As an accounting firm owner, you know how chaotic managing client information, communication, and collaboration can get. With multiple clients, it’s even more complicated.

If you’re using manual methods, you’ll deal with endless email threads, overflowing inboxes, and misplaced paperwork. This can cause you to miss deadlines, leading to frustrated clients and wasted time chasing missing files.

Thankfully, accounting firms now have a powerful tool: the client portal.

A client portal is a secure online platform that streamlines communication, simplifies document exchange, and fosters collaboration between you and your clients.

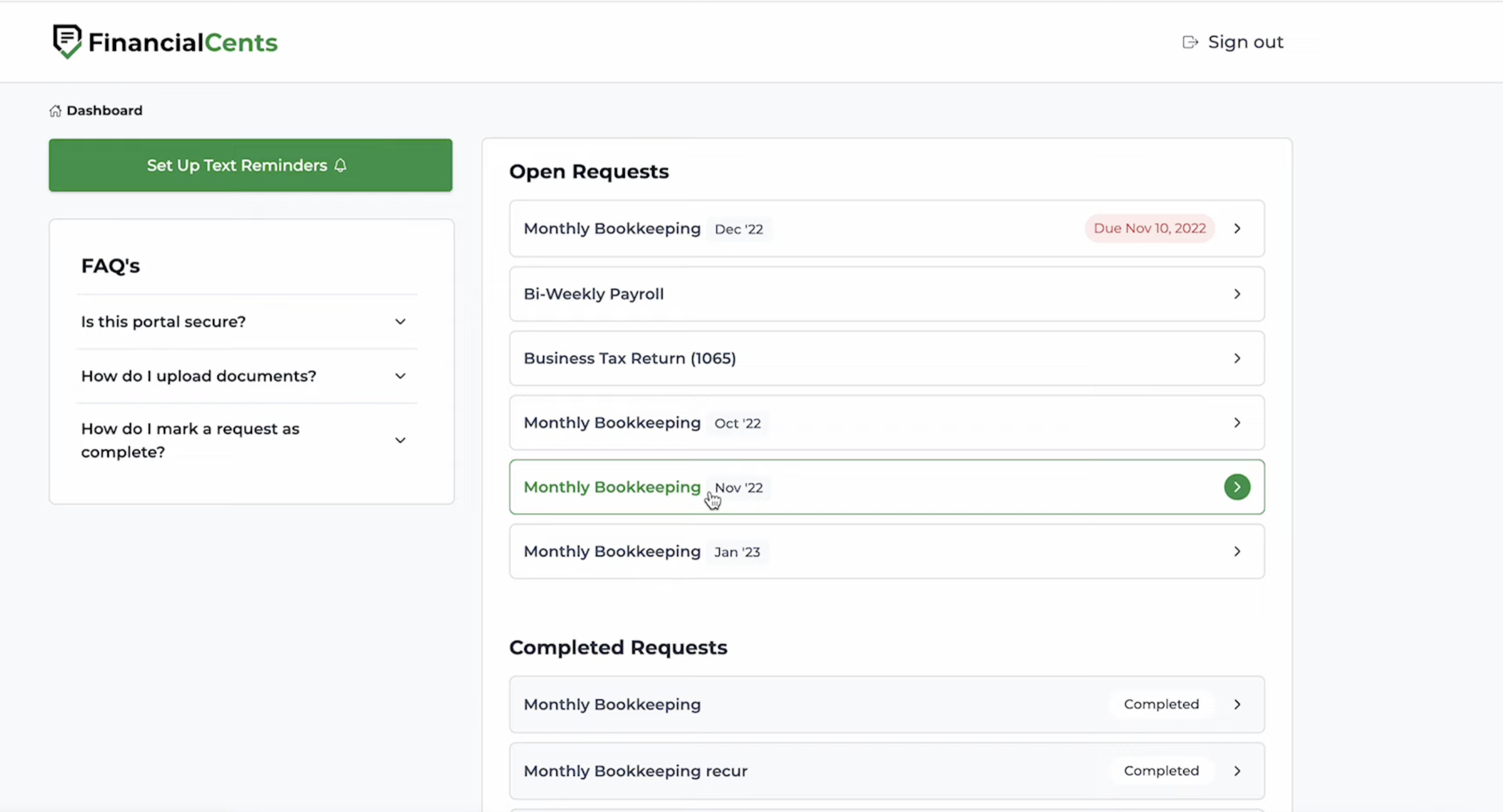

By utilizing a client portal, you can eliminate the inefficiencies of manual methods and create a smoother workflow for both you and your clients. No more chasing down information. Your clients can easily upload documents, receive updates, and communicate with you all in one place.

However, with many client portal options available, selecting the one with the right features for your practice can be hard. In this article, we’ll guide you through the essential functionalities every accounting client portal must possess so that you can make an informed decision.

Benefits of Using a Client Portal for Accounting Firms and Clients

By using a client portal for accountants, you enjoy:

- Improved client experience: Client portals provide clients with self-service options. They can access important information like tax forms, previous returns, and invoices 24/7, reducing frustrating back-and-forth communication. Faster messaging within the portal also ensures timely responses and keeps clients informed.

- Increased efficiency for accounting teams: Streamlined document sharing is a game-changer. You can request documents from clients, who can oblige by uploading them directly to the portal. You can also automate follow-ups via the portal, which frees up valuable time for your team to focus on higher-value activities and strategic client service.

- Enhanced client satisfaction and loyalty: With easy access to information and faster communication, client portals provide a more positive client experience. Clients feel valued, leading to increased satisfaction, loyalty, and a strengthened relationship. Imagine the positive impact on your reputation when people rave about the ease and convenience of working with your firm.

- Reduced paperwork: Client portals usher in a new era of paperless accounting. Secure document storage within the portal allows for easy retrieval of past records without the hassle of physical files. This not only saves on storage space but reduces the risk of document loss or damage. It also translates to a more eco-friendly practice.

- Modern and secure service: Another benefit is that they project a professional and modern image for your accounting firm. They demonstrate your commitment to utilizing technology to enhance client service and data security. For instance, multi-factor authentication and role-based access control ensure that only authorized users can access sensitive financial information, giving you and your clients peace of mind.

Overall, client portals offer a win-win situation for accounting firms and their clients. They optimize workflows, improve communication, and enhance security, thus promoting a more efficient and productive working environment.

Key Features a Good Client Portal Must Have

We’ve established the clear benefits of client portals for accounting firms. Now, let’s dive into the essential features your chosen portal must possess to enjoy these advantages.

Security and Compliance

Since financial data is highly sensitive, robust security measures are important. Look for features like multi-factor authentication, data encryption, role-based access control, and audit trails so only authorized users can access specific information. These features protect sensitive information and ensure compliance with industry regulations.

Financial Cents, an accounting practice management tool, doesn’t treat security lightly. Its client portal has an encrypted password (and an identifier), which expires every thirty days. After this expiration, Financial Cents will send you a six-digit code (by email or SMS) to give you access for the next thirty days. This regular change prevents outsiders from accessing the portal.

Financial Cents also tracks the email address from which your client visits the portal to prevent any other email address from accessing it. That way, unauthorized (or terminated) employees cannot use your client’s magic link to access the portal.

Ease of Use

A user-friendly interface is necessary. The portal should be intuitive and easy to navigate, even for clients with limited technical experience. A clean layout with clear menus and functionalities will encourage client adoption and maximize the portal’s benefits.

Financial Cents takes ease of use to a new level with its passwordless approach. Your clients do not need a username and password to sign in. Instead, they just need to enter the verification code sent to their email.

This is perfect for those reluctant to create another username and password. If you need to notify your clients about Financial Cent’s client portal, you can use this template.

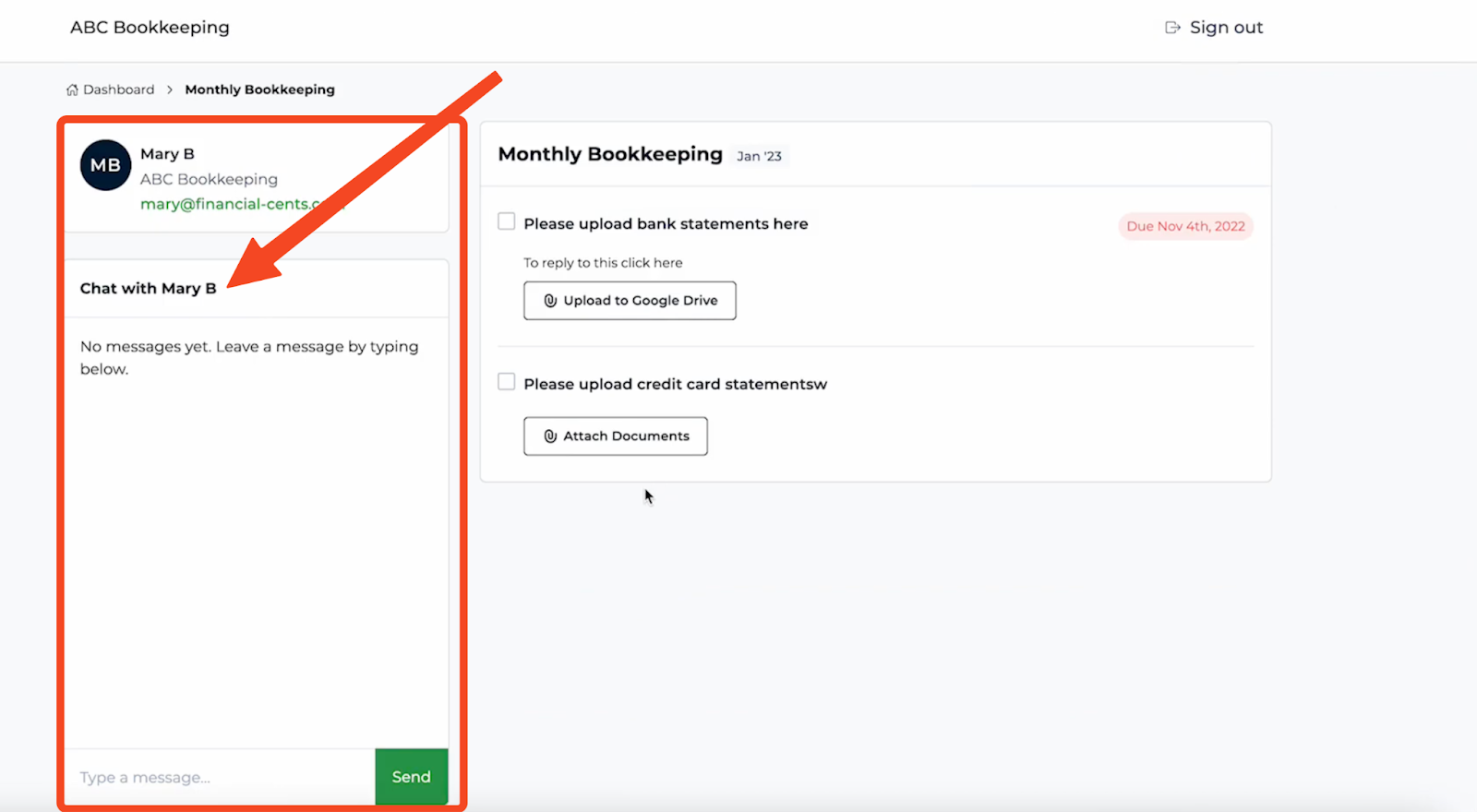

Client Communication

Effective communication is key to building strong client relationships. Secure messaging within the portal allows for real-time communication. Additionally, features like client chat enable quick responses to simple questions and clarifications, enabling a more responsive service.

With Financial Cents, you can chat with your clients in real-time via the “Client Chat” feature. Kellie Parks, Founder of Calmwaters Cloud Accounting, uses this feature a lot. She says,

Financial Cents is my client portal, and I use this function to chat with my clients."

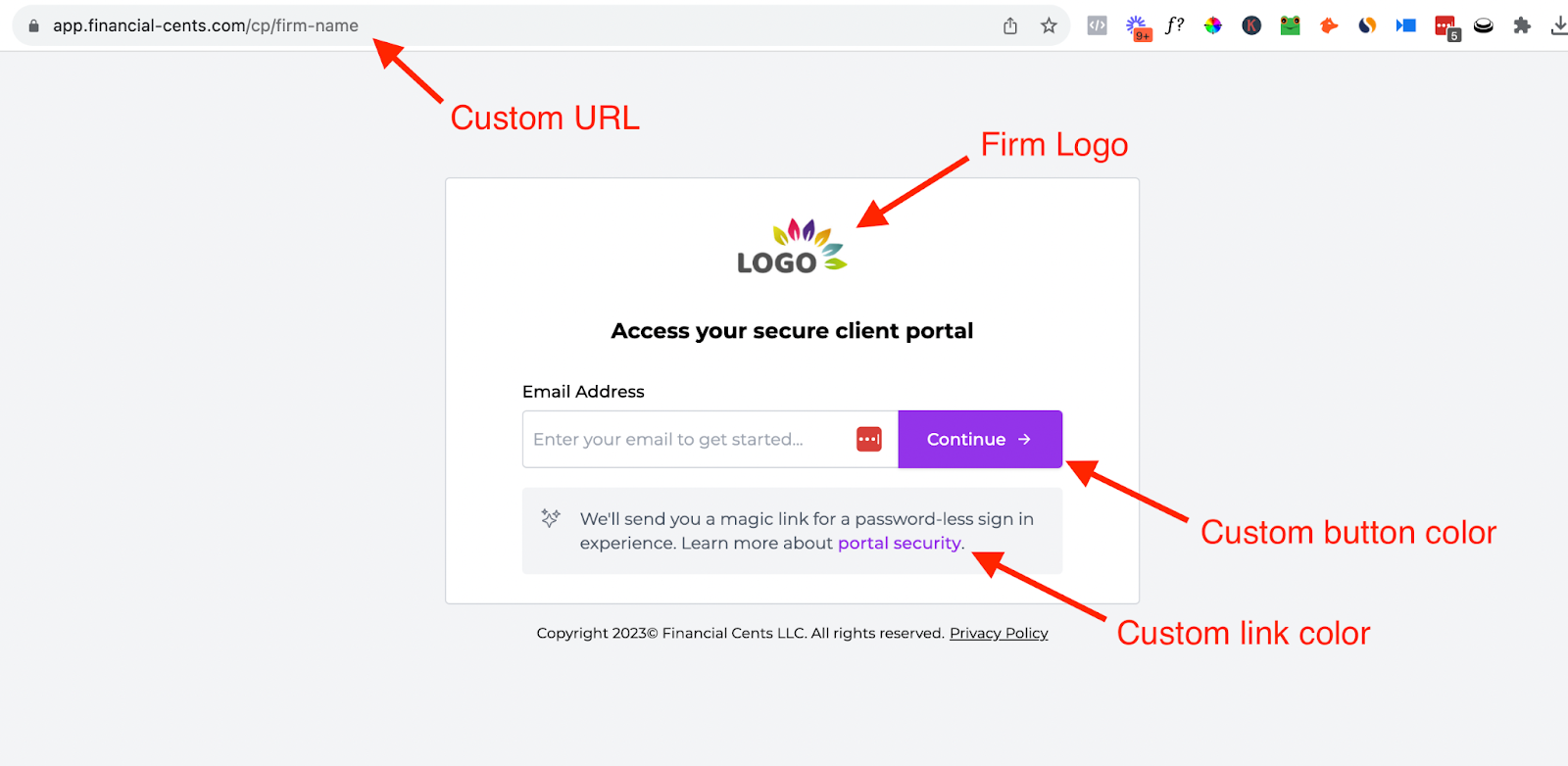

Branding Customization

The ability to customize the portal with your firm’s branding goes a long way in helping you maintain a consistent brand identity. This includes incorporating your company URL, logo, and color scheme. A branded portal fosters professionalism, reinforces brand recognition and creates a cohesive client experience.

You can brand your client portal in Financial Cents to customize the URL, color of the buttons/ links and display your firm’s logo.

To do this, log into your account, select “Settings” and click “Company”. Then scroll to “Custom Portal Branding”, upload your logo, customize the Portal URL, and choose your brand color.

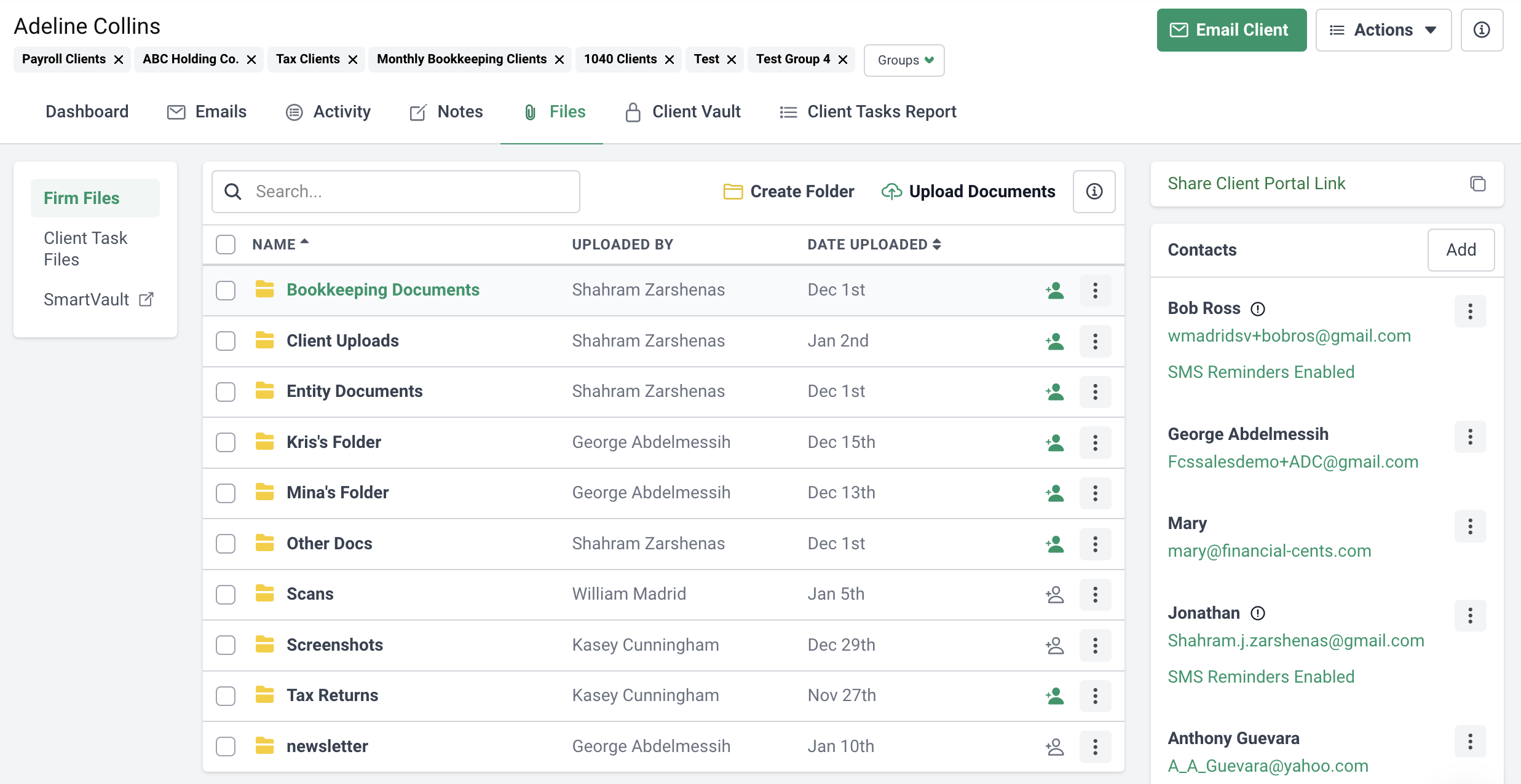

Document Management and Uploads

The client portal you choose should have a document management system. Clients should be able to seamlessly upload documents in various formats, while you should be able to organize documents into different folders and subfolders.

With Financial Cents, clients can upload documents onto the portal so you can access them.

It also lets you organize files into groups like Bookkeeping Clients, Tax Clients, Leads/Prospects, etc.

Create a group by clicking “Manage Groups” from the Client tab:

You can even tag them with keywords for easy retrieval and management.

Realtime Updates

You need to keep clients informed with real-time activity updates to promote transparency and build trust. That’s why you should go for a tool with notifications for uploaded documents, completed tasks, and upcoming deadlines to ensure clients stay in the loop throughout the engagement.

Financial Cents sends live notifications for every action/modification you or your client takes. It also sends notifications via email.

As Kellie says about this feature,

There isn’t a delay… there isn’t another need to log in or refresh. It actually just keeps adding those tasks even as they are looking at them."

Integrations

Look for a client portal that integrates with your existing accounting software. This ensures data consistency and eliminates manual data entry between systems, saving time and effort.

You can connect Financial Cents with QuickBooks online, Gmail & Outlook, SmartVault, and Adobe E-Signature. Our software also integrates with Zapier, which lets you connect to over 5000+ different apps like Anchor, GoProposal, Ignition, Dropbox, Proposify, etc.

Client Access Management

Maintain control over user access with granular permission settings. Assign different levels of access based on user roles so only authorized personnel can view sensitive data. To do this, look for features like secure folder sharing with permission controls and version control to track changes,

Financial Cents has this feature. You can create folders or documents and share them with clients, then restrict their access to either “View Only” or “View and Upload.”

Automated Reminders and Notifications

No need for manual reminders. A good portal must be able to automatically send reminders and notifications to clients about upcoming deadlines, requests, and task completions. This keeps everyone on track and promotes a more organized and efficient workflow.

In Financial Cents, all you need to do after sending a request is set reminders for your preferred intervals, and the tool will take care of it.

Other Factors to Consider

- Pricing and budget: Pricing matters, so evaluate your needs and budget to find a cost-effective option that offers the features most important to you.

- Scalability: Consider your firm’s size and future growth plans. Choose a portal that can scale with your needs and accommodate a growing client base.

- Customer support: Reliable customer support is important for any software solution. Ensure the vendor offers adequate support options to address any technical issues or questions you may encounter.

- Free Trials and demos: Many vendors offer free trials or demo versions of their client portals. Take advantage of these opportunities to test-drive the software and see if it fits your needs.

Financial Cents: Your All-in-One Accounting Practice Management Software

Financial Cents is a comprehensive client portal solution designed specifically for the needs of accounting firms. Packed with all the essential features discussed throughout this article, Financial Cents:

- Ensures maximum security with robust data encryption, multi-factor authentication, and granular permission settings.

- Streamlines communication and collaboration with secure messaging, task management tools, and real-time activity updates.

- Simplifies document management with secure storage, drag-and-drop upload functionality, and folder organization options.

- Enhances client experience with self-service access to information, automated reminders, and a mobile-friendly interface.

However, beyond a client portal, Financial Cents offers a suite of features to manage all aspects of your accounting practice like:

- Track project progress and deadlines: Ensure your team stays on top of deadlines and deliverables with clear task management and progress-tracking features.

- Automate repetitive tasks: Save time by automating data collection, recurring projects, and client communication.

- Centralize client information: Manage all client data, from contact details to financial records, in one secure and organized location.

- Collaborate seamlessly with your team: Promote efficient communication and collaboration within your firm with built-in messaging tools and project management functionalities.

Sign up for Financial Cents to elevate your client service with a powerful client portal, optimize internal processes, and boost team productivity.