Ask any accounting or bookkeeping firm owner what keeps them up at night, and “waiting on clients” is usually near the top of the list. Whether it’s clients going silent after a request, sending incomplete files, or missing deadlines, poor communication creates roadblocks that slow everything down.

Case in point, 64% of firm owners named “chasing down clients for information” as their biggest challenge in our 2025 State of Accounting Workflow & Automation Report, ranking higher than staffing, tech adoption, or even client acquisition.

Delays like these affect your entire workflow: deadlines get pushed back, work piles up, and margins shrink. And while clients may be the ones stalling, they often don’t realize it. To them, slow communication feels like poor service, and that can quietly erode trust, increase churn, and hold back your firm’s growth.

But when communication is clear, centralized, and easy on both sides, everything changes. Projects move faster, your team works more efficiently, and clients feel taken care of.

In this article, we’ll break down how poor communication holds your firm back, what streamlined communication looks like in practice, and how to build systems that drive both client satisfaction and long-term growth.

Why Client Communication Is the Backbone of a Thriving Firm

Accounting is a relationship-driven business, and how you communicate is often just as important as the work you deliver. Here’s why strong client communication is at the heart of every successful, growing firm.

Accounting Is a High-Trust, Service-Based Industry

When clients choose an accounting firm, they’re handing over access to sensitive financial information: payroll records, tax IDs, banking details, business performance data, and more. And in today’s world, people are more cautious than ever about where that information goes and how it’s handled.

With cyberattacks on the rise especially for accounting firms (reported attacks on accounting practices have jumped 300% according to Today’s CPA), trust is more important than ever. Clients need to feel confident that your firm is taking data security seriously.

Reassuring clients that their data is safe starts with how you communicate: using secure portals, confirming receipt of documents, setting clear expectations, and being transparent about your process. These small moments help build the kind of trust that keeps clients loyal long-term and sets your firm apart from others that may seem less organized or less secure.

Clear, Timely Communication Builds Credibility

When clients reach out with questions or send over documents, how quickly and clearly you respond directly affects how professional your firm seems. If your replies are delayed, incomplete, or unclear, it gives the impression that you’re disorganized or unreliable.

On the other hand, when you consistently respond on time, explain things in plain language, and keep clients updated without being asked, it fosters trust. Clients feel confident that you’re on top of things, and that builds your credibility.

Clients Expect Speed, Clarity, and Transparency

Today’s clients are used to fast, clear, and on-demand experiences in nearly every area of their lives, from food delivery to online banking. They bring those same expectations into their business relationships, including with their accountant or bookkeeper.

That means long email threads, vague updates, or waiting days for a response feel frustrating to them. Clients want to know where things stand without having to ask. They expect clear answers to their questions, updates on their deadlines, and visibility into what’s happening with their work.

More importantly, they want to feel like they’re not being left in the dark. If something is delayed or needs their input, they expect you to say so early and clearly. If you’re transparent and proactive in your communication, clients are more likely to trust your process, feel in control, and stay loyal to your firm.

Firms that meet these expectations deliver a better client experience and work more efficiently because they spend less time answering repeat questions or managing client frustrations.

Effective Communication Fosters Long-Term Relationships and Repeat Business

Good communication helps prevent small misunderstandings from turning into bigger issues. It sets clear expectations, reduces confusion, and builds a foundation of trust. That trust is what keeps clients from second-guessing your fees, questioning your advice, or seeking a new provider.

It also increases your chances of growing accounts over time. Clients who have a smooth, professional experience are more likely to ask about additional services, refer you to others, and renew without hesitation. In other words, effective communication is one of the best ways to retain clients and grow your firm through repeat business.

How Poor Communication Hurts Firm Growth

Communication gaps may seem like minor issues at first, but over time, they compound and affect your firm’s performance and growth in the following ways:

Leads to Client Frustration and Churn

PwC’s consumer-trust research shows that 32 % of customers will stop doing business with a brand they like after just one bad experience. And slow or confusing communication certainly counts as a “bad experience.” If communication is slow, unclear, or inconsistent, clients may start to feel neglected and eventually leave.

In an accounting firm, churn doesn’t just mean losing this year’s fee; you also lose years of recurring revenue and the referrals that happy clients typically send your way.

Wastes Time Through Unnecessary Back-and-Forth

When communication isn’t clear or organized, it leads to constant back-and-forth that wastes time for both your team and your clients. Maybe the client didn’t understand what you needed. Maybe they sent the wrong file or missed part of your request. Now, you’re following up to clarify, and they’re replying with questions or partial information, starting the cycle all over again.

This kind of back-and-forth adds up. Instead of moving work forward, your team gets stuck chasing details, sending reminders, and digging through email threads for context. It slows down project timelines, pulls staff away from billable work, and makes your processes feel more reactive than proactive.

Increases the Risk of Errors and Missed Deadlines

Scattered communication makes it easy to overlook key details. Important updates get buried in email threads, messages go unanswered, and files end up in the wrong place. This can cause your team to work with outdated or incomplete information, which affects the accuracy and timeliness of your work. And such mistakes can be costly for your clients and for your firm.

Incorrect tax filings may lead to penalties. Misreported financials can damage a client’s ability to secure funding. A missed payroll run creates frustration and compliance risks. Even if you fix the issue quickly, the damage to client trust is harder to repair.

Beyond the financial impact, these errors often lead to extra hours spent on rework, explanations, and books cleanup. Your team loses time, your schedules get thrown off, and clients start to question whether they’re in the right hands.

Makes Onboarding and Project Delivery Harder

In our State of Accounting Workflow & Automation Report, “onboarding new clients” ranked as the third biggest workflow challenge for accounting firms, and it’s easy to see why. For many firms, the process is still manual and inconsistent. Teams rely on email, spreadsheets, and scattered messages to request documents, answer questions, and get new engagements off the ground.

This setup creates delays from day one. Clients aren’t always clear on what’s needed or when to send it, so they respond in fragments. That means your team has to follow up repeatedly, clarify requests, and piece everything together, wasting valuable time on both sides.

Creates Bottlenecks as the Firm Scales

Poor communication might be manageable when your firm is small, but as you grow, the cracks start to show. More clients mean more emails, more status updates, more document requests, and more people involved in each workflow. Without a clear system in place, communication becomes a bottleneck that slows everyone down.

Partners and senior staff often then become the default source of truth. They’re looped into every update, pulled into every decision, and left answering basic questions that should be handled at the team level. Instead of focusing on high-value work or strategy, they’re stuck sorting through threads, clarifying next steps, or tracking down missing details.

How Easy Communication Drives Growth and Efficiency

Here’s how better and streamlined communication contributes to smoother operations, happier clients, and a more scalable firm.

Faster Response Times = Higher Client Satisfaction

When clients consistently get prompt, helpful responses, they feel like your firm is on top of things. That responsiveness makes them more confident in your service and more likely to stay with you long term. It also reduces the number of follow-up emails they send, which frees up your team to focus on actual work.

Centralized Communication = Less Confusion for Your Team

When all client conversations, files, and task updates live in one organized place and are tied to the client’s profile or project, everyone knows where to look and what’s already been handled. There’s no duplication, no confusion, and no risk of two people doing the same task differently because they didn’t see the same message. It brings clarity and consistency to every client interaction. New hires can also get up to speed faster because the context they need is right in the platform, not buried in someone’s inbox.

Fewer Follow-Ups = More Time To Focus on Billable Work

Every time your team chases a client for missing documents or asks a follow-up question that could have been avoided, they’re spending time that doesn’t generate revenue. Multiply that across all active clients, and it becomes a major drag on your team’s capacity.

By simplifying how clients communicate, you reduce the need for back-and-forth. Clients know what to send, where to send it, and by when. Your team can focus more of their time on actual deliverables, not inbox management. That’s how communication improvements turn into higher billable hours without working longer days.

Streamlined Onboarding = Better First Impressions

A well-structured onboarding process sets the tone for the entire client relationship. When your team has all the necessary documents, context, and information from the start, they can begin the work without unnecessary delays or confusion. There’s no need to chase missing files or go back and forth clarifying instructions.

This saves time and also reassures the client that they’re in good hands. The quicker you can move from signing the agreement to deliver real value, the stronger the relationship starts off.

Better Collaboration = Fewer Errors and Rework

Streamlined communication keeps everyone working on a project aligned. It ensures that task owners are notified on time, that comments are logged where they’re relevant, and that clients know what’s expected of them. With fewer misunderstandings, your team spends less time fixing mistakes and more time moving forward. That leads to smoother engagements, higher-quality work, and less stress for everyone involved.

Professionalism = More Referrals and Client Loyalty

Clear, reliable communication creates a sense of professionalism that clients value. When they know they’ll get timely updates, that their requests won’t be forgotten, and that working with your firm won’t add to their stress, they’re more likely to stay with you long term and refer others. Over time, that consistency becomes one of your firm’s strongest growth channels.

What Easy Client Communication Looks Like in Practice

Here’s what firms with strong communication systems typically have in place and how each one makes life easier for both your team and your clients.

Centralized Messaging Tied to Client Profiles and Projects

Instead of jumping between email, Slack, and text messages, all communication lives in one place, right alongside the client’s active tasks, files, and notes. You can see the full history of requests, approvals, and conversations without searching your inbox. That means fewer miscommunications, faster turnaround times, and a clear source of truth for the whole team.

Financial Cents, an all-in-one practice management software helps with this. Its Client Chat feature lets your team ask clients questions directly within the system, and keeps all communication neatly organized by project and client. You can further organize conversations by topic to keep things structured and easily search across all client chats to find key details fast.

It helps ensure that nothing slips through the cracks, and that your team always has the context they need to do their job well.

Want to see it in action? Check out a full walkthrough of the Client Chat feature here:

Secure File Sharing and Approvals

With a secure accounting portal, clients can upload documents, view reports, and approve requests without back-and-forth emails. Secure sharing also simplifies compliance. You’re not relying on unsecured emails or open shared drives to handle files that contain payroll data, tax IDs, or financial statements. Instead, everything is stored and accessed in a way that meets professional security standards.

Financial Cents makes this seamless with a passwordless client portal that allows you to:

- Share folders and documents securely with your clients

- Give clients access to archived reports whenever they need them

- Let clients upload documents that aren’t tied to specific tasks or requests

You also stay in control by managing who can access each item or folder so everyone has exactly what they need, and nothing more.

Automated Reminders and Deadline Notifications

Manually following up with clients to collect documents or confirm deadlines is a time-consuming process. Automated reminders solve this by keeping clients on track without your team needing to send repeated emails or messages.

With Financial Cents, you can set automated reminders that follow up with clients via email and SMS until they complete the task request list you’ve sent. This saves a lot of time and keeps projects moving forward. Clients are more likely to take action when they receive clear, timely prompts, allowing your team to stay focused on completing work instead of managing follow-ups.

Client Work Status Tracking

Giving clients access to real-time updates builds trust and keeps them engaged. When clients can see what’s in progress, what’s pending, and what’s coming next, they feel informed and confident in your process.

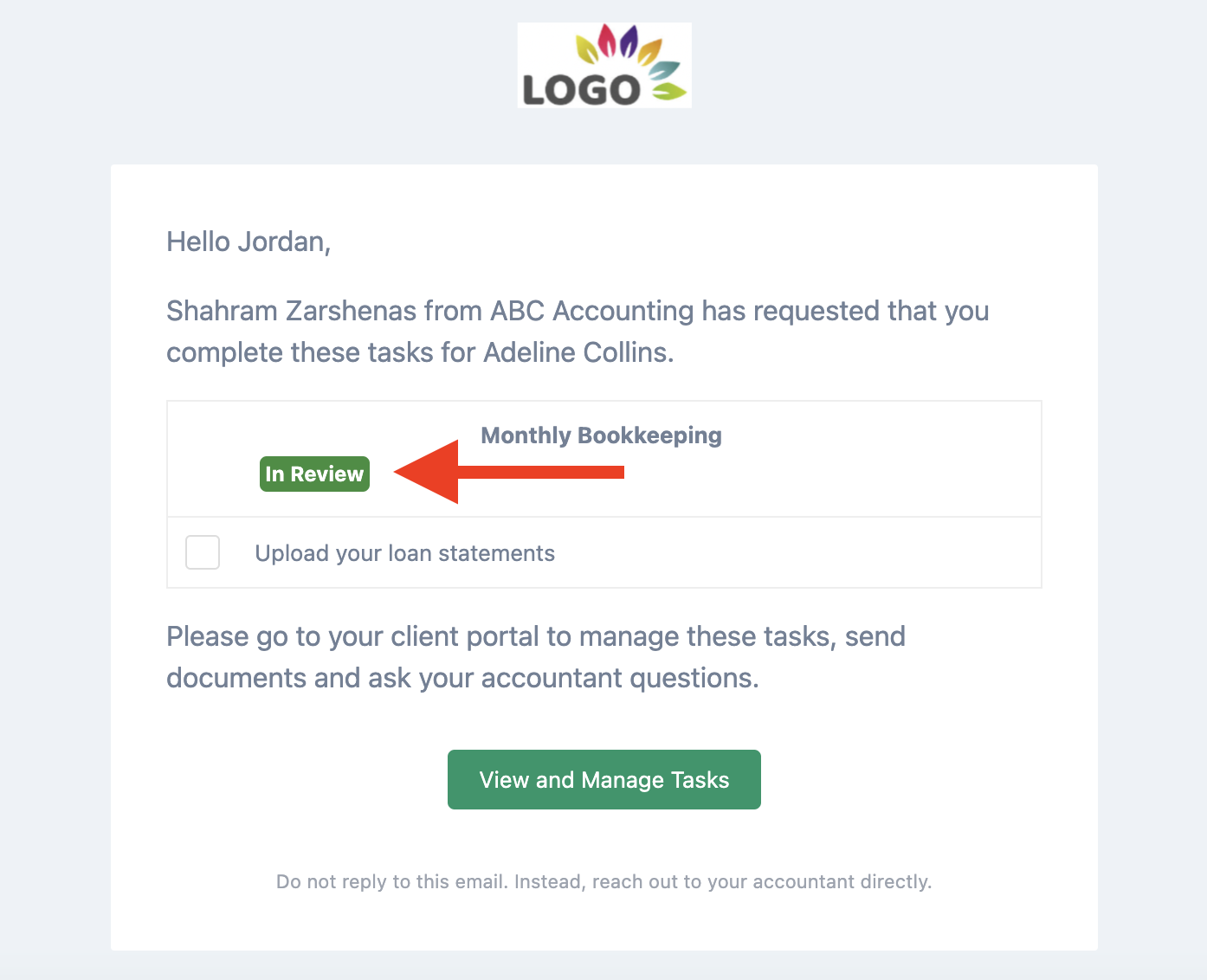

Financial Cents makes this simple with a client-facing status tracking feature built into the client portal. Clients can log in to the Requests tab or check their email notifications to see where things stand, without needing to call or follow up:

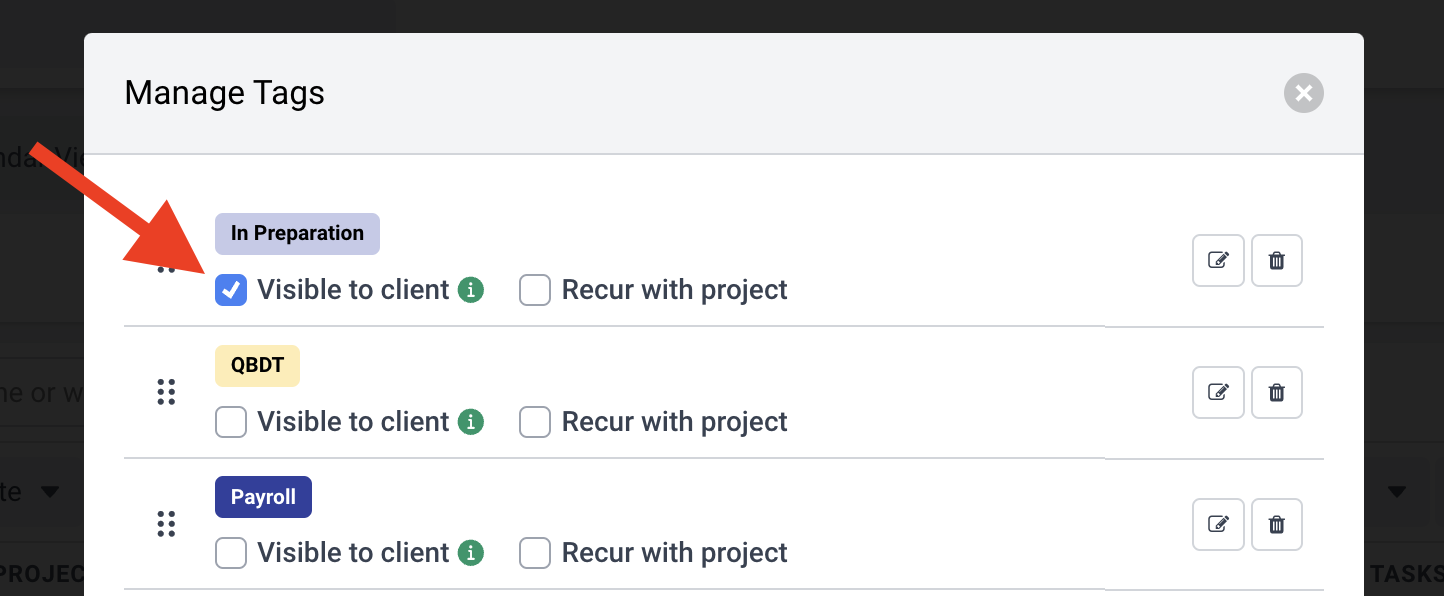

Status tracking in Financial Cents is powered by tags, so you can easily customize which tags are visible to clients by selecting “Visible to Client” when managing your workflow tags:

t’s a small change that makes a big difference: clients feel informed, and your team spends less time answering “Where are we with this?” messages.

Avoiding Email Overload or Lost Threads

One of the most common workflow issues in accounting firms is losing key details in cluttered email chains. Centralized communication solves this by organizing conversations around clients and tasks, so everything stays in context.

Financial Cents takes it a step further by integrating your Gmail or Outlook inbox directly into the platform, giving you full control of client communication without ever leaving your workflow. Key features include:

- Focused client inbox: View only emails from clients—no clutter, no distractions

- Convert emails into projects: Instantly turn ad hoc requests into projects

- Pin important emails to projects: Keep key info visible to the entire team

- Unified inbox: Manage multiple addresses in one place

- Send and receive emails: Communicate with clients by sending emails from within Financial Cents

- Track everything: Maintain a full audit trail of all client communication

With full two-way sync, any action you take in Financial Cents, like archiving, deleting, or reading an email, will reflect instantly in Gmail or Outlook, and vice versa. So whether you’re in your inbox after hours or managing work during the day, everything stays up to date automatically.

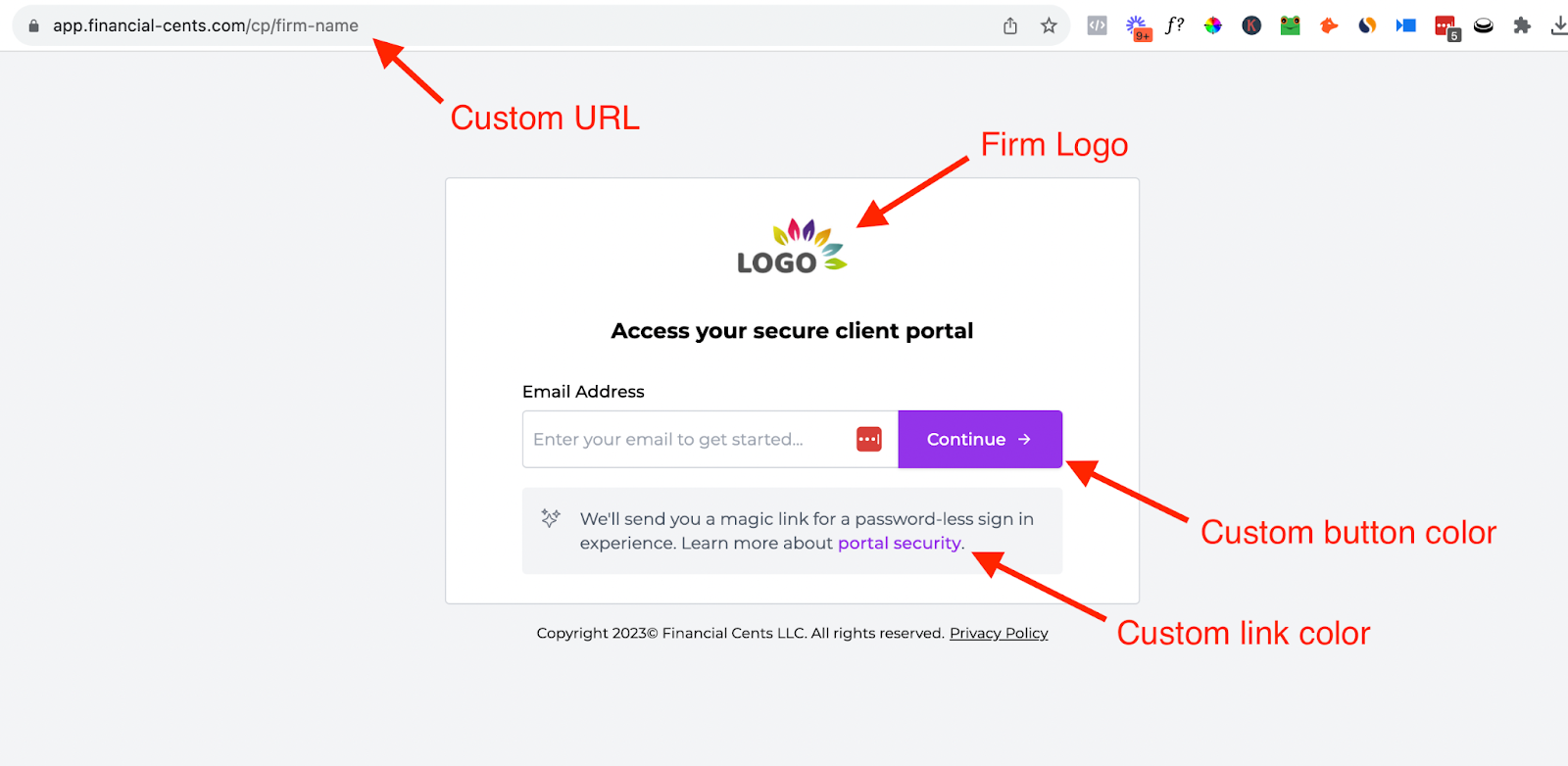

Consistent, Branded Communication

Every touchpoint — from reminders and status updates to file requests and onboarding instructions — should feel consistent, professional, and on-brand. This reinforces trust and makes your firm feel organized and reliable.

With Financial Cents, you can elevate your client experience with firm branding features that let you white-label both your client portal and communications. You can customize your client portal URL with your firm’s name, adjust button and link colors to match your brand, and display your firm’s logo across the portal and in client task emails:

Use Financial Cents To Improve Your Communication

Just like you wouldn’t run your firm without solid accounting tools, you shouldn’t leave communication to chance. The tools you use to manage client interactions, share updates, and keep work organized are just as critical as the tools you use to reconcile books or file returns.

If you’re looking for a simple way to improve how your firm communicates, Financial Cents makes it easy. With built-in messaging, automated reminders, secure file sharing, and client dashboards, it gives you the structure you need to stay responsive and organized.

Explore Financial Cents’ client communication and management features to see how your firm can deliver a better client experience and scale more efficiently.