In our 2024 Workflow Automation Report, conducted among accountants, CPAs, advisory, tax, and bookkeeping professionals, we found that 8.7% of accounting firms are still using generic project management (PM) software to manage their workflows. Surprisingly, 49.7% are still relying on spreadsheets—an even more limiting option.

While project management tools like ClickUp, Asana, and Monday.com are popular for their affordability and ease of use, they often fall short when it comes to meeting the specific needs of accounting firms.

Many accounting professionals are drawn to these tools because they’re simple and widely recognized, but that convenience can come at a cost. Generic PM tools lack the specialized features necessary for managing accounting-specific tasks.

So, how can you overcome these limitations and find solutions that truly align with your work? Let’s discuss this in detail.

What Makes Accounting Firms Different?

Deadlines, Compliance & Security

Your day-to-day likely involves complex tasks like tax filings, audit trails, and financial reporting. On top of that, you have to track client info, keep communication flowing, and make sure every detail is documented correctly. These aren’t things you can easily manage with a basic, one-size-fits-all project management tool.

You need software that not only tracks tasks but also helps manage accounting-specific workflows—like getting client approvals, signing documents, and keeping up with tax compliance. Without those specialized features, things can go downhill quickly, leading to missed deadlines, unhappy clients, or even fines for non-compliance.

The stakes are higher for accounting firms like yours, and that’s why generic project management tools don’t always meet your needs.

Cyclical Nature of Accounting Tasks

Tax season, month-end closings, and audits happen like clockwork, and each of these periods comes with an intense workload. You’re not just managing random projects that pop up—you’re juggling recurring deadlines, each with its own set of specific tasks, documents, and client communications.

To stay on top of these cycles, you need a workflow automation system that allows for repeatability. For example, during tax season, you want to set up workflows that guide you through gathering documents, preparing filings, getting client approvals, and submitting forms—without having to reinvent the wheel every year.

Task Management & Billing

Keeping track of billable hours, invoicing your clients, and managing your team’s workload are all crucial for staying profitable. However, when you use generic project management tools, you might find these features missing or hard to use.

For example, if you want to track billable hours in Asana, you’ll need to integrate it with another tool, like TaskBill, just to create invoices for your clients. That’s an extra step you shouldn’t have to deal with.

On the other hand, accounting workflow tools like Financial Cents are built specifically for your needs. You can track billable hours right from your dashboard, generate accurate invoices, and easily manage your team’s workload. This means you can spend less time on paperwork and more time giving your clients the attention they deserve.

Limitations of Generic Project Management Tools

Poor Integration with Accounting Software

There are many reasons why generic project management software isn’t a good fit for accounting firms, but one of the biggest challenges you’ll likely encounter with generic PM tools is that they don’t integrate with the specific needs of the industry.

Take Asana, for example. Sarah Landrum, an office manager at Ascension CPA, found it difficult to use for tasks like updating due dates when client work extended beyond the original timeline. She had to manually make these updates, which wasted valuable time.

Additionally, Asana didn’t offer a centralized place to store client information, login details, and passwords. Sarah had to rely on multiple tools to manage these details, which she described as “going to different places to do things”—far from an efficient use of time.

Even more complex tools like monday.com aren’t sufficient for managing accounting needs. While monday.com had time-tracking functionality, Amanda, a firm manager at Badger CPA, found it wasn’t user-friendly. “We wanted to track time by individual employees and each task, but we couldn’t,” she explained, highlighting another limitation of generic project management tools for accounting firms.

Whether it’s QuickBooks or Xero, your workflow depends on having all your data connected and flowing smoothly. Generic tools often don’t integrate well, which means you’re stuck manually updating information across multiple platforms. This creates extra work, increases the risk of errors, and makes it harder to keep track of the data that’s critical to your client’s work.

Limited Customization for Repetitive Workflows

Unfortunately, most generic project management tools lack the customization options you need to streamline and automate repetitive tasks. For example, let’s say you handle monthly bookkeeping for several clients. With a generic tool, you may find yourself manually setting up the same tasks—like reconciling accounts, preparing financial statements, or sending client reminders—every month. Instead of having a system that automatically generates these recurring projects, you’re forced to recreate them over and over again. This repetitive work eats up time that could be better spent focusing on your clients or handling more complex accounting tasks.

Security Concerns

Generic PM tools often don’t come with the level of security features necessary to protect sensitive data. Many of them lack advanced encryption, multi-factor authentication, or detailed permission settings. This puts your firm at risk of data breaches or unauthorized access, which could lead to serious consequences for both you and your clients.

Inflexible Client Management

Generic project management tools often lack the flexibility needed for handling client-specific workflows. For instance, let’s say you manage two clients: one needs regular tax filings, while another requires bookkeeping and quarterly financial reviews. Each client has different tasks, deadlines, and documents to track.

With most generic tools, you can’t easily customize workflows to reflect these unique needs. Instead, you’re forced into a one-size-fits-all approach that doesn’t align with your firm’s processes. As a result, you end up juggling multiple systems, spreadsheets, or manual workarounds, making it harder to stay organized and keep client work running smoothly.

Lack of Visibility into Team Tasks

As your accounting firm grows, it becomes critical to have a clear view of your team’s workload. You need to know who’s handling which tasks, the progress of each project, and whether anything is falling behind schedule. With a generic project management tool, you might only see basic task lists without knowing if a particular accountant is overloaded or if a task is stuck due to missing information.

In Asana, you could accidentally click on something and hit a spacebar, and it's gone. But in Financial Cents, before you can delete something, you have to get into that area to delete it. And if your staff deletes information in Financial Cents, you can always find it in the trash section of the app, which gives you more control over your firm's data"

Amanda Birch, President, Birch Accounting and Tax ServicesGeneric tools often provide simple task tracking, but they don’t offer the in-depth reporting or real-time updates needed to manage an accounting team effectively. This lack of visibility can create bottlenecks, cause missed deadlines & information, and even lead to team burnout because it’s hard to monitor capacity and manage workloads efficiently.

The Risks of Relying on Generic PM Tools

While it might be tempting to use widely available project management tools, relying on them can expose your accounting firm to several significant risks.

Risk of Compliance Failures Leading to Missed Deadlines & Damaged Client Trust

With accounting, even a small oversight can lead to missed deadlines and serious consequences. For example, if you’re using a generic PM tool that doesn’t adequately track important tax filing dates, you might miss a crucial deadline for a client’s tax return. This not only results in penalties for your client but can also damage the trust they place in you as their advisor. Rebuilding that trust can take time and effort, and it may lead clients to seek out other firms that can better handle their compliance needs.

Decreased Efficiency and Productivity

Imagine you’re in the middle of tax season, juggling numerous client filings. If your project management tool requires you to spend extra time manually entering tasks or updating information, you’re wasting precious hours that could be spent preparing client documents or communicating with your team. This added time pressure can lead to burnout, which further affects your overall productivity and the quality of your work.

Client Dissatisfaction

When your tools slow you down, your clients notice. If you’re consistently late with reports or tax filings because your project management system is cumbersome, it can lead to client dissatisfaction. For instance, if you’re trying to prepare month-end financials for multiple clients but can’t easily access the necessary documents or track the progress of your tasks, you might deliver those reports late. Clients expect timely updates, and failing to meet their expectations can result in frustration or even lost business.

Data Security Issues

If you’re using generic PM tools that don’t prioritize robust security features, you may inadvertently put your clients’ sensitive information at risk. A data breach could expose confidential financial details, leading to not only regulatory consequences for you but also a loss of trust from your clients.

Having to Customize the Software to Work for You

Lastly, many firms need to customize generic PM tools to make them fit their specific needs. While customization might seem straightforward, it can often be time-consuming and complicated. For example, if you spend hours tweaking a generic tool to track your billable hours accurately or to create a workflow for a recurring task, you may find that the software still doesn’t fully meet your needs. This adds to your workload and can lead to frustration when the system still doesn’t perform as you’d hoped.

How Accounting Firms Can Overcome the Limitations

You don’t have to keep struggling with the limitations of generic project management tools. Switching to specialized accounting tools can streamline your work and get the efficiency and control you need.

Adopt Specialized Accounting Project Management Tools

To overcome the limitations of generic project management tools, you should consider adopting project management software like Financial Cents designed specifically for accounting firms.

Although you can close out tasks in Trello, the way it was laid out was such that after a while, tasks would just get bogged down with a lot of stuff. And then, we would have to scroll all the way down to find what we were looking for. So, the more we grew, the more we added tasks to our work. Whereas, because Financial Cents is strictly for accounting & bookkeeping firms and specifically for our industry, it eliminates having a lot of those nuances"

Anna Murphy, CEO & President (Murphy & Associates Consulting)These specialized tools cater to the unique needs of your workflows, offering features like time tracking for billable hours, client-specific task management, and automated reporting—features that generic tools often lack.

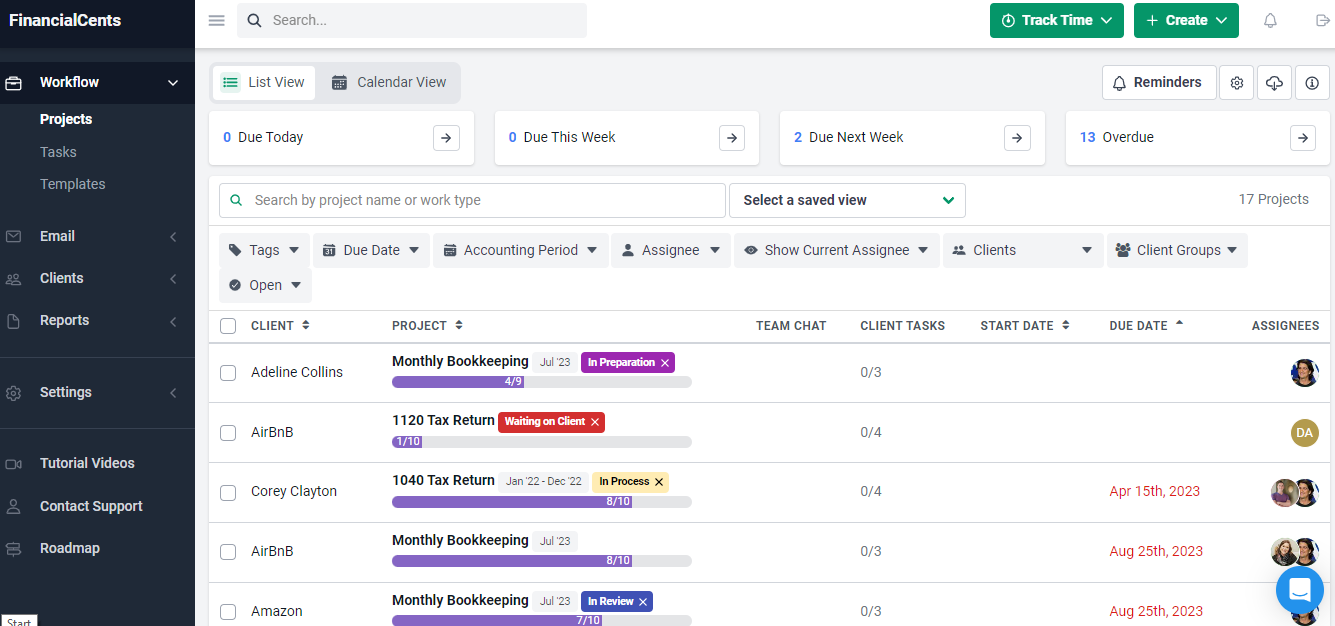

For instance, in Financial Cents, you can easily track the progress of client tasks, such as tax filings or month-end closings, all from a single view.

Setting up recurring tasks for seasonal activities—like tax season—means you won’t need to recreate tasks or double-check deadlines each year.

With the due date tracking, you get automatic reminders of upcoming deadlines, helping you avoid missed due dates and freeing up your time to focus on more critical client work.

Furthermore, with the accounting client portal feature in Financial Cents, you can easily receive client information, manage documents, and communicate with clients—all from one centralized location. This keeps you organized while enhancing your responsiveness, which your clients will greatly appreciate.

Another major advantage of these tools is their time-tracking and invoicing capabilities. When managing multiple projects, accurate time tracking allows you to know exactly how long each task takes, ensuring precise billing. Financial Cents offers built-in time-tracking tools and automated invoicing, reducing the need for manual administrative work and saving you valuable time.

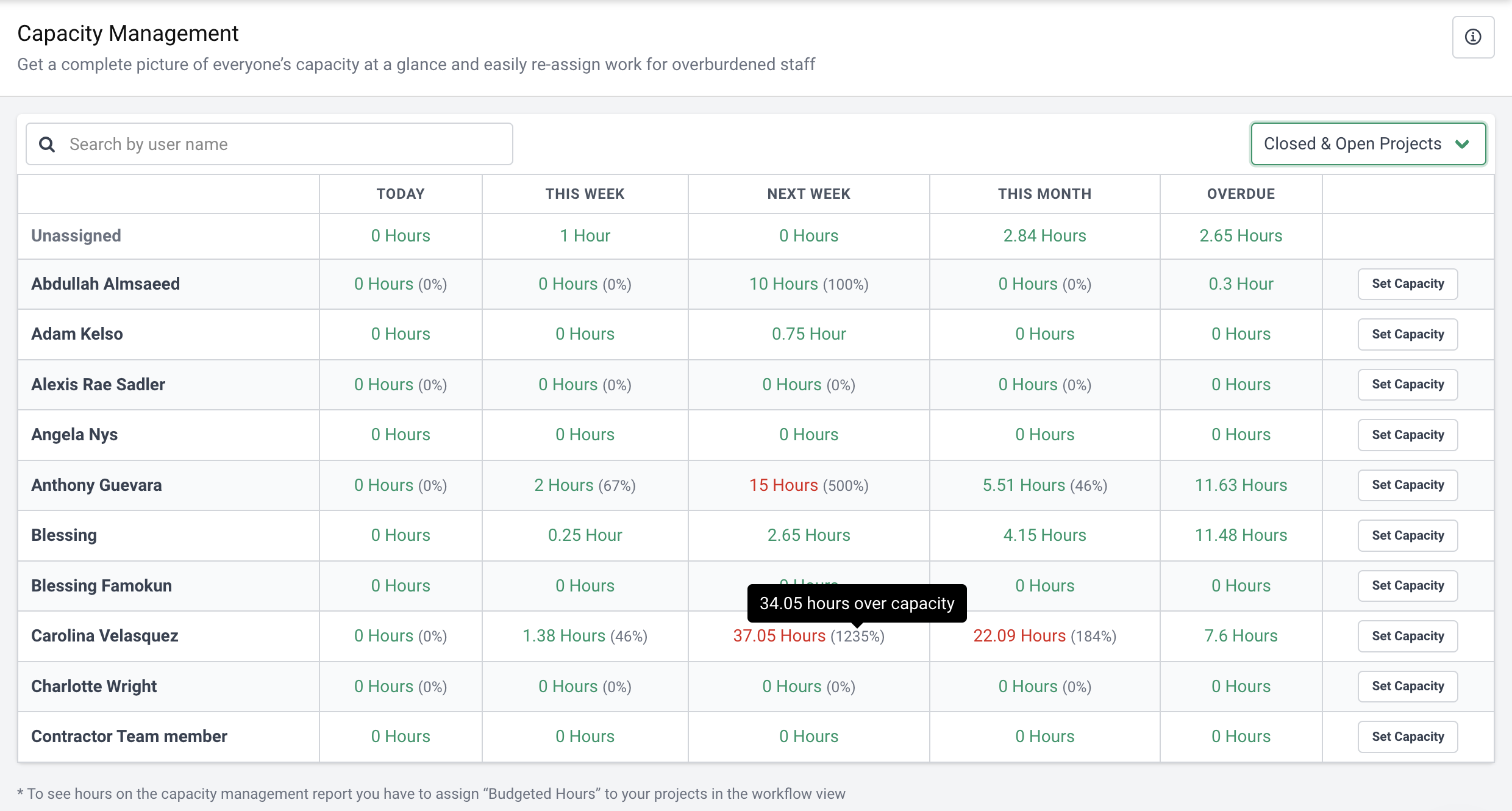

Additionally, the capacity management feature enables you to monitor your team’s workload, spot bottlenecks, and reassign tasks as needed to keep workflows smooth and efficient. Ultimately, this boosts your firm’s overall efficiency and ensures nothing slips through the cracks.

Don’t just take our word for it—hear from other firm owners who have made the switch from generic project management software to Financial Cents.

Utilize Customizable Features in Existing Tools

If you’re not ready to switch from your current project management tool, you can still enhance its functionality for accounting tasks by integrating third-party solutions.

For instance, consider using a time-tracking plugin to accurately monitor billable hours or adding an invoicing feature to generate client bills directly within the software. Automation tools like Zapier can also be beneficial for streamlining repetitive tasks, such as sending reminders for tax deadlines or generating monthly reports.

While these add-ons can provide immediate improvements, it’s essential to recognize their limitations. Connecting various systems may lead to inefficiencies and potential errors, particularly as your firm grows. Relying on these temporary fixes can be unsustainable.

Ultimately, investing in a dedicated accounting workflow tool like Financial Cents will likely prove more beneficial, as it can save you time, reduce errors, and streamline your firm’s processes in the long run.

Implement Workflow Automation

One of the best ways to improve your firm’s efficiency is through workflow automation. Tools like Financial Cents are specifically designed for accountants, offering features that streamline processes and boost productivity. For example, you can automate recurring tasks like tax season filings or monthly financial reports by creating custom workflows that cover every step—from gathering client documents to submitting final reports. Once set up, these automated workflows send reminders to you and your team about upcoming deadlines, eliminating the need for constant oversight.

If you’re not sure where to start, we’ve written a five-page guide to accounting workflow automation that’ll point you in the right direction.

Conclusion

Generic project management tools can pose significant challenges for accounting firms. They often lead to inefficiencies as you and your team waste valuable time trying to adapt these tools to your unique workflow.

We don’t need 100 hours of training to use Financial Cents like ClickUp. Because Financial Cents is intuitive, creating custom workflows is super-easy for the Payroll Solutions Plus team. This allows the entire team to use their time for the work that matters, which is fixing the broken payroll of their clients"

Shannon Theis, Owner, Payroll Solutions PlusMoreover, these tools can expose your data to unnecessary risks, leading to potential errors and compliance issues. Together, these problems can seriously hinder your firm’s productivity and affect the quality of service you deliver to clients.

It’s important to take a close look at your current workflow and see how these tools might be affecting your work. If they are causing delays or errors, it may be time to switch.

We recommend moving to an accounting-specific workflow software like Financial Cents. It offers strong features to manage your tasks, workflow, and team in one place, without jumping between multiple platforms.