The 5 Best CRMs for Accounting Firms

Author: Financial Cents

In this article

Success in business comes down to getting and retaining the right buyers, which explains why companies spend so much on systems that help them build quality customer relationships. From legal CRM to engineering and accounting CRM, they work the same way.

CRM solutions collect and organize data from all customer touchpoints so that firms can know and serve them (customers) better.

What is an Accounting CRM software?

An accounting customer relationship management (CRM) software, also called an accounting CRM is any technology that helps accounting firms understand (and strengthen interactions with) their customers and improve customer service.

This means the ability to understand your client’s demography, business type, work type, challenges, goals, and every other information you need to provide the service they hire you to do. But it also means more.

Organizing all your clients’ information and storing them in a place that your team can easily access is so critical. It helps to ensure that your team delivers good quality work that impresses and retains clients."

Shahram Zarshenas, CEO, Financial Cents.Benefits of CRM for Accountants

The right accounting CRM solution should help your accounting firm maximize its resources, convert more leads and increase client satisfaction by

-

Centralizing All Client Data

Accounting CRMs collect and organize relevant client data from your firm’s website, telephone calls, email inquiries, social media messages, and all contact points between clients and your firm. This puts client information at your team’s fingertips so they can work much faster.

-

Tracking Service Issues

Accounting CRM gives you visibility into your client management processes so that you can make decisions that improve your relationships.

-

Enhancing Collaboration

Most accounting CRM software solutions enable teams to share files and information among themselves and with clients to improve accuracy.

-

Increasing Productivity and Efficiency

Accounting CRMs make finding information easy for your team. Most Accounting CRMs also have the Client Task feature, which helps them create (and automate) tasks for clients to provide the necessary information. This frees up time for you to focus on other projects.

-

Improves Relationship with Clients

This is one of primary reasons for the use of an accounting CRM. A CRM software for accountants should help you foster good relationship with your clients by ensuring you don’t miss out important client communications, tracking client work, never missing client deadlines and more. Read this blog to learn how to use accounting crm to build strong client relationship with your clients.

-

Aid Client Retention

By properly utilizing the features of a crm software for accounting firms you can ensure your clients are satisfied with the services you provided to them. Customer satisfaction is essential for retaining clients. You can learn how to use accounting crm software to retain clients by reading this blog.

Features of a Good Accounting CRM Solution

- Client information dashboard

- Client file storage

- Client communication

- Client vault

- Client notes

- Activity timeline

- Client groups

- Automated data collection

- Integration with quickbooks

Accounting firms can save over $19,200 a year (per employee) with the right client relationship software.

Choosing the wrong CRM tool for your firm will cost you more time (and money) to change than you can imagine.

That is why you must look for the following features before committing your time and money to one.

-

Client Information Dashboard

This gives your team a central location to find up-to-date client information to serve clients to the best of their abilities.

-

Client File Storage

A secure place to store your client files to keep your accountants from jumping between too many platforms to find the documents they need for work.

-

Client Communication

To send, receive, and manage client interactions seamlessly in one place.

-

Client Vault

A secure platform to protect sensitive client files and information from unauthorized access.

-

Client Notes

To enhance team collaboration with the ability to leave notes to keep everyone up to speed with client work.

-

Activity Timeline

To give you an audit trail of all interactions between your firm and your clients. This helps you to see which team member is speaking with a client about what and when.

-

Client Groups

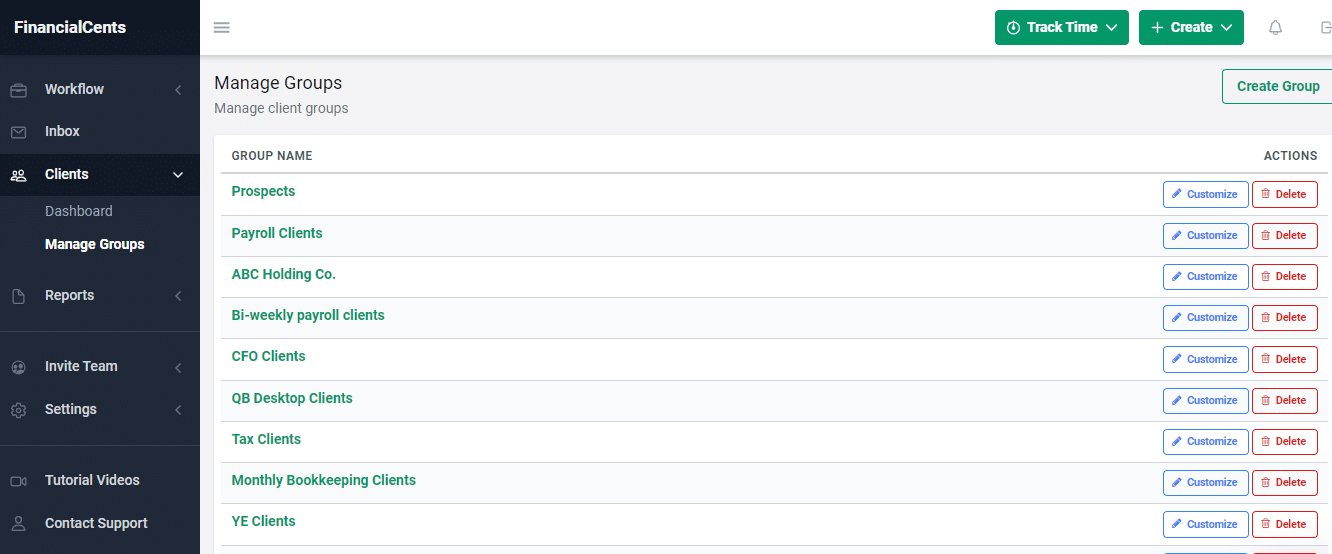

To organize your clients by any predetermined criterion—work type, location, entity type, or business size. This also enables you to duplicate work for all clients in a group, reducing the time spent on admin work.

-

Automated Data Collection

To keep you from getting stuck and chasing clients to send the information you need to do their work. It lets you request information from your clients automatically. This is possible especially when your project management software also has a CRM feature.

-

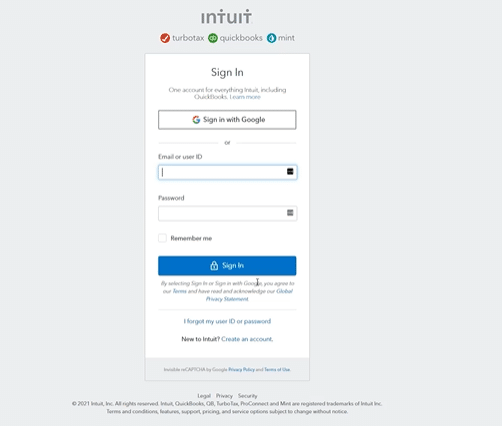

Integration with QuickBooks

To sync relevant client data between your CRM and QuickBooks for accurate invoicing and reporting.

The more of these features an accounting CRM has, the more helpful it will be for your firm.

We cover in detail features an accounting client management software should have in this blog.

You may be interested in

Client Onboarding: 8 Ways to Make It Memorable (+ Free Template)

List of The Best CRM Software For Accounting, Bookkeeping and Tax Firms

These accounting CRM solutions have most, if not all of these features to help you manage client relationships in the accounting and bookkeeping way.

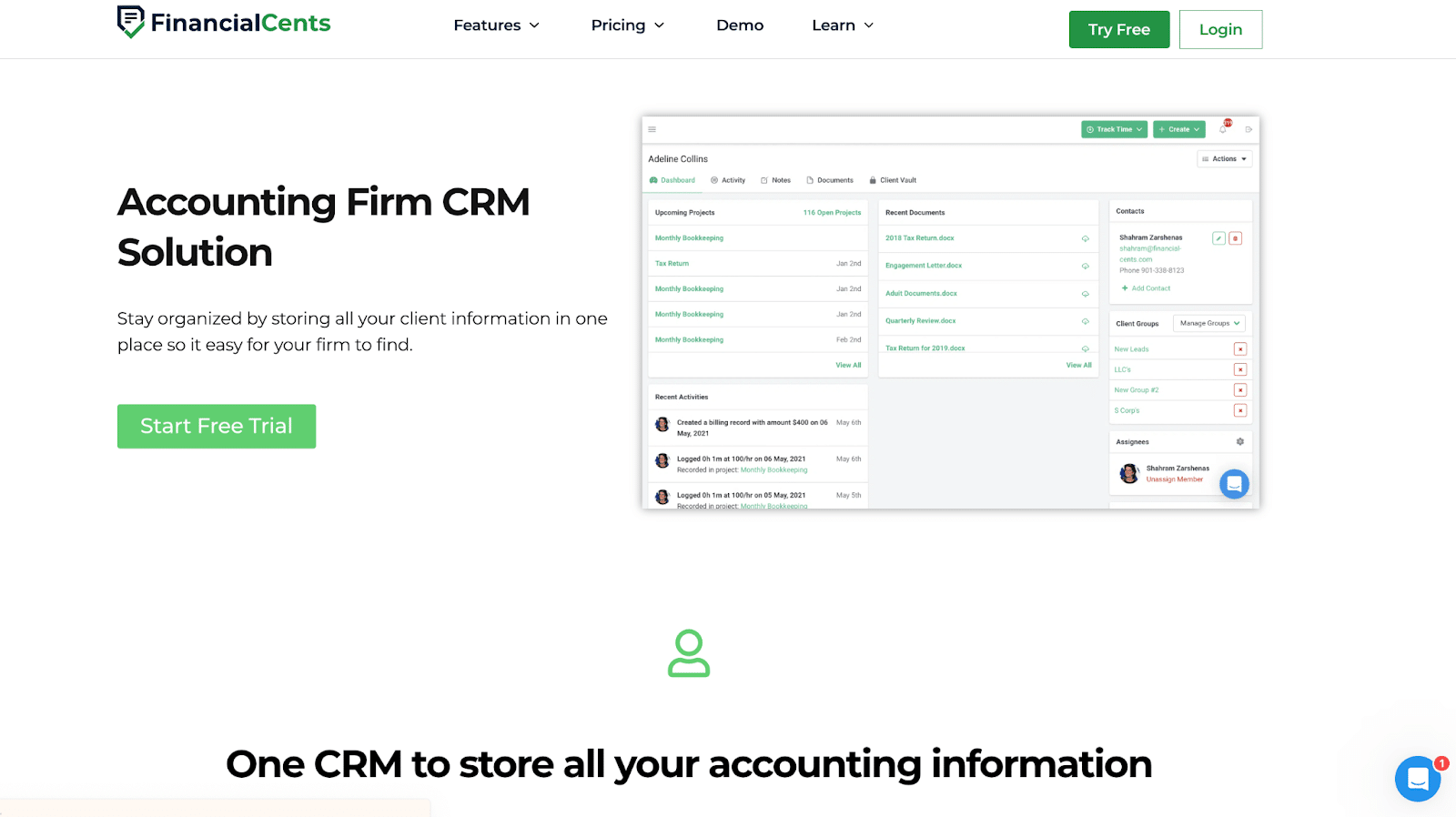

1. Financial Cents

Financial Cents is an accounting CRM solution that helps you:

- Organize client information

- Securely store client information

- Keep track of team-client interactions

- Collaborate with clients

- Automate client data collection so you can get information faster

- Communicate with clients

Its most popular features are the

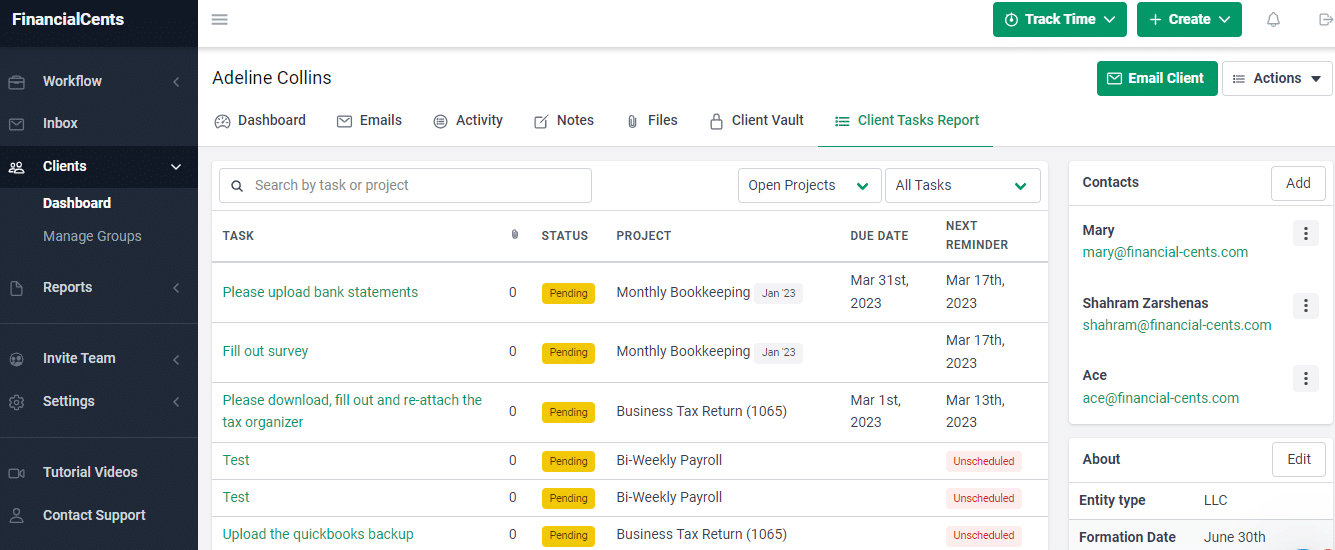

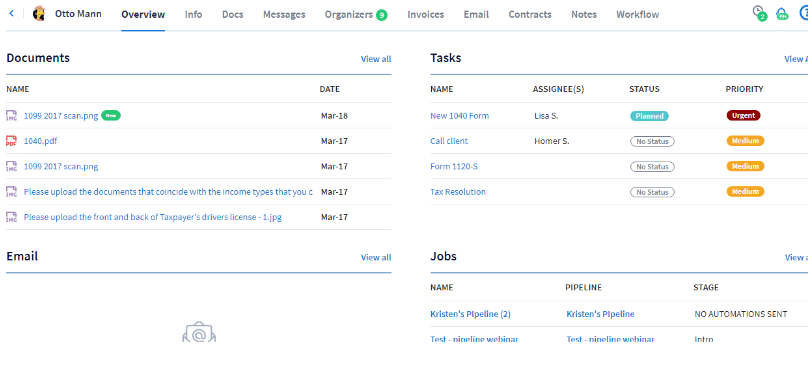

Client Information Dashboard

The Client Information Dashboard is the first thing you see when you click on a client’s profile in Financial Cents. It displays all the client information you need to make decisions that help you serve them better.

The dashboard information includes

- Upcoming projects for that client.

- Meeting notes your team members left on the client profile.

- The most recent documents your team shared with the client.

- The client task request.

- Other information that gives you a bird’s eye view of your firm’s interaction with the client.

Filters in Financial Cents CRM help you sift out specific client information by location, work type, business size, etc.

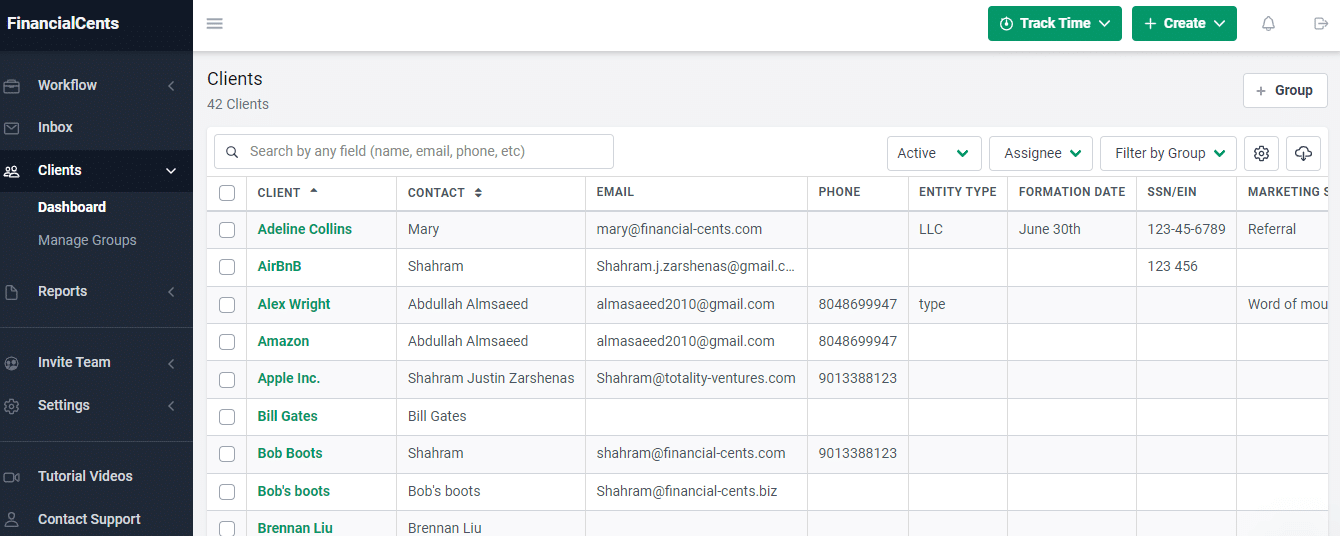

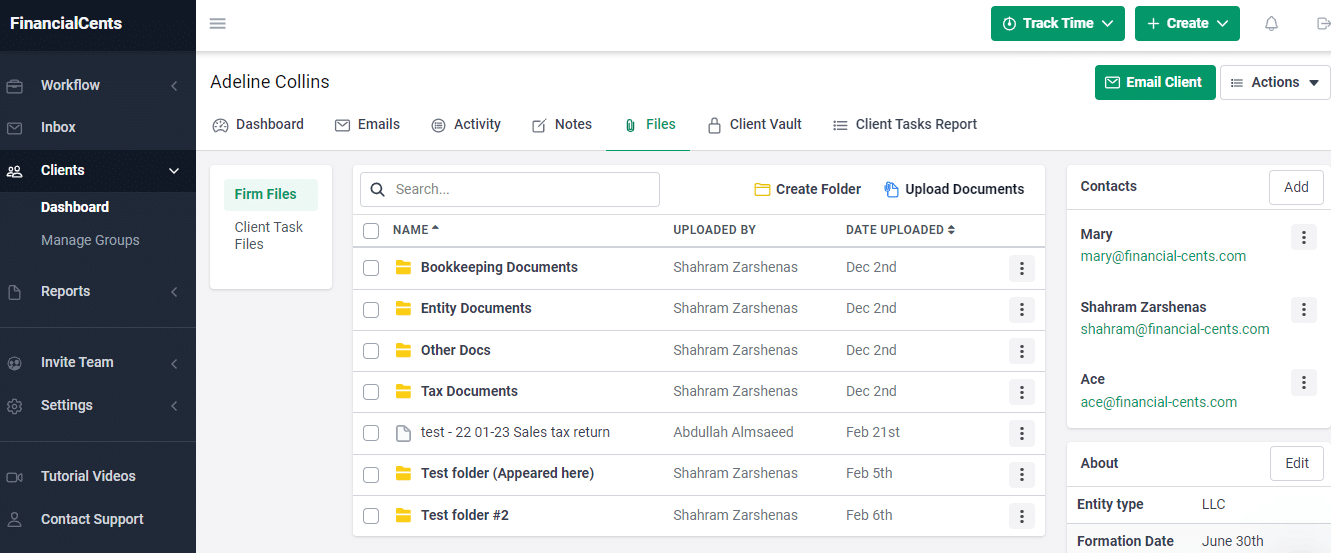

Client File Storage

Financial Cents displays all client-related files in one central place—the client profile. Apart from the client’s name, you can see the uploader and the date it was uploaded. Your team members can pick and use any file as they see fit.

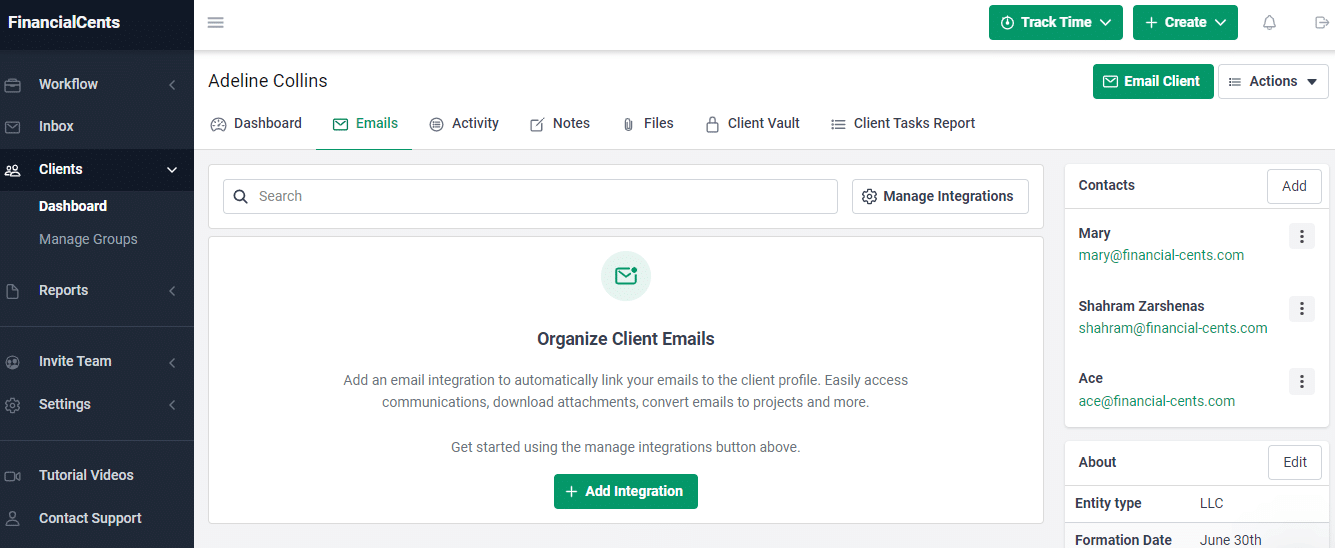

Client Communication

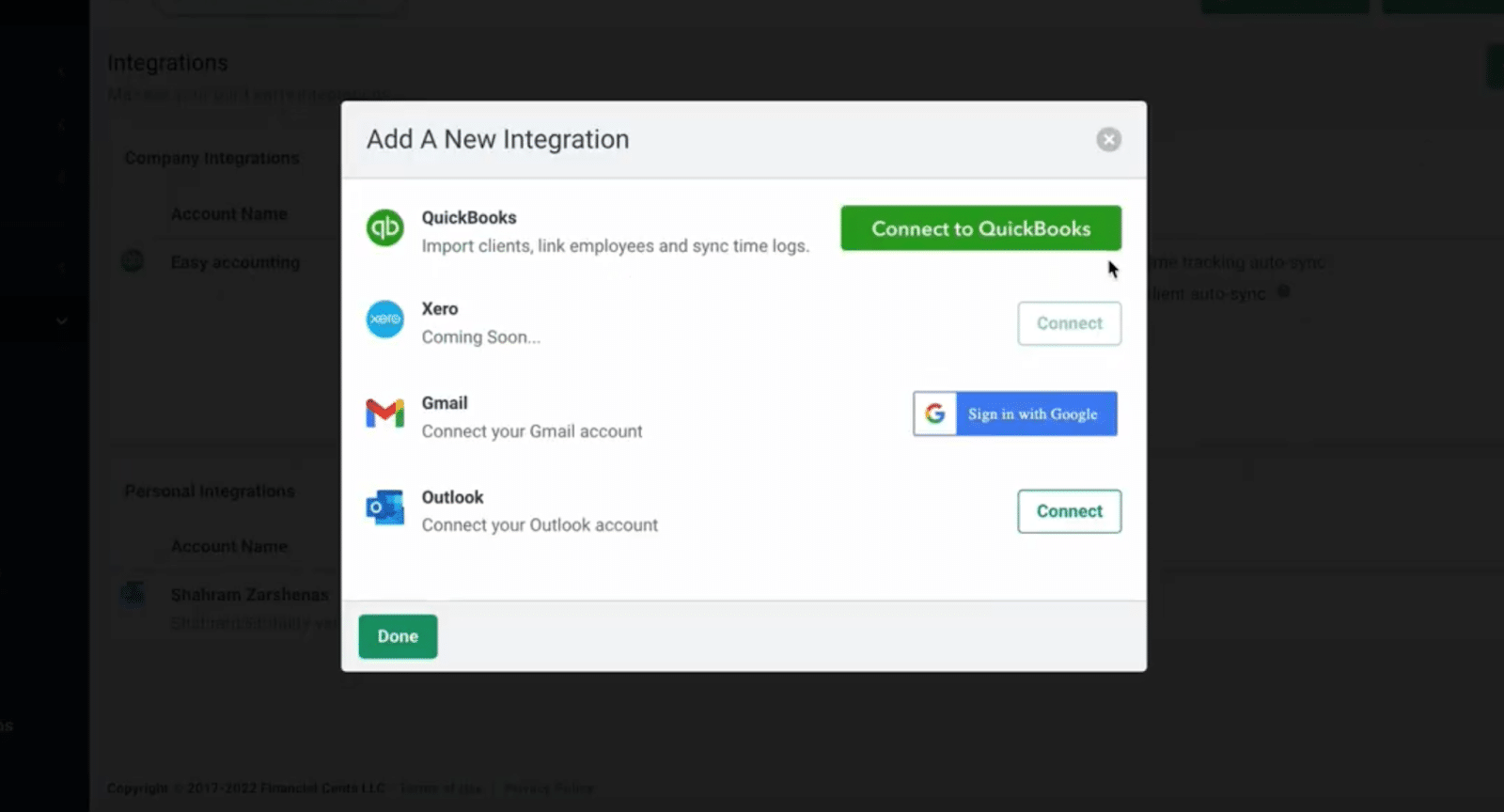

Financial Cents helps you communicate with clients on the go with the email feature.

The email integration allows you to sync your Gmail or Outlook with your Financial Cents account to enable you to send, read, archive, or delete emails from inside Financial Cents.

You can also download attachments and convert client emails to projects in Financial Cents.

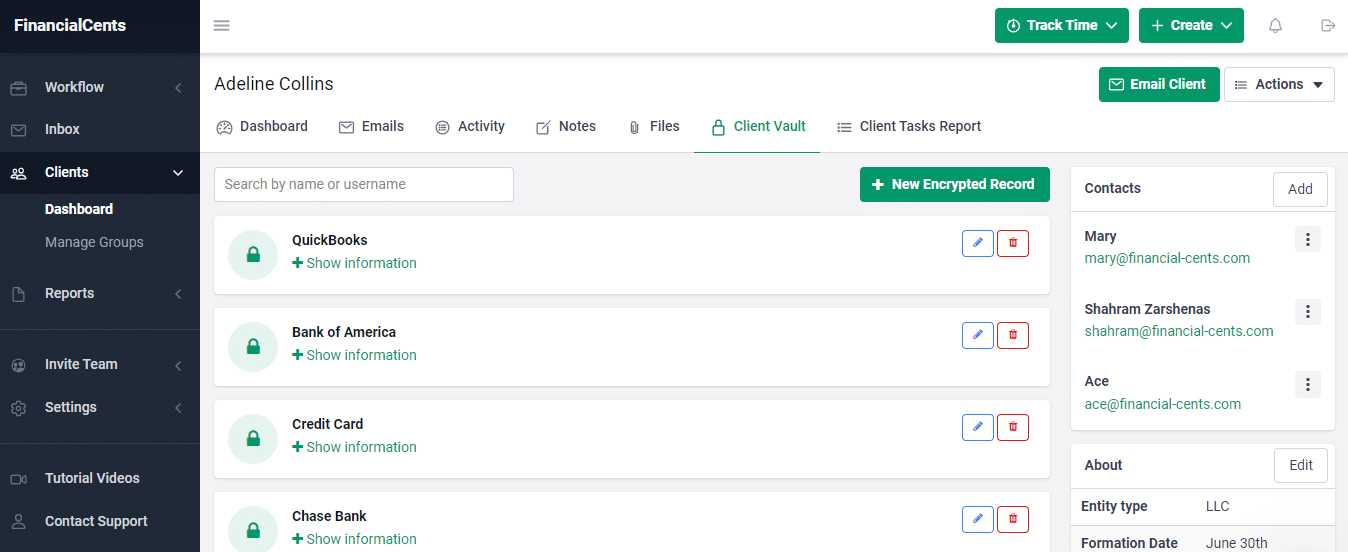

Client Vault

Financial Cents Client Vault keeps your sensitive information (like usernames, passwords, and credit card information) from the prying eyes of cybercriminals.

It uses data encryption to convert natural language (plaintext) into code (ciphertext) so that only those you give the decryption key can decrypt and read them.

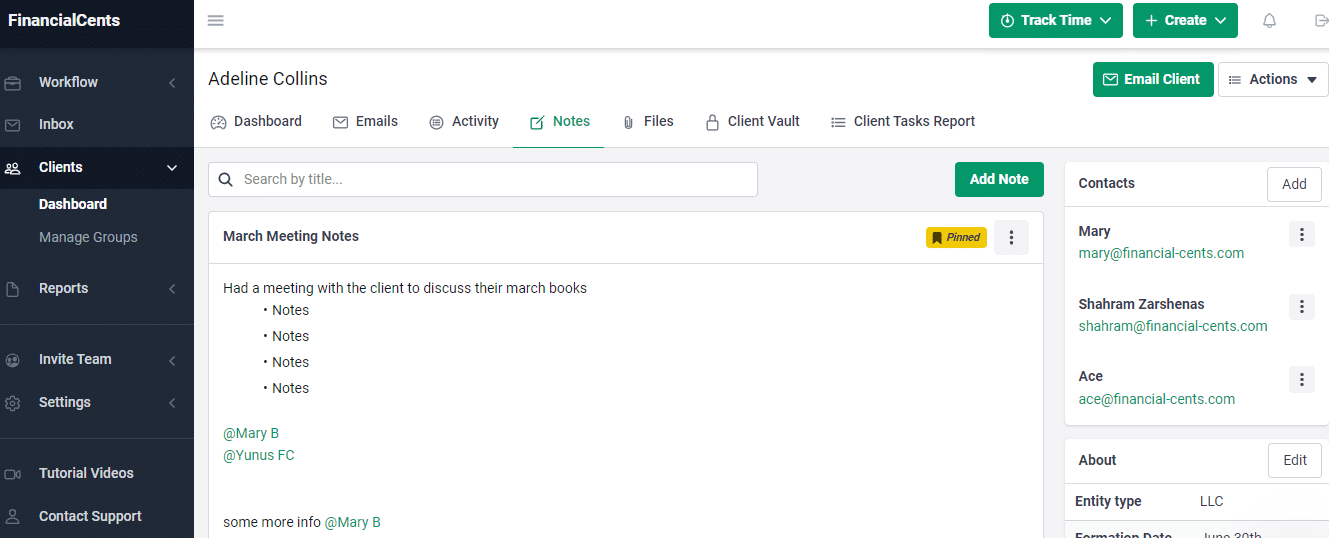

Client Notes

Financial Cents client notes let you make notes to give updates or context to client work to help your team members work with the latest client information.

Client notes are stored on the client’s work so that assignees can find them for work to ensure nothing falls through the cracks in your firm.

If you want the system to notify a team member about the note, the @mention feature lets you pull them directly into it by sending them an in-app and email notification.

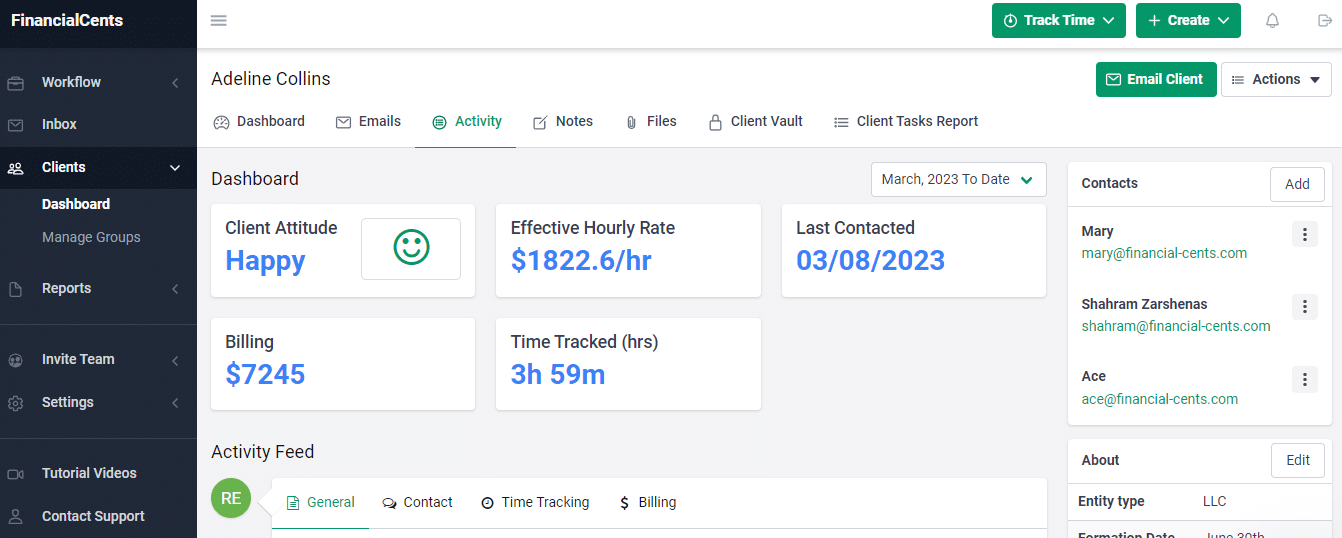

Activity Timeline

The client activity timeline helps you see the interaction history between your team and clients.

This includes the person that last interacted with a client, what they talked about, the client’s attitude during the last contact, and the time your team has tracked for their work to give continuity to your firm’s interaction with clients.

Client Groups

Financial Cents allows you to segment your clients by their type of work, marketing funnel stage, business size, location, industry, etc. This enables you to filter your database or perform bulk actions.

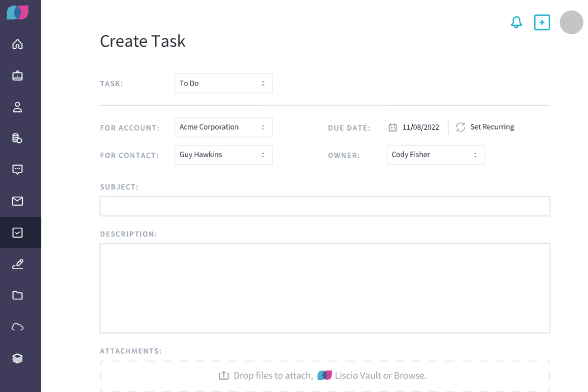

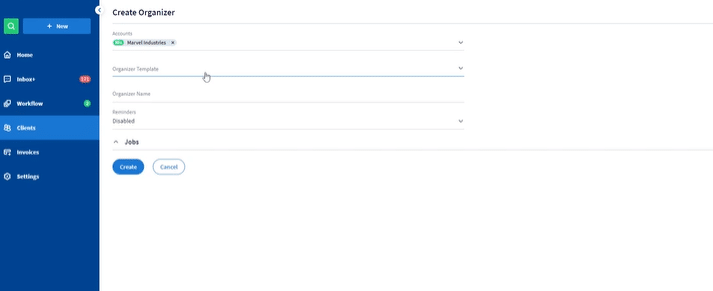

Automated Data Collection

Financial Cents enables you to create a task checklist for them to complete. Describe what you need them to do, assign a due date, and set a reminder for Financial Cents to follow up with them automatically until they send what you need.

Integration with QuickBooks

Financial Cents enables you to easily import and auto-sync your clients and time tracked with QuickBooks Online for accurate and timely invoicing.

Free Trial and Cost

Financial Cents offers a 14-Day free trial.

After your free trial, you can continue using its full suite of features at:

- $39/month per user (for annual payment).

- $49/month per user (for monthly payment).

Cloud-based?

Yes.

Financial Cents Features

- Automated client requests and reminders

- Clients Database

- Client Portal

- Turn client emails into tasks or projects in Financial Cents.

- ChatGPT and AI integration to create email templates for client communications and to create workflow templates in seconds.

- Securely store client passwords.

- Email integration with Gmail and Outlook

- Manage your email from Financial cents

- Time tracking and billing

- QuickBooks integration

- Simple and easy to use. Financial Cents is rated 4.9/5.0 for ease of use.

- Collaborate and communicate with team members with inbuilt chats, @mentions.

- Workflow management automation

- Automate recurring tasks

- E-Signature

- Capacity management for managing staff workload.

- Zapier integration with 5,000+ Apps

- Project Management

- Document Management and integration with other DMS (Google Drive, Drobpbox, OneDrive, SmartVault etc)

- Over 50+ workflow templates

- Facebook community group for users

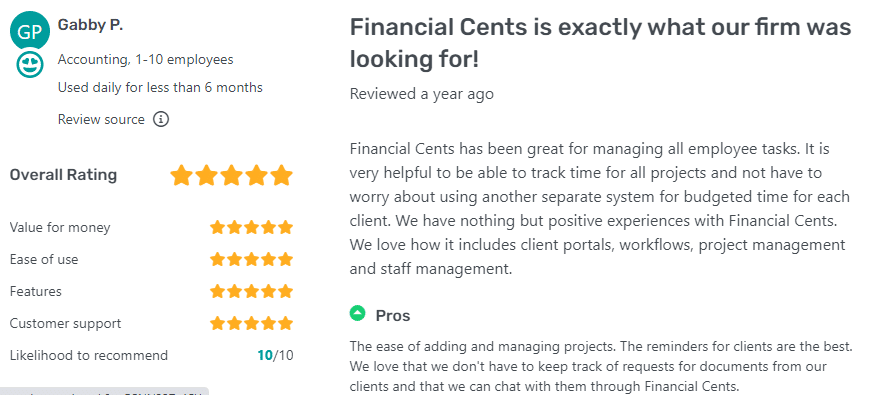

Customer Reviews

See how Gerry from Blue Canyon uses Financial Cents CRM solution to maintain high quality and improve client satisfaction.

(You may be interested in: The Best Accounting Practice Management Software Options in 2024.)

2. Pixie

Like Financial Cents, Pixie is an accounting project management software with a CRM system feature that lets your firm manage client relationships and communications from one central place.

Pixie’s CRM features include

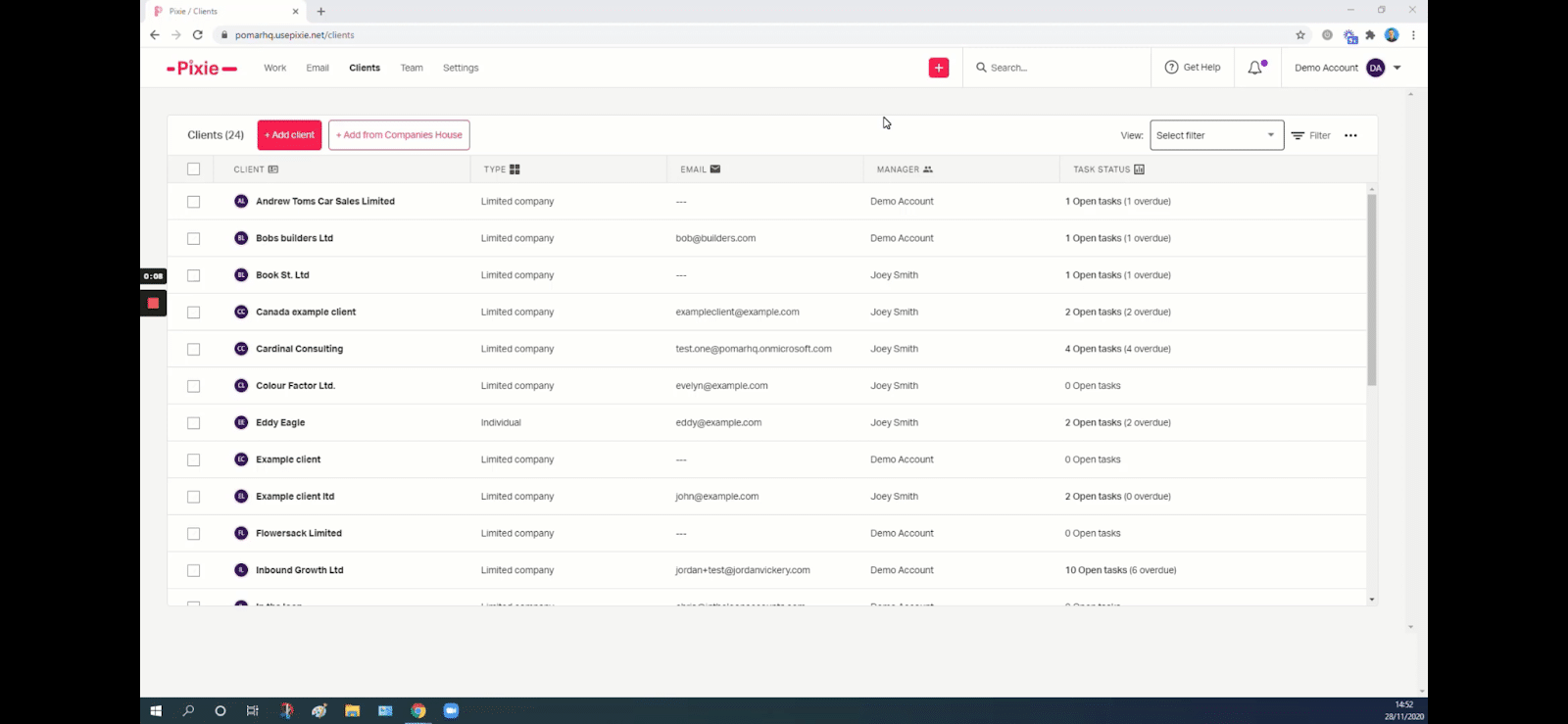

Client Information Dashboard

Pixie’s CRM dashboard shows all your clients by name, business type, email address, client manager, and task status.

Its custom fields enable you to create as many client records as you need to manage the relationship effectively. This includes passwords, company registration numbers, reference numbers, and relevant client dates.

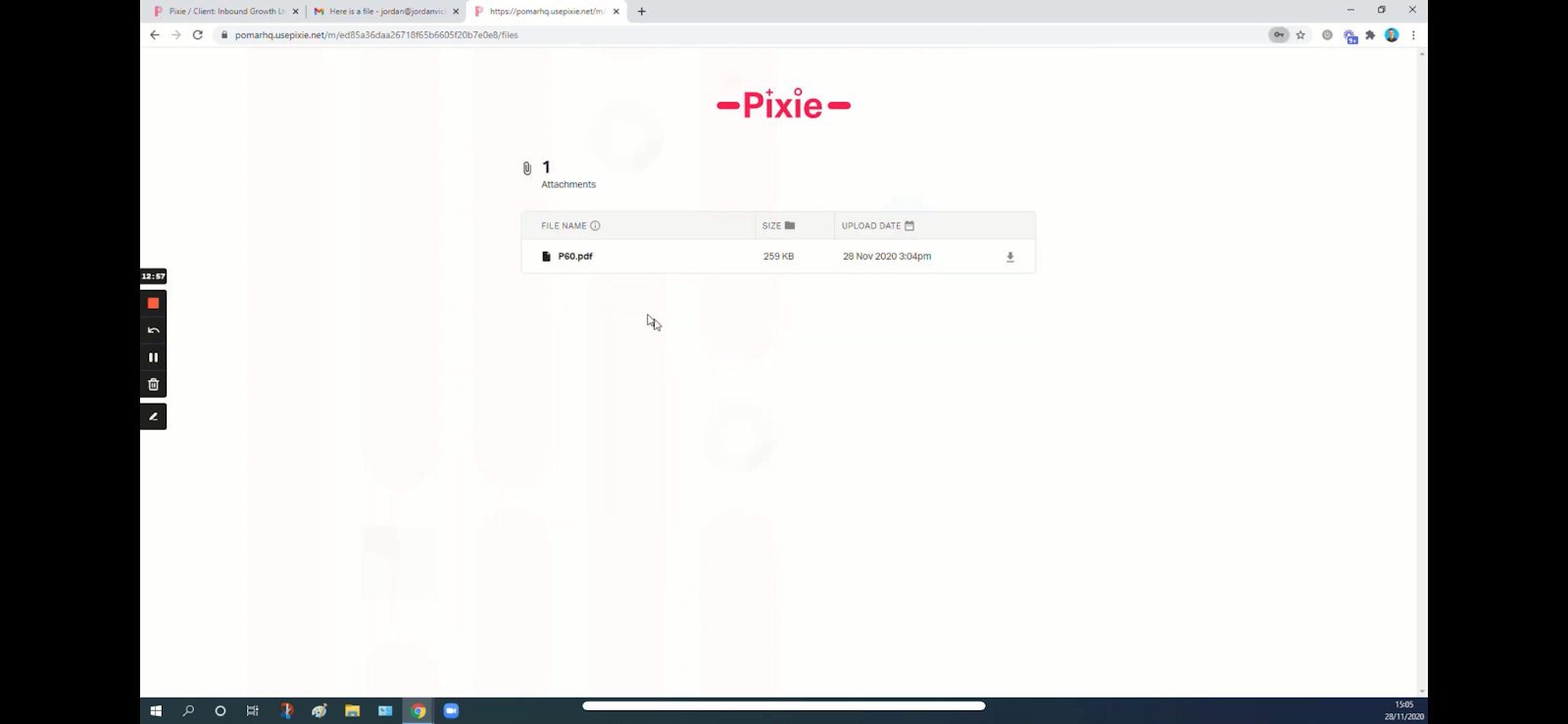

Client File Storage

Pixie saves all your client files to your client records so your team can use them when doing the client’s work.

Pixie’s integration with Companies House (UK) enables it to pull client information directly into your Pixie account.

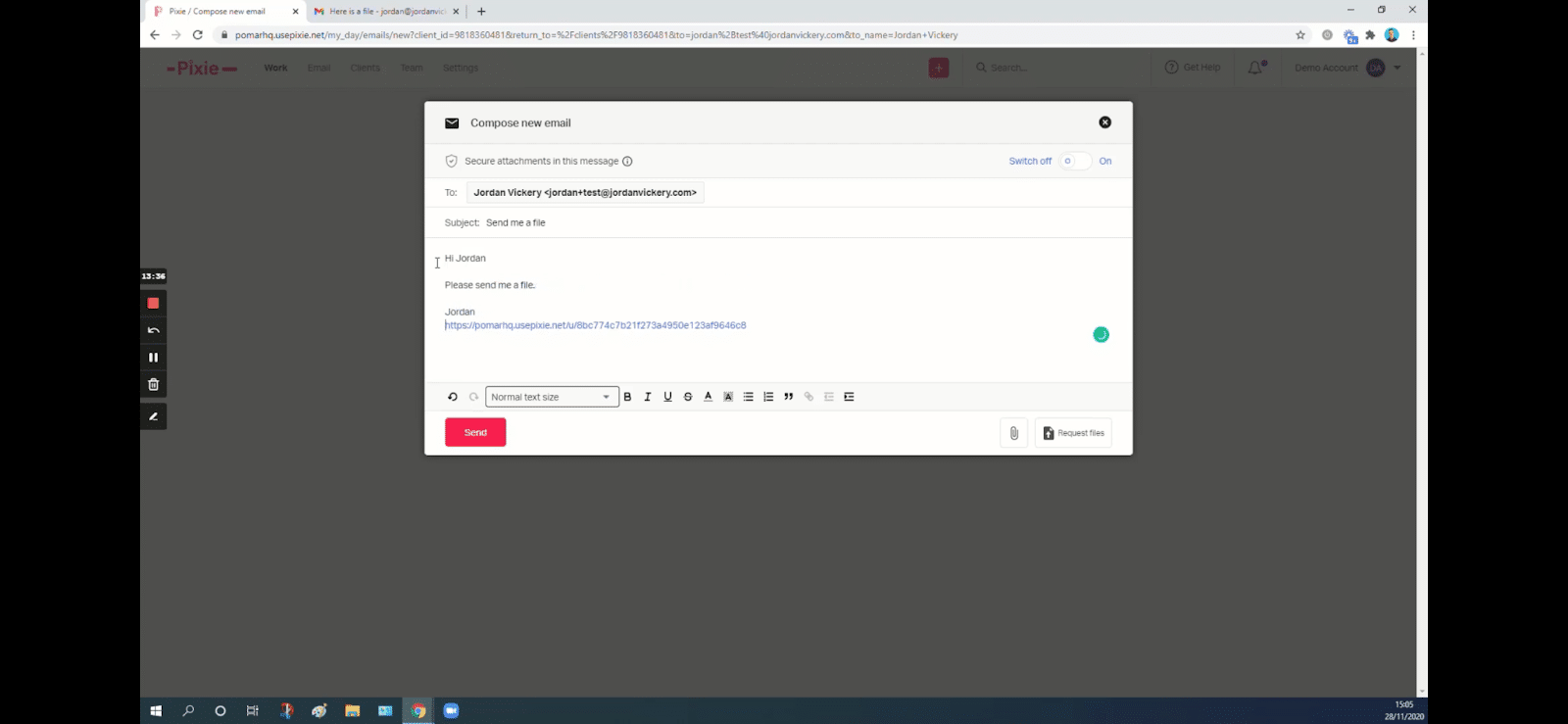

Client Communication

When you click on a client record, you will see your contact persons in the client’s business and communication history.

All communications from your firm via Pixie automatically go to the primary contact at your client’s business, except you adjust your settings to send to all the contacts at your client’s company with Pixie’s CC feature.

-

- Emails: Pixie automatically logs all emails between anyone in your firm and your clients for visibility over client communication.

Client Files

For saving any files clients send to your team automatically and save any files you’ve requested from the client.

Client Notes

For adding notes to give your team relevant information that helps them serve the client better.

Client Groups

You can organize clients in groups in Pixie by filtering and saving the filtered views. This allows you to easily find clients by their business type, work type, client manager, etc.

Use Pixie’s filters to perform bulk actions—like creating new tasks, archiving work, scheduling tasks, bulk emails, bulk assignments, bulk updating, and updating for clients with similar attributes.

Automated Data Collection

When you need additional data from your clients, you can

- Send them an email (or a secure attachment with an email explaining what you need them to do) from their record.

The client will get a notification, and upon entering their passphrase, they’ll be able to access the attachment and do what you need them to do.

- Or use The Request File Button in the Client Files also lets you request files from your clients by inserting a link for your client to upload (by dragging and dropping) the file.

You can also set up reminders, you can also build email templates into your workflow, and let Pixie auto-remind clients for information on your behalf.

Free Trial and Cost

Pixie does not have a free trial.

Its prices depend on the number of clients you have to manage:

- $69/month for 50 clients and below.

- $129/month for 51 to 250 clients.

- 199/month for 251 to 500 clients.

- Etc.

Cloud-based?

Yes

Customer Reviews

3. Liscio

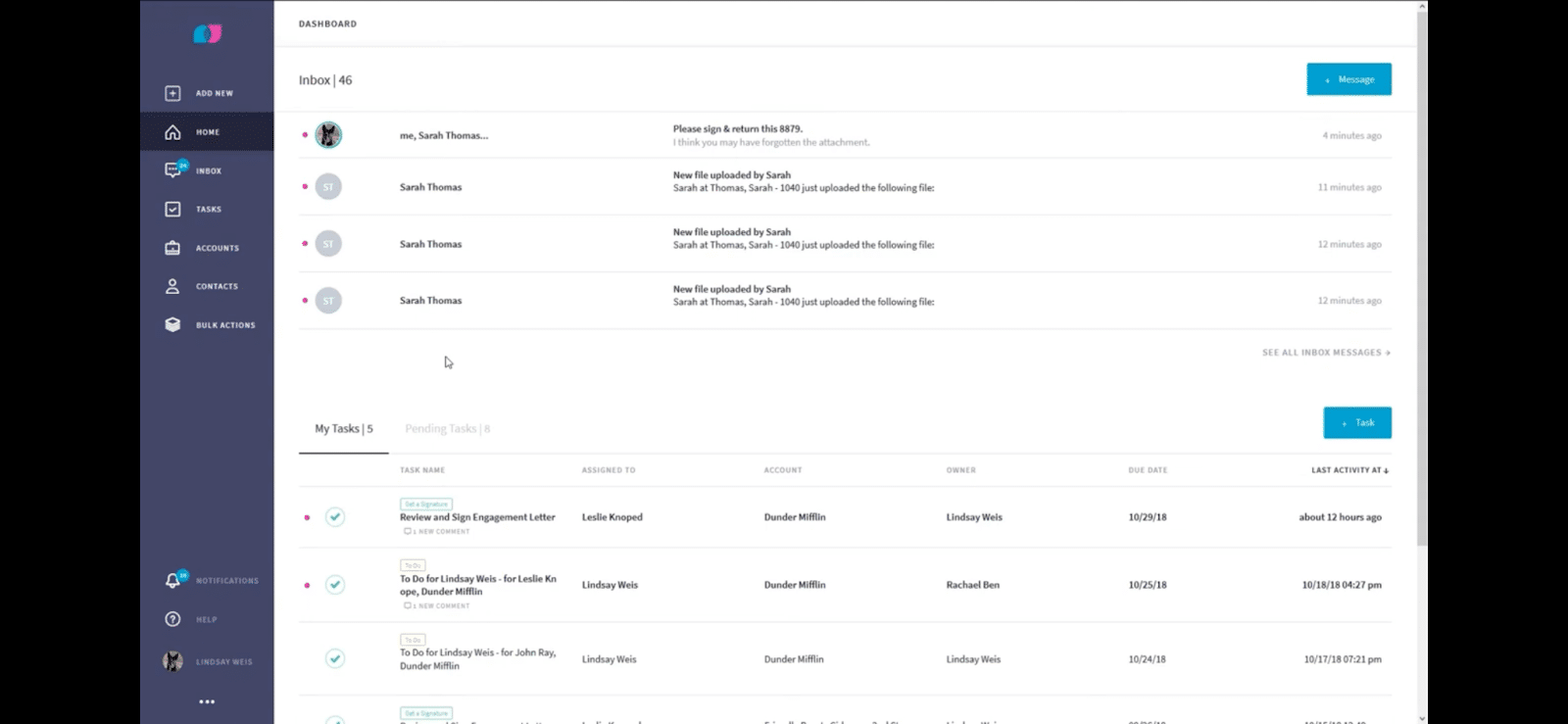

Liscio is a specialized client management software that streamlines client data and communication so that teams can sit down to work with everything they need at their fingertips.

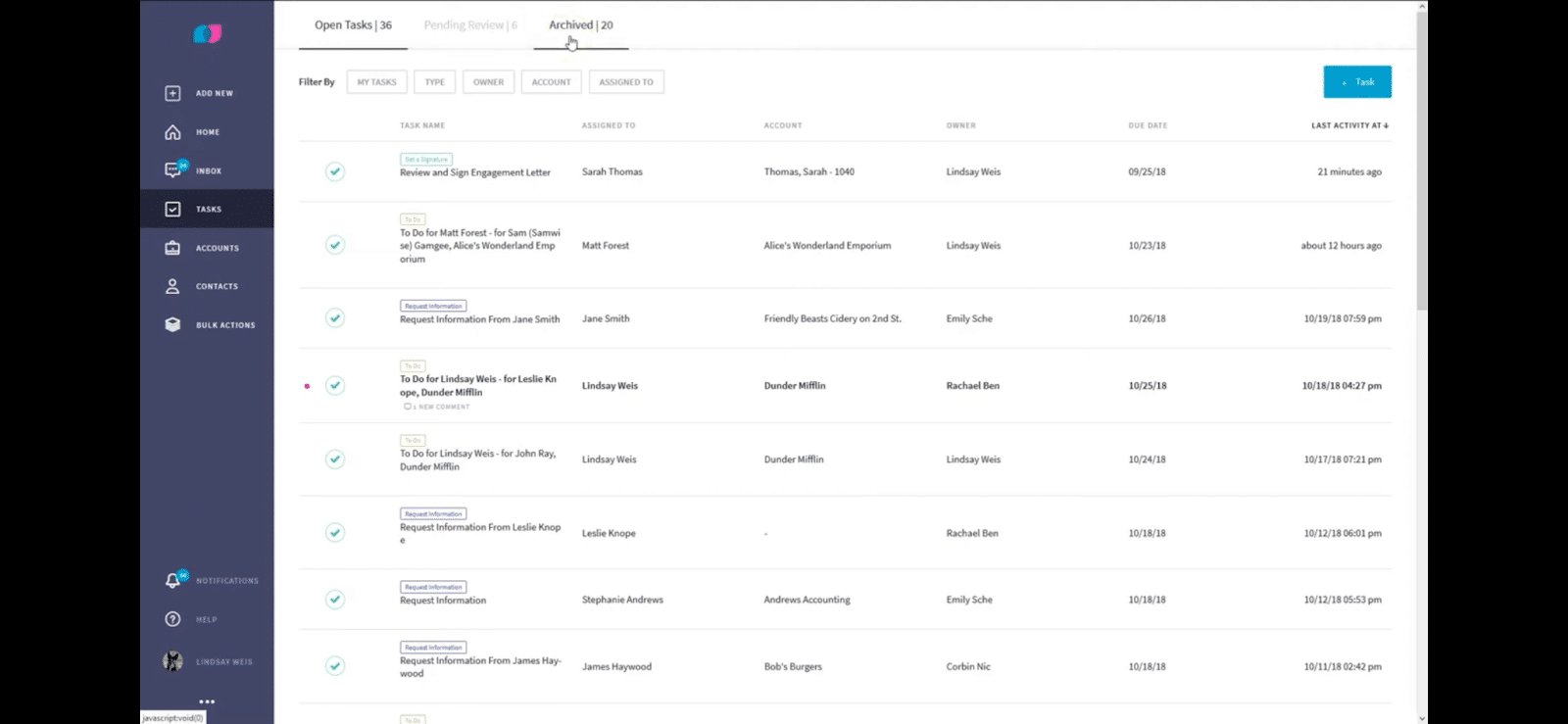

Liscio’s client management features include

Client Information Dashboard

Liscio’s dashboard displays all the features you need to manage your clients, including

- The Add New button is for creating a new message, internal notes, and client account and uploading files.

- Notification Centre to pull in all notifications for messages, alerts, and tasks in a single view. You can filter your notifications tab by “read” and “unread” to avoid missing out on client information.

- Inbox for messages you exchange with your teammates or clients.

- My tasks to show you the things you need to do.

- The outstanding tasks tab contains the work that has not been completed (but has been sent to the client).

Client Communication

Liscio allows you to hold conversations with your clients. You can pin relevant messages to your inbox for your team to easily refer to them.

Its other client communication features include

- Real-Time Messaging allows your clients to receive your messages instantly.

- Email: you can turn client emails into tasks or notes for your team members.

- The inbox tab displays your messages in drafts, sent, archived, and pinned message for better visibility into your client interactions.

Text Notification triggers the system to notify your clients about your messages instantly.

File Storage

Liscio’s Files Tab houses all the files in your firm. Each file carries its name, the uploader, and the upload date.

You can navigate client files with the

- Search bar to search your files by keywords on file names

- Filter feature. It allows you to sort by sources, tags, months, or accounts to narrow down the files in your view.

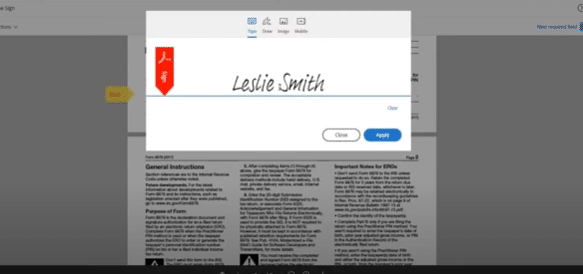

Electronic Signature

Liscio integrates with Adobe Sign to enable your clients to sign and share documents with you from within Liscio.

Automated Data Collection

The Client Task feature allows you to create tasks for your client to complete. Liscio has a space to describe what you need them to do and add a due date to show how urgent it is.

Integration with QuickBooks

Liscio integrates with QBO to enable you to create invoices (in Liscio or QBO), get paid, and satisfy QBO receivables. You can also set up recurring invoices and sync your Liscio data with your QBO records.

Free Trial and Cost

Liscios does not offer a free trial.

Its packages are

- Monthly at $40/month per user.

- Annual at $50/month per user.

Cloud-based?

Yes

Customer Reviews

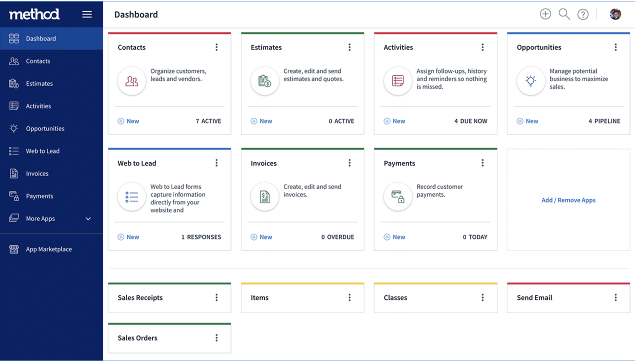

4. Method

Method:CRM helps businesses collect, organize and manage client (and potential client) data to scale their business.

Its key features are

Contact Management

Method dashboard displays all apps you need to get visibility into (and manage) client relationships. The dashboard contains the

- Contacts app, which lets you organize and manage your clients and leads and their information in one place. This puts everything your team members need at their disposal.

- Activities app to track your client interaction from one place. You can also set reminders to keep tasks at the top of your client’s mind so that nothing slips through the cracks.

- Send Email app for sending emails to clients. It also contains Method’s email templates which you can customize for your client communication needs.

- Invoice app, for your team to create, edit and send invoices for timely payment.

Client File Storage

Contacts app, which lets you organize and manage your clients and leads and their information in one place. This puts everything your team members need at their fingertips.

Client communication

Activities in Method allows you to monitor interactions between your firm and clients so you can reach them with the right message at the right time.

Automated Follow-ups enable you to stay in touch with your clients with messages and reminders.

- MailChimp Integration allows you to create email campaigns to attract new clients and retain existing ones.

Integration with QuickBooks

Method integrates with QuickBooks to enable firms to create invoices and reminders to clients for timely payment.

Free Trial and Cost

Method is available for free for 14 days.

Its paid plans cost are:

- Contact Management at $ 25/month Per user (Billed annually) or $28 per user (billed monthly).

- CRM Pro at $ 44/month Per user (Billed annually) Or $49/month per user (billed monthly).

- CRM Enterprise at $ 74/ month Per user (Billed annually) Or $85/month per user (billed monthly)

Cloud-Based?

Yes

Customer Reviews

5. Taxdome

TaxDome, the tax accounting and bookkeeping platform, also has a CRM component that enables firms to build better relationships with clients and leads.

Its CRM platform features include

Client Information Dashboard

TaxDome’s client dashboard shows you everything you need to know to move client work forward.

From your unread messages, pending organizers, and unpaid invoices, TaxDome helps to keep your unfinished tasks at the top of your mind so they don’t escape your attention.

The dashboard also features

-

Custom fields

To create custom records that best serve your data need in one place.

Client Portal

TaxDome client portal provides

- The File Upload tab to upload files directly from the dashboard.

- The New Messages tab to track all messages between your firm and your clients.

- The Appointment tab for your clients to schedule meetings with you.

Client Communication

TaxDome syncs with your existing email to send emails directly from TaxDome to your clients.

- Messages enable you to create conversation threads to resolve issues and gain clarity inside TaxDome.

- E-Signature: you can request a signature from your clients by sending organizers to them. The system will send your client a notification inside their TaxDome to-do list so they can sign and send it back to you.

Automated Data Collection

TaxDome allows you to send your client organizers, which they can fill out and submit so that you can have what you need to do their work.

You need to add the questions or requests you need from your clients into these organizers so that your client can easily know what to do. They can answer your questions or upload files to the organizers and submit them to you.

Integration with QuickBooks

TaxDome integrates with QuickBooks to automatically sync all payments and invoices.

Free Trial and cost

TaxDome offers a 2-week free trial. After that, you will need to pay

- $25/Month (billed annually)

- $50/month per user

Cloud-based?

Yes

Customer Reviews

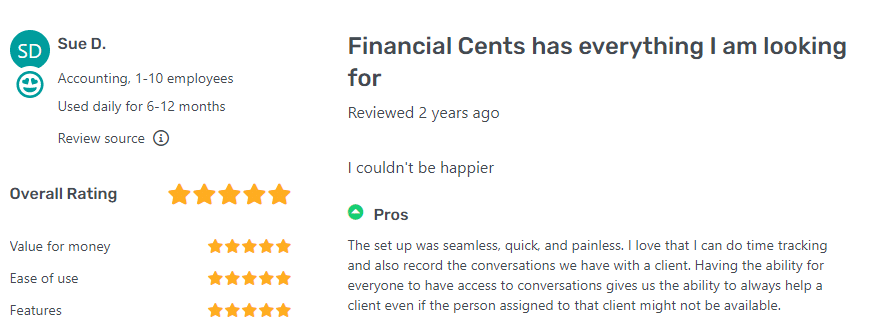

Financial Cents: The Most Comprehensive Accounting CRM of Them All

Financial Cents helps you stay on top of your client relationships by collecting and organizing relevant client data, in addition to managing and automating customer data collection. One of our clients, Sue D. testifies to this in her review.

As an accounting-specific CRM solution, Financial Cents has everything your accountants need to improve their client relationships each month.

Financial Cents Client Portal is Clients’ Favorite

Something accountants often overlook in CRMs is a client portal, it is essential that the client relation management solution you choose for your firm has a client portal, this will ensure all your client data are centralized in one place and clients do not have to login to multiple apps to send you information or documents. Here’s 5 reasons why your accounting CRM software should have a client portal when selecting.

Clients love Financial Cents client portal because it allows them to send documents to their accountants without creating login details of any kind.

The average client hates creating login details, so don’t be surprised when clients delay sending you the files you need to complete their work, which can lead to missed deadlines.

In Financial Cents, your client will only receive an email from you to click on the link that will take them directly to the portal, where they can perform any action you need them complete.

This helps you organize everything your team needs in one place to get the most work done in the least time possible.

Start using all of Financial Cents’ CRM features for free today.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

The 7 Best Karbon Alternatives to Consider in 2024

There is a suitable practice management tool for every accounting firm. When it is the right firm, Karbon provides most of the…

Apr 16, 2024

The Top 8 TaxDome Alternatives for Your Accounting Firm

Practice management software, like TaxDome, should help firm owners manage their projects, clients, and staff to improve client service and stay profitable.…

Apr 08, 2024