Our tech stack organizes our day-to-day work to reduce our workload and reliance on our memory."

Stacey FeldmanWith a solid and integrated technology system, you can achieve any goal you set for your firm, wherever you are.

Software for accounting firms makes manual, time-consuming tasks more efficient and reliable.

However, finding the right combination of software solutions (that will grow with your firm) can be overwhelming.

You likely lack the resources (time, money, and personnel) to research and try out the large number of apps available on the market.

This article will show you some of the best apps for your accounting, bookkeeping, CFO, and tax firm needs in 2024.

Types of Software You Should Have in Your Firm

a. General Ledger

This software solution helps with recording your client’s financial transactions. It presents the information on inventory, sales, purchases, assets, and liabilities, which forms the basis of your client’s financial reports.

b. Practice Management

Accounting practice management software works like the human brain that holds your firm together.

It reduces administrative work, enhances collaboration, and stores the information you need to manage your projects, clients, and team in one place.

c. Tax Preparation

Tax preparation software provides the tax workflows and calculations that help tax preparers file their client’s tax returns as efficiently as possible.

d. Project Management

Project management software provides visibility into client projects and automates manual processes, helping accounting teams finish work on time.

e. Payroll

Payroll software helps process and administer your firm’s and clients’ salaries, wages, and deductions.

This ensures that employees are paid the right amount on time, improving employee morale and regulatory compliance.

f. CRM

The CRM software tracks everything you and your clients have done together so that you can focus on improving the relationship.

CRM tools enable you to ask the right questions and offer services that your client needs by helping you organize client information in one place,

The Top 10 Software for Accounting, Bookkeeping, CFO and Tax Firms

1. QuickBooks (General Ledger)

QuickBooks is a cloud-based software that organizes your client’s financial records, reports, and documents in one place. It allows you to monitor your sales, purchases, and expenses to maximize revenue.

Its set of features is beneficial for both simple and complex financial needs.

These features include:

- Invoice Tracking: invoice tracking that automates payment reminders to ensure timely payments.

- Workflow Automation: sales and billing workflows with automatic approval requests and notifications processes.

- Bank Feeds: connect clients’ QuickBooks accounts to their banks for real-time visibility.

- Expense Tracking: tracks clients’ expenses in one place and improves your ability to manage their tax deductions.

- Inventory Management: Real-time inventory manager that gives regular updates on low stocks to help order management.

Integrations

Here are a few of the apps QuickBooks integrates with:

- Financial Cents

- PayPal

- Square

- Amazon Business

- Gusto

- Zapier (5,000+ apps)

Price

QuickBooks costs:

- $8/month per subscription (QuickBooks Ledger)

- $9/month (Simple Start)

- $13.50/month (Essentials)

- $19/month (Plus)

- $38/month (Advanced)

Free Trial

QuickBooks offers a 30-day free trial.

Reviews

QBO has 4.3 (out of 5) stars on Capterra and 4.0 out of 5 stars on G2.

| Pros | Cons |

| Ease of use | Advanced features have a learning curve |

| Mobile access | |

| Real-time financial data |

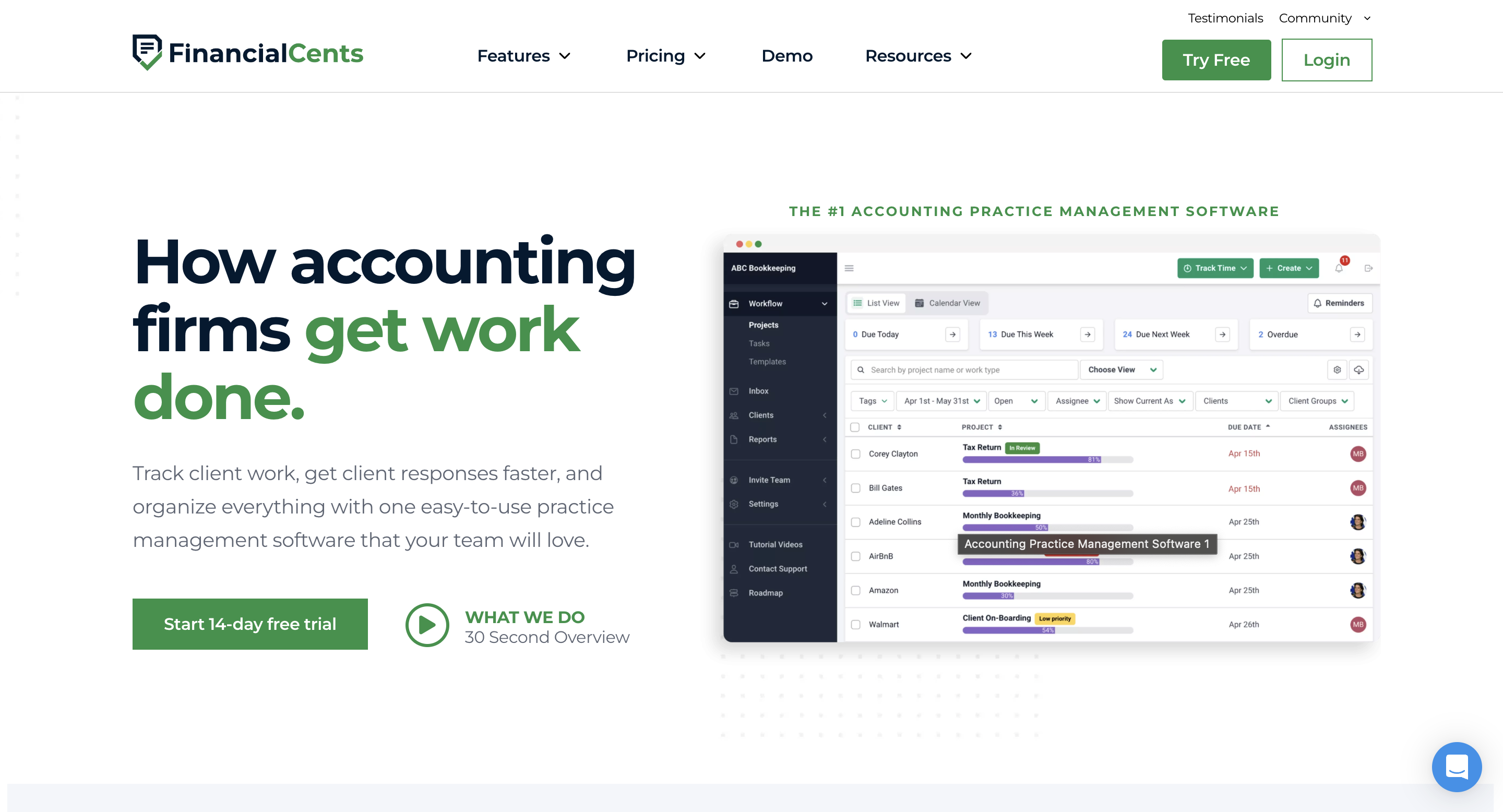

2. Financial Cents (Practice Management)

Financial Cents is the backbone of everything in an accounting or bookkeeping firm. If Financial Cents weren't there, we would fall apart."

Alexis Sadler, CEO of Accounting Therapy, Inc.Financial Cents organizes your accounting firm by storing information relating to projects, clients, and team communication in one place.

Remote work denies you the chance to go over to your team member’s desk to discuss project or client needs. With Financial Cents, you get firm-wide visibility, enabling you to confidently hold your team accountable and make time-sensitive decisions.

Its practice management features include:

- Time Tracking: start and stop timer that keeps your firm working on the right projects at the right time profitably. It also helps you measure your ROI by client based on your time commitment and revenues generated.

- Capacity Management: employee dashboard that monitors your team’s workload to prevent burnout and maintain peak performance.

- Email Management: Gmail and Outlook integration that gives you better control of your inbox by bringing all your client emails into a focused client folder inside Financial Cents.

- ReCats: client collaboration that clarifies uncategorized transactions and allows you to update them in QuickBooks from Financial Cents.

Integrations

Financial Cents integrates with other accounting-critical solutions like:

- QuickBooks Online

- Gmail and Outlook

- SmartVault

- Adobe Sign

- Zapier (5,000+ apps)

Price

Financial Cents costs:

- $9/month for the solo plan on an annual billing cycle

- $39/month per user (Team Plan)

- $59/month per user (Scale Plan)

Free Trial

14 Days free trial

Reviews

| Pros | Cons |

| Ease of use | Only caters to the accounting industry |

| Visibility across firm | |

| Insightful community of accounting and bookkeeping professionals |

3. Drake (Tax Preparation)

Drake is designed for tax ease and flexibility. It takes care of the heavy lifting by automating the tax return process, so that you can focus on client service and firm growth.

Drake’s Features Include:

- Drake Scheduler: manages a tax preparer’s appointments and daily schedules. It also generates tax organizers and client email reminders.

- Tax Planner: analyzes a client’s tax returns over several years to find money-saving opportunities.

- Research Tool: customizable feature to keep tax preparers up-to-date with industry regulations.

- Drake Documents: organizes years’ worth of tax-related files and forms.

- Data Backup: keeps your clients’ tax data safe against system failure.

Integrations

Drake integrates with the following solutions to sync your data across the board.

- SmartVault

- Right Networks

- Cloud 9 Hosting

- Doc.It

Price

Drake costs:

- $355 per return for 10 tax returns. Additional individual returns cost $34.99 while additional business returns cost $49.99.

- Its 1040 plan costs $1,620 for unlimited individual tax returns and $1,970 for unlimited business tax returns.

Free Trial

14 Day free trial

Reviews

Drake has 4.0 (out of 5) stars on Capterra and 4.5 (out of 5) stars on G2.

| Pros | Cons |

| Easy to use | Real-time updates require all users to log out, which can be cumbersome for large firms |

| Multi-year tax analysis |

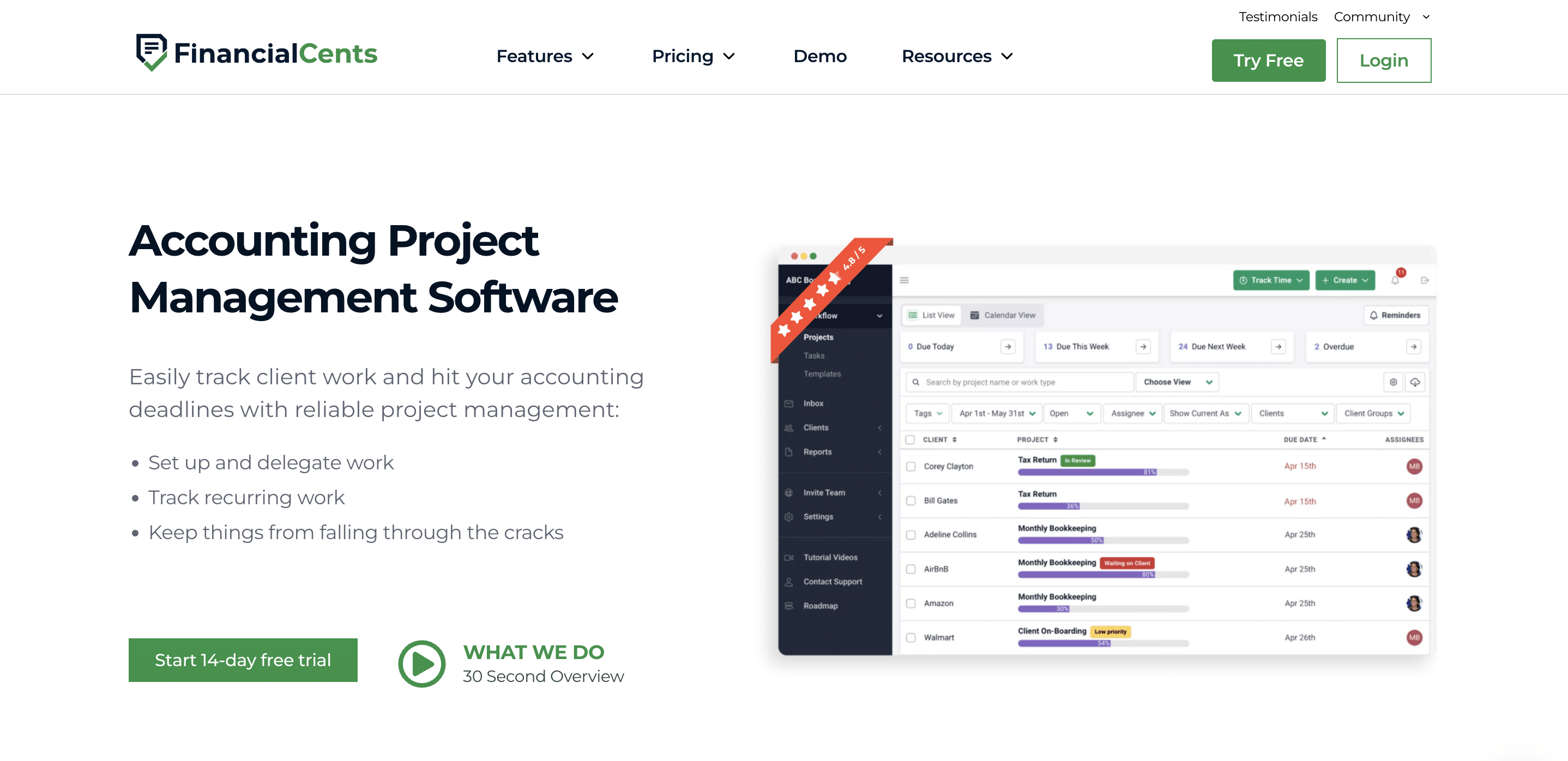

4. Financial Cents (Project Management)

Financial Cents provides clarity (and comfort) that things are getting done on time and properly. It provides the structure that enables scalability."

Stacey Felman, COO of Full Send FinanceFinancial Cents project management solution keeps you on top of client projects and helps your team collaborate to meet client deadlines at scale.

Its project management features include:

- Workflow Templates: SOPs that standardize the completion of client projects.

- Tag Automation: automatic work status to track client projects on the go.

- Recurring Projects: automatically create repetitive work to prevent forgetting and letting it slip through the cracks.

- Dependencies: automatic work hand-off between team members in projects that require multiple hands.

- Team Chat: a collaborative space for accounting teams to share files and information with teammates.

- Document Storage: project-relevant files organized inside the project.

Integrations

Financial Cents communicates with other software solutions, such as:

- QuickBooks Online

- Gmail and Outlook

- SmartVault

- Adobe Sign

- Zapier (5,000+ apps)

Price

Financial Cents costs:

- $9/month for the solo plan on an annual billing cycle

- $39/month per user (Team Plan)

- $59/month per user (Scale Plan)

Free Trial

14 Days free trial

Reviews

| Pros | Cons |

| Feature-specific videos that increase adoption. | No direct billing feature |

| Superior customer service |

5. Gusto (Payroll)

Gusto streamlines payroll, benefits administration, and employee time tracking for small and mid-sized businesses.

Its features include:

- Time Tracking: records employees’ time for managerial approval and payment.

- Project Management: visibility into employees’ work to help resources management.

- Sync Payroll Hours: Automatically syncs employees’ hours with their payroll.

- Workforce Reporting: organizes team reports by date, departments, and employees for efficient analysis and decision-making.

- PTO Administration: automates paid time off processes to free up time for strategic tasks.

Integrations

- Accounting Suite

- ActiveCampaign

- AllGeo

- Bookkeeper360

- Docusign

- Zapier (5,000+ apps)

Price

Gusto costs:

- $40/month (Simple Plan)

- $60/month (Plus Plan)

- $135/month (Premium)

Free trial

Gusto allows you to create an account you can use until you process your first payroll.

Reviews

4.6 (out of 5) stars on Capterra and 4.5 (out of 5) stars on G2.

| Pros | Cons |

| Auto-sync hours | State compliance features can be better at the city and country level. |

| Tax payments |

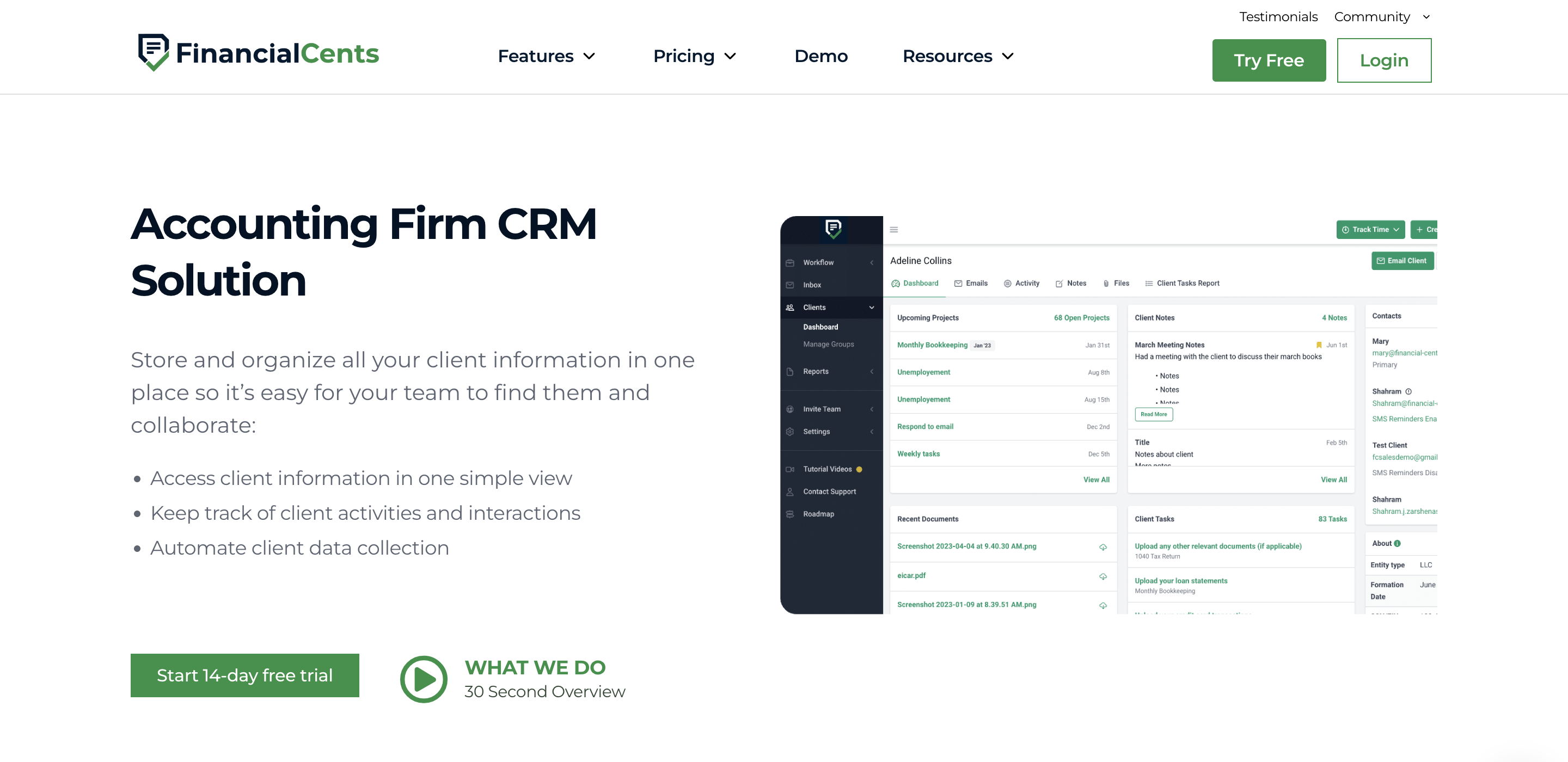

6. Financial Cents (CRM)

Financial Cents’ client management solution helps accounting firms and CPAs store client information to get work done to the client’s satisfaction.

This solution enables accounting teams to collaborate with clients and get project-related information faster.

Its CRM features include:

- Client Database: a dashboard that displays all client information in one view.

- Client Activity Tab: shows which team member last contacted a client and what they talked about, helping you to stay up to date with your client relationships.

- Client Emails: An integration with Outlook and Gmail that brings all client emails into a dedicated folder in Financial Cents.

- Client Task: allows you to request and securely receive client information. Its automated reminders save you the time and effort of chasing clients for information.

- Passwordless Portal: Magic link-enabled access that saves clients the inconvenience of creating one more login information.

- Client Vault: encrypts and stores sensitive client data (like passwords and credit card information securely.

Integrations

Financial Cents communicates with other software solutions, such as:

- QuickBooks

- Gmail and Outlook

- SmartVault

- Adobe Sign

- Zapier (5,000+ apps)

Price

Financial Cents costs:

- $9/month for the solo plan on an annual billing cycle

- $39/month per user (Team Plan)

- $59/month per user (Scale Plan)

Free trial

14 Day free trial

Reviews

| Pros | Cons |

| Ability to import clients from QBO | No native integration with Xero. |

| Automated client reminders |

7. Ignition (Proposal and Engagement Letters)

Ignition simplifies client engagement by automating the proposal, billing, and payment process.

Its features include:

- Engagement Letters: easy-to-sign proposals that establish terms of engagement by outlining your services, prices, and billing dates.

- Automated Client Payments: a convenient system for sending and receiving payments instead of chasing clients.

- Automated Billing: a set-and-forget billing system that eliminates incidences of unbilled work.

- Business Dashboard: visibility into revenue forecast, sales pipeline, and client contracts due for renewal.

Integrations

- QuickBooks

- Xero

- Gusto

- MYOB Business

- Xero Practice Manager

- Zapier (5,000+ apps)

Price

Ignition costs:

- $99/month (Core)

- $199/month (Pro)

- $399/month (Pro+)

Free Trial

14 Day free trial

Reviews

Ignition has 4.7 (out of 5) stars on Capterra and 4.5 (out of 5) stars on G2.

| Pros | Cons |

| Direct billing and invoicing | ACH payment takes a fair bit of time |

| Responsive customer service |

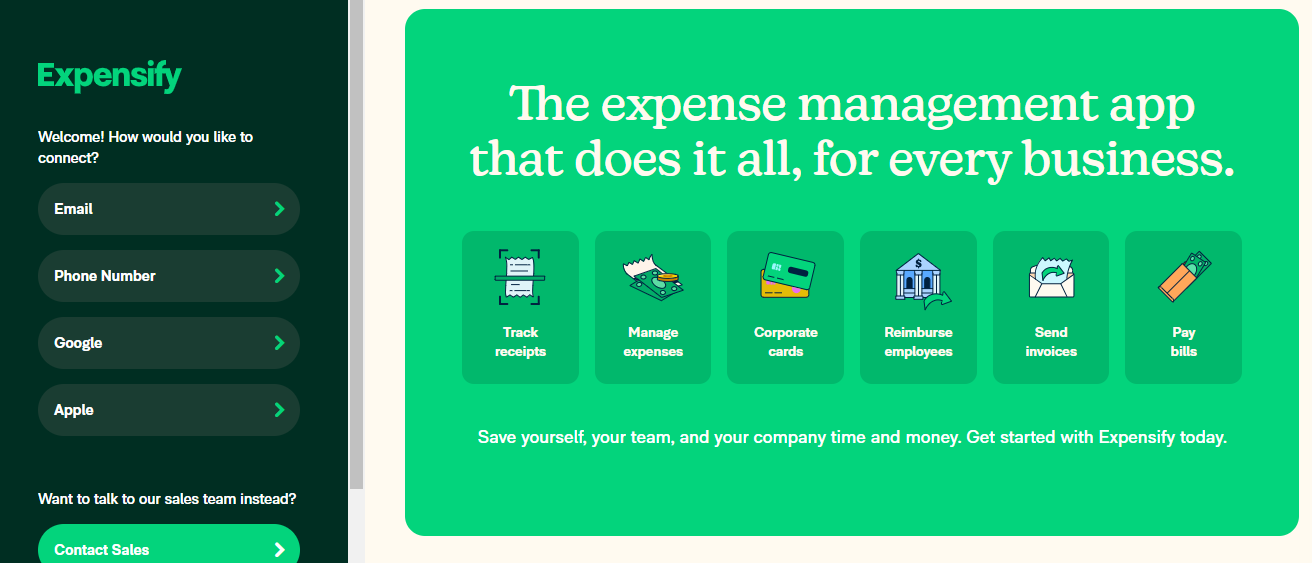

8. Expensify (Expense Management)

Expensify is a software that tracks, organizes, and reimburses expenses, enabling businesses to manage their expenditures.

Its features include:

- Receipt Scanning: allows users to snap images with their mobile devices and scan them into Expensify.

- Expense Management: validates reported expenses to ensure they are reimbursed adequately.

- Corporate Cards: reimburses expenses with the swipe of company cards.

- Global Reimbursements: an automated system that ensures stress-free local and cross-border payments.

- Invoicing: send invoices and get paid online.

- Invoice Templates: predesigned invoices that can be customized to suit your firm’s needs.

- Bill Pay: automated bill payments like a traditional bill payment app.

Integrations

- QuickBooks

- Xero

- Netsuite

- Sage Intacct

- FinancialForce

- Zapier (5,000+ apps)

Price

Expensify costs:

- $5/month per user (Collect Plan)

- $9/month per user (Control Plan)

Free Trial

Expensify offers a Six-week free trial.

Reviews

Expensify has 4.4 (out of 5) stars on Capterra and 4.5 (out of 5) stars on G2.

| Pros | Cons |

| Minimal learning curve | Customer service needs improvement |

| Ease of approval and rejection of expense requests |

9. SmartVault (Document Management)

SmartVault is an integrated document management software and client portal for accountants.

The DMS features allow firm owners to organize documents with clients while the client portal makes document collaboration easy and secure.

Its features include:

- E-signature: receive client approval for documents and forms inside SmartVault.

- Document Request Lists: send clients a list of the documents you need from them.

- Version Control: view the previous versions of your documents to track what has changed over time.

- Scanner Integration: a scanner that uploads your documents online with one touch.

- Bank-Level Security: automatic file backup and data encryption technology (AES-256) that keeps documents inaccessible to unauthorized persons.

- Mobile Enabled Experience: on-demand access from anywhere and with any device.

Integrations

- Financial Cents

- QuickBooks online

- Ultratax CS by Thomson Reuters

- Docusign

- Liscio

- Zapier (5,000+ apps)

Price

SmartVault costs:

- $25/month per user (Standard Plan)

- $45/month per user (Accounting Pro Plan)

- $65/month per user (Accounting Unlimited)

- $50/month per user (Business Pro)

Free Trial

14 Day Free Trial

Reviews

4.4 (out of 5) stars on Capterra and 4.3 (out of 5) stars on G2.

| Pros | Cons |

| Integrated document management and client portal | Require training to set up |

| Document security | |

| Version control |

10. Adobe Sign (E-Signature)

Adobe Sign provides one place for all your document signing tasks. Its E-signature features enable you to turn client engagements around quickly.

By enabling your clients to sign documents and forms online, you save them the stress of printing and scanning documents for signatures, which improves the overall client experience.

Its E-signature features include:

- Passwordless Access: clients can access and sign your documents without signing up.

- Document Scanner: easily scan and upload inside Adobe.

- Bulk Send: send a document to multiple signers with its personalization intact.

- Mobile Access: receive client signatures faster wherever your clients are.

Integrations

Here are some of the apps you can use with Adobe Sign:

- Netsuite

- Financial Cents

- Salesforce

- Zoho CRM

- GoogleDrive

- Dropbox

- Zapier (5,000+ apps)

Price

You can get Adobe Sign for:

- $12.99/month (Acrobat Standard)

- $19.99/month (Acrobat Pro)

Free Trial

14 Day free trial

Reviews

Adobe Sign has 4.6 (out of 5) stars on Capterra and 4.4 (out of 5) stars on G2

| Pros | Cons |

| Multi-language support | Limited room for customization |

| Signature management |

Factors to Consider When Selecting a Software Solution for Your Accounting Firm

Drawing on insights from Stay Feldman, COO of Full Send Finance, the following factors will help you get the blend of software solutions your team will find truly beneficial.

I. Functionality

Document your processes to see where things are sticky and where things can be automated. One of the primary features we wanted was workflow automation, which means creating a task list for clients that recur each month. It eliminates reliance on memory."

Stacey Feldman, COO of Full Send FinanceThe challenges you want to address with accounting software should inform your buying decision. Stacey took stock of her firm’s struggles before getting Financial Cents as their practice management software.

II. Scalability

We make every decision through the lens of scalability. We want to grow our firm four or five times what we are today. We don’t want our software system to hinder us in that process. So, as we think about delivering our work today, we ask ourselves if the tool will serve us when we are doing 10 times the volume of work we’re doing today?"

Stacey Feldman, COO of Full Send FinanceMaking software decisions with growth in mind is critical because switching tools when you have many clients will require you to re-train your clients to use them, which can impact your client experiences negatively.

-

Customer Support

Customer support reduces a product’s time to value. It also helps troubleshoot problems, helping you to maximize software to meet their strategic and operational goals.

-

Integrations

Maximizing your tech stack depends on your ability to connect them. It enables you to perform several tasks from one app instead of jumping between individual apps.

Look out for relevant native integrations in the tools you’re considering. This will determine how well your apps will communicate with each other in an integrated system.

-

User-friendly Interface

What good will a piece of software do if your employees need to devote more time and mental energy to understanding how to use it to complete tasks?

In evaluating a product, make sure it is:

- Easy to install (and update).

- Easy to navigate

- Secure

- Fast

This is where free trials are invaluable. Many software developers allow you to take their product for a spin (for two weeks or more) to see how it will work in your firm.

-

Reviews and Testimonials

User reviews are important because they communicate unfiltered opinions about a software product.

Users are more likely to recommend a good product they have used (and warn against a bad one) so that potential users can be guided.

Platforms like Capterra and G2 are filled with reviews and testimonials from verified app users.

FINANCIAL CENTS: One Powerful, Easy-to-Use Software to Manage Your Accounting Practice

It’s best to have a single software solution that does everything you need from software products. But that is almost impossible.

The next best thing is to have most of the features you need in one tool. It prevents context (and app) switching and allows your team to focus on their tasks.

This is what Financial Cents offers accounting firms and CPAs. Here’s an end-to-end process of managing projects, clients, and employees in Financial Cents.

-

Create Work and Client Profile in Financial Cents

OPTION 1: Create work from scratch by entering the client and project information.

OPTION 2: take advantage of the Zapier integration to automatically create client work and profile when a prospect signs your engagement letter in Ignition, Anchor, or other proposal software.

Whichever option you choose, Financial Cents allows you to establish the order of completing the work with the dependency feature. And if it’s a repetitive project, you can set it to recur with the recurring work feature.

-

Track the Project

The client’s project is added to your dashboard from where you can track its status through the stages. Workflow Filters helps you quickly search for the client’s information in your workflow dashboard.

-

Request Client Information and Signature

The client task feature allows you to request files and information from the client without leaving Financial Cents.

Thanks to a secure and passwordless portal, your clients can grant your requests on the go and when they need clarity, they can ask using the Client Chat feature.

-

Store Client Information

The client is given a profile (database) in Financial Cents, where their information (including contact, project, login, SSN, EIN, etc.) is stored. There is also the Custom Fields feature for storing any type of client-specific information.

-

Manage Client Communication

Financial Cents integration with Gmail and Outlook saves you the stress of switching between your email and workflow tool to communicate with the client.

Financial Cents pulls all emails from the client into a focused folder, keeping you on top of your communication with them while doing their work inside Financial Cents.

With this integration, you can assign ad hoc email requests to team members, pin email updates to client profiles, and create projects from client emails.

-

Track Time Spent

The time tracking feature helps you manage your team’s time and bill adequately for the project. With Financial Cents integration with QuickBooks, you can transfer your timesheets into QBO for invoicing.

-

Monitor Employee Workload

Financial Cents’ capacity management reports show your employees’ workload and who might be working for too many (and too few) hours.

From here, you can reassign work between your employees to ensure the project finishes on time.

Organize your firm (for free) with Financial Cents’ project, client, and team management solution.