One main benefit of solo accounting is the freedom to make quick decisions, which helps you take advantage of growth opportunities.

Being self-employed saves you the stress of getting approvals for the type of client to serve, the model of work to adopt, and the amount to charge and earn.

In the 2023 Firm Revenue Report, solo firm owners earned an average of $62,327. Employed accounting professionals earned less than that and did not enjoy the freedom, lifestyle flexibility, and professional satisfaction self-employed accountants enjoy.

As attractive as the prospects of solo accounting are, it requires slightly different sets of skills and approaches than most accounting professionals imagine.

This article covers all you need to know to build a firm you enjoy running full-time, part-time, or as a side job.

Who is a Self Employed (Solo) Accountant?

A solo accountant is an accounting professional who provides accounting, tax, or bookkeeping services to businesses without employing others or being employed by someone.

Steps to Becoming a Successful Self-Employed Accountant

Essential Qualifications and Skills

I. Marketable Certifications and Qualifications (CPA, CMA, etc.)

You are likely already educated in one accounting field or the other, but that’s not enough. Apart from equipping you with the skills and confidence to solve accounting problems, certifications will also tell prospective clients about your ability.

Even though you can legally start a firm without a CPA designation or CMA certification in the US, having them makes you more marketable. Who wouldn’t prefer a trained mechanic to an untrained one?

Relevant qualifications include:

- CPA: The Certified Public Accountant designation requires you to meet the requirements of the boards of accounting by passing the Uniform CPA Exam. This title qualifies you to earn more and offer specialized services like audit, financial consulting, tax planning, and tax preparation.

- CMA: Certified Management Accounting is a globally recognized accounting certification. It qualifies you to provide management-level accounting services, audit, tax preparation, and business consulting services.

II. Technical Accounting Knowledge

Technical skills help with understanding the reality of working with clients, using accounting technology, and navigating regulatory standards–like the GAAP.

This also helps with accounting codes of ethics, such as confidentiality, objectivity, and transparency. Knowing these will enable you to comply with them.

Working for another accountant presents the opportunity to build a wealth of experience (in accounting operations), which you can draw from when you run into difficult situations in your solo firm.

III. Soft Skills

Beyond the hard skills of running a firm, soft accounting skills will get you where you want to be much quicker.

With technology’s increasing ability to perform time-consuming tasks and the growth of advisory services, soft skills have become more critical to accounting professionals’ relevance to clients.

These skills are more people-centered and invaluable in resolving complex situations in a way that makes clients feel seen and heard.

For example,

Asking the right questions helps with extracting words from your clients, helping you understand how to satisfy them.

Active listening makes your clients feel heard, improving your grasp of your client’s challenges.

Managing and communicating expectations helps with under-promising and over-delivering client expectations, which prevents client dissatisfaction.

IV. Business Acumen and Entrepreneurial Spirit

A good business sense empowers you to provide reliable insights by showing how different factors work together to help clients achieve their business goals, making you a trusted advisor.

Fortunately, you can grow your business acumen with these kinds of free accounting courses with certificates.

You can also improve your accounting project management skills with the help of workflow experts like Kellie Parks, CPB, Ron Baker, and Heather Satterley, CPA from Accounting Workflow Academy.

Setting Up Your Practice

-

Business Structure

Choosing your business structure is necessary for personal liability and tax compliance, among other reasons.

The most common structures for self-employed accountants are:

- Sole Proprietorship: This simple business structure indicates complete ownership of your firm’s profits and debts. Here, your firm’s income and expenses will reflect your Personal Income Tax, which puts your assets at risk.

- Limited Liability Company (LLC): this structure gives you some of the benefits of a corporation, such as limited liability over your firm’s debts, but you have to maintain a separate personal and business account. You may also be subject to pass-through taxes, which may increase your tax.

I. Legal and Regulatory Requirements

The legal and regulatory requirements for setting up accounting firms differ from state to state and country to country. You need to find out the required registration and paperwork.

For example, you need an employer identification number (EIN). You will also need to receive licenses and approvals for signage, operating your firm at home, etc.

Generally, the more confidentiality your accounting services require, the higher the legal and regulatory scrutiny involved.

II. Office Setup (Home Office, Shared Workspace, Virtual Office)

Here’s where you set up your work environment based on your preferred working style. If you prefer to work from the office, get a space and furnish it as well as it suits your productivity.

Working from home? Set up your workstation in a way that removes all distractions. You may also prefer a co-working environment, where you share a workspace with someone else.

In any case, you need reliable computers, a high-speed internet connection, an ergonomic furniture set, and good lighting and reliable technology to work comfortably.

III. Technology and Software Needs

Technology will save you hours of admin work weekly, giving you more time for analytical and advisory tasks that help your client make better business decisions.

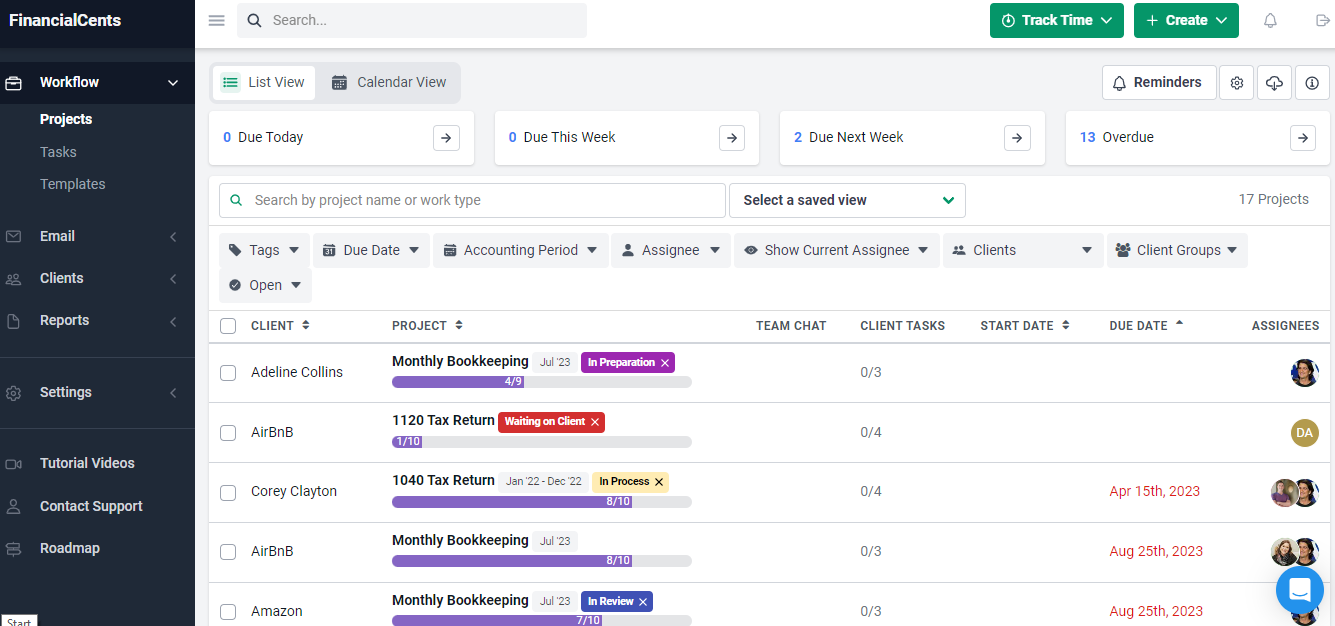

For example, project management tool for accountants like Financial Cents enables you to organize work and client-related information in one place for accessibility and productivity.

Financial Cents also has automated features that save you hours of work by creating repetitive work, collecting client data, and categorizing uncategorized transactions without leaving the app.

Moreover, the visibility Financial Cents provides gives a bird’s eye view of all client projects, helping you see what needs the most urgent attention on time and keeping you from missing client deadlines.

Finding and Retaining Clients

I. Identifying Your Target Market

You can’t run a successful solo accounting firm without knowing who your ideal client is and what keeps them up at night. The more of your ideal client you know, the easier it will be for you to complete projects and earn well.

One way to identify your ideal client is to understand your niche (the areas of accounting where you can be most helpful and profitable).

Identifying your target market will also help you tailor your marketing and sales efforts to the right person.

II. Marketing and Branding Strategies

Most firm founders start their marketing too late, but the earlier you develop your marketing strategy, the better.

In creating your branding and marketing strategies, decide what you want your firm to be known for. This will include your logo, colors, and other design elements.

Determine where and how you want to connect with your potential customers. Here, your options include:

- Paid advertising: using Google and social media advertising tools to target your ideal clients (businesses of specific sizes, industries, and locations).

- Social media marketing: setting up a professional profile on social media (Facebook, LinkedIn, Twitter, etc.) and sharing your expertise to position yourself as a credible accounting service provider.

- Creating a website: create a professional-looking website to increase your visibility online and attract clients.

- Google My Business profile: set up your business on Google Maps so that people searching for your services in your locality can find you.

Recommended:

III. Networking and Building Relationships

Networking helps you to build professional relationships and improve existing ones. Engaging with your ideal clients where they hang out (conferences, social media, etc.) makes your firm more visible to potential clients and business associates.

Most firm owners forget to tap into their existing relationships when networking. Checking on your existing relationships to see how their businesses are doing can remind them of your services, which may result in repeat business.

IV. Client Onboarding and Relationship Management

Few things are more important than creating and cultivating the right client relationships in accounting, and every strong client relationship begins with an effective onboarding process.

While the first impression comes during the client onboarding, a client’s satisfaction with your service quality will make them stay for the long haul.

That is why a client relationship management solution is critical. By helping you collect, store, and manage client information and requests, it enables you to meet client deliverables, which translates to recurring work and referrals.

Financial Management and Business Planning

I. Set Your Pricing and Fee Structures

Since money is the lifeblood of any business, your fee structure will determine how much you earn and how easily you find clients.

In finding the best way to set the rates for your services, here are some pricing strategies you can consider:

- Hourly rate: where accountants bill their clients based on the hours spent on client work. Since the better you get at your job, the quicker you complete client projects, this strategy may not reward improvement in speed of service delivery.

- Fixed-rate: this allows accountants to charge their clients a fixed amount for each service rendered.

- Value pricing: this allows you to charge your clients based on the value your work provides instead of the hours it took you to complete the project.

II. Managing Finances and Cash Flow

Well-managed finances produce positive cash flow that enables you to run your firm smoothly.

One way to improve cash flow in your accounting firm is to ensure quick billing. This has become easier with billing and invoicing software that creates and sends invoices (and reminders) to ensure you get paid on time.

Another way to increase cash flow in your firm is to provide multiple payment options, making it easier for clients to pay you. When combined with installment payments, your clients will pay you much faster because they won’t have to wait until they have all the money to pay you.

III. Create a Business Plan

As an outline of your marketing, sales, and funding plans, a business plan can lead you to your desired goal more quickly.

It clarifies your strategic decisions and revenue opportunities while minimizing risks.

IV. Plan, Prepare and File Your Taxes

Do you want to do your taxes by yourself, or will you pay another accountant to do it for you?

You will want to hire another accountant to do your taxes, especially if taxes are not your specialty. With frequent changes to tax laws, it might be best to use the experience of some who do taxes all year round.

Ultimately, choose whichever option works best for your compliance.

Work-Life Balance and Time Management

I. Balancing Work and Personal Life

Work-life balance is difficult in accounting because most projects are deadline-driven, and tax seasons are long and hard to deal with.

However, mental, physical, and emotional wellness requires scheduled breaks and holidays. Without it, you will struggle to have enough time for other important things, which leads to burnout.

Taking advantage of technology and automation, setting realistic expectations, and making adequate plans for peak seasons can help you manage your workload and prevent the overwhelm of busy seasons.

II. Time Management Strategies

Poor time management accounts for most of the pressures of running an accounting firm. This results from taking on more work than you can realistically handle or failing to manage and allocate your time effectively.

Project management and time-tracking software show you how many projects you can take on and where your time is going.

The right time-tracking solution also ensures that you are billing clients adequately, giving you more value for your time and preventing the need to take on more projects than you can deliver.

III. Delegating Tasks and Outsourcing

Effective delegation buys you time to get out of the weeds of your firm to attend to strategic functions. Today, technology can handle time-consuming tasks accurately, giving you more opportunities to delegate tasks to software and free up your time.

The best part is that these solutions can integrate with each other to complete multi-stage processes without human input.

For example, you can use Financial Cents’ Zapier integration to automate client onboarding, from proposal signing to work and profile creation creation, and client data collection.

IV. Building a Support Network

Connecting with other accounting professionals allows you to build a support system you can lean on in difficult times.

Join professional groups to share your accounting expertise and experience running your firm. This helps you build relational equity (with other firm owners) that you can draw from when needed.

You can also take young accountants under your wings (in a mentorship relationship) and help them grow professionally. They can be your source of support when you need someone to help with some tasks down the line.

Bonus Tip: Use Accounting Practice Management Software to Optimize Your Firm for Maximum Productivity

If your main strength is your number-crunching abilities, technology might catch up with you soon—if it hasn’t already. You risk losing businesses to other professionals who can combine their expertise with AI.

For instance, many accountants spend unnecessary hours trying to remember the steps involved in their day-to-day processes when they could have created workflow templates out of those steps for future use.

Aside from saving you time and mental energy, workflow templates ensure you never miss a step in your processes. Plus, if you decide to hire other accountants or obtain help from sub-contractors, the templates will guide them, ensuring consistency in your work quality.

One of my favorite accounting best practices is building workflow templates in my workflow software. I advise firm owners to find software that will let them add notes to a task so that when they do the task, and it recurs again, they have the same notes to remind them how to do it. "

Blake Oliver, CPAACTION POINT: Streamline Your Solo Practice at $19 A Month

There's so much work in running an accounting firm. You can't do it without a project management system to help you manage it. I always had project management software. I wouldn't have worked without one"

Phil McTaggart, CEO, Shine A Light Accounting Service (SALAS)Most solo firm owners do not see the need for practice management software because they believe they will remember to pick things up where they left off.

But that is hardly the case.

Between scheduling appointments, taking phone calls, responding to emails, onboarding new clients, collecting (and storing) client information, and doing the actual client work, there is only so much you can do as a solo accountant without losing your mind.

That is where practice management software for solo firms comes in handy.

Practice management software has a combination of features that puts every piece of information at the fingertips of solo firm owners.

Financial Cents enables me to set up templates for projects. This helps me set my new clients up when I’m bringing them on. Just setting them up with those templates helps me see what they might have missed. In Canada, we have a GST filing. Setting up my GST workflow templates in Financial Cents helps me remember what I need to do over the month or quarter."

Phil McTaggart, CEO, Shine A Light Accounting Service (SALAS)More importantly, Financial Cents’ solo plan gives you everything you need to run your solo practice without paying for more features than you actually need.

The features of the solo plan include:

The dashboard displays every project in your firm, including its status, due date, related clients, progress reports, and other important information.

This enables you to track your deadlines and prioritize tasks so that nothing falls through the cracks.

Financial Cents enables me to go into my workflow dashboard to see how many overdue projects I have. This allows me to know why they are overdue and which ones I can close off. I do the same with the upcoming due dates like month-end close."

Phil McTaggart, CEO, Shine A Light Accounting Service (SALAS)- Workflow To-Do Lists: create the tasks for all your accounting processes so you never miss out on any important step.

- QuickBooks Integration: Import and auto sync your clients, time tracking and invoicing to Financial Cents with one click. You can also sync your time-tracked, invoices and online payments from Financial Cents to QBO.

- Workflow Automation: automatically changes the status of each project when a task is complete, showing you where each project stands at a glance.

- Client Tasks and Requests: ask clients for the files and information you need for their work.

- CRM: a secure client database that houses all client information (like contact details, communication history, client’s usernames, passwords, and custom information.

- Document Management: a secure platform to manage client documents in compliance with US and Canadian data residency laws.

- Client Portal: an easily accessible portal for collaborating with clients by exchanging files and information.

Give your firm the best chance to succeed. Use Financial Cents to manage your solo firm.

Excellent article! Thanks for these self employed accountant tips will be helpful for my own tax planning UK business.