As an accountant, you know the world of taxes is not just about numbers and regulations, it’s also ripe with humor, especially during those long, caffeine-fueled tax seasons.

So, to lighten up your day, we’ve compiled 50 hilarious memes for the tax work that you can probably relate to. And if you’re searching for some tax returns-inspired laughter, you’ve hit the jackpot!

You may be interested in:

Laugh now. Extensions later – 50 Hilarious Tax Memes

1. That question must be a joke

2. You start asking yourself “how could I make such a mistake?”

3. “It’s not complicated, let me show you why real quick”

4. Free at last! Now where’s that beach

5. Trying to decide if you should go on vacation or send reminders to your client

6. The struggle is real. For every client who said, “It should be simple.”

7. “Well, at least I can buy a used bandaid now”

8. At least, you gave it a shot

9. Client audit? May the odds be ever in your favor

10. Nope, not today!

11. “I think I saw one in 2017”

12. The disappearing act is always out of this world

13. Make it stop!

14. With the way things are going…

15. Well, I guess I’ll just do the same

16. Client’s file thicker than a Stephen King novel

17. Just another Monday, isn’t it?

18. Quiet room and spreadsheets? An ideal vacation

19. This feels like winning the lottery

20. Why is it so hard to understand?

21. Tax season hangover? It’s a marathon, not a sprint

22. Might as well send it through a bird

23. These assumptions need to end

24. That’d be $50 please

25. Caffeine drip installed

26. Just for a while

27. What is this ‘sleep’ you speak of?

28. Trying to relearn everything (Now, from the top)

29. The type of relationship that comes in handy

30. Inner peace

31. It’s the effort that counts

32. …and so the cycle continues

33. End of tax season > birthday

34. Who’s gonna check me?

35. Tell me more!

36. You never know what might happen

37. Normal is boring

38. Things are not what they used to be

39. It’s not that hard, is it?

40. Let’s get this out of the way!

41. Scrolling through endless Google articles for tax advice only to realize you’re the expert they’re all talking about

42. When you can’t catch a break even while you are sleeping

43. Where exactly are you coming from?

44. Here we go again

45. Time for another bumpy ride

46. Optimism or delusion? Only your snooze button knows for sure.

47. Doing wrong or doing well, seems like either way, your wallet can’t catch a break!

48. This is how it feels

49. Very seamless I tell you. It sticks!

50. Just happy to have survived the tax season

Step-by-Step Guide to Navigate the Tax Season

1. Start planning early: Don’t wait until the last minute to start gathering your tax documents and preparing your return. This will help you avoid stress and make the process easier.

2. Get organized: Create a file folder for your tax documents and keep them all in one place. This will make it easier to find what you need when you’re ready to file your return.

3. Gather your tax documents: You’ll need to gather a variety of tax documents, including W-2s, 1099s, receipts, and bank statements. Make sure to keep all of your documents for at least three years in case the IRS audits you.

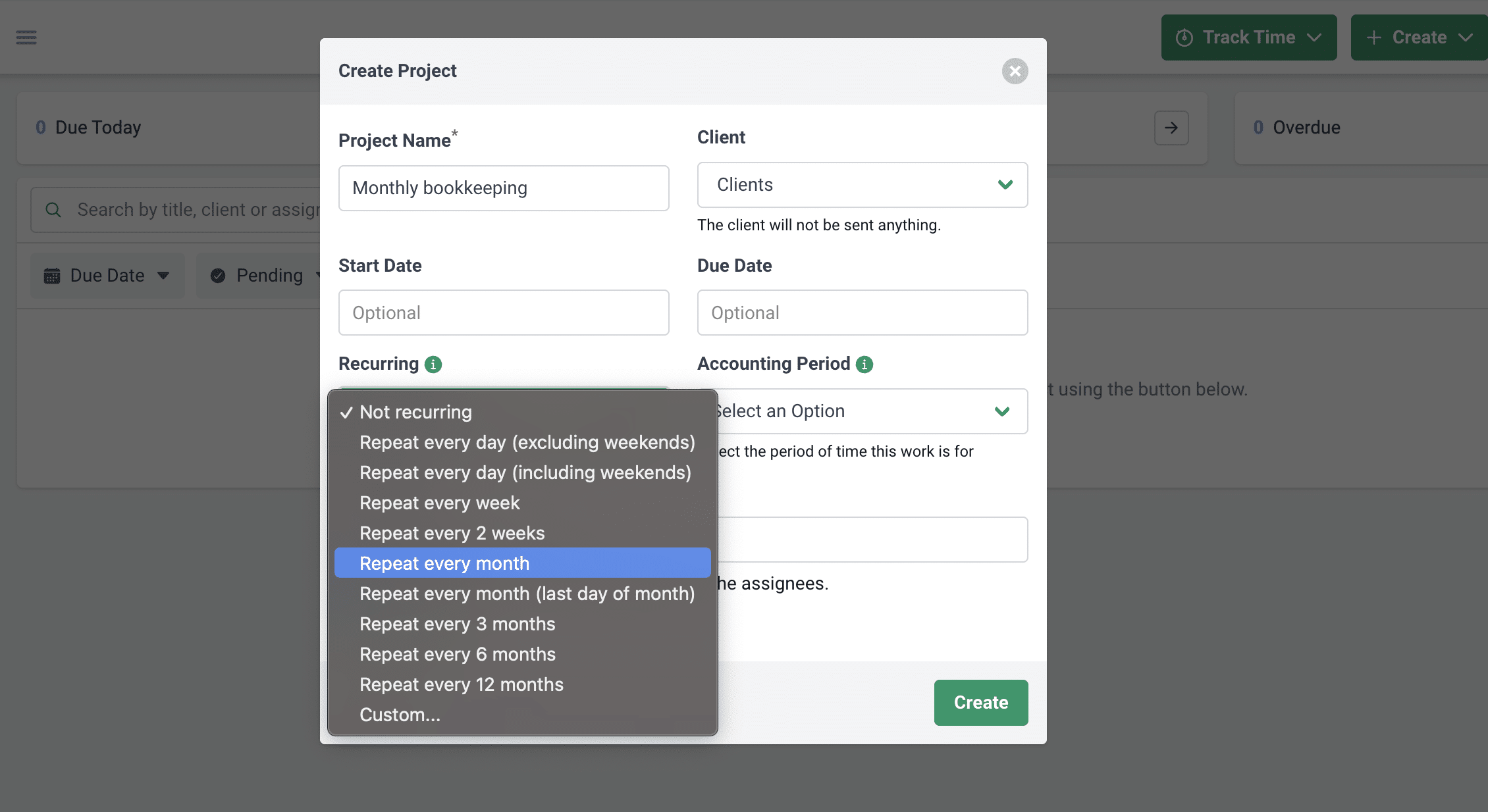

4. Use workflow management software: An accounting workflow management software can make the process of filing your taxes much easier. There are many different software programs available, so you can choose one that’s right for you.

5. Review your return carefully: Before you submit your tax return, be sure to review it carefully to make sure that all of the information is accurate. You should also double-check your math to make sure that there are no errors.

6. File your return on time: The deadline for filing your tax return is usually aorund April 15th. However, there are some exceptions, so be sure to check with the IRS to see if you have any special filing deadlines.

7. Save time by automating manual tasks: There had to be a way to automate those accounting and bookkeeping tasks that take up several hours of accounting and bookkeeping work every week, workflow automation became the answer. With automation, your team gets their time back to focus on the tasks that are best suited to humans instead of performing the same set of tasks every week.

Tips for Tax Pros

- Set realistic expectations: Tax season is always busy, so it’s important to set realistic expectations for yourself and your clients. Don’t try to do too much at once, and be sure to take breaks when you need them.

- Delegate tasks: If you have the ability to delegate tasks to your staff, do it. This will free up your time so that you can focus on the most important things.

- Take care of yourself: Tax season can be stressful, so it’s important to take care of yourself physically and mentally. Get enough sleep, eat healthy foods, and exercise regularly.

Recommended Resources for the Busy Season

- The 5 Best Tax Deadline Management Software

- Tax Preparer Checklist for Clients

- All You Need to Know About IRS Form 8821

- IRS Form 2848 – Power of Attorney: A Guide for Accountants

- IRS Form 2553: All You Need to Know

- All You Need to Know About IRS Form 8886 Reportable Transactions

- Checklist Templates for completing taxes

The stress and panic that accompanies tax season doesn’t have to be an annual ordeal. With the right tools and strategies, you can transform this typically frantic time into a streamlined and manageable process. One key solution lies in implementing workflow management software.

Why Workflow Management Software?

Workflow management software is designed to streamline and automate repetitive tasks, which is a plus during tax season. This helps you keep track of deadlines, organize documents, and ensure that every part of your tax process is completed efficiently and on time.

Here’s how workflow management software like Financial Cents can help:

- Automated task management: Automate routine tasks like data entry and document sorting. This reduces manual errors and frees up your time to focus on more complex aspects of your tax preparation.

- Document organization: Keep all your tax-related documents in one place. With features like cloud storage and easy retrieval systems, you’ll spend less time searching for documents and more time on analysis and strategy.

- Collaboration made easy: If you work with a team or an accountant, workflow management software enhances communication and collaboration. Share documents, track progress, and keep everyone on the same page without the hassle of endless email threads.

- Deadline reminders: Never miss a deadline again. Set up reminders for important dates and milestones to ensure you’re always ahead of schedule.

- Real-time reporting: Monitor your tax preparation progress with real-time reporting features. This helps in making informed decisions and adjustments promptly.

Financial Cents’ features are better experienced than explained. Try out all these features (and more) in our free trial.

Thanks for the article!