Manual accounting processes often lead to time wastage, higher labor costs, and preventable errors. As your firm grows, the pressure to deliver accurate reports quickly only increases. Between completing client work and tracking what has been completed, even experienced teams can feel overwhelmed.

Today’s accounting firms are expected to move faster, collaborate remotely, and deliver clearer financial insights. Without standardized processes, work becomes inconsistent, deadlines slip, and small errors compound over time.

That is why systemizing your and improving your accounting processes is critical.

Accounting spreadsheet templates give you and your team structure. They outline the exact steps required to complete tasks, improve accuracy and reduce guesswork.

In this article, we share 15 accounting spreadsheet templates to help you standardize your processes, improve collaboration, and scale your firm with confidence.

What is an Accounting Spreadsheet Template?

An accounting spreadsheet template is a spreadsheet that outlines the steps that make up (or conditions to be met to complete) an accounting process.

These templates can be created as a procedure for completing work (as in a monthly bookkeeping template) or a comprehensive list of information or documents needed to track and complete a service (as in Tax Preparer’s checklist).

Are Accounting Spreadsheet Templates Different from Accounting Excel Templates?

No. Accounting spreadsheet templates and accounting Excel templates are the same. The names are interchangeable. They are called Excel templates because Excel is the most popular spreadsheet program.

15 Accounting Spreadsheet and Accounting Excel Templates:

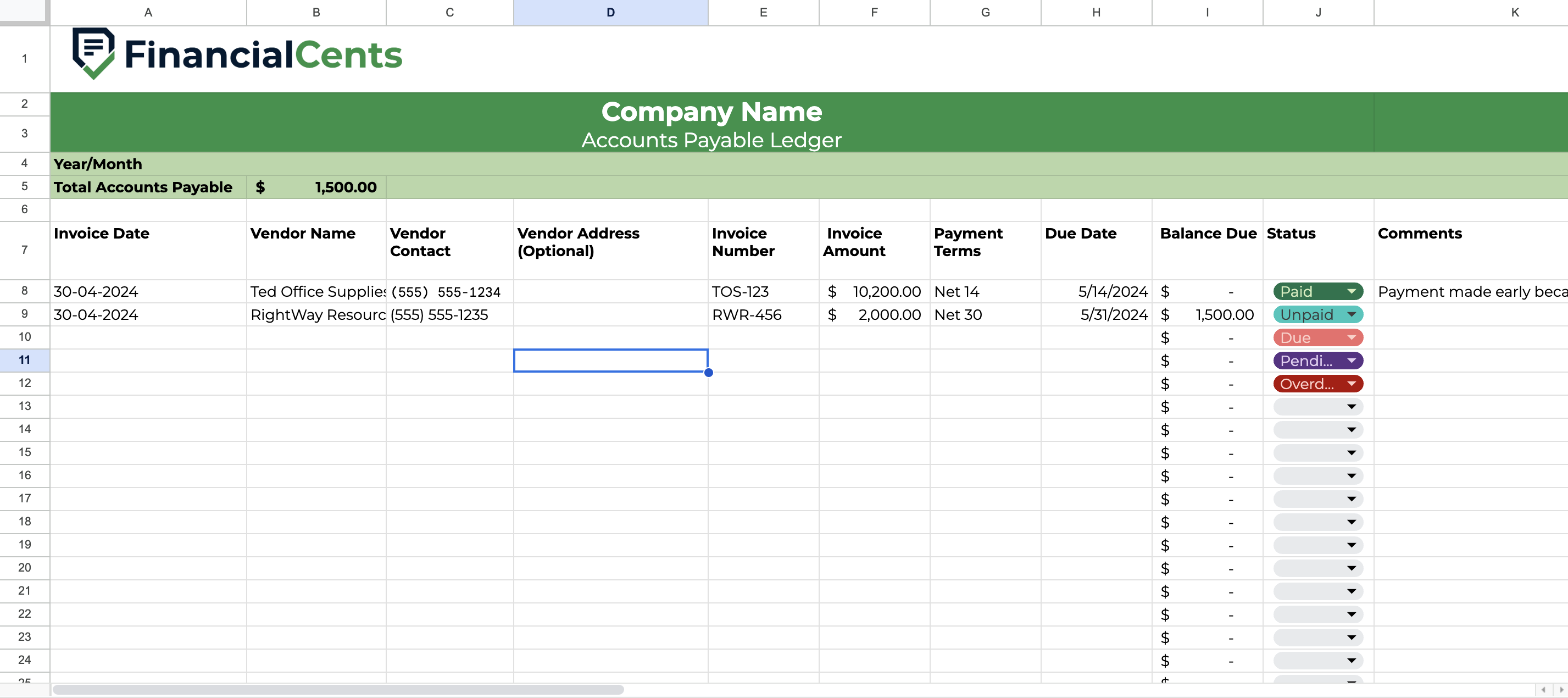

1. Accounts Payable Template

The Accounts Payable Template is a list of vendor bills. It is designed with formulas that calculate your client’s paid and unpaid bills.

The template information includes bill number (and amount), payment terms, and due date. This allows you to fill the sheet as Accounts Payable events occur.

Why You Need it

Organized AP data helps to prevent overpaying or underpaying a vendor. The template gives your team one place to go for up-to-date AP information.

That way, relevant team members can monitor your client’s AP reporting to manage their cash flow more confidently.

How to Use It

- Download it by clicking here

- Review the information to add and remove rows and columns as you see fit.

- Share it with your team members in your preferred file-sharing system.

- Start managing your client’s Accounts Payables with the template.

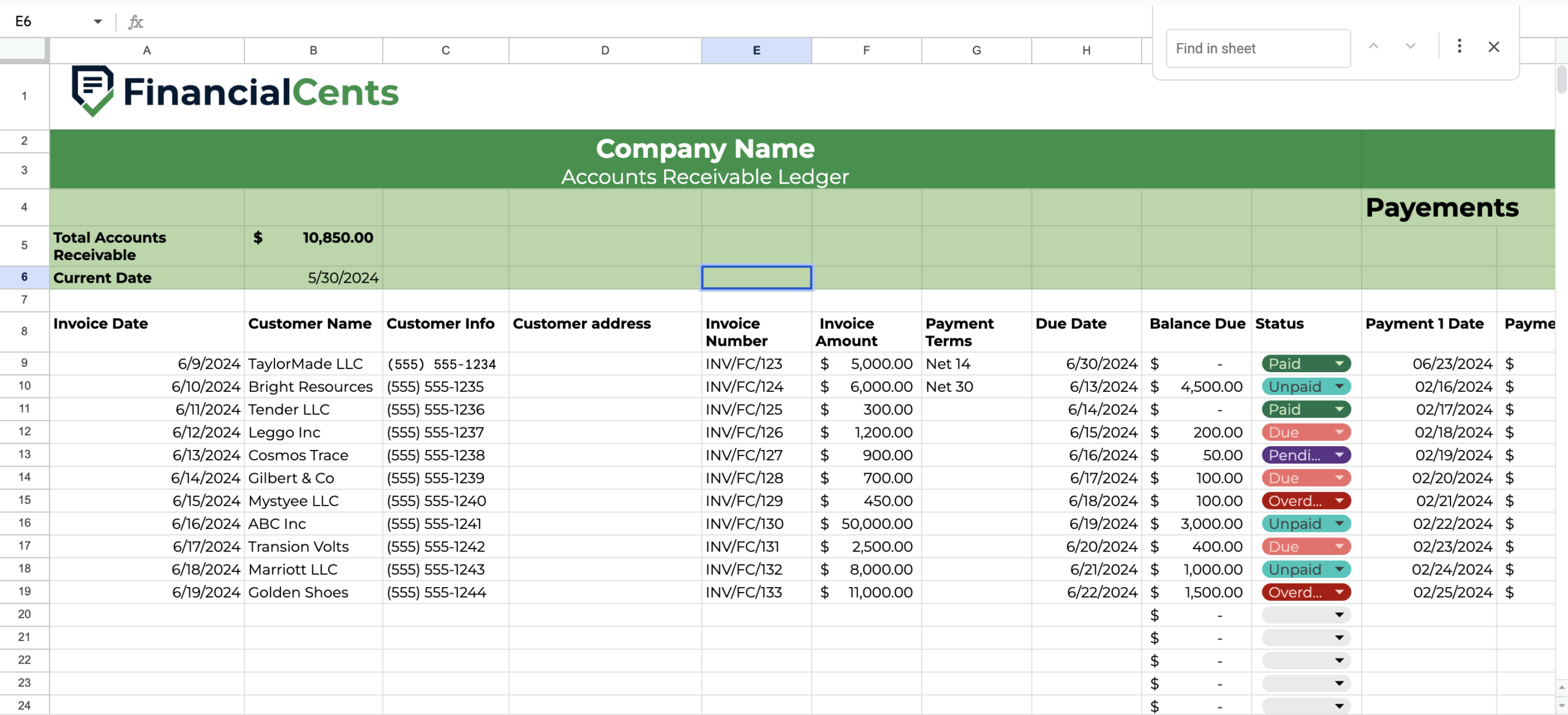

2. Accounts Receivable Template

The Accounts Receivable Template helps to document the name, contact information, credit terms, balance due, payment date, Etc. of everyone who owes your client.

When you capture this essential information in one place, it becomes easier to manage receivable collections and avoid bad debt.

Why You Need It

Centralizing all your client’s receivable information in one place helps you to prioritize follow-up.

The template has formulas that automate the calculation of the account receivable balances, reducing human errors and giving you accurate data to improve your client’s liquidity.

How to Use It

- Download the template here.

- Review the information to add rows and columns as needed.

- Share with your team using your preferred file-sharing system.

- Start filling it with your invoicing data.

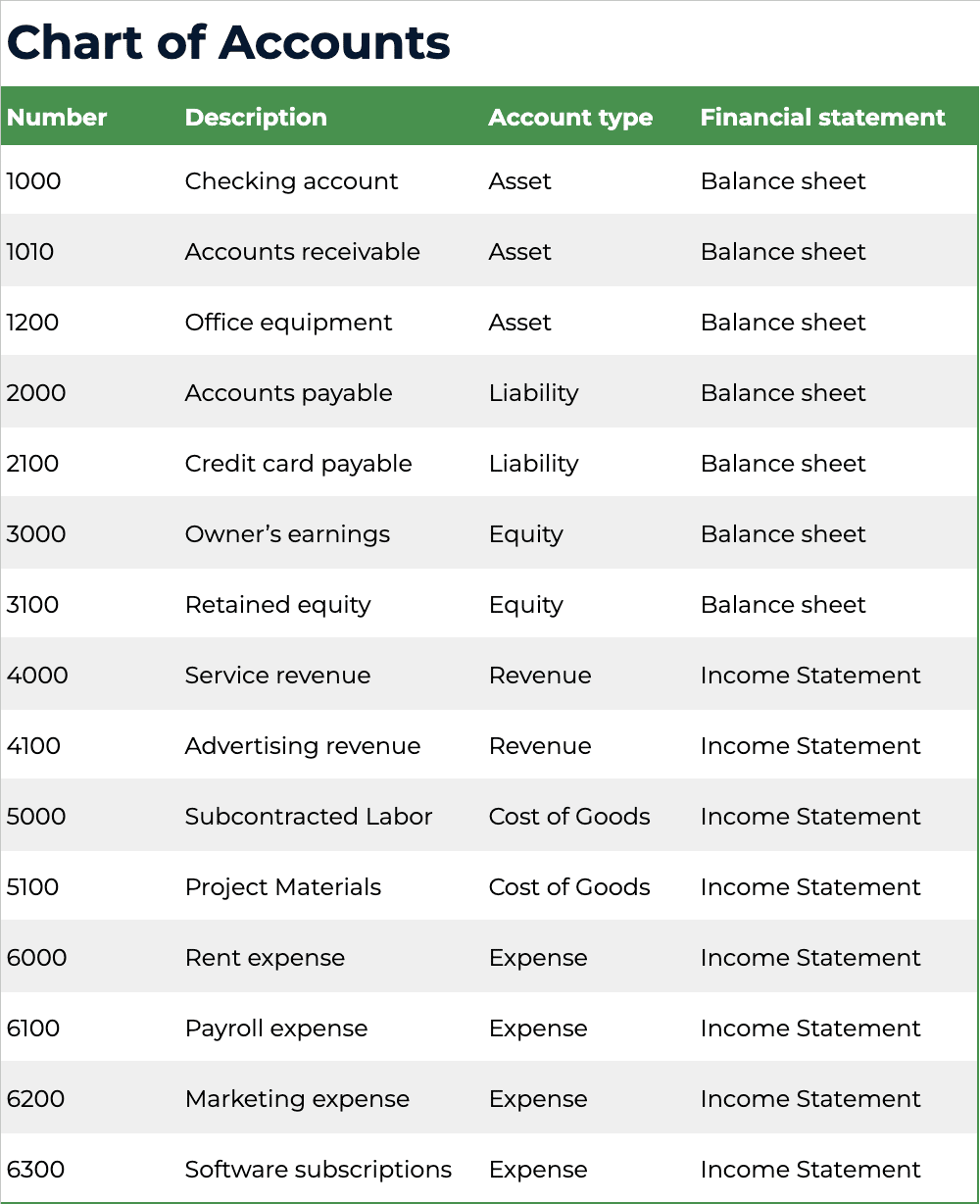

3. Chart of Accounts Template

A chart of accounts is the backbone of any accounting system. It organizes all financial transactions into categories, ensuring your client’s financial statements are accurate and easy to interpret.

Setting up a chart of accounts from scratch can be time-consuming, especially when onboarding new clients. This Chart of Accounts Template gives you a structured foundation you can quickly customize for different industries and business sizes.

Why You Need It

A well-structured chart of accounts helps you classify transactions consistently, prepare accurate financial statements, and improve reporting clarity. It also speeds up reconciliations and ensures compliance with accounting standards.

Instead of starting from a blank spreadsheet every time, this template gives you a professional framework that reduces setup time and improves consistency across clients.

How to Use It

- Download the template here.

- Review the pre-filled categories and subcategories.

- Customize account names and codes to match your client’s business model.

- Add or remove accounts based on industry-specific needs.

- Share with your team or import into your accounting software.

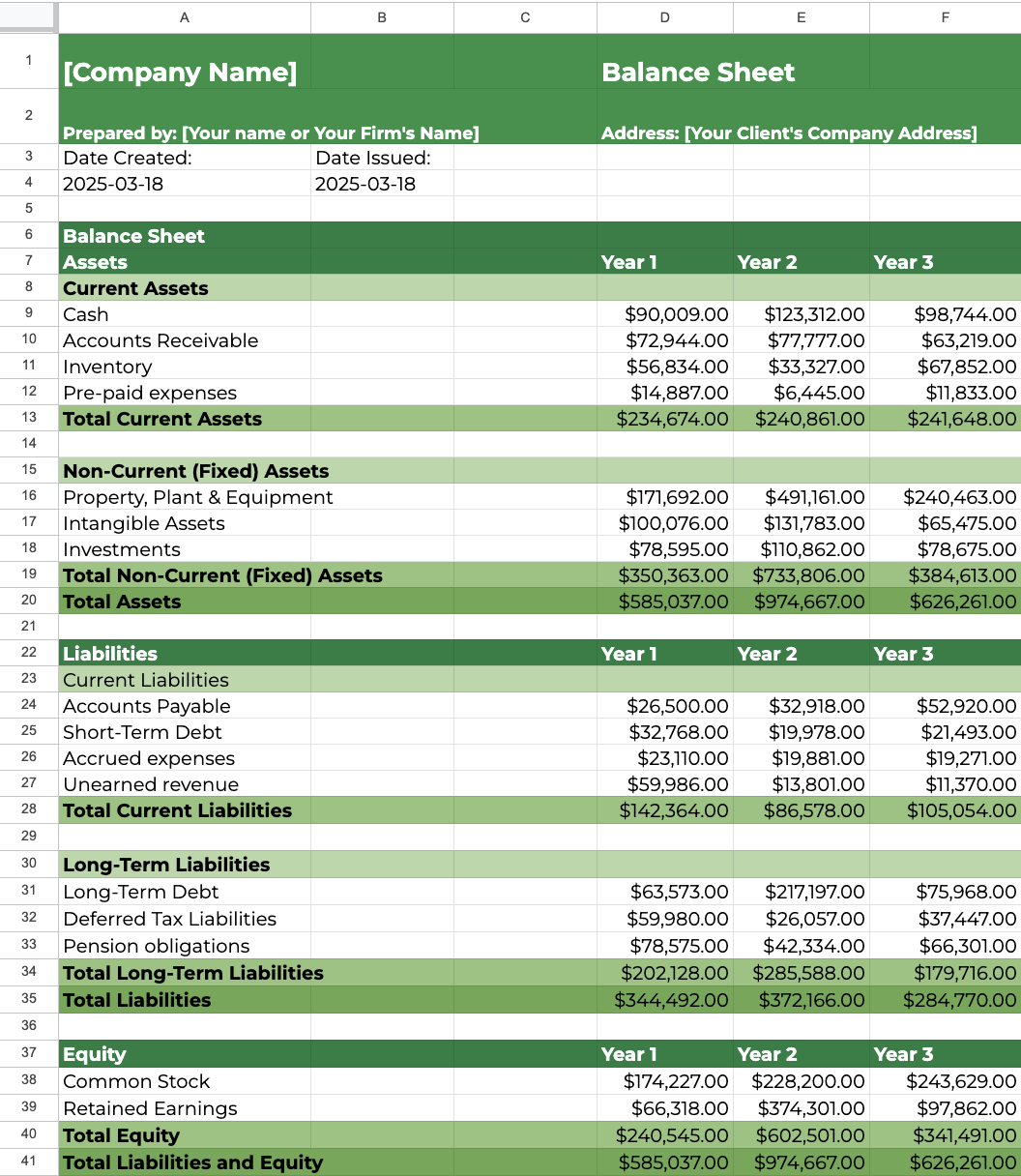

4. Balance Sheet Template

Balance sheet is an important financial statement that provides a snapshot of a company’s financial position at a specific point in time. This Balance Sheet Template is designed to help accounting and bookkeeping professionals easily track and organize assets, liabilities, and equity, ensuring accurate financial reporting and informed decision-making for their clients.

Why You Need It

Using this template will help you simplify your financial analysis. It automates the calculation of total assets, liabilities, and equity, ensuring your books stay balanced. Whether you’re preparing financial statements for internal review, tax filings, or investor reporting, this free template offers a structured and efficient way to manage financial data. It is also available in Excel and Google Sheets.

How to Use It

- Download it by clicking here.

- Review the available columns and rows for assets, liabilities and equity.

- Review the automatic calculations with test data to ensure it is balanced.

- Share with your team members.

- Start balancing your books.

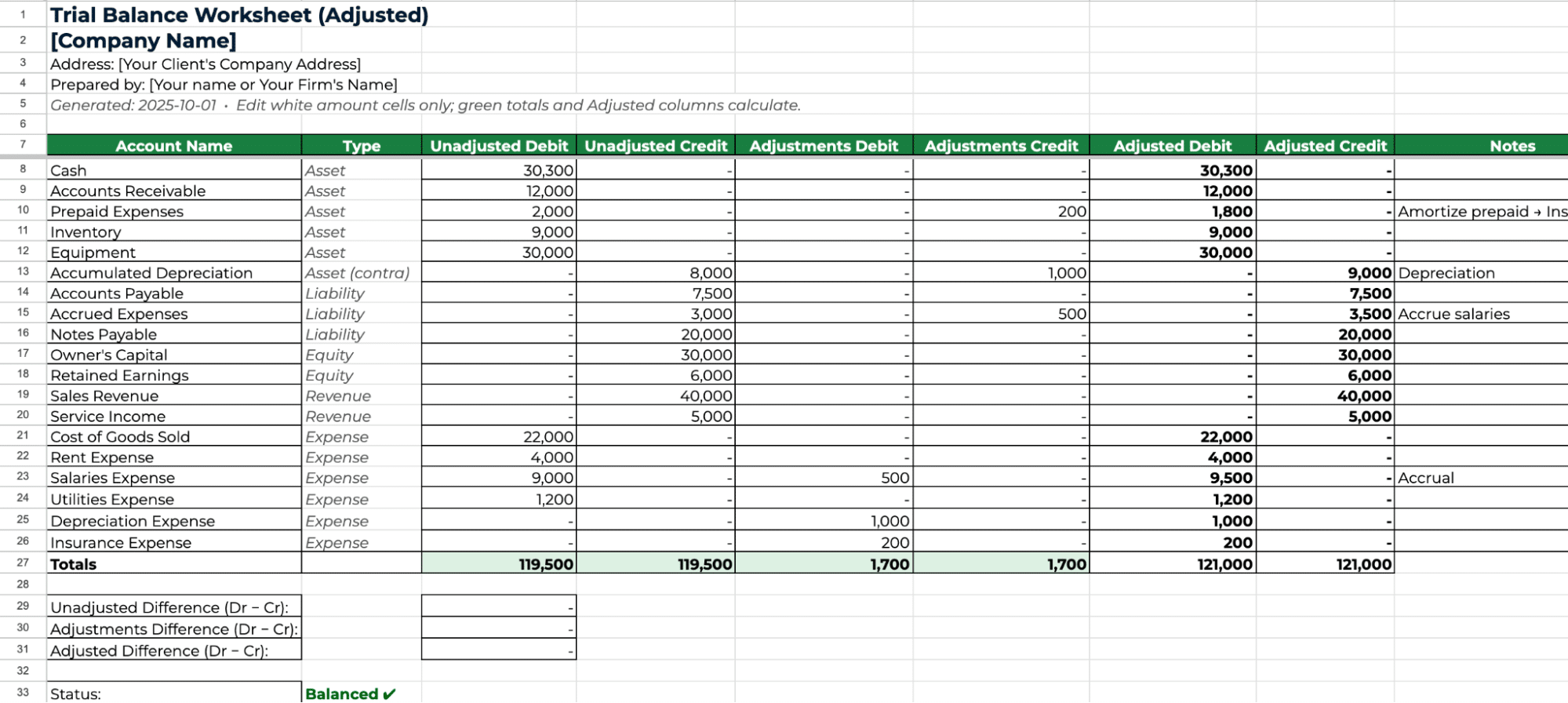

5. Trial Balance Worksheet Template

Before preparing financial statements, you must confirm that total debits equal total credits. If they do not, your reports will not be accurate.

The Trial Balance Worksheet Template helps you organize ledger balances in one structured sheet so you can quickly verify that the books are balanced before moving to financial reporting.

Why You Need It

A trial balance worksheet helps detect posting errors, transposition mistakes, omissions, and double entries before they affect financial statements. It simplifies the review process by listing all accounts in one place and automatically calculating debit and credit totals.

Using this template reduces rework, prevents compliance issues, and keeps your reporting process consistent across clients.

How to Use It

- Download the template here.

- Enter account names and ending balances from the general ledger.

- Review the debit and credit totals to confirm they match.

- Investigate and correct any discrepancies before preparing financial statements.

- Share with your team for use.

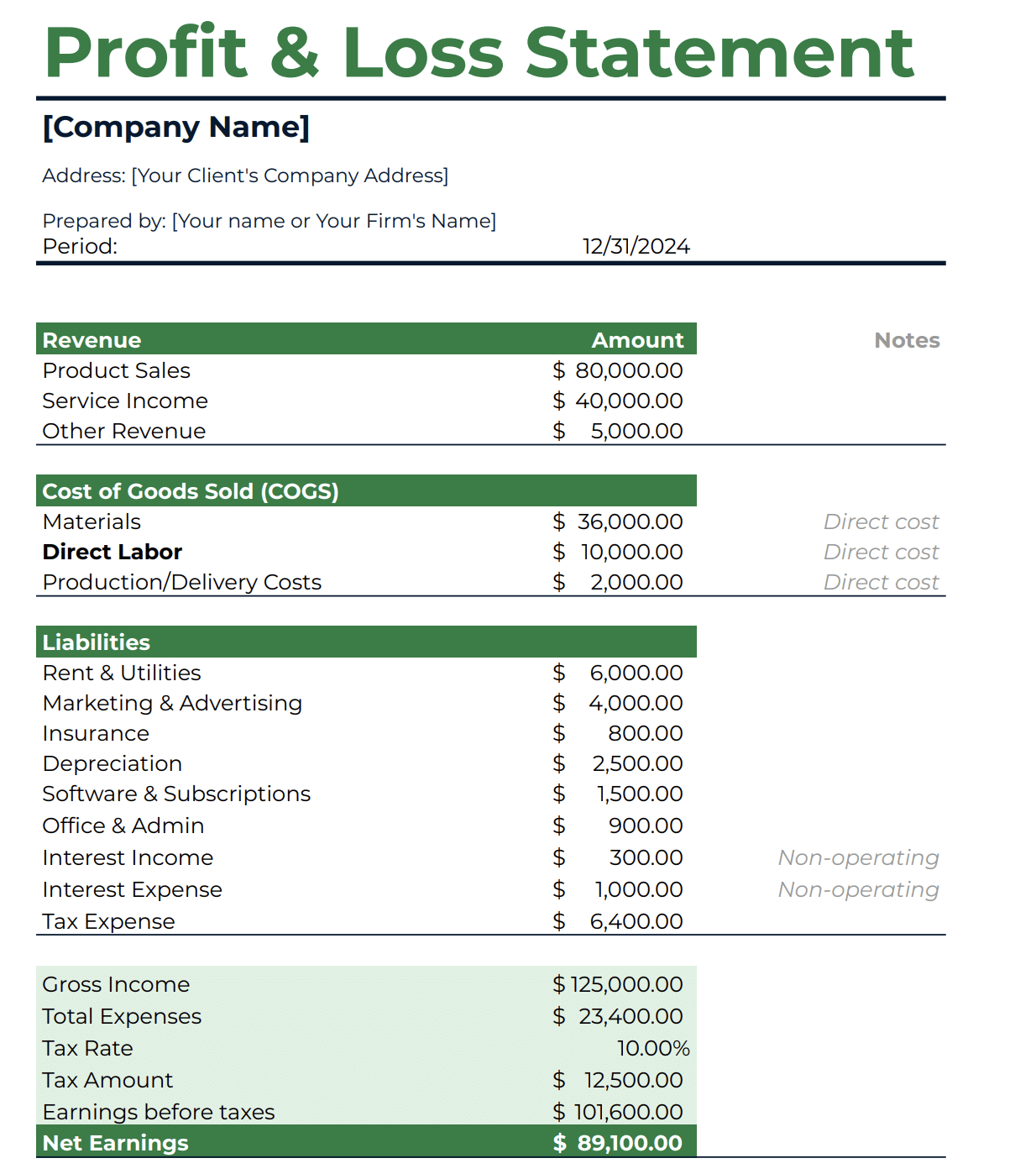

6. Profit and Loss Statement Template

A profit and loss statement shows your client’s revenue, expenses, and net profit over a specific period. It is one of the most important financial reports for tracking performance and guiding business decisions.

Instead of building a P&L from scratch each time, this template provides a ready-to-use structure with built-in formulas that automatically calculate totals as you enter data.

Why You Need It

This template saves time and reduces errors by automating calculations for gross profit, operating income, and net profit. It also ensures consistency in reporting across periods and clients, making comparisons easier and improving the clarity of your financial analysis.

A structured P&L helps you present financial performance in a way clients can easily understand and act on.

How to Use It

- Download the template here.

- Enter revenue and expense figures in the appropriate sections.

- Review automatic calculations for accuracy.

- Add notes where necessary for client clarity.

- Share the report with clients or stakeholders.

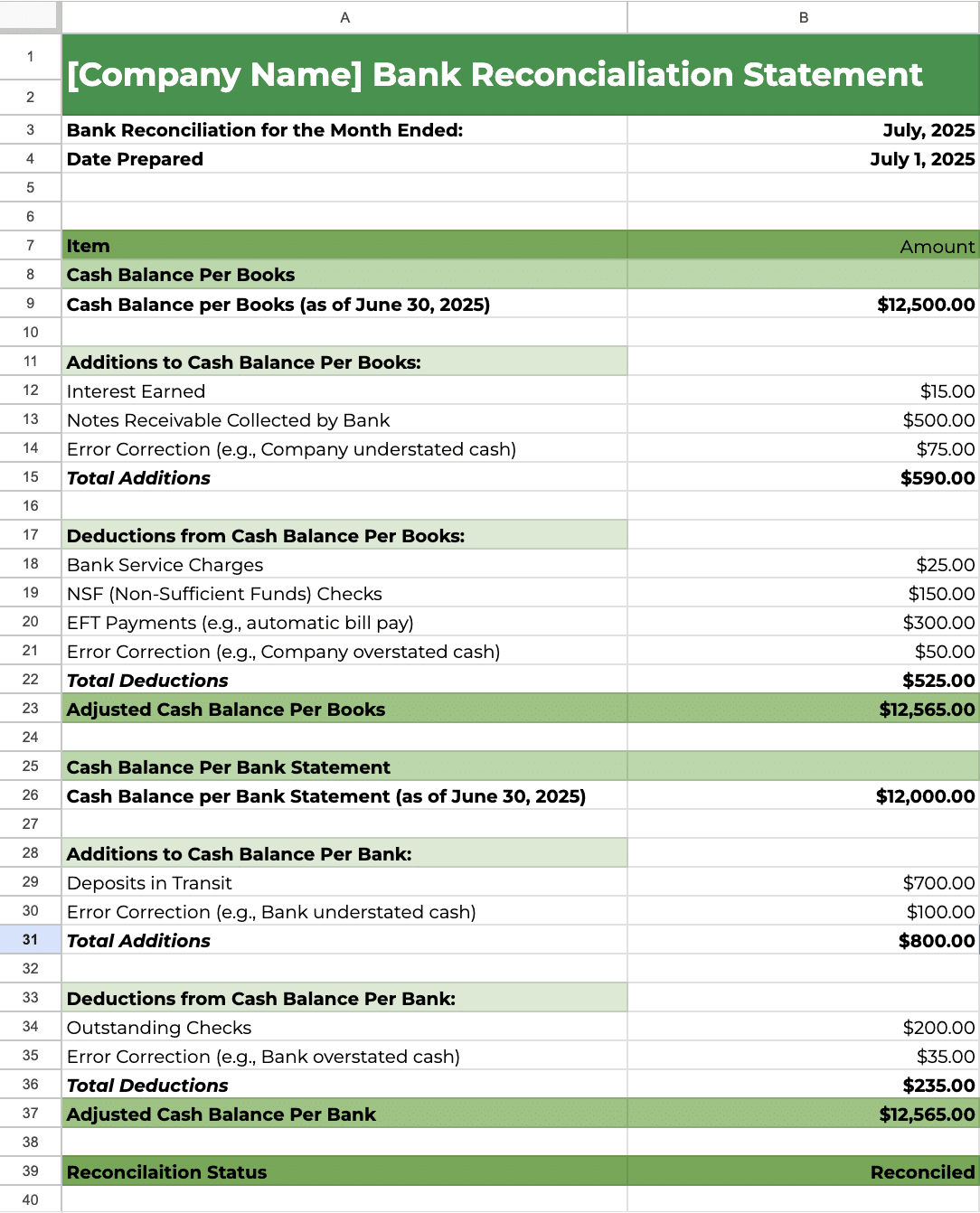

7. Free Bank Reconciliation Template

There’s nothing more frustrating than realizing your client’s books don’t match their bank statement, especially at month-end. The Bank Reconciliation Template helps you identify and resolve discrepancies between book balances and actual bank activity by giving you a structured, repeatable process to follow.

This template is designed specifically for accounting and bookkeeping professionals who want to perform accurate reconciliations without having to start from scratch each month.

Why You Need It

Bank reconciliation is one of the most important internal controls in accounting. It not only helps you detect data entry mistakes, timing issues, and missing transactions, but it also protects your client from fraud and ensures their reports are accurate.

Using this template helps you catch errors and duplicates before they impact financial statements, maintain clean, audit-ready books, and verify your client’s cash position to avoid unexpected issues. It also creates a clear paper trail for monthly reconciliations and saves hours with built-in formulas that automatically calculate balances and flag discrepancies.

How to Use It

-

Download the template here

-

Enter the starting balance per the books and bank statement

-

Fill in deposits in transit, outstanding checks, interest earned, fees, and any necessary adjustments

-

The sheet will auto-calculate totals and show whether the books and bank balance match

-

If reconciled, the status will show “Reconciled”; otherwise, it’ll display “Not Reconciled”

-

Share with your team or upload it to your firm’s workflow platform (like Financial Cents)

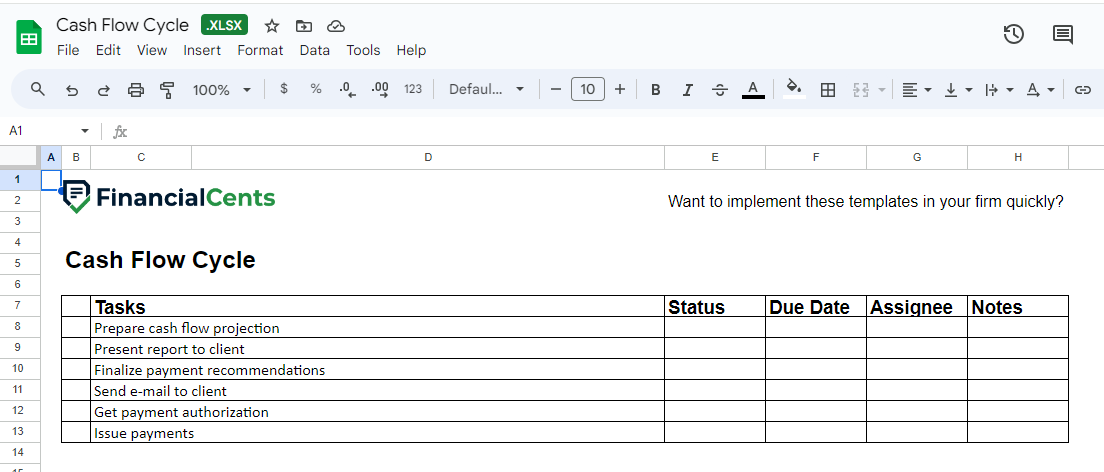

5. Free Cash Flow Cycle Checklist Template

This template is a step-by-step list of the tasks your staff needs to do to help your clients understand how cash moves in and out of their businesses. The template includes the status, due date, and relevant comments for each of your cash flow cycle tasks.

The checklist is actionable because the tasks were created using the procedures of experienced accounting and bookkeeping professionals.

Why You Need It

This checklist template structures the review of your client’s cash flow cycle projects in a way that enables your team to make business information accessible and understandable.

The template also helps you to identify the causes of cash flow problems in your client’s business. Designed to make collaboration easy, this accounting Excel template allows you to work with your team to offer solutions that work.

How to Use It

- Download the template here.

- Review and customize the template for your clients’ needs.

- Share with your team (or use it inside Financial Cents by creating your account for free here).

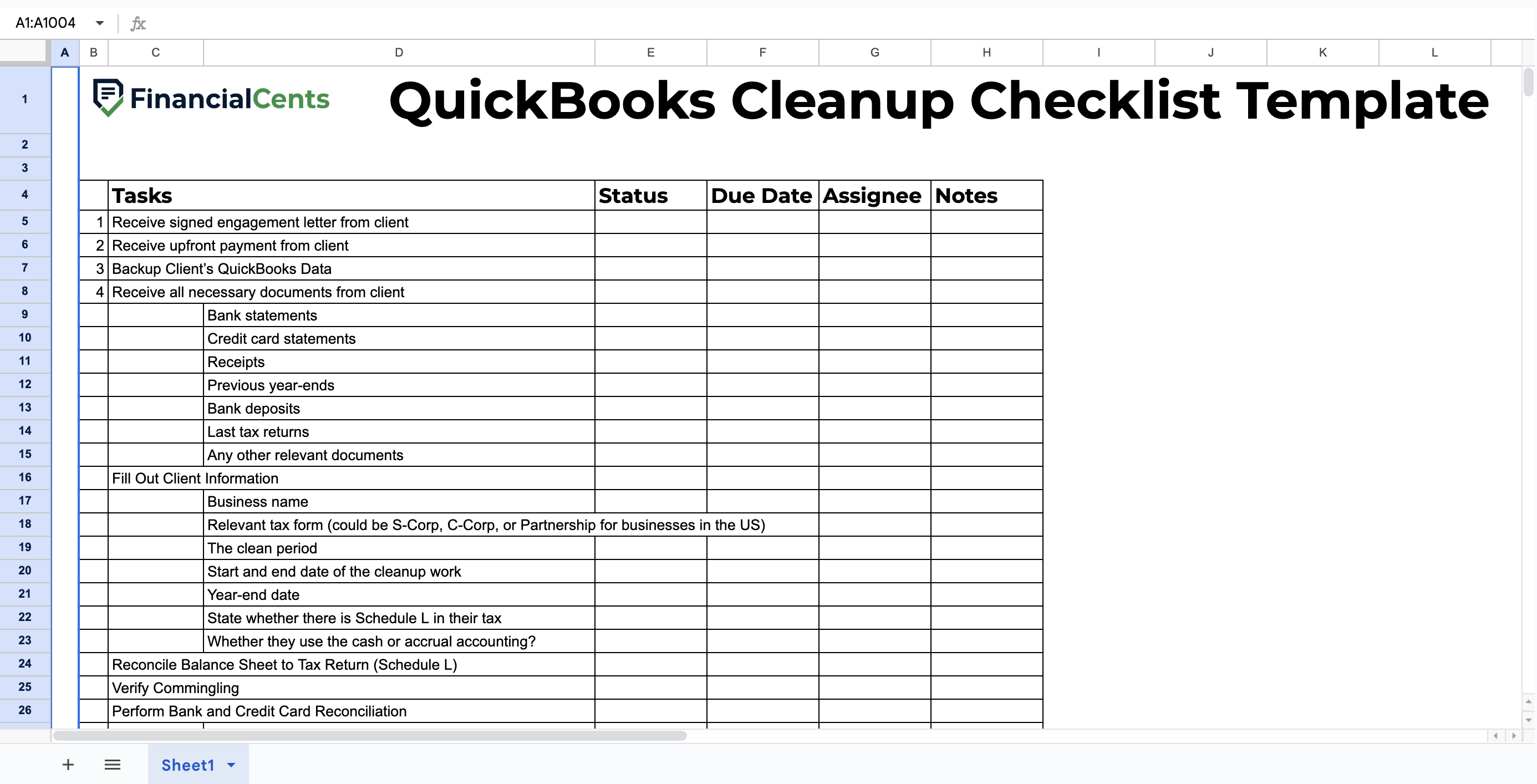

6. QuickBooks Cleanup Checklist Template

Making your clients’ books more complete, accurate, and tax-ready can be overwhelming, especially for inexperienced employees.

The QuickBooks cleanup template is designed to streamline the process for everyone involved.

Why You Need It

This template simplifies QuickBooks cleanup by laying out the process for your team in one central place. When used well, your team will become faster, more accurate, and more efficient at reviewing and cleaning up your client’s financial data.

How to Use It

- Download the template here.

- Review the tasks for missing or unnecessary steps.

- Share with your team (or use it inside Financial Cents by creating your account for free here).

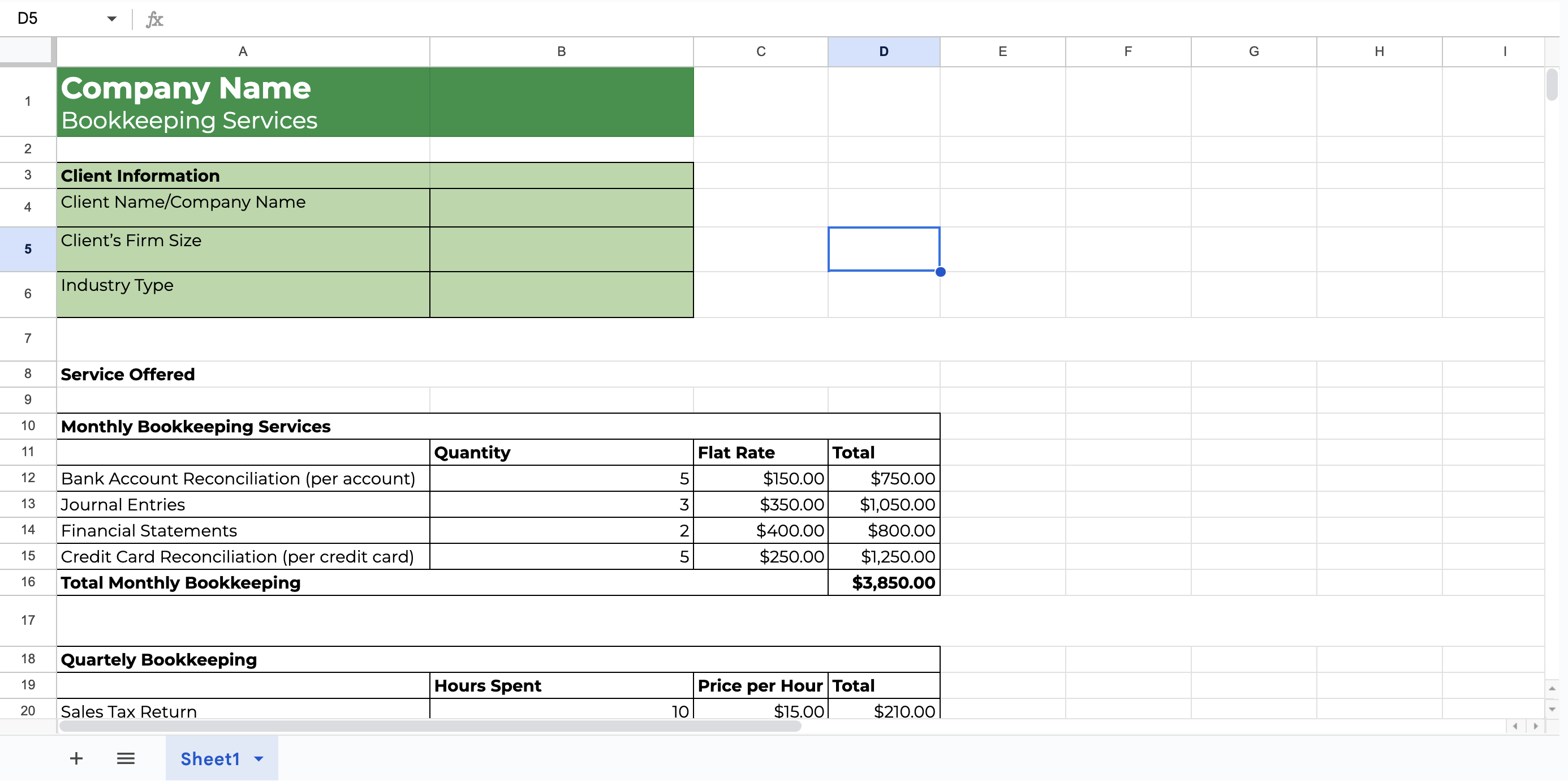

7. Bookkeeping Pricing Template

This template makes your bookkeeping pricing structure easier to understand. Communicating your rates on time helps clients budget adequately and makes your firm look more professional.

However, creating your rate card from scratch each time you add a new client is time-consuming. Once you download and customize this template to your pricing structure, you’ll have a ready rates card you can share with your clients whenever necessary.

Why You Need It

Your rate card helps to screen clients who might not be a good fit for you (if they think you’re overpriced). This bookkeeping pricing template empowers you to share your rate and screen out misfit clients quickly.

How to Use It

- Download the template here.

- Add the client’s information.

- Replace the fees with your specific rates and supply missing information (or remove unnecessary steps).

- Store it in your file management system.

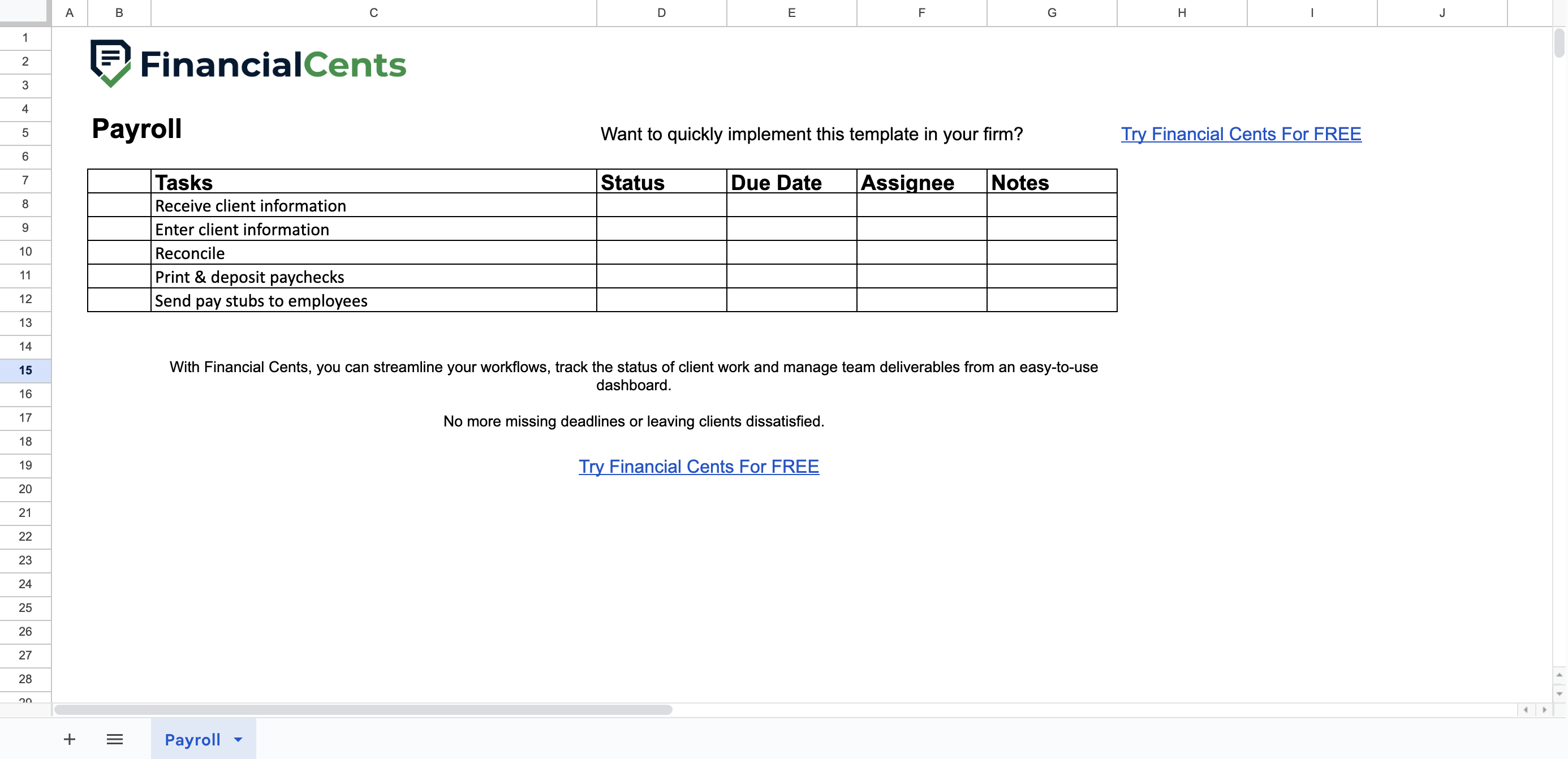

8. Free Payroll Checklist Template

You can store your operating procedures in your head when managing payrolls for a few clients and you may do just fine.

But as your clients and staff increase, documenting your procedures becomes critical to timely and accurate payroll project management.

Why You Need It

Using this template to create projects for your team gives you visibility into your payroll projects.

It also tells your staff what to do ahead of time, making for a faster turnaround time for your payroll projects.

How to Use It

- Download the template here.

- Review the tasks to see how well they align with your payroll procedures.

- Share with your team (or use it inside Financial Cents by creating your account for free here).

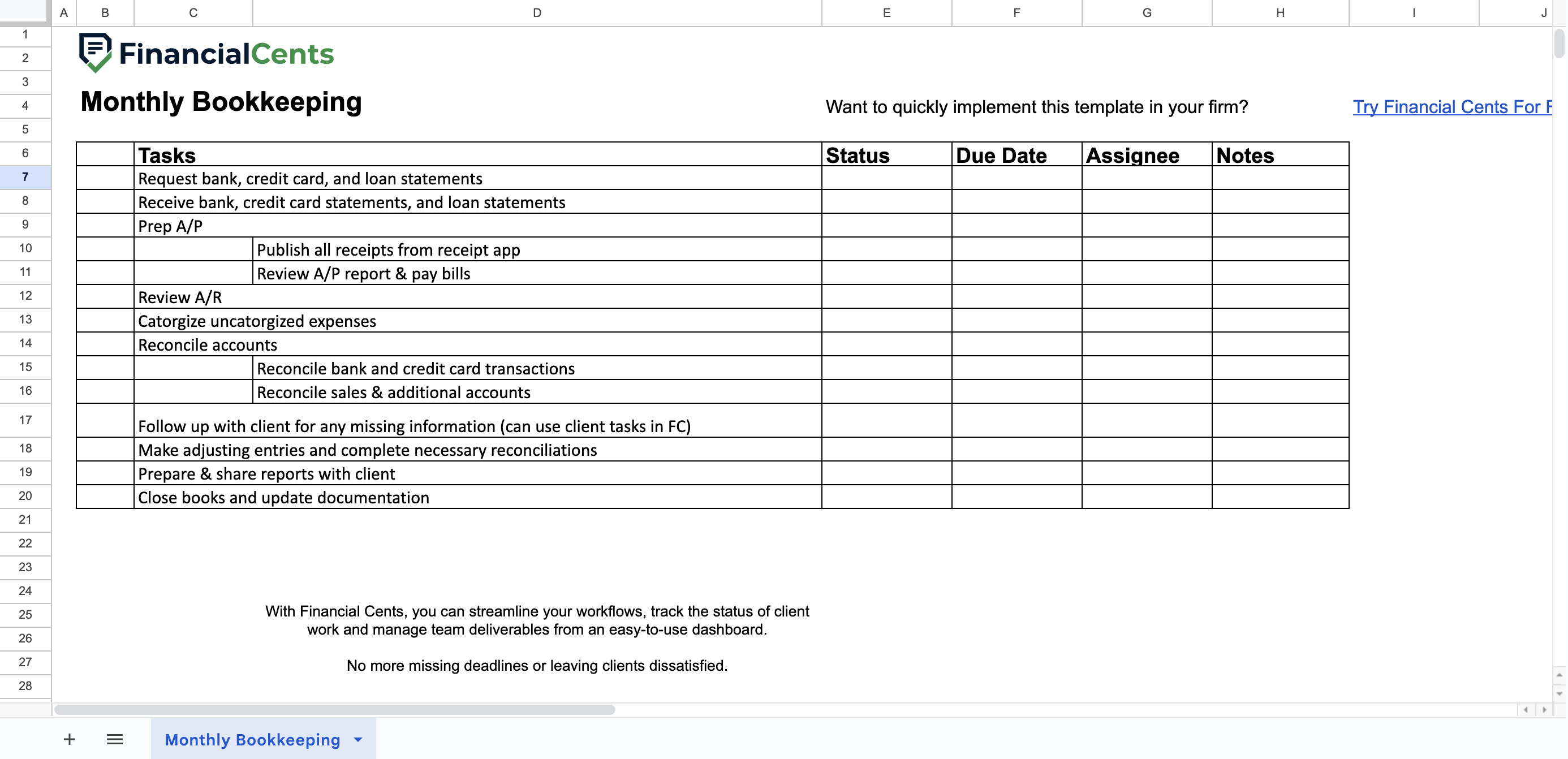

9. Free Monthly Bookkeeping Checklist Template

This monthly bookkeeping template helps you maintain up-to-date records of your client’s financial activities.

With columns for assignees, status, and due date, this template tracks the progress of your monthly bookkeeping projects.

If anything noteworthy happens during the work, it can be added to the notes section. This helps bookkeeping teams collaborate and get work done efficiently.

Why You Need It

This template ensures accurate financial reporting by ensuring that your team does not forget to collect relevant information from your monthly bookkeeping clients. It also helps them remember every step needed to complete the monthly bookkeeping process.

How to Use It

- Download the template here.

- Review each step to see where to add or remove any step.

- Share with your team (or use it inside Financial Cents by creating your account for free here).

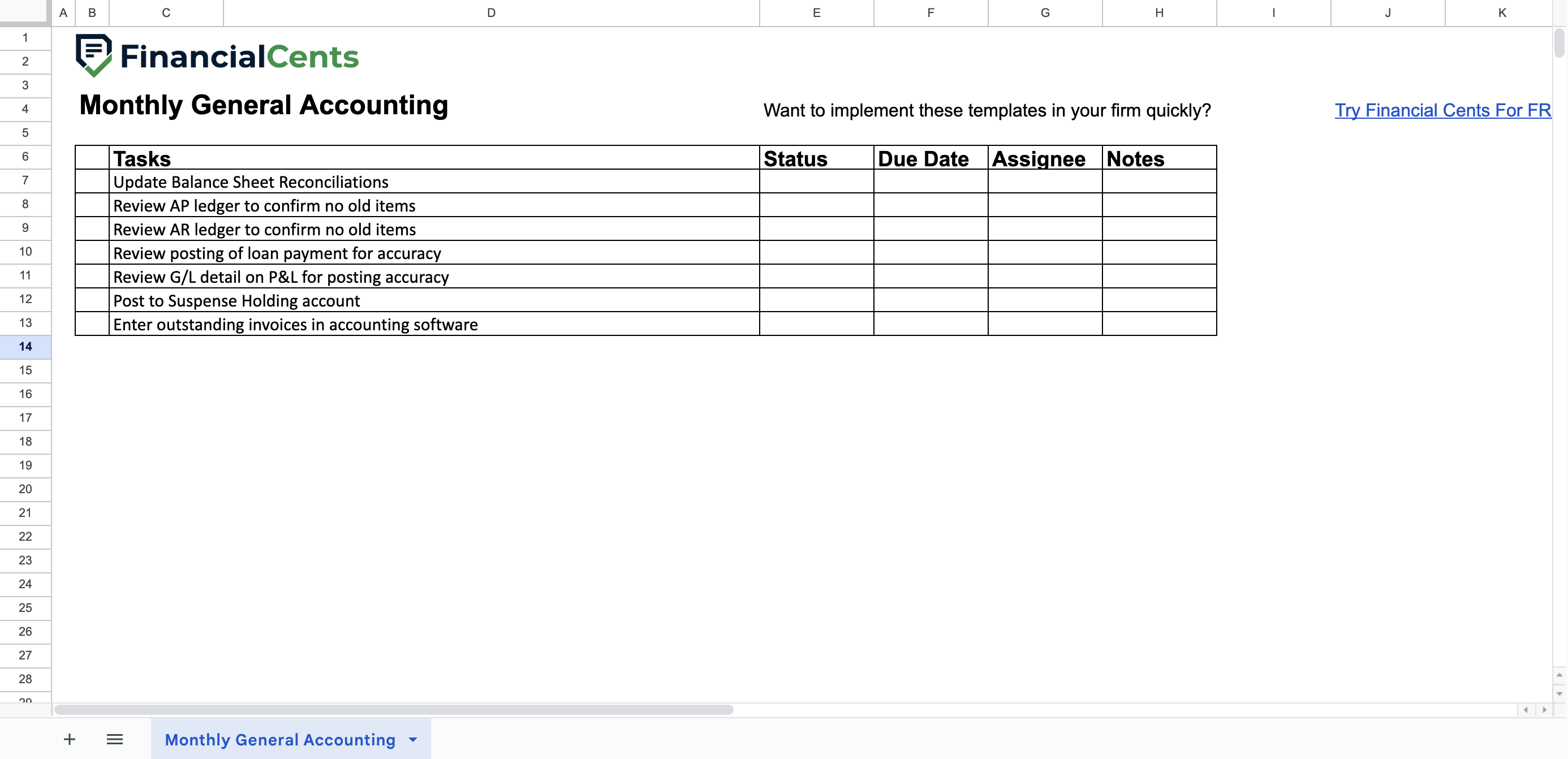

10. Free Monthly General Accounting Checklist Template

The monthly general accounting checklist template outlines the steps and activities that ensure the completion of your client’s financial records every month.

Why You Need It

It breaks down the monthly general accounting work, which enables your team members to focus on the task that falls to them. This makes the overall project more complete and accurate while giving clients accurate data for their financial decisions.

The template also helps you see changes that your team members make to your client records.

How to Use It

- Download the template here.

- Review the steps to ensure they fit the general accounting procedure needs of your clients.

- Share it with your team (or use it inside Financial Cents by creating your account for free here).

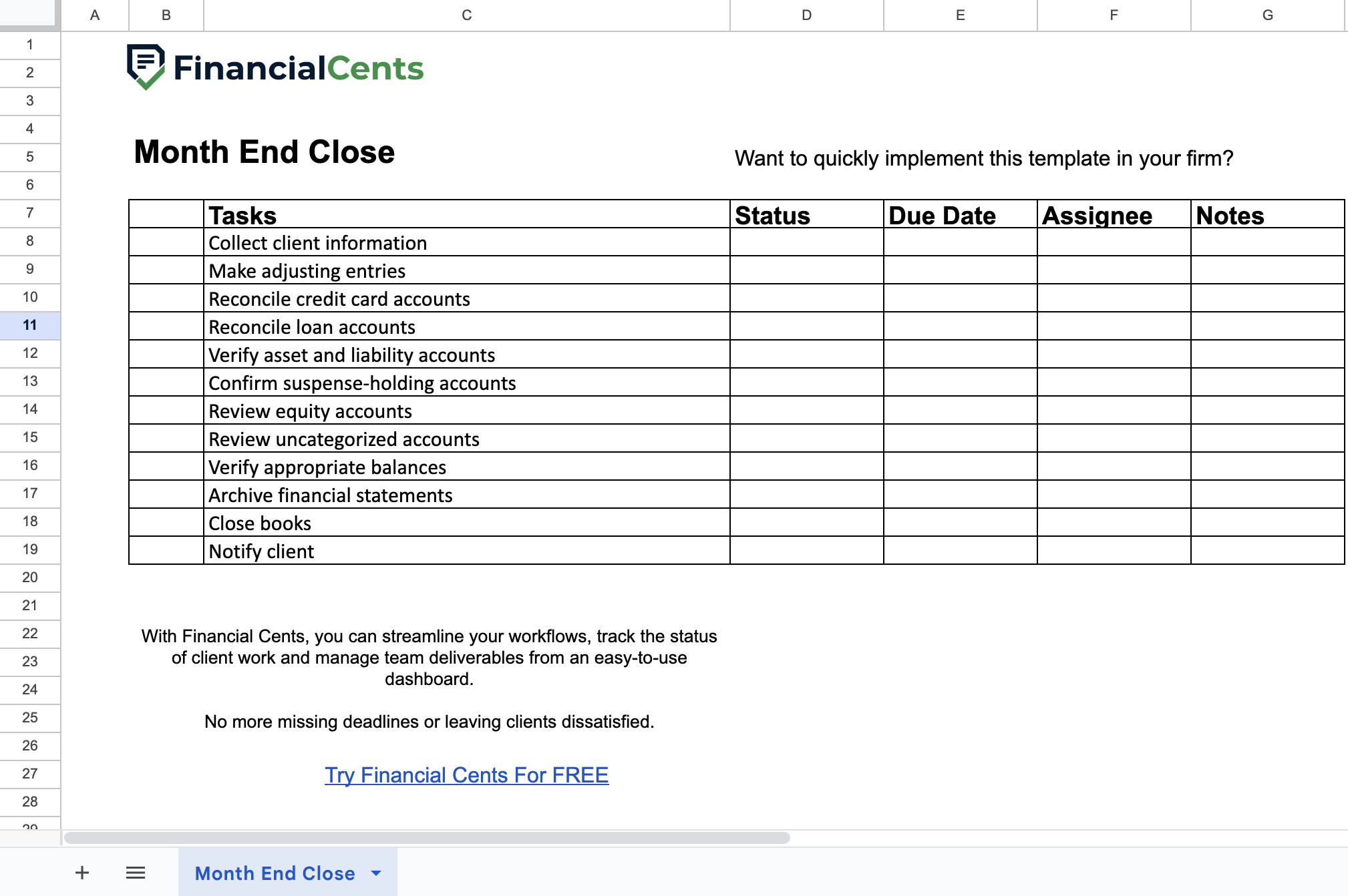

11. Free Month-End Close Checklist Template

This Accounting and Bookkeeping template breaks down the month-end close process into smaller, more actionable parts.

Why You Need It

The last thing you want your team to do during their month-end work is second-guessing their approach to work. Any time spent second-guessing themselves can affect their ability to ensure your client’s financial reporting is through.

Thanks to this well-laid-out month-end procedure, your team can focus on spotting and fixing errors.

How it can be used

- Download the template here.

- Review the steps to be sure they all fit the general accounting procedure needs of your clients.

- Share with your team (Or create an account with Financial Cents to access the template here).

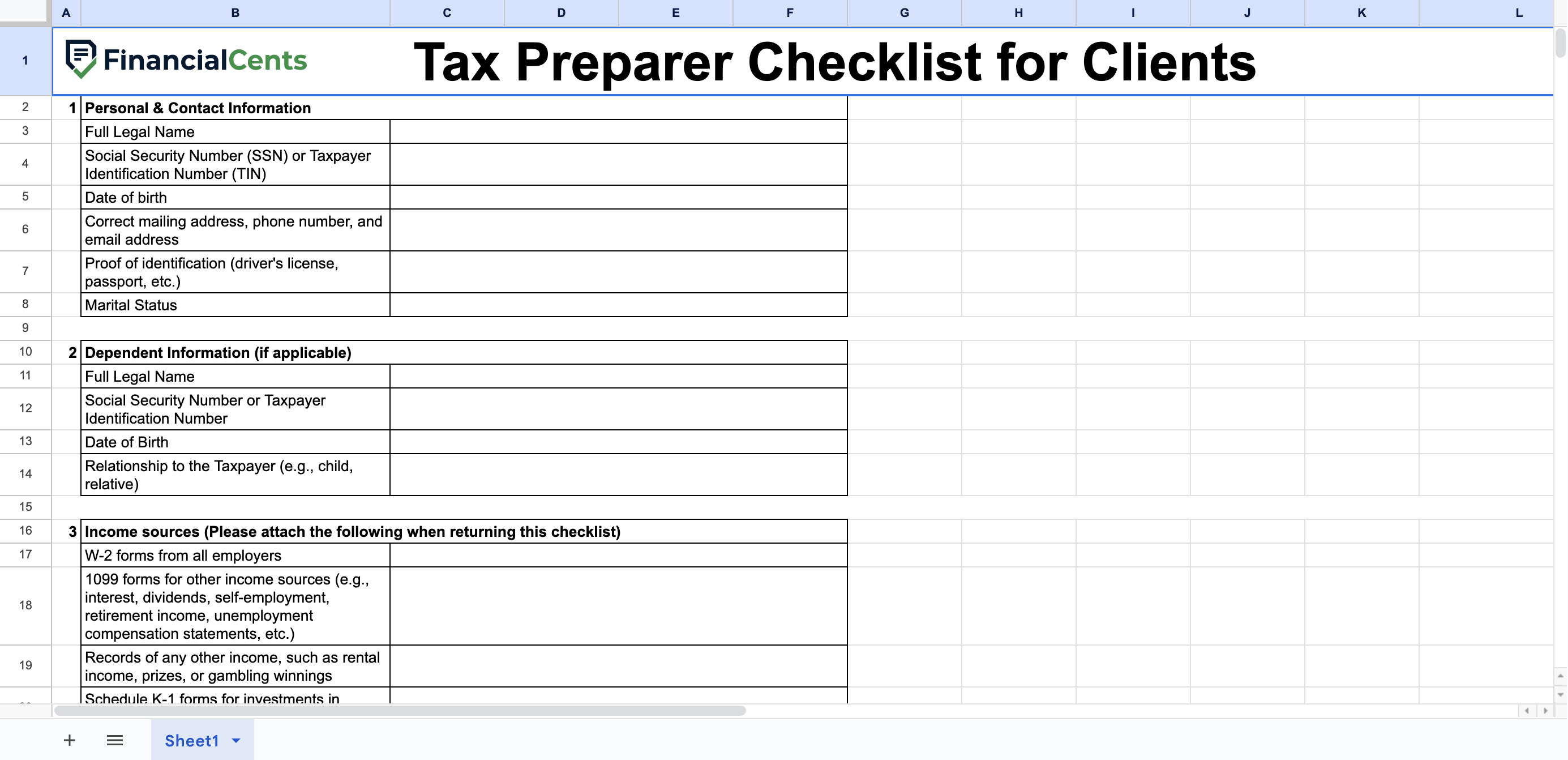

12. Tax Preparer Checklist Template for Clients

The tax preparer checklist template sets up your team for success during the busy season.

With spaces to request information like personal & contact information, dependent information, income sources, SSN, taxpayer number, deductions and credits, and other relevant documents, the templates will help you remember to collect all the information you need to file client taxes on time.

Why You Need It

This template is important because increasing your client base requires better management of your resources—the pressure to complete more projects within the same timeframe increases.

This template shows all team members the specific information they need from clients to get their tax work done.

When followed well, your team will approach tax season fully equipped (or be clear on what’s missing) with relevant client information and documents.

Here to Use It

- Download the template here.

- Review the data for missing or unnecessary information. Add and remove information or document requests where necessary.

- Share with your team and clients.

Benefits of Using Accounting Spreadsheet Templates

-

Improves Efficiency and Saves Time

Templates eliminate guesswork out of your service delivery by equipping you and your team with every piece of information they need to meet client deliverables.

Without it, your employees will waste time figuring out the procedure. Eventually, they will resort to processes that suit them, which may take them more time to complete or result in preventable corrections that increase the time spent on the project.

-

Reduce Errors and Increase Accuracy

When your team members are left to figure out the procedure for their work, mistakes are more likely to happen.

Built with input from seasoned accountants and bookkeepers, our templates accurately capture most, if not all, of your accounting processes.

Over time, this improves reporting accuracy and builds greater client trust.

-

Standardize Processes and Enhance Consistency

Consistency is essential as your firm grows. Templates ensure that both new and experienced team members follow the same procedures and deliver work to the same standard. It helps ensure your team the same result, regardless of the person executing it.

Plus, your firm won’t grow as much as it can until you get your SOPs out of your head so that any staff member can complete projects to your standard.

Two Reasons to Move from Accounting Spreadsheets to Workflow Software

-

The Need to Regain Time for Revenue-Generating Activities

Spreadsheets require you to manually enter data, track work, and schedule tasks for your team.

That is why about 45% of accountants and bookkeepers who use spreadsheets spend 1-5 hours per week scheduling and updating their tasks on spreadsheets. Some spend as much as 10-15 hours.

Unlike workflow software that auto-populates data, auto-tags projects (to show their status), and auto-creates (so they are not forgotten). This reduces the time spent on these tasks from five (5) hours to less than an hour a week, giving you more time for more strategic tasks.

-

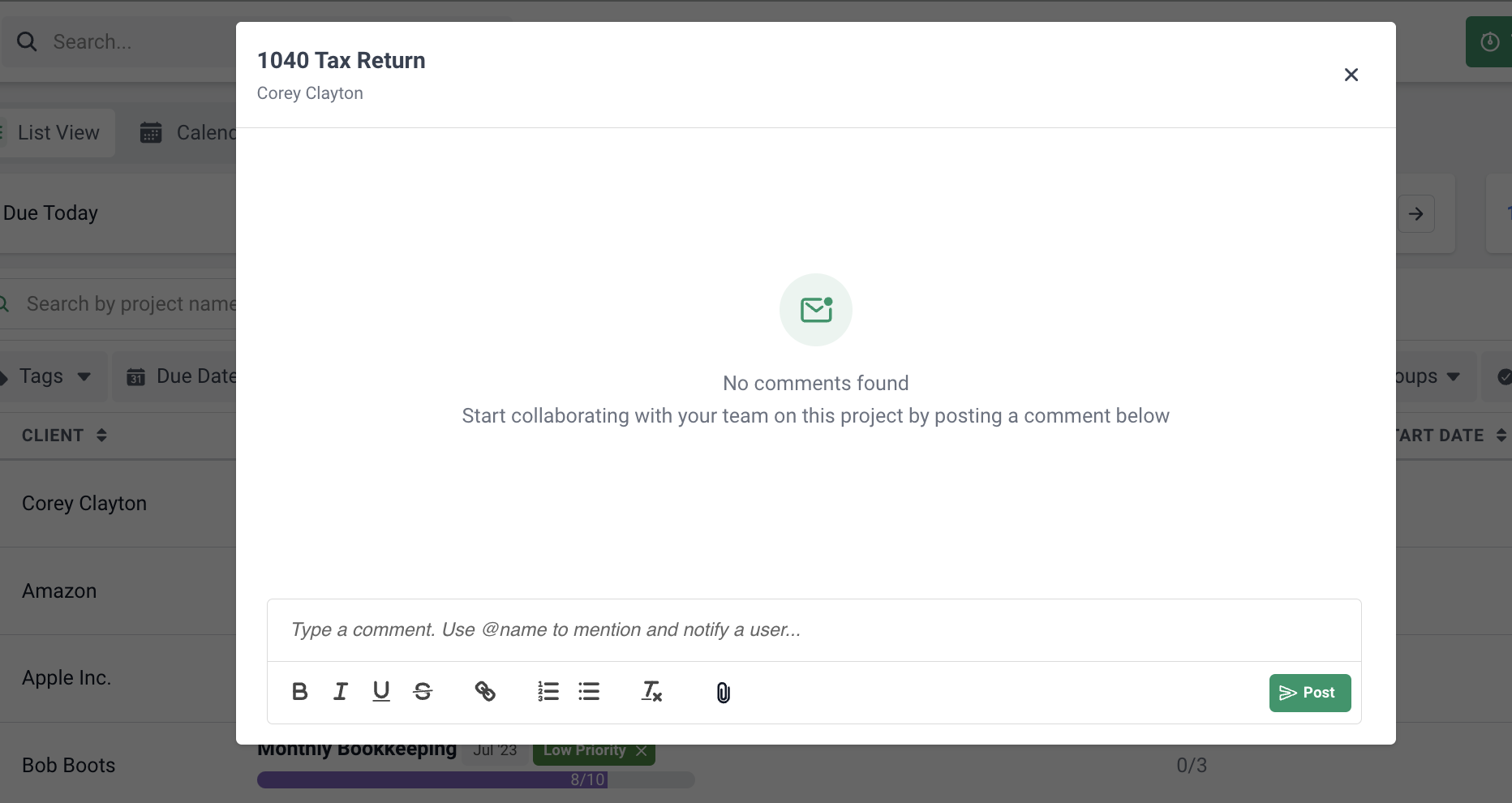

The Need to Collaborate with Your Team and Clients

Collaboration in spreadsheets requires accounting teams to create several versions that they can share back and forth with their team members. In the end, they will update the master spreadsheet from the other versions.

This increases admin work and the chances of losing valuable information in individual email inboxes. Client communication is almost non-existent here in spreadsheets.

That is why 53% of accountants and bookkeepers who use spreadsheets struggle to collaborate, while 18% cannot collaborate.

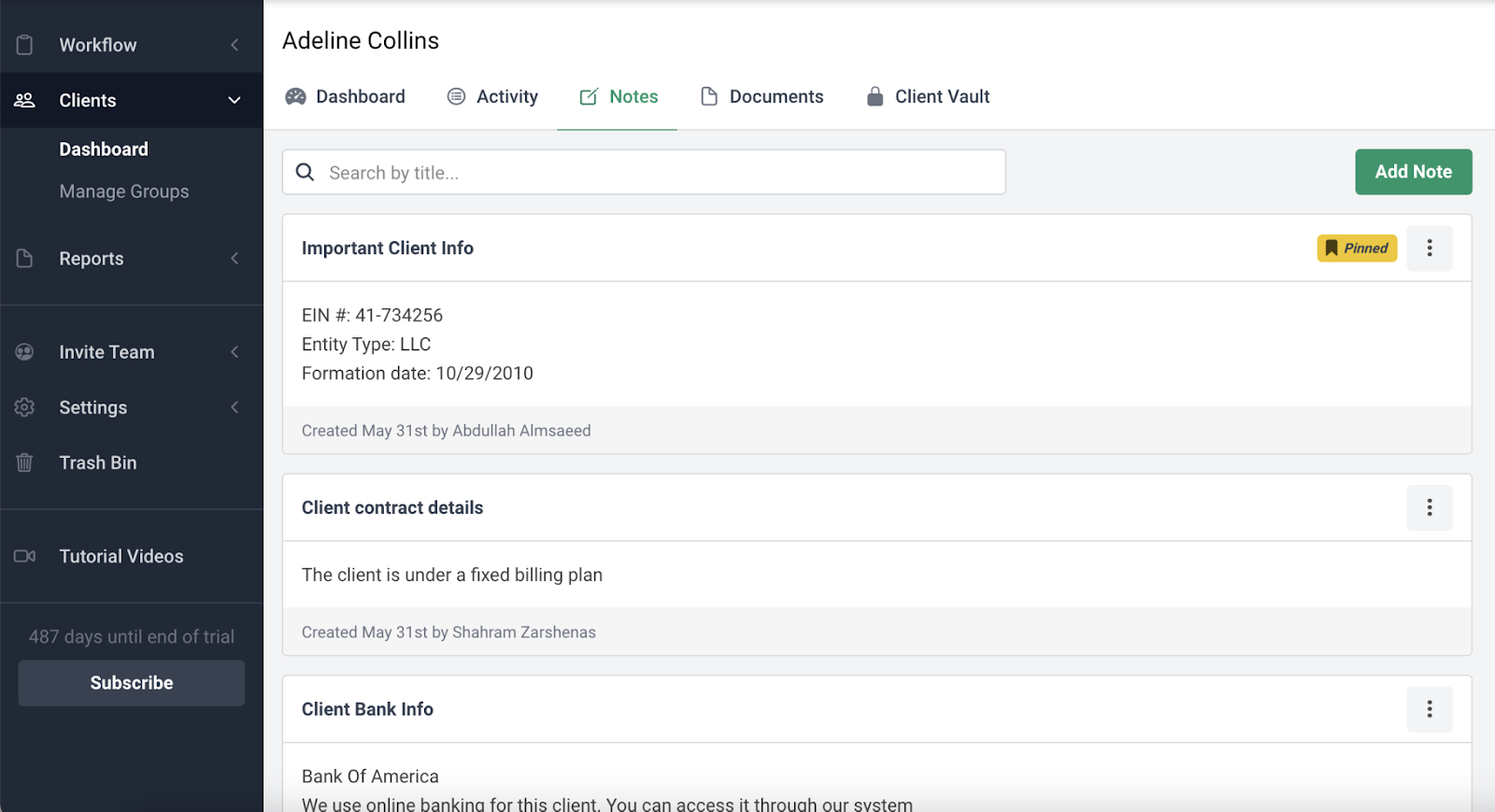

With Workflow Software, the Team Chat Feature lets you communicate with your team inside the client project.

You can use:

- The @Mention button to tag your team members in your comment to draw their attention to the comment.

- Client Notes to share client-related updates with your team.

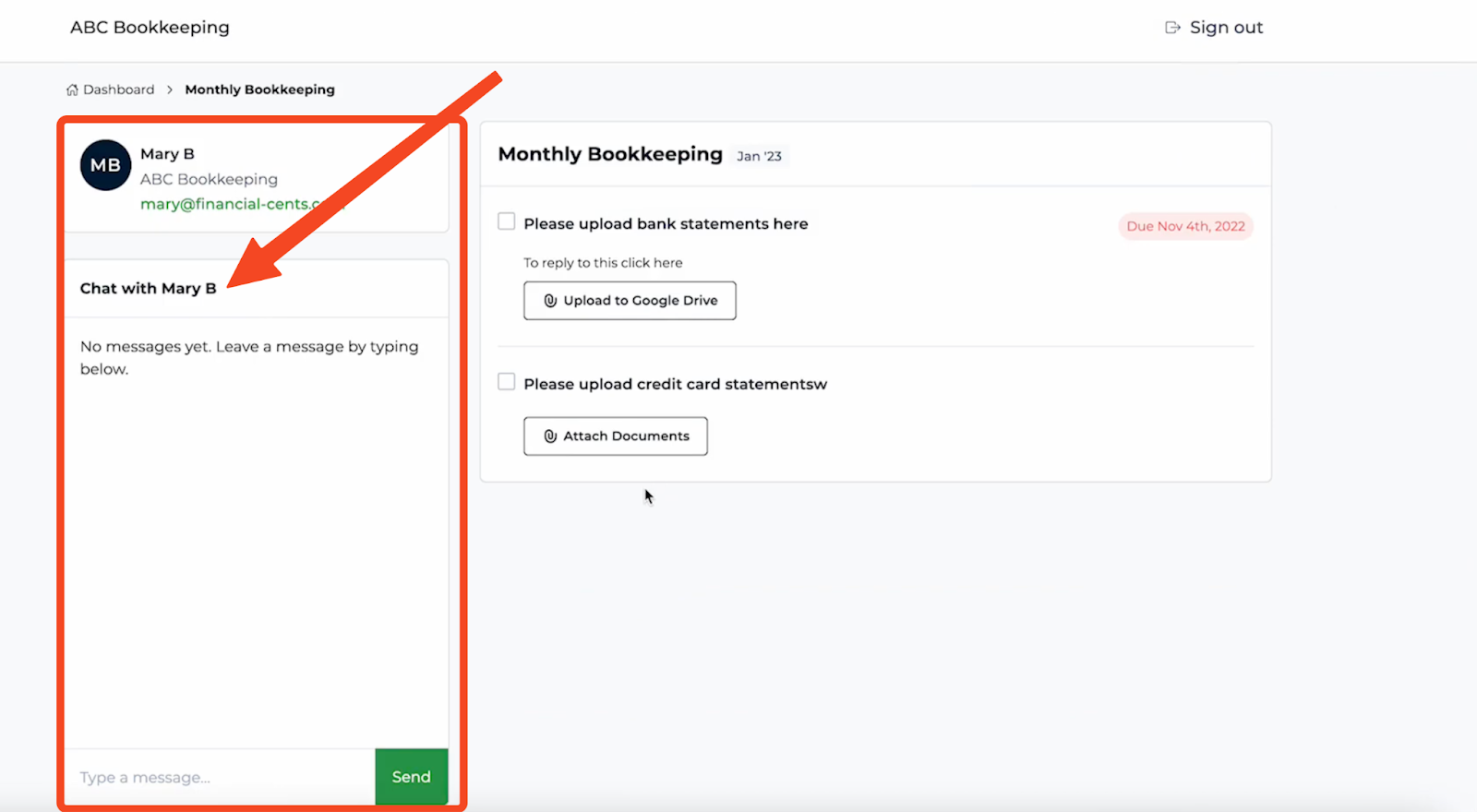

Financial Cents Client Portal enables client communication and collaboration.

In the portal, you can

➔ Request client information and documents

➔ Request client signature on documents and file returns

➔ Discuss with clients to better understand what you want.

Put Your Accounting and Bookkeeping Templates to Better Use Inside Financial Cents

The 15 templates shared in this guide are designed to help you bring structure and clarity to your accounting processes. From foundational financial statements to recurring operational checklists, each template plays a role in reducing errors, saving time, and improving consistency across your firm.

The usefulness of an accounting spreadsheets begins and ends with a one-person (two-person, at maximum) team.

Once your team exceeds a manageable client or staff threshold, spreadsheets begin to create too many blind spots in your firm’s workflow, client, and team management. It becomes amplified as your clients (with their unique accounting and bookkeeping needs) increase.

Using your Excel templates in Financial Cents enables you to create work directly from your accounting spreadsheet templates.

Once you have created the project from your accounting spreadsheet template, you can:

- Assign each task in the template to your team members.

- View the status of all client work in one simple workflow dashboard.

- Collaborate with your clients in a secure client portal.

See all of these in action with a 14-day Free Trial.