For accountants, the busy season isn’t just a calendar date circled in red. It is an annual high-stakes drama, a financial Olympics, a Black Friday of deadlines, and a Super Bowl of client needs, all rolled into one. Pressure mounts, stress levels soar, and unique challenges test even the most seasoned accountant.

This peak season brings a unique set of challenges. The sheer volume of work can be overwhelming, with tax returns, financial reports, and audits all vying for attention. Each client presents its complexities, requiring accountants to trudge through the long hours, adapt, and strategize on the fly. This constant juggling act can lead to increased stress and the potential for mistakes if not managed effectively.

But amidst the pressure, there’s also an opportunity for growth and satisfaction. Successfully navigating the busy season requires skill, resilience, and strategic planning.

With our comprehensive survival guide for the busy season, you will be equipped with the necessary tools and tips to conquer this demanding period.

What is Busy Season Accounting?

Accounting season, often referred to as “busy season,” is a period of intense workload for accountants, typically occurring in the first quarter of the year (January to March).

During this period, accountants experience a significant increase in client activities due to several key factors:

- Tax deadlines: April marks the filing deadline for individual and business tax returns, triggering a rush to gather paperwork, prepare returns, and meet submission deadlines.

- Year-end closings: For many businesses, the fiscal year ends on December 31st. This makes January a critical time for accountants to finalize the books, create financial statements, and prepare for potential audits.

- Quarterly reporting: Private companies often prepare quarterly reports for internal stakeholders like investors, board members, or management while public companies file quarterly reports. This often translates to long hours for accountants in March as they ensure timely report submission.

When is Busy Season Accounting?

The specific timing and intensity of the busy season can vary depending on the type of accounting work you do.

For example, tax accountants are usually busiest in the weeks leading up to the April 15th deadline, while auditors may be busiest in the weeks leading up to the end of the fiscal year.

Let’s break it down for different accounting functions.

For most tax accountants, the busy season is between January – April because both individual tax returns and business returns are due within this period. Activities such as client consultations, document gathering, tax return preparation and filing, handling IRS inquiries, and managing extensions are common for such accountants.

For public accountants, this season is between February – March due to quarterly reporting deadlines for privately held and publicly traded companies. For instance, the Securities and Exchange Commission (SEC) filing for publicly traded companies is required 45 days after the end of each quarter. Activities during this period often include year-end audits and reviews, financial statement preparation, internal control testing, and communicating with auditors and stakeholders.

For management accountants, the busy season is between December – February due to budgeting and forecasting needs for the upcoming fiscal year. Activities include analyzing financial data, preparing budgets and forecasts, variance analysis, cost accounting, and internal controls monitoring for these accountants.

For forensic accountants, the busy season is not dependent on a timeline in the year but on their involvement in a case and court schedules.

Since they perform activities such as investigating fraud, analyzing financial records, preparing expert reports, and testifying in court, they aren’t tied down to the traditional January – April timeline like most of their counterparts.

Survival Tips for Accounting Busy Season

Start your planning and preparation early

Early preparation allows you to delegate tasks effectively, prioritize workloads, and schedule client deadlines strategically. This organized approach translates to calmer days, better work-life balance, and reduced stress for you and your team.

To begin, adopt a proactive approach rather than a reactive one. Basically, think of common challenges that might occur during this season and create solutions to tackle them way ahead of time.

For instance, it is common to misplace, mix up, or receive incomplete client documents during the filing process – a costly mistake that no accountant hopes for. Tackle this by providing your clients with checklists of sorts for different filing purposes or creating a secure portal where clients can upload their documents electronically.

If you want to make this seamless for yourself, you can adopt an accounting workflow tool like Financial Cents that lets you receive client documents, set reminders for deadlines, and manage prioritization of your work within a simple dashboard.

Recommended Reading

Prioritize tasks based on urgency and importance

Prioritizing tasks effectively is the difference between staying afloat and getting swamped during this busy season.

Every task vying for your attention needs to be judged by two crucial criteria: urgency and importance. Does this task have a pressing deadline or immediate consequence if delayed? Does this task contribute significantly to your long-term goals or client satisfaction?

Using urgency and importance as a two-axis matrix, you can easily group your tasks and make informed decisions about what to tackle first.

Here’s how to categorize them:

- Urgent & Important: These are your top priority tasks that demand immediate attention. Think of client deadlines, critical audits, or urgent tax filings. Tackle these first, even if it means rescheduling less urgent tasks.

- Not Urgent but Important: They might not have immediate deadlines, but their impact on your goals is significant. Schedule time to tackle these tasks.

- Urgent but Not Important: Delegate, automate, or streamline these tasks as much as possible. Client calls can often be handled by assistants, data entry can be automated, and routine reports can be scheduled.

- Not Urgent & Not Important: These are the low-hanging fruit, the tasks that can be safely put on hold or even eliminated.

Utilize workflow automation software

One powerful tool for gaining traction during peak season is utilizing workflow automation software to streamline all your processes and boost efficiency for you and your team.

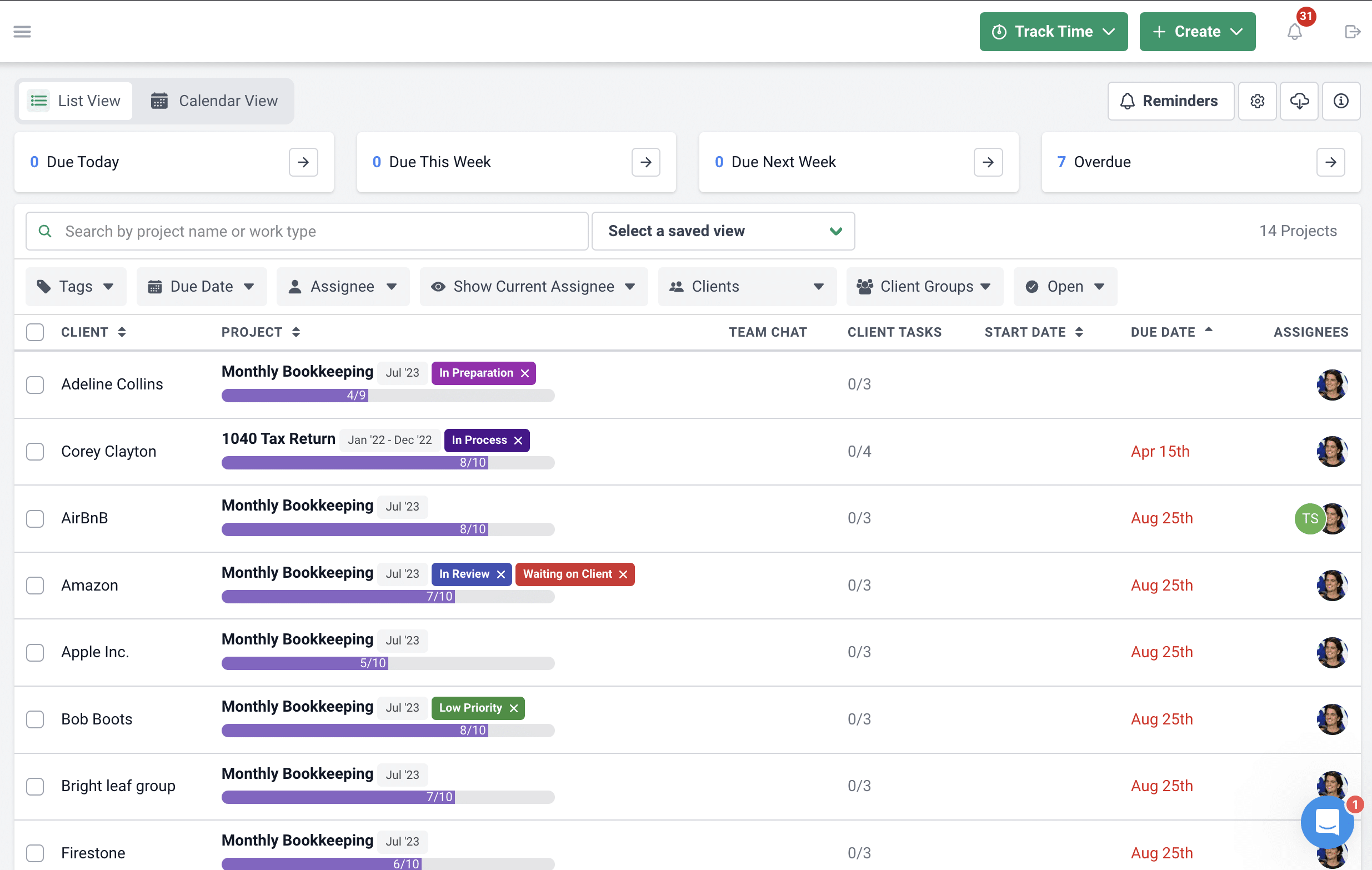

With a workflow tool like Financial Cents, you can automate manual and repetitive tasks, track the status of your client’s work, assign team members to different tasks to know who’s responsible for what, and create standard procedures for new hires to get up to speed.

Our essential features can help you cut back on time-wasting tasks and prioritize what is important to you. Scheduled reminders and proactive notifications keep you on top of critical dates, reducing stress and ensuring client satisfaction. Upload documents for approval, track their progress, and notify relevant parties without the need to schedule a physical meeting.

Prepare client documents early by automating data collection

Your success during the accounting season hinges on one crucial factor: client documents. Their timely and accurate arrival empowers you to deliver exceptional service, meet deadlines flawlessly, and avoid the stress of scrambling for missing information. It all starts with data collection – the very foundation of your workflow.

To avoid missed deadlines and errors, prioritize early document preparation and automate the process. This frees you up and lets you focus on high-value tasks.

Here’s how our workflow automation software can help:

- Schedule email, text, or SMS reminders to nudge with our client tasks feature.

- Provide a convenient platform for clients to upload documents and use client data collection features to highlight needed documents.

- Authenticate documents and get signatures easily with our e-signature integration.

Batch similar tasks together

Batching similar tasks is a simple strategy that can dramatically boost your efficiency and reduce stress during those busy months.

Firstly, analyze your workload and group similar tasks into categories. This could be based on function (e.g., all data entry, all client calls), complexity (e.g., simple returns, complex audits), or deadline (e.g., urgent tasks, long-term projects).

Next, carve out time slots in your calendar specifically for each category. Dedicate uninterrupted periods to tackling similar tasks in rapid succession without context switching. This minimizes mental refocusing and maximizes momentum.

During each batched session, eliminate distractions and immerse yourself fully in the task at hand. Utilize techniques like the Pomodoro method to maintain focus and prevent burnout. The repetitive nature of similar tasks within a batch can actually enhance your concentration and lead to a productive flow state.

Delegate tasks evenly among your team

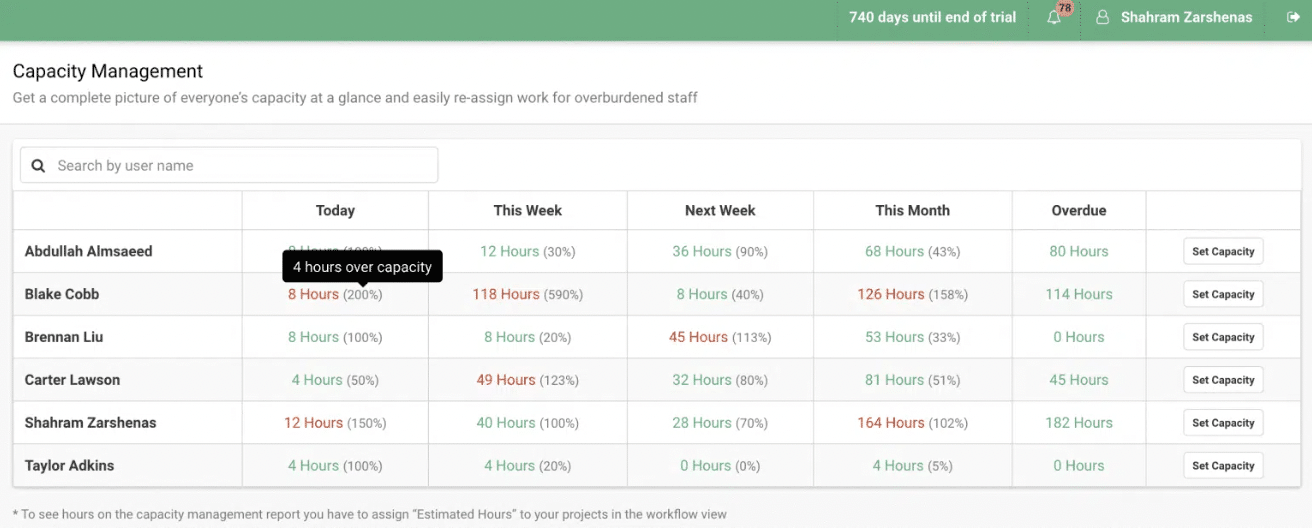

Another key strategy to employ during this season is effective task delegation. By distributing responsibilities evenly among your team, you not only lighten your own workload but also empower your team, optimize efficiency, and ultimately, achieve a smoother, more productive season.

To sail successfully during this season, first identify the necessary tasks that need to be fulfilled. Assess the skills and experience of each team member and match tasks appropriately. Prioritize tasks based on urgency, complexity, and their impact on overall goals.

Afterward, delegate the tasks, set deadlines/expectations, and provide guidance or support as needed.

Thankfully, our capacity management feature lets you handle this efficiently by providing an overview of your team’s capacity, letting you set predetermined hours of work, and reassign tasks to prevent burnout.

Communicate effectively with your team and clients

Effective communication is nonetheless crucial during this season. It helps your team know what’s at stake in due time and keeps your clients informed throughout the whole process.

At the start of the season, outline individual and team responsibilities, set achievable deadlines, and ensure everyone is aware of the overall workflow. Then, encourage regular check-ins, both formally (e.g., team meetings) and informally (e.g., quick chats or direct messages) to ensure everyone’s on the same page.

With your clients, don’t wait for inquiries. Inform them about progress, potential delays, and any critical information early on. Manage expectations and avoid unnecessary misunderstandings.

Free up valuable time by outsourcing

When the inevitable workload surge comes, you’d want to free up as much time as possible for yourself and your team. While some tasks demand your specialized expertise, others like bookkeeping services can be outsourced for greater efficiency.

Just picture facing a mountain of bookkeeping while juggling numerous deadlines – it can be overwhelming for even the most experienced accountants. Outsourcing can lessen the burden, prevent burnout and maintain mental well-being throughout the busy season.

Maintain work-life balance

The busy season will always come and go every year, but there’s no need to sacrifice your health in order to meet up with client demands.

Define clear work hours and communicate them to colleagues and clients. Resist the urge to work constantly, and schedule breaks throughout the day for physical and mental rejuvenation, such as reading tax memes or funny accountant jokes to make you laugh.

Learn to delegate tasks effectively to colleagues or team members. Don’t be afraid to say no to additional workload if it compromises your existing commitments or capacity. Prioritize high-impact tasks and let go of non-essential activities.

Use Financial Cents to Manage Busy Seasons and Your Firm

Empowering your firm with the right accounting workflow and management software is the final puzzle piece for conquering the busy season and thriving year-round. This powerful tool takes the chaos out of client document collection, automates repetitive tasks, and streamlines communication, freeing you and your team to focus on high-value work.

Use Financial Cents to automate repetitive tasks, streamline communication, and free you and your team to focus on high-value work.