It’s tax season again, and your firm is already feeling the familiar pressure. Your inbox is filling up with clients asking about the status of their tax filing. You’re chasing missing W-2s from one client, waiting on 1099s from another, and once again reminding a long-time client to upload last year’s return.

Meanwhile, your team is trying to keep everything organized across email threads, spreadsheets, and scattered notes. And at the end of it all, you’re left wondering how much faster and smoother things would be if every client simply sent the right documents from the start.

A tax preparer checklist for clients can fix that. When you give clients a list of exactly what they need to provide, and set expectations early, you cut down on delays, avoid back-and-forth, and reduce the risk of errors or missed deductions.

In this guide, we’ll walk through a comprehensive tax preparer checklist you can use or share with clients, along with practical tips for staying organized. You’ll also see how tools like Financial Cents make it easier to request documents, follow up with clients, and automate the entire process.

What Is a Tax Preparer Checklist?

A tax preparer checklist is a simple but powerful tool that helps you collect all the information and documents you need from a client before you start their return. It outlines everything required for the filing process, like personal details, income forms, deductions, credits, prior-year returns, and any supporting records.

This ensures you don’t miss or overlook important details that could cause delays, affect the accuracy of a return, or create issues with the IRS later.

It also improves your tax preparation workflow efficiency because when clients know exactly what to provide upfront, your team can focus on preparing the return instead of chasing missing documents.

What a Tax Preparer Checklist for Clients Should Include

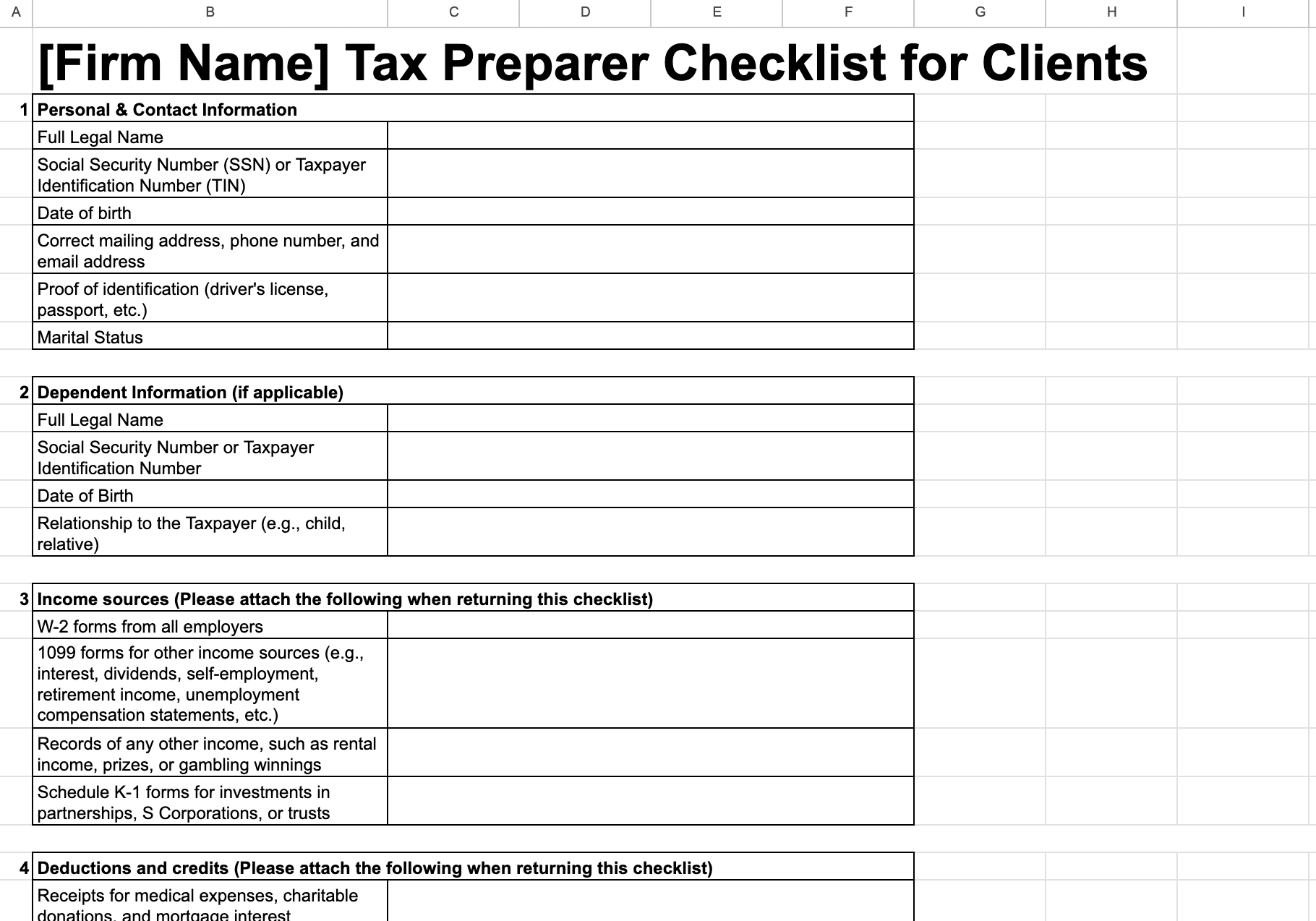

The more organized your clients are, the faster you can complete their return. This section breaks down everything they should send, grouped by category. You can share this as a downloadable checklist or include it in your client onboarding packet at the start of tax season.

1. Personal Information

To start a return, you’ll need your client’s accurate personal details. This includes:

- Social Security Number: Clients must provide their SSN so you can verify their identity, match their tax records with the IRS, and ensure all income forms link correctly to their return.

- Date of birth: This helps confirm eligibility for age-based credits or deductions.

- Correct mailing address and a current phone number: This ensures any IRS correspondence goes to the right place and you can reach clients quickly during tax season.

- Proof of identification: Such as a driver’s license or passport.

2. Dependents Information

If your client has dependents, you’ll need the following:

- Social Security Number: Used to verify dependent claims, child tax credits, and household-related deductions.

- Date of birth: Important for calculating eligibility for child-based credits.

- Relationship to the taxpayer: Helps determine whether the dependent qualifies under IRS rules.

3. Income Sources

You need to collect all applicable income forms to ensure the return reflects every income stream and complies with IRS reporting requirements.

- For employees & retirees, collect:

- W-2: This shows wages, salaries, and tax withholdings. Missing a W-2 can trigger IRS notices later.

- SSA-1099: You need this to calculate taxable Social Security benefits.

- 1099-R: This covers individual retirement arrangement (IRA), pension, and 401(k) distributions, including early withdrawal penalties or taxable amounts.

- For self-employed & gig workers, collect:

- 1099-NEC: This reports non-employee compensation for freelance or contract work.

- 1099-K: This is issued by payment networks like PayPal, Venmo, Square, or Stripe, and it helps ensure gross receipts match what payment platforms reported to the IRS.

- For investors & savers, collect:

- 1099-INT: This covers interest from banks, credit unions, or other financial institutions.

- 1099-DIV: This reports dividends and capital gain distributions.

- 1099-B: These are proceeds from broker/barter exchange transactions and provide details needed to calculate capital gains or losses.

- K-1s: This reports income from partnerships, S-corps, trusts, or estates.

3. Deductions and Credits

To help your client identify all possible deductions and credits, start by asking for supporting documents. These can reduce taxable income or trigger credits that lower their tax bill. The documents to request include:

- Tax-Deductible Expenses

- Medical/dental expenses: Receipts or statements are needed, especially if expenses may exceed the AGI threshold for deductibility.

- Taxes paid: State and local income/sales tax receipts (up to the $10,000 limit).

- Mortgage interest (Form 1098): This shows deductible mortgage interest and real estate taxes.

- Charitable donations: Receipts or acknowledgment letters for cash and non-cash donations.

- Credits & Education

- Child/dependent care expenses: You need the provider name, address, and EIN/SSN to claim the Child and Dependent Care Credit.

- Education (1098-T): This shows tuition paid. Book and supply receipts may also be deductible.

- Energy credits: These are receipts for qualifying energy-efficient home improvements (e.g., insulation, solar).

4. Payments, Adjustments, & Miscellaneous

This section includes tax-related payments or adjustments that impact the final return. Collect documents like:

- Self-employment tax payments: Proof of estimated quarterly tax payments made to avoid underpayment penalties.

- Retirement contributions: Records of IRA or HSA contributions made during the tax year (or up to the filing deadline, if allowed).

- Health insurance forms (1095-A, 1095-B, 1095-C): Needed to reconcile marketplace insurance or verify coverage.

- Alimony paid/received: Clients must provide divorce decree details so you can determine tax treatment.

5. Assets & Investments

These documents are key for reporting capital gains/losses, depreciation, and other asset-related tax items like:

- Real estate purchase or sale documents

- Stock or mutual fund sales (supporting cost-basis details)

- Retirement distributions or conversions (Roth conversions, etc.)

6. Other Relevant Documents

The extra documents you need to file a tax return are:

- Previous year’s tax return (if available): Helps you compare figures, identify carryovers, and catch changes.

- Bank statements and investment account summaries: Useful for verifying income, dividends, or unusual transactions.

- Records of any major life events, such as marriage, divorce, or birth of a child: Marriage, divorce, birth of a child, moving, or adopting a dependent can affect filing status and credits.

- IRS notices: If the client received a notice, it should be reviewed and addressed during prep.

- Business income or expenses (if applicable): For clients who run a small business or side hustle, including receipts, mileage logs, home office details, and bookkeeping records.

Tax Preparer Checklist for Clients

Why Tax Preparers Need a Client Checklist

Here’s why every tax preparer should rely on a standardized checklist:

Reduce Back-And-Forth Communication

Most delays during tax season happen because clients send documents in pieces or forget essential forms. A checklist gives them a complete, organized list of what to provide from the start, reducing follow-up emails, calls, and reminders, making client communication more effective. This frees up your team to focus on strategic and higher-value tasks.

Improve Accuracy and Compliance

A checklist ensures you collect the right information the first time, helping you file accurate and compliant returns. It also minimizes the risk of overlooking documents that can cause errors, missed deductions, or issues with the IRS.

Save Time During the Busy Season

When all required documents arrive early and in one place, your team can work faster. Instead of stopping mid-prep to send follow-up emails, you can keep things moving. This helps you manage your time better and handle more clients without increasing stress.

Create a Better Client Experience

Clients love clarity, and a checklist helps them prepare ahead, reduces guesswork, and makes the process smoother for both sides. This can improve client satisfaction and increase the likelihood of referrals or repeat business.

Ensure Nothing Is Missed in Documentation

Anyone can make a mistake, but a standardized checklist protects against oversight by ensuring your team and your clients follow the same process every time. It gives you confidence that all required information has been collected, reviewed, and documented.

Tips for Using Checklists

The tips below will help you get the most value out of your tax preparer checklist and make tax season easier for your firm.

Share the Checklist Early

Send the tax checklists as soon as you open your calendar for tax season. This gives clients enough time to gather documents, request missing forms, or reach out with questions before deadlines approach. The earlier you send it, the fewer last-minute surprises you’ll deal with.

Communicate With the Client Clearly Regarding the Required Documents

Clients may still be unsure about certain forms, so include short explanations or examples in your checklist to help them understand what each item is and why it matters.

Send Automated Reminders for Missing Documents

Clients get busy and forget. Instead of manually chasing them to share necessary documents, set up automated follow-up emails at set intervals with tools like Financial Cents. You can request documents from clients, schedule follow-ups, and let the system do the nudging for you until the documents come in.

Address Client Questions and Concerns Promptly

Some clients will still have questions about forms, deadlines, or how to upload documents. Make it easy for them to reach out and be quick to respond. This shows clients you’re on top of things and makes them likely to recommend you to others.

Encourage Clients To Use a Secure Portal for Uploads

A secure accounting portal helps clients upload documents safely and keeps everything in one place. It eliminates the risk of lost emails or scattered attachments and makes it easier for your team to track what has already been submitted.

Review Submissions Weekly To Avoid Last-Minute Rushes

Don’t wait until the final weeks before the deadline to review client uploads. Check submissions weekly to confirm you’ve received all required forms and identify any missing pieces early. This reduces last-minute pressure and allows your team to prioritize returns more efficiently.

Managing the Tax Preparation Process Efficiently

A checklist is a great starting point, but to really stay ahead during tax season, you need systems that help you manage client communication, document collection, and team workflows all in one place. That’s where an accounting practice management tool like Financial Cents makes a big difference.

Here’s how our practice management software helps streamline the tax preparation process from start to finish:

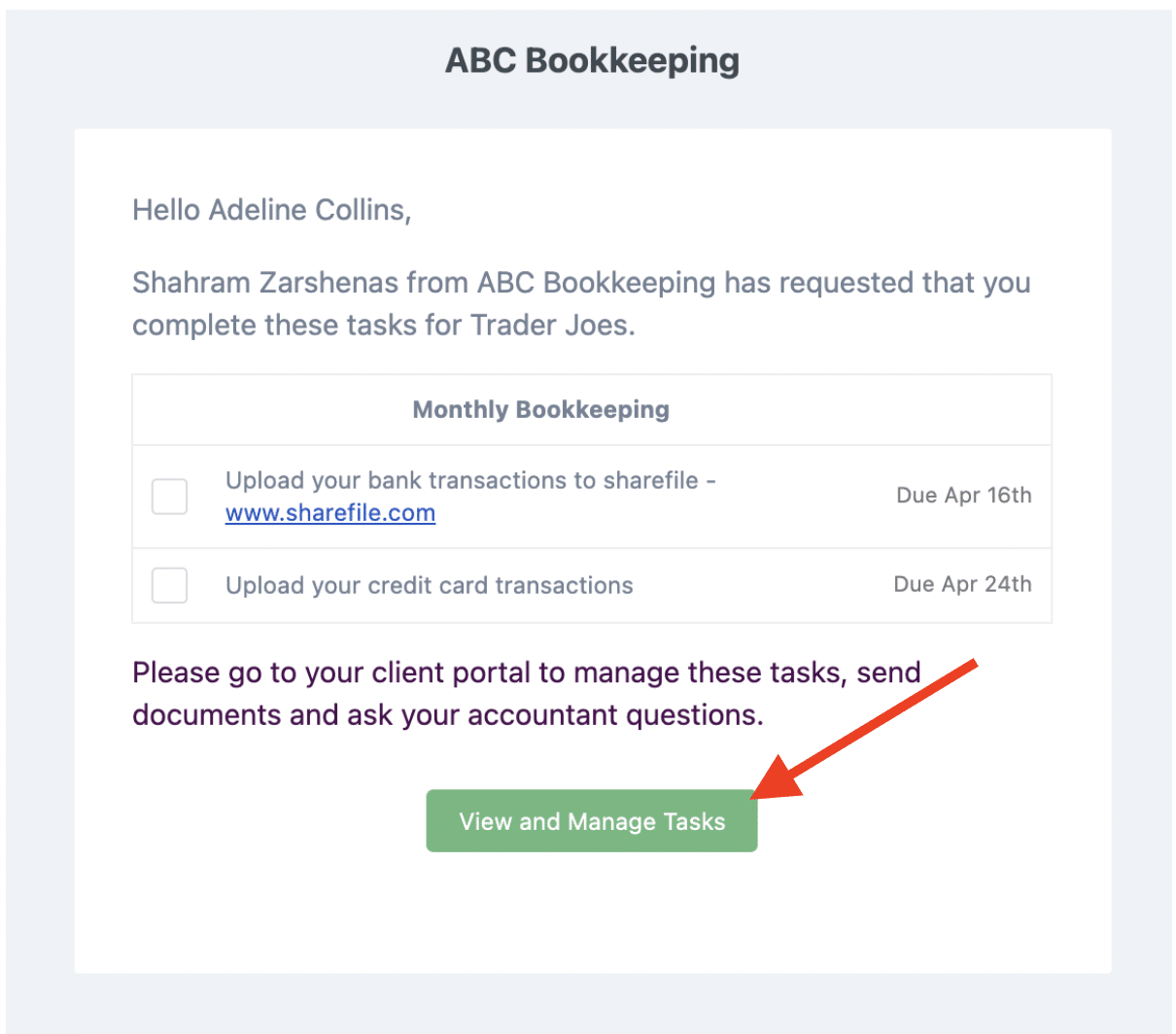

Use a Secure Client Portal

Instead of asking clients to email sensitive tax documents, Financial Cents gives you a dedicated client portal where they can upload everything directly to their file. This keeps documents organized, easy to access, and safe.

Best of all, clients don’t need a username or password to access the portal. Here’s how it works:

- Clients receive an automated email from Financial Cents with a “View and Manage Tasks” button.

- When they click the button, they’re taken to a secure portal where they request a verification code.

- The code is sent to their email and remains valid for up to 30 days.

- Once entered, they can view their task list, upload documents, and communicate with your team, without needing to remember a password.

It’s a smoother, more secure experience for both sides.

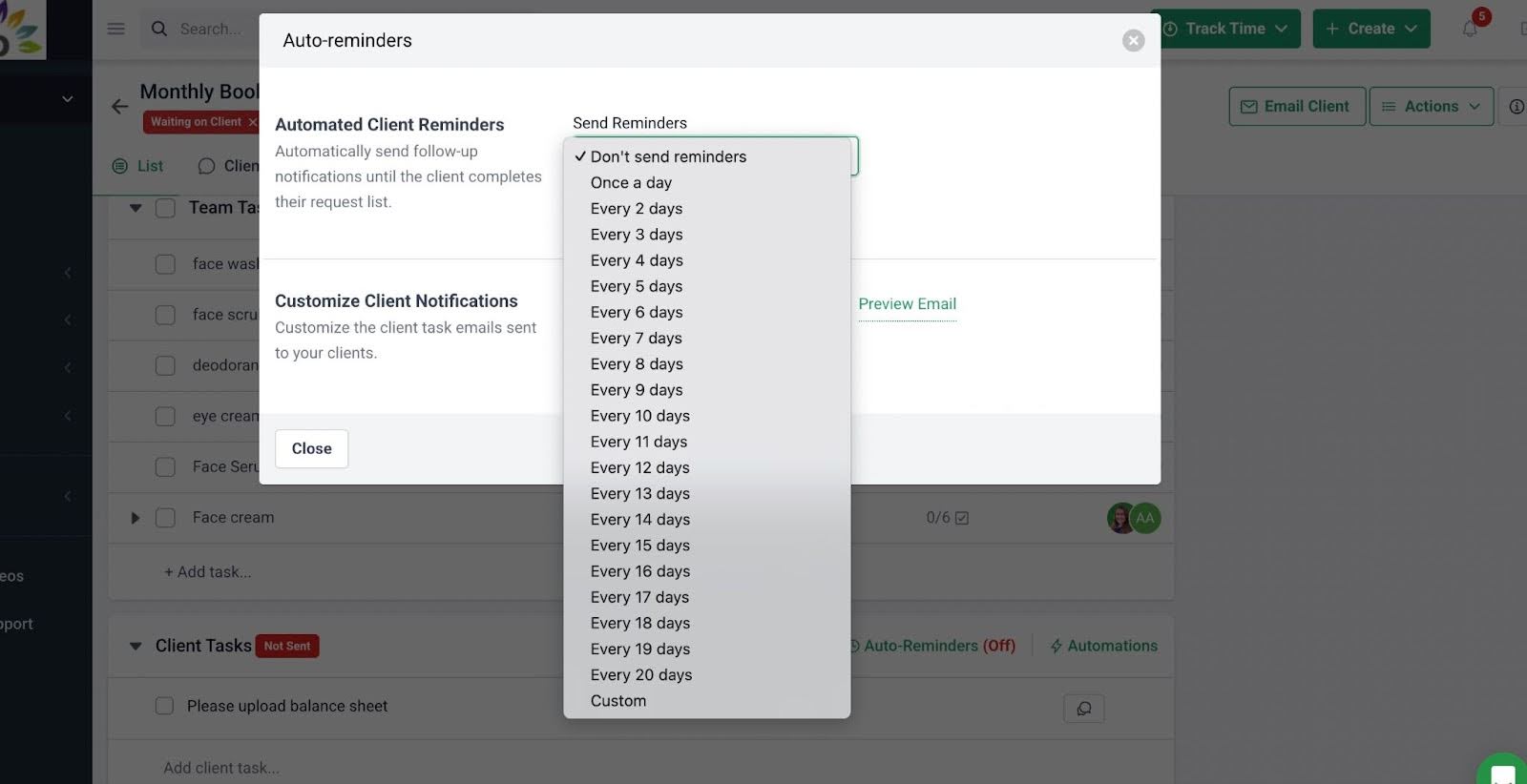

Automate Client Information Requests and Follow-Ups

Timely tax preparation depends on how quickly clients respond to your information requests. When clients delay, your entire workflow gets pushed back. Automating those requests helps your team stay on track and meet deadlines more consistently.

With Financial Cents, you can use Client Tasks to assign document requests to clients and set up automated reminders at regular intervals. You decide how often clients should be nudged—whether it’s every few days or once a week—until they complete the task.

You can even enable SMS notifications to increase response rates by sending reminders straight to their phones.

With automated reminders handling the follow-up for you, your firm can work faster and more efficiently.

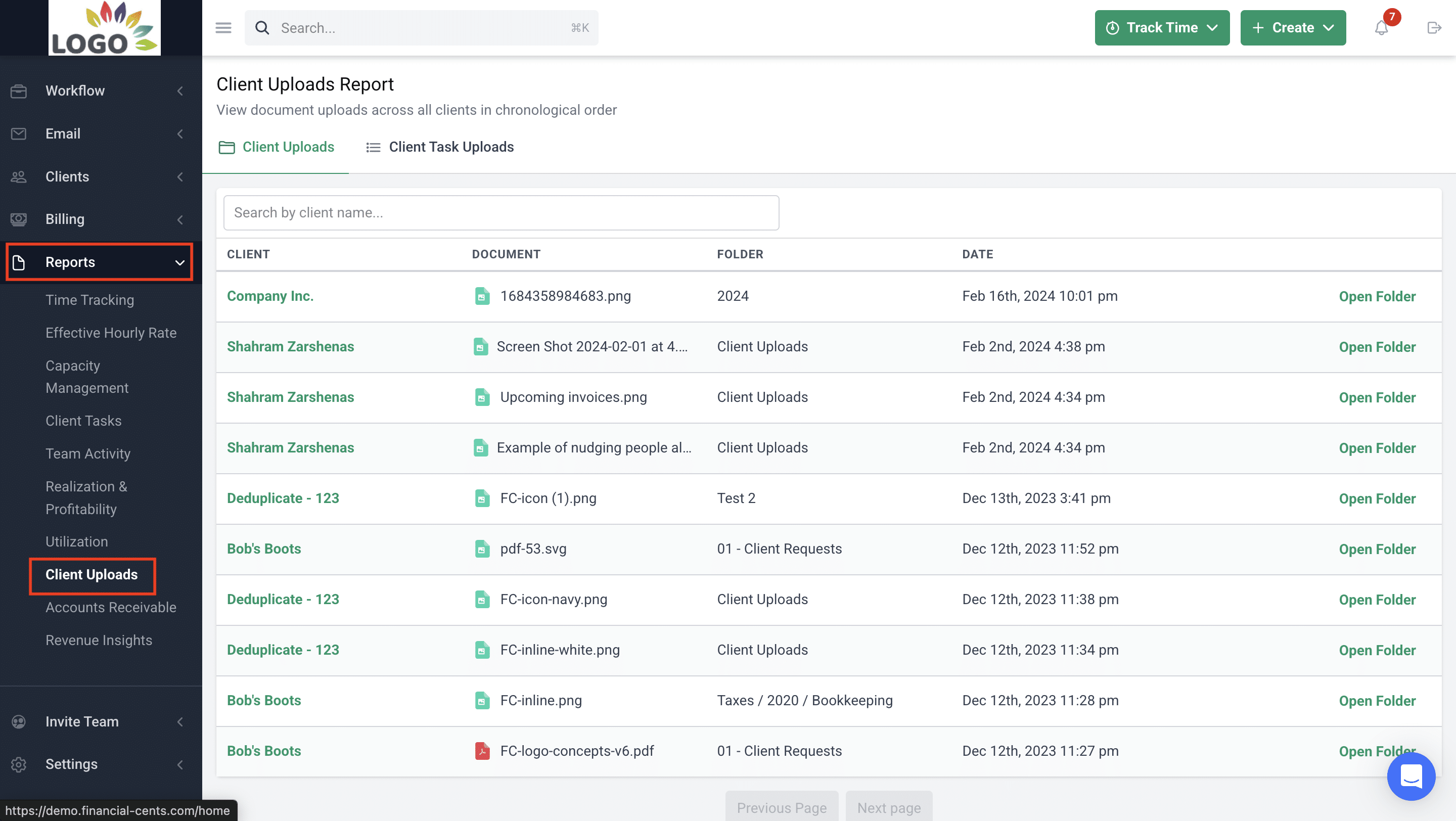

Track Which Clients Have Submitted Their Tax Docs

During tax season, keeping track of who has uploaded what can become overwhelming, but Financial Cents solves this with the Client Uploads Report, which gives you a real-time view of all files submitted by your clients:

It centralizes every document, whether clients uploaded them through the Client Files section or attached them to a Client Task inside a project.

Instead of wasting hours digging through messages or folders, you’ll have everything in one centralized place and can easily access it. It’s a good way to stay organized, keep clients accountable, and stay on schedule.

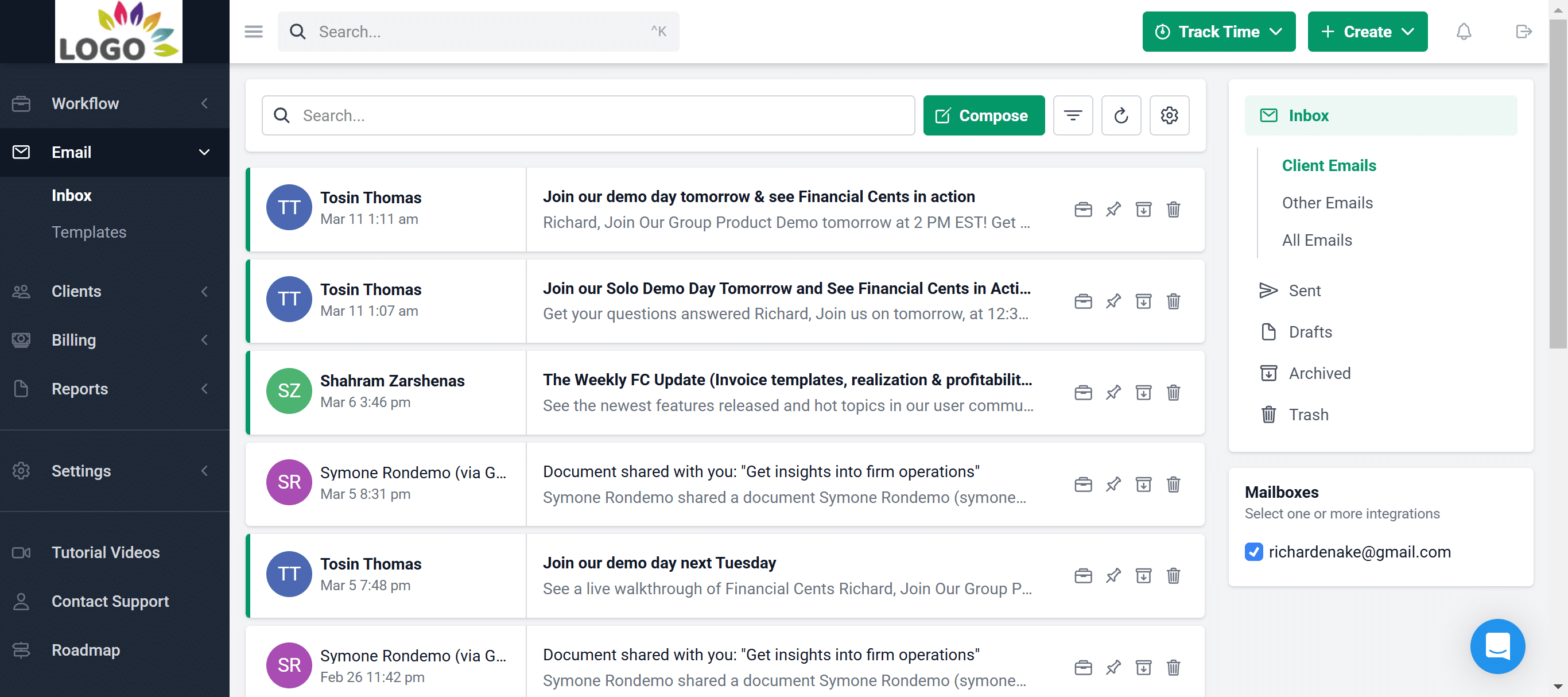

Communicate With Clients

Tax season can generate a flood of emails, messages, and follow-ups, and Financial Cents helps you simplify client communication by centralizing everything.

It integrates directly with Gmail and Outlook, automatically pulling any client email sent to you or any team member into the client’s profile. This gives your entire team a single, unified view of every message. You can even pin important emails to specific projects to keep context where it matters:

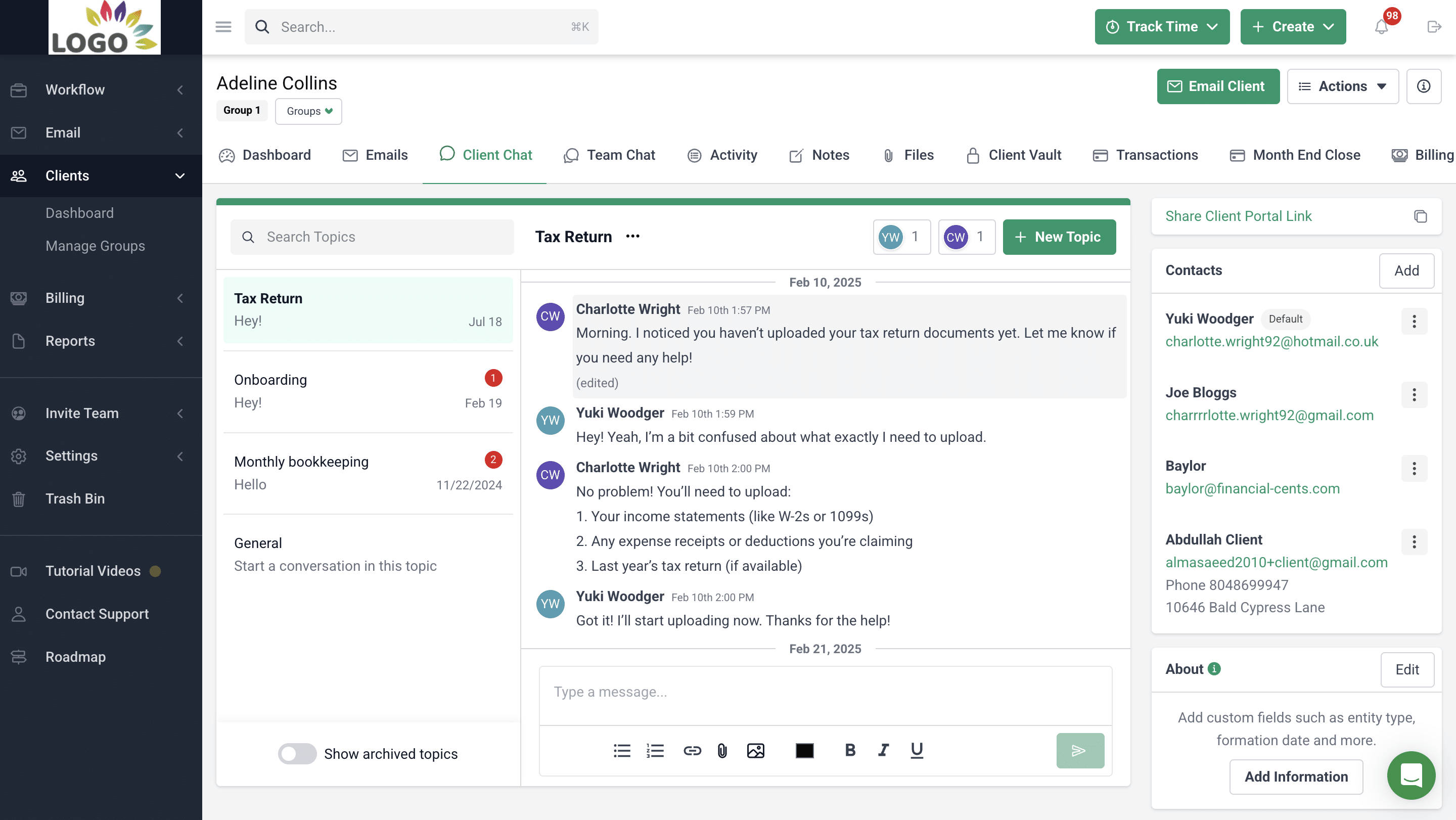

The Client Chat feature lets you and your clients communicate directly inside Financial Cents. This eliminates scattered email threads, reduces repeated questions, and makes it easier for clients to send quick updates.

You also have access to the Client Audit Trail, which logs all client interactions, so your team always knows what’s been done and what still needs attention:

With everything in one system, your firm can collaborate more efficiently, deliver faster responses, and provide a great client experience, which improves retention.

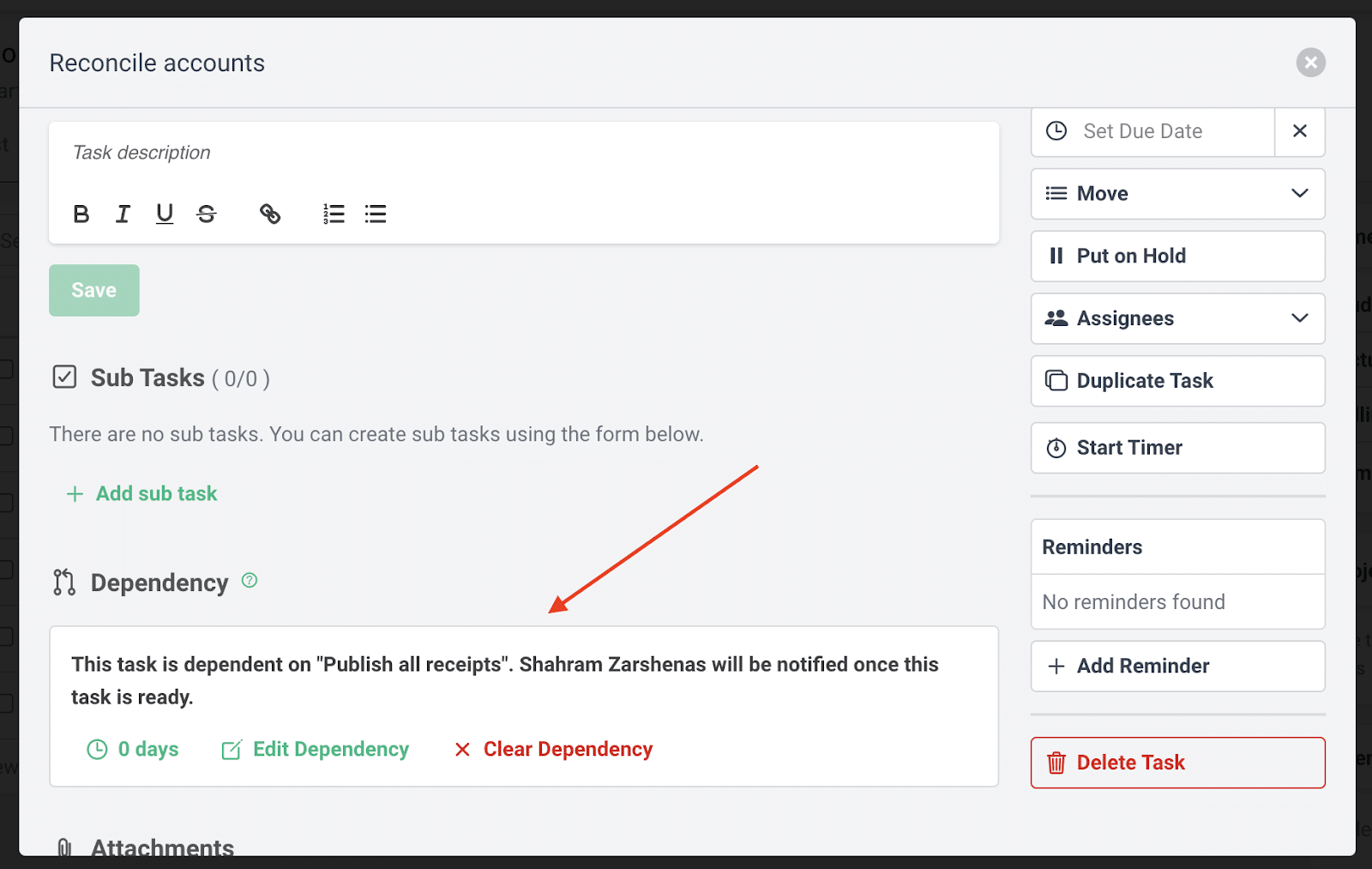

Assign and Monitor Team Tasks

Financial Cents makes it easy to manage your team’s workload during tax season.

You can assign tasks to specific team members and use Dependencies to control task flow. When one task is completed, the next person in the workflow is automatically notified that it’s their turn to start. This keeps your projects moving without the need for constant manual check-ins.

With dynamic due dates, you can set task deadlines based on when a previous task is completed. For example, if Task B is due 5 days after Task A is done, Financial Cents will calculate that due date automatically.

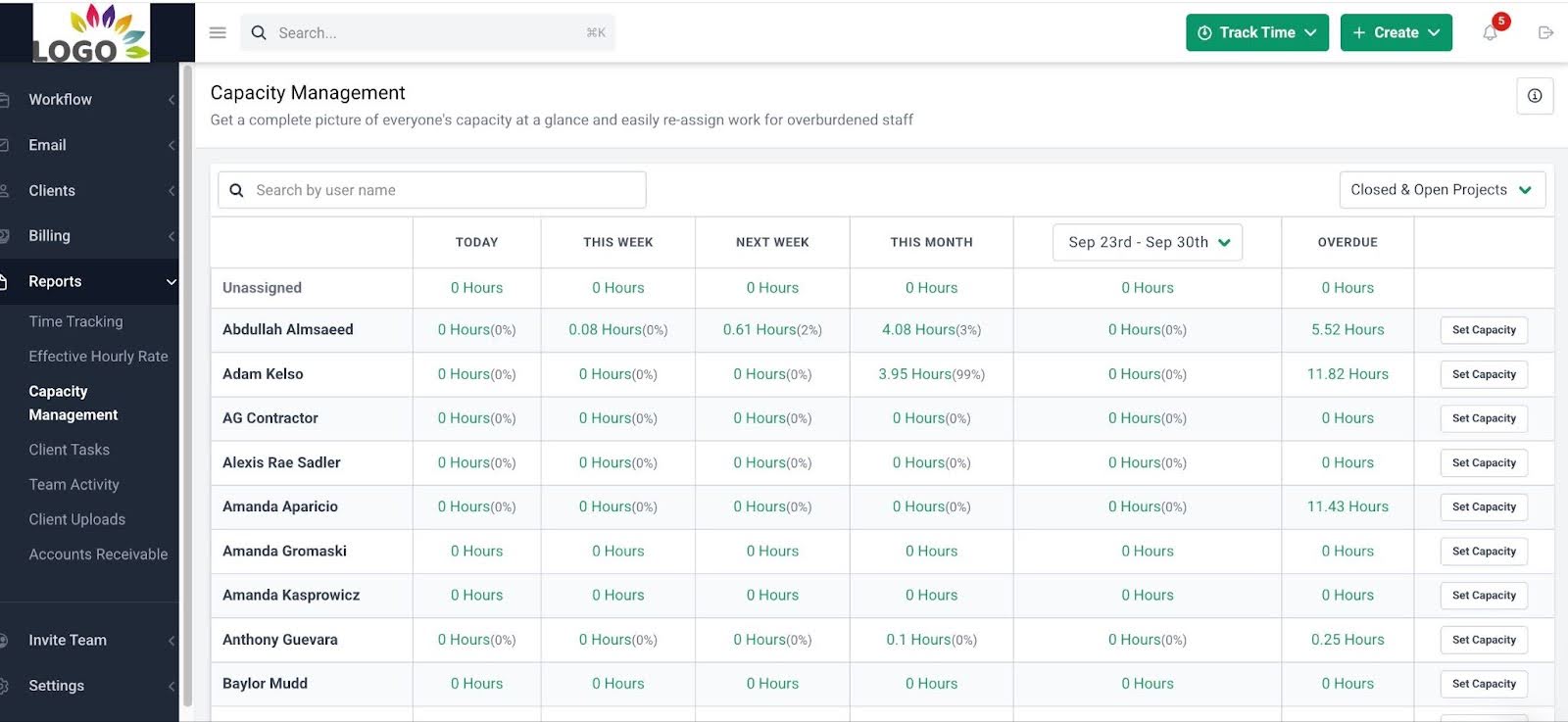

To stay on top of team workload, use the Capacity Management Report to see how much work each team member has assigned. This helps you balance tasks, avoid overload, and keep your team operating efficiently:

You can also use the Workload View to see what’s due today, this week, and next week for each person, making it easy to assign tasks intelligently and prevent burnout during busy periods.

Keep Track of Due Dates & Hit Deadlines

Every project in Financial Cents comes with due dates that help your team prioritize work and ensure nothing slips through the cracks.

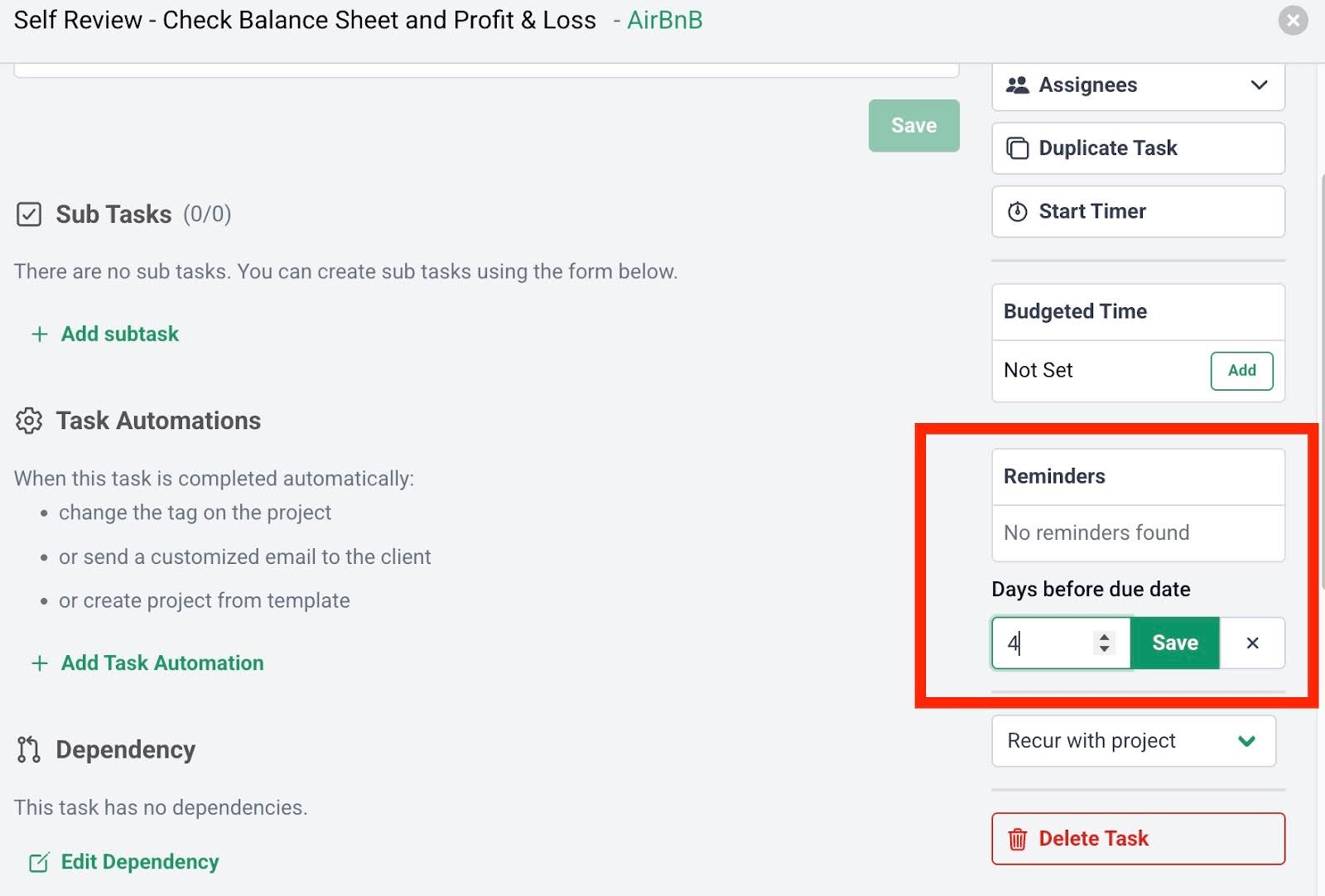

But it doesn’t stop there. Financial Cents also includes a Due Date Reminder feature that alerts your team when tasks are approaching their deadline. This gives firm owners, managers, and staff the visibility they need to adjust priorities and keep urgent projects moving:

Stay Organized This Tax Season

Tax season doesn’t have to be overwhelming. A tax preparer checklist for clients helps you collect everything you need upfront, avoid delays, and deliver a smoother experience for your clients. It also reduces errors, keeps your team aligned, and makes your entire process more efficient.

But a checklist works best when you pair it with an organized workflow. Good communication, easy document sharing, and clear tracking keep your team on schedule and reduce mistakes.

Tools like Financial Cents make this easier by helping you request documents, automate follow-ups, track submissions, assign team tasks, and stay on top of deadlines. This helps your firm handle tax season more efficiently and with far less stress.