There are no flying cars yet, but remote work is here to stay, steadily changing how businesses operate.

For accounting firms, transitioning from a traditional office setup to a home-based model can be as exciting as it is challenging. This shift caters to the growing demand for flexibility and offers significant benefits, such as attracting top talent, enhancing work-life balance, and boosting employee satisfaction.

This transformation is about adapting to the present and future-proofing your accounting firm. The question is no longer “Should we go virtual?” but rather “How can we do it effectively?”

In this article, we’ll explore why going virtual is a strategic move for your accounting firm and provide actionable steps to ensure a smooth transition. From leveraging technology to managing remote teams, we’ll cover everything you need to know to thrive in this new working environment.

The Need to Go Virtual

Competitive Advantage in the Job Market

In the cutthroat job market, offering virtual work options is akin to having a secret weapon. Today’s professionals are increasingly valuing flexibility, and accounting firms that adapt can easily outshine competitors stuck in the old ways. By providing remote work opportunities, your accounting firm becomes a magnet for top-tier talent, showcasing a progressive and employee-centric approach that stands out.

Moreover, this can improve employee retention. Employees who have the flexibility to work from home are often more satisfied with their jobs, leading to higher retention rates. This reduces the costs and disruptions associated with high turnover, ultimately benefiting your accounting firm’s bottom line.

Access to a Wider Talent Pool

Gone are the days when your hiring pool was limited to your city or region. Remote work opens the doors to a global talent pool, allowing you to bring on board the best professionals from anywhere in the world. This enriches your firm’s expertise and perspectives and ensures you have the right skills for every project, no matter how niche. This diversity can lead to creative problem-solving and fresh ideas, giving your accounting firm a competitive edge.

You may be interested in:

Recruitment And Retention Strategies For Scaling Your Accounting Firm.

Whether you need an expert in specific accounting software, a tax specialist with international experience, or a financial analyst with a deep understanding of a particular industry, remote work allows you to find the perfect fit for your team, regardless of location.

Cost Savings

Going virtual can significantly cut down your accounting firm’s operational costs. Imagine slashing your rent, utility bills, and office supply expenses. These savings can be redirected into growth initiatives, such as technology upgrades, employee development programs, or competitive salaries that attract and retain top talent.

Reasons Why Accounting Firms Hesitate to Go Virtual

Security Risks and Data Protection

The idea of handling sensitive clients’ data outside the office can make any accounting firm owner break into a cold sweat. Security is a valid concern, but with the right measures, it’s manageable.

- Robust Cybersecurity Solutions: Investing in encrypted cloud storage solutions ensures data is securely stored and transmitted. Also, use secure VPNs (Virtual Private Networks) to protect your clients’ data that are being accessed remotely.

- Employee Training: Regularly train your team on best practices for data security. This includes recognizing phishing attempts, using strong passwords, and understanding the importance of secure data handling practices.

- Regular Security Audits: Conduct periodic security audits to identify and address vulnerabilities. This proactive approach helps in maintaining a secure remote work environment.

- Incident Response Plan: Develop and maintain an incident response plan to quickly and effectively address any security breaches. This plan should include steps for containment, investigation, and remediation.

Maintaining Productivity and Managing Performance

The concern that running a virtual accounting firm might lead to decreased productivity is common but often unfounded. With the right strategies, maintaining and even enhancing productivity is possible.

- Clear Performance Metrics: Establish clear, measurable performance metrics for your team. Define what success looks like for each role and project. This helps maintain accountability and ensures everyone knows what is expected of them.

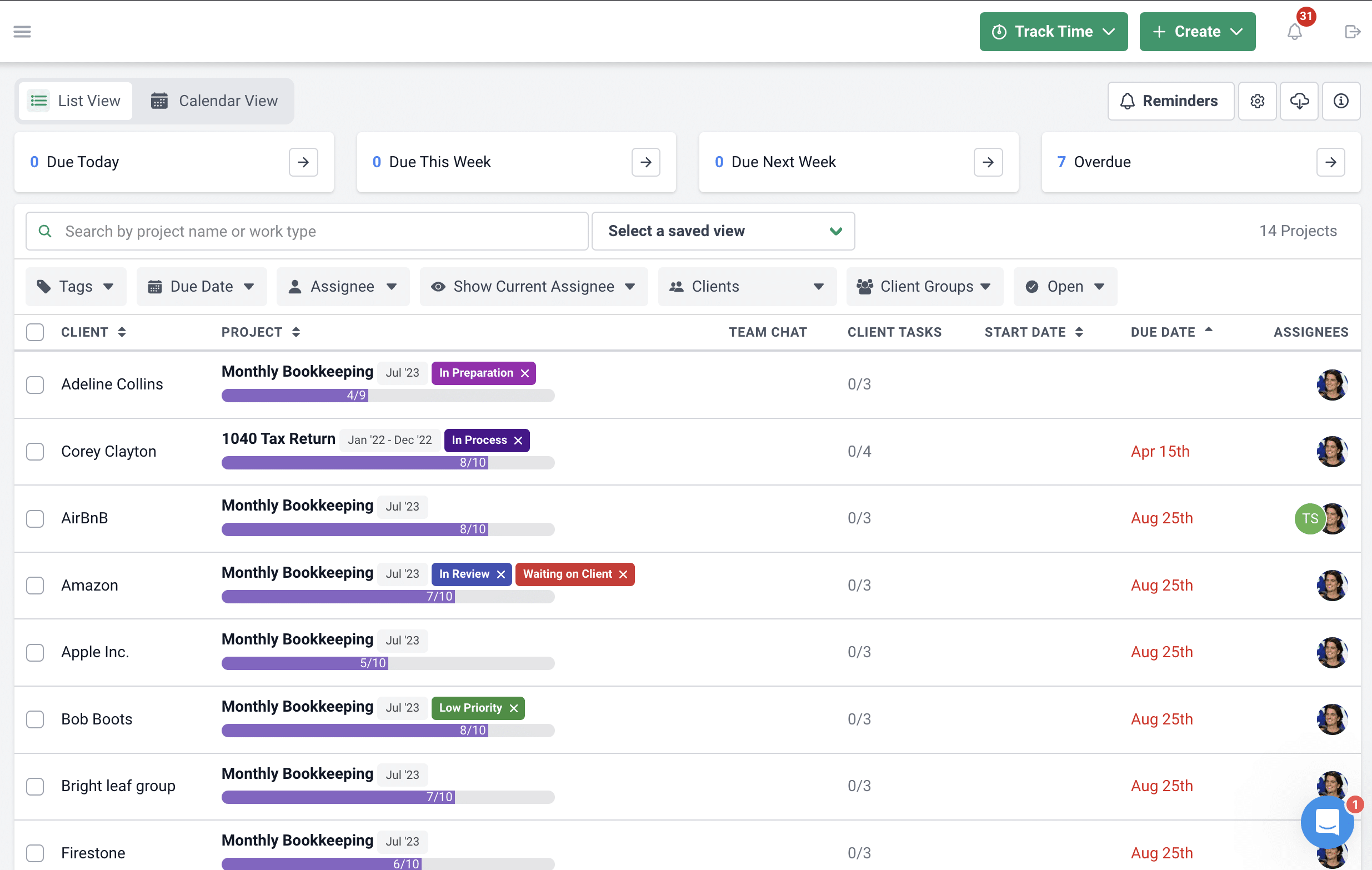

- Project Management Tools: Utilize accounting project management tools like Financial Cents to track tasks, deadlines, and progress. These tools provide visibility into ongoing projects and help in managing workloads efficiently.

- Regular Check-ins: Schedule regular check-ins with your team to discuss progress, address any challenges, and provide feedback. This keeps everyone aligned and ensures that any issues are promptly addressed.

- Flexible Working Hours: Allow flexible working hours to accommodate different time zones and personal schedules. This flexibility can lead to increased productivity and job satisfaction.

- Performance Reviews: Conduct regular performance reviews to provide constructive feedback and recognize achievements. This helps motivate employees and identify areas for improvement.

Clear Communication and Collaboration

Without face-to-face interaction, it’s easy for misunderstandings to occur. Ensuring clear and consistent communication is key to maintaining a cohesive team.

- Reliable Communication Tools: Invest in reliable communication tools like Slack for instant messaging, Zoom for video conferencing, and G-Suites for collaborative workspaces. These tools facilitate real-time communication and make it easier to share updates and information.

- Establish Communication Protocols: Set clear communication protocols, including response times, preferred communication channels for different types of messages, and guidelines for virtual meetings. This helps in reducing misunderstandings and ensures that everyone is on the same page.

How to Make the Transition to a Virtual Accounting Firm

Develop Standard Operating Procedures (SOPs)

SOPs are your best friends as an accounting firm owner. They provide a roadmap for consistency and efficiency in your accounting firm.

- Define Key Processes: Identify and document all critical processes within your accountg firm, such as client onboarding, financial reporting, and internal audits. This includes detailing each step, responsible parties, and required tools or resources.

One of the things that I like to do is actually record myself doing the work that I’m asking the team to do. And we take that recording and transcribe it to create written SOPs. We end up having a video that goes along with a step-by-step process of what I’m asking them to do"

Nayo Carter-Gray, Owner, 1st Step Accounting.- Create Detailed Guidelines: Develop comprehensive guidelines that outline the procedures for each process. These guidelines should be easy to follow and include any necessary templates, forms, or checklists to streamline tasks.

- Regular Updates: SOPs should be living documents that are regularly reviewed and updated to reflect changes in technology, regulations, or your accounting firm’s practices. Assign a team member to oversee this process and ensure SOPs remain current and relevant.

- Training and Onboarding: Use SOPs as a training tool for new employees. By providing new hires with clear instructions and expectations, you can reduce the learning curve and ensure they quickly become productive members of the team.

Owning a firm doesn't mean you should go through the workload alone, employ people, train them to be as good as you."

Ryan Lazanis, CPA.- Accessibility: Store SOPs in a central, easily accessible location, such as a cloud-based document management system. In Financial Cents, you can integrate workflow processes with a centralized library for easy access and continuous improvement. This ensures that all your team members can access the information they need, regardless of their location.

You may be interested in:

Leverage Technology

Technology is the backbone of successful remote work. Equipping your team with the right tools can facilitate communication, collaboration, and productivity, ensuring a seamless transition to a virtual work environment.

- Accounting Project Management Software: If you use project management software designed for every industry, you will struggle to make it work for your team. And that may be at the risk of losing sensitive project information, among other things. That is why a solution like Financial Cents is recommended. With it, you can view your team’s tasks & client requests at a glance, automate recurring tasks, assign projects, and manage your team’s workload, amongst other benefits.

- Collaboration Tools: Invest in collaboration tools like Microsoft Teams, Slack, or Zoom to enable real-time communication and virtual meetings. These platforms provide features such as video conferencing, screen sharing, and instant messaging, which are essential for maintaining team connectivity.

Leading a Virtual Team

Oftentimes, this requires a shift in management style and a focus on fostering a strong remote work culture. Effective leadership can help maintain team morale, productivity, and cohesion. Here are ways you can make it work:

- Regular Communication: Establish regular communication routines, such as daily check-ins, weekly team meetings, and monthly one-on-ones. This helps maintain transparency, keeps everyone aligned, and provides opportunities to address any issues promptly.

Watch:

- Virtual Team-Building Activities: Organize virtual team-building activities to strengthen relationships and build a sense of community. Activities can include virtual coffee breaks, online games, or team challenges that encourage collaboration and fun.

- Employee Recognition: Recognize and celebrate employee achievements and milestones. Whether through virtual shout-outs, digital badges, or remote-friendly rewards, acknowledgment can boost morale and motivation.

How to Transition Your Clients to a Virtual Working Style

Clients might be apprehensive about working with a remote accounting firm, fearing a drop in service quality. Addressing these concerns through transparent communication and demonstrating the benefits of remote work can help gain their confidence.

- Transparent Communication: Clearly communicate your transition plans to clients, explaining how remote work will not impact the quality of service. Reassure them that all security measures are in place to protect their data.

You may be interested in:

- Highlight Benefits: Emphasize the benefits of remote work for clients, such as increased accessibility, faster response times, and the ability to work with a wider range of experts.

- Client Onboarding Process: Develop a smooth onboarding process for new clients, ensuring they are comfortable with the remote setup. Provide them with clear instructions on how to communicate and collaborate with your team.

Client onboarding sets expectations and boundaries, ensuring a smooth transition from the sales process to service delivery. It ends when all necessary information is obtained from the client. "

Veronica WasekYou may be interested in:

Workflow Diaries: Nikole Mackenzie’s Workflow For Onboarding New Clients.

Going Virtual is Achievable

Remote work is not just a temporary solution; it is a strategic move towards future-proofing your accounting firm. By embracing the virtual work environment, you can drive innovation, improve efficiency, and provide exceptional service to your clients, no matter where they are located.

Remember, the journey to going virtual is a marathon, not a sprint. Take it step by step, learn from the process, and continuously refine your approach.

Here at Financial Cents, we understand the importance of a seamless workflow process, and it’s not hard to figure out why accounting firm owners pick Financial Cents as the accounting practice management software they can’t do without.

Manage your virtual firm with our workflow management solution today.