For many accountants accustomed to a 40-hour workweek, a 15-hour schedule might seem like a distant dream. Studies show the average accounting professional clocks in at 43.4 hours weekly. However, the reality can be even more demanding. In some parts of the world, busy seasons push accountants to work upwards of 55 to 58 hours per week.

While dedication is admirable, the reality is constant overtime can lead to burnout and leave you feeling perpetually behind.

But what if there was another way? Sounds like a dream, right? Well, hold on – a 15-hour workweek is gaining serious traction, and it has the potential to change your life. The benefits are undeniable: a life beyond the office, a healthier work-life balance, and the potential for a newfound joy in what you do.

Let’s explore how to cut down your work hours while achieving impressive results dramatically.

Roadmap to a 15-Hour Workweek

1. Assess Current Workflows

The foundation for achieving a 15-hour workweek lies in a deep understanding of your current workflow. This involves a thorough analysis of your team’s daily tasks, time spent on each activity, and potential bottlenecks that hinder efficiency.

Research from our 2024 State of Accounting Automation Workflow Report shows that beyond lost revenue and missed deadlines, inefficient workflows contribute to a poor work-life balance for over half (55.9%) of firms.

Digging deep into your current workflow and making improvements can boost team morale and open the door to a more flexible work schedule.

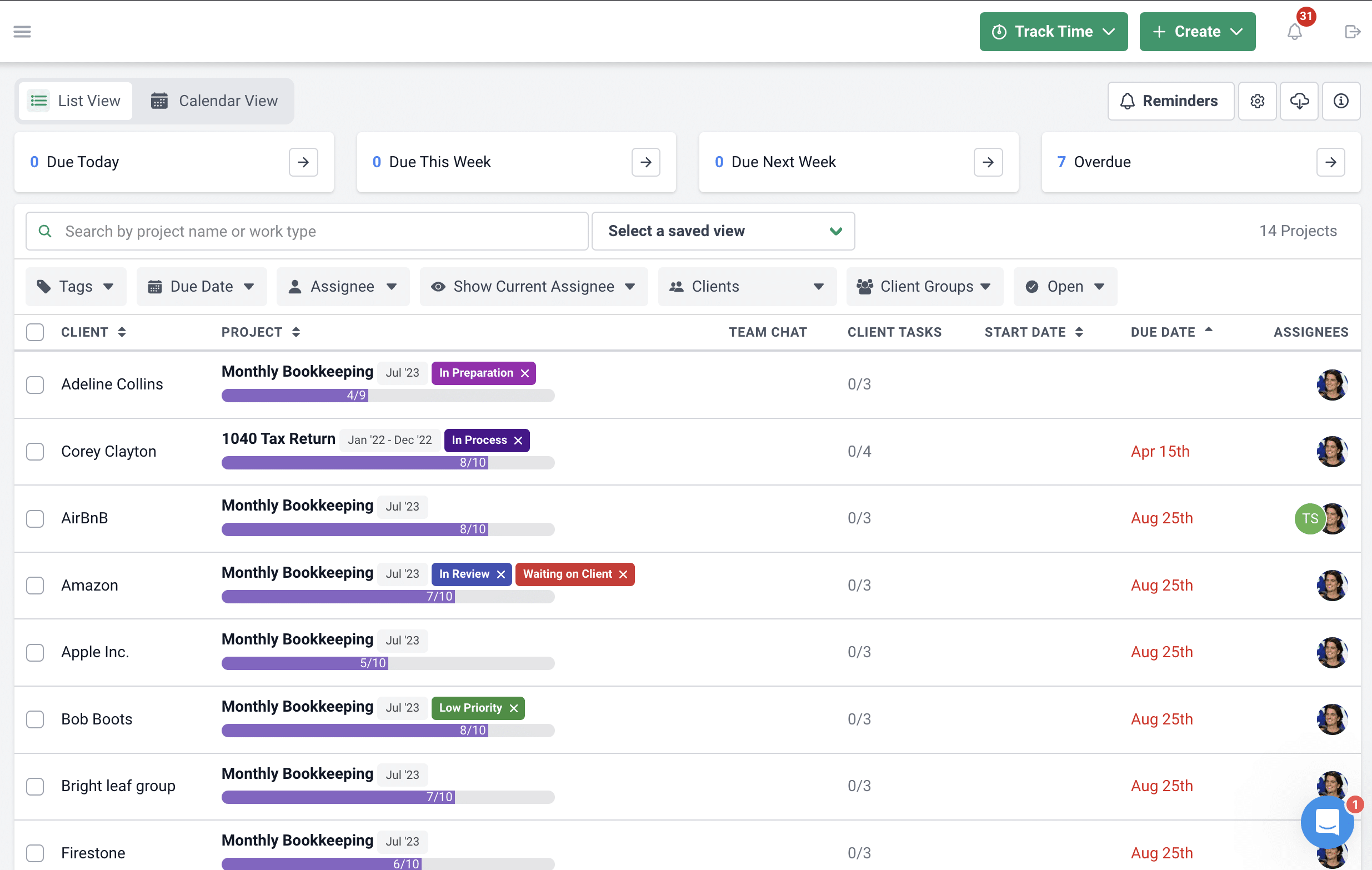

This is where powerful tools like workflow analysis and accounting practice management software like Financial Cents come into play.

This workflow management software goes beyond simply housing client data.

It allows you to visualize your existing processes, identify bottlenecks, and track task completion times. This helps you gain mastery of your accounting workflow.

When you see the workflow laid out clearly, it’s easier to pinpoint areas where things get held up. Is it waiting on client information? Is there a manual data entry step that could be automated? These bottlenecks can be addressed to improve overall flow.

2. Effective Delegation

Delegation isn’t just about offloading tasks; it’s about empowering your team and creating a more efficient workflow. Don’t just hand off a task and hope for the best when scaling down to a 15-hour workweek. Communicate the desired outcome, deadlines, and any specific instructions or protocols.

Amanda Owens, PAFM (Firm Administrator, Badger CPA), advises that “over-communication is necessary” when communicating your vision to your team. This reduces confusion and ensures everyone is on the same page.

Encourage open communication with your team. Make yourself available to answer questions or address roadblocks before tasks are delegated. Regular check-ins can help identify any issues early on and ensure the project stays on track.

When delegating, consider each team member’s strengths and weaknesses. Assigning tasks that align with their skills and interests will not only ensure quality work but also boost employee morale and engagement.

No matter how big or small your team is, you must align your team against specific organizational goals, and I think that starts with a vision that is clear and concise, that you can communicate and you can track."

Amanda Owen.Delegation doesn’t stop within your team. Learn to leverage outsourcing as a strategic tool. By delegating accounting services like bookkeeping, data entry, or payroll processing to qualified external providers, in-house staff are freed from administrative burdens. This allows them to focus on higher-value activities such as strategic tax planning and client consultations, ultimately reducing overall workload and boosting firm efficiency.

3. Implement Automation

One key strategy to achieving a 15-hour workweek in your accounting firm is through automation. Let’s face it: accounting is full of repetitive tasks that, while essential, can bog down your team.

Studies show workflow automation can slash repetitive task time by a whopping 60-95%.

Accounting software has come a long way, offering features like automatic data entry, document management, time-tracking, and managing uncategorized transactions. By leveraging these features, you can significantly reduce manual data manipulation and free up your team for strategic analysis, client communication, and proactive financial planning.

Don’t just set up your accounting automation workflow and leave it; be sure that it produces the results you want. Develop standardized workflows for common tasks like bookkeeping, payroll, and tax preparation. Set clear agendas, stick to time limits, and consider replacing unnecessary meetings with email updates or video conferences.

Check out our free accounting checklist templates.

Take your cue from Advocate Accounting LLC, an accounting firm that wanted a way to manage tasks and workload as they grew.

Erin Louis initially managed the firm using Gmail Calendar. However, as the firm grew, Erin needed a workflow management tool to delegate tasks and automate repetitive processes. She also wanted a tool to track employee time and workload.

Financial Cents was the solution Erin was looking for. It allowed her to delegate tasks, automate repetitive tasks, and track her team’s time and workload, freeing up her time to focus on more strategic work.

Financial Cents also helped Erin’s team to be more organized and efficient. Our software stores all client information in one place, which saves time and frustration for Erin’s team. Additionally, our software makes it easy to track time and generate billing reports. Erin is also confident in the accuracy of the billing information because Financial Cents integrates well with QuickBooks.

Erin’s not alone. Financial Cents empowers countless accountants like Dawn Brolin to strengthen client relationships by freeing them from administrative burdens.

4. Optimize Communication and Client Management

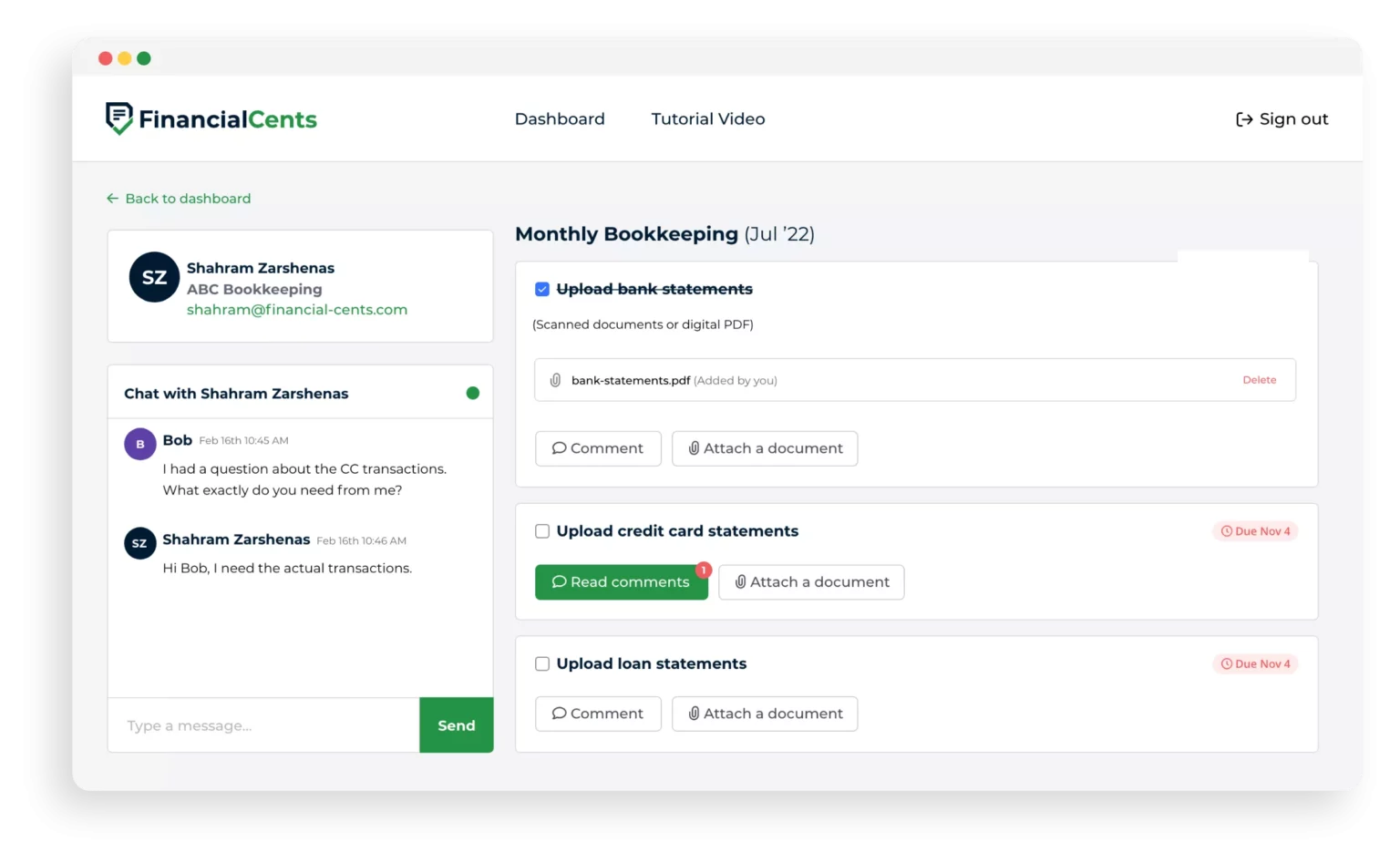

Constant communication ping-pong with your clients can eat into valuable hours. Establish preferred methods of contact (email, client portal messaging, etc.) and define response timelines for both routine and urgent matters. This helps manage client queries efficiently and reduces unnecessary calls or emails.

Use automated tools to send gentle nudges to clients for missing information or upcoming deadlines. This frees you from the burden of manual reminders and keeps projects moving smoothly.

Consider implementing a secure online client portal for your accounting firm where clients can access essential documents, track progress on tasks, and securely upload requested information.

This reduces email back-and-forth and keeps everything organized in one place.

In addition to this, develop onboarding checklists and workflows to streamline the client onboarding process.

Nikole Mackenzie, CEO & Founder of Momentum Accounting, Inc. states that “part of what makes a good onboarding process is having a good sales process.”

This makes the handoff process of sending welcome emails, collecting essential information, and scheduling initial meetings much easier.

We’re building trust during onboarding. And a lot of times, the client still needs to trust us. And we have to be very, very highly communicative. They need to remember what they signed."

Nikole MackenzieLastly, develop a clear offboarding plan that outlines the steps involved in transitioning a client out, including finalizing accounts, transferring documents, and collecting outstanding fees.

5. Time Management Techniques

Time management is crucial for maximizing productivity while aiming for a 15-hour workweek. Here are some techniques you can try:

- The Pomodoro Technique: This method utilizes focused work intervals followed by short breaks. Set a timer for 25 minutes and dedicate that period to a single, high-priority task. After 25 minutes, take a 5-minute break to refresh your mind. Repeat this cycle for several rounds, with a longer break (20-30 minutes) after completing multiple 25-minute intervals.

- Time Blocking: In contrast to working in long stretches, time blocking involves allocating specific time slots in your calendar for dedicated tasks. Block out time for focused work, client meetings, email management, and administrative tasks. Consider the natural flow of your energy levels when scheduling tasks.

- Eisenhower Matrix: The Eisenhower Matrix can help you prioritize effectively. Categorize tasks based on urgency and importance. Urgent and important tasks require immediate attention. Important but not urgent tasks can be scheduled on your calendar. Delegate or eliminate urgent but unimportant tasks. Not urgent and unimportant tasks should be eliminated.

Building a 15-Hour Workweek Culture

Building a 15-hour workweek culture doesn’t just happen overnight. Firms that prioritize efficiency and time management can lay the groundwork for a transformative culture that fosters a streamlined workweek.

Angela Main Roberts, (Owner of Main Accounting Services LLC) hits the nail on the head when she said: “Culture is defining the mood of the business.”

This culture shapes how your team interacts, tackles challenges, and interprets daily tasks.

By fostering a culture that champions these goals, you can create a sustainable shift towards a 15-hour workweek. This goes beyond temporary adjustments – it’s about building a long-term commitment where efficiency is ingrained in your team’s DNA.

Achieving a 15-hour workweek in accounting firms requires a significant shift in approach.

In terms of staffing, move from traditional departmental structures to project-based teams with clear goals and deadlines. This allows for focused work and potentially reduces redundancy.

Embrace part-time and flexible work arrangements to attract top talent who may not want a full-time schedule.

Also, invest in cross-training employees to increase skill sets and allow for coverage during absences without requiring extra hours.

In terms of service offerings, leverage technology for client communication, document sharing, and collaboration. This streamlines processes and reduces time spent on administrative tasks.

Regularly conduct internal efficiency audits to identify bottlenecks and areas for improvement.

And lastly, educate clients about the benefits of the 15-hour workweek model for their projects. Emphasize the focus, attention to detail, and improved work-life balance it can bring.

Addressing Challenges

Transitioning to a 15-hour workweek within an accounting firm presents undeniable advantages, but it’s crucial to acknowledge potential challenges that you may face:

Client Resistance: Clients accustomed to immediate responses or extended hours may initially resist the reduced schedule.

Complex Projects: Time-intensive projects with tight deadlines could be difficult to manage within a compressed workweek.

Staffing and Coverage: Ensuring adequate staff coverage during core business hours might require adjustments.

Here are some strategies for overcoming challenges:

Client Communication: Clearly explain the benefits of the 15-hour workweek for both the firm (improved staff well-being, increased productivity) and the client (enhanced service quality). Offer alternative communication channels (email, online portals) to address accessibility concerns.

Project Management: Implement stricter project scoping and time management practices. Consider offering tiered service packages with different response timeframes. Explore technology solutions to streamline workflows and automate repetitive tasks. We provide a definitive accounting project management guide in this article.

Flexible Staffing: Explore alternative staffing models like part-time employees, freelancers, or staggered work schedules to ensure coverage during peak hours.

Focus on Data: Gather data showcasing the positive impact of a 15-hour workweek on employee productivity and client satisfaction in similar firms.

Phased Approach: Consider a trial period with a small group of employees or specific projects to demonstrate the feasibility and benefits.

Open Dialogue: Address staff and client concerns openly and honestly. Emphasize the long-term benefits of a sustainable work model for the entire organization.

Wrapping Up

Time is money, especially in the accounting world. By streamlining your practice and maximizing efficiency, you can directly translate those gains into a lighter workload and more free time.

Financial Cents isn’t just another accounting software. It’s your key to achieving the 15-hour workweek dream. It empowers you to free yourself and your team from tedious manual work.

Use Financial Cents to get work done effectively.