The volume of accounting apps has exploded over the past few years. Accounting firms now have access to individual apps for communication, collaboration, client management, time tracking, and workflow management.

However, working with these numerous apps has a disadvantage: tool fatigue.

Tool fatigue is when users become overwhelmed by the sheer number of tools they have to work with. Ironically, rather than increasing productivity, these tools do the opposite: reduce productivity.

In an accounting firm, your clients expect you to do their work well and deliver on time. Tool fatigue ultimately hinders this. It consumes valuable time, prevents you from meeting deadlines and producing quality work.

Rather than having multiple tools to perform all these functions, why not have one encompassing tool? After all, more is not always better.

That’s where accounting Customer Relationship Management (CRM) software comes into play. It integrates all necessary functions into a single platform, which reduces tool fatigue and increases productivity.

An accounting CRM should have many features like client management, task tracking, invoicing, and analytics. And importantly, It should also have a client portal. In this article, we look at why your accounting CRM software should have a client portal and the benefits it brings.

What is an Accounting CRM?

An accounting CRM is software that provides an all-in-one solution for accounting, bookkeeping, or CPA firms. It serves as a central hub for storing client information, tracking interactions, and streamlining various accounting tasks.

Using CRM software is the key to scaling your firm as it helps you free up your time to take on more clients and offer high-level services like Client Accounting Services (CAS) or Client Accounting Advisory Services (CAAS). It also helps you retain existing clients.

Some accounting CRM options include Financial Cents, Jetpack Workflow, Aero Workflow, and Pixie. Your choice depends on your needs and goals, but our survey shows that by using Financial Cents, accounting firms save an average of $19,200 per employee each year.

What is an Accounting Client Portal?

An accounting client portal is a secure cloud-based platform that allows clients to access their projects. It provides a convenient way for customers to interact with your firm in different ways. For instance, they can communicate with you, track & comment on tasks, upload files, or download documents. This eliminates the need for back-and-forth emails or phone calls.

The portal functions as a two-way street. Through it, you can request documents from clients, communicate with them, and receive notifications when they complete a task.

Although some accounting CRMs neglect this feature, it’s crucial. It enables the exchange of sensitive information securely and efficiently, facilitates seamless collaboration, and centralizes all client-related activities.

In essence, a client portal streamlines the accounting process of firms so they can deliver exceptional client services, thereby enhancing the overall client experience.

5 Reasons Your Accounting CRM Software Should Have a Client Portal

1. Enhanced Communication

Client portals often have a chat feature that lets customers talk to their accountants in real-time. It’s a much more organized process than a cluttered email thread or using multiple communication channels. These portals usually have alert systems to inform you and your clients about new messages. This improves responsiveness and ensures important information is not missed.

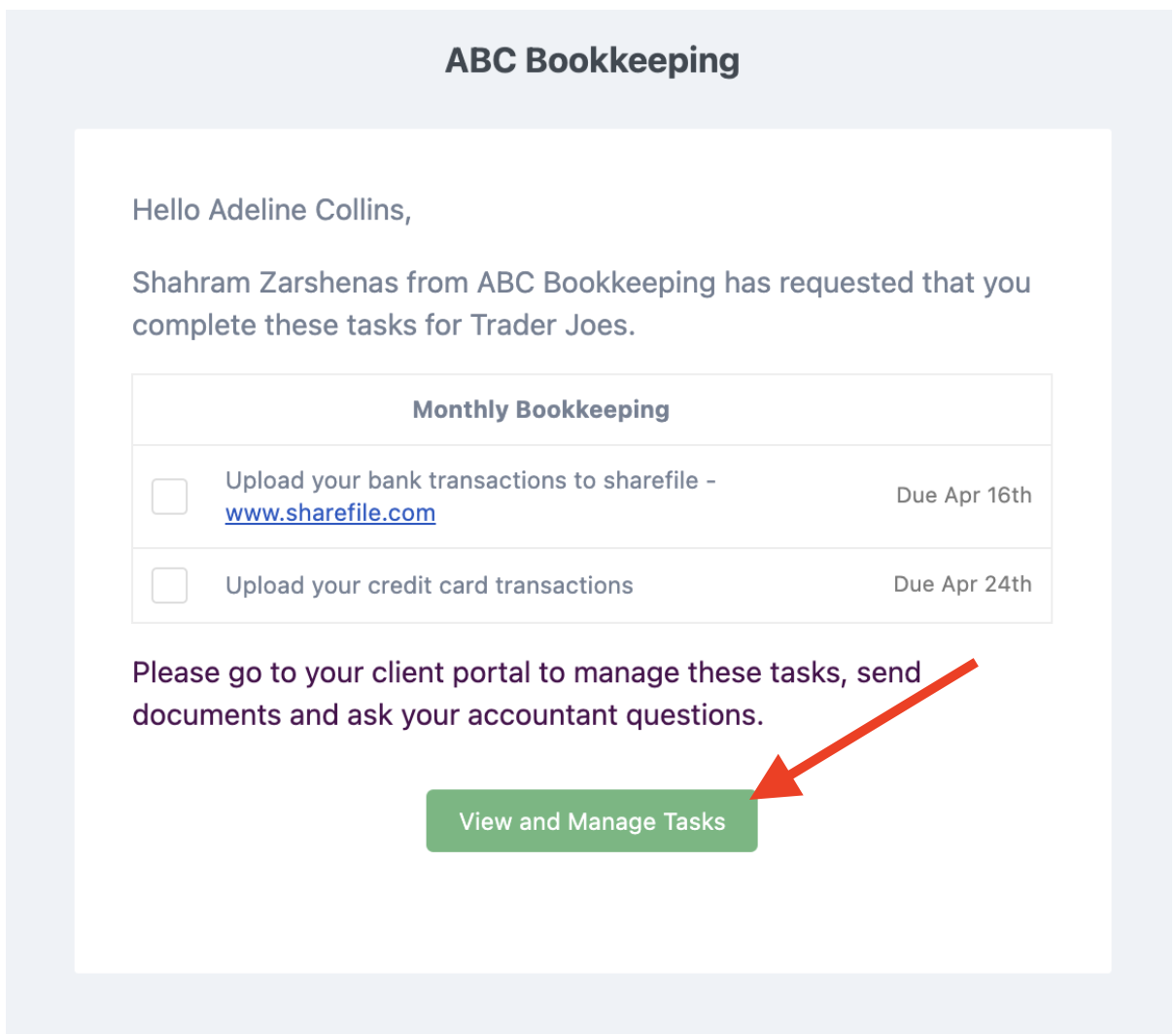

The chat feature is available in Financial Cents, a CRM with a client portal. To access and use the portal, clients must click the “view and manage tasks” button. The portal can also be accessed via the email notification sent to them:

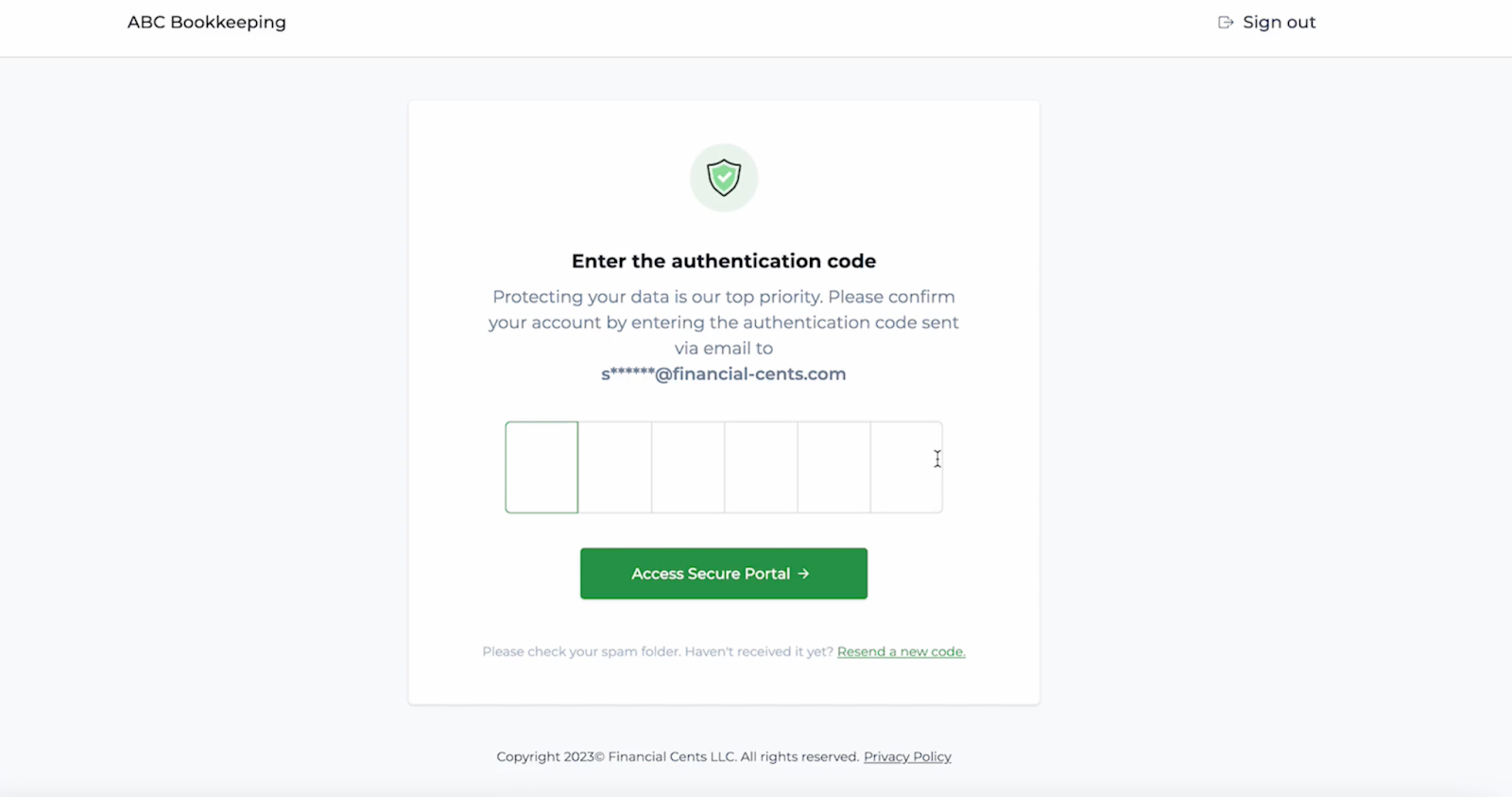

When they click the button, it’ll take them to a page that requests a verification code, which they’ll find in their email inbox. We use this method instead of a username/password or login method because we know how difficult it can be to convince clients to create profiles.

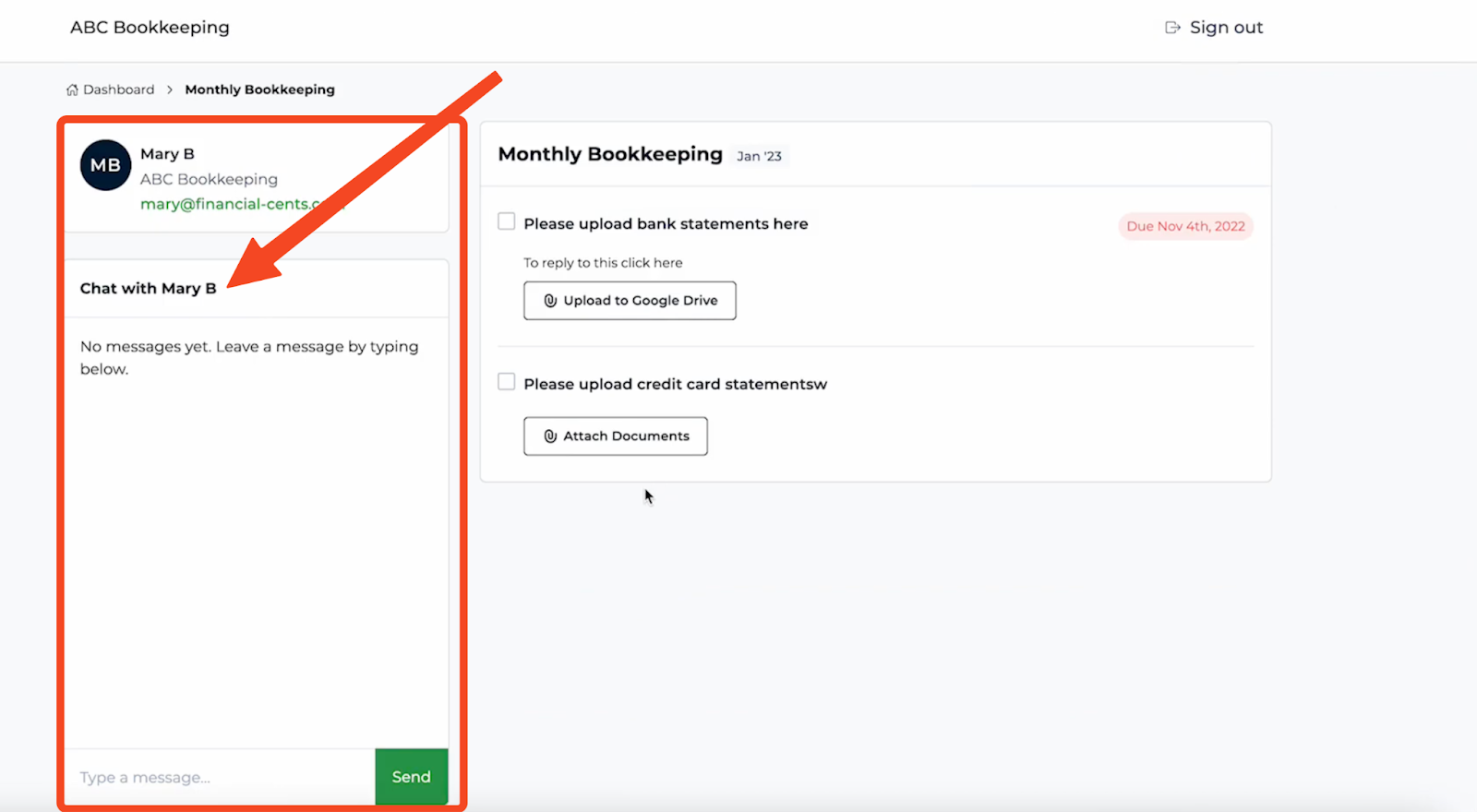

Once in the portal, clients can find the chat box on the left-hand side of the page, which can be used to exchange messages with someone from your firm.

2. Streamlined Document Sharing and Collaboration

File sharing is a constant in accounting firms. Clients must share important documents, sign contracts, or fill out forms.

Historically, firms have had to send these documents by email or physical mail. But that’s no longer safe; hackers can intercept these documents, putting sensitive information at risk. Or they could even go missing in the case of physical mail.

Client portals offer a secure and efficient method of file sharing, where clients can easily upload and download documents, streamlining the collaboration between you and your clients. This ultimately ensures the safe exchange of all important documents.

If you’re using Financial Cents, you can request documents and automatically send reminders to clients at set intervals until they complete your request.

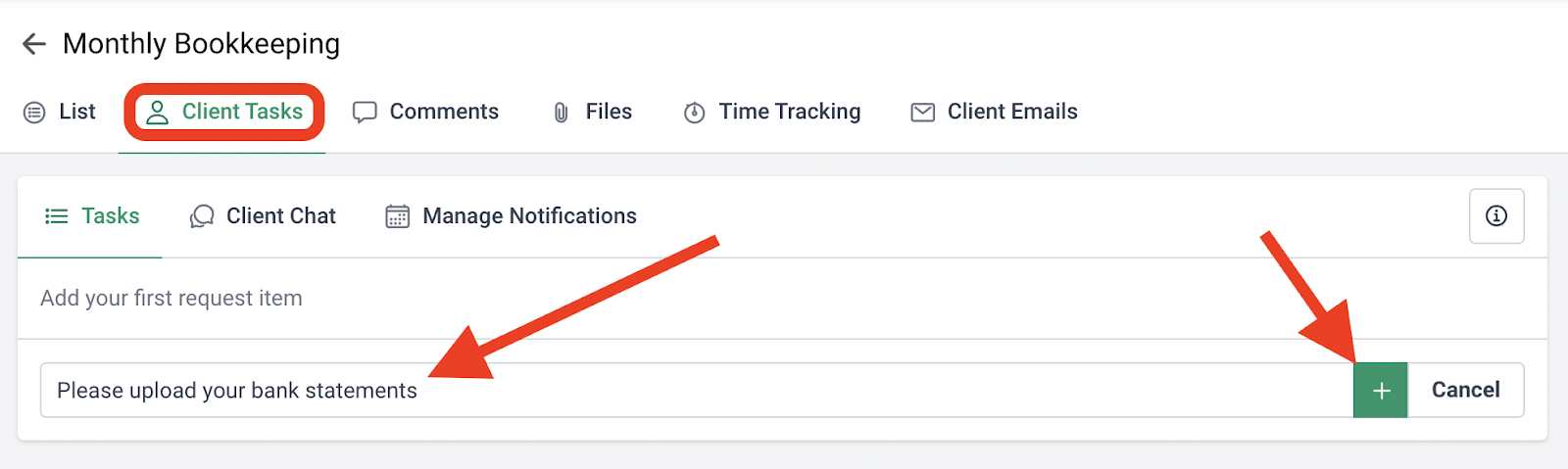

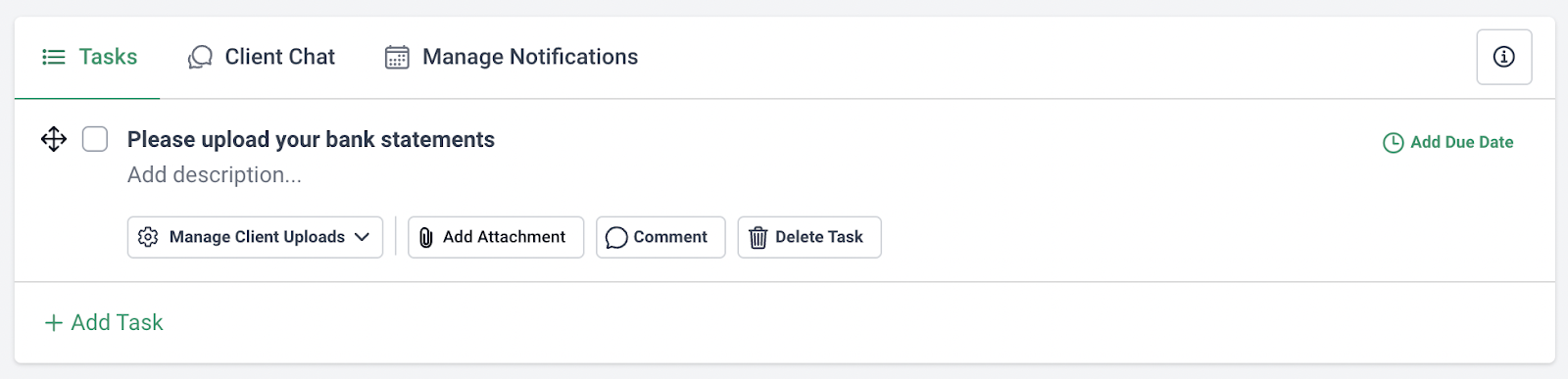

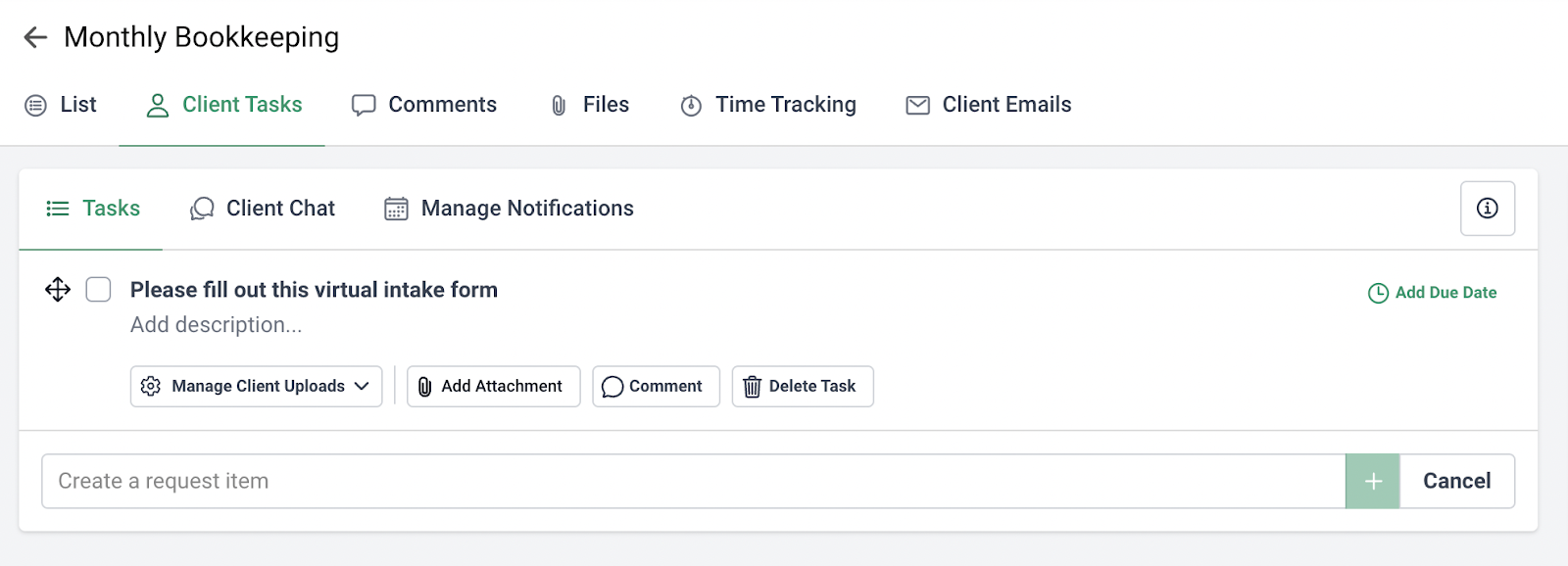

- To make a request, go to “Client Tasks,” enter what you need from the client, then click “+”:

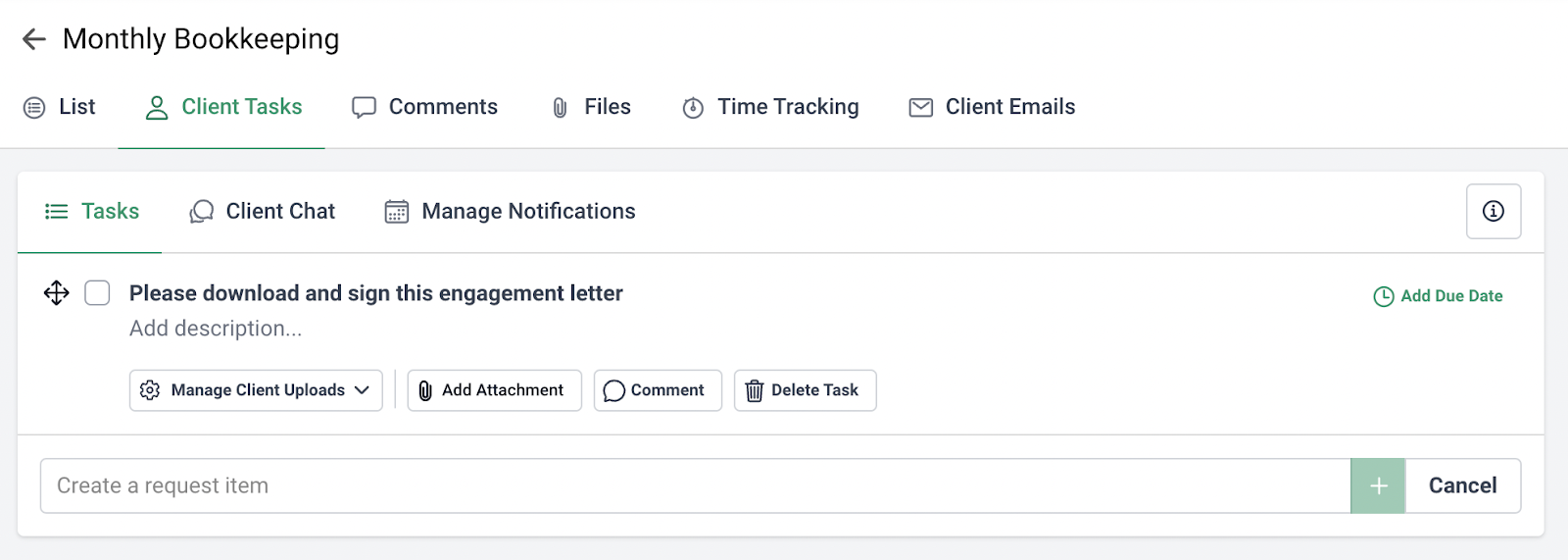

We recommend you enter a description to provide further context and a due date so they understand the urgency of the request:

The client will receive a notification, and they’ll respond accordingly.

- To send documents to clients, the process is also simple. Enter the description of the file you’re sharing:

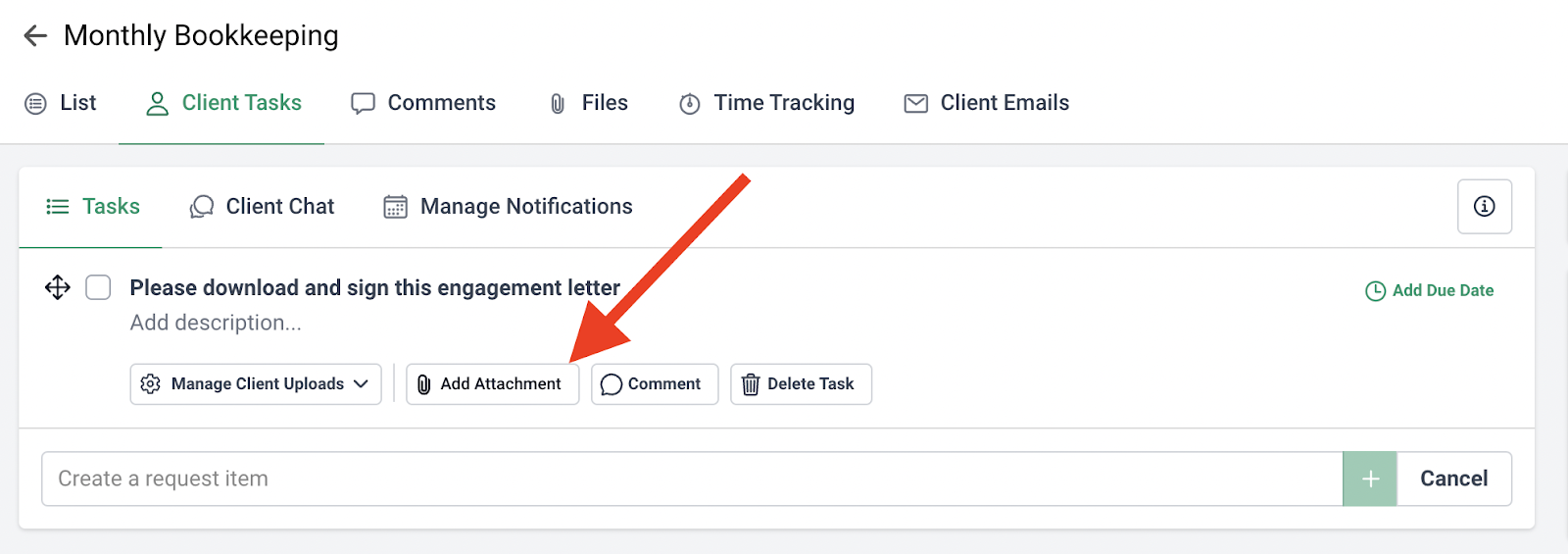

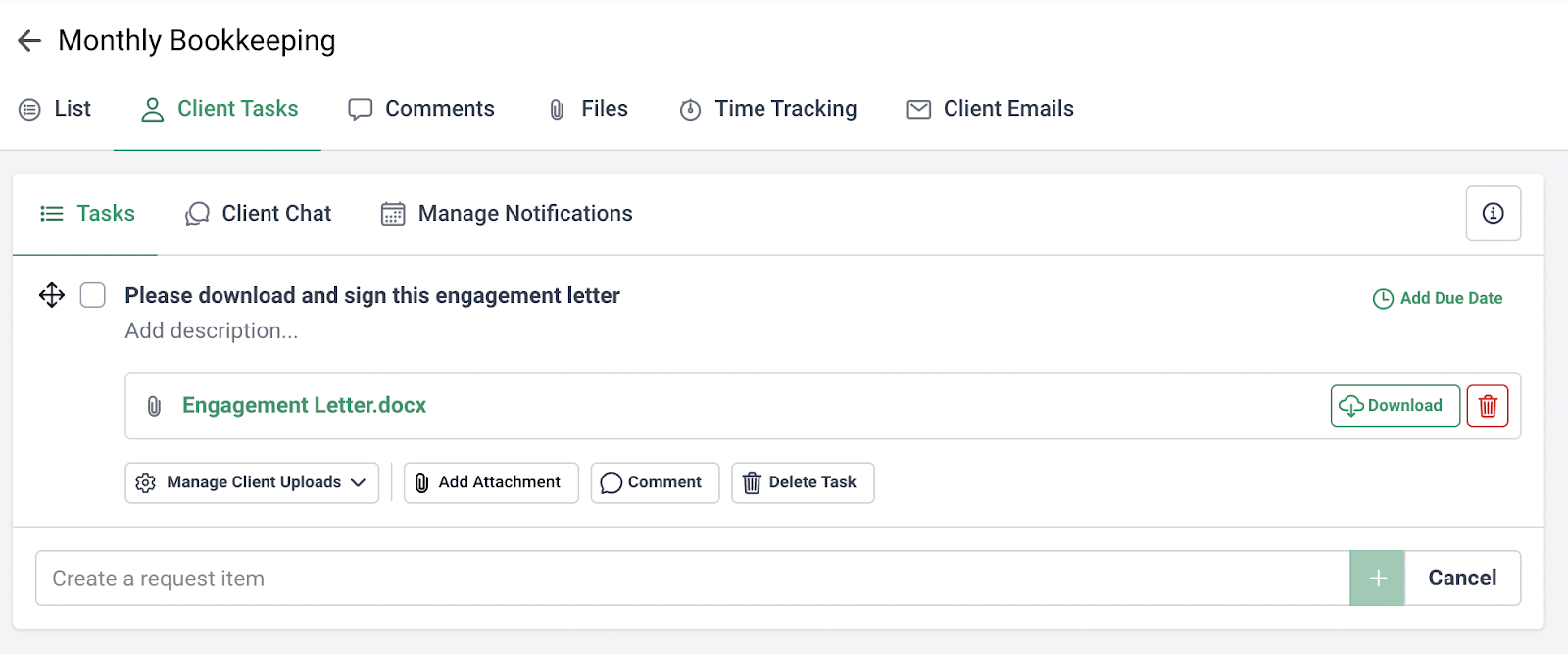

Attach the document to the task item by clicking “add attachment.”:

And select the correct document:

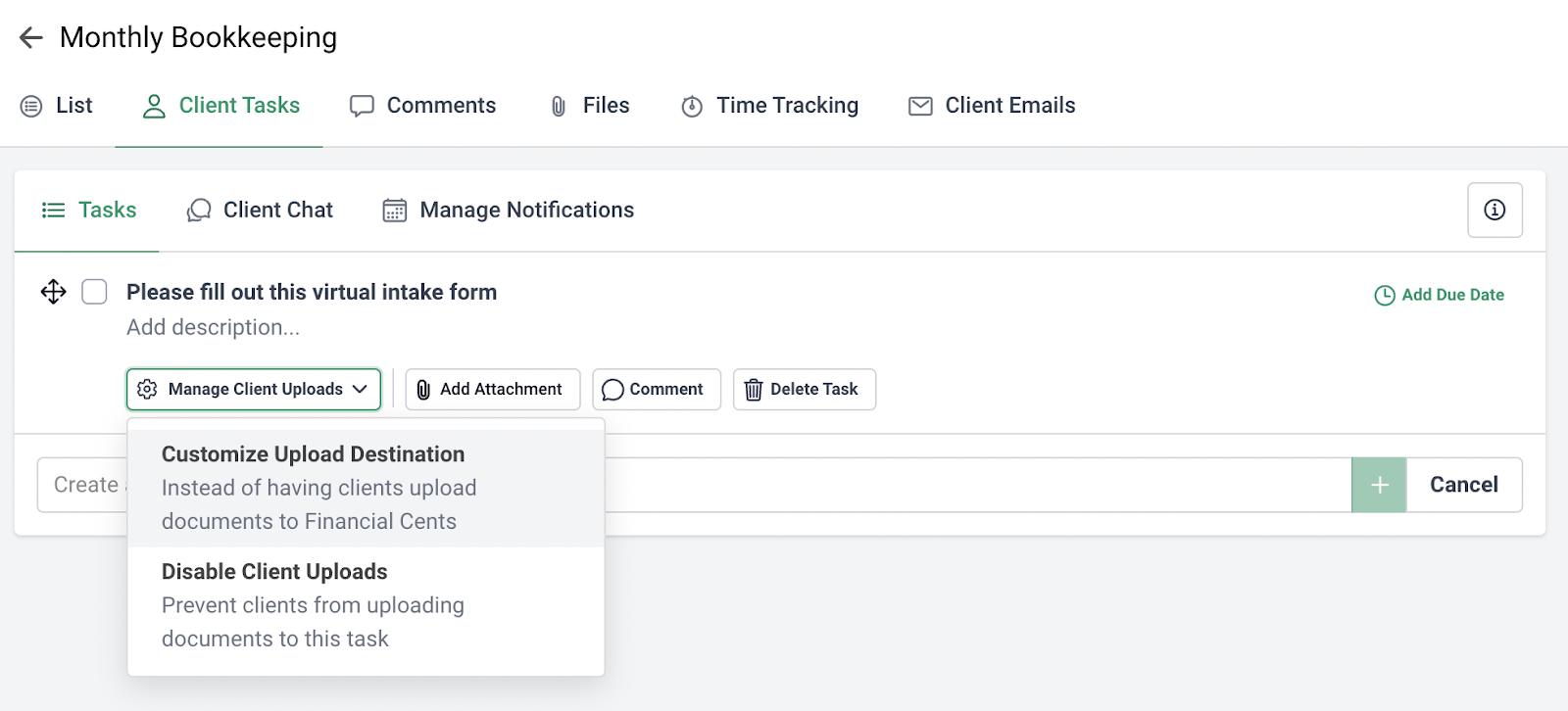

- To have them fill out a form, first specify the type of form:

Customize upload destination:

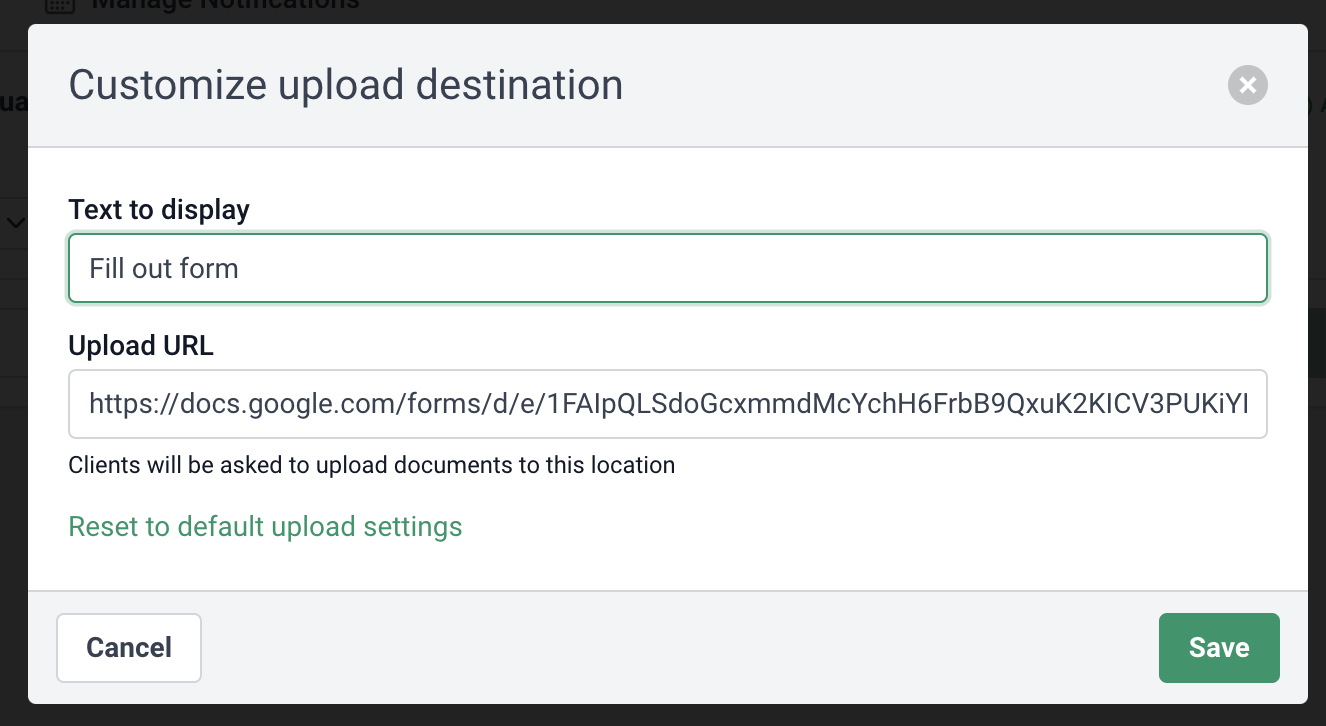

Modify the button display text to say “Fill out form,” and upload the URL to the online form:

Voila! Your client will receive the form, and they can click the link to complete it. Once they’re done we’ll notify you.

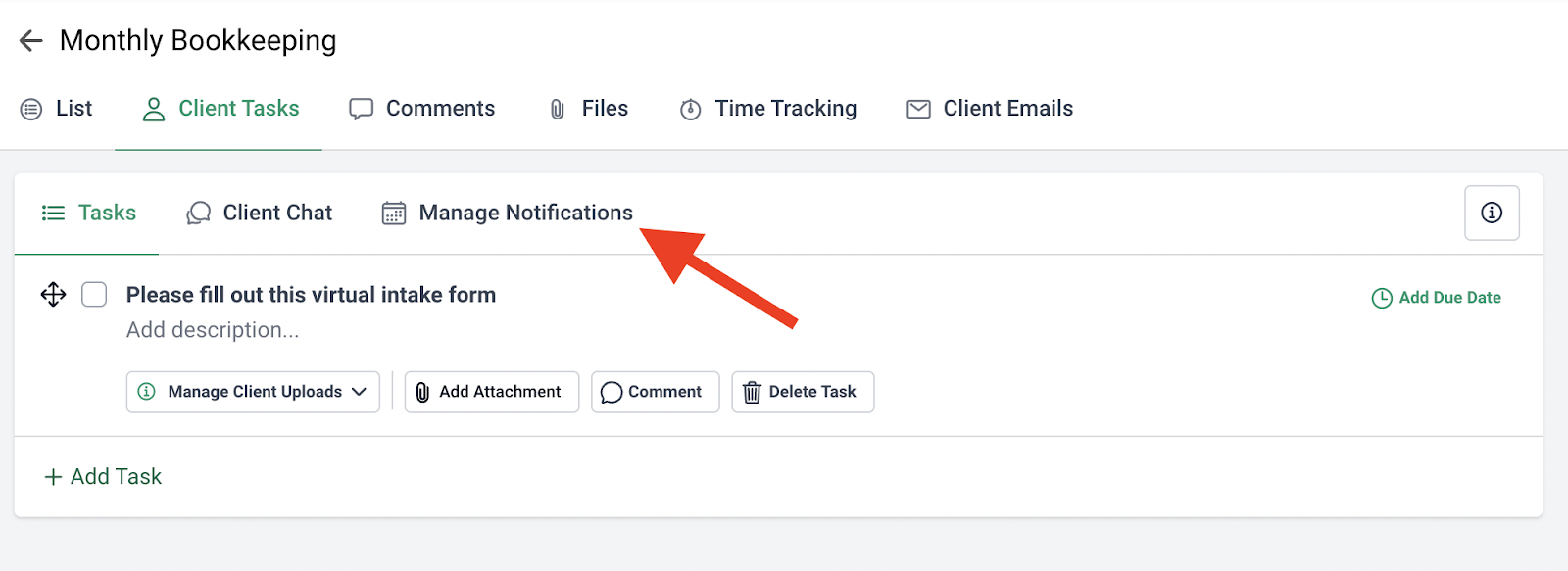

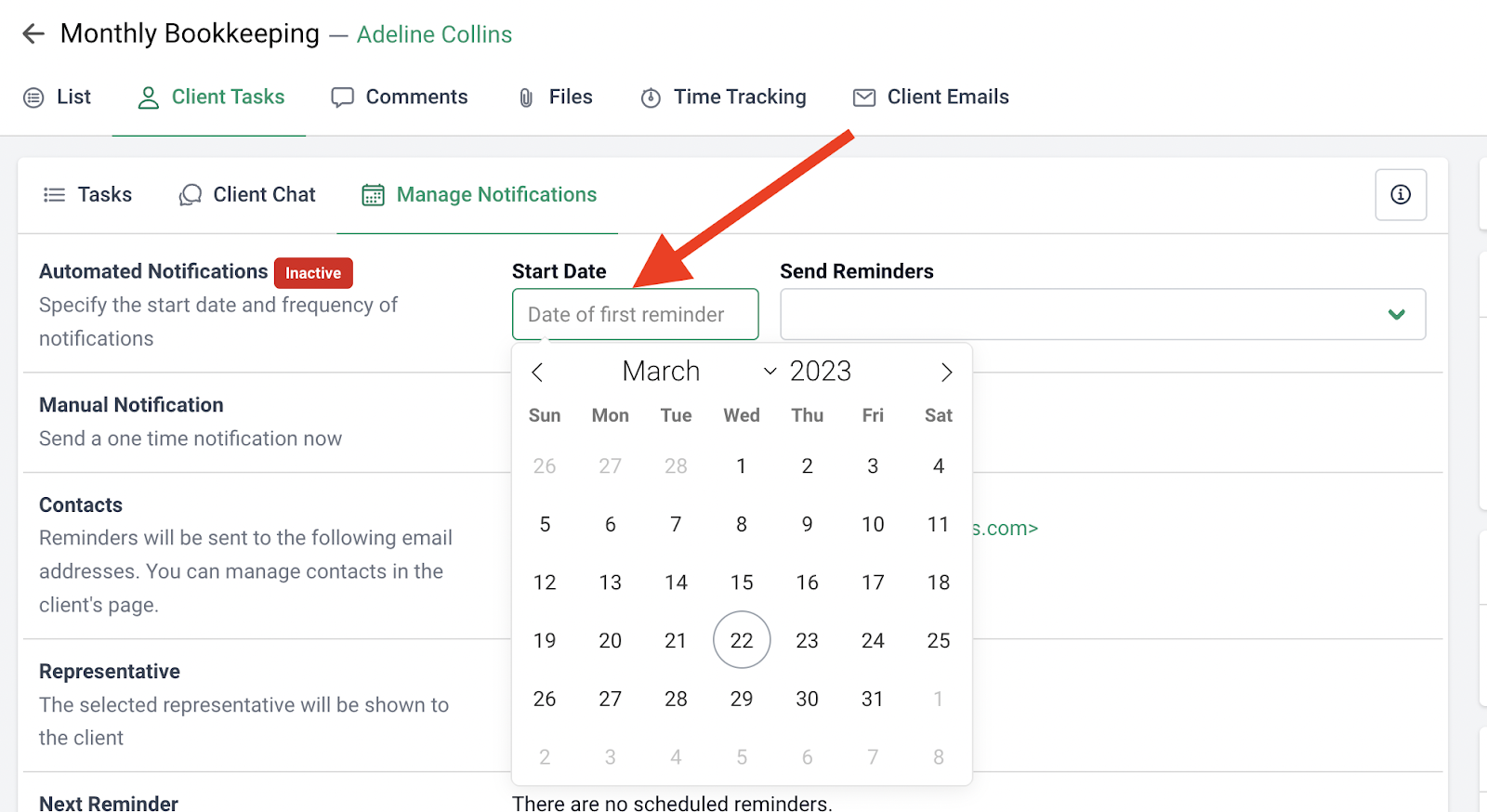

- For automated reminders, select “Manage Notifications”:

Choose a start date:

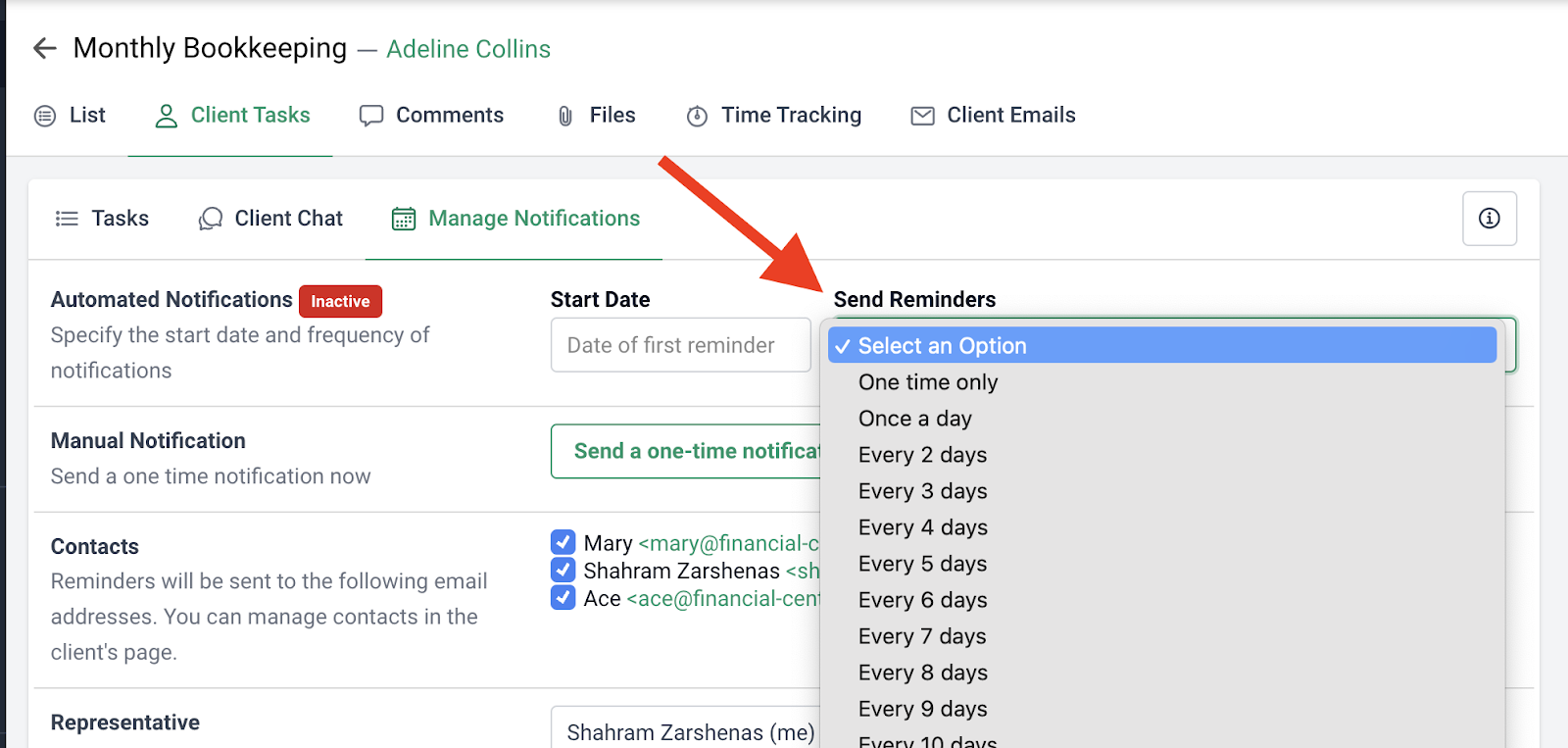

Then select the interval periods for your reminders until they complete the request list:

3. Strengthened Client Relationships and Satisfaction

Clients are happier when able to access a platform for smooth file sharing, communication, and collaboration. Customers appreciate an organized firm that executes projects without stressing them out with unnecessary back and forth. They love the convenience of having all their interactions in one place.

The client portal allows for transparency, which builds trust and strengthens the client-firm relationship. It also lets them feel more involved in the process.

Recommended Reading:

4 Ways Accounting Firms Can Retain Clients Using Accounting CRM Software

4. Increased Efficiency and Productivity

Another benefit of client portals is they help accounting firms optimize their workflows and eliminate time-consuming manual processes.

Instead of using physical paperwork, searching through email threads, or sending multiple follow-ups, you can share documents and automate reminders via the portal.

And with Financial Cents, you can also automate repetitive tasks. For instance, if you perform a task for a client regularly and need documents for them, you can set the requests to recur every week or month or whenever you choose. This saves you the time of creating a new request list every time, making you more efficient and productive.

5. Cost Savings

Using a CRM with a client portal can help you save business costs significantly in the following ways:

- There’s no need to pay for multiple tools again, as one CRM solves most of your needs for a fraction of the cost you would have spent.

- You make fewer mistakes, so you spend fewer resources fixing errors.

- The automation features and optimized workflow increase efficiency, helping you save time and money.

- With enhanced productivity, you can serve more clients without hiring additional staff.

- Improved client satisfaction leads to repeat business and referrals. With that, you don’t spend as much on marketing.

Ultimately, you spend less running your accounting practice and have the potential to make more money with increased clients and value-added services.

Tip: You can now customize your clients’ portal with our newly launched feature. By customization, we mean you can white-label and brand the portal by customizing the URL, buttons, and link colors. You can also display your firm’s logo.

Use Financial Cents, The All-One Accounting CRM With a Client Portal

Financial Cents brings everything under one roof with a client portal, chat box, simple overview dashboard, notifications, and encryption records (for storing client passwords) to help firms get work done in an efficient manner.

But that’s not all. Our tool is more than a CRM. It’s a practice management software. This means you can use it to:

- Get organized and manage your firm

- Track client work so nothing falls through the cracks

- Ensure you meet deadlines

- Store client information

- Track time and invoice clients with QuickBooks integration

- Automate workflows

- And manage the capacity of staff

Use Financial Cents to Manage Your Clients.