Just landed a fantastic new client? Congratulations! But before you dive into the numbers, there’s one crucial step: securing a solid bookkeeping contract agreement. This document isn’t just legalese, it lists the services you’re providing, your fees, the timelines of the project, and the responsibilities of both parties.

It’s a win-win. A clear contract protects you from scope creep, and ensures your clients know exactly what they’re getting for their investment.

In this guide, we’ll equip you with everything you need to create a solid contract for bookkeeping services. We’ll cover key elements to consider, best practices, and a free downloadable template to get you started.

What is a Bookkeeping Contract Agreement?

A bookkeeping service agreement is a legally binding document that formalizes the professional relationship between a bookkeeper (you) and a business owner (your client). It acts as a roadmap, outlining the specifics of the services provided and ensuring both parties are on the same page.

For you, the bookkeeper, this agreement is essential because it:

- Defines the scope of work, preventing scope creep and ensuring fair compensation.

- Outlines client responsibilities, such as timely record-keeping and access to necessary documents.

- Provides legal recourse in case of payment disputes.

For business owners, the agreement:

- Ensures clarity on the services they’re paying for and the expected deliverables.

- Sets clear timelines and deadlines for completion of tasks.

- Protects confidential financial information through confidentiality clauses.

The agreement also serves as a reference point for both of you for any questions or concerns that may arise during the engagement. In essence, a well-crafted bookkeeping contract is the foundation for a successful and long-lasting working relationship.

Difference Between a Bookkeeping Contract and an Engagement Letter

A bookkeeping engagement letter is sometimes used interchangeably with a bookkeeping contract. Both establish the terms of service between a bookkeeper and a client. However, there’s a subtle difference in their scope and application:

- A bookkeeping contract is a more exhaustive document governing the ongoing professional relationship between the bookkeeper and the client. It details everything from services, payment & termination terms, client responsibilities, dispute resolution, limitation of liability, governing law and other essential details.

- While an engagement letter is typically a shorter and less formal document focusing on the scope of services for a specific project or engagement. It might be used for a one-time cleanup of financial records or a short-term bookkeeping task.

Think of a bookkeeping contract as the comprehensive user manual for the ongoing relationship. An engagement letter, on the other hand, is a more focused document outlining the specifics of a particular project within the larger framework of the contract.

Key Elements to Include in Your Bookkeeping Contract

When creating your bookkeeping services agreement, what should you include? That’s what you’ll find out below.

Clearly Defined Parties

Start by identifying the bookkeeper and business owner. Add your full legal name, business name (if applicable), and contact information. Likewise, detail your client’s full legal name, business name, and contact information. This clarity prevents any confusion about who is bound by the terms of the agreement.

Comprehensive Service Description

This section is the heart of the contract. Detail the bookkeeping services you’ll provide to the client. Be as specific as possible to avoid misunderstandings. Examples include:

- Bank statement reconciliation

- Accounts payable and receivable management

- Payroll processing

- Generating financial reports (income statement, balance sheet, etc.)

- Tax preparation assistance (if applicable)

- Categorizing transactions

- Book cleanup (for neglected books)

Be sure to specify the frequency of services and any potential softwares leveraged to keep expectations clear. Leaving the scope of services ambiguous can lead to misunderstandings and potential disputes in the future.

Transparent Fees and Payment Terms

Next, specify the fee structure for your bookkeeping services (hourly rate, monthly retainer, fixed rate, value-based pricing, or tiered packages).

To learn more about how to price your bookkeeping services, check out our piece.

For fixed rate or value-based pricing, Alexis Sadler, CEO of Accounting Therapy, suggests considering factors like the number of monthly transactions, reconciliation time, and complexities:

I look at the number of transactions in a month. I figured a minute per transaction, and then I averaged 15 minutes for reconciliation. But then I look at are we doing any specific journals that require us to get out of apps? Are we doing app support? Are we onboarding and onboarding employees? Because they have high turnover? [I look at] Those kinds of things as well. But my basic is a minute per transaction and 15 minutes per reconciliation"

Be sure to detail payment terms, including the due date for invoices, late payment fees (if applicable), and preferred payment methods (e.g., check, ACH transfer).

Setting clear fees and payment terms avoids confusion and financial complications.

Term and Termination

Define the agreement’s duration, whether it’s a fixed term (e.g., one year) or an ongoing arrangement with a minimum commitment period. Additionally, specify the termination clause, including the notice period required by either party to terminate the agreement.

Client Responsibilities

Outline the client’s responsibilities in the engagement. These can include:

- Providing timely and accurate financial records (bank statements, receipts, invoices)

- Granting the bookkeeper access to necessary accounting software and documents

- Approving financial reports on time

- Communicating any changes to the business or financial situation

This fosters the client’s active participation in the bookkeeping process.

Confidentiality and Data Security

This section is crucial for protecting the client’s sensitive financial information. Both parties should agree to maintain the confidentiality of all client financial information.

Explain the data security measures the bookkeeper will take to safeguard client information, such as using secure cloud storage, password protection, and encryption.

Dispute Resolution

Outline the process for resolving any disagreements that may arise during the agreement. Options include mediation or arbitration. Having a clear process in place helps minimize disruptions and allows for a more amicable resolution of any conflicts.

Limitation of Liability

Define the extent of each party’s liability in case of errors or omissions. This clause helps manage expectations and protects both parties from unforeseen circumstances. It’s important to consult a legal professional to ensure you draft this clause appropriately.

Amendment Process

Specify the process for amending the agreement if needed. This ensures both parties agree to any changes made to the original contract.

Governing Law

Identify the state or jurisdiction whose laws will govern the interpretation and enforcement of the contract. This is important in case of legal disputes.

Signatures and Date

Finally, include a date and signature section. This signifies that both parties have read, understood, and agreed to the terms of the contract. . A signed copy protects both your interests and serves as a reference point if needed. Without this section, the agreement isn’t valid, and you can’t enforce it if things go south.

Best Practices for Creating a Contract for Bookkeeping Services

Here are some tips to keep in mind when creating a bookkeeping contract.

Use Clear and Concise Language

Avoid legalese and complex jargon. Your contract should be easy to understand for both you and your clients. Use plain language and straightforward sentence structure. If you must include any technical terms, provide clear definitions within the contract itself.

Maintain Professional Formatting

First impressions matter, and a professional-looking contract makes a positive statement. Use a professional font and layout that is easy to read and navigate. In addition, make the formatting consistent throughout the document with clear headings, bullet points, and proper spacing.

Proofread Carefully

Typos and errors are sloppy and undermine the professionalism of your agreement. Before finalizing and sending the bookkeeping contract to the client, proofread it meticulously for any mistakes. It’s also advisable to have someone else (like a team member or professional editor) review the document for any errors you might have missed.

Review and Update Regularly

Your business and client needs may evolve over time. It’s essential to review your bookkeeping contract agreement periodically, at least annually, so it reflects your current services and pricing structure.

Alexis also advises to evaluate your fixed pricing regularly. She says “We have a process to do the 90 day evaluation, the six month evaluation, and then we evaluate every year just on an anniversary basis. So we are always evaluating that number.”

If you feel there’s any need for change, update the agreement and sign the revised version with your client.

Simplify Your Bookkeeping Service Agreement Through E-Sign

You no longer have to print, sign, and mail physical copies of contracts. Many online tools now offer a secure and convenient e-signature feature to streamline the agreement process.

Financial Cents, an accounting and bookkeeping practice management software, for example, provides an e-signature integration with Adobe Sign which allows you to:

- Upload your bookkeeping contract template directly to the platform.

- Send the contract electronically to your client for review and signature.

- Receive instant notification once your client has signed the agreement.

- Securely store signed copies of the agreement for both you and your client.

This streamlines the signing process, saves time, and ensures both you and your client have a readily accessible copy of the signed agreement. With this feature, finalizing your bookkeeping contracts becomes effortless and convenient.

Free Bookkeeping Contract Agreement Template

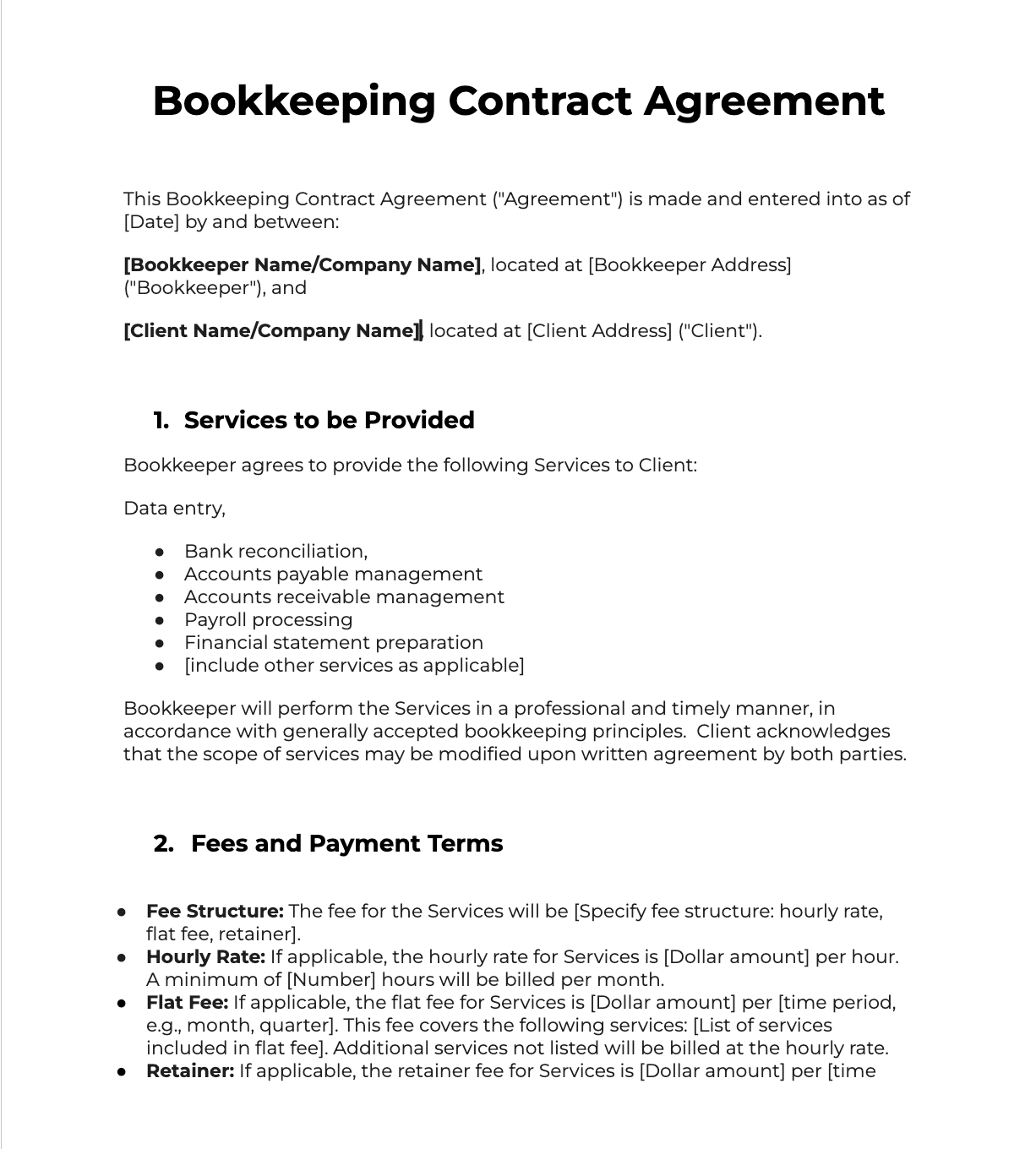

Here’s a free template you can copy/paste and use:

This Bookkeeping Contract Agreement (“Agreement”) is made and entered into as of [Date] by and between:

[Bookkeeper Name/Company Name], located at [Bookkeeper Address] (“Bookkeeper”), and

[Client Name/Company Name], located at [Client Address] (“Client”).

1. Services to be Provided

Bookkeeper agrees to provide the following Services to Client:

Data entry,

- Bank reconciliation,

- Accounts payable management

- Accounts receivable management

- Payroll processing

- Financial statement preparation

- [include other services as applicable]

Bookkeeper will perform the Services in a professional and timely manner, in accordance with generally accepted bookkeeping principles. Client acknowledges that the scope of services may be modified upon written agreement by both parties.

2. Fees and Payment Terms

- Fee Structure: The fee for the Services will be [Specify fee structure: hourly rate, flat fee, retainer].

- Hourly Rate: If applicable, the hourly rate for Services is [Dollar amount] per hour. A minimum of [Number] hours will be billed per month.

- Flat Fee: If applicable, the flat fee for Services is [Dollar amount] per [time period, e.g., month, quarter]. This fee covers the following services: [List of services included in flat fee]. Additional services not listed will be billed at the hourly rate.

- Retainer: If applicable, the retainer fee for Services is [Dollar amount] per [time period, e.g., month, quarter]. The retainer will be applied towards hourly charges incurred during the [time period]. Any unused portion of the retainer will be refunded at the end of the term or upon termination of this Agreement.

Payment Terms: Payment is due [Number] days from the date of the invoice. Late fees of [Percentage]% may be applied to any outstanding balance after [Number] days (optional). Accepted forms of payment are [List accepted payment methods].

3. Term and Termination

- This Agreement will commence on [Start Date] and will continue for a period of [Term Length] (the “Term”).

- This Agreement may be terminated by either party upon [Number] days’ written notice to the other party.

- This Agreement may be terminated by either party immediately upon written notice in the event of a material breach by the other party that is not cured within [Number] days of written notice.

4. Client Responsibilities

Client agrees to:

- Provide Bookkeeper with timely and accurate financial records, including bank statements, invoices, receipts, and canceled checks.

- Grant Bookkeeper access to Client’s accounting software or relevant financial data as necessary to perform the Services. Client is responsible for any costs associated with providing such access.

- Review and approve financial reports provided by Bookkeeper in a timely manner.

- Provide any additional information or assistance reasonably requested by Bookkeeper to perform the Services.

- Inform Bookkeeper of any changes in Client’s business structure or tax situation.

5. Confidentiality and Data Security

Confidentiality:

- Both parties agree to hold in confidence all confidential information of the other party obtained in connection with this Agreement. Confidential information includes, but is not limited to, financial records, client lists, and business practices.

- Each party agrees not to disclose such confidential information to any third party without the prior written consent of the other party.

Data Security:

- Bookkeeper agrees to implement and maintain reasonable security measures to protect Client’s data from unauthorized access, disclosure, alteration, or destruction. Such measures may include, but are not limited to, password protection, encryption, and firewalls.

- Bookkeeper agrees to notify Client promptly in the event of any data breach or security incident.

6. Dispute Resolution

Any dispute arising out of or relating to this Agreement will be settled by [Specify method of dispute resolution, e.g., mediation, arbitration].

7. Limitation of Liability

Bookkeeper’s liability to Client for any claim arising out of or relating to this Agreement will be limited to the amount of fees paid by Client to Bookkeeper under this Agreement in the preceding [Time period, e.g., month, year].

8. Independent Contractor

Bookkeeper is an independent contractor and not an employee of Client. Bookkeeper is solely responsible for all taxes and social security contributions associated with its services.

9. Entire Agreement

This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior or contemporaneous communications, representations, or agreements, whether oral or written.

10. Amendment

This Agreement may be amended only by a writing signed by both parties.

11. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State].

Signatures and Date

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

Bookkeeper

________________

Signature & Date

Client

_________________

Signature & Date

You can also get it in Microsoft Word or Google Docs format if you prefer.

Free Bookkeeping contract service agreement

Manage Your Firm With Financial Cents

A bookkeeping contract is a must-have for your firm. It sets clear expectations, highlights responsibilities, and minimizes the potential for misunderstandings. In the end, this sets the stage for a long-lasting and successful working relationship.

If you haven’t yet, download our free bookkeeping service contract agreement template here.

Also, if you’re managing multiple clients and projects, it can be hard to keep up, which is why you need Financial Cents.

Our user-friendly software helps you manage your workflow and boost efficiency. It automates repetitive tasks, allows you to collaborate with clients and team members, and helps you track project progress and