You’re sitting in your office, surrounded by stacks of paperwork and endless spreadsheets, wondering why your accounting firm isn’t scaling to new heights. Well, you’re not alone. A staggering number of accounting firms hit a growth plateau at some point in their journey.

But why does it matter? The consequences are more than just a dip in profits. Stagnant growth can lead to a domino effect of troubles: dwindling profitability, a revolving door of talent as employees seek greener pastures, and the looming threat of being overshadowed by competitors in the market.

Many accounting firms run into a roadblock that hinders their growth, often called the “growth ceiling.” This ceiling acts like an invisible barrier that prevents them from reaching higher levels of success. Even using well-established methods, many firms find themselves stuck at this ceiling, unable to move their growth forward.

So, what are the culprits behind this growth standstill? We’ll address five common reasons that could be holding your accounting firm back, each one a puzzle piece in the larger picture of stalled progress. Alongside each problem, we’ll unveil actionable solutions to shatter that growth ceiling once and for all.

5 Reasons Your Accounting Firm’s Growth is Stuck (+ Practical Solutions)

Reason 1: Not Understanding Your ICP and Serving Them Optimally

Have you ever felt like your firm is spread too thin? You take on clients from all industries with varying needs and complexities. This might seem like a good way to cast a wide net, but in reality, it can make you appear like a generic option.

Why?

Spreading yourself thin or trying to be a “Jack of all trades” to serve everyone can backfire. You lack the in-depth knowledge to truly impress any specific clientele, making it harder to justify your fees or stand out in a crowded market.

Crafting an ideal client profile and focusing on a specific industry or niche allows you to develop deep knowledge of their accounting practices, regulations, and common challenges. This positions your firm as the go-to expert for that niche, attracting high-quality clients who value your specialized knowledge.

When you understand your ideal client’s needs and challenges, you can tailor your messages to resonate with them. This attracts a steady stream of qualified leads, turning your efforts into client acquisition.

Solution 1: Identify and Embrace Your Niche

Instead of being a jack-of-all-trades, become a master of a specific area.

Firstly, analyze your existing client base. Who are the clients you enjoy working with the most? What are the common characteristics? Industry? Business size? Pain points they bring to the table? Who consistently pays on time and values your expertise? Look for commonalities that matter to you and your firm’s growth.

As Rachel Fisch puts it,

Having elements of an ideal profile would help identify your client, state out what you want your clients to have or possess; anyone with these elements is your ideal client"

Next, research industry trends. Are there booming sectors with specific accounting needs? Maybe you have expertise in a new tax regulation or software platform. Identify areas where your skills can add significant value.

Lastly, consider your interests in accounting. Do you enjoy the puzzle of tax planning for startups? Or maybe the intricacies of managing payroll for a specific industry? Your passion can be a powerful magnet for attracting clients who share your enthusiasm.

It’s better to serve a specific group exceptionally well than offer generic services to a broad audience.

As Richard Roppa-Roberts puts it,

You don't have to settle when it comes to clients. You want clients that complement your business with goals you can identify and help them achieve."

Reason 2: Outdated Marketing Strategies

Moment of truth – print ads and cold calling just don’t cut it anymore, especially in this era of content-driven marketing. Print ads only reach a fraction of your target audience, and those who see them might not be actively looking for an accountant.

Also, cold calling disrupts people’s day and often feels impersonal. A flier in a magazine or a call interrupting their lunch break isn’t exactly sparking excitement about your accounting services. These methods make it difficult for you to build trust or showcase your expertise.

The good news? There’s a better way to reach out to potential clients with modern marketing strategies. One such fast-growing strategy is inbound marketing. It’s all about attracting ideal clients to you by providing valuable content that addresses their needs and pain points. This creates trust and positions you as an expert, making them more likely to choose you when they need accounting services.

Solution 2: Leverage Modern Marketing Techniques

Gone are the days of waiting for clients to find you. Today’s accountants wear multiple hats, including that of a business owner and marketer. To thrive, you need to actively reach the ideal clients for your accounting firm.

Amanda Watts emphasizes,

As a business owner, you are a marketer because you have to go out and get the best clients for your business to succeed"

Here’s how you can leverage modern marketing techniques to get your firm in front of the right audience and jumpstart growth.

Content marketing: Create valuable, informative content that educates potential clients on relevant tax and accounting topics. This establishes your firm as a thought leader in the industry, showcases your expertise, and builds trust with potential clients. You can create:

- Blog posts on tax law updates, bookkeeping tips, or financial planning strategies

- Infographics that simplify complex financial concepts

- White papers on industry trends or specific tax topics

- Or host client webinars on relevant financial issues

Social media marketing: Build a strong presence on social media platforms that your target audience uses, such as LinkedIn, Facebook, and Twitter. Share informative content you create, industry news, and even client testimonials (with permission).

Engage with your followers by responding to comments and questions promptly. Participate in relevant online communities and discussions to establish your expertise. Lastly, consider running targeted social media ads to reach a wider audience.

Keep in mind that there are many content formats you can try to achieve your goals. Some of them include:

Blog Posts: Write informative blog posts (like the one you’re currently reading) about common accounting challenges faced by your ideal client. Offer clear, actionable steps they can take, and showcase your expertise in a digestible format.

Case Studies: Create case studies that highlight real-world examples of how you helped businesses like theirs overcome specific financial hurdles. Showcase the positive impact you have on such businesses.

Client Testimonials: Let your happy clients sing your praises. Feature video testimonials or written quotes from satisfied clients. Social proof builds trust and demonstrates the value you bring to other businesses.

You may be interested in:

How To Build Go-To-Marketing Strategies For Your Accounting Firm

These content formats are powerful because they position you as a thought leader in the accounting industry. Potential clients actively searching for help will find your content, learn about your expertise, and see the positive impact you have on others. Remember, don’t just create content, promote it.

Reason 3: Not Embracing Technology

One major reason your accounting firm might stagnate is a lack of investment in modern technology. While the familiar comfort of your old ways might be tempting, clinging to outdated practices can hold you back.

Vulnerable older systems or software might not be compatible with the latest security measures, leaving your firm exposed to potential security breaches. Time-consuming tasks like crunching numbers by hand or using clunky old software eat away at billable hours.

With modern accounting tools like Financial Cents, you can automate repetitive tasks, freeing you up for more strategic work.

Also, embracing technology doesn’t mean you have to do it yourself. You can hire someone to manage and systemize that process for you. Many firms get stuck because they tackle technology first without clear processes in place.

Ryan Lazanis recommends –

delegating this task to a virtual assistant, fractional director of operations, or a full-time director of operations, depending on your firm's size, can free up time and help you put processes in place."

Cloud-based accounting software, for example, allows accountants to access and update financial records from anywhere with an internet connection.

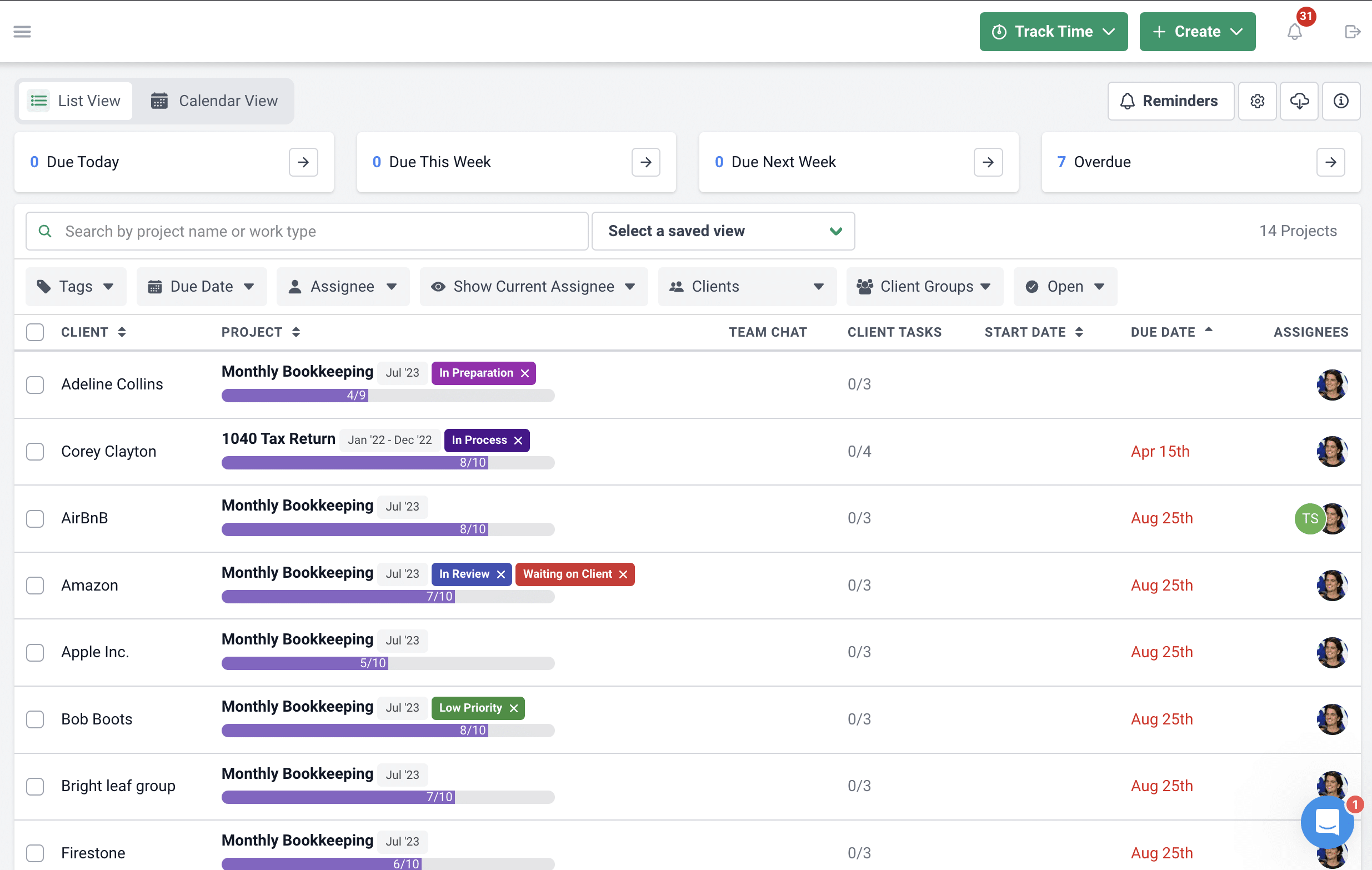

Accounting practice management software like Financial Cents acts as a central hub for accounting firms, streamlining their operations and boosting efficiency.

Features like project tracking, task assignment, and workflow automation streamline client work, ensuring tasks are completed on time and staff are utilized effectively. Client vaults and portals provide a secure platform for information exchange. Document management keeps all files organized and readily accessible, while time tracking ensures accurate billing.

This combination of features empowers accounting firms to deliver exceptional service, improve profitability, and build stronger client relationships.

Additionally, automated workflows can streamline repetitive tasks like data entry and uncategorized transactions, while data visualization tools transform raw financial data into easy-to-understand charts and graphs, enabling accountants to identify trends, patterns, and potential areas of concern at a glance.

Solution 3: Invest in Growth-Enabling Technology

Many accounting tasks are repetitive and time-consuming. Manual data entry, chasing down clients, and consolidating information can eat up valuable hours.

Investing in accounting-based technology that propels growth helps you dedicate your billable hours to more strategic tasks. Think about it this way: our recent workflow automation report found that firm owners using such software cut down time spent on manual tasks by a whopping 48%.

Imagine what you could achieve by freeing up half the time spent on repetitive processes. These recovered hours can be strategically reinvested in growth initiatives like marketing and business development, propelling your firm forward.

Consider cloud-based accounting software that allows you to access your data and applications from anywhere with an internet connection. This translates to improved efficiency – no more being chained to your desk. Look for ones that also offer robust data security features, ensuring your client’s financial information is protected. Additionally, it should allow your clients to easily upload documents, track invoices, and communicate directly, fostering a more collaborative working relationship.

Reason 4: Poor Client Service

Clients are the lifeblood of any professional service business, and accounting is no exception. When you prioritize exceptional client service, you’re investing in the future growth of your firm.

Happy clients are more likely to recommend your firm to others. Positive word-of-mouth marketing is a powerful tool; exceptional client service is a surefire way to generate it. Clients who feel valued and appreciated are more likely to return for future services. The opposite usually spells bad news for any business.

Remember that the accounting industry can feel commoditized, where price becomes the only differentiator. Exceptional service easily sets you apart from the competition.

Just like Brandon Hall, CPA, advises,

Think about your current client communication strategy. Does your team respond to clients on time, or do clients' messages go days without getting a response? Come up with ways to fix that"

Solution 4: Improve Your Client Service

Take the time to understand each client’s unique needs and goals. Tailor your communication and service approach accordingly.

Alison Ball says, “As you think about your client experience – how are they experiencing your firm within the lens of the systems that you’re asking them to use? Everything needs to be easy and automatic”.

Don’t wait for clients to reach out with questions or concerns. Keep them informed throughout the process with regular updates on deadlines, project progress, and any relevant industry changes.

You may be interested:

How this firm owner effectively manages communication across her firm.

An accounting CRM tool is a good investment to consider as it’ll help you streamline communication, track client interactions, and manage deadlines more effectively. This allows you to focus on providing personalized attention and offering value-added services, ultimately improving the overall client experience.

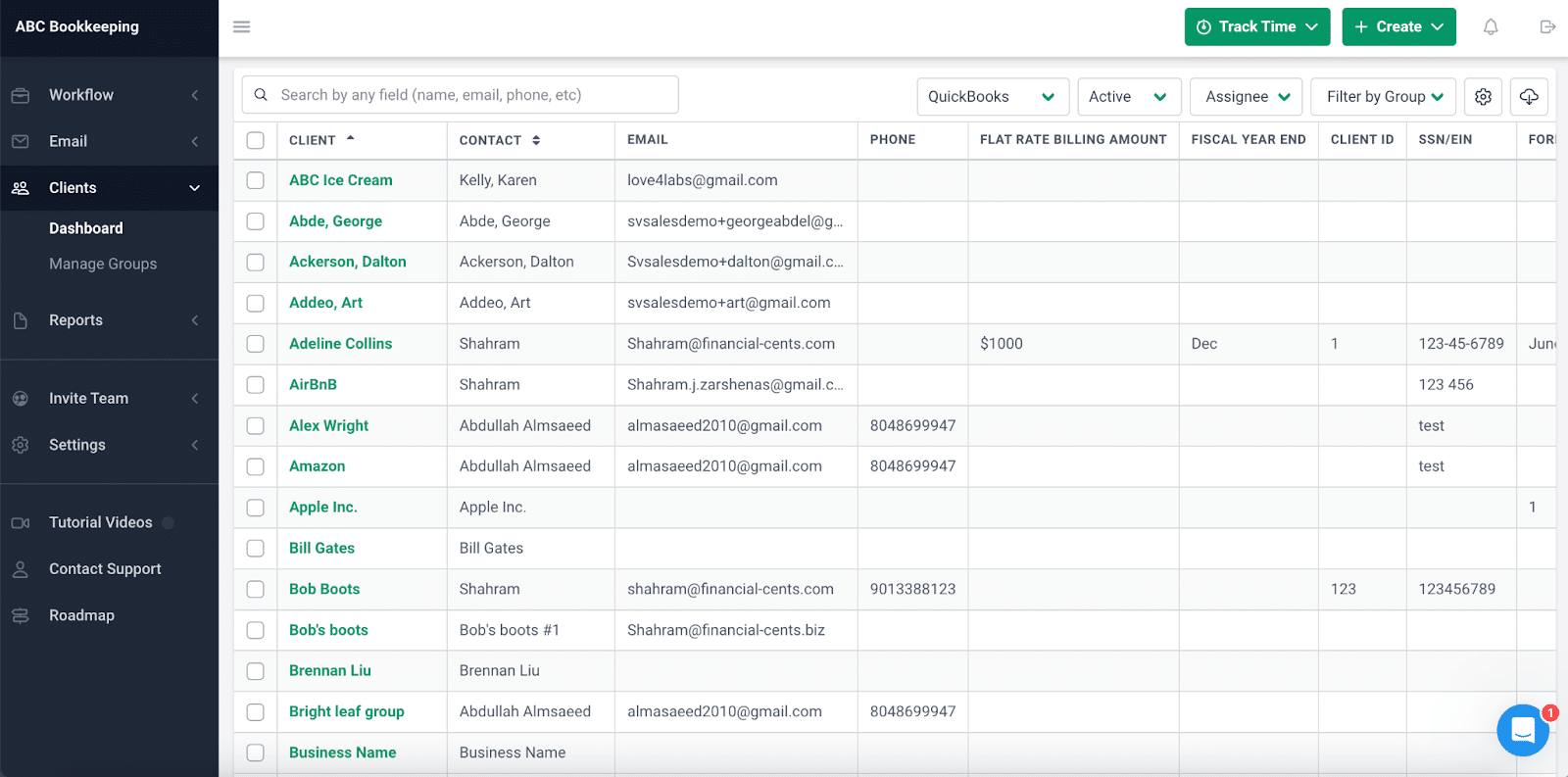

For instance, with Financial Cents, you see an overview of all your clients’ information at a glance and dive deeper into specific details for each client.

Clicking a client’s name reveals details about their projects, tasks, documents, team members, and any notes your team has on the client or their business.

Reason 5: Fear of Change and Risk Aversion

It’s natural to feel a sense of security in sticking with what’s familiar, especially when it comes to something as important as your accounting practice. However, it’s important to recognize that calculated risks are an essential part of growth in any industry. Businesses that never adapt or explore new opportunities can find themselves stagnant and ultimately left behind.

Risk aversion could mean reluctance to adopt new technologies, explore niche markets, or delegate tasks to free up time for strategic planning.

Solution 5: Embrace a Growth Mindset

The key here is to find a balance and cultivate a growth mindset. This simply means believing that your firm’s skills and abilities can be developed through effort and continuous learning. Instead of viewing challenges as insurmountable obstacles, a growth mindset sees them as opportunities to improve.

This doesn’t mean taking reckless leaps into the unknown. The solution lies in taking small, calculated steps outside your comfort zone. Perhaps it’s exploring a new software program, attending an industry conference on a new area of practice, or dedicating a set amount of time each week to brainstorm new service offerings.

The important thing is to celebrate each success, no matter how small, as a stepping stone on your growth journey. This positive reinforcement will fuel your confidence and propel you further toward achieving your firm’s full potential.

Wrapping Up

Do you recognize any of the reasons we discussed as potential culprits behind your accounting firm’s stalled growth? Don’t worry, you’re not alone. Many firms face these challenges at some point.

The good news is there are actionable solutions for each one. By implementing the tips throughout this article, you can shatter that growth ceiling and propel your firm to new heights.

Financial Cents can be your partner in growth. With our comprehensive suite of features, we can help you scale to new heights.

Use Financial Cents to grow and scale your accounting firm.