The busy season is in full swing, and you’re balancing four clients with deadlines piling up. Suddenly, a client emails at the eleventh hour, requesting a correction on an old deduction.

Meanwhile, another client calls to confirm if their quarterly taxes have been filed. You shift gears, open multiple spreadsheets, and start working frantically to meet everyone’s expectations.

A few days later, you realize that while you were adjusting one client’s tax return, you forgot to send an important invoice to another.

Now, your cash flow is delayed—and worse, you’re scrambling to fix the mistake before it escalates.

According to a recent Gartner Survey, 18% of accountants report making errors daily, while 33% make several errors weekly, and 59% admit to making multiple errors per month.

For large firms, an extra pair of eyes or dedicated review teams help catch mistakes. But for solo accountants, there’s no safety net—you’re both the preparer and the reviewer, which makes you more vulnerable to human error.

By the end of this article, you’ll learn how creating step-by-step processes can help prevent mistakes and even scale your practice when you’re ready to grow. With documented processes, you’ll no longer feel like you’re constantly putting out fires—instead, you’ll operate with confidence, precision, and peace of mind.

What Are Documented Processes?

Documented processes are detailed instructions or guidelines that outline how tasks and operations should be performed in a business.

They serve as an essential framework that ensures consistency, reliability, and accountability in how you manage your work. For solo accountants, having documented processes is like having an operating manual for every core function of your practice.

These processes ensure you follow the same steps every time, minimizing the chance of human error, streamlining workflows, and ensuring nothing gets overlooked.

Here are different types of documented processes, why they matter, and how they can transform your day-to-day operations.

Types of Documented Processes

1. Standard Operating Procedures (SOPs)

SOPs are step-by-step instructions for completing recurring tasks. These procedures help ensure that every task is performed the same way each time, leaving no room for ambiguity or shortcuts. For example, you could create an SOP for client onboarding that outlines:

- The documents you need to request

- Steps for entering client data into your accounting software

- How to set up a welcome email to new clients

SOPs act as ready-made instructions for tasks that are routine but critical to your operations, such as payroll processing or financial reporting. If you hire help in the future, your SOPs can act as the perfect training tool.

2. Checklists

A checklist is a simple but powerful tool that ensures you never miss a step, especially during multi-stage processes. Checklists are often used for time-sensitive tasks, like tax filing or month-end closing, where forgetting one small step can create big problems. For instance:

- Tax Season Checklist: This might include gathering receipts, submitting required forms, and verifying deductions.

- Monthly Reconciliation Checklist: A checklist here could help you confirm that all transactions are accounted for, discrepancies are investigated, and the general ledger balances.

I like to start by thinking about milestones. Your checklist should represent these milestones, each task setting off the next. This approach helps create effective workflows. It’s also crucial to consider the desired outcome of the checklist. What problem is it solving?"

Kellie Parks, CPB, Owner, Calmwaters Cloud Accounting3. Workflow Diagrams

A workflow diagram is a visual representation of the steps involved in a process. This helps you see how one task flows into the next, making it easier to identify bottlenecks or inefficiencies. For example, a client payment workflow might show:

- Step 1: Invoice sent to the client

- Step 2: Payment received and recorded

- Step 3: Receipt sent to the client

- Step 4: Update the books and close the transaction

Workflow diagrams are especially useful for complex processes that involve multiple steps or systems, such as audit procedures or expense tracking.

4. Templates

Templates ensure uniformity in the way documents are prepared and shared. For example, using a pre-designed invoice template guarantees that all invoices have the same format, making it easier to review and track payments. Other examples of templates include:

- Engagement Letter Templates: A standardized letter for new clients outlining your services, fees, and expectations.

- Report Templates: Ensure all client financial statements follow a consistent format.

Templates make your work more efficient by reducing the time spent designing new documents and maintaining a professional appearance.

5. Process Maps or Flowcharts

Similar to workflow diagrams, process maps give a big-picture view of your operations. These are helpful when planning to automate certain parts of your business or when you need to outsource tasks. For instance, a tax preparation process map could show how client data moves from your intake form to your accounting software, through review and filing and finally to the issuance of tax reports.

Practical Steps to Start Documenting Your Processes

Getting started with documenting processes might seem overwhelming, especially when you’re already busy managing clients and deadlines. However, process documentation doesn’t have to be a massive project. The key is to break it down into small, manageable steps that build over time. Below, we discuss detailed and practical strategies to help you establish effective documentation in your solo accounting practice.

Step 1: Identify Key Tasks and Workflows

The first step is to identify the tasks that have the biggest impact on your business operations. Start with processes that:

- Occur frequently (e.g., monthly invoicing, payroll processing).

- Involve complex or multi-step workflows (e.g., annual tax filings).

- Are prone to errors (e.g., manual data entry, reconciliations).

- Impact client satisfaction or compliance (e.g., onboarding new clients, submitting reports).

Focus on documenting high-impact processes first, which will yield the most immediate benefit. Once these essential tasks are documented, you can gradually move on to secondary processes.

Examples of Key Processes to Document:

- Client Onboarding: Steps to collect contact information, contracts, prior financials, etc.

- Monthly Bank Reconciliation: Procedures to match transactions between bank statements and accounting software.

- Invoice Creation and Payment Collection: How to generate invoices, follow up with clients, and record payments.

- Quarterly and Annual Tax Filing: Steps to prepare and file taxes, including deadlines and forms required.

- Compliance Checks: Routine processes to ensure your firm follows local tax regulations and financial reporting standards.

Step 2: Choose the Right Tools for Documentation

The abundance of apps can lead to confusion and overwhelm. Finding the right apps involves first gaining clarity on your firm goals and services."

Veronica Wasek, CPASelecting the right tools makes the process smoother and ensures your documentation stays organized and accessible.

Depending on your preference, you can opt for simple tools like Word and Excel or more advanced options like workflow management software. Below are some tools to consider for different documentation styles:

- Google Docs / Microsoft Word: Ideal for creating Standard Operating Procedures (SOPs) with detailed step-by-step instructions.

- Google Sheets / Microsoft Excel: Great for developing templates, checklists, and data entry forms.

- Notion / Evernote: Useful for creating a central knowledge base where all your processes can be organized by category.

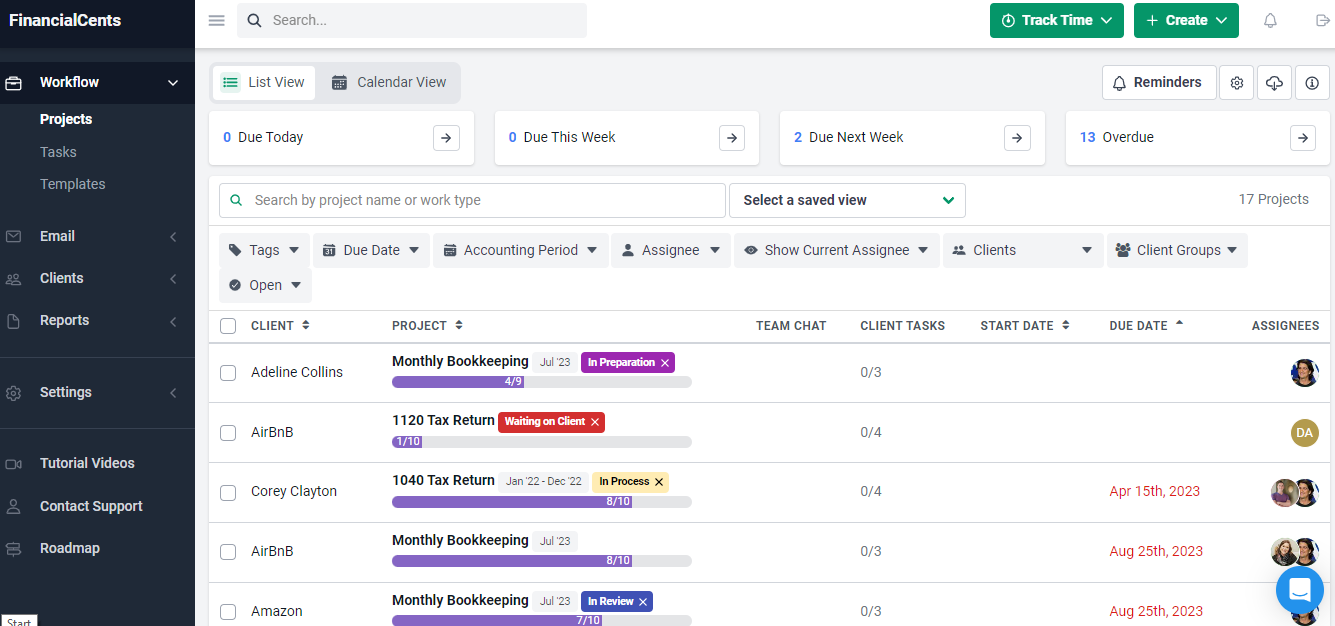

- Financial Cents: Perfect for setting up visual workflows and task boards to track progress on recurring tasks. This is a specialized software designed for accounting workflow automation and project tracking.

Pro Tip: Financial Cents has a solo plan that replaces expensive, complicated workflow tools you’ve tried in the past. This plan includes everything you need to run your solo firm for just $9/month in one easy-to-use software.

The interesting part? It replaces the 3 tools mentioned above.

Some of the features include:

- Task management: Track the work you need to do and prevent tasks from slipping through the cracks.

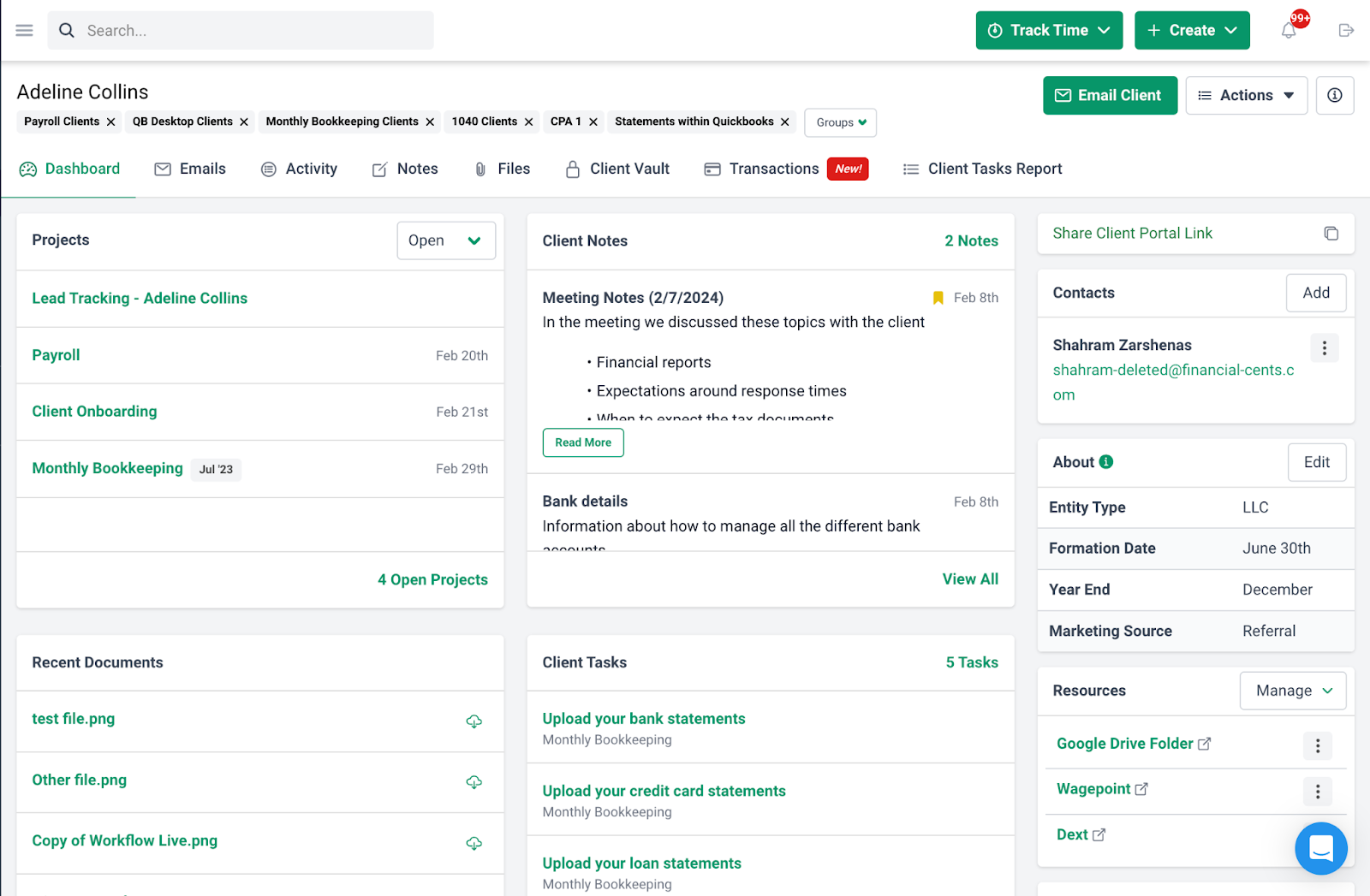

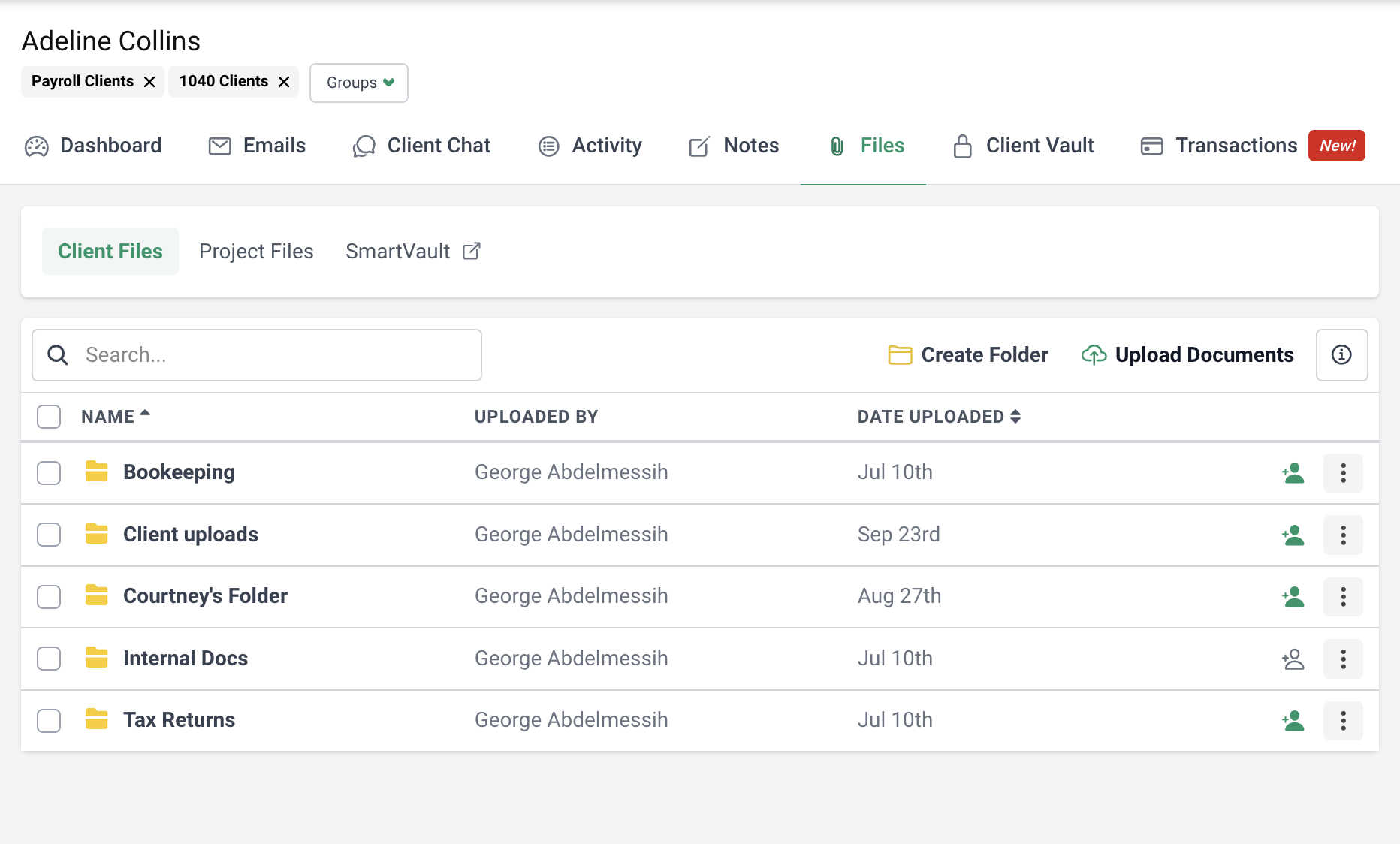

- Client CRM: Centralize client information so it is easy to find. It’s also cloud-based, enabling access to documents anywhere and anytime.

- QuickBooks Integration: Import and sync your clients, time tracking and invoicing to Financial Cents. You can also sync your time-tracked, invoices and online payments from Financial Cents to QBO.

- Client Portal: Get client responses faster without chasing them down for information and documents

- Workflow checklist templates: Quickly get set up with 50+ templates, or simply import your templates or a friend’s.

It also offers a variety of document organization options, including a simple and comprehensive view, folders and subfolders, client groups, and customizable data fields. Here, you’ll have all your client information in one granular view, so you don’t need to use multiple apps or spreadsheets to organize them.

Some of the sections in this profile include upcoming projects, client notes, recent documents, client groups, etc.

Step 3: Break Down Each Task into Steps

Once you’ve identified a process, break it down into individual, actionable steps. Be as specific as possible, assuming that the person reading your documentation may not have prior knowledge of the task.

Example: Monthly Bank Reconciliation SOP

- Log into the bank portal and download the latest bank statement.

- Open the accounting software (e.g., QuickBooks).

- Match each transaction in the bank statement with the corresponding entry in the software.

- Flag any discrepancies for review.

- Generate a reconciliation report and save it in the designated folder.

Breaking down processes this way ensures consistency and makes the tasks easier to follow, even if someone else steps in to help with your workload.

Step 4: Integrate Documentation into Your Daily Routine

Creating documentation doesn’t have to disrupt your workflow. Instead of setting aside large blocks of time, try documenting processes as you perform them. This approach ensures that your documentation reflects the real-world way you operate, making it more relevant and practical.

How to Integrate Documentation into Your Routine

- Document on the Go: As you complete a task, write down the steps you followed.

- Record Screenwalks: Use screen recording tools to capture processes like data entry or report generation. Later, you can transcribe these recordings into written SOPs.

- Set a Documentation Schedule: Dedicate 10-15 minutes at the end of each day to document one small process. Over a few weeks, you’ll build a library of SOPs and templates.

Step 5: Review and Update Your Documentation Regularly

Processes aren’t static—they evolve as your practice grows or as new tools and regulations emerge. Schedule regular reviews (e.g., every 3-6 months) to keep your documentation current and relevant. This ensures that your workflows reflect the latest best practices and legal requirements.

Steps to Review Documentation:

- Set calendar reminders for periodic reviews.

- Check if any processes need updating based on recent workflow changes or regulatory updates.

- Solicit feedback from contractors, clients, or collaborators to refine your processes.

- Update SOPs, checklists, and templates to reflect any changes, ensuring your documentation remains accurate and useful.

Step 6: Train Yourself and Others to Use Documentation Consistently

Your documentation will only be effective if it’s used. Make it a habit to refer to your SOPs and templates whenever you perform a task. If you work with contractors or part-time assistants, train them to follow the documented procedures..

Training Tips:

- Walkthrough Sessions: Set aside time to review the documentation with new assistants or collaborators.

- Reinforce Usage: Encourage yourself to rely on your checklists, especially during busy periods.

- Monitor Compliance: Periodically check if tasks are performed according to the documented processes. This ensures that workflows stay consistent.

Start Small, Build Consistently

The idea of documenting every process in your solo accounting firm can feel overwhelming, but the key is to start small and build consistently over time. Trying to document everything all at once may lead to burnout or poorly organized documentation. Instead, focus on one high-priority task at a time and gradually expand your efforts.

If you’re looking for software to simplify your documentation efforts and ensure consistency, Financial Cents is your best bet.

With Financial Cents, you can streamline your documentation efforts, ensuring that your processes are not only written down but also actively used. It will transform your workflows, eliminate errors, and position your solo accounting firm for sustainable success.

The journey may start small, but with consistent effort, you’ll build a practice that runs like clockwork.