For accountants and bookkeepers, staying organized is critical. If you don’t have a document management process, you’ll waste time searching for files, miss deadlines, and have frustrated clients on your hands.

In fact, a 2023 study by Coveo found that workers spend about three hours per day searching for the information they need to do their work. Additionally, three in ten workers can’t find urgent information on a weekly basis.

That’s a lot of wasted time and effort, which affects efficiency, client relationships, and, ultimately, your bottom line.

To resolve this, you need an accounting document management system (DMS).

A DMS helps you manage your documents, streamline workflow, and improve your firm’s productivity. Utilizing a DMS lets you centrally store your financial documents in a secure and easily accessible location. This can save you time and frustration when finding a specific document.

Benefits of Using an Accounting-Based DMS

There are two categories of DMS: generic and industry-specific.

However, to get the best result as an accounting or bookkeeping firm, it’s best to use the latter, i.e., an accounting-based DMS.

Here’s why:

Improved Organization and Accessibility of Financial Documents

A DMS centralizes document storage, eliminating the need to have them scattered across various locations. This allows easy categorization, tagging, and indexing, facilitating quick retrieval.

Enhanced Collaboration and Client Communication

A strong DMS enhances security by facilitating accounting document sharing and collaboration with clients and colleagues. Shared folders, chat functionalities, and document activity tracking streamline these processes.

Increased Efficiency in Document Retrieval and Processing

With a DMS, you can quickly find any document you need using powerful search functionality. This eliminates the time-consuming task of manually searching through files.

Strengthened Security and Data Protection for Sensitive Client Information

Most accounting document management systems have security features designed to protect your clients’ data from unauthorized access and give you peace of mind.

Key Features of a Great Accounting DMS

When choosing an accounting DMS, consider the following features:

Centralized Storage and Collaboration

The accounting profession thrives on collaboration. Tax season, audits, and complex financial projects often require input from multiple team members. So, it’s important for everyone to be able to access information and remain on the same page to deliver accurate work.

A DMS with centralized storage can be a game-changer. It will allow you to store all your financial documents, including invoices, receipts, tax returns, and financial statements, in one location so your staff can easily find the documents they need whenever.

This eliminates the need to search through multiple folders and filing cabinets to find specific information.

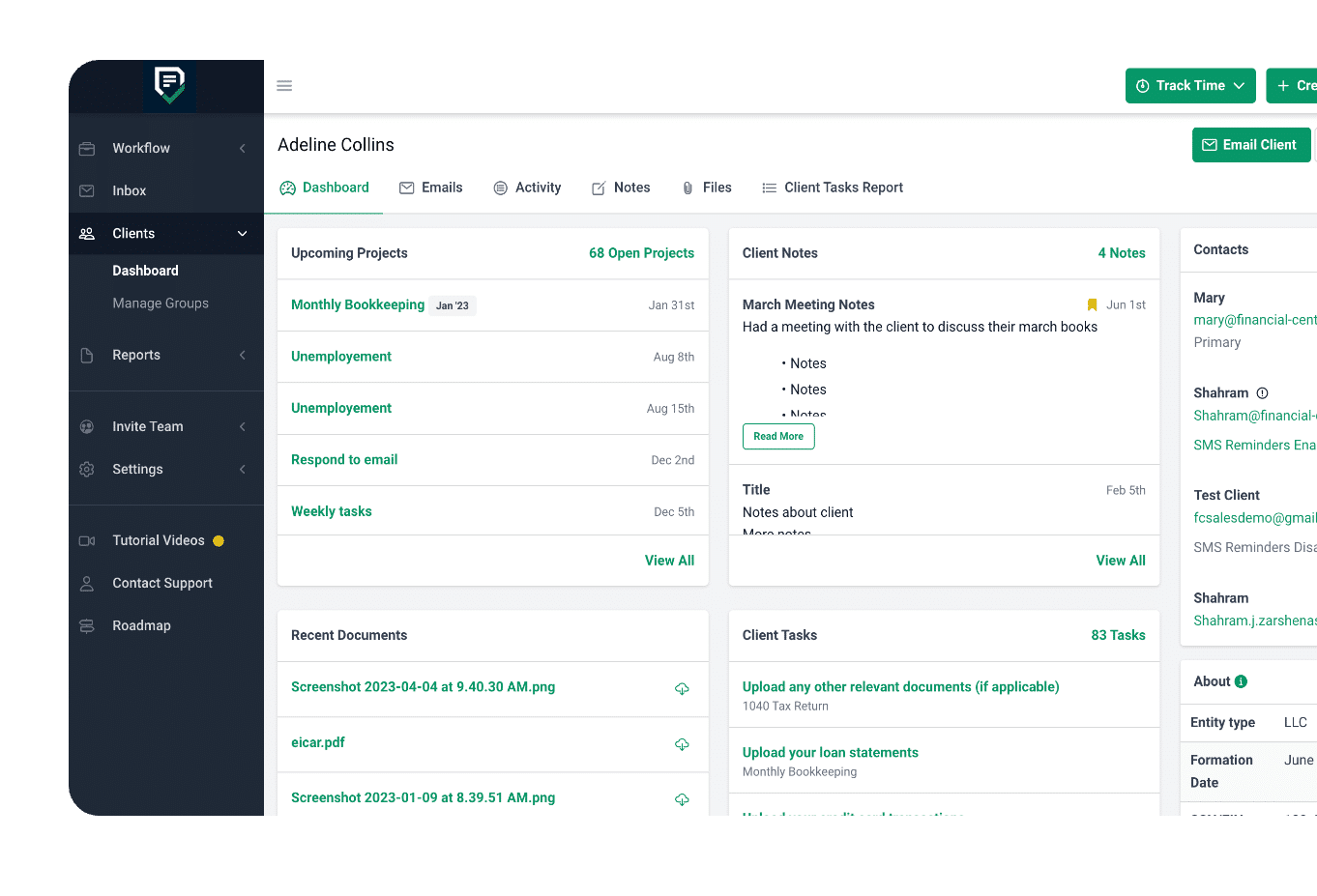

Financial Cents, an accounting-based workflow management software with DMS features. Additionally, with our CRM solution, you can store all your information in one place so your team can easily find them and collaborate.

It’s also cloud-based, enabling access to documents anywhere and anytime.

See what one of our customers, Sue D, said about this feature:

Financial Cents is allowing everyone in my office access to the same information. It keeps us all on the same page. Knowing what needs to be completed each week will prevent something from falling through the cracks or missing a deadline."

Document Organization

Even with centralized storage, it’s still possible to be disorganized. Knowing a file exists isn’t enough; you must find it quickly and easily. That’s why you should choose a DMS with features to help you organize your documents.

This may include the ability to create folders and subfolders, add notes and custom metadata, tag documents with keywords, and so on.

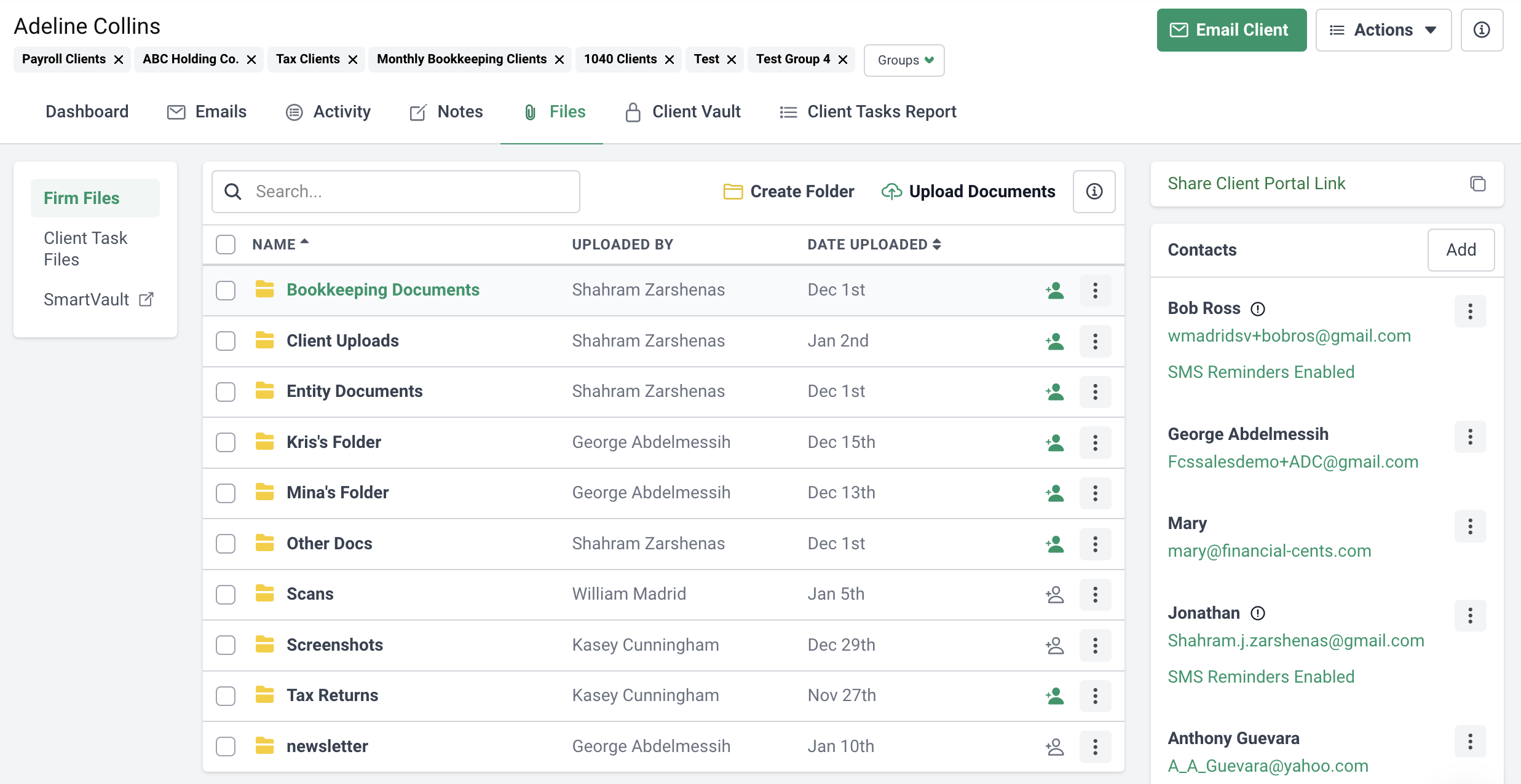

Financial Cents DMS feature offers a variety of document organization options, including a simple and comprehensive view, folders and subfolders, client groups, and customizable data fields.

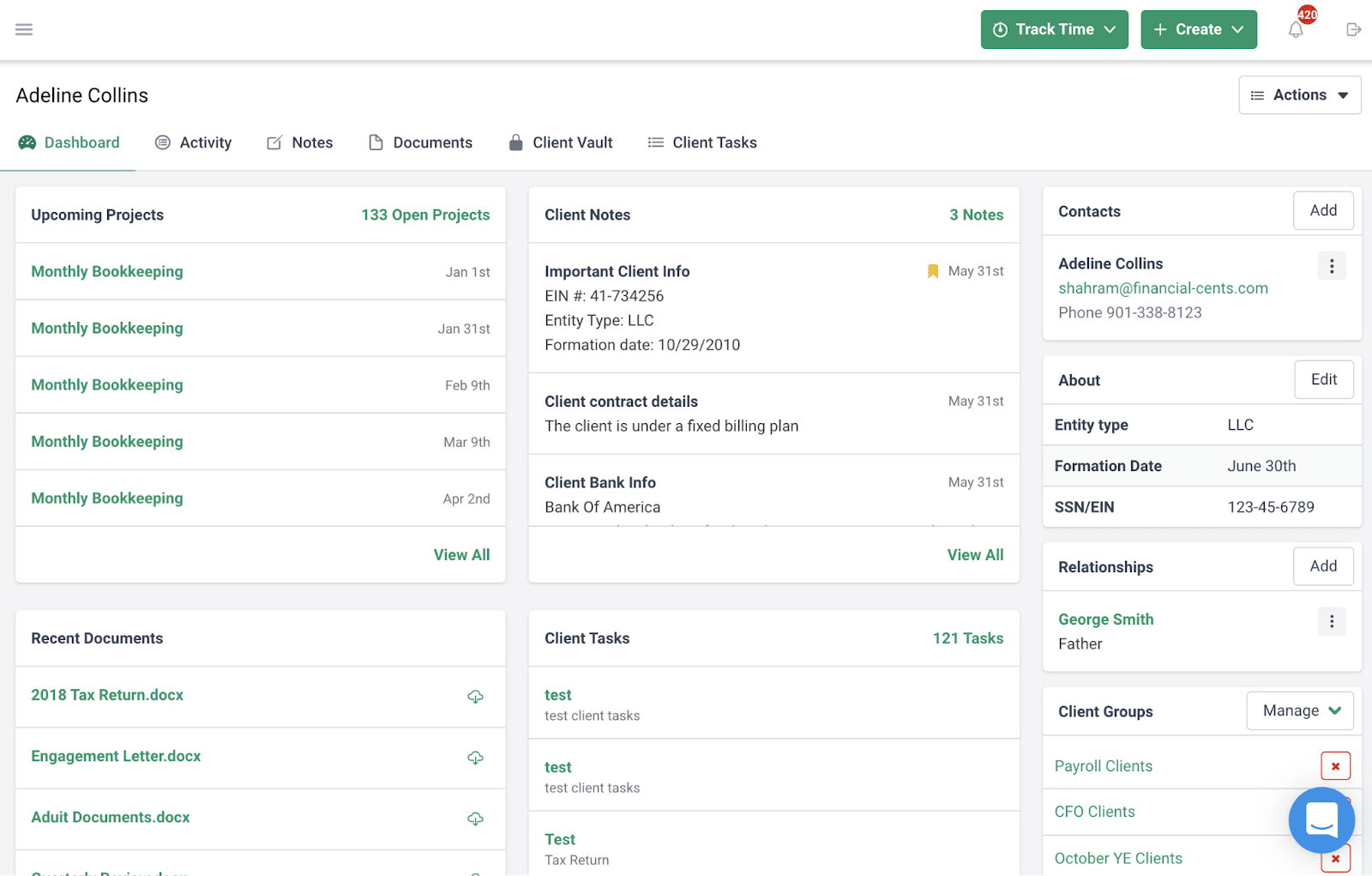

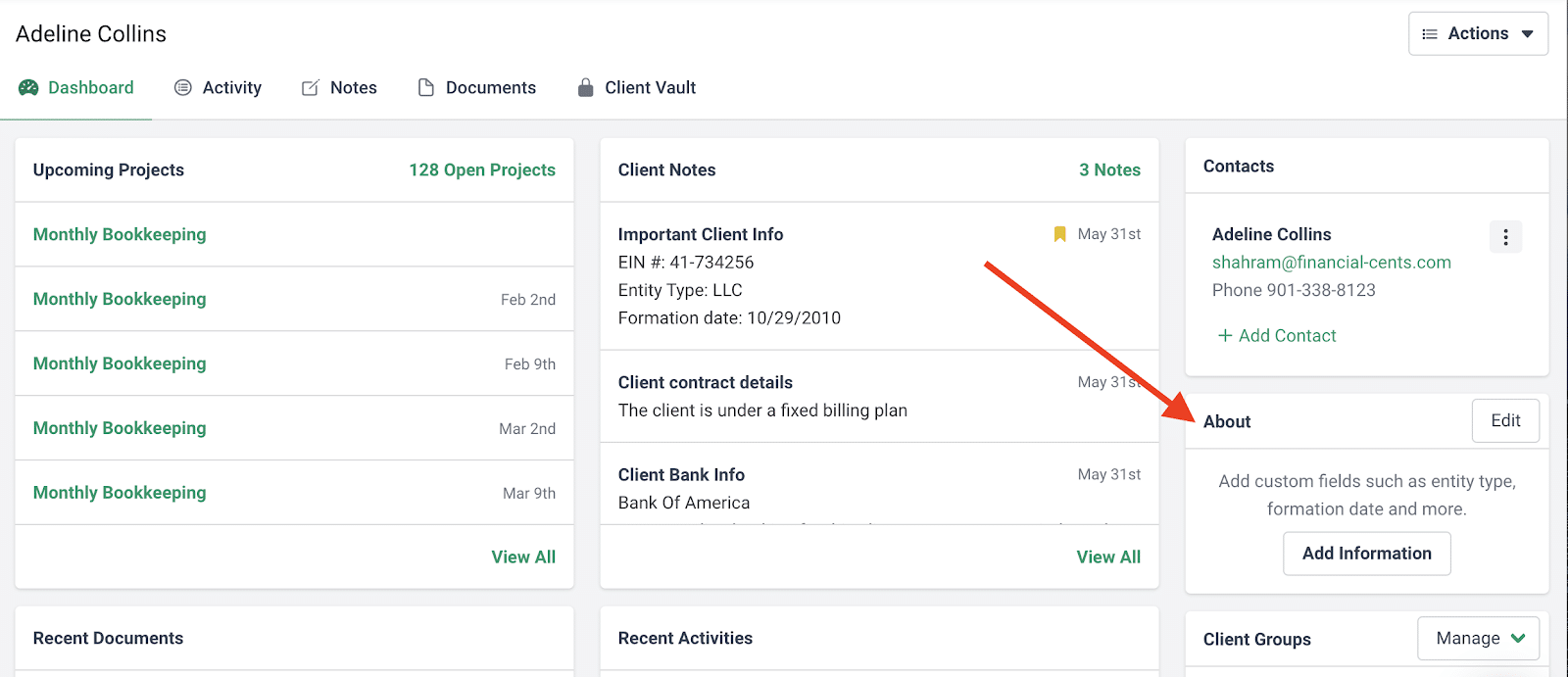

- In the client profile on Financial Cents, you’ll have all your client information in one granular view, so you don’t need to use multiple apps or spreadsheets to organize them. Some of the sections in this profile include upcoming projects, client notes, recent documents, client groups, etc.

- You can create any type of folder structure that reflects your specific needs. For example, categorize by client, project type, or tax year:

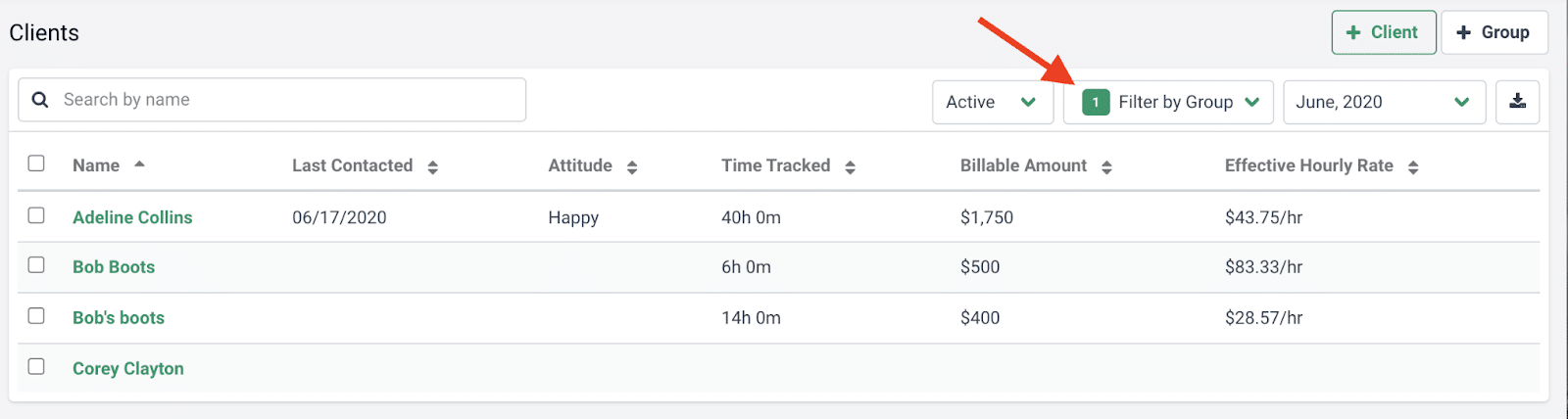

- Client groups are great for keeping you organized. Financial Cents lets you organize your client base into groups like Bookkeeping Clients, Tax Clients, Leads/Prospects, etc.

Create a group by clicking “Manage Groups” from the Client tab

You can filter your dashboard to specific groups so you can assimilate all the information you need at one glance:

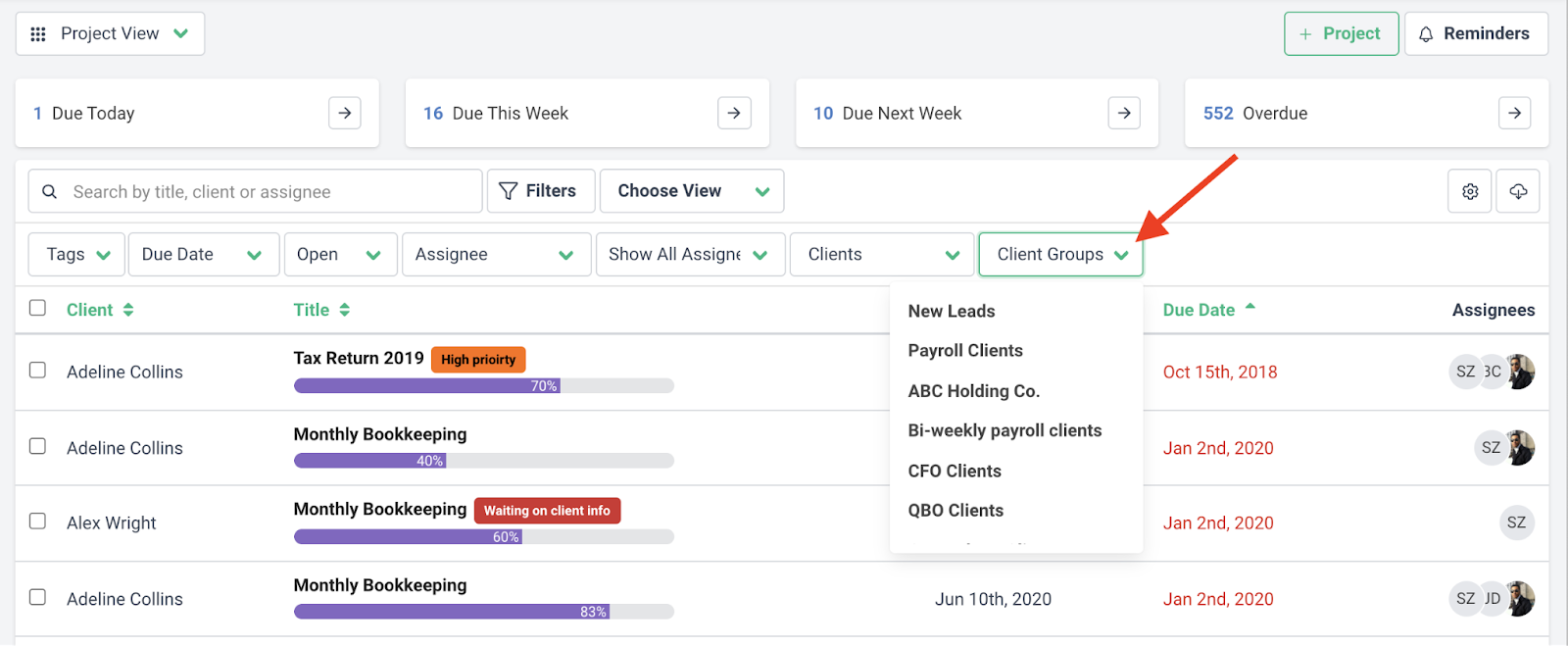

Or filter your workflow by groups to see all the work related to a specific group/type of client:

- Add custom fields to capture unique information relevant to your practice, like “Start Date” or “Entity Type.”

To add or edit custom fields, click “Add information” or “Edit” in the “About” section of the client’s profile:

There will already be a few default fields, but you can add more custom fields by clicking “Manage Fields.”

Recommended Review:

Advanced Search and Retrieval

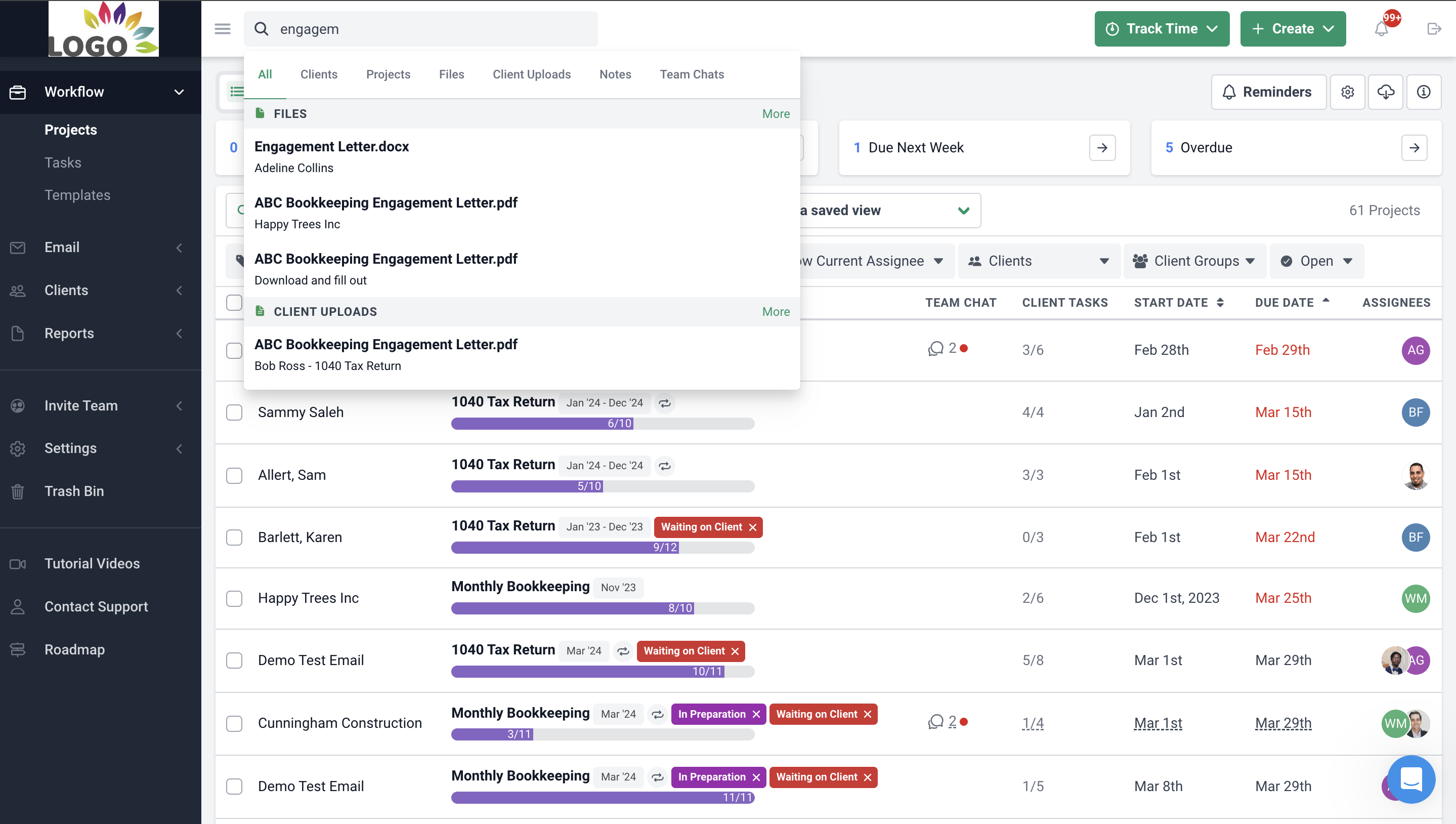

A good search function is essential for any accounting DMS. No more sifting through endless folders, wasting precious time to find information. You should be able to search for documents by keyword, date, client name, or any other relevant criteria.

Financial Cents “Global Search” feature lets you quickly find the documents you need. It allows you to search results by categories such as clients, projects, files, notes, client uploads, and team chats.

Workflow Automation

Accounting firms are often bogged down by repetitive tasks like data entry, acquiring documents from clients, and onboarding new clients. Workflow automation streamlines these processes, improving efficiency and reducing the risk of human error.

For example, with Financial Cents, you can create a workflow that requests documents from clients and sends them automatic reminders at intervals until they complete your request. This saves you the time and effort of manually contacting and following up with them.

You can also automate the status & tags of your work as it moves through the stages with “Tag Automators.”

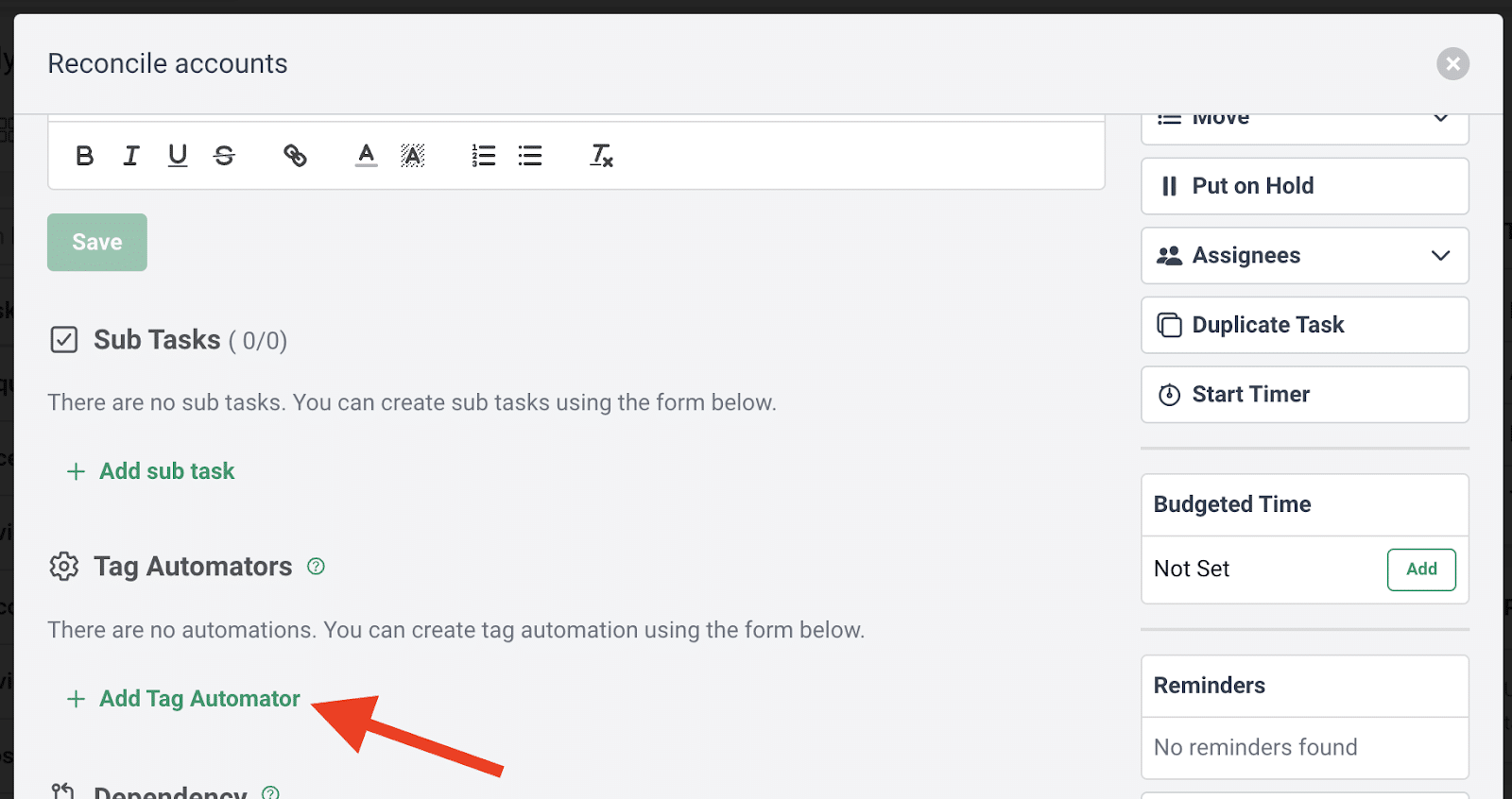

To do this, click “Add Tag Automator” within a task:

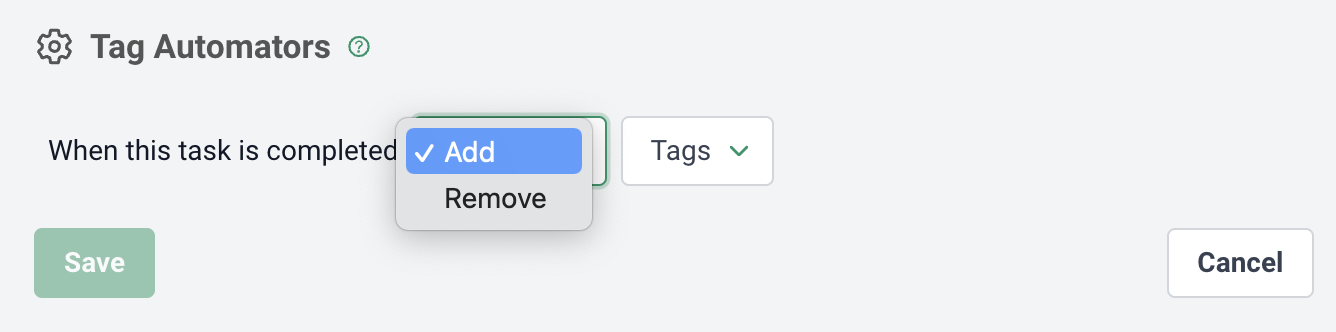

Then, either choose to add or remove a tag when you complete a task:

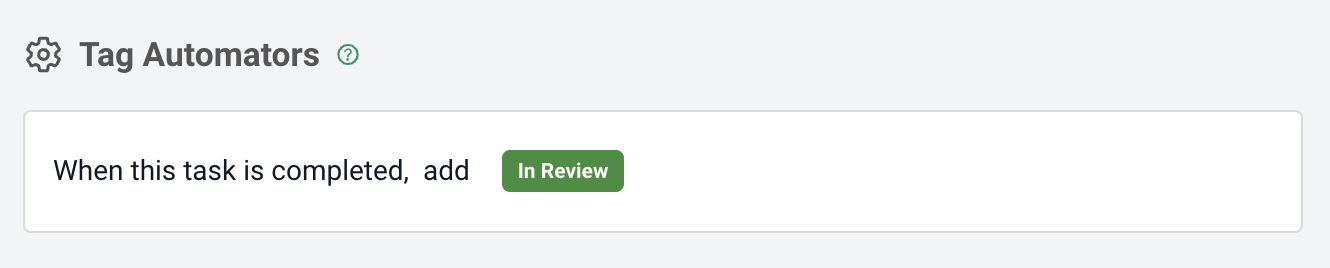

After making your choice, select the tag you want added on completion of the task:

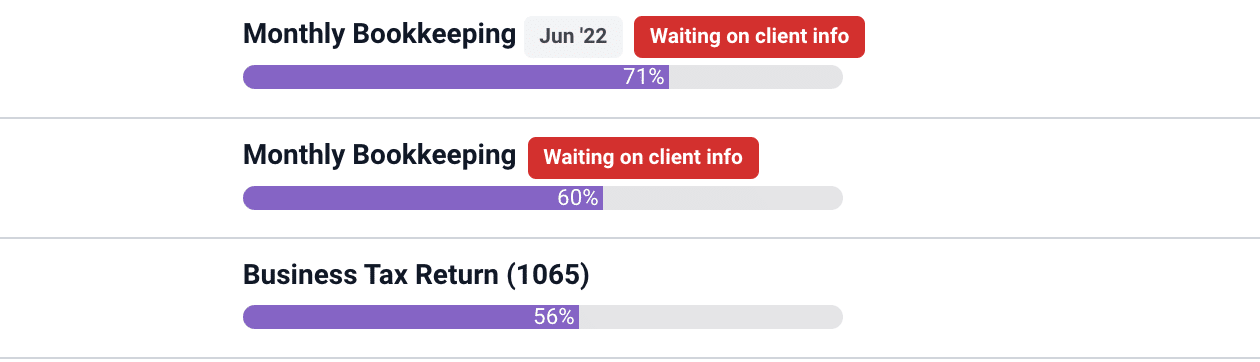

Tag Automators work for client requests, too. When you request, the project’s tag (or status) will automatically change to “Waiting on client info.”

Then, when the client uploads the document, the system automatically removes the tag.

Integration With Accounting Software

Another feature of a good accounting DMS is that it should integrate with your existing accounting software. This will allow for a smooth data flow, thus reducing manual data entry and errors and improving efficiency.

Some Financial Cents integrations include:

- QuickBooks: This lets you easily import and auto-sync all your clients from QuickBooks in seconds, sync your time entries to QuickBooks Online, and add your QuickBooks online service items to Financial Cents for invoicing and reporting.

- SmartVault: With our integration with SmartVault you can

- Import or link clients from SmartVault to Financial Cents

- Automatically create clients in SmartVault when you create a client in Financial Cents

- Access SmartVault from within projects, clients, or the documents section in Financial Cents,

- Enable automatic routing of client documents uploaded to the FC client task portal directly to their designated SmartVault folder.

- Adobe E-signature: You need this integration, which allows you to request signatures from clients within Financial Cents and organize all your signed copies in one place.

- Zapier: Use Zapier to integrate Financial Cents with 5,000+ apps like Anchor, GoProposal, Ignition, Dropbox, Proposify, etc.

Client Portal

A client portal lets you securely share documents and collaborate with clients on projects. Clients can upload documents, view their account information, and communicate with you directly through the portal.

Financial Cents DMS feature offers a secure client portal that does the above. You can share folders and documents with your clients and have them access or upload documents.

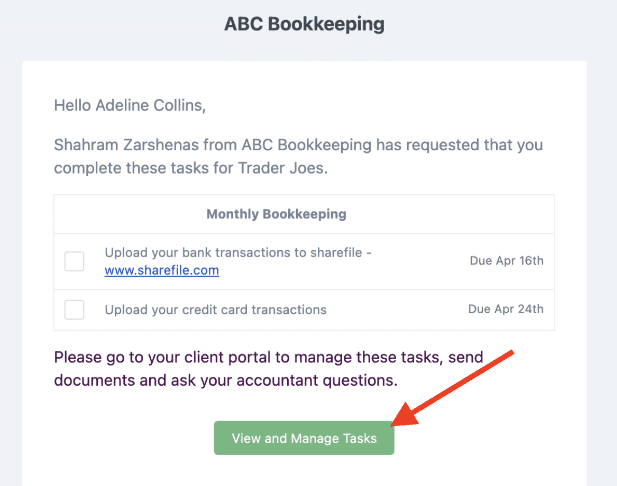

To access and use the portal, clients must click the “view and manage tasks” button in their email notification.

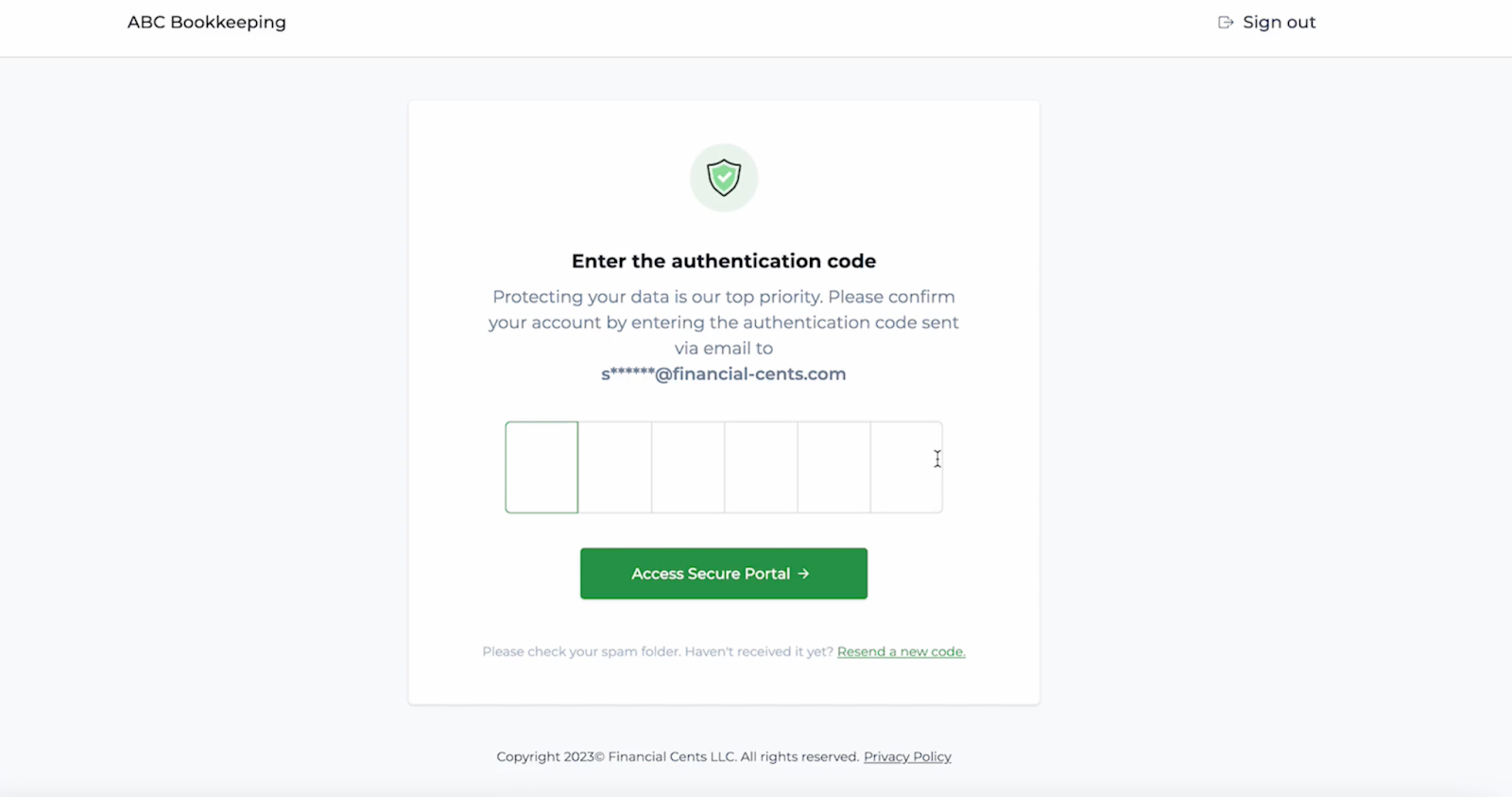

It’s passwordless: The client portal doesn’t use the standard username and password login method. Instead, clients only have to click a button that sends an authentication code to their email. Then, they’ll use the code to access their portal.

Manage Uncategorized Expenses via ReCats: A feature native to Financial Cents, ReCats uses the client portal to manage uncategorized transactions. Via this portal, you can ask clients about certain transactions so they can upload receipts or other documents that provide more context for the transaction.

Robust Security and Access Controls

Security is a top priority for any accounting firm. So, any DMS you select must have robust security features to protect clients’ data. This includes features like user authentication, data encryption, and audit trails.

In Financial Cents, client information and documents are always safe. Financial Cents’ encryptor uses OpenSSL to provide AES-256 and AES-128 encryption. Also, a message authentication code (MAC) signs all FC’s encrypted values, so no one can modify their underlying value once encrypted.

Use Financial Cents to Manage Your Documents

Financial Cents is a cloud-based accounting firm management software with DMS features that can help you organize your documents, access them from one place, and make your team more efficient.

Financial Cents offers several benefits, such as:

- Workflow management to always meet deadlines.

- Time tracking to track billable and non-billable hours.

- Capacity management to ensure no one is underworking or overworking.

Financial Cents is affordable, easy to use, and can scale with you to meet the needs of your growing firm.

To learn more about Financial Cents, sign up for a free trial.

Thanks for the article!