As important as accounting knowledge is, most accounting firms don’t stay small because they lack expertise.

They battle with growing their businesses when they forget that running a successful accounting firm requires more than just crunching numbers, interpreting tax laws, and other core accounting tasks.

It relies on your ability to manage your team, streamline processes, and keep clients satisfied in an industry where expectations are rising daily.

When firm owners get this wrong, their teams struggle with:

- Missed deadlines (because no one knows exactly where projects stand).

- Disorganized processes (which leave staff to figure things out on their own).

- Frustrated clients (who don’t feel valued or carried along).

Instead of searching for different tools to manage individual parts of your firm, accounting practice management software solves them all by streamlining operations, organizing client data, and automating repetitive tasks, allowing your accounting team to focus on delivering client service and building relationships.

For example, all 816 accounting firms in the 2025 State of Accounting Workflow & Automation Report spent more than one hour every week scheduling tasks (because they didn’t have practice management software). After implementing one, 43.7% of them spent less than an hour scheduling tasks, which significantly reduced their admin time.

This article will show how the features of accounting practice management software will help firm owners and managers standardize workflows, maintain control, and scale their firms.

What Is Accounting Practice Management Software?

Accounting practice management software is a cloud-based system designed to centralize information, streamline workflows, and automate accounting tasks to let teams focus on client satisfaction and firm growth.

It differs from generic practice management software in that its features and functionalities are specifically designed to meet the unique needs of the accounting community.

Some firm owners take it as their digital command center, for others, it is their single source of truth. Yet, some see it as the brain that holds the firm together, a central processing unit. But all these are different aspects of the same thing.

Every solid accounting practice management software clarifies project details, such as deadlines, assignees, and dependencies, to keep everyone on the same page, prevent duplicate efforts, and ensure projects are efficient and profitable.

Why Accounting Firms Need Practice Management Software

Someone compared running an accounting firm without a dedicated practice management software to managing client finances without a ledger. It is risky and prone to errors.

Here are some of the reasons firm owners use a practice management tool:

-

Missed deadlines

Missing deadlines is easy when you rely on your memory, spreadsheets, or sticky notes. These systems require a lot of time and manual effort to update project information, track deadlines, and reallocate tasks to prevent any from slipping through the cracks.

They also require jumping between disparate systems to find work-related files and information, which further delays workflow.

A practice management solution centralizes all information, enabling team members to understand which project is most urgent, what’s required of them, and find the information to complete their tasks on time.

-

Siloed communication

When you communicate with clients across disconnected channels, each app can retain different sets of information, which misaligns teams, slows down client data collection efforts, and prevents teams from accessing up-to-date client records to do quality work.

These communication channels also require your team and clients to track communication in multiple places, which is a waste of time for your team and clients.

Accounting practice management software pulls client emails, chats, notes, and files into the client records.

In Financial Cents, all communication is recorded in the client profile. This gives your team the same information across the board, reducing confusion and standardizing the client experience.

-

Inefficient processes

With spreadsheets and sticky notes, your team relies on their memory to remember their tasks, follow up on project status, or remind clients about documents needed to execute tasks or follow up on.

The brain was not designed to hold so much information and juggle between too many apps. Each small project management decision your team members have to make reduces their ability to do the actual analytical and financial problem-solving work they are paid for.

As more clients increase, the mental load of completing tasks in the firm will become more overwhelming, which could compromise work quality and reduce the focus on client relationships.

With accounting practice management software, it takes only a click for team members to see their assigned tasks, and clients are automatically notified. You wouldn’t need to lift a finger.

These will reduce your reliance on memory and manual efforts. With that, your team members have more time and energy for client service.

-

Limited visibility

Tracking work with spreadsheets and sticky notes can be easy until you have up to two team members and a handful of clients in your firm.

You suddenly realize you can’t remember where you left things off like you used to. Your team members can alter client information, and you wouldn’t know.

To know where each client’s project stands and what is most pressing requires you to set time aside to drill through spreadsheets, and by the time you’re done, you may not have enough energy to do actual accounting work anymore.

When you can’t easily see project details for yourself, providing client updates can’t be timely, which can impact client relationships.

With good project management software, tracking information would be the least of your worries.

Every project in your firm is displayed in the workflow dashboard with its critical information (like client, assignee, due date, etc.), helping you to measure your team’s workflows and productivity

You may be interested in:

-

Inconsistent work quality

The absence of a practice management solution makes it difficult to standardize your processes and train your team on the procedures to do their work to standard, which leaves too much room for team members to execute tasks randomly.

Practice management software provides (and allows you to create) accounting workflow templates and checklists that clarify how work should be done in your firm. This enables your firm to deliver the same quality of work, regardless of the team member assigned.

If you’re currently struggling with any of these challenges, these are the top accounting practice management software helping accounting firm owners overcome them.

Key Features to Look for in an Accounting Practice Management System

These crucial features directly affect most accounting firms’ workflow, client, and team management challenges:

1. Workflow Management and Automation

Accounting workflow management helps to standardize your accounting projects by defining the steps involved, who is assigned which task, and when the project is due.

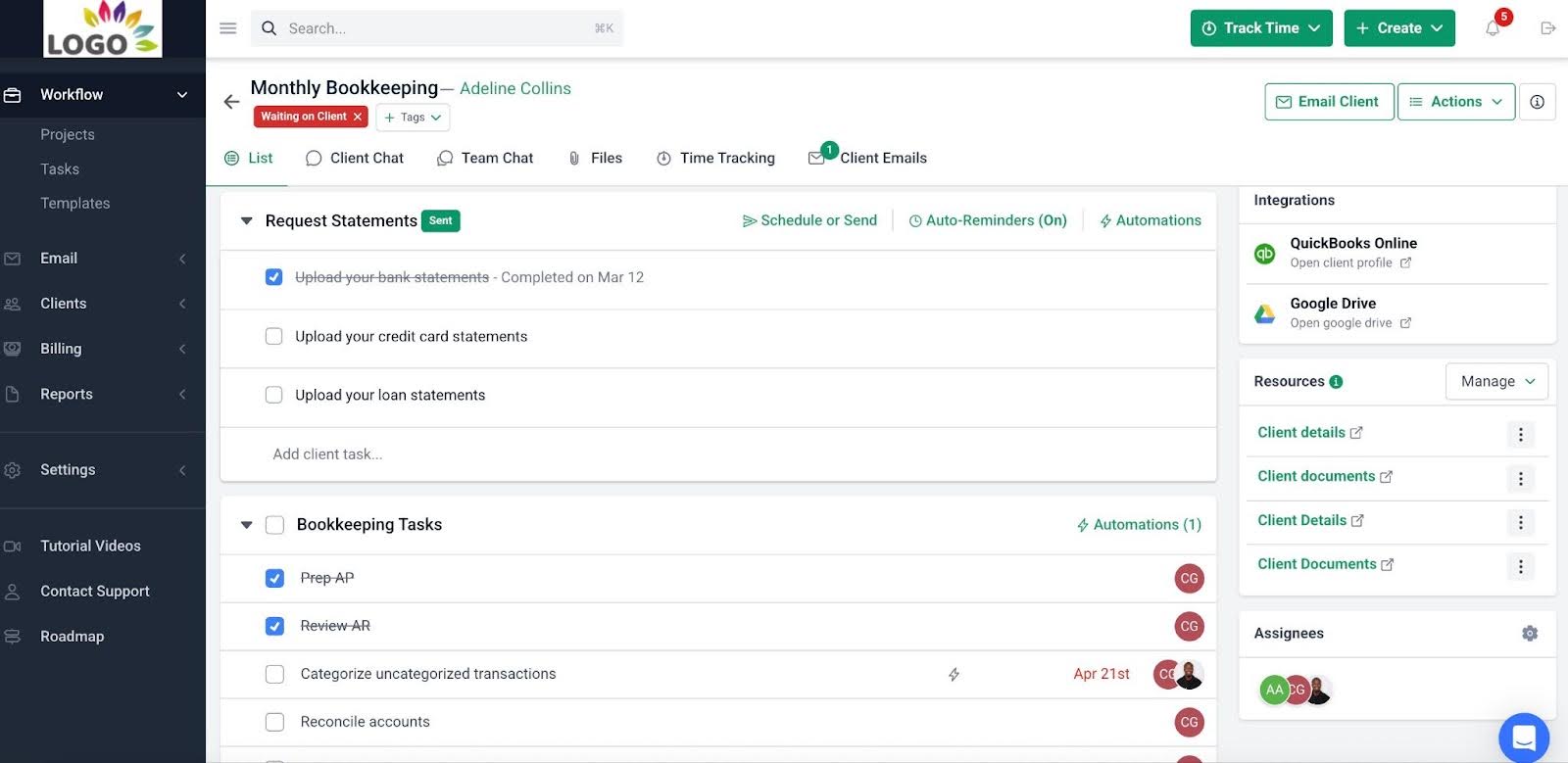

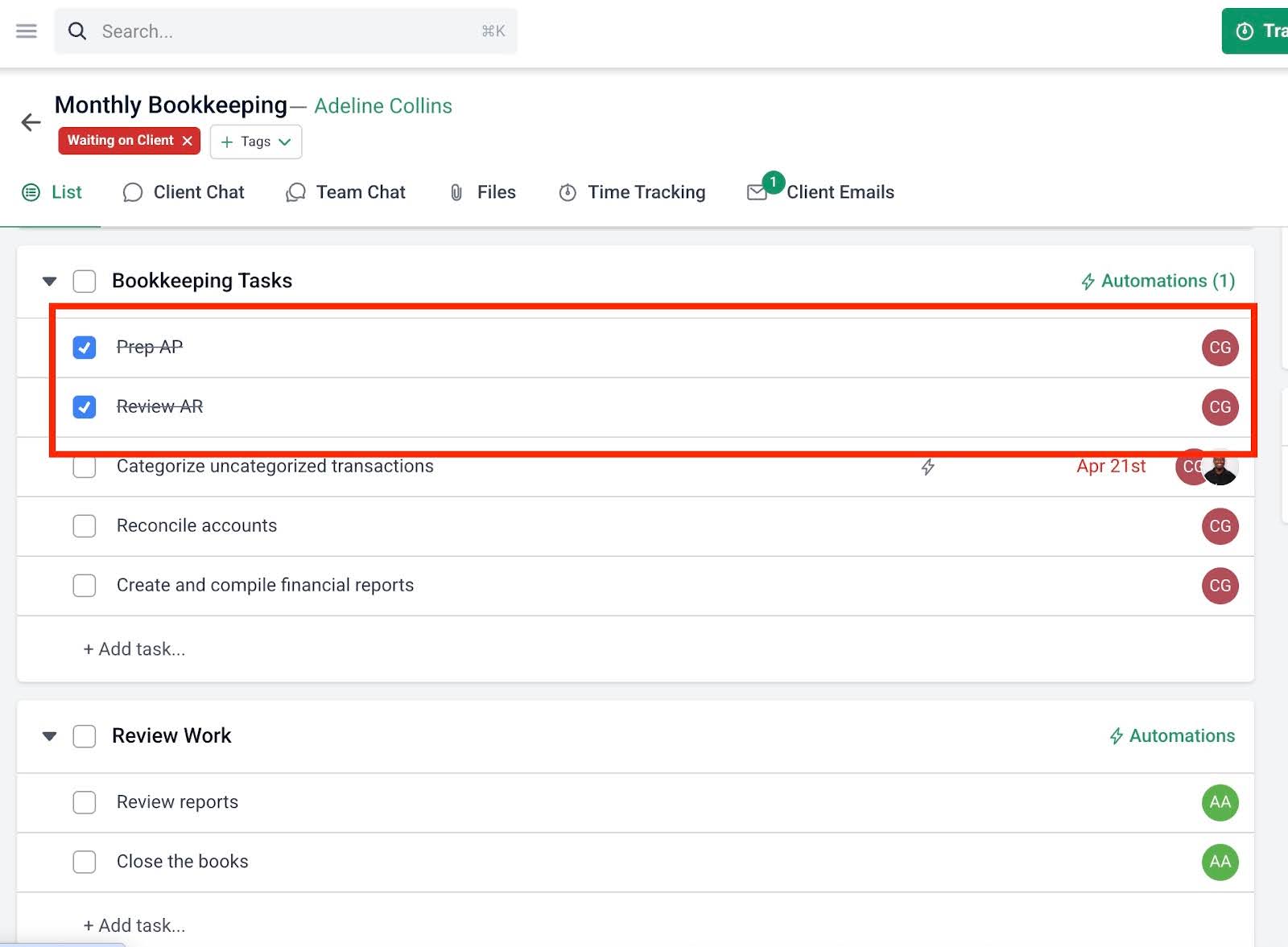

In Financial Cents, the workflow dashboard contains all the projects in a firm, and each project is divided into team tasks and client tasks, has an assignee, a due date, and a progress report to help you gauge your ability to meet client deadlines.

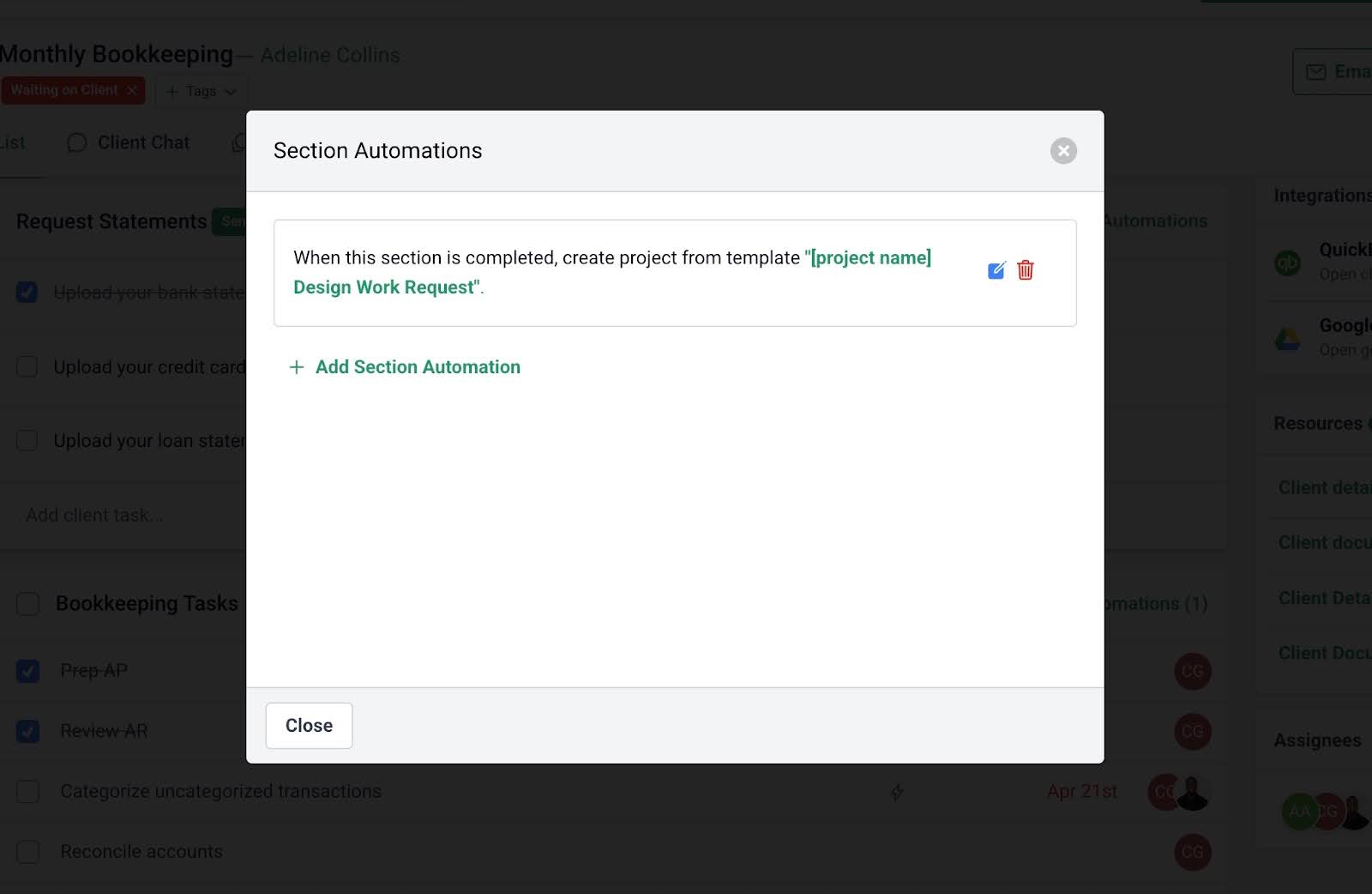

Meanwhile, workflow automation ensures that manual tasks, such as recreating future copies of repetitive projects (when the current one is completed), reminding team members about due dates, and client data collection, are handled with little to no human input.

With Financial Cents, you can also automatically notify clients about the progress of their work and, where necessary, tell them what’s required of them to enable your team to complete the project on time.

2. Task and Deadline Tracking

The task and deadline tracking feature provides a centralized view of the client work in your firm, and their due dates to show progress made and the urgency of each project, ensuring that no deadline is missed.

The Financial Cents workflow dashboard displays every project. Here, you can see your most pressing deadlines in one view.

Project progress reports are measured by the number of tasks completed versus the number of tasks left. This enables you to measure your likelihood of meeting deadlines to identify where to allocate more resources.

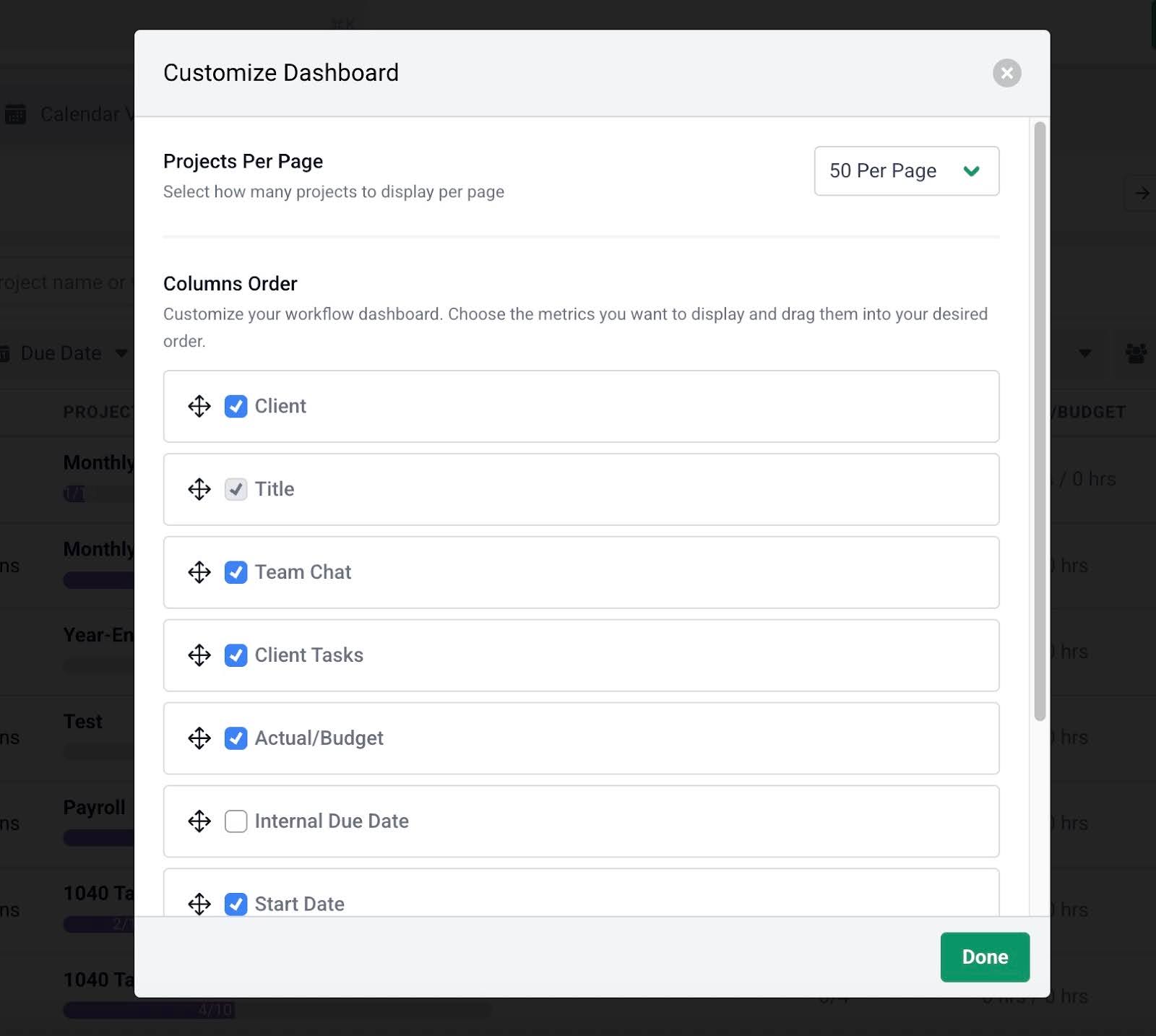

You can also customize the dashboard to show you the high-level project information you prefer to see. The options include team chat, Actual/Budget, and internal due date.

The Financial Cents’ due date feature enables you to define the deadlines for the projects in your firm. This also empowers you to establish your priorities to meet all client deliverables on time.

3. Client Management (CRM)

The accounting crm system is about organizing client information in one easily accessible place, instead of jumping between multiple tools to stay on top of client projects, communication, and relationships.

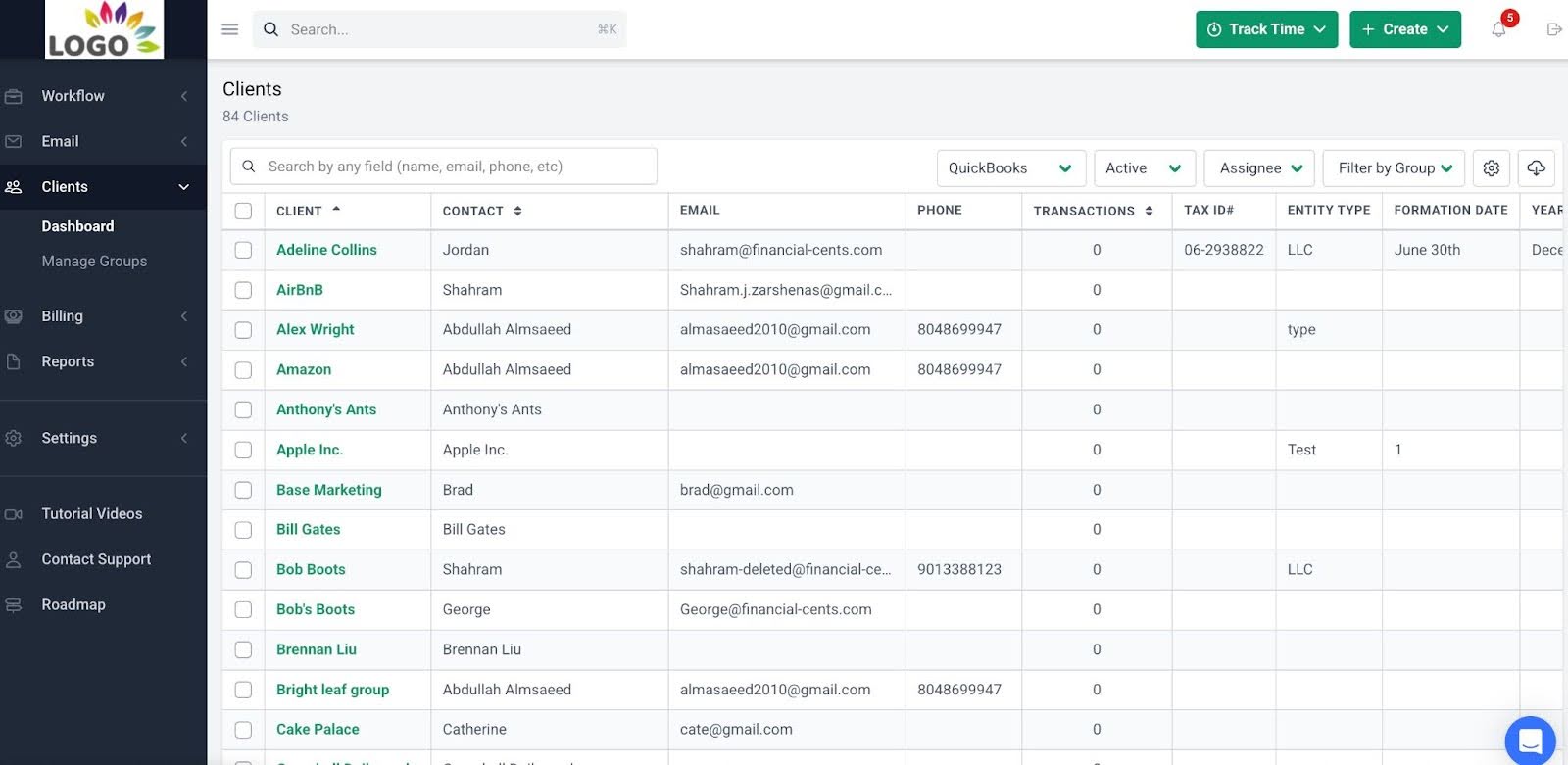

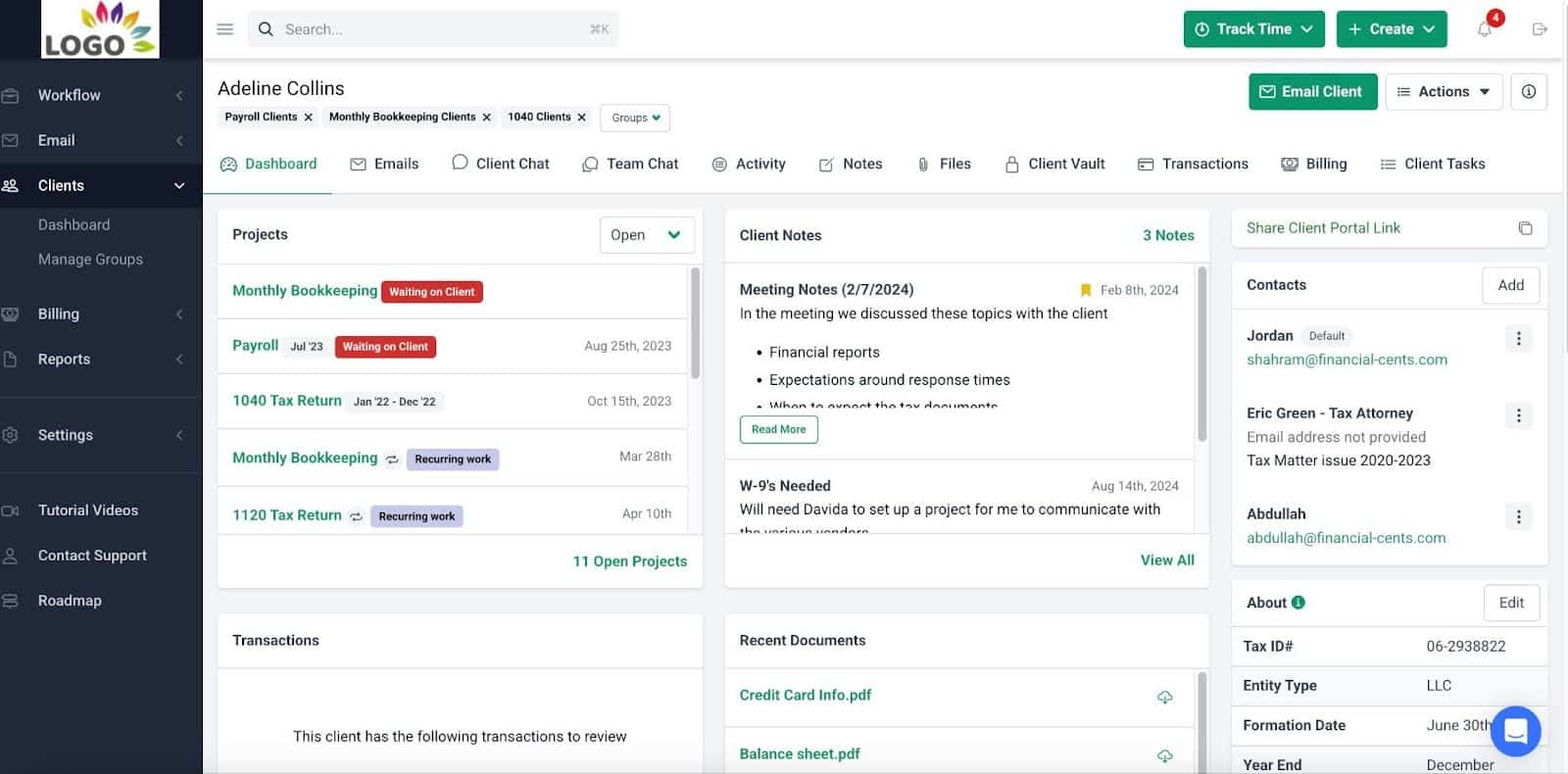

In Financial Cents, all of your clients are accessible in the client database, and the client profiles store each client’s information.

In the client profile, you have tabs for contact details, communication history, projects, emails, files, notes, and custom fields, which store unique information about each client.

The client group feature in Financial Cents enables firms to segment clients by service type and industry to personalize their service and communication.

4. Client Portal

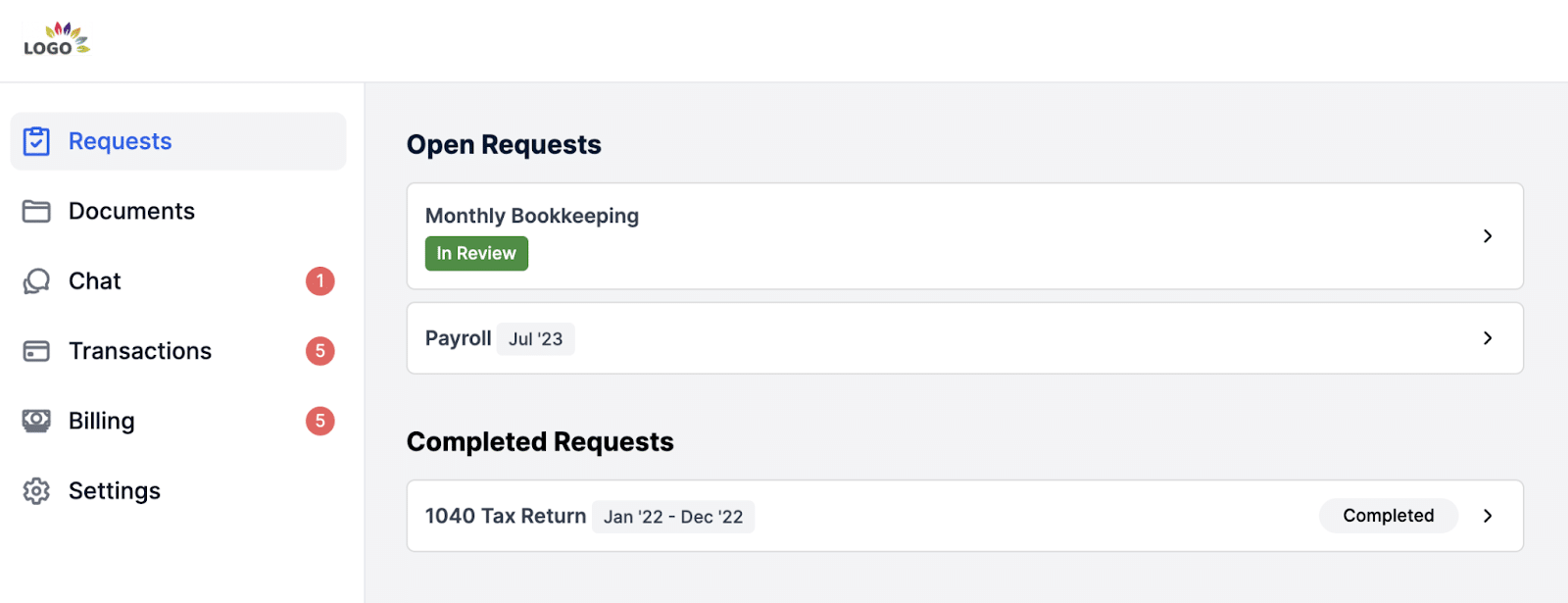

The client portal is a secure (usually branded) space for direct and on-demand communication and collaboration with clients. Firms love it because it makes it easier to track client communications, and clients love it when it is friendly and easy to use, which is where Financial Cents excels above most of the options on the market.

First, the Financial Cents client portal doesn’t require your clients to create or maintain login information. It uses secure magic link technology that updates itself every 30 days and relies on security protocols that cannot be replicated (unlike regular passwords).

The Financial Cents client portal is divided into:

- Client Tasks: Speeds up document collection by clarifying what’s needed and making it easy for clients to upload documents.

- Client Chat: Allows you to discuss document requests and project needs with clients.

- Folder-Sharing: Enables you to share documents with clients, so they can access them on demand. Clients can also upload documents anytime, even when you didn’t request it.

- Billing: Shows clients their invoices and past payments.

- ReCats: Makes it easy to collaborate with clients to clarify uncategorized transactions.

5. Time tracking & billing

The time tracking and billing feature addresses your team’s productivity and profitability. Time tracking monitors time usage to increase your billable hours, reduce the non-billables, while billing enables you to collect payments efficiently.

Financial Cents allows your team members to track time as they work or record time manually. The time is logged against projects.

Combined with the billing feature, your billable time is converted into invoices that you can send from inside Financial Cents. This makes it easier to invoice your clients on time and accurately, to increase your chances of early payments.

The feature comes with a payment reminder, which auto-nudges clients to pay you on time.

6. Team Collaboration and Visibility

This feature centralizes team communication for maximum visibility into team activities, encouraging teamwork. Without it, information silos grow, and team members won’t find the resources they need to do timely and accurate work.

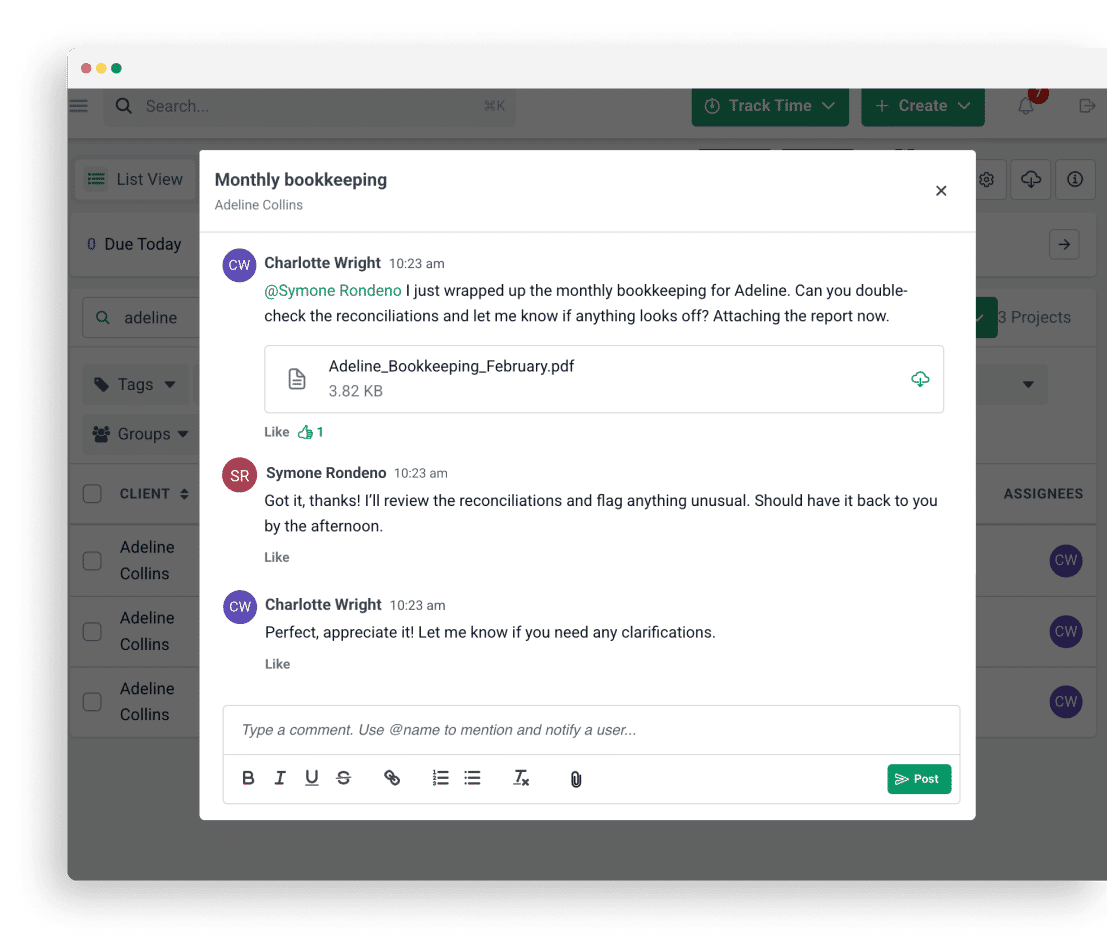

Financial Cents’ Team Chat feature allows team members to collaborate inside the project. Combined with the Comments, Mentions, and files features, it’s easy to see the history of team communication and file-sharing on each task and project, helping newly assigned team members to get up to speed as quickly as possible.

Other accounting team collaboration features in Financial Cents include task assignment, client notes, and a capacity dashboard that shows the tasks assigned to each team member for workload balance.

7. Reporting & business insights

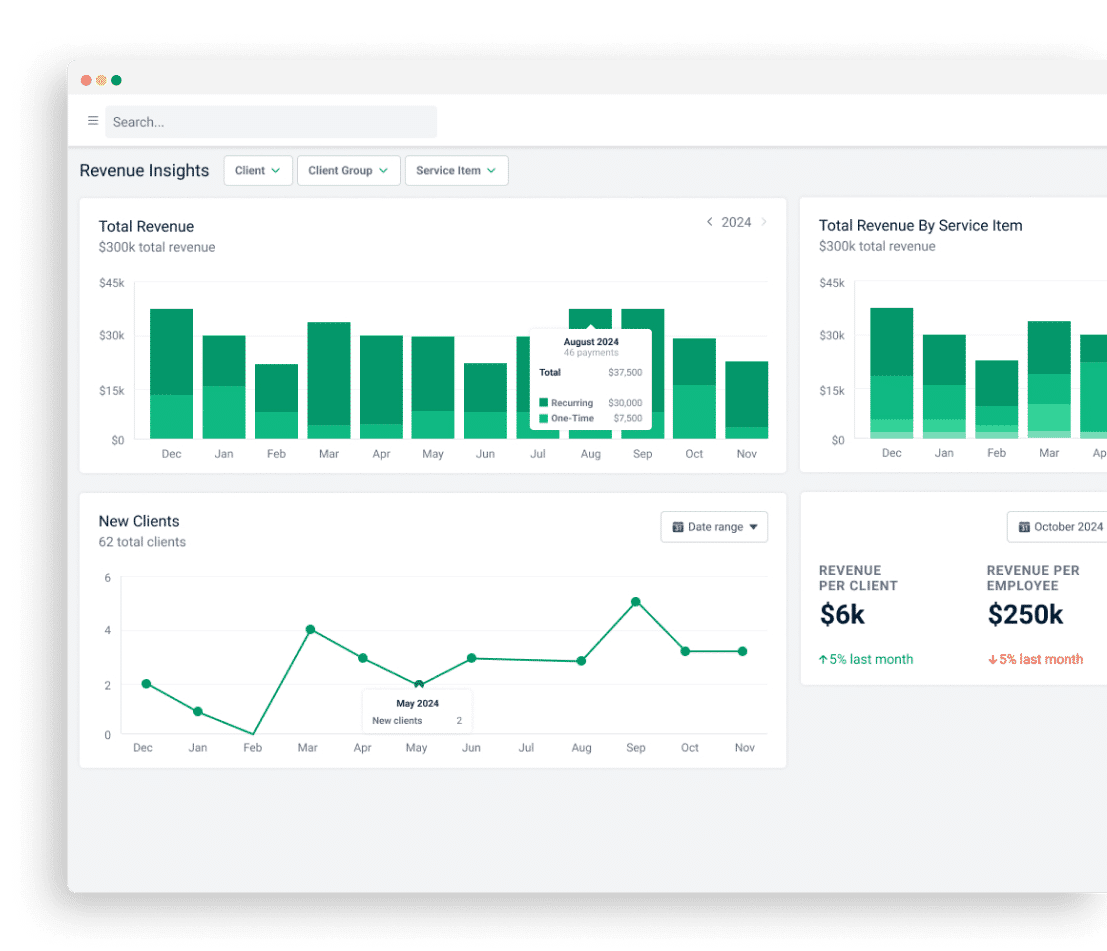

The reporting and business insight feature gives you the data you need to make informed decisions to improve team performance and grow your firm.

Financial Cents provides several report dashboards that sum up your firm’s productivity, efficiency, and profitability.

This includes:

- Time-Tracking: Shows your actual/budgeted time and billable/non-billable hours.

- Capacity Management: Displays team workload distribution to improve task assignment and hiring decisions.

- Client Task Report: Tracks outstanding client requests

- Realization: Tracks profits by client, team member, and projects.

- Etc.

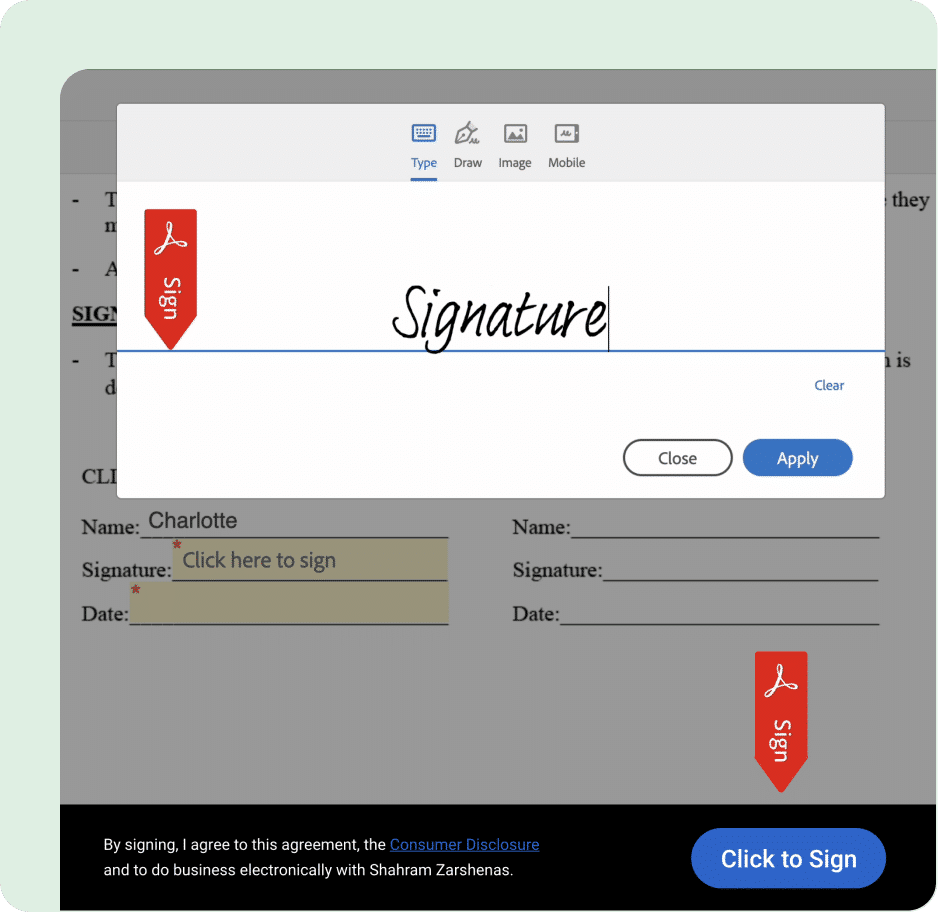

8. E-signatures

The E-signature feature makes it easy and secure for clients to sign documents. This improves client responses and enables you to close deals and convert your clients faster.

It saves your clients the manual efforts of signing documents (printing, signing, and scanning) by making it all possible online. Your clients only need to open the digital document and add their signatures.

In Financial Cents, you can send tax returns, proposals, and other documents for clients to sign.

This feature also comes with automated reminders that help them remember to sign the documents faster.

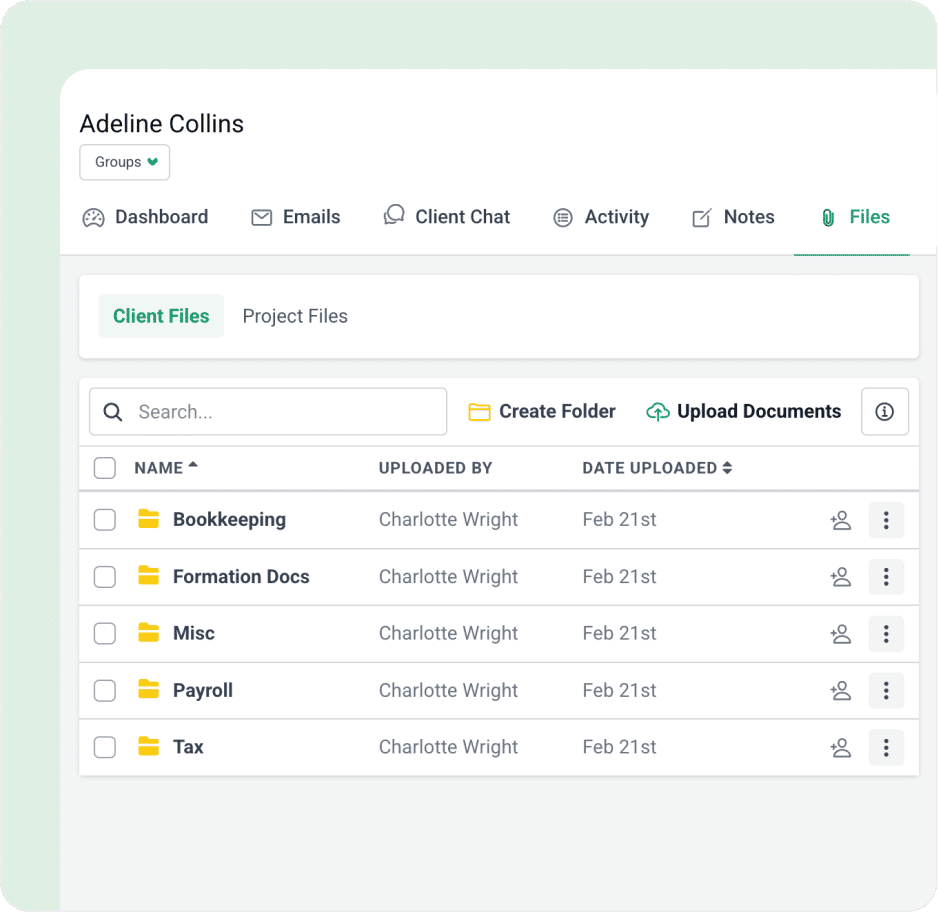

9. Document Management

Your team’s ability to retrieve client documents on a moment’s notice will significantly increase their speed and accuracy. That’s why the document management feature is crucial for accounting firms.

It organizes your documents to enable your team to find up-to-date client information, instead of searching through multiple email threads.

Financial Cents stores each client’s documents in the client’s profile, protecting them with advanced data security technology that complies with global standards, like SOC II, SOC III, and GDPR.

Financial Cents also provides a multi-country data storage system that enables firms operating in the U.S, U.K., Canada, and Australia to keep clients’ data within their respective national borders in compliance with relevant data privacy and residency regulations.

Benefits of Using a Practice Management Tool

-

Increased efficiency and productivity

By centralizing project information, standardizing workflows, and automating repetitive tasks, accounting practice management software enables your team to produce more output with less input and complete more tasks in less time. This translates to serving more clients and generating revenue.

-

Reduced errors and missed deadlines

There’s only so much manual work the brain can handle before mixing things up. When your team members use their mental bandwidth for manual accounting tasks, the ability to crunch numbers accurately is compromised, leading to avoidable errors.

Mental fatigue also slows down workflows, impacting your team’s ability to meet compliance deadlines.

Accounting practice management software takes care of routine and repetitive tasks (like data collection, status updates, and client reminders) with inbuilt due date tracking software, so that your team members can spend their time and creative energy on the tasks that need their mental resources. This minimizes errors and speeds up accounting workflows.

-

Better client service and transparency

With automation, accounting practice management software reduces data entry and other manual tasks, and the fewer time-consuming tasks your team members have to deal with, the greater their ability to deliver satisfactory client service, respond to client messages, and carry clients along on their projects. This also makes the onboarding process for accounting clients smooth.

Solutions like Financial Cents also provide a client portal that clients can access at any time to discuss projects and align expectations.

You can also make the tags on projects visible to clients, so that clients can view their project’s status inside the Client Portal. All of these improve client experiences and make your workflows more transparent to clients.

-

Improved team collaboration and accountability

Accounting practice management software centralizes team communication and provides visibility into team members’ tasks, enabling firm owners to effectively assign responsibilities and hold team members accountable.

With Financial Cents, team collaboration happens on the project and tasks, keeping team communication in the right context to prevent information silos.

-

Scalability for growing firms

While manual systems like spreadsheets become unwieldy as your team and client base grow, accounting practice management software organizes work and client information neatly, regardless of your client count.

It also provides an audit trail of activities in your firm to keep you informed about actions taken on projects and client information.

Plus, the workflow management and automation features standardize your processes to avoid confusion and automate manual tasks, which buys back time to serve more clients.

All of these help you to serve clients at scale and manage your growing firm more seamlessly.

How to Choose the Right Management Software for Your Firm

Accounting practice management software works best when firm owners approach the decision with the right mindset.

Here are some tips to help you choose the best tool for your firm:

I. Consider your firm size, number of clients, and workflow complexity

Each accounting firm’s workflow, collaboration, and reporting needs depend on its team size, number of clients, and specialty.

Larger firms need tools with extensive audit trails and automations to manage complex workflows and keep up with client demands. Small firms usually prefer simple and easy-to-use solutions that won’t overwhelm them.

The key is to understand and choose what your firm’s needs are in terms of team and client size. If you choose a tool because everyone is choosing it, you could waste your money on tools that do not suit your firm.

II. Look for scalability and integrations

A scalable practice management software will grow with your team. It can be an extensive tool that allows you to use and pay for only the features that matter to your firm.

Similarly, integration connects your practice management software with the other relevant apps (like your general ledger) in your tech stack. If this is absent, your team will have to manually transfer files and information across multiple tools, which will increase manual work and human error.

Together, these qualities make your practice management software navigable and inclusive, ensuring it remains useful in the long term.

III. Evaluate support and onboarding

The way your tool is set up can significantly influence the value you get from your practice management software, and that’s where provider-assisted onboarding is crucial.

A smooth onboarding process shows your team the corners of a practice management software, so you can maximize its features and functionality, especially those that can be easily overlooked.

Even after the onboarding phase, you need to be sure you can access customer support easily. This will help you navigate the unlikely moments of system downtime.

IV. Assess ease of use

Ease of use ensures that your team can implement and navigate your practice management software for daily tasks without too much effort. If a tool is difficult to use, your team will waste more time trying to use a tool that’s supposed to save time. Financial Cents is known for its ease of use across the industry with a rating 4.9/5.0 for ease of use on Capterra.

The same applies, especially, to clients. Your practice management software should have a user-friendly interface that clients in low-tech industries can easily use.

Otherwise, they’ll resort to sending sensitive documents by email, which could pose a data security threat.

One way to understand a product’s ease of use is to take advantage of free trials. A free trial shows you everything you need to know about a product firsthand, given that no one’s word about a product comes close to using and navigating a tool by yourself.

V. Request Demo

Product Demos are similar to free trials. They show you the features and functionality of a practice management system at no cost.

With a Demo, an expert of the product shows you and your team how to use the product to perform accounting tasks.

This will help your team gather the insights you need to choose a tool that truly aligns with your unique workflows.

VI. Consider the Pricing Model

Pricing models determine how well you can afford an accounting practice management tool on a long-term basis.

The common pricing models include per user, per client, and per feature.

When choosing a preferred pricing model, consider your growth trajectory to understand the implications of hidden fees and add-ons on the final cost.

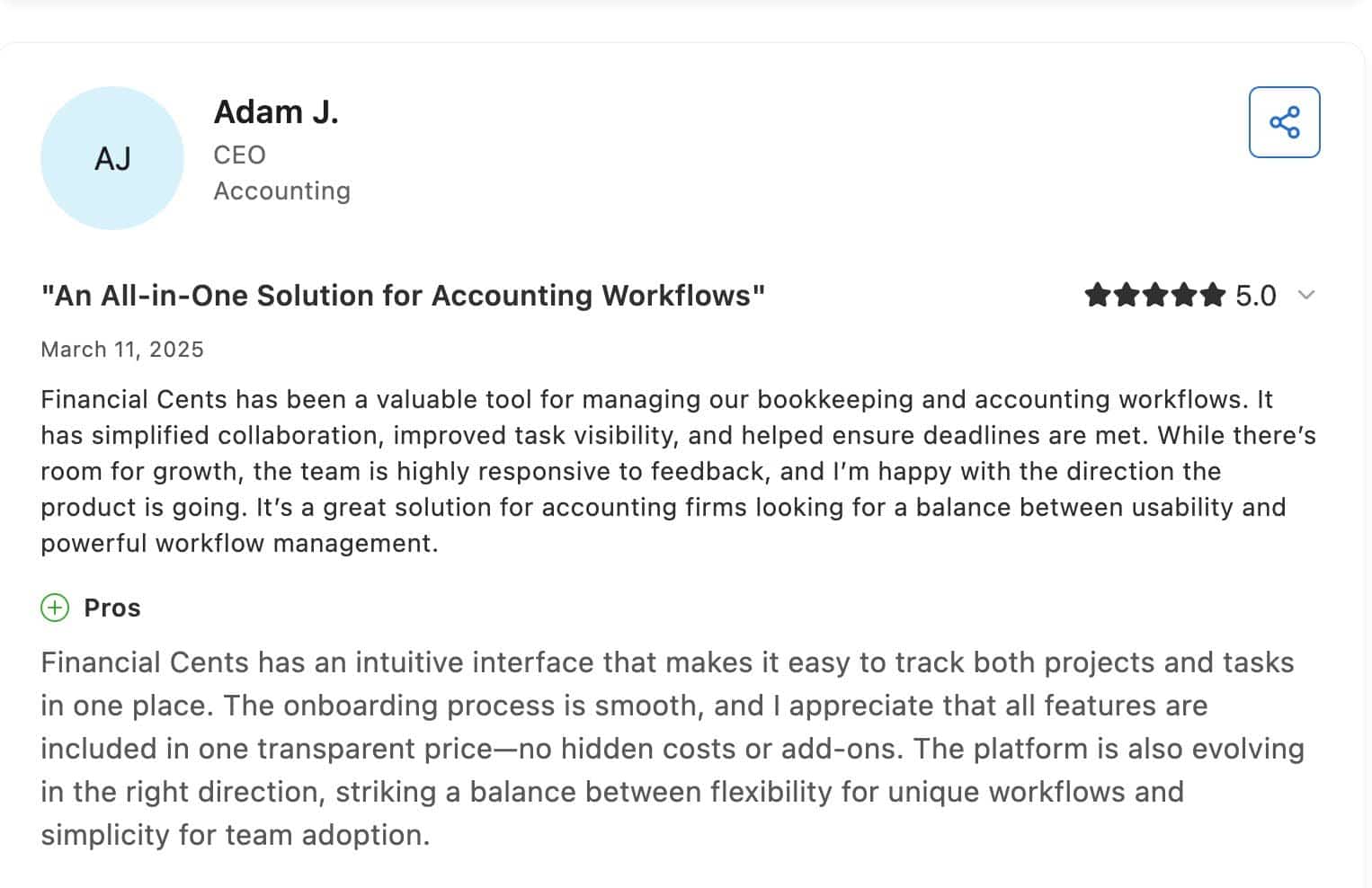

VII. Read reviews

User reviews on platforms, like Capterra and G2, are as authentic a source of insights as it gets.

Past and current users of accounting practice management software go to these sites to provide their independent opinions.

Search for your prospective practice management tool on these sites to see what other firms have to say about it. This can save you the time, effort, and money you’d have invested in the wrong software solution.

Best Practices for Implementing Practice Management Software

-

Standardize workflows before migration

New wines don’t do well in old wineskins; today’s problems can’t be solved with yesterday’s thinking, and disorganized workflows won’t work even with the best practice management software on the market.

Before moving to your new practice management software, take the time to document all your processes (monthly bookkeeping, year-end, tax returns, etc.) into standard operating procedures. This will save time, clarify procedures, and improve accuracy in the new accounting workflow management system.

Thankfully, software tools like Financial Cents provide prebuilt workflow checklists that you can customize to document your processes from top to bottom.

If that’s not enough, the Financial Cents Template Library, a community of accounting firm owners who are sharing their best workflows, can inspire you as you create yours from scratch inside Financial Cents.

As your team finds better ways of getting work done, update your workflow templates to keep them relevant and efficient.

-

Use Workflow Templates

Creating projects from scratch whenever they need to be completed is another time-consuming endeavor. Workflow templates will not only help when creating single projects, but they also allow you to duplicate a workflow template for all clients in a group.

This saves your time and keeps you from forgetting the standard steps needed to complete the projects.

-

Train team members thoroughly

Regular team training can be the difference between a team that is struggling to adopt a tool and another that is maximizing it to the fullest extent.

This is where the resources from the practice management provider are helpful. From onboarding sessions to webinars and walkthrough sessions, these materials enable each team member to understand how the product functions.

In addition to these, Financial Cents provides short videos that show how to use specific features and self-paced courses that turn new users into Pros on specific aspects of the program.

-

Start small and scale usage across the firm

Implementing a practice management tool can be overwhelming if you try to move everything at once.

Most firm owners have found that starting with a single function, team role, or client group can help teams ease into practice management software without disrupting too many things. This can also help you to gather feedback and manage your team’s resistance to change more confidently.

-

Leverage automation to reduce repetitive tasks

Automation features (like automatic reminders, recurring tasks, and client document requests) help to eliminate manual work and free up capacity for strategic work and client relationship management.

Automating repetitive tasks also makes it easier to identify and correct errors that could compromise service quality.

When you don’t find every opportunity to automate your processes, you’re leaving too much value on the table.

Common Mistakes to Avoid

Here are some mistakes that keep firms from realizing the benefits of accounting practice management software

a. Choosing based only on price, not features

Cost is important for resource management, but it shouldn’t be your only consideration. Features and functionalities are just as important.

If you buy a cheap solution that is too difficult to navigate or doesn’t have the features your team needs, it’ll only be a matter of time before you set it aside, resulting in a total waste of time and money.

At the same time, while a high price generally indicates the high value of a product, that value may also be based on features that have little to nothing to do with why your team needs a practice management tool.

b. Lack of training and buy-in from staff

Many firm owners invest in new software due to their individual preferences, but, like Dave Kersting learned, team members need to find the useful, and that only happens when they understand it enough to find it valuable.

I went with a different software because I felt Financial Cents was too new and that it would be a shiny object.

I thought I had made the right call until my team said, ‘Dave, stop. We like this other program, and it's called Financial Cents."

c. Not fully using automation or reporting capabilities

The aim of practice management software is defeated when you don’t use its automation and reporting features to the fullest extent.

Automation saves you from non-billable and time-consuming work and frees you to make your resources count where they matter most, like client advisory.

Similarly, the reporting feature shows where your team spends its resources, which client is bringing the most revenue, and how to improve team performance. Otherwise, any workflow, team, or client management decision you make will be based on guesswork that can produce unintended results.

Using an All-in-One Accounting Practice Management Software

Ultimately, the true weight of an accounting practice management software is measured by how many of your accounting functions you can do without leaving the app or piecing together too many different apps.

That’s why accounting firm owners and managers value Financial Cents’ all-in-one practice management software features.

Built specifically for the accounting industry, Financial Cents enables firm owners to manage their entire firm with all the features we’ve covered in this article, including:

- Workflow Management: Tracks the status of client work, and who’s working on what, and displays all your deadlines in one place to prevent missed deadlines.

- Workflow Automation: improves your team’s efficiency and productivity by automating time-consuming manual tasks.

- Team Collaboration: Centralizes team conversations, emails, files, notes, etc., on the work, so everyone has what they need to complete their tasks.

- Client CRM: Organizes each client’s information (contact details, emails, projects, interactions, notes, documents, passwords, etc. in one place to nurture client relationships more effectively.

- Document Management: Stores client documents securely and organizes files for ease of access and retrieval.

- Email Integration: Brings all emails (Gmail and Outlook) from clients into the client’s profile in Financial Cents, enabling your team to track client communication where they are working.

- Client Request: A secure and passwordless client portal that allows you to request documents, share folders, bill, and communicate with clients in real-time. Built-in automated reminders prevent clients from forgetting the requests.

- Capacity Management: Provides real-time visibility into team workload to understand who’s at capacity and who is available for more tasks, improving overall efficiency and preventing burnout.

- Time Tracking: Records the time your team spends on client work to increase billable work and improve revenues.

- Proposals and Engagement Letters: Send professional proposals & engagement letters to prospects quickly to improve your chances of converting them. Proposals have automated billing and payment collection built in.

- Budget and Reporting: Provides real-time insights firm owners need to make their teams more efficient, productive, and profitable.

- E-signature: Collect client signatures online without the hassle of printing and scanning documents.

- Billing and Payments: Automated billing, reminders, and payment collection enable you to get paid faster inside Financial Cents.

- Uncategorized Transactions: Identifies uncategorized transactions and enables you to ask clients for clarification inside Financial Cents. Once the client provides additional information, you can publish to QBO to categorize the transactions all within Financial Cents.

Since you can store every information and manage every project inside Financial Cents, you save your team members time, cut costs (because you’re not spending on several tools), and reduce the number of apps grappling for your attention daily.

Give Your Firm a Great Chance to Grow with Financial Cents

The future of any accounting firm is defined by how well its operations are managed, not just the team’s accounting expertise.

Accounting expertise is most useful in a firm where client information is easily accessible to everyone, deadlines can be tracked in one intuitive dashboard, and manual labor is minimized. This enables team members to work without the limitations of a manual and disconnected tech stack.

With Financial Cents, you’re getting a system of streamlined processes, centralized client information, and automated workflows that free your team up to apply their accounting knowledge to your clients’ financial situations at scale.

Use Financial Cents to manage your firm for Free for the next 14 days. Click here to start your free Trial.