Workflow management is a huge deal for accountants and bookkeepers partly because one software is never enough for any accounting or bookkeeping team to work efficiently.

Tools that automate parts of accounting processes like expense tracking, general ledger, payroll, and client management are already common knowledge. The 2025 State of Accounting Workflow Automation Report showed that 75.8% of accounting firm owners spend between 0-5 hours per week after implementing workflow automation in their firm.

However, the number of hours your team gets back with workflow automation depends on the extent you go to automate your processes.

Adding a tool like Zapier to your already existing tech stack, you can go beyond automating individual tasks in separate accounting tools to automating entire processes by connecting the various software solutions to hand work off between one another without human input.

Here’s an Example of a Client Onboarding Process with Zapier Integration

Assuming the following are the steps in your client onboarding process that you want to automate it;

- New client signed

- Create client to Financial Cents

- Create client in QBO

- Create client folder in Google Drive

- Send email to set up kick-off call with Gmail

- Find a suitable time in Calendly

- Send more information with Gmail

- Schedule Kick-off Call with (Google Meet)

- Kick-off call complete

Using the Zapier integration means that once you sign a new client, the client will be added to your Financial Cents account, which will trigger the other events to follow one after the other (like a domino effect). That makes the task of creating the client in Financial Cents your trigger event and the subsequent events your action events.

What is Zapier, and How Does the Integration Help?

Zapier is a software that lets you connect multiple apps that communicate with one another to automate routine tasks. Each automated workflow (sequence of steps) is called a Zap, and a Zap has one trigger and one or more actions involving multiple apps.

By integrating with Zapier, Financial Cents enables you to connect with 5,000 other apps you need for various day-to-day accounting processes.

This will further streamline your workflows, reduce time spent on manual processes, and give your team the most up-to-date information to work with, inside Financial Cents.

How to Optimize Your Accounting Processes with Financial Cents and Zapier Integration

Creating Zaps boils down to using trigger and action events to tell Zapier what to do in each app, and it is not as complex as you would imagine.

The key is to document your processes so it is easier to understand the order in which the trigger sets off the dependent actions.

You can automate as many steps (actions) in a process as you need if all the relevant apps integrate with Zapier. But the following are the ways you can create single-step Zaps using Financial Cents and Zapier Integration.

But first, you need to create a free Zapier account by entering your email and desired password here.

Here are some of the processes you can start automating with the Financial Cents and Zapier integration today.

Client Proposal and Onboarding Process

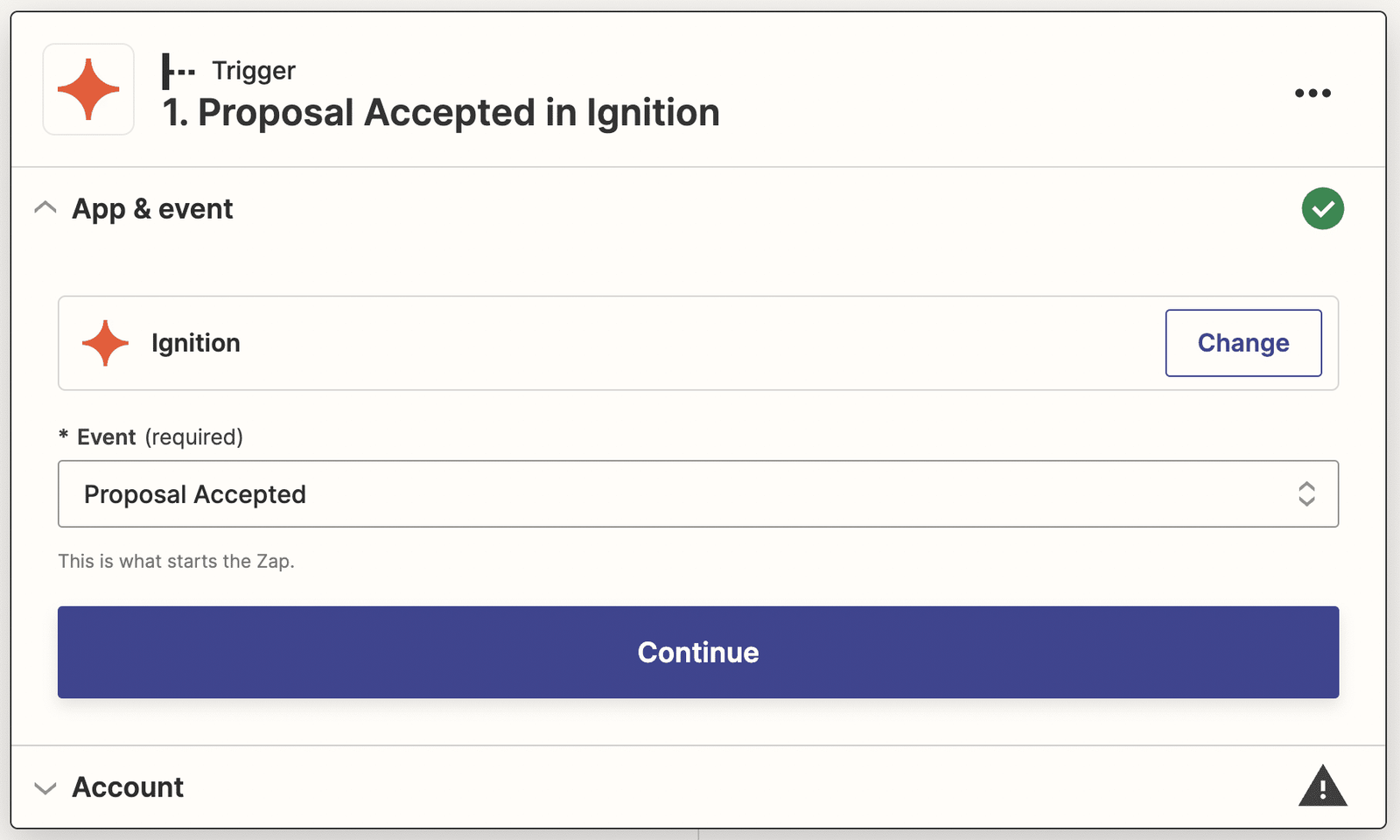

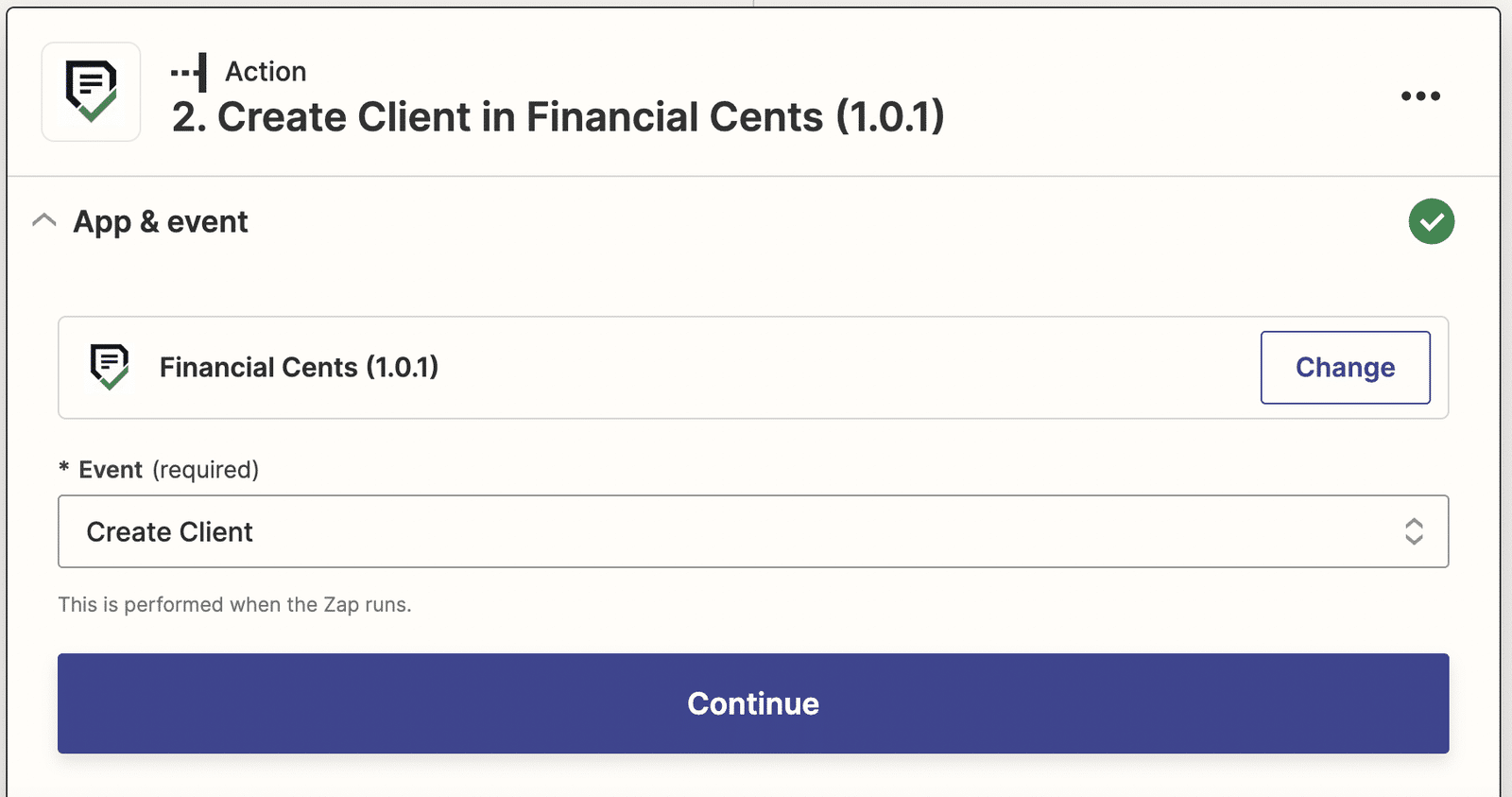

The Zapier integration enables you to automatically create a client in Financial Cents when the client signs your proposal in Ignition. That way, you wouldn’t need to create a client profile in Financial Cents each time you get a new client.

Notice: Financial Cents now integrates directly with Ignition, you do not need to connect both apps through Zapier anymore, you can learn more about the integration here.

You can set the Zap up in six steps:

- Select Ignition as the trigger app

- Select Proposal Accepted as the trigger event.

- Select Financial Cents as the action app

- Select Create Client as the action event, and click on Continue

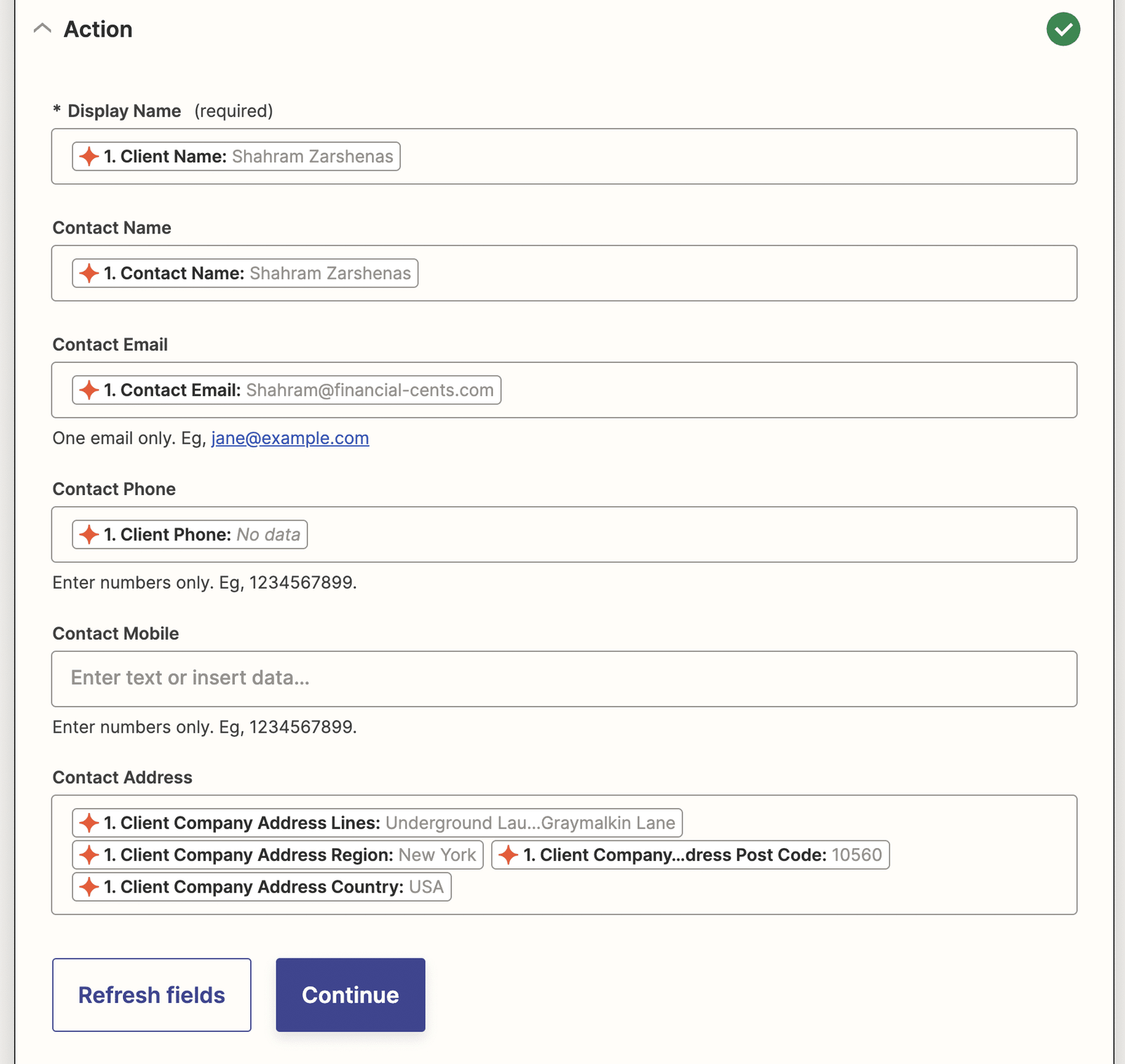

- Select the information you want to pull from the Ignition proposal to create the client in Financial Cents.

- Test and publish the Zap

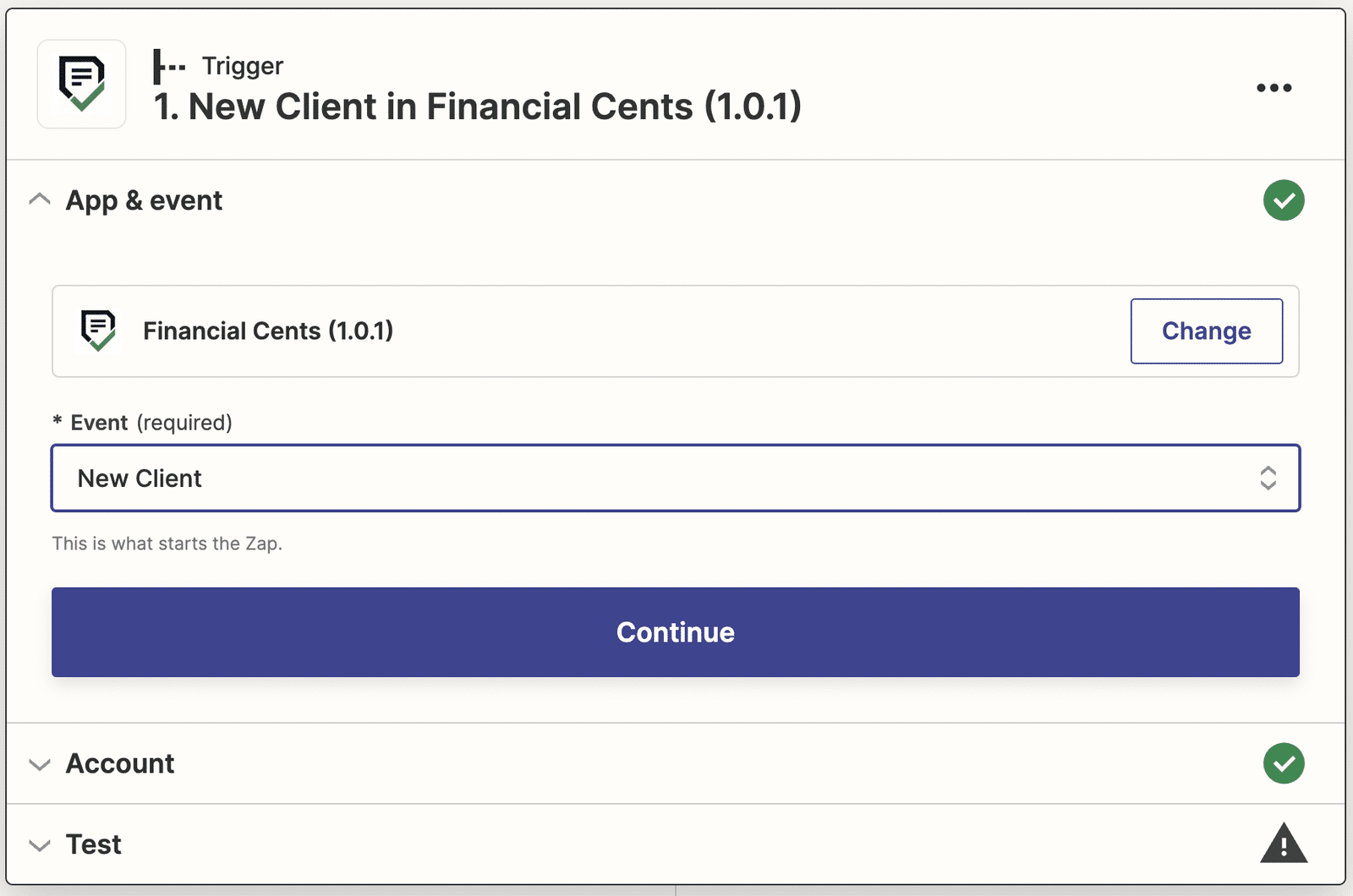

Create Folders in Your Document Management System After Creating a New Client in Financial Cents

With this automation, you can automatically create a client folder in your preferred Accounting Document Management System (like Dropbox, Google Drive, Box, Sharefile, and OneDrive) after you have created it in Financial Cents

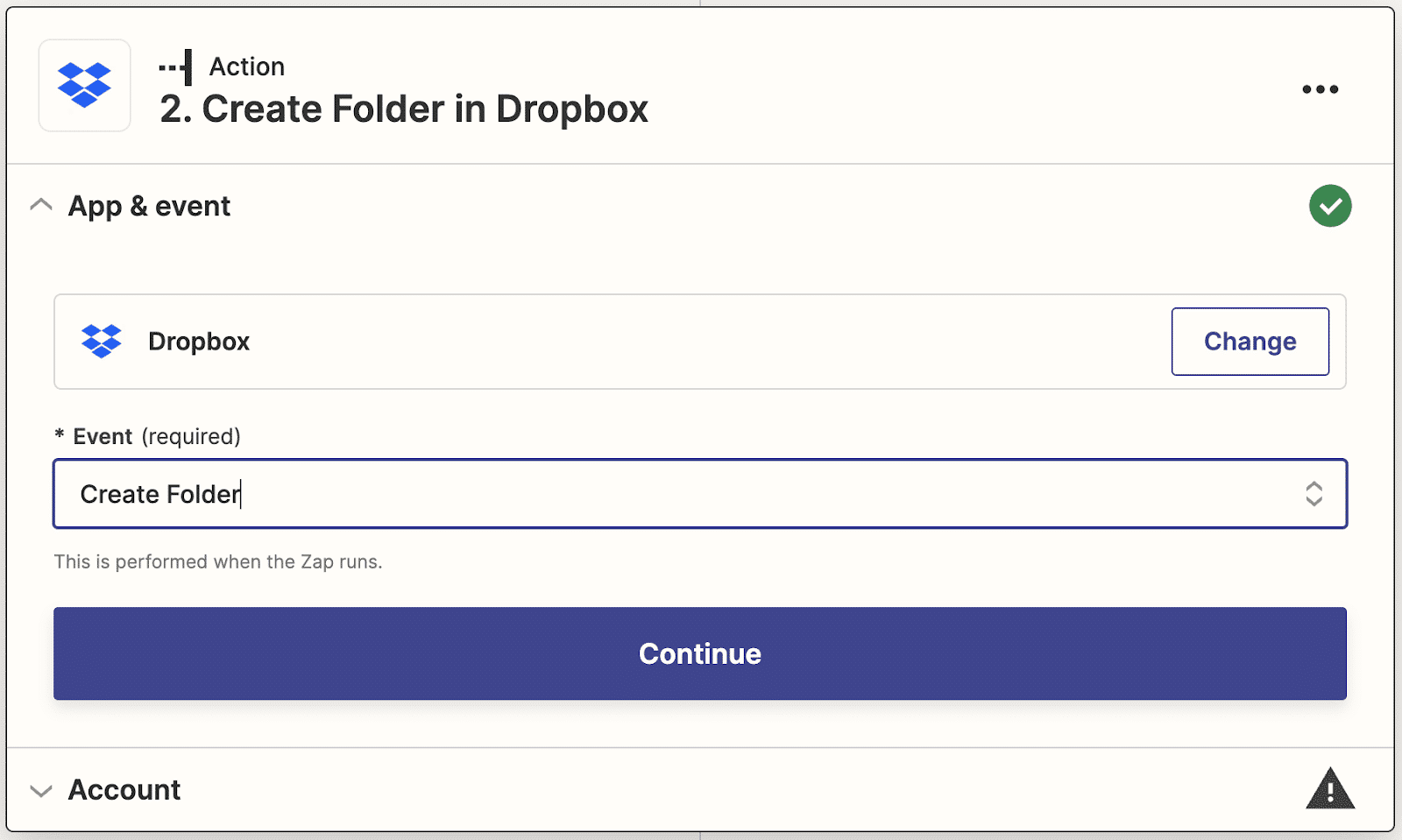

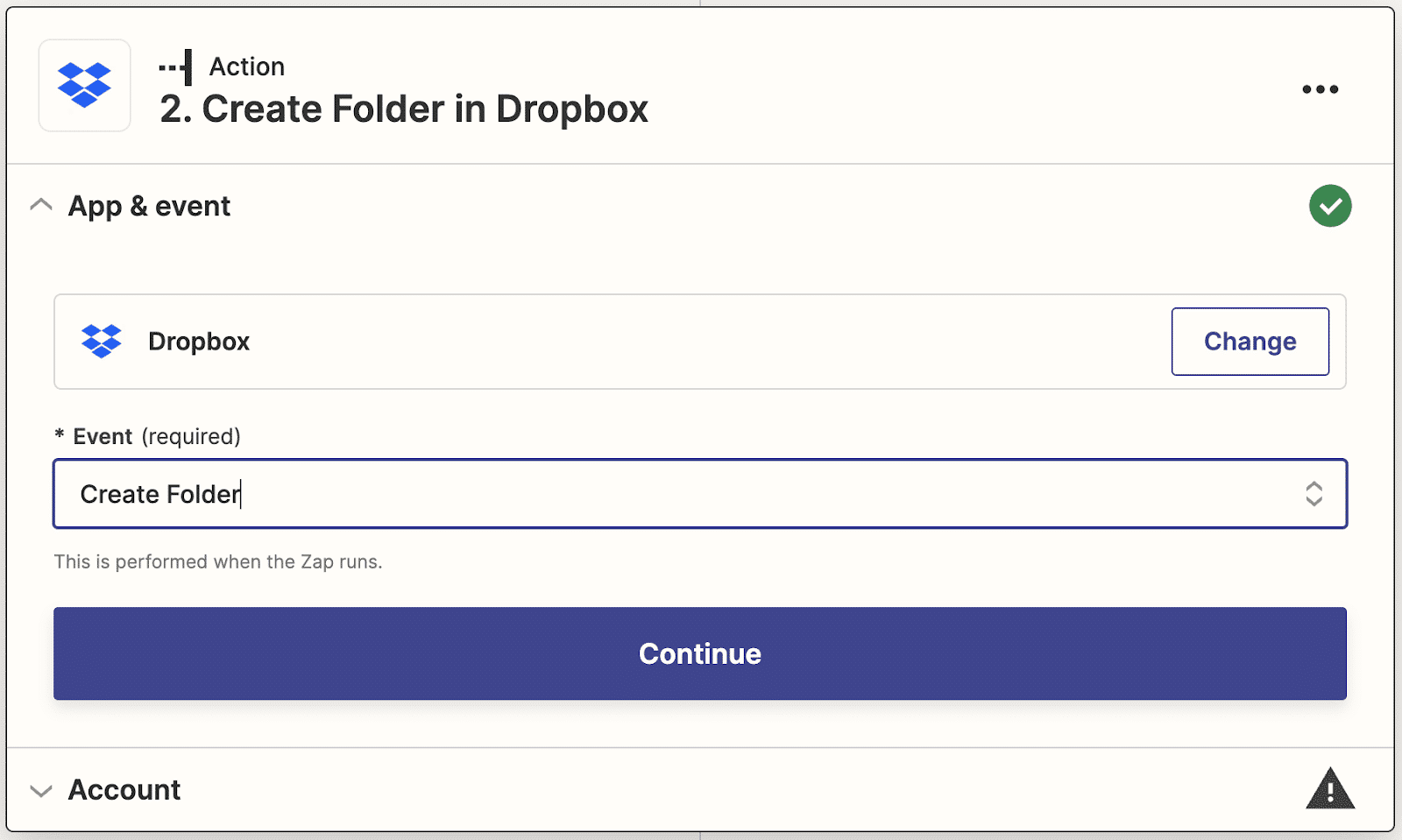

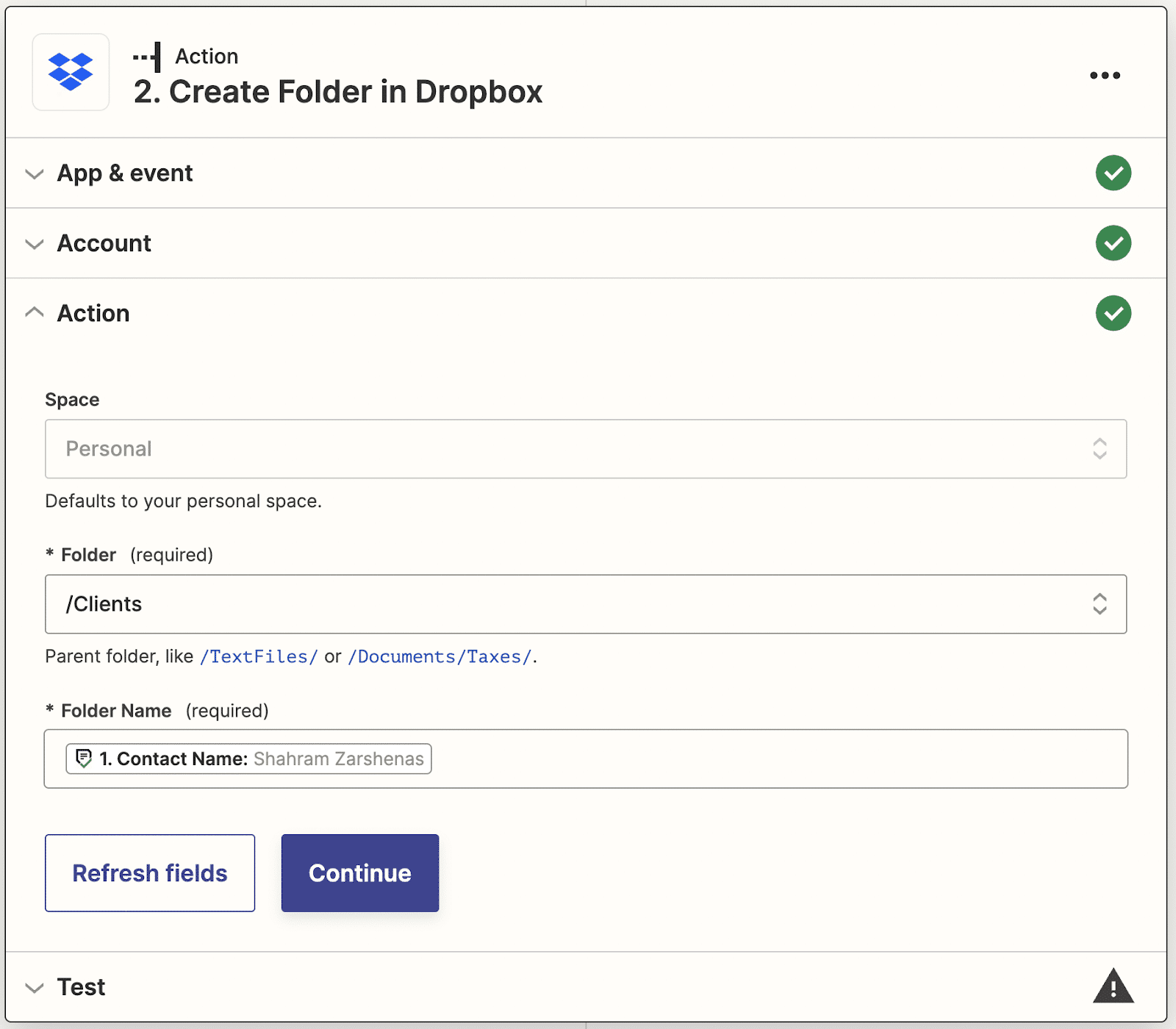

DropBox

Set this Zap up in the following steps

- Select Financial Cents as the trigger app

- Select New Client as the trigger event

- Select DropBox as the action app

- Select Create Folder as the action event.

- Select the Space and Folder for the new client folder

- Use the information in Financial Cents as the new client Folder’s Name

- Test and publish the Zap

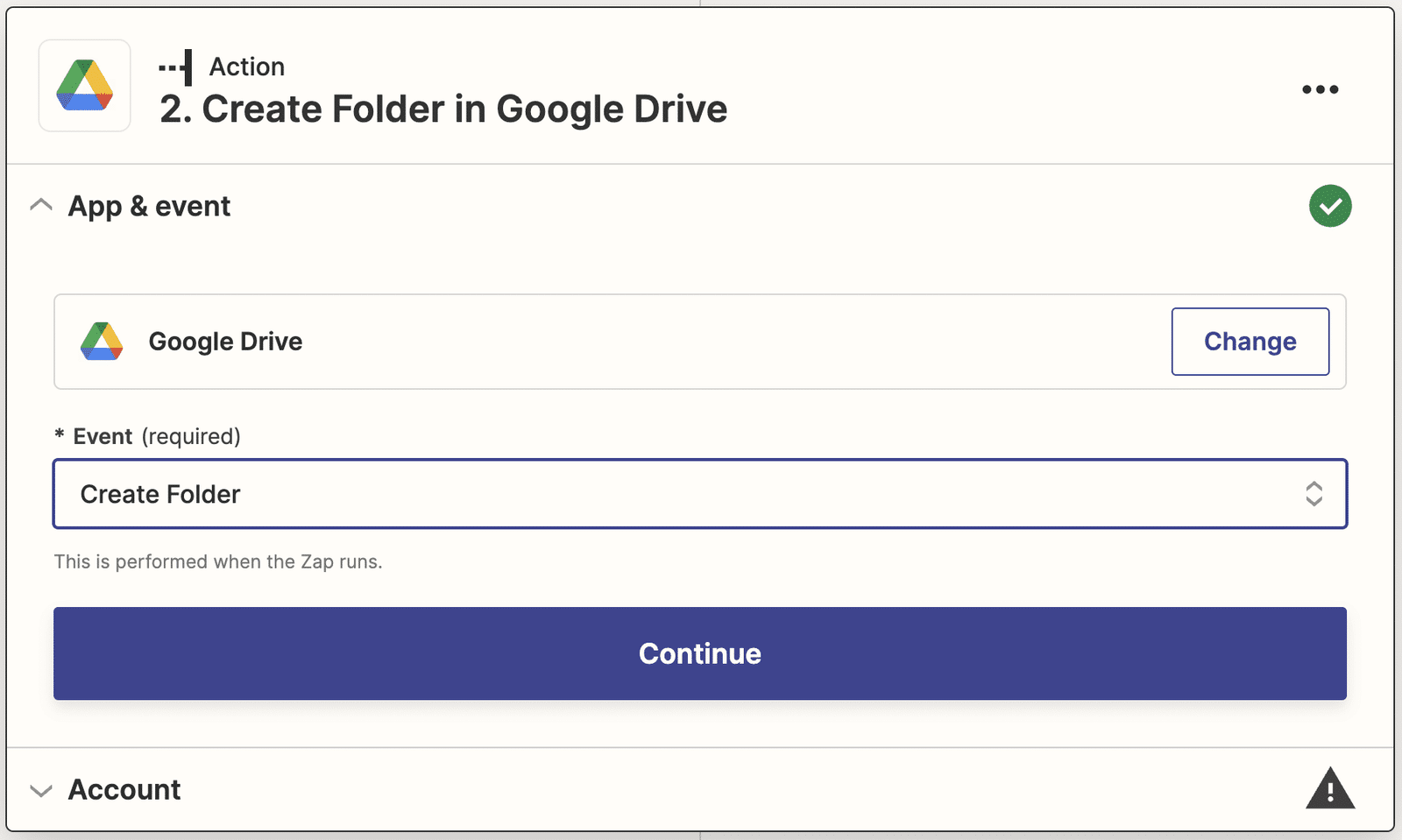

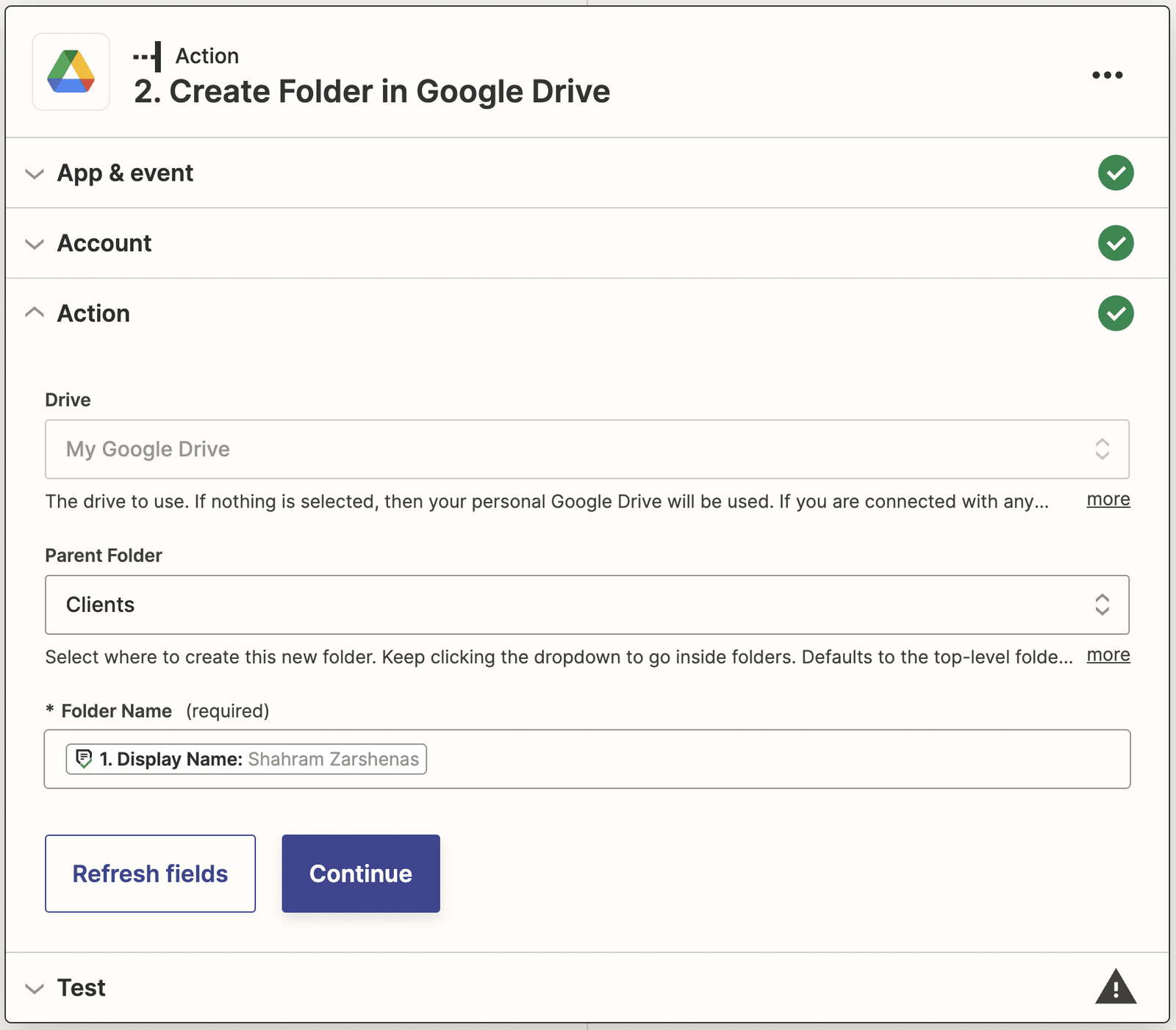

Google Drive

You can set up GoogleDrive Zap like this:

- Select Financial Cents as the trigger app

- Select New Client as the action event.

- Select Google Drive as the action app

- Select Create Folder as the action event.

- Select the Drive and Parent Folder for the new client folder.

- Use the information in Financial Cents as the new client Folder’s Name.

- Test and publish the Zap

Here’s how you can create zaps for other Document Management Systems like Box, Sharefile, and OneDrive

Create a Client to Other Apps in Your Tech Stack After Creating a New Client in Financial Cents

Financial Cent’s Zapier integration gives you the ability to create a client’s profile in Financial Cents with the client information in your other accounting software programs like 17hats and Xero

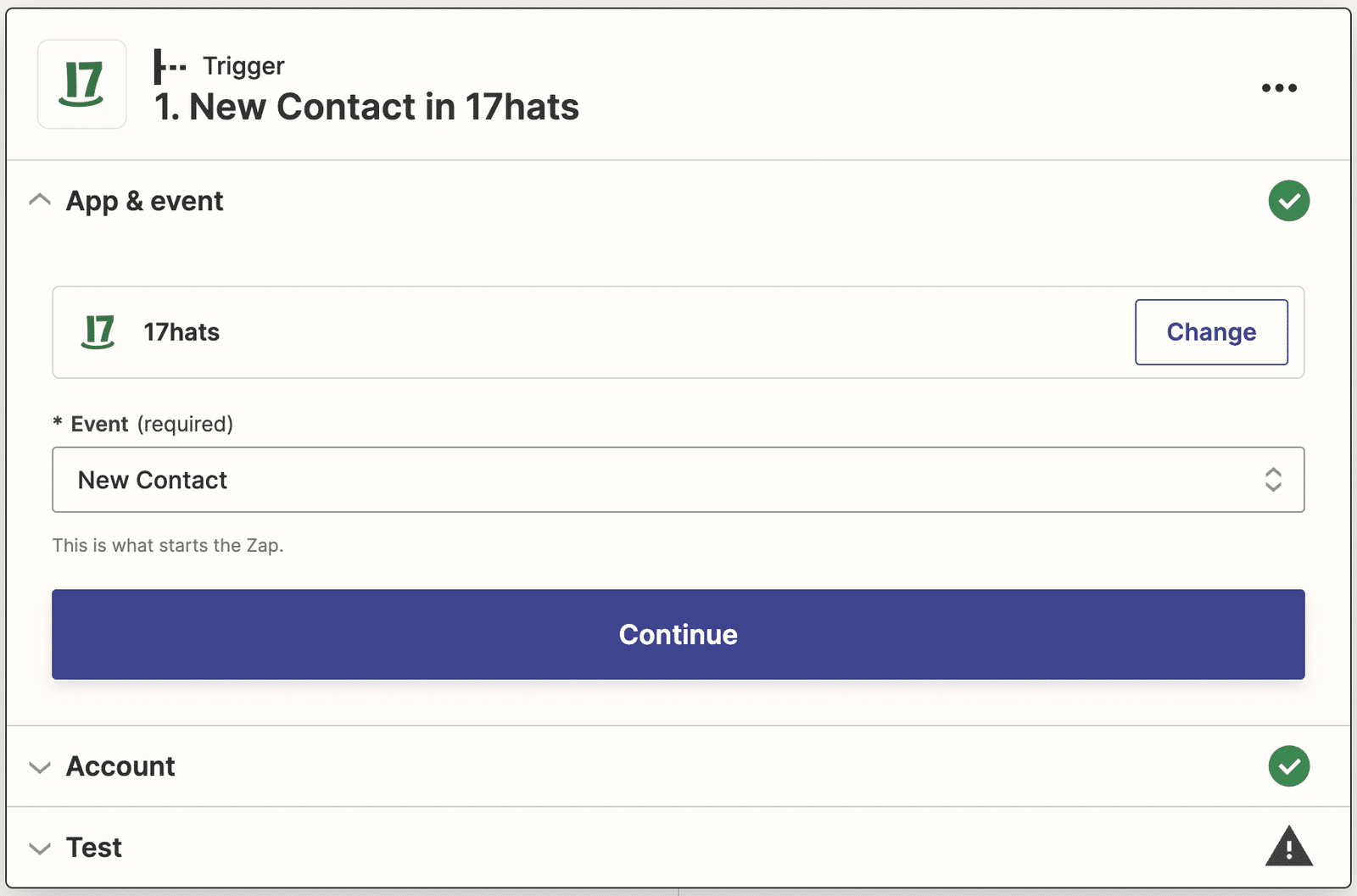

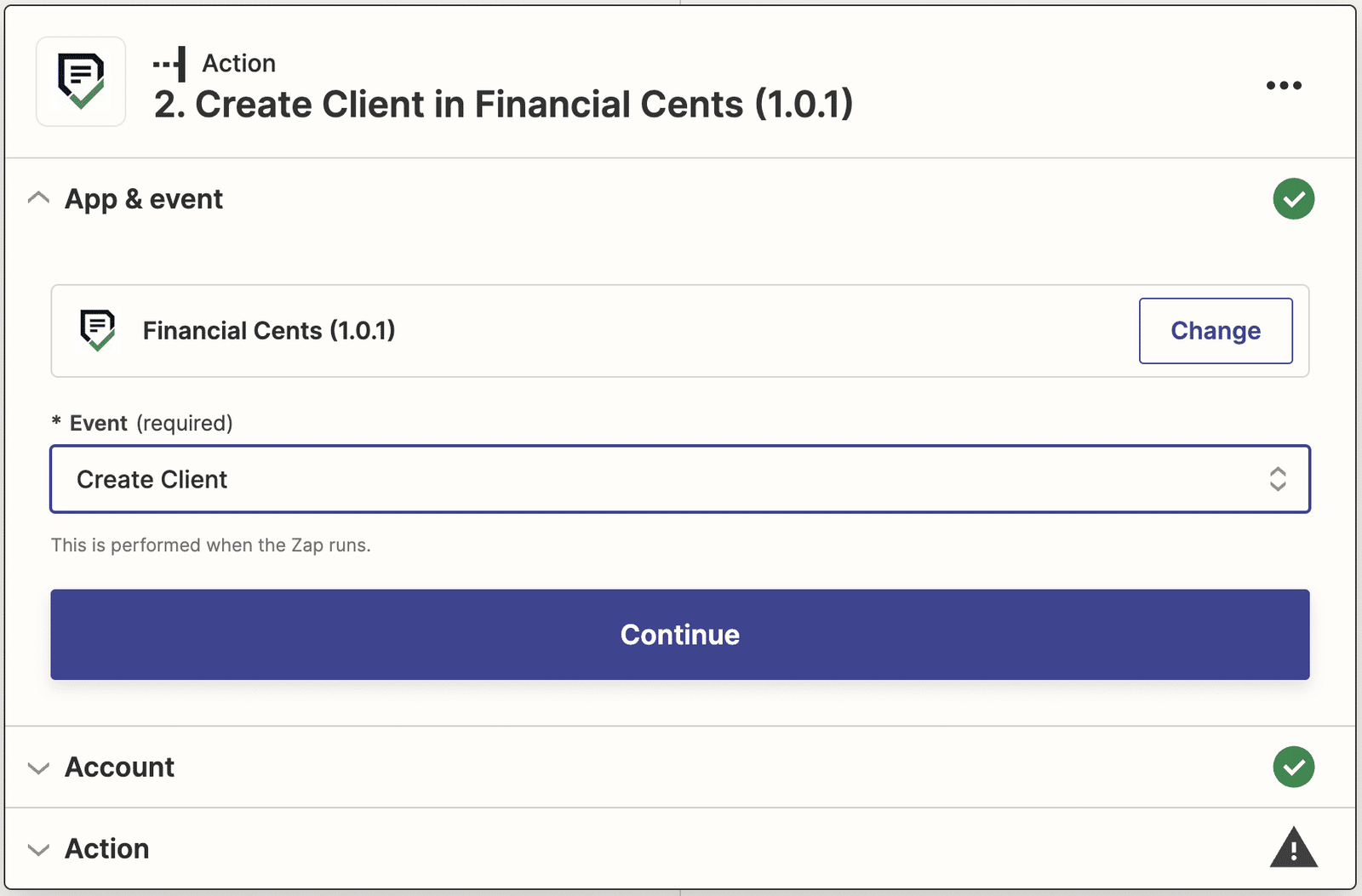

17hats

Here’s how to set it up for 17hats

- Select 17hats as the trigger app

- Select New Contact as the trigger event

- Select Financial Cents as the action app

- Select Create Client as the action event

- Select the information 17hats to feed Financial Cents for the new client profile

- Test and Publish the Zap

Xero

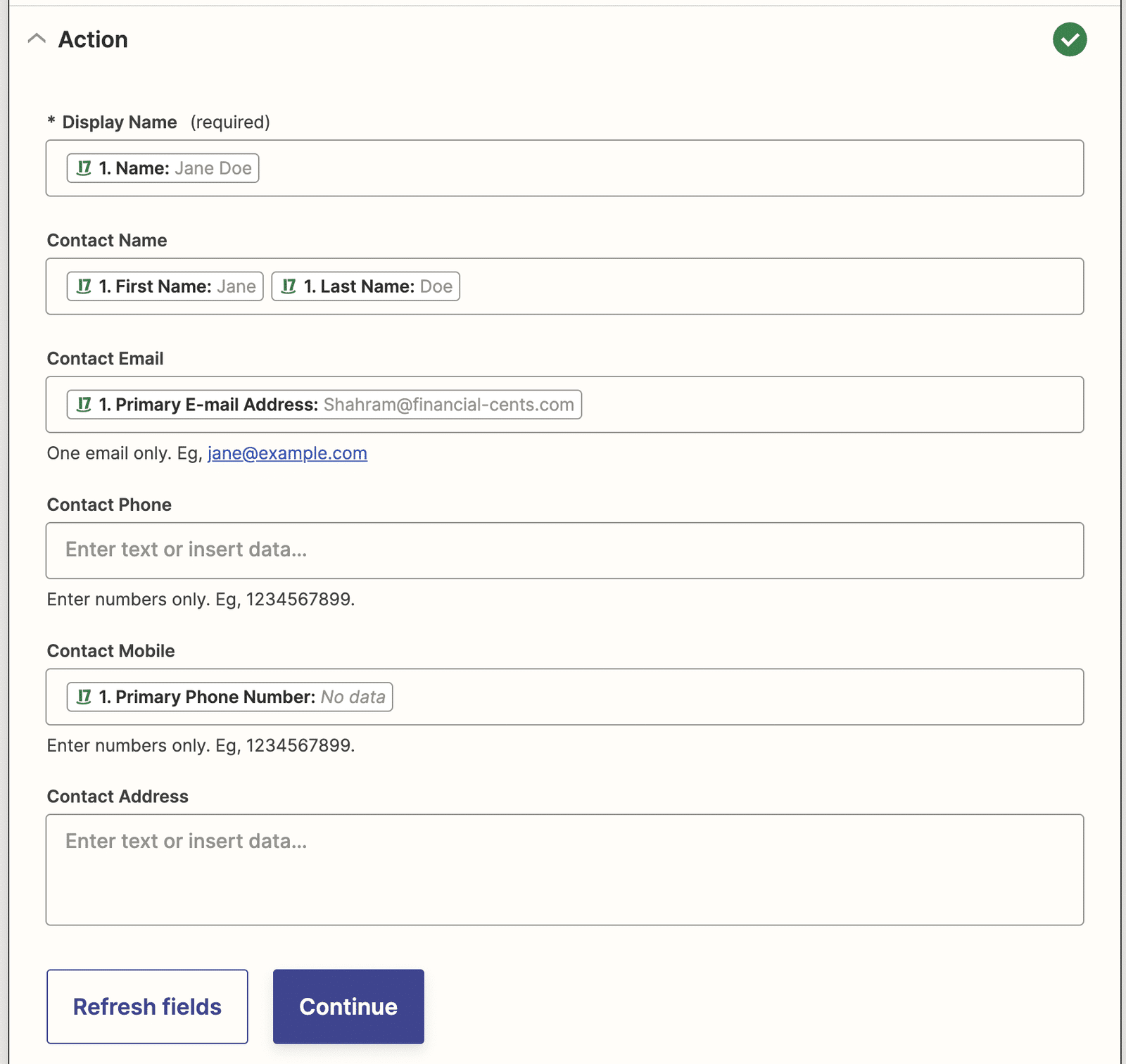

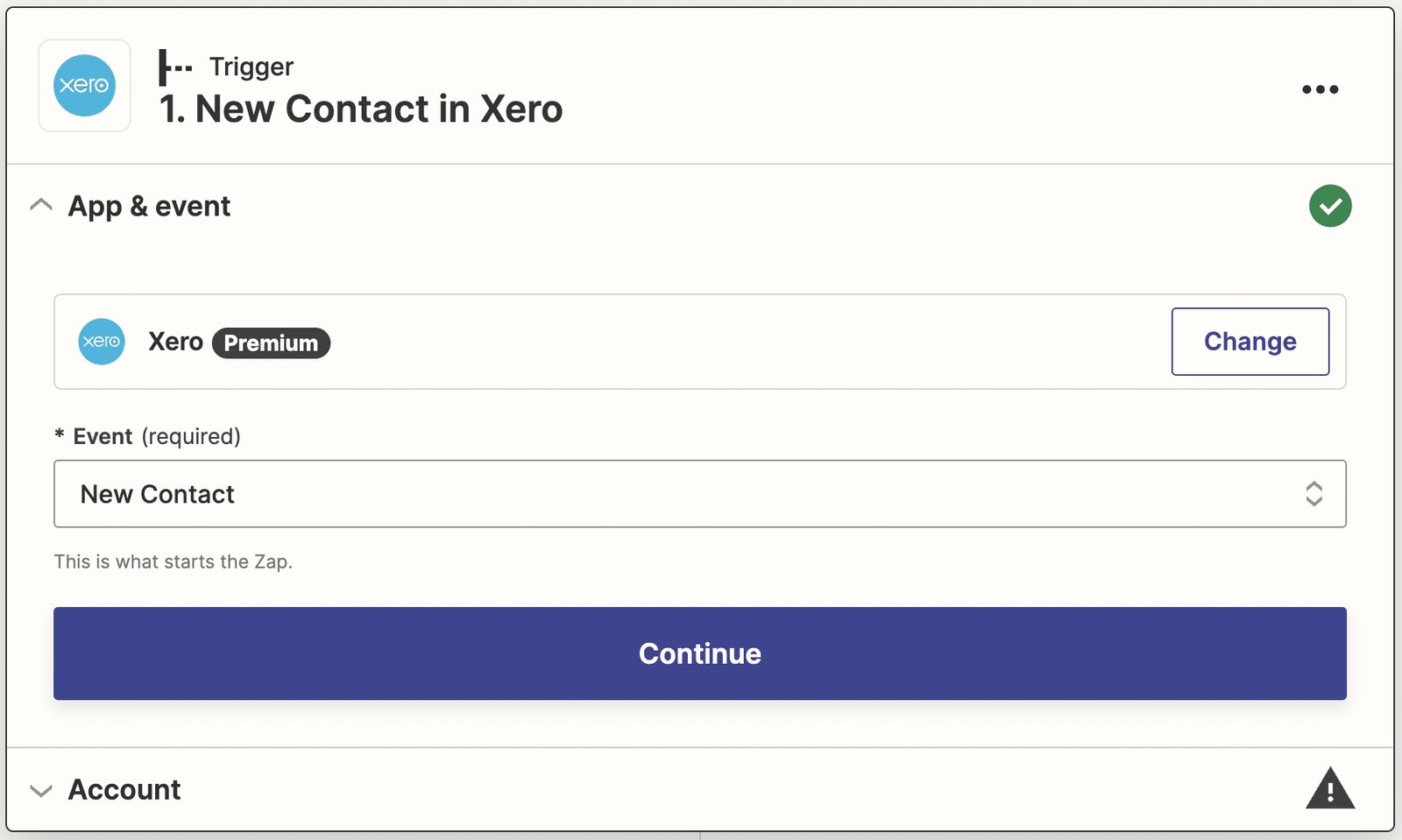

Here’s how to create Zaps for Xero

- Select Xero as the trigger app

- Select New Contact as the trigger event

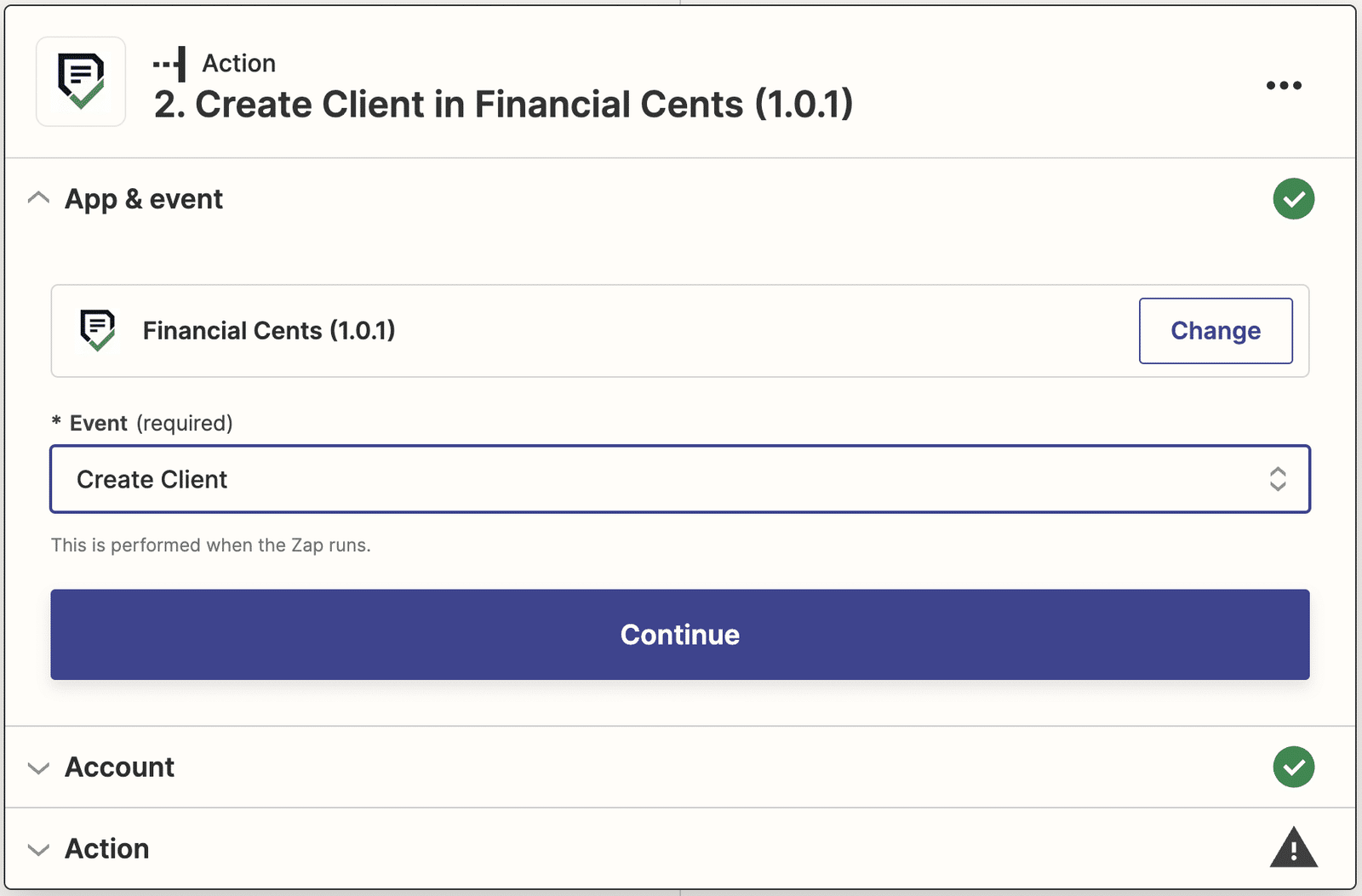

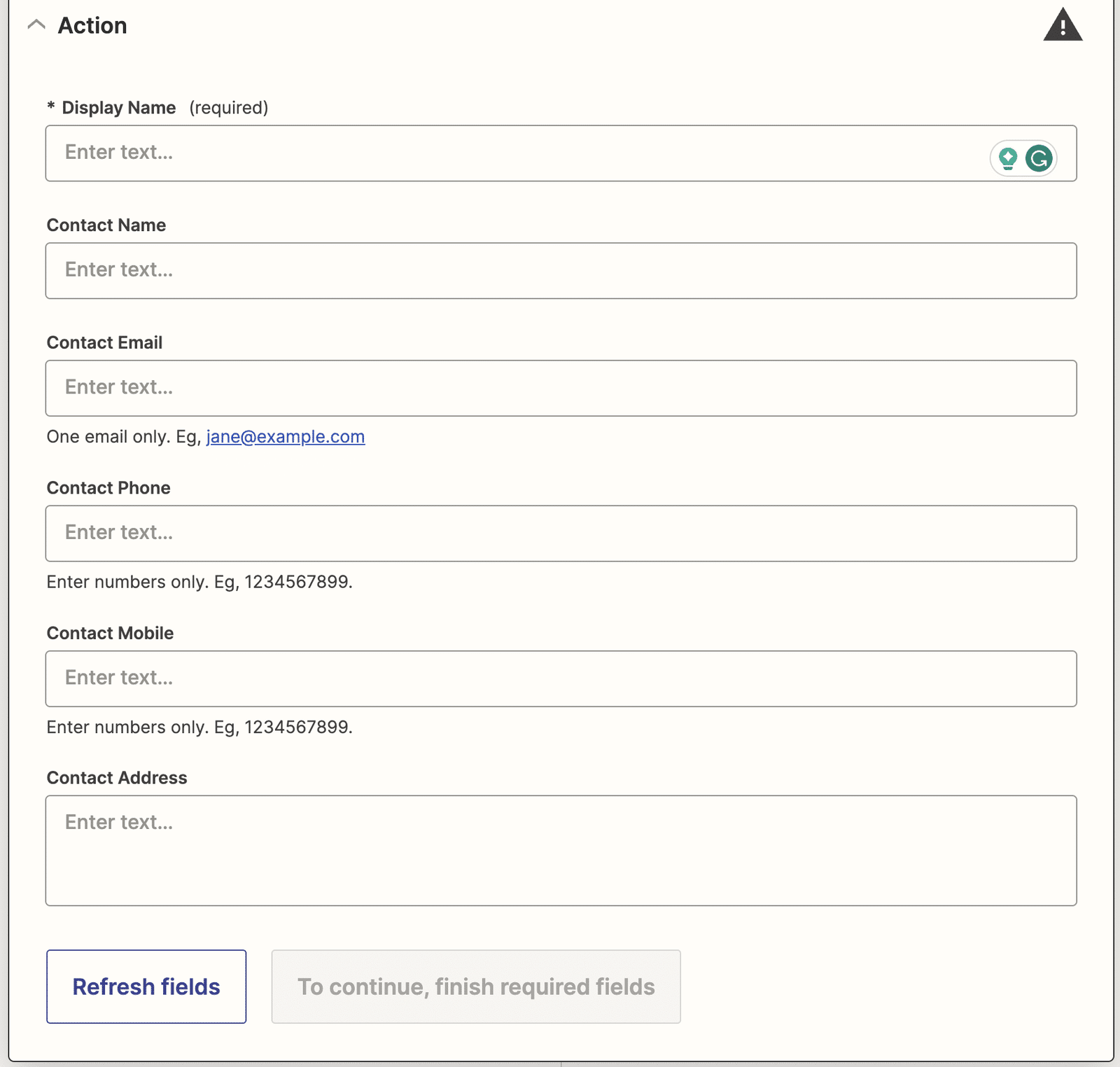

- Select Financial Cents as the action app

- Select Create Client as the action event

- Select the information you Xero to feed Financial Cents for the new client profile

- Test and publish the Zap

Start using the Financial Cents and Zapier Integration

The Financial Cents and Zapier integration will help you maintain data integrity across your accounting apps by ensuring that there’s no human input (which would increase the risk of error) when transferring client data from one app to another.

Moreover, the average accounting firm spends a lot of time transferring data (by copying, pasting, and uploading CSVs) between apps, adding form responses to your database, or sending the same email to leads many times over.

While these tasks may not be a big deal when done as one-off tasks, doing them daily (sometimes several times a day) can cost your firm hours of billable work. Sometimes, just remembering to do them is sufficient cause for concern. So, why not automate them so you can focus on the 20% of activities that bring in 80% of your results?

Zapier’s integration with Financial Cents will help you guarantee that by connecting and moving your financial and work-related information between the apps you use daily.