Our CRM keeps us so focused that we don't need to check our email often, and that is good for us. My email traffic has dropped by sixty percent, so I'm now focusing on sales, marketing, and innovation."

Gerry Anderson, M.Sc., CPA, President of Blue Canyon CPATaking care of your existing clients is the best strategy to win new ones. A satisfied customer will become not just a repeat buyer, but also a loyal advocate, referring their associates to your firm. That is why it is five to 25 times more expensive to get a new client than to retain an existing one.

However, firms struggle to keep their best clients happy, and you can’t blame them. They are overwhelmed. They are relying on the wrong tools to see what is going on with each client.

- Take spreadsheets, for example. New firm owners use it to track client names, birthdays, and see the last time they contacted a client, so it feels fine in the immediate.

But it is not a client management tool. Sooner, rather than later, their team and clients will increase, and the lack of automation and version control will become too costly to manage.

We found that every accountant was going to Excel to manage their business, but it doesn't work, especially when you have a multi-office firm with clients that are more fluid.

We wanted to make sure we could easily service the needs of the client, but also have a place to quickly log in and find out what's going on. We also needed something to hold clients accountable. Spreadsheets didn’t quite cut it."

- Email is worse. While you can create folders and labels and highlight threads, client information gets buried in individual inboxes. You can’t see what your team members have discussed with clients in their inboxes except you ask them manually.

When we used emails for client communication, we had to always hunt through conversations in email threads. Now, we communicate with clients in the Financial Cents’ Client Chat, and Client emails and notifications have decreased. We try to ensure our clients get into Financial Cents, so that we can communicate inside the dedicated Client Chat feature, where every team member can easily chime in."

Gerry Anderson, M.Sc., CPA, President of Blue Canyon CPAWhat is an Accounting CRM?

An Accounting Client Relationship Management (CRM) is a software designed to help accounting firms collect, organize, and centralize client information, making it easier to deliver satisfactory services and nurture quality relationships throughout the client’s lifecycle.

Unlike the generic CRM, this software is tailor-made for (or at least accommodates) the workflow needs of the accounting industry, which revolves around organizing client data, centralizing client communication, and enabling collaboration (through file sharing, document requests, E-signature, etc.).

We found that with Financial Cents, we're really able to focus on client needs because our tech stack is paying off. Financial Cents allows us to communicate with clients 24/7, 365, while our staff work according to the time that fits with their needs."

Gerry Anderson, M.Sc., CPA, President of Blue Canyon CPAWhy Accounting Firms Need a CRM Solution

A. Centralize client information and communication history

Accounting CRM software centralizes every client’s data (contact details, service history, notes, emails, files, and meeting summaries, etc.) for team members to find the information they need to complete their work.

The easier and faster team members can find these, the better their ability to deliver services that consistently satisfy your clients.

B. Track leads, prospects, and client pipelines

When you have the information of the people who have shown interest in working with you, it becomes easier to follow up with them, share helpful ideas, or do whatever else you can to convert them to clients.

Accounting CRM system enables you to organize this information, so you understand where they stand, who should follow up with them, when, and how.

C. Automate follow-ups, reminders, and email sequences

With the automation features in accounting CRMs, client onboarding, collaboration, and updates wouldn’t require your manual efforts.

When you need additional files or information, the client task and auto-reminder feature will automate data collection and client reminders. To keep your clients updated about their tasks, the auto-update feature sends an automated email to the client at a time you have decided.

These automations save time (worth as much as $19,200 per employee), prevent important steps from being forgotten, and encourage timely client responses.

D. Improve client experience with personalized engagement

By putting client information at your fingertips, client relationship management software for accountants enables you to tailor your services and interaction with clients to their needs. For example, the client group feature shows your tax clients in one place, making it easier to send them tax season reminders on time.

Nayo Carter-Gray, EA, the Owner of 1st Step Accounting, relies on the Client Notes feature on her accounting CRM software to record dates and events that matter to her clients. This enables her to get her clients gifts when they are celebrating an occasion, which strengthens client relationships.

E. Sync data across team members and reduce manual coordination

The CRM is a single source of truth, showing everyone in your firm where each client’s projects, conversations, and overall relationship stand. This helps everyone in your firm to speak with one voice at all times to provide consistent client services and experiences, thereby helping you retain clients.

The 10 Top CRM For Accounting, Bookkeeping and Tax Firms

1. Financial Cents

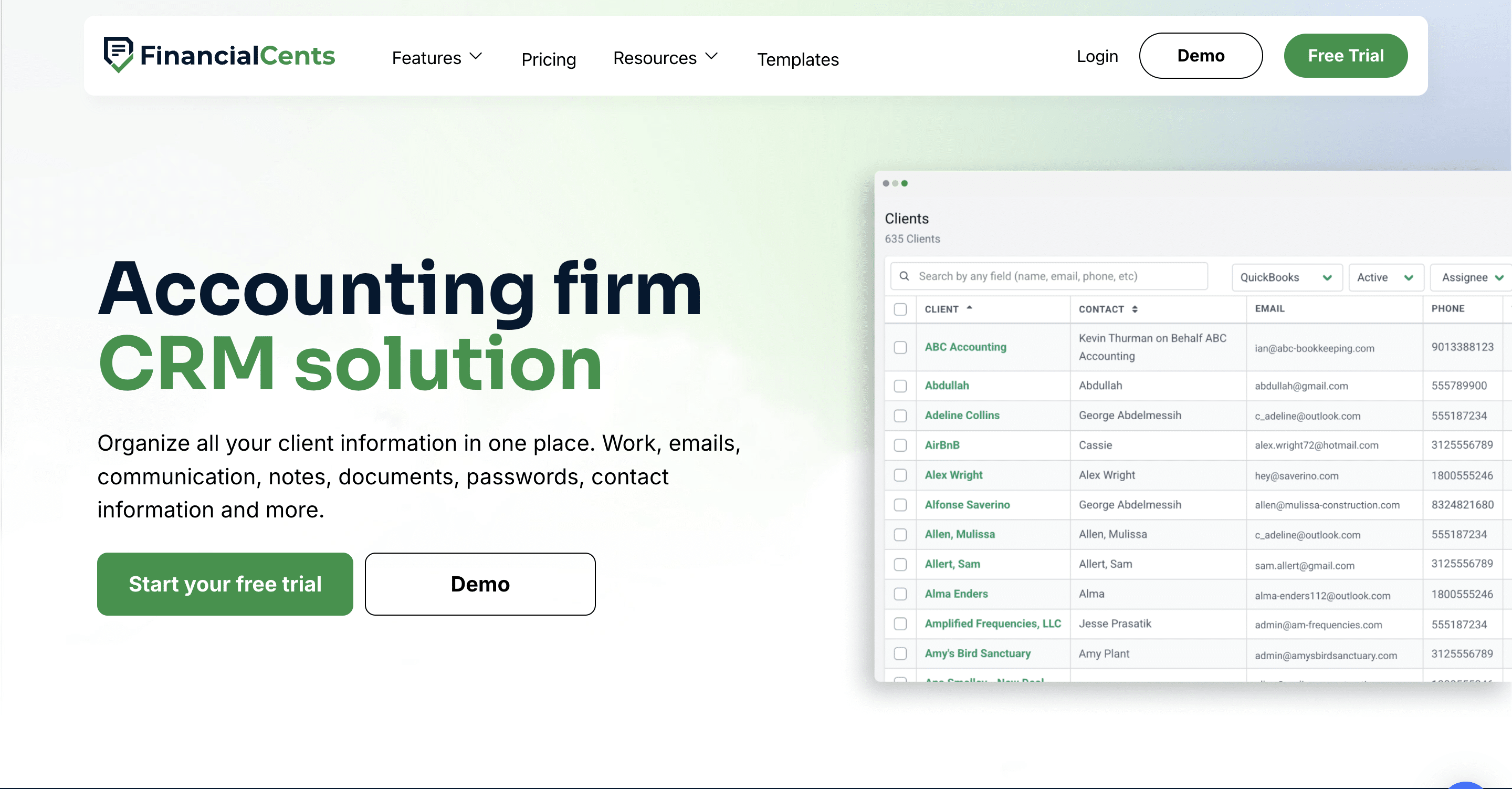

Financial Cents’ comprehensive client relationship management (CRM) is built specifically for accountants to organize all their clients’ Information (contact details, emails, communication, notes, documents, passwords, etc.) to nurture quality client relationships conveniently.

As an all-in-one accounting practice management software, Financial Cents unifies your CRM features alongside your projects, workflow time, billing, and capacity management features in one place, giving you one place to manage your practice instead of using multiple apps for the different aspects of your workflows.

Here are some of Financial Cents’ CRM features and what they do:

Client Database and Profile

- Client Database: A high-level view of all the clients in your firm. You can find client information by entering the client name or specific information (EIN, phone number, email, etc.) in the search bar.

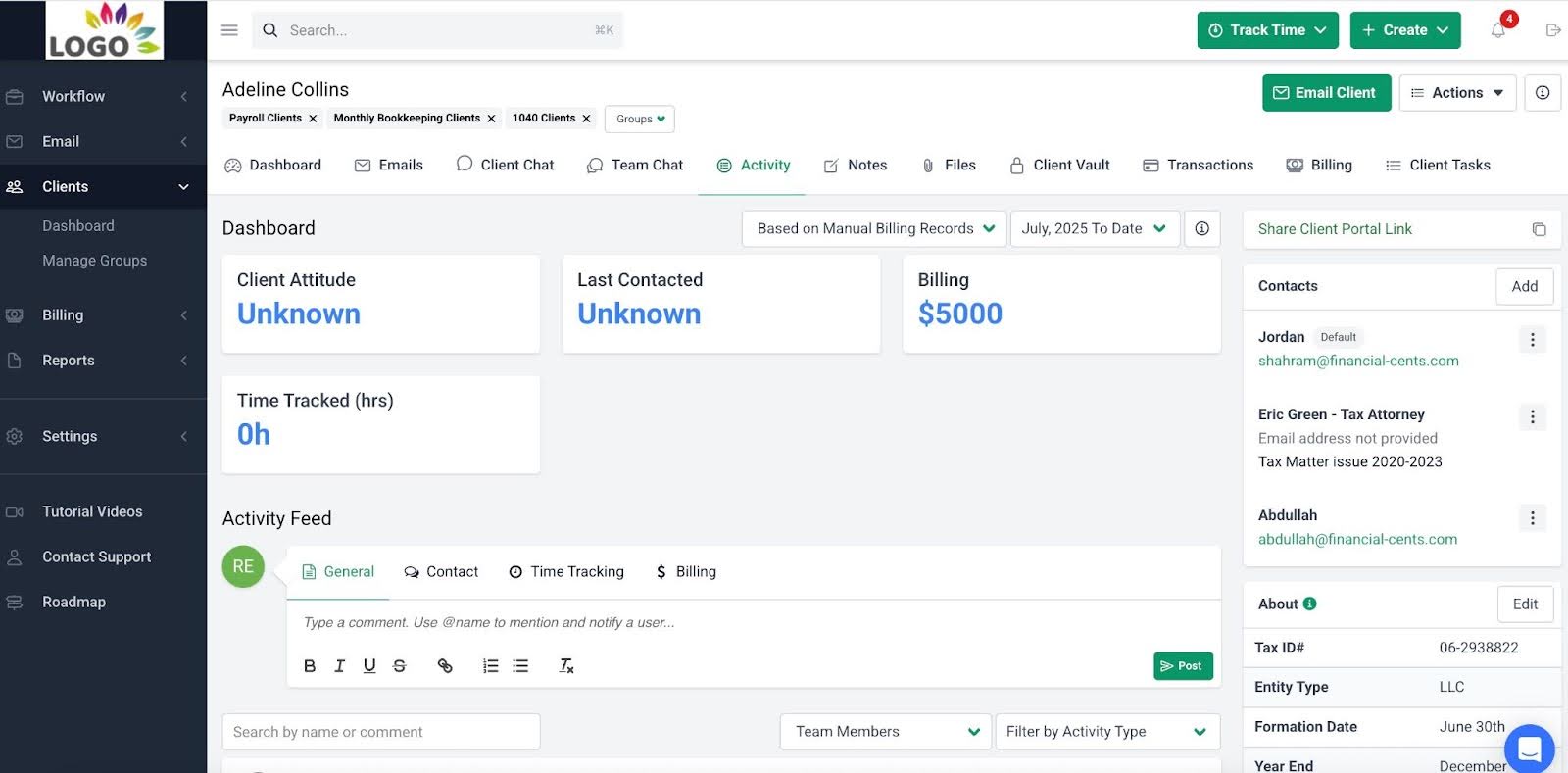

- Client Profile: Stores each client’s information in sections, which include:

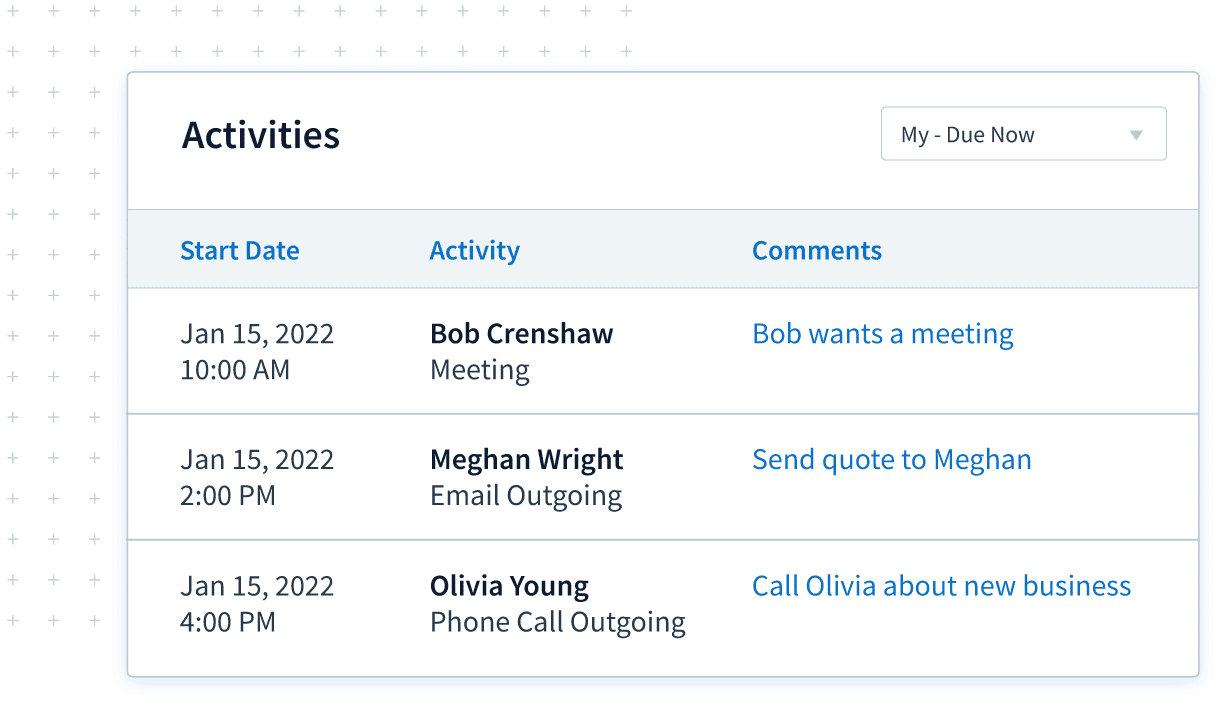

- Activity Tab: A view of every team member that has spoken to the client, when, and what they discussed.

-

- Custom Fields: Unique information about each client, such as birthday, formation date, tax ID, entity type, etc.

- Client Vault: An encrypted vault to store your client’s passwords, only accessible to authorized persons.

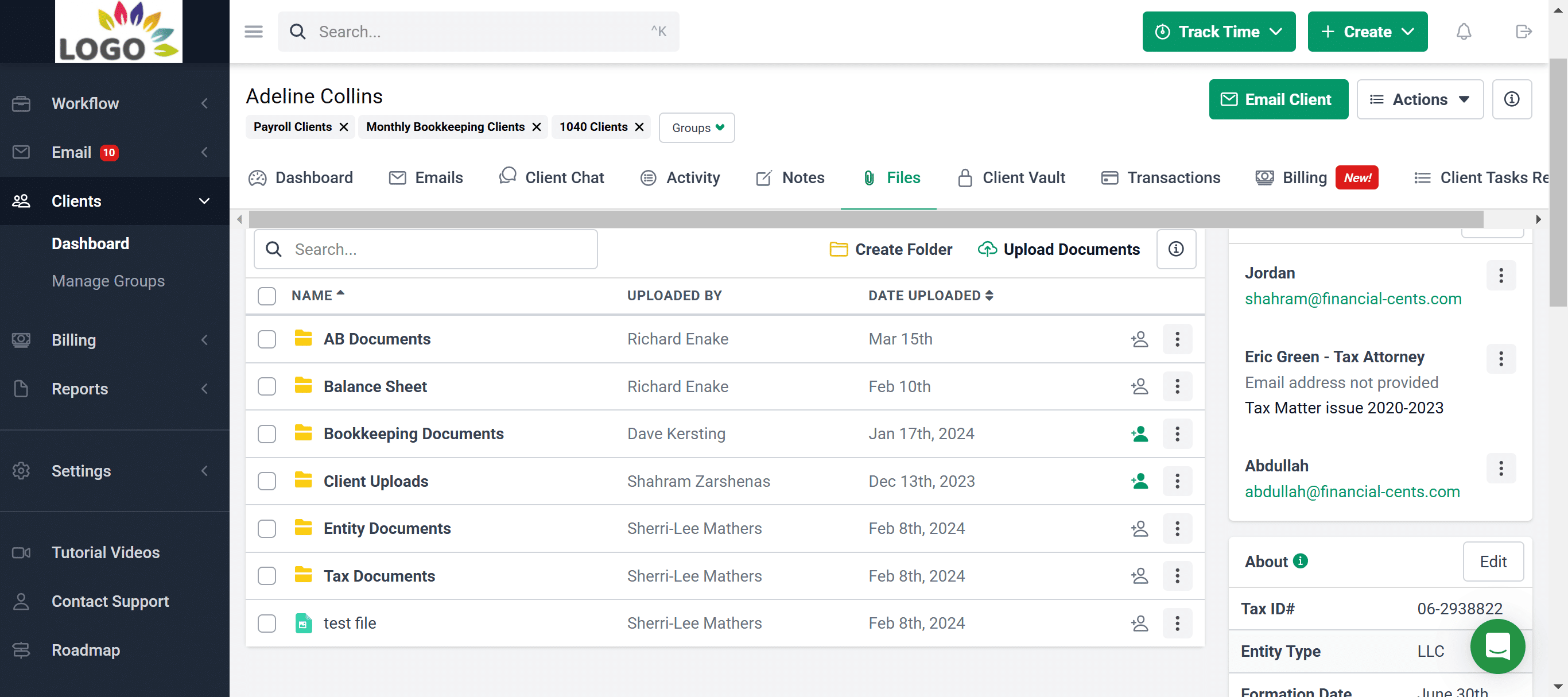

- Files Tab: Organizes your client’s documents into folders inside the client’s profile.

-

- Team Chat: Internal space accounting teams use to collaborate on clients.

- Client Notes: Allows your team to record critical details from the meeting.

- Client Groups: Categorize clients with similar attributes to track them more easily. An example, your tax or monthly bookkeeping clients can be in a group, enabling you to, for example, duplicate a project for all clients in the group.

- Emails Tab: All the emails your clients send to you are logged in a dedicated folder in their profile.

- Relationship: Defines the relationship between your clients.

Client Portal

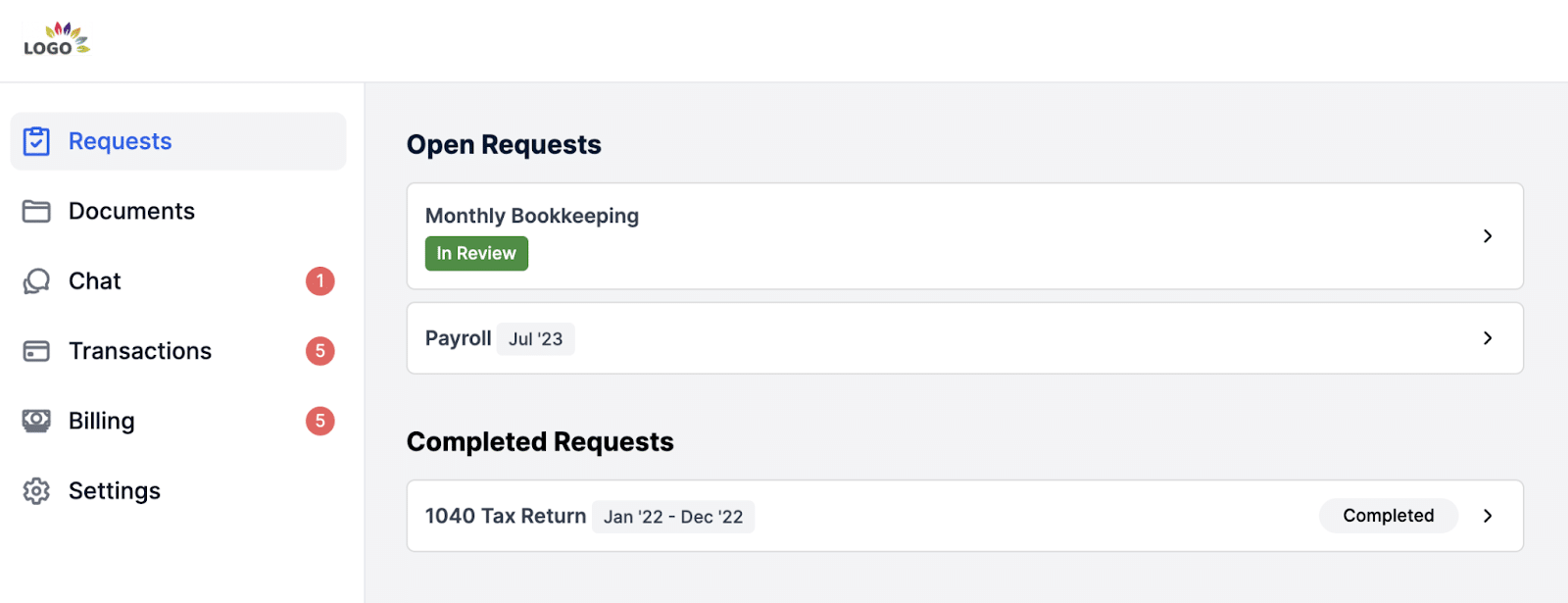

Financial Cents’ secure, passwordless, and client-facing portal for client communication and collaboration provides a single source of truth for your clients.

Here is the information they can track in the client portal:

- Client Tasks and Requests: Displays your document and e-signature requests (with their due dates), questions, and files you shared with the client.

- Billing and Proposal: Clients can view (and pay) outstanding invoices, past paid invoices, and manage their payment methods. Clients also sign their proposals here.

- Client Chat: Allows your team to discuss documents and projects to build clarity. You can streamline conversations in the portal into topics and add relevant team members to these topics.

- Secure Folder Sharing: Your clients can view the documents and folders you shared with them and upload documents to the shared folders on demand.

- ReCats: Allow clients to provide information, documents, and receipts that you need to categorize uncategorized transactions.

Additional client collaboration features in Financial include:

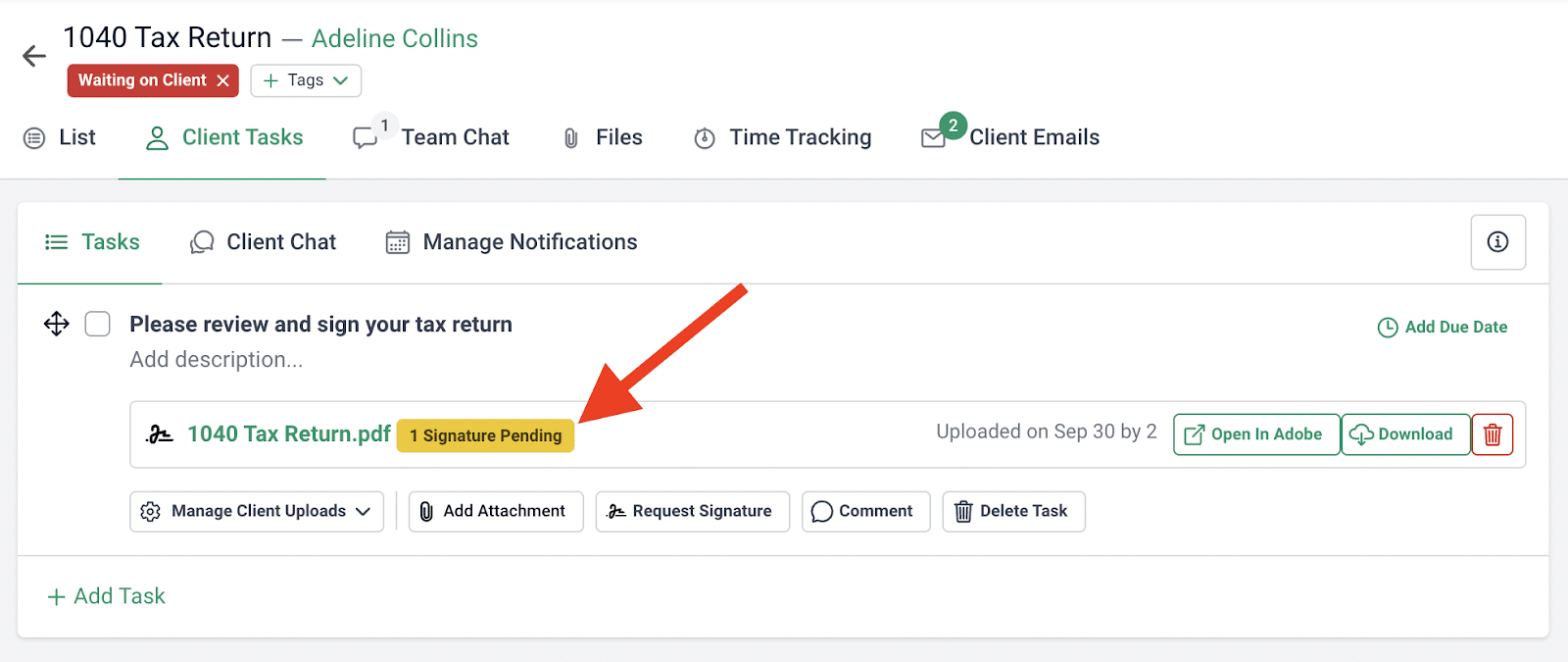

E-signature: Request Signatures and Organize Signed Files

- E-signature Request: Send clients proposals, tax forms, and other documents for them to sign online, speeding up E-signature collection.

- Security & Compliance: Uses Adobe’s security certification and compliance.

- Automatic Notifications: Your team is notified when a client signs the document, preventing unnecessary delays in the workflow.

- Centralized Doc Storage: Signed documents are organized in the Client Task File section of the client portal, making them easier to retrieve.

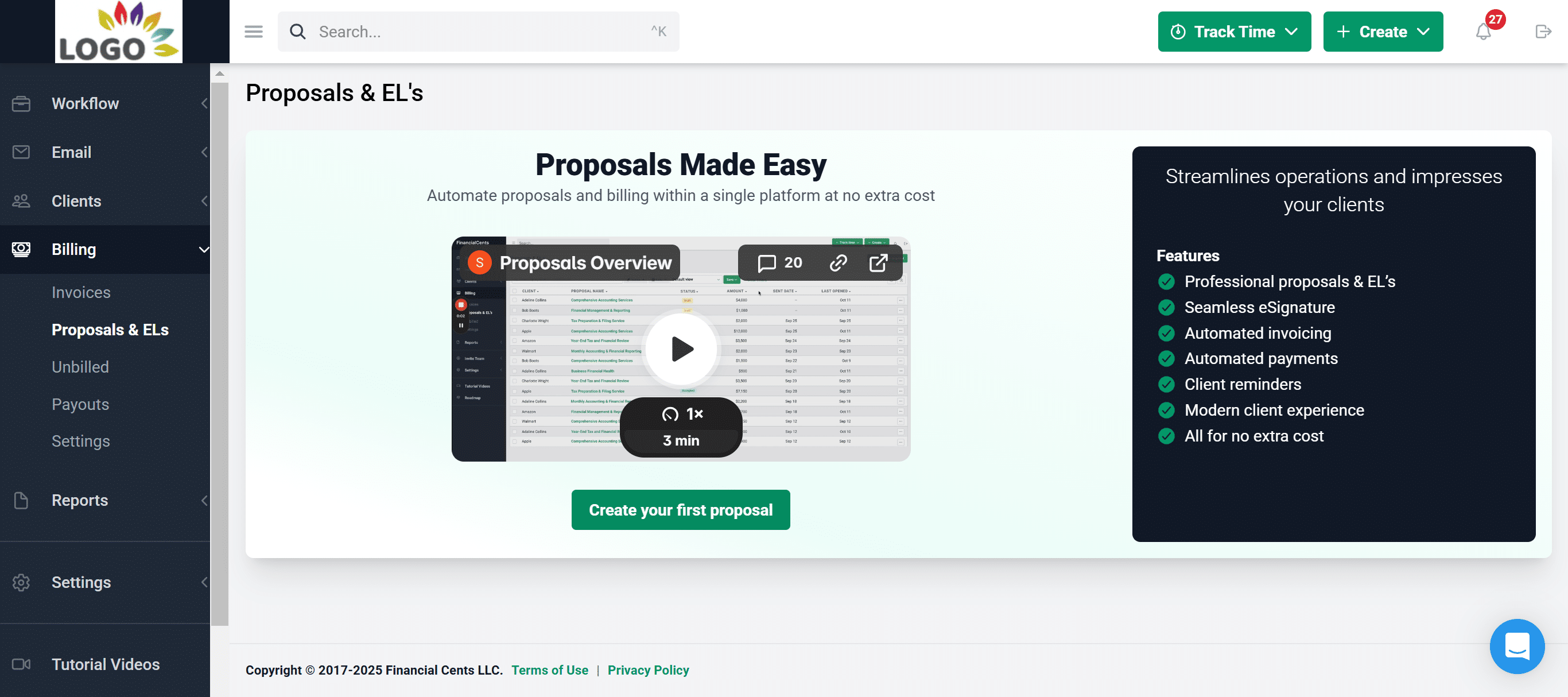

Client Proposals: Streamline Client Onboarding

- Engagement Letters: clarify project scope and define the terms of your engagement with clients.

- Auto Reminders: Financial Cents will follow up with clients to ensure they sign your proposals.

- Optional Add-On Service: Add complementary services for a chance to upsell your new client.

- Videos: Use a video welcome to make your proposal more personal.

For more resources to help you streamline your client onboarding, read this article: Client Onboarding: 8 Ways to Make It Memorable (+ Free Template)

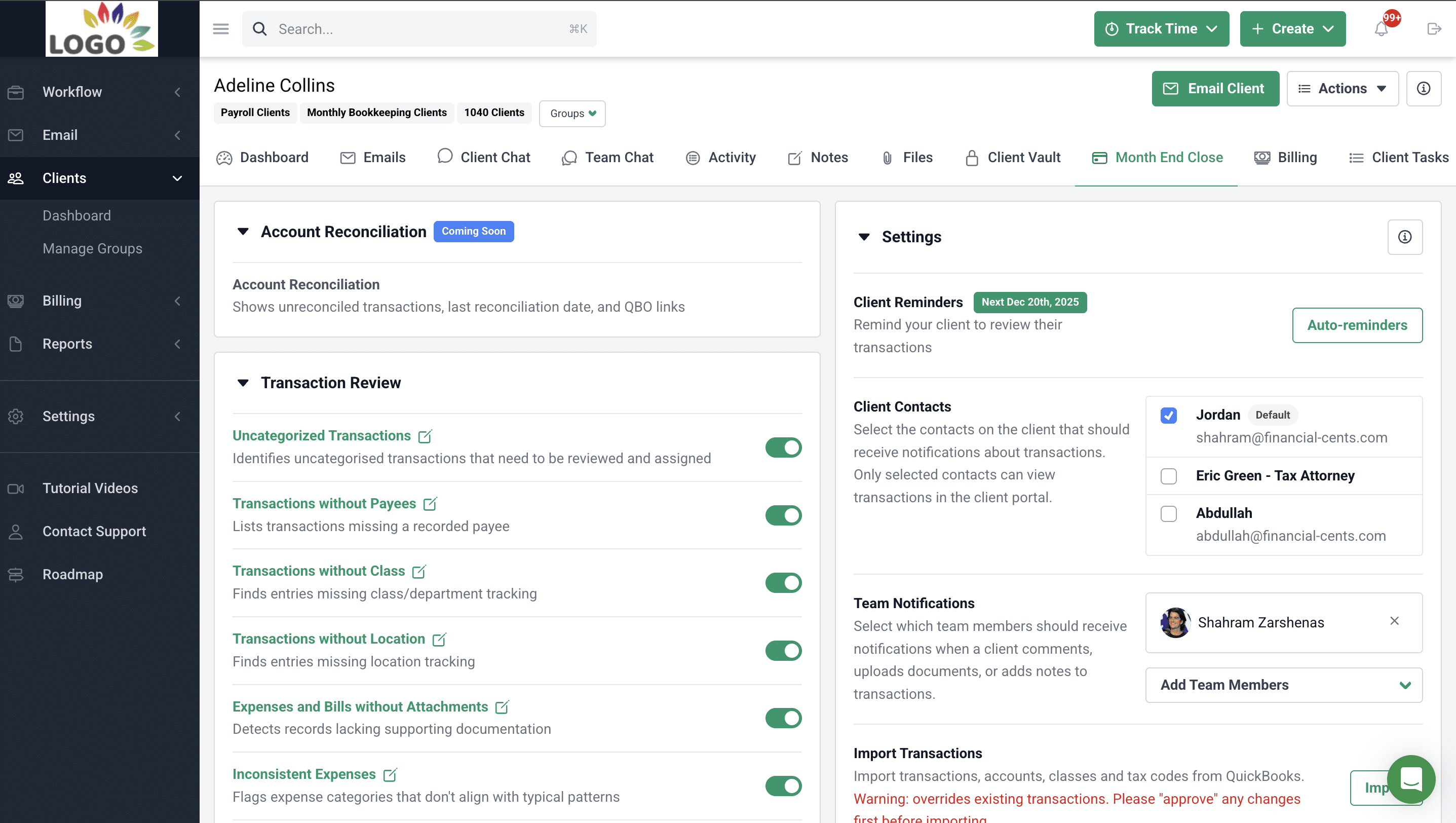

Month End Close

- The Month End Close tab in Financial Cents gives your team a centralized place to review, correct, and finalize client books. Instead of exporting data to spreadsheets or managing reviews over email, you can handle month-end review directly inside Financial Cents and sync approved changes back to QuickBooks Online.

- Transaction Review: MEC pulls in transactions from QuickBooks Online and automatically flags potential issues. Your team can review, edit, and categorize transactions directly in Financial Cents as part of the month-end close process.

- Client Requests & Descriptions: Ask clients questions directly on transactions and request missing details. Clients can add notes, upload documents, and provide explanations that give your team the context needed to complete the review.

- Auto-Reminders: Automated reminders notify clients when they have outstanding review items, so your team can stay focused on closing the books instead of chasing responses.

- One-Click Sync to QuickBooks: Once information is reviewed and approved, changes can be pushed back to QuickBooks Online with one click—keeping books accurate and the close moving forward.

- 1099 & W-9 Requests: MEC pulls vendor data from QuickBooks Online and helps identify vendors that may require a 1099. You can request W-9s directly from vendors or clients and sync updated vendor details back to QuickBooks.

Pricing

- Solo: $19/month per user (billed annually)

- Team: $49/month per user (billed annually)

- Scale: $69/month per user (billed annually)

- Enterprise: Custom

Free Trial

A 14-day free trial is available

Ratings

Financial Cents is rated:

Pros

|

Cons

|

We went with Financial Cents after looking at all the other tools and found the price, the value, and the speed of improvements were just incredible."

Gerry Anderson, M.Sc., CPA, President of Blue Canyon CPA(You may be interested in this review: The Best Accounting Practice Management Software Options in 2026.)

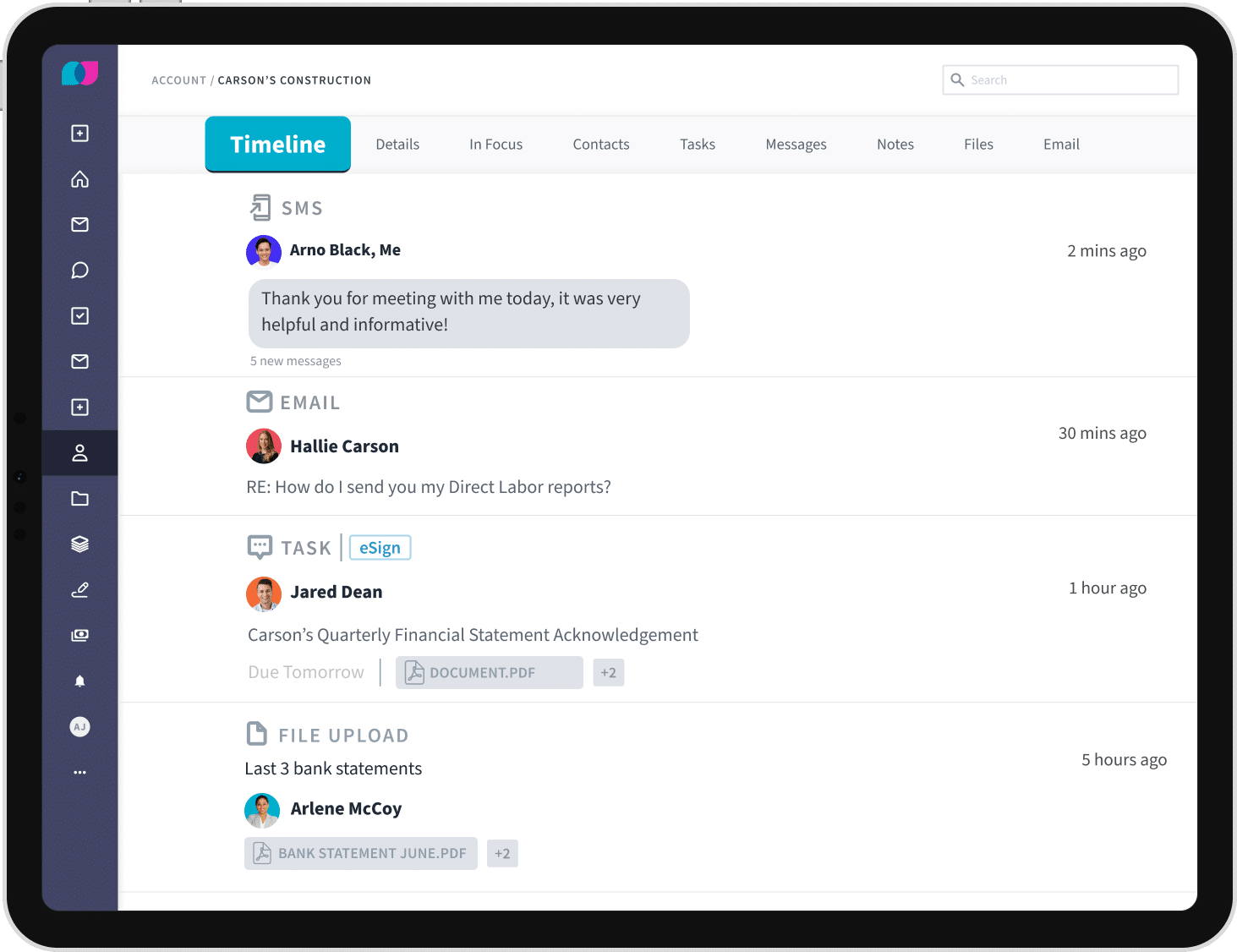

2. Liscio

Liscio is an accounting CRM that saves you the time and stress of managing client relationships by providing everything you need to work with in one secure platform.

From client files to messages and signatures, Liscio brings them together to prevent confusion, helping you to focus on tasks that move relationships forward.

Here are some of its CRM features and what they do:

- Timeline: Shows client the conversations the client has shared (via emails, messages, text messages, task requests, etc.) with your team on a single page.

- Secure Messaging: Liscio encrypts sensitive client information and communication.

- Client Tasks: Create tasks for clients to help them provide necessary files and information on time, so your team can complete their work.

- Automatic Reminders: Liscio automatically follows up with your clients to ensure they grant your request before it’s too late.

- Email Integration (Gmail and Outlook): Liscio automatically collates client emails in one place to save your team the time of searching for them in their inboxes.

- Instant Email Association: Emails in Liscio are automatically associated with the clients. You do not have to use CC or BCC.

- File Sharing: Your client’s files are stored in one place and can be downloaded to your document management system.

Pricing

- Tax Solo: $49/month per user

- Tax Team: $99/month per user

- Essentials: $49/ month per user

- AI Pro: $59/ month per user

- Tax Enterprise: Custom

Free Trial

Liscio does not offer a free trial

Ratings

Pros

|

Cons

|

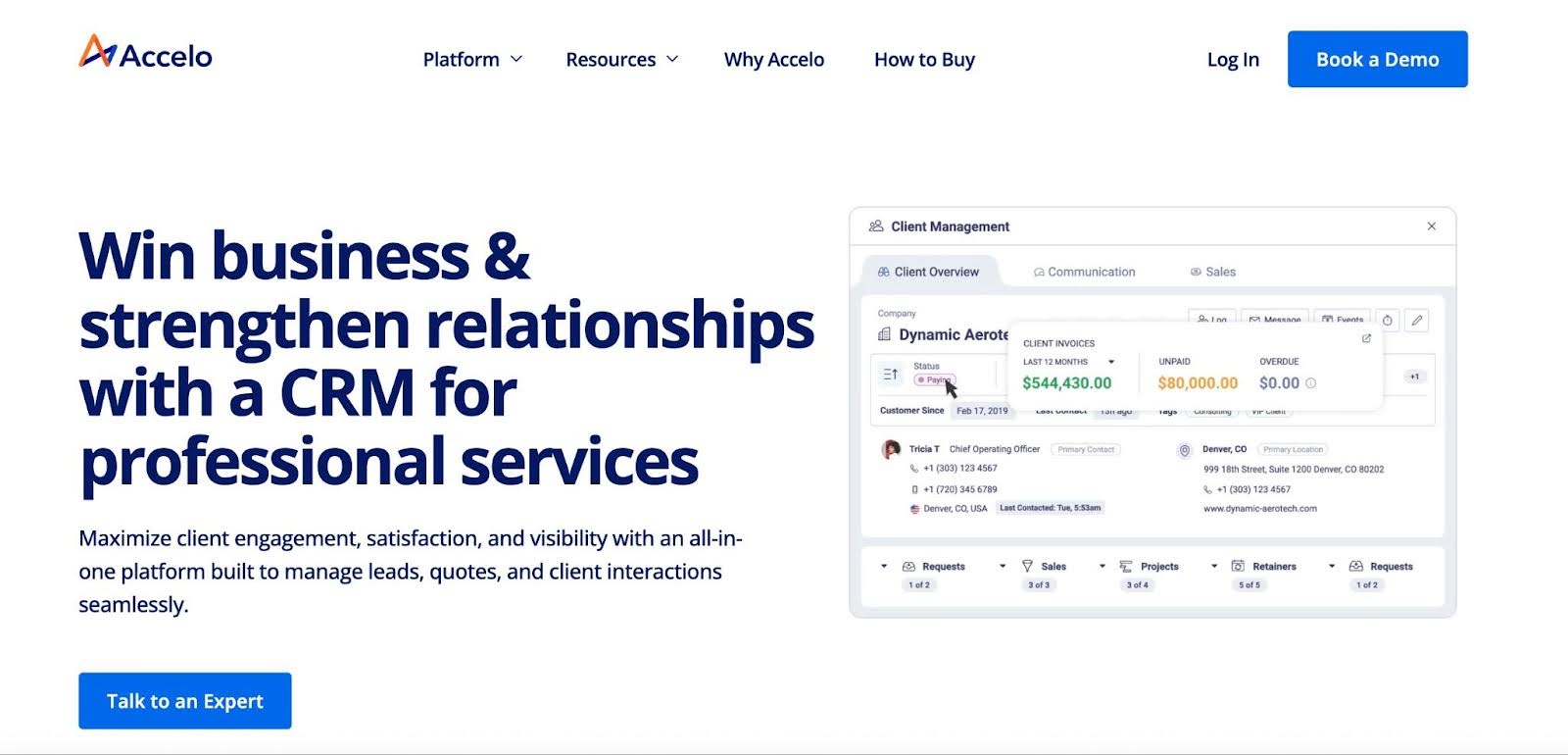

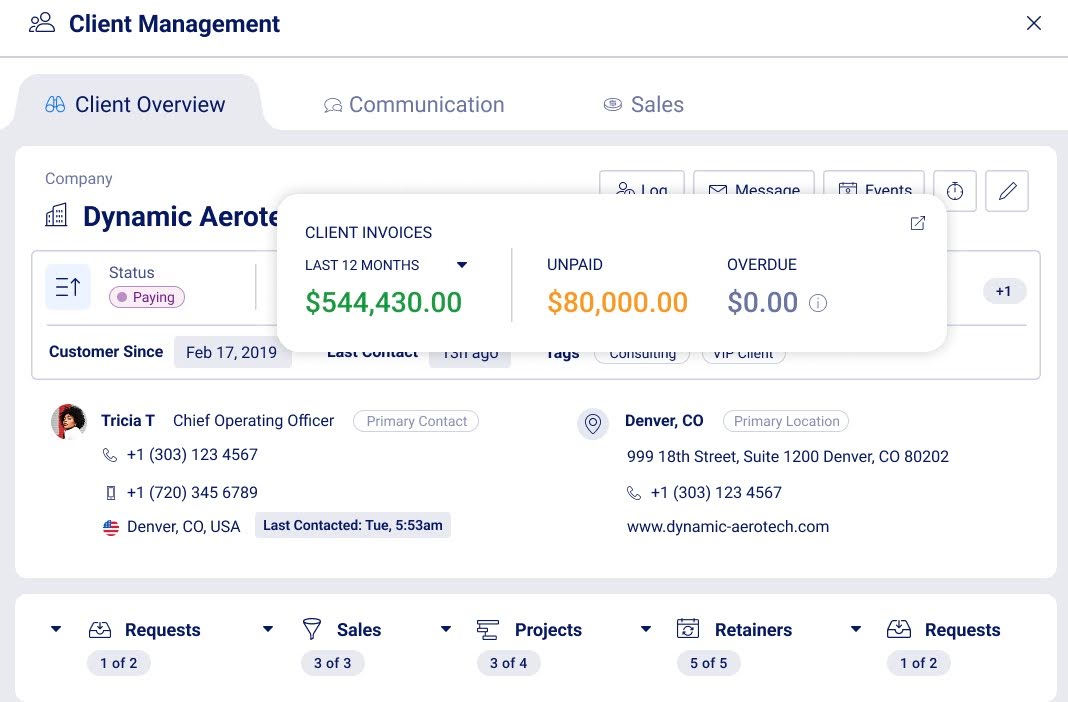

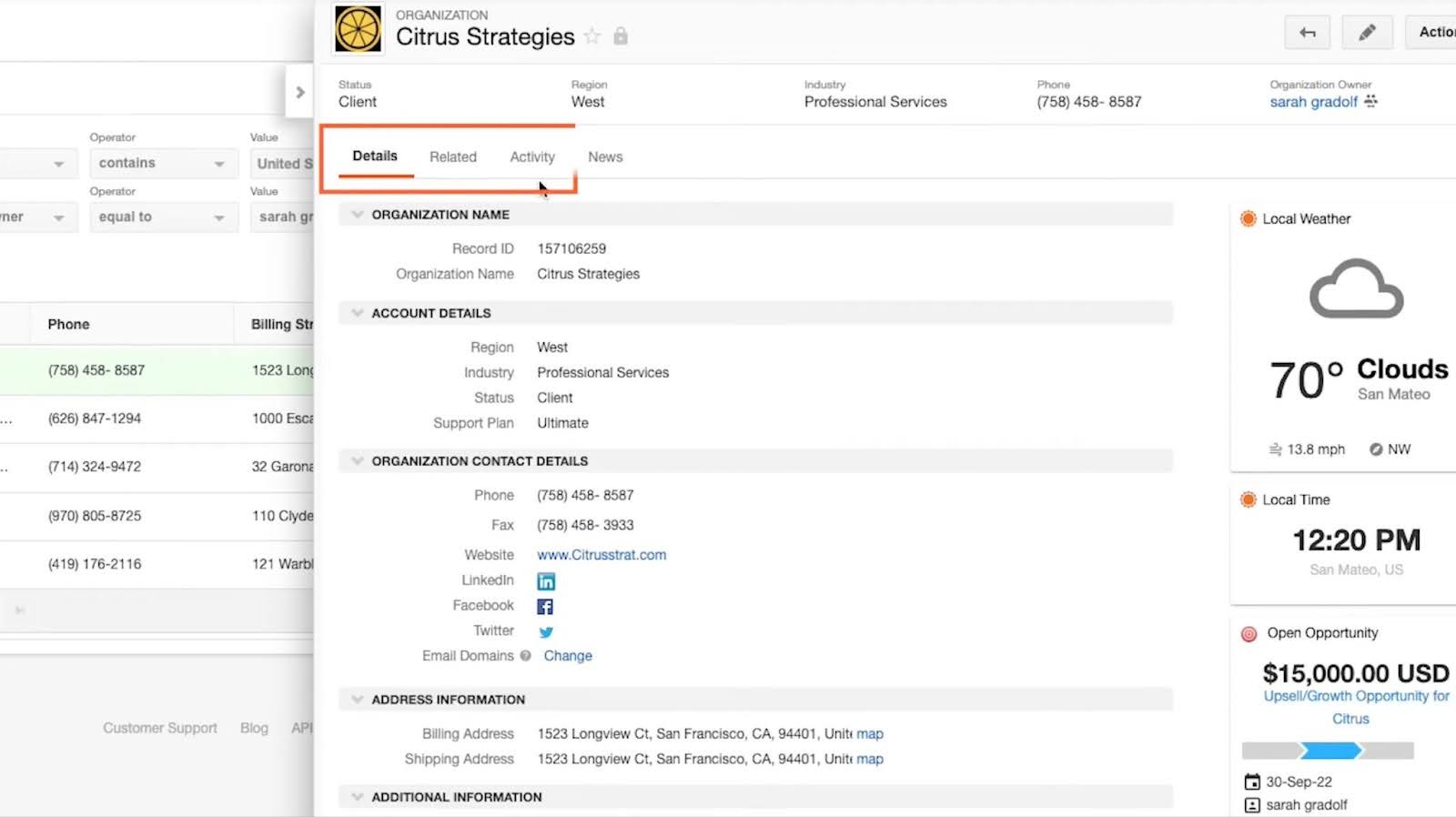

3. Accelo

Accelo is a professional service automation software with a client relationship management feature that helps firms to win new clients and strengthen existing relationships by managing leads, quotes, and client interactions.

Here are some of its CRM features and what they do:

- Client and Contact Management: centralizes client and contact data to enhance client relationship monitoring.

- Notes: allows you to record important client information.

- Custom Fields: capture your client’s unique business information to ensure your work meets their standard.

- Integrated Email Sync: Accelo syncs with Gmail, Outlook, and Office 365 to automatically log client emails and attachments to the client record.

- Activity Logs: Monitors and stores every interaction between your team and client in the client’s records.

- Sales Pipeline: Tracks your leads by their stages and value, and shows the likelihood of converting them to clients.

- Automated Follow-Ups: Accelo allows you to set rules for client reminders and email sequences.

- Client Intelligence: A performance measurement dashboard that enables you to analyse projects, client performance, and billing data to understand client value over time.

Pricing

- Professional: custom

- Business: custom

- Advanced: custom

Free Trial

No. Accelo doesn’t offer a free trial.

Rating

Accelo is rated:

Pros

|

Cons

|

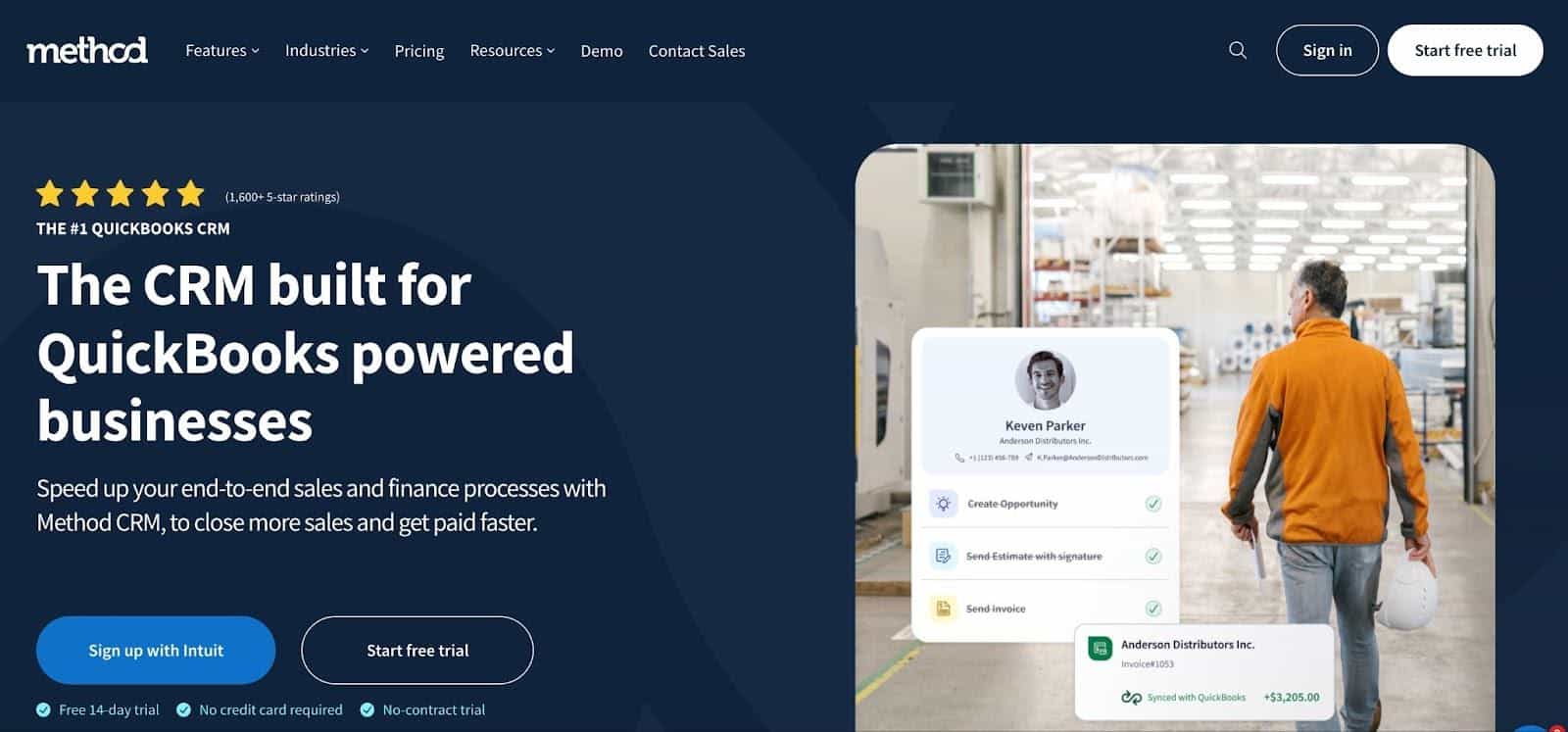

4. Method

Method is a QuickBooks-powered CRM that promises to help businesses turn leads into revenue through CRM workflow automation.

Its feature suite helps growing businesses to make their teams more productive, close deals faster, and delight their customers.

Here are some of its CRM features and what they do:

- Web to Lead Forms: Embedded forms that help you capture leads on your website.

- Import Tool: Upload your lead spreadsheets to Method in a few clicks.

- Activity Tracking: Logs the details of each interaction in the platform to schedule timely follow-up where necessary.

- Custom Fields: Capture each of your leads’ unique needs and preferences to enable you to personalize their engagement.

- Email Integrations: Saves the information in client emails on Gmail or Outlook directly to your CRM.

- Proposals: The Method’s proposal solution is highly customizable for all clients, helping you convert clients faster.

- E-signatures: Allow clients to review and sign documents online.

- Payments & Invoicing: Proposal approvals can trigger invoices to get you paid faster.

- Integration with QuickBooks: You can manage multi-entity operations in Method by synchronizing information with QuickBooks Online, QuickBooks Desktop, or Intuit Enterprise Suite.

Pricing

- Contact Management: $ 25/month per user per month (billed annually)

- CRM Pro: $44/month per user (billed annually)

- CRM Enterprise: $74/month per user (billed annually)

- CRM Multi-entity: Custom

Free Trial

A 14-day free trial is available

Ratings

Method is rated:

Pros

|

Cons

|

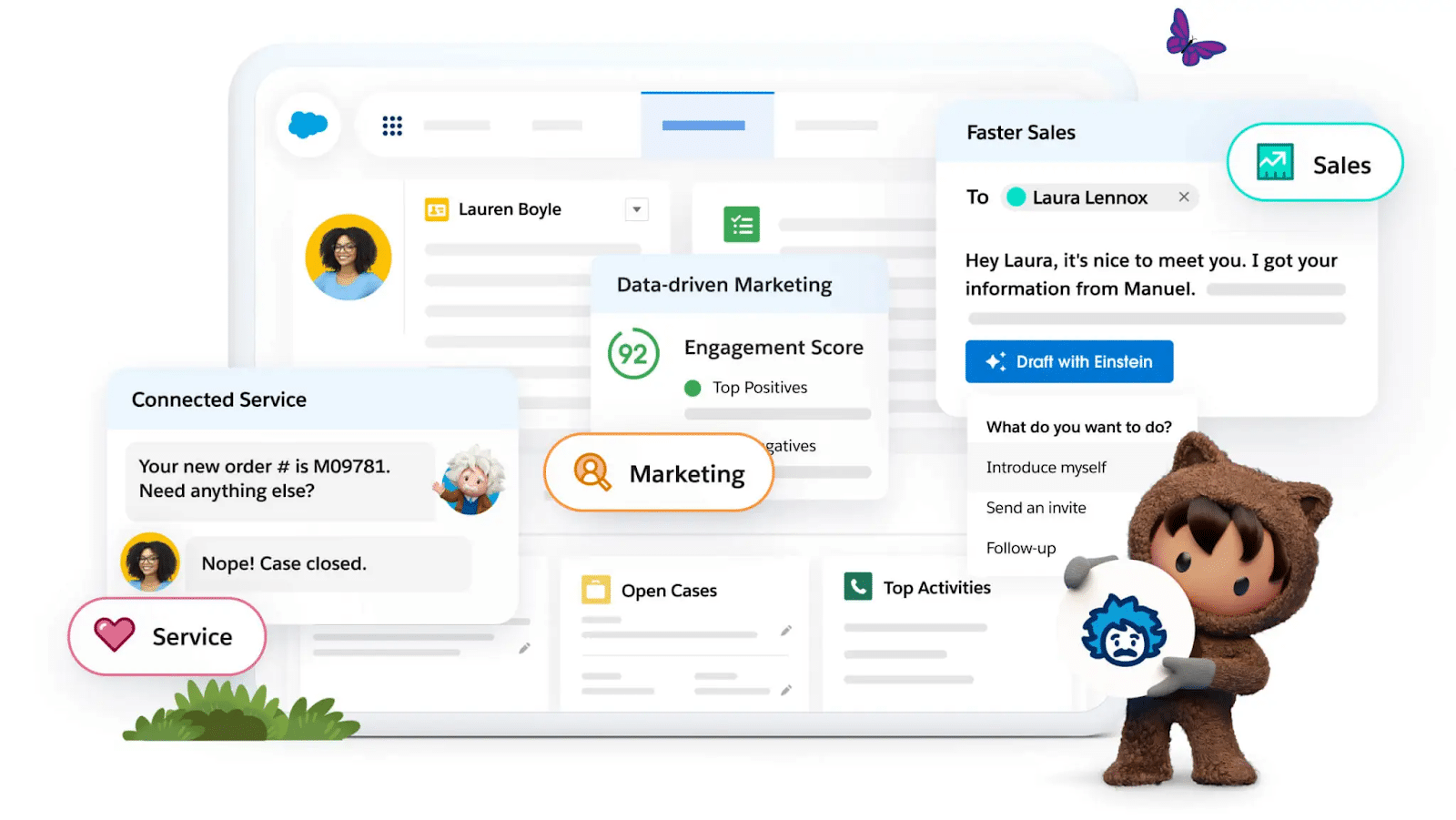

5. Salesforce

Salesforce’s CRM solutions unite your sales, services, and marketing efforts to attract more prospects, close more deals, and strengthen existing customer relationships.

Salesforce’s robust CRM features make it suitable for the needs of big and small businesses alike, allowing you to customize it to suit your needs.

Here are some of its CRM features and what they do:

- Contact and Account Management: Salesforce organizes each client’s information (names, contact info, communication history, account status) in the client profile. The profile is searchable and contains unique details like tax year data, entity type, service tier, relationship, etc.

- Lead Tracking: Monitor sales pipeline for new client enquiries, proposal approvals, and log calls, and create follow-up schedules to take advantage of sales opportunities.

- Email Integration: Salesforce connects with your Gmail or Outlook to log email conversations in the client’s profile.

- Client Activity Management: Tracks client onboarding, follow-ups, client check-ins, etc.

- Workflow Automation: Uses rules to automatically initiate actions like client reminders, engagement renewals, birthday wishes, etc.

- Salesforce Files: Manages your documents by enabling you to attach and share client-related files to help your team find documents easily.

Pricing

- Foundations: $0

- Starter Suite: $25/month per user

- Pro Suite: $100/month user

Free Trial

A 30-day free trial is available

Ratings

Salesforce Service Cloud is rated:

Pros

|

Cons

|

6. Insightly

Insightly helps fast-growing companies grow faster by meeting client expectations and nurturing strong client relationships.

It breaks down communication silos and provides a single source of truth for everyone in your firm, which translates to a consistent client experience.

Here are some of its CRM features and what they do:

- Pipelines: Show the status of your lead tracking efforts, including what has been done and what needs to be done next.

- Custom Fields: Enable you to create fields for client information that are not available in Insightly.

- Custom Object: Stores data that does not align with the regular information in Insightly.

- Opportunity Records: Important details that help your team understand your leads better to personalize their nurture.

- Probability Percentage: Forecasts of future revenues from pipelines.

- Activity Set: Automatically creates tasks and activities in pipeline stages ahead of time.

- Opportunity Pipeline: Allows anyone in your team to drag and drop sales opportunities from one stage to another.

- Validation Rules: Prevent accidental human errors when organizing client data.

- Advanced Permission: allows people to access data without altering it without authorization.

Pricing

- Plus: $29/month per user

- Professional: $49/month per user

- Enterprise: $99/month per user

Free Trial

A 14-day free trial is available

Ratings

Insightly is rated:

Pros

|

Cons

|

7. HubSpot CRM

HubSpot’s CRM provides the software, integrations, and resources you need to unite your marketing, sales, and customer service to grow your business faster.

Its AI-powered platform is easy to use by solo firm owners and enterprise-level firms needing robust client information features.

Here are some of its CRM features and what they do:

- Deals: organizes the sales opportunities your team is trying to take advantage of.

- Pipeline Manager: Gives you a bird’s-eye view of your sales opportunities to help you close more deals.

- Tasks and Activities: Tracks all the To-Dos that help your team deliver satisfactory client service.

- Conversation Intelligence: Analyzes customer calls and interactions to find opportunities to improve your service.

- Customer Portal: Organizes customer support tickets, making it easier and faster to address their challenges.

- SLA Management: HubSpot automated ticket routing that helps your team meet client deliverables.

- Service Analytics: Reports that help you make your service delivery more efficient and authentic.

- User Permissions: allows you to grant access to team members based on their customer service needs.

- Automated Customer Service: uses AI to automatically solve routine tasks for customers.

Pricing

- Free Tools: $0 (Free for up to 2 users)

- Starter Customer Platform: $15/month per seat

Free Trial

A 14-day free trial is available

Ratings

HubSpot is rated:

Pros

|

Cons

|

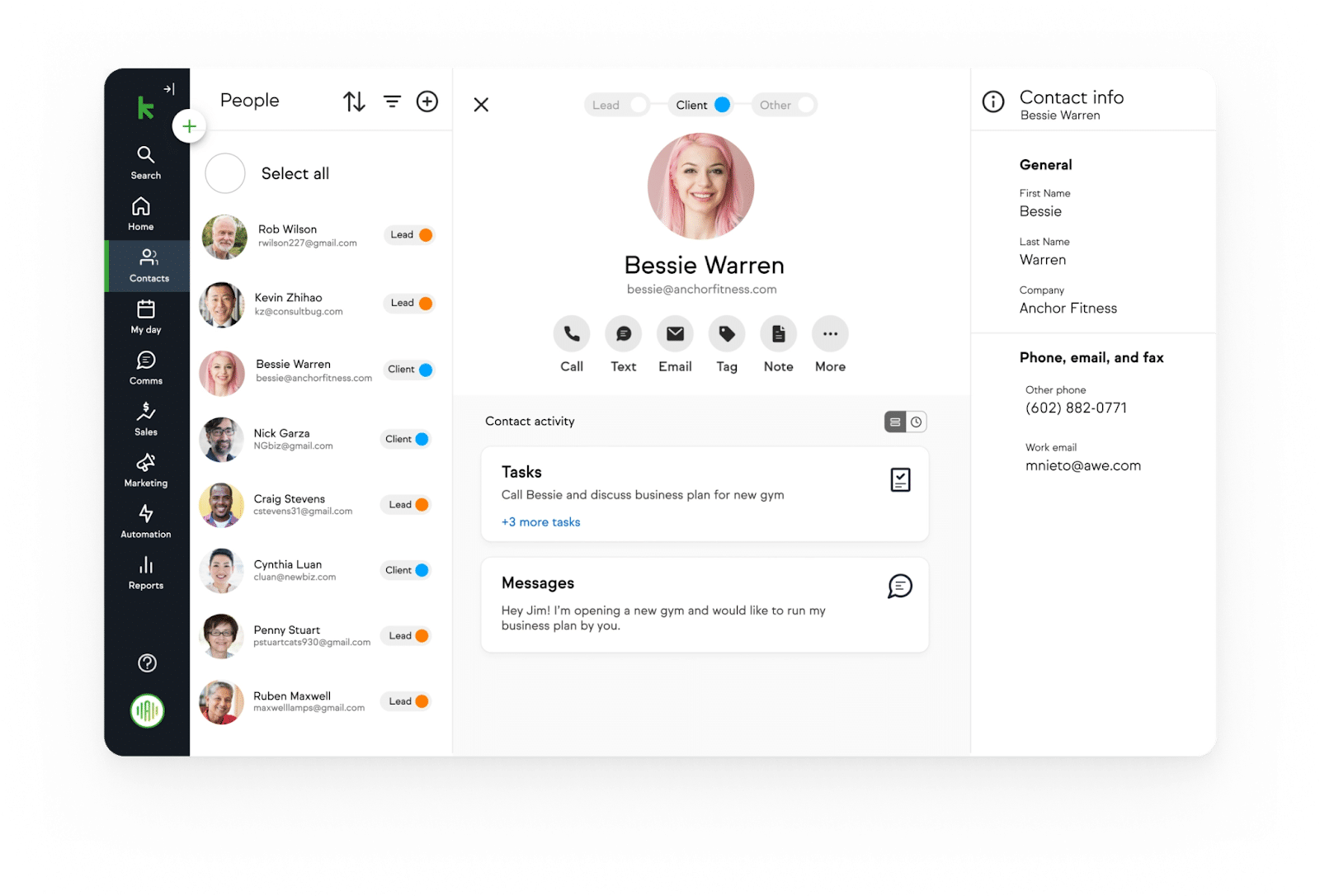

8. Keap

Keap is a CRM software for accounting and tax professionals who want to skip the busy work to focus on revenue-generating tasks. It enables you to manage your clients’ contact details and interactions in a way that builds lasting client relationships.

Here are some of its CRM features and what they do:

- Lead Forms and landing pages: Enable you to capture leads automatically by collecting and organizing their information in one place.

- Lifecycle Assessment: An industry assessment formula that compares your business with other businesses in the industry to show you your strengths and weaknesses.

- Appointment Reminder: Scheduled reminders that help clients to keep their appointments.

- Audience Segments: Categorizes your audience to enable you to personalize their services and interaction.

- Purchase Follow-up: Send thank you notes to clients when they make full payment.

Pricing

Starting from $299/month (Billed monthly) for 2 users and 1,500 contacts.

Free Trial

A 14-day free trial is available.

Ratings

Keap is rated:

Pros

|

Cons

|

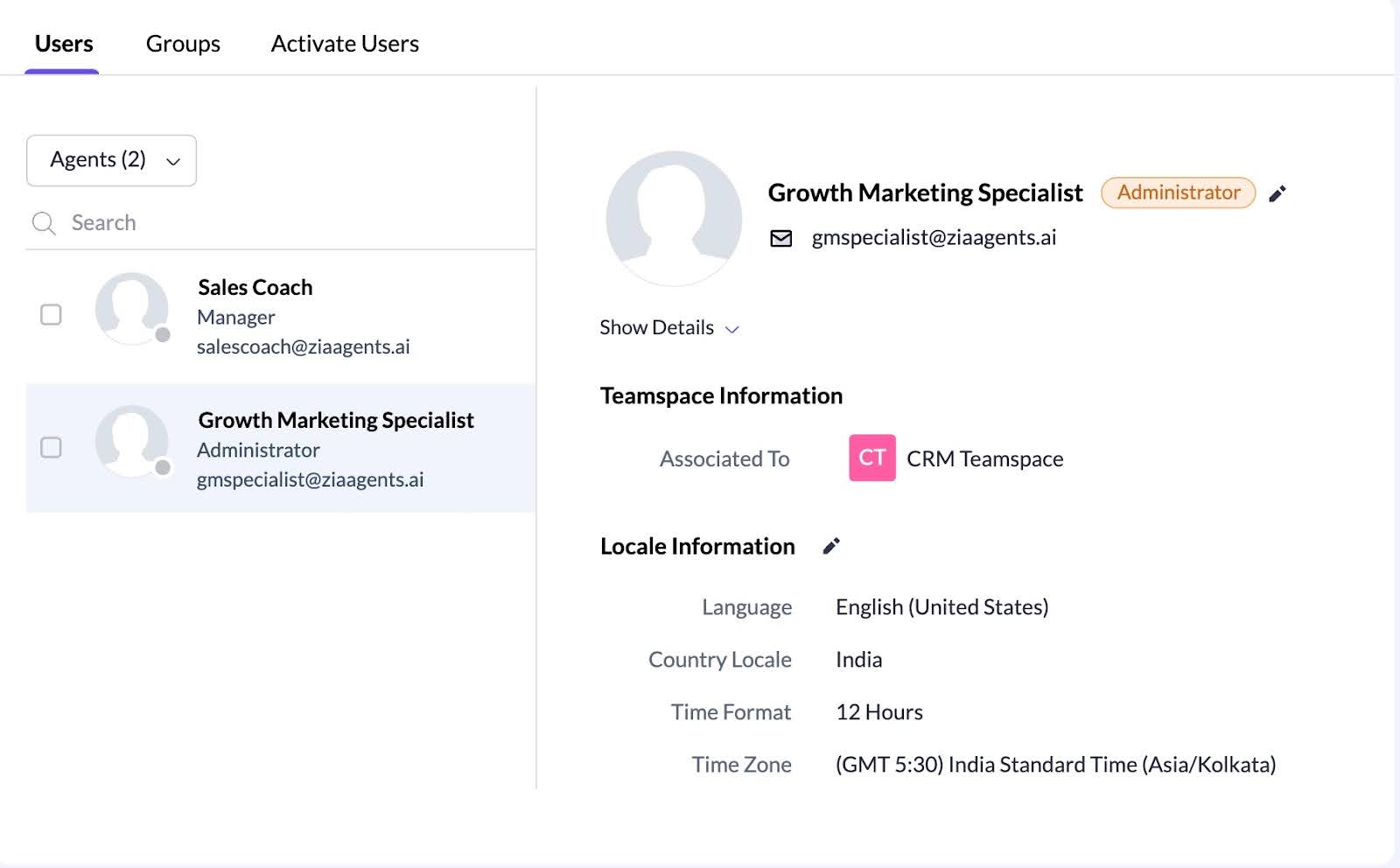

9. Zoho CRM

Zoho CRM helps businesses build resilient businesses through quality customer service. Its artificial intelligence feature provides the automation you need to increase leads, accelerate sales, and measure sales performance.

Here are some of its CRM features and what they do:

- Teamspaces: Allows you to bring your team into your CRM.

- Automated Tasks: Automates data management, emails, and follow-ups to allow your team to focus on closing more clients.

- Generative AI: An AI Assistant that creates work, modules, and reports for clients using your CRM data.

- Churn Scores: Zoho AI identifies the services your clients will likely stop using to enable you to address them and increase the chances of client retention.

- Field Prediction: Zoho also enables you to build custom predictions based on a scorecard that matters to your business. For example, you can build a prediction for the likelihood of winning or losing a client.

Pricing

- Standard: $25 per Organization per Month (Billed annually)

- Premium: $59 per Organization per Month (Billed annually)

- Enterprise: Custom

Free Trial

A 14-day free trial is available

Ratings

Zoho CRM is rated

Pros

|

Cons

|

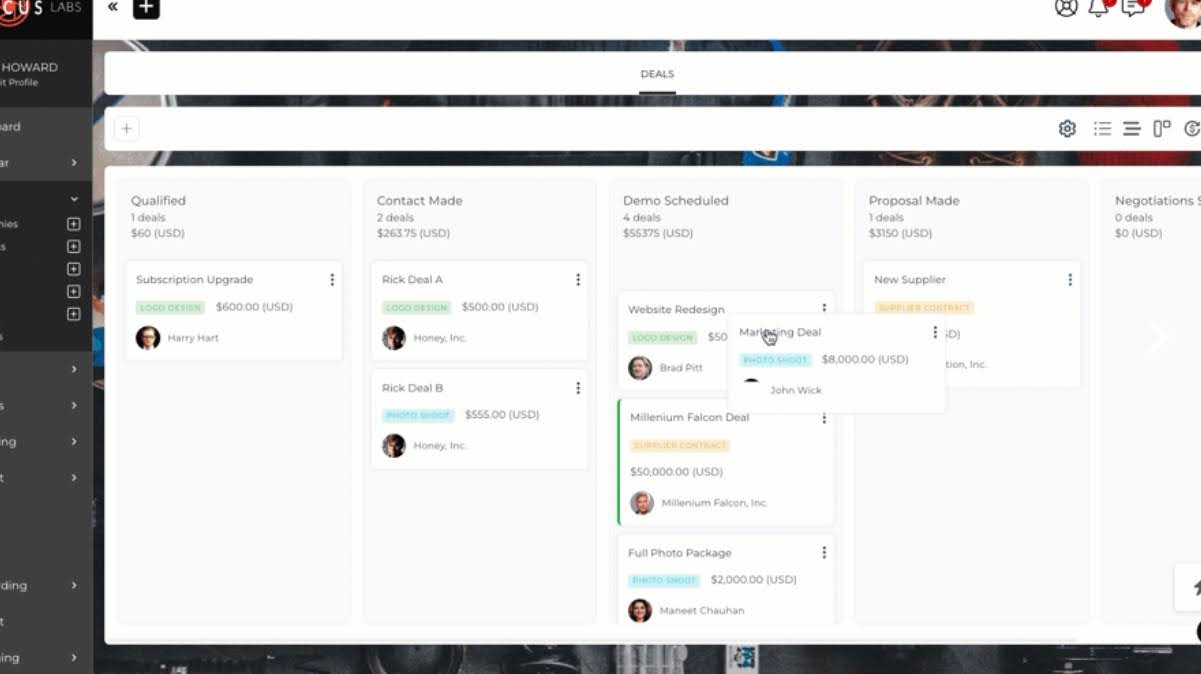

10. SuiteDash

SuiteDash is a multi-faceted software that consolidates the tools small and mid-sized businesses use to enhance efficiency across the board.

Its CRM solution automates team and client interactions, making it easier to stay on top of client relationships.

Here are some of its CRM features and what they do:

- Roles: Categorizes your contacts into one of three Roles (Lead, Prospect, or Client) to tailor their engagement accordingly.

- Kickoff Forms: Allows Contacts to add themselves to your client base by filling out a form on a website.

- Circles: Makes it easy to assign files and dashboards to multiple clients.

- Client Portal: Enables clients to collaborate with your team and track project progress.

- Deal: Tracks income opportunities within a visual pipeline, giving you a better chance of winning clients.

- Follow-up Generator: Creates a sequence of follow-up messages to remind clients about files, information, or next steps.

Pricing

- Start: $19month

- Thrive: $49month

- Pinnacle: $99month

Free Trial

A 14-day free trial is available

Ratings

SuiteDash is rated:

Pros

|

Cons

|

Features to Look Out for in CRM for Accountants

I. Client Management Features

Client management features organize various client information in a way that is easy for your team members to find. For example, a client database shows your client list with their basic information. The client profile zooms in on each client’s information, displaying the different sections of the client data.

Similarly, the Client notes allow your team to capture important client updates from meetings or client calls, and the client group not only makes it easier to view clients with similar attributes, but it also makes it easier to automate manual tasks, like duplicating an action for every client in a client group.

II. Email Integration and Management

Email integration and management synchronize your email inbox with your CRM solution to log all client emails in the client profile. This enables you to read, send, and archive client emails from your accounting CRM.

This will not only prevent client emails from slipping through the cracks, but it will also improve your responsiveness to client enquiries, which makes the client experience more memorable.

III. Client Portal

The client portal is a secure and easy-to-use section of the CRM where clients can share documents, view the ones you shared with them, and communicate with your team on demand.

For CRM solutions like Financial Cents, the client portal is passwordless, but even more secure than the regular client portal. This saves your clients the need to provide usernames and passwords to access the portal.

IV. Inbuilt client communication tools

Built-in communication tools consolidate your client communication efforts by eliminating the need for third-party, external tools, which reduces information silos.

The best CRMs for accounting firms combine client chat features with SMS notifications to draw your clients’ attention to conversations in the CRM.

V. File and document storage

The accounting CRM’s data security features make it a suitable place to store and share files with clients. Without this feature, you’ll have to rely on a third-party document management system or, worse still, use emails to share files with clients, which carries huge data security risks.

The file and document storage feature stores files and documents (such as contracts, financial statements, tax returns, etc.) online, making them easier for your team to access from anywhere. The file and document storage feature also helps you to store client documents for as long as legally required by applicable data retention regulations.

VI. Reporting and client insights

The reporting feature enables you to analyze your client’s activities, revenues, and interactions with your team. The insights will empower you to improve client service and identify opportunities to upsell clients.

VII. Data security and access control

Data security and access control protect client information from unauthorized access. Most accounting CRM systems encrypt client information, making it impossible for unauthorized persons to access it without the cipher code..

With role-based access control, you prevent your team members from accessing or editing the client information.

The top accounting CRMs, like Financial Cents, have a client vault that stores their most sensitive client information (like social security numbers, credit card information, usernames, and passwords to third-party apps). This keeps you compliant with security standards like SOC 2, GDPR, PIPEDA, HIPAA, etc.

VIII. Integration with QuickBooks

Having this feature in your CRM ensures that your clients, service items, time logs, and billing information are automatically imported and synced between QBO and your CRM.

It saves you the time and stress of manually entering the same information in multiple places. It also gives room for errors that can potentially strain your client relationships.

For example, importing your clients from QBO to Financial Cents allows you to add your active clients (one by one or in bulk) to Financial Cents in a few seconds. All subsequent additions and editing of client information in QBO will be reflected in Financial Cents. This keeps your client information (email, phone number, address, and notes) uniform.

Things to Consider When Selecting an Accounting Firm CRM

-

Firm size and complexity

Accounting CRMs’ effectiveness is due partly to their ability to categorize client information, so your firm’s size and the complexity of your client base should be crucial to your final decision.

A multi-location firm with clients in several industries and with complex compliance requirements needs an extensive tool to capture and organize their unique information for seamless retrieval and accurate financial reporting.

A small bookkeeping firm may require only basic client management and communication features. Robust features can become overwhelming for the team.

-

Unlimited contacts

Being sure your CRM software will accommodate all your current and future clients will save you significant costs on upgrades, which could disrupt your budget and scalability when your clients exceed that limit.

Otherwise, you might be forced to consider moving your firm to another CRM down the road or use multiple tools to manage your large client base, which will defeat the purpose of a CRM.

-

Unlimited client file storage

As you serve more clients, your documents will accumulate over time. Unlimited file storage enables you to store all the files you need to serve all your clients in one place (while complying with data retention regulations).

If your CRM’s storage is capped or limited, it’s only a matter of time before it gets full and you’ll need an external storage device. Apart from the time and effort of managing client data in two different places, an external storage device will fragment your files and documents, making it easier to lose important client data.

-

Ease of adoption for your team

is not enough for an accounting CRM to be great on paper. If their usability is poor, you will waste money, time, and other opportunities to grow.

Your CRM should be clean, friendly, and integrate smoothly with your team (and clients’) day-to-day operations. This will improve team adoption and your client engagement, ensuring a good return on investment.

CRM SUCCESS STORY: How Blue Canyon CPA Used Financial Cents to Transform Client Relationships Dramatically

Gerry Anderson and the Blue Canyon CPA team used spreadsheets to manage their clients when they started.

After some time, two major challenges began to stand out for them. They struggled with:

- Tracking client engagements to understand the progress made.

- Difficulty collecting client documents for timely service.

Fast forward to 2020, Gerry Anderson, CPA, moves the team to Financial Cents, and those problems have all gone away. Since clients could now share documents with them in the Financial Cents client portal, file sharing could now be done at any time and from anywhere, improving client responses.

The combination of Financial Cents CRM and client portal enabled the Blue Canyon team to deliver timely client service that transformed client relationships dramatically.

The Financial Cents client portal works so well for Gerry’s team because clients do not have to create usernames and passwords to use. It saves your clients the stress of managing more login information.

Thanks to Financial Cents, we found out that we could use portals and client tasks, which has been a game changer, especially during COVID. That has transformed and reduced our processing times dramatically. We're no longer touching a file five, six, seven, eight times because the client’s documents are not ready. "

Gerry Anderson, M.Sc., CPA, President of Blue Canyon CPAYou can start managing every aspect of your firm like Gerry Anderson CPA today.