Managing multiple clients, ensuring accurate records, and generating reports on time—these are just a few of the daily challenges bookkeeping firms face. With so much data to manage, even a small mistake can cause delays, extra work, and unhappy clients.

That’s where spreadsheet templates come in handy. Templates can streamline bookkeeping tasks by providing a structured format for recording transactions, tracking income and expenses, and reconciling accounts. Instead of starting from scratch or manually formatting spreadsheets every time, bookkeepers can use pre-built templates to maintain consistency and accuracy across multiple clients. These templates also help save time and increase efficiency.

In this article, we’ve compiled 13 bookkeeping spreadsheet templates designed to help you stay organized and efficient.

Why You Should Use Bookkeeping Spreadsheets Templates

Bookkeeping spreadsheets templates have so many benefits for accountants and bookkeepers, including:

Efficiency

Bookkeeping spreadsheets templates help you work faster as they are ready-made, meaning you don’t have to set up columns, formulas, and formatting every time.

With these spreadsheets, you can quickly track income and expenses, categorize transactions, and generate basic reports without needing specialized accounting software. This is especially useful when handling multiple clients, as you can create and duplicate templates to fit different business needs.

Accuracy

Accurate records are essential for financial reporting, tax compliance, and decision-making, and using well-designed bookkeeping spreadsheets help maintain clean, error-free records.

These spreadsheets often automate calculations or include error-checking features, such as conditional formatting or validation rules, that highlight missing or incorrect entries. They follow a consistent format for recording transactions which reduces data entry mistakes and ensures records are error-free.

Time Savings

Bookkeeping spreadsheets help you complete tasks faster by eliminating the need to set up new documents or manually enter repetitive data. With pre-built templates, you can jump straight into recording transactions, tracking expenses, and generating reports without formatting everything from scratch.

Automation features like formulas, drop-down lists, and linked cells speed up calculations and data entry. Instead of spending time adding up numbers or checking for inconsistencies, you can let the spreadsheet handle it. Many templates also come with built-in summaries and reports, reducing the time needed to compile financial data for clients.

Consistency

They help maintain a uniform format for recording financial data across all clients. This is especially useful when you have a large team. It becomes difficult to ensure everyone follows the same structure when recording transactions, categorizing expenses, or generating reports. With standardized templates, you eliminate inconsistencies and make it easier for your team to review and verify data.

Consistency also simplifies client reporting. When all financial records follow the same format, it’s easier to compare data across different periods, spot trends, and ensure accuracy in financial statements. This not only saves time but also improves the overall quality of your bookkeeping work, making it more reliable for decision-making and tax preparation.

Customization

Bookkeeping spreadsheets are flexible, allowing you to tailor them to fit your firm’s or client’s specific needs. They let you add custom categories, formulas, and formatting based on how you prefer to track financial data.

You can modify templates to include extra fields, adjust tax rates, or create automated reports that match your workflow. Whether you need a detailed cash flow tracker, a customized expense report, or a client-specific reconciliation sheet, spreadsheets give you full control over how data is recorded and analyzed.

This flexibility ensures that your bookkeeping system works for you, rather than forcing you to adapt to pre-set formats that might not fit every client’s needs.

13 Bookkeeping Excel Templates to Use in Your Firm

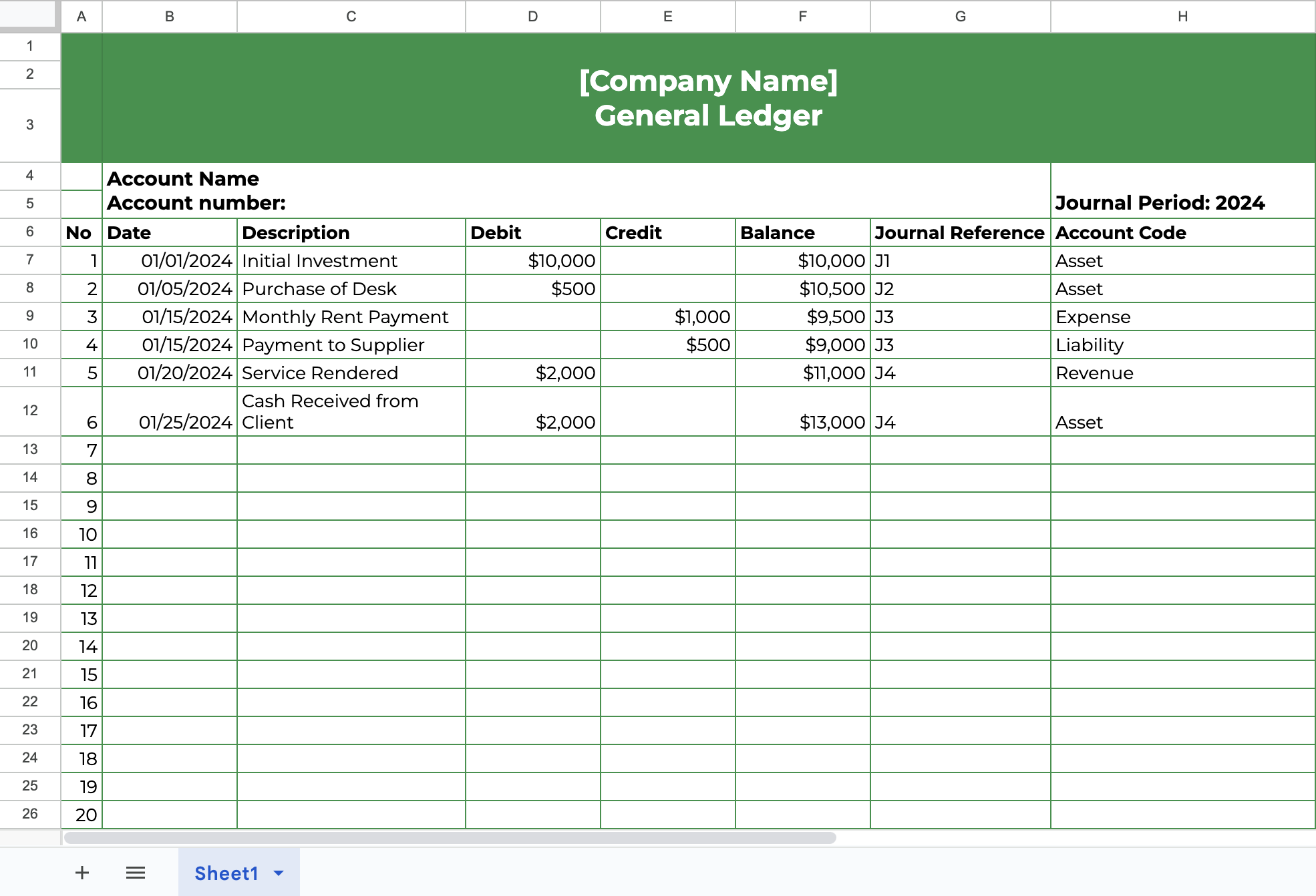

1. General Ledger Template

The General Ledger (GL) template is a structured spreadsheet used to record and track all financial transactions in one place. It serves as the foundation for bookkeeping by organizing data into key categories, such as date, account name, transaction description, debit, credit, and balance. This template helps maintain accurate financial records and monitor the overall financial health of your client’s businesses.

GL is important because it provides transparency into the flow of money within a business, so business owners can make informed decisions, assists with tax preparation with its organized and accurate financial records, and also aids in budgeting and forecasting.

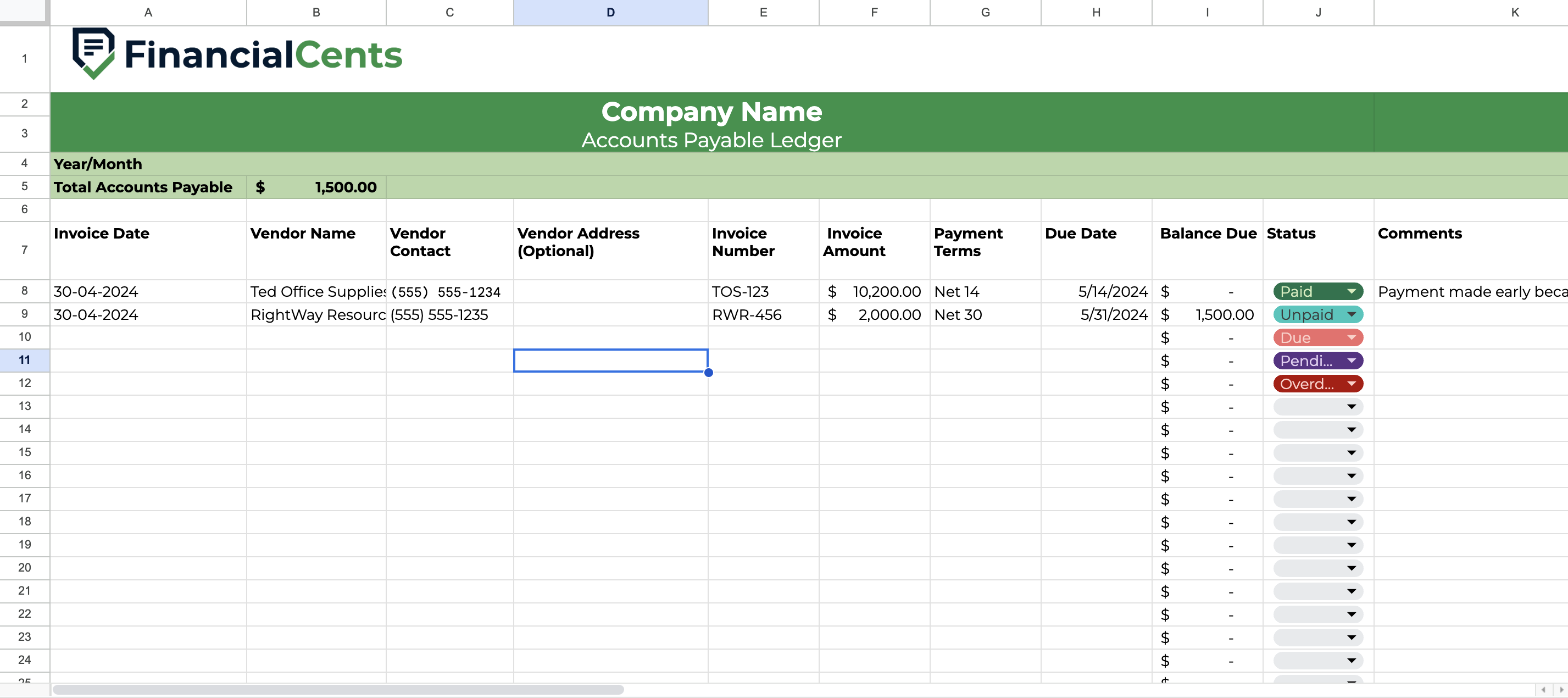

2. Accounts Payable Template

This Accounts Payable (AP) template is helpful for tracking outstanding bills and payments your clients owe to suppliers or vendors. It includes key details such as invoice date, due date, vendor name, bill number, amount due, payment status, payment date etc.

The AP template helps your client avoid late payments, simplifies reporting, organizes all AP data, and allows for efficient tracking of outstanding invoices and payments. With it, you can stay on top of due payments, avoid late fees penalties, and help your client maintain good relationships with vendors.

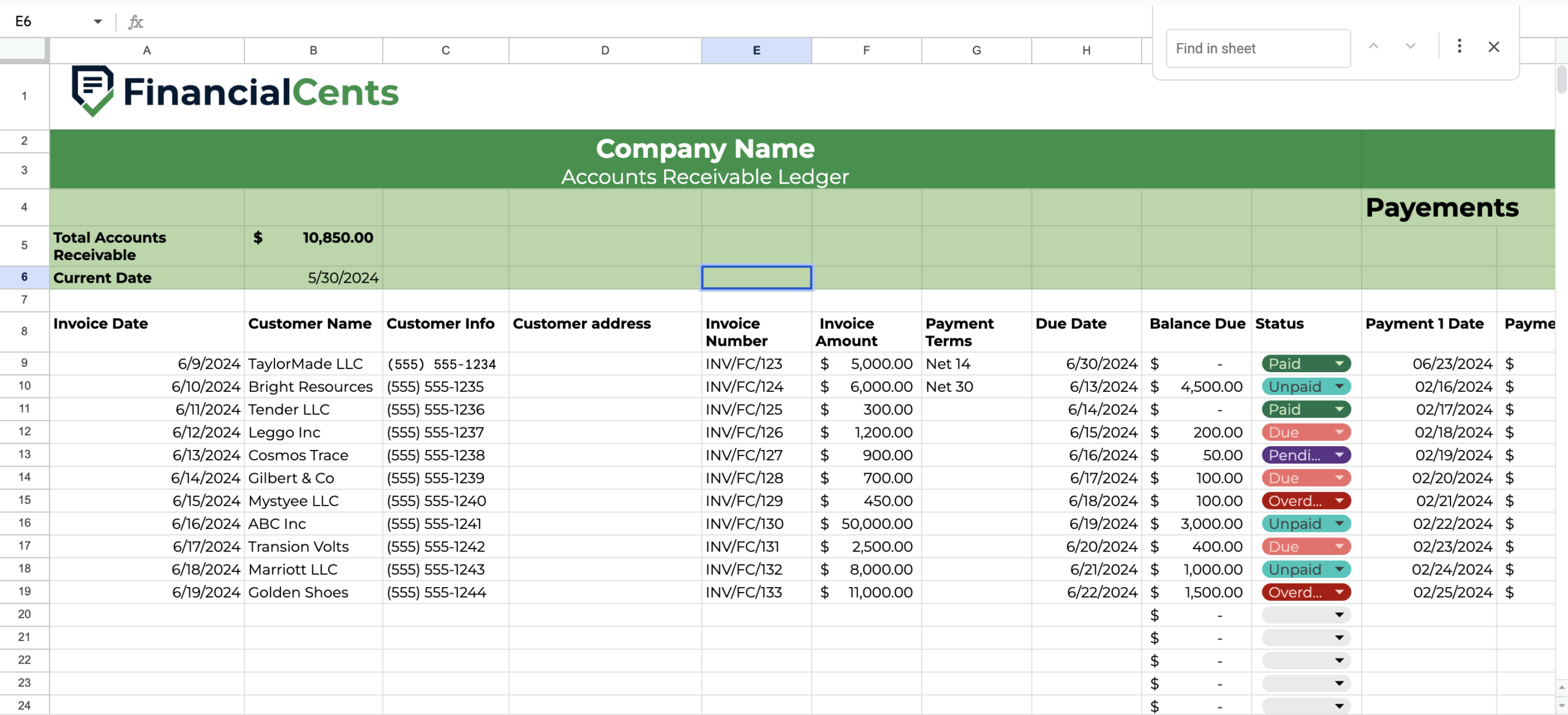

3. Accounts Receivable Template

Want to track all monies owed to your clients by their customers? Use this Accounts Receivable (AR) template. It helps bookkeepers monitor outstanding invoices, due dates, payment statuses, and customer details in one place. The template typically includes columns for invoice numbers, client names, credit terms, due dates, amounts due, payment statuses, and received payment dates. Businesses then use this information to improve their cash flow, and create better financial reports.

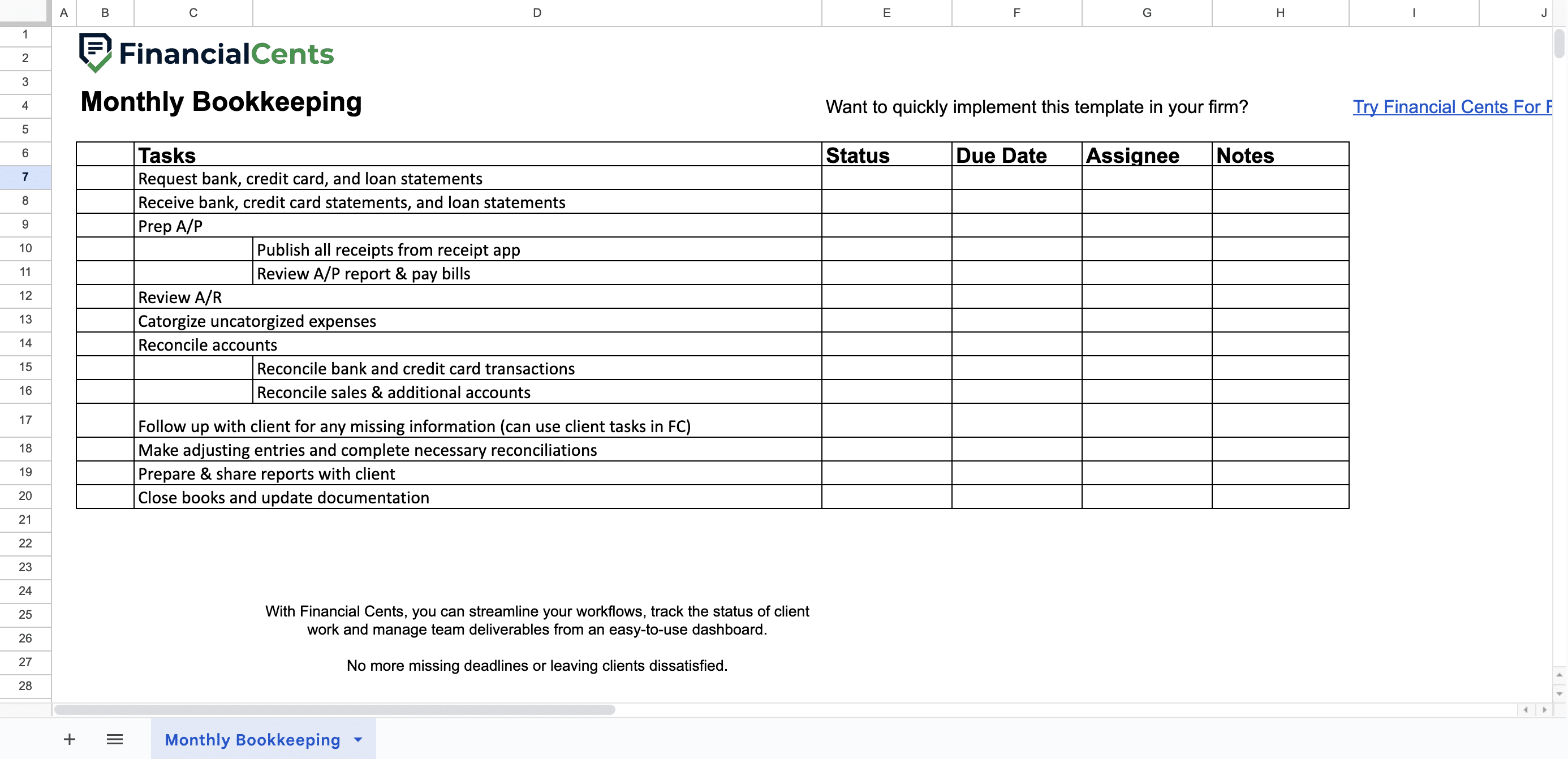

4. Monthly Bookkeeping Checklist Template

You need to stay on top of your clients’ financial records to ensure accuracy, compliance, and smooth operations. A monthly bookkeeping checklist template helps you systematically complete key bookkeeping tasks for each client so you don’t overlook any task.

This template outlines essential monthly tasks, such as reconciling accounts, reviewing financial statements, categorizing transactions, and preparing reports. It acts as a step-by-step guide, helping you maintain consistency and efficiency across multiple clients. It also allows you to meet deadlines and keeps your firm organized.

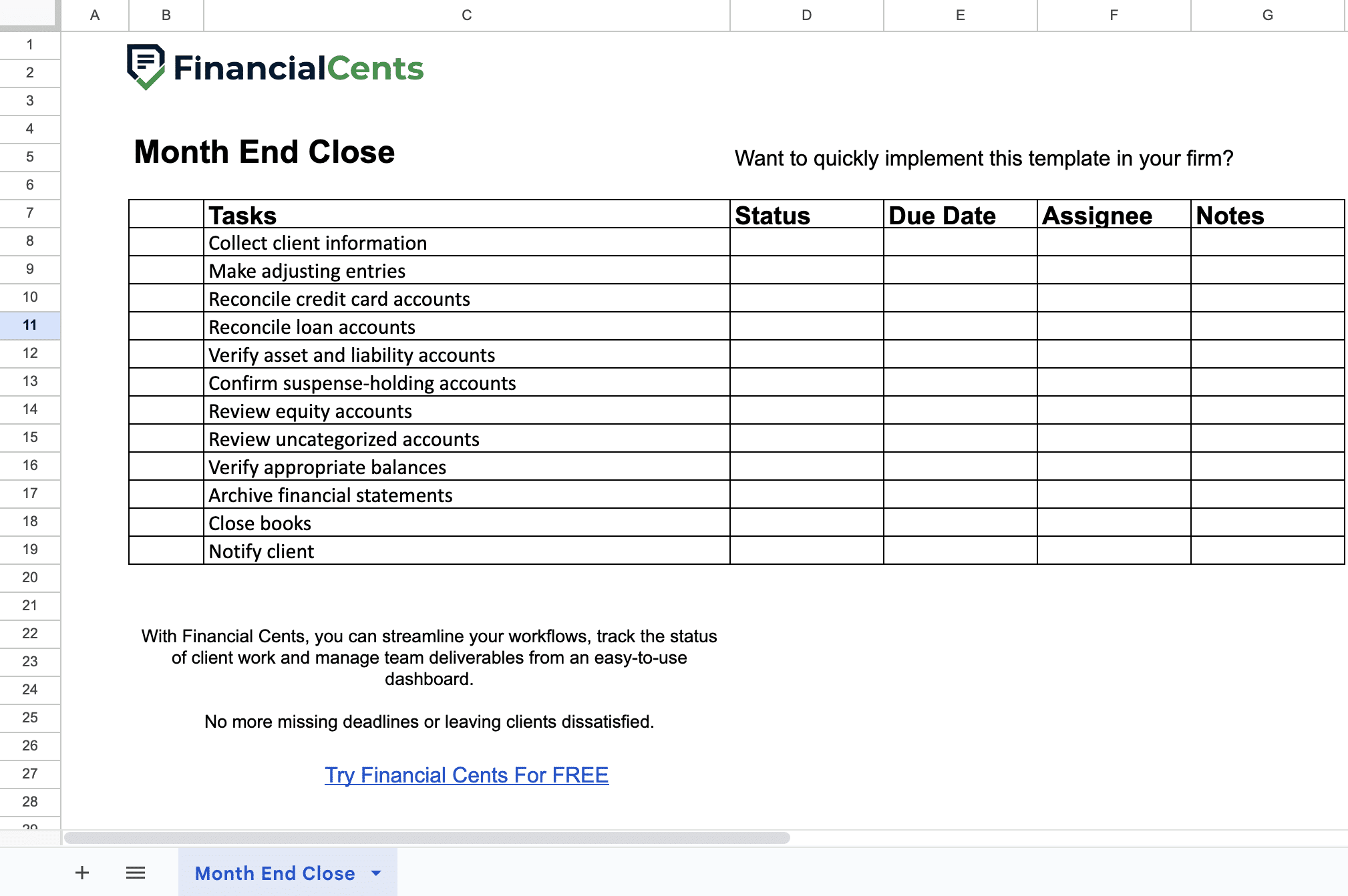

5. Month-End Close Checklist Template

Closing the books at the end of each month is essential for every business. It ensures that financial records are accurate, complete, and ready for reporting. As an accounting or bookkeeping firm, this is a task you likely handle for multiple clients. But keeping track of every step—especially across different clients—can be overwhelming without a structured process.

This month-end close checklist template provides a clear, step-by-step guide to help you complete all necessary closing tasks efficiently. With it, you won’t forget a step or key process while finalizing a client’s books.

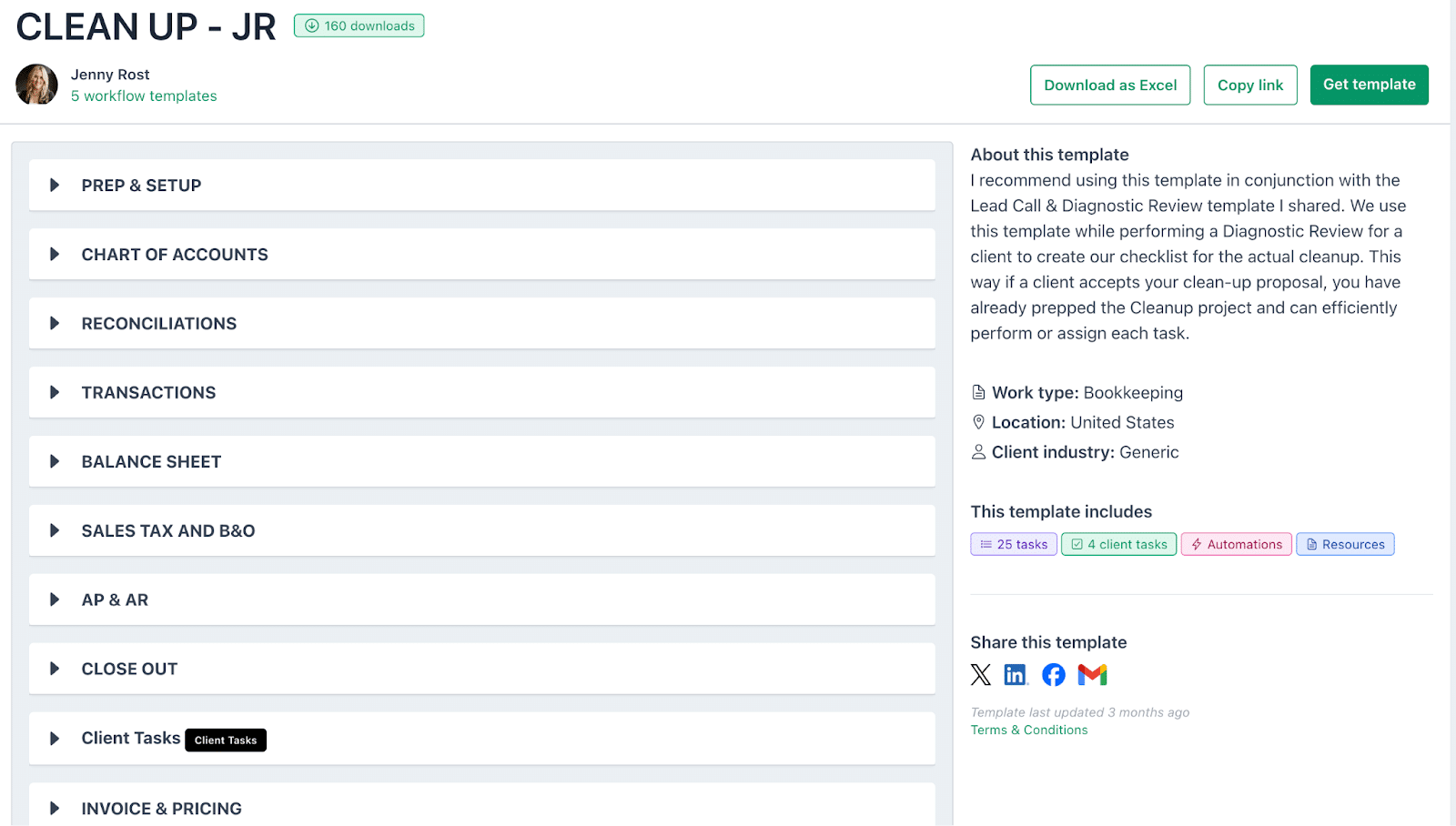

6. Bookkeeping Cleanup Checklist Template

This template is useful for systematically cleaning up a client’s financial records. Whether you’re onboarding a new client with disorganized books or fixing errors in an existing client’s records, the bookkeeping cleanup checklist template makes sure you don’t overlook any detail.

It outlines essential tasks such as reviewing bank reconciliations, categorizing transactions correctly, reviewing AP and AR, closing out balances, etc. This structured checklist helps bookkeepers bring messy records up to date efficiently and set a solid foundation for accurate bookkeeping moving forward.

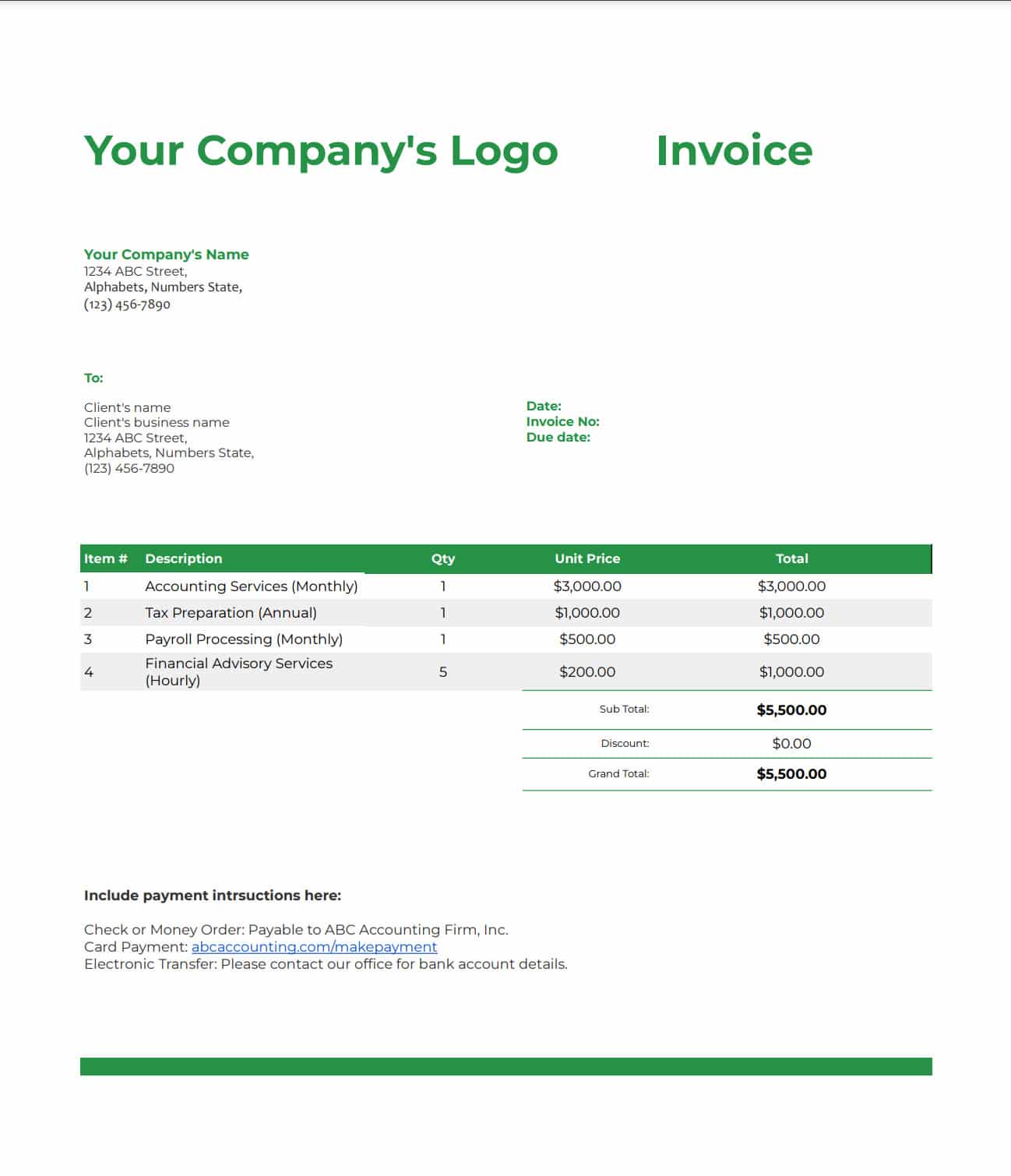

7. Accounting Invoice Template

Your invoices as a firm should be clear, professional, and easy for clients to process. A well-structured accounting invoice template helps you bill clients accurately and professionally. It allows you to list services provided, calculate totals, and include payment terms—all in a standardized format that simplifies invoicing.

This template includes fields for your firm’s name, client details, invoice number, service descriptions, itemized list of charges, total amounts, payment due dates, and accepted payment methods.

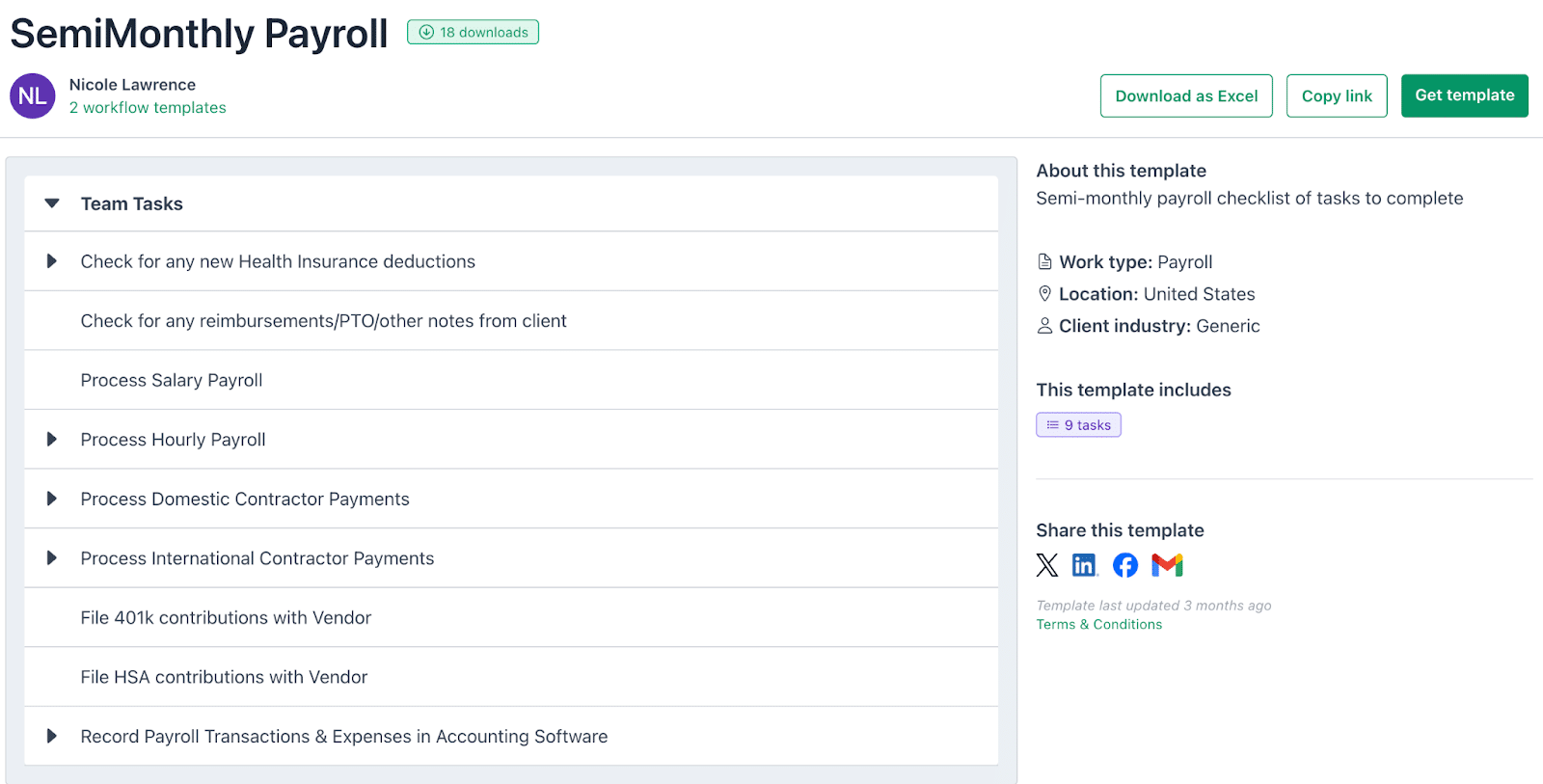

8. SemiMonthly Payroll Checklist Template

If you manage payroll for clients, you can’t afford to make mistakes or miss payments, as that can lead to compliance issues, penalties, and unhappy employees. A semi-monthly payroll checklist template helps process payroll correctly and on time every time by following a structured approach every pay period.

This template outlines key payroll tasks you need to complete, such as verifying employee hours, calculating wages, deducting taxes, and submitting payments so you don’t miss any and cause problems for your client.

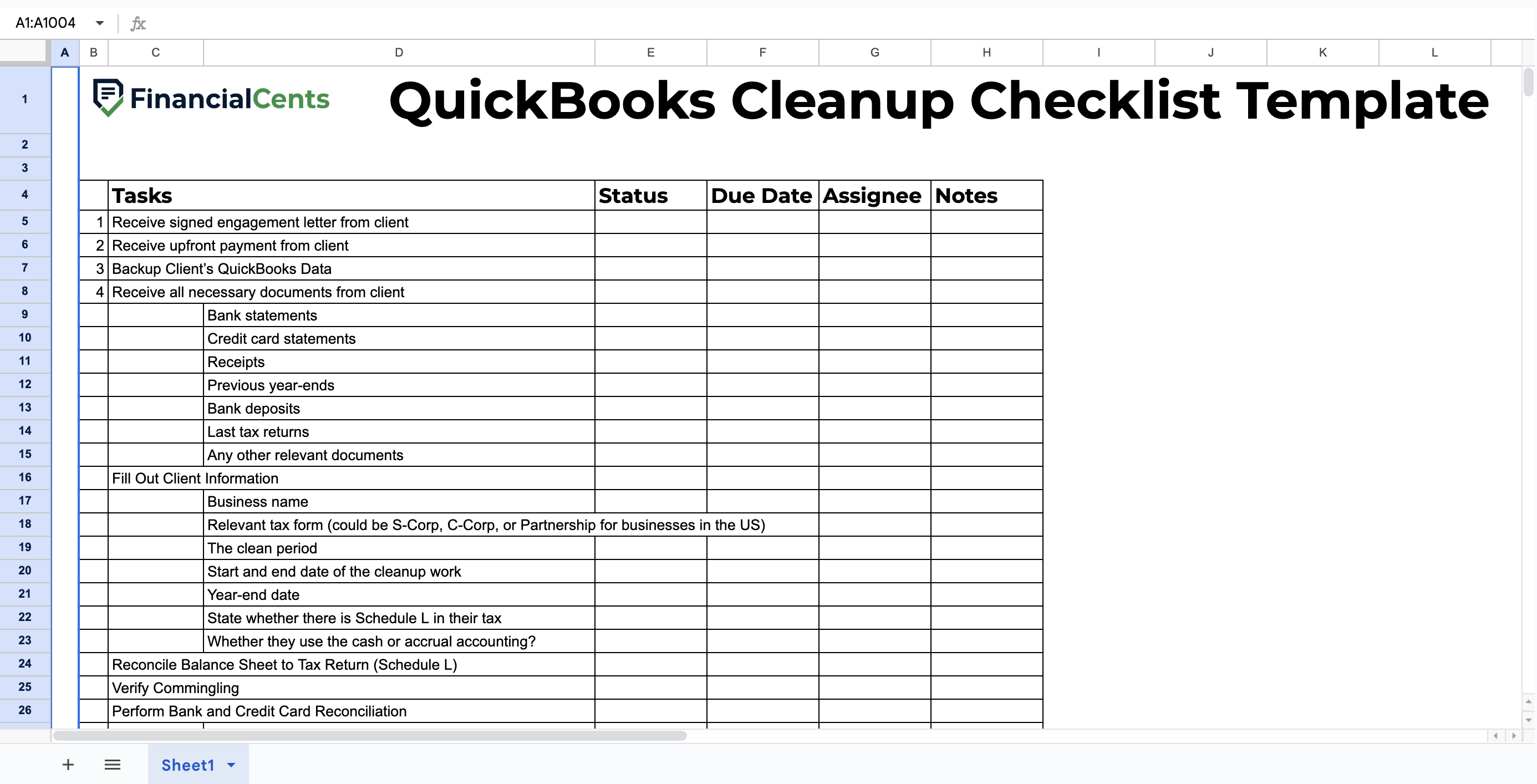

9. QuickBooks Cleanup Checklist Template

Without proper maintenance, your clients’ QuickBooks accounts can become cluttered with duplicate entries, uncategorized transactions, and reconciliation discrepancies. Regularly reviewing and cleaning up these records ensures accuracy, compliance, and smooth financial reporting.

However, if you manage multiple clients, this process can become time-consuming. That’s where a QuickBooks cleanup checklist template comes in. It provides a structured, step-by-step guide to efficiently reviewing and fixing QuickBooks records.

This checklist outlines essential cleanup tasks such as backing up data, collecting client information, reconciling accounts, examining chart of accounts, etc. It streamlines the process, ensuring your clients’ financial records are accurate and well-organized.

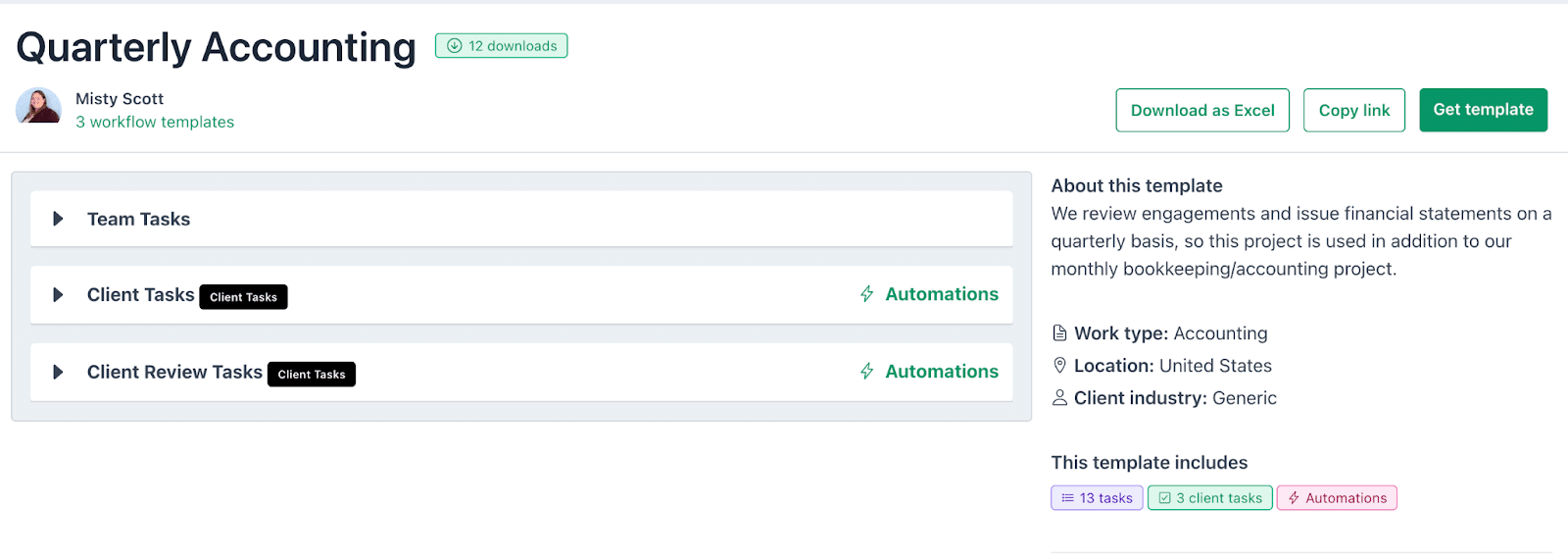

10. Quarterly Accounting Checklist Template

In addition to handling monthly bookkeeping and accounting, businesses require quarterly financial reviews to stay on top of their financial health and reporting obligations. To perform this task efficiently and ensure you don’t overlook anything, you need a quarterly accounting checklist template.

This template provides a step-by-step guide for conducting a thorough financial review every quarter. It helps you reconcile assets, assess tax liabilities, create reports, etc, ensuring your clients’ books are accurate and up to date.

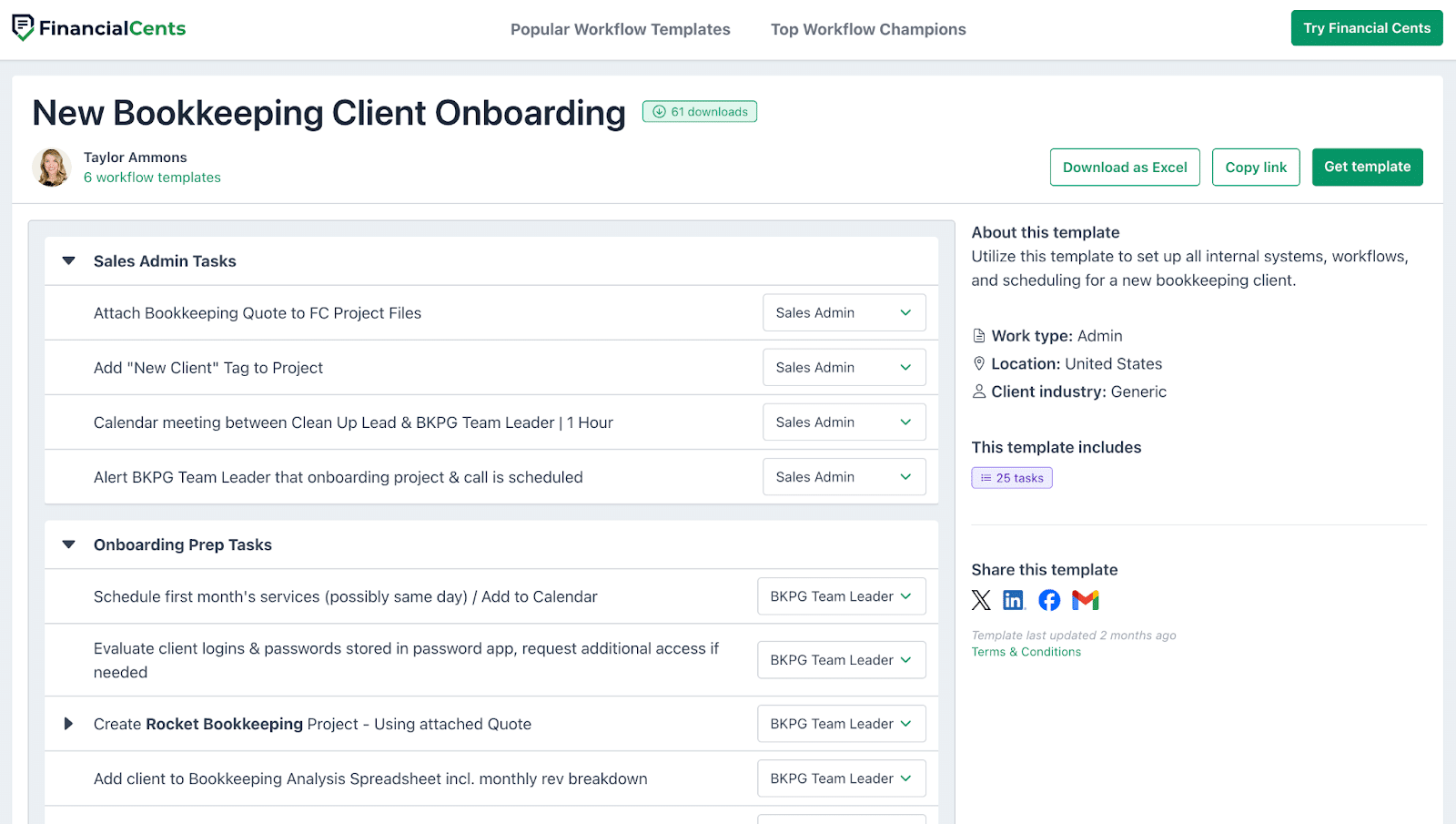

11. Bookkeeping Client Onboarding Checklist Template

How you onboard clients into your firm sets the tone for your working relationship. A well-structured onboarding process ensures a smooth transition, establishes clear expectations, and sets the foundation for accurate and efficient bookkeeping.

If you have an inconsistent or clunky onboarding process (like 51.4% of those surveyed in our workflow automation report) you risk delays, missing key information, and frustrating both your team and your clients.

A bookkeeping client onboarding checklist template helps standardize the process, making it easy to collect necessary documents, set up accounting systems, and execute projects well.

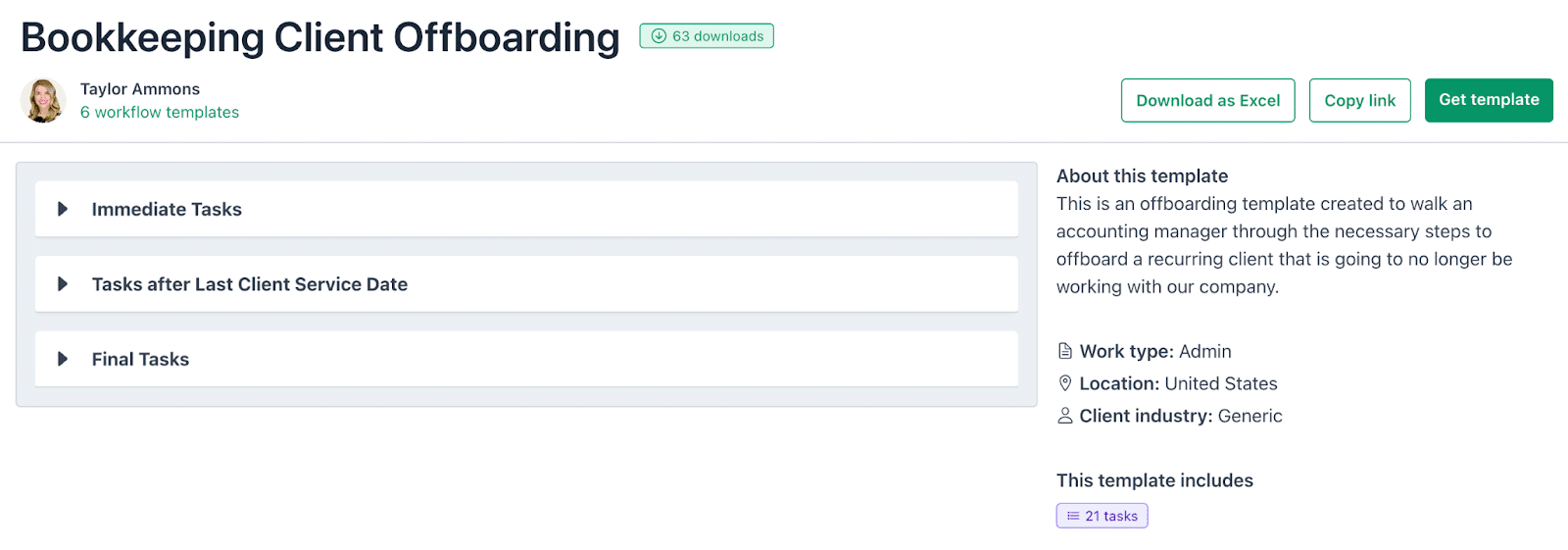

12. Bookkeeping Client Offboarding Checklist Template

A client engagement ending? It’s never ideal, but it happens. When it does, having a structured offboarding process allows for a smooth transition, protects your firm, and leaves the client with everything they need. This bookkeeping client offboarding checklist template helps you tie up loose ends, revoke access to accounts, and document final reports efficiently and professionally.

Our checklist includes immediate tasks like cancelling recurring meetings and sales receipt charges, invoicing them for all billable work, revoking your access to their QuickBooks, archiving them in your practice management tool like Financial Cents, etc.

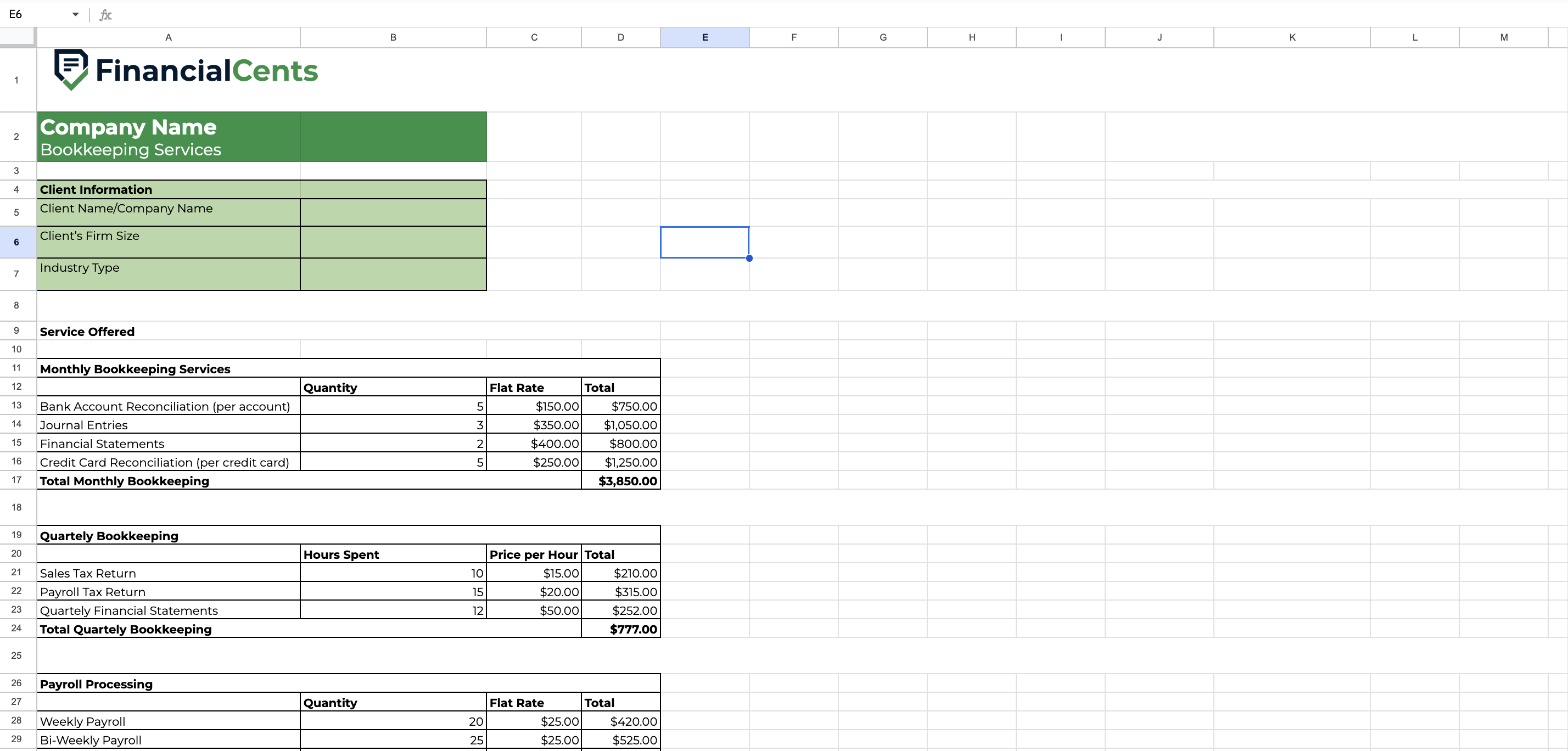

13. Bookkeeping Pricing Template

Struggling to price your bookkeeping services? You’re not alone. Setting rates that are both competitive and profitable can be tricky—especially when different clients have different needs. That’s why you need this bookkeeping pricing template.

This template helps you structure your pricing based on services offered, complexity, estimated hours, etc. Instead of guessing or constantly adjusting rates, you can use a clear, standardized approach to set fair and transparent prices that reflect the value of your services.

Downloading the Checklist Templates as Excel Template from the Template Library

Here’s a quick walkthrough of how to download these templates for your use:

Best Practice for Using Excel Templates to Manage Bookkeeping Tasks

To get the most out of these templates, here are a few tips.

Organize Your Files

If you have multiple templates, set up a structured folder system with consistent naming conventions so you don’t scramble to find the right spreadsheet when you need it. Create separate folders for each client and categorize templates based on their purpose, like general ledger, accounts payable, and payroll.

Keep Templates Updated

As your firm grows and you take on more clients, your bookkeeping processes will evolve. That’s why it’s important to keep your templates updated to match these changes. Also, if tax regulations shift, accounting standards get revised, or you introduce new services, your spreadsheets should reflect those updates.

Outdated templates can cause errors, inconsistencies, or compliance issues. Updating them might take a little time upfront, but it saves you from headaches down the road.

Train Your Team

Your templates are only as useful as the people using them. If your team isn’t familiar with to use them, they’ll make mistakes which will affect their efficiency. Take the time to train your team on how to use these templates properly.

Make sure they understand key functions like formulas, data validation, and shortcuts that can speed up their workflow. If you update a template or introduce a new one, walk them through the changes so everyone stays on the same page.

Regular Backups

Files can get accidentally deleted, corrupted, or overwritten, and it’s difficult or even impossible to recover them. That’s why you must back up all data and templates regularly. Whether you use cloud storage, an external hard drive, or an automated backup system, having copies of your files ensures you can quickly restore them if something goes wrong.

Integrate with Software

Streamline your bookkeeping workflow by integrating your templates with accounting software. This keeps all your templates in one place that other team members can easily access, improving efficiency. Using your spreadsheets with an accounting workflow management software like Financial Cents also offers different functionalities like describing tasks, tracking deadlines automatically, making notes that can be viewed on one screen, at a glance, etc.

Financial Cents has over 100 free templates across different use cases you can try:

Step Away from the Chaos: Streamline Your Tasks with Workflow Automation

Spreadsheets are useful, but they have their downsides when it comes to managing client work. They can be time-consuming and overwhelming and make it hard to track deadlines and tasks. 58.7% of firms from our Workflow Automation Report say using spreadsheets didn’t improve their workflow.

So if your firm relies on spreadsheets alone, you risk missing important client deadlines, struggling to keep everything organized, and spending hours on non-billable admin work. In fact, from the same report, about 45.8% spent between one to five hours just scheduling and assigning work, while 45.5% spent the same amount of time reviewing and updating work status before That’s valuable time that could be spent on higher-impact tasks.

Spreadsheet templates are great for consistency and efficiency, but they work best when combined with an accounting workflow management tool like Financial Cents. With our software, 34.8% now spend an average of 0-1 hour scheduling and assigning work per week, and 33.5% now spend 0-1 hour reviewing and updating the status of work each week.

Why not try Financial Cents out today to save time and improve efficiency with your spreadsheets?