There comes a time when most accounting firm owners realize their current practice management software is no longer the right fit for them — possibly even causing them to lose money. So they need to migrate…soon.

Often, this realization doesn’t meet enthusiasm. And that’s because making such a change is a long and painstaking process.

You have to deal with everything from setting up new subscriptions, transferring data and recreating all your tasks all over again. Not to mention trying to ensure client adoption, training your team members on using the new software, and minimizing disruption to business operations when transitioning.

It’s certainly not an easy move or one you take lightly, but it’s necessary. This is because the benefits outweigh the temporary discomfort and will serve your firm better in the long run.

While you can’t eliminate the pains of migration, you can alleviate most complications with a well-thought-out plan, which we’ll discuss in this post.

Reasons Why Accounting Firms Migrate to a New Practice Management Software

There are many reasons a firm would take the bold step to disrupt its current flow and use different software. Most of the reasons relate to limitations in the current tool, as we’ll see below.

Lack of scalability

As the firm grows, adding more clients, employees, and services, the existing software may be unable to handle an increased workload, leading to performance issues.

This can result in the firm looking for another tool to handle its current needs and future expansion.

Limited features

The current practice management software may lack advanced features, limiting the growth or efficiency of the cpa firm. Some important features it should have but might not include:

- Client portal: a secure area where customers can log in, view their project’s progress and collaborate with the business.

- E-signatures: for quick and legally binding digital signatures on documents.

- CRM capabilities: to manage client relationships and interactions.

- Automated client requests: to set up automated requests for necessary documents from clients.

- Cloud-based capabilities: so users can access their data anywhere and collaborate with multiple users in real-time.

- Unlimited storage space: to store a growing amount of files.

The absence of these capabilities can prompt the firm to consider another option.

Little to zero integration with other apps.

Another factor that can drive a firm away is the software’s integration abilities. Insufficient integration causes an inefficient workflow, leading to manually transferring data from one tool to another.

In addition to email integration, a good accounting practice management tool (like Financial Cents) should integrate with apps like QuickBooks (for invoicing), Zapier (for workflow automation), SmartVault (for document management and secure file sharing), Adobe Sign (for e-signatures) etc. These integrations with other apps will help the firm manage its day-to-day operations.

Lack of Innovations

In a fast-evolving technological landscape, software must innovate their product regularly to stay relevant. For instance, AI is all the rave these days, with most tools incorporating its abilities to improve predictive analytics or handle basic accounting tasks like bookkeeping, data entry, and fraud detection.

If the present software isn’t keeping up with these breakthroughs and advancements, it’ll force customers to look elsewhere.

Financial Cents has an Artificial intelligence features, which helps you create any type of workflow template in seconds. See how it works here.

Bad UX

Bad user experience can be a major deterrent for a firm using a practice management tool. If the interface is not intuitive or the software is too complex to navigate without extensive training, it can lead to frustration and decreased productivity. Instead of helping the user improve productivity, it slows them down.

As such, the firm may prefer to switch to a more user-friendly alternative. It will reduce the time needed for training and increase the adoption rate among team members and clients.

Poor customer support

According to Zendesk’s CX Trends 2022, 54% of customers say it feels like customer service is an afterthought for most businesses they interact with. I.e. Many companies don’t have great customer service.

Furthermore, 61% say they would switch to a company’s competitor after one bad customer service experience. That figure rises to 76% due to multiple bad experiences. This happens because poor customer service can cause significant downtime and disruptions.

It’s no wonder businesses would rather opt for a company with excellent service.

Cost efficiency

Another common reason is the cost of the current system. Either there was an unjustified recent price hike, the system is charging for features the firm doesn’t need, or the cost increase for business growth is too high. Either way, they may migrate if the firm sees another option with equal or better features at a lower cost. After all, every business aims to minimize costs while maximizing revenue or profits.

Now that we’re done with the “why” of it, let’s look at the “how.”

7 Quick Steps to Migrate to a New Accounting Practice Management Software

When switching tools, one of the biggest mistakes you could make is rushing into the process. For a seamless transition, follow the seven steps detailed below.

1. Have a complete understanding of what accounting practice management is.

First, do your research. You have to know the why, i.e. what accounting practice management entails and why it is so important.

Accounting practice management is the process of overseeing and managing the operations of an accounting practice. It involves key aspects like client management, workflow management, project management, capacity management, time tracking and invoicing.

Benefits include:

- Improved efficiency

- Enhanced communication and collaboration

- Better client management

- Ability to scale and increase profits fast

- Improved analytics for decision-making and strategic planning.

Regardless of the size of your firm, you need to implement practice management solutions, which brings us to the next step.

2. Identify and list your company’s needs in an accounting practice management software.

This step requires a deep dive into your organization’s current way of managing operations. Identify the areas that require improvement and those that are functioning well. Your list could include needs such as:

- Better communication with clients and team members.

- A more efficient document management system to stop losing information.

- Advanced analytics to gain insights into your firm’s activities.

- A system with fewer bugs.

- A platform that integrates with your current tech stack.

- Ability to create recurring projects.

Once you’ve documented your needs, move to step three.

3. Research the best accounting practice management software options that align with your listed needs.

Capterra has 203 listings of “Accounting practice management software”. Instead of going through each of them, which would take considerable time, check out our list of The Best Accounting Practice Management Software Options in 2025 with real customer ratings from G2 and Capterra.

P.S. ➣ Financial Cents has a 4.9 ease of use rating on Capterra, and we’re also listed in Capterra’s 2023 Shortlist for Top Performers in the Accounting Practice Management Software Category.

Aside from the ratings, other things to look out for in a practice management tool include:

- Reviews from real users

- Features and functionality to be sure it fits your requirements

- Pricing and cost structure

- UX and intuitive interface

- Customer support

Ensure the options you’re considering tick all the ‘must-have’ features necessary for your firm’s success. It should also tick some, if not all, of the ‘nice to have’ functionalities.

4. Receive Training on the software.

Where available, request demos for you and your team so the vendor can educate you on the tool. It is even better if they offer a free trial, as you can give the tool a test run before making a decision.

Financial Cents provides a demo and a 14-days trial so firms can have a first-hand experience exploring the software. This experience will help you better check our capabilities than just reading or hearing about them.

5. Let your clients know that you’re about to upgrade your practice management software.

Once you’ve decided on a tool and informed your employees, don’t forget to communicate the changes with your clients, as it affects them, too. Getting them to agree is often tricky as it might seem like an unnecessary convenience to them.

To secure their support,

- Craft a clear and concise message highlighting the benefits of the new software. Detail how the upgrade will enhance their experience, improve service delivery, and increase efficiency in managing their financial information. Personalize this message according to the client’s preferences and involvement with your firm’s accounting processes.

- Don’t spring it up on them a few days before you migrate. Give them adequate notice so they can expect the changes and adjust accordingly.

- Proactively address your clients’ concerns or questions about the change. You can include an FAQ section in the message you send them and encourage them to ask if they have any more questions.

- Teach them the step-by-step process of how to use the software.

With Financial Cents, they don’t need a password and username to access their portals. They can log in via secure magic links and verification codes, a more straightforward method.

- Follow up with them to remind them to switch tools and offer your assistance every step of the way.

6. Migrate your data —documents, client information, workflows.

Before transferring your data from the old system into the new one, back it up first. This way, you have a safety net if any issues arise during the migration.

Follow the guidelines provided by the software vendor to ensure a successful and accurate transfer of your data. Afterwards, compare the imported data with the backup to ensure accuracy.

Data migration is a delicate process. If you don’t have a professional on your team, consider outsourcing this step to avoid disastrous mistakes.

When you sign up with Financial Cents, we can help you safely migrate your data at a minimal cost.

7. Monitor Progress.

Once the system is up and running, it doesn’t end there. For the first few months, observe the new system’s performance. While no software is perfect, it has to serve your needs reasonably. Check to see if it meets your expectations. Ask users (staff & clients) for feedback and if they have any complaints. Conduct regular audits to ensure the integrity of data within the system.

In essence, ensure the software’s operation is optimal, bringing in the desired results.

Manage Your Firm Efficiently with Financial Cents Practice Management Software

Financial Cents is one of the top practice management software, and we have proof of this claim.

First, our 4.8 and high performer rating on G2.

Second, our 4.9 ease of use rating (which proves Financial Cents is easy to implement and use) and top performer in the accounting practice management category on Capterra.

Third, the hundreds of positive testimonials from our clients, some of which you can find here.

Here are a few of our top features to help you in managing your firm.

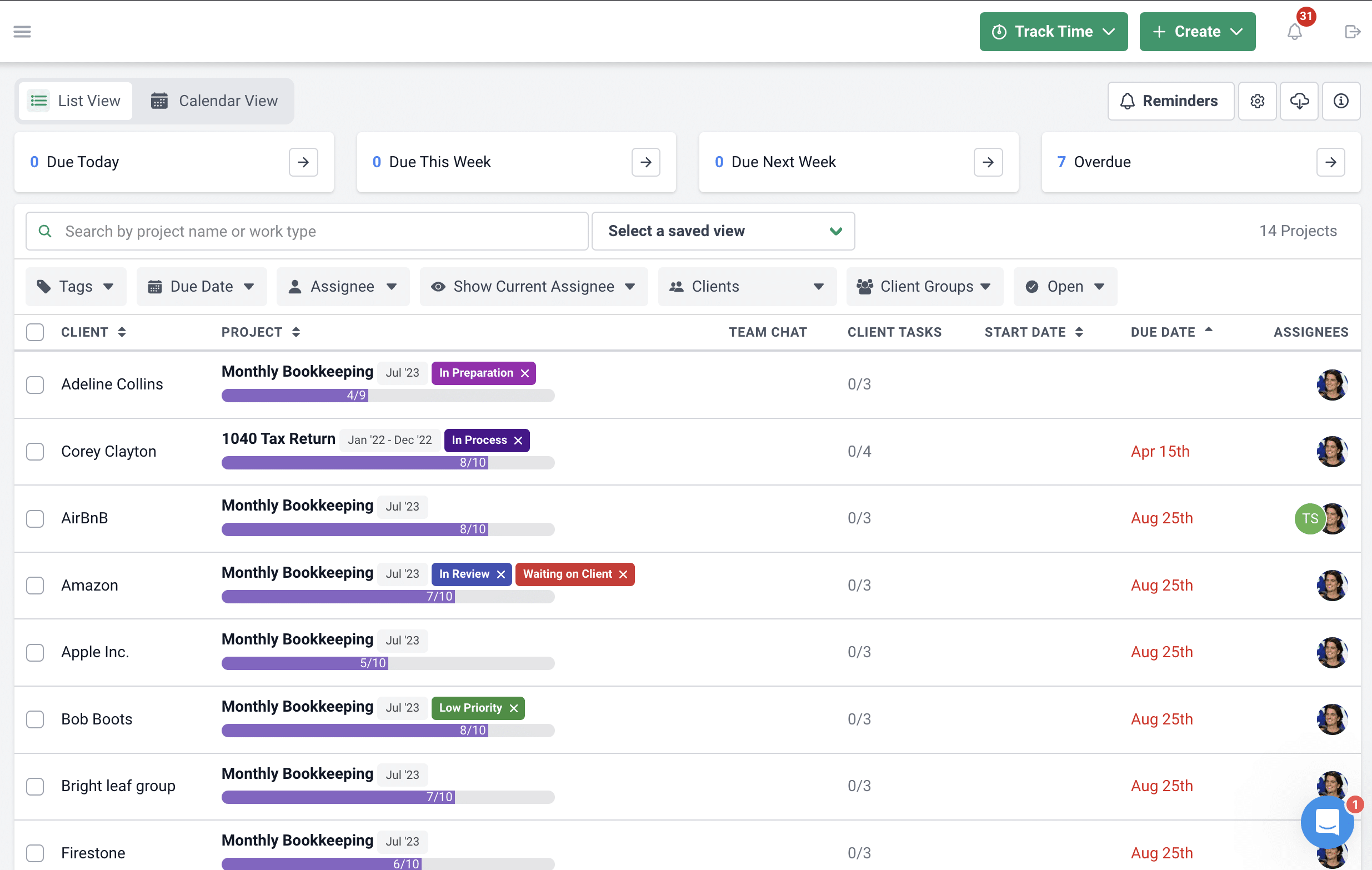

- A dashboard that provides a bird’s eye view of all projects.

- An Accounting workflow solution to help you always meet deadlines.

- A CRM solution to store client information and collaborate with them.

- Automated client requests and reminders to collect documents faster.

- Manual and automatic time tracking & invoicing.

- Capacity management to ensure no employee is over or underworked and everyone is right on schedule.

- Workflow templates to streamline operations.

- Unlimited number of clients for free so that you can scale with no extra costs.

Start a free trial to access the full scope of our features and manage your accounting firm.