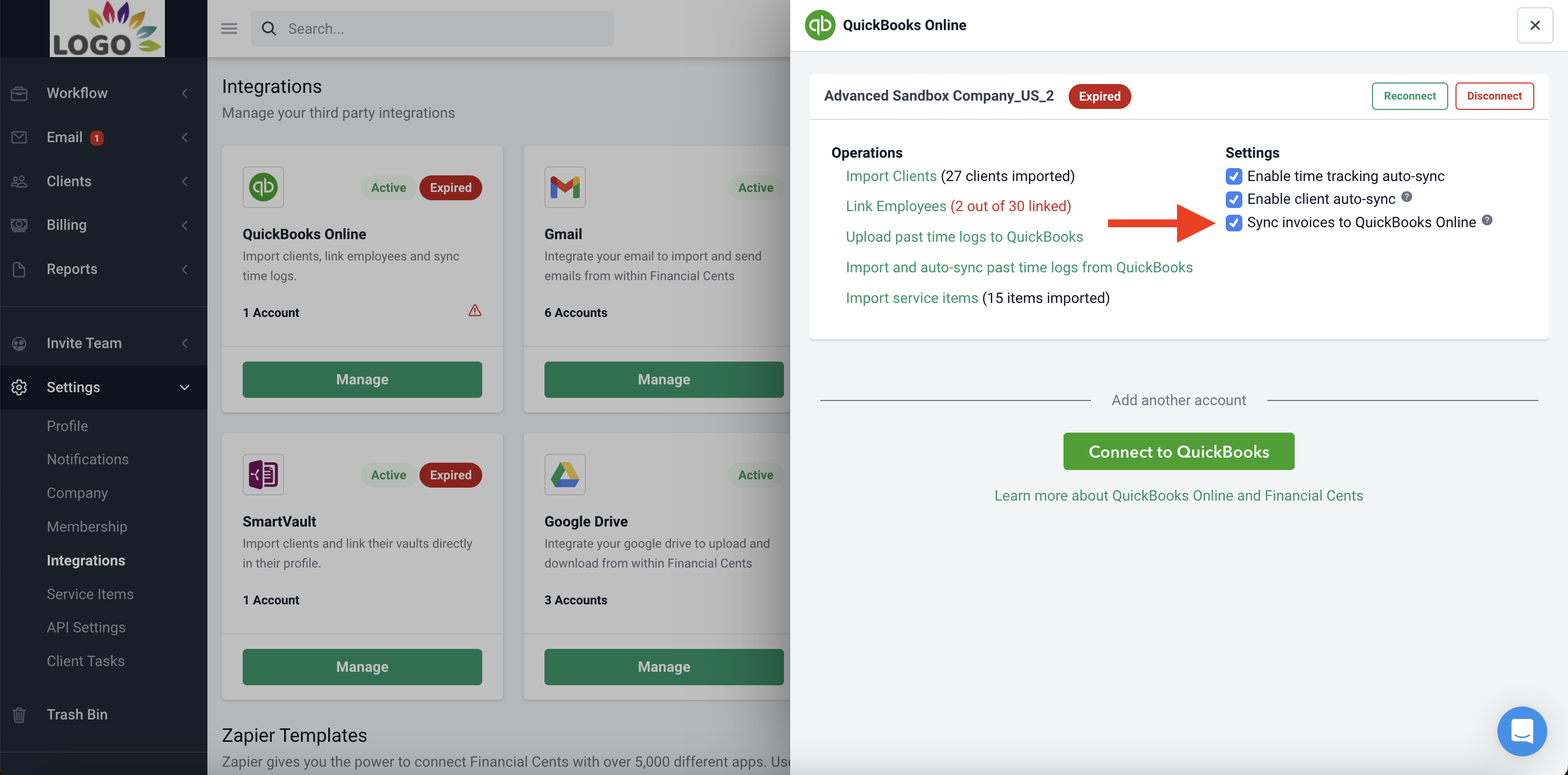

- Sync Invoices and Payments with QuickBooks Online: Financial Cents integrates directly with QuickBooks Online, so any invoices you send and payments you receive are automatically synced with your accounting records. No need to enter the same info twice or worry about missing data. Everything stays accurate and up to date across both platforms.

Want help setting it up? Here’s a full walkthrough.

Aside from automating your billing and invoicing, Financial Cents can also help you manage your firm. It’s an all-in-one platform built specifically for accounting and bookkeeping professionals, so you can manage client work, deadlines, communication, and internal processes all in one place.

With our software, you can track tasks, standardize workflows with templates, collaborate with your team, and even message clients or request documents, all from the same dashboard. You can also track billable hours, manage your team’s workload, and keep a clear view of your entire firm’s operations.

Whether you’re a solo bookkeeper or managing a growing team, Financial Cents helps you stay organized, deliver work on time, and scale your business without the chaos.

Automate your invoicing process and get paid faster with Financial Cents.