Monday.com is a versatile project management software designed to help teams track projects, collaborate internally, and manage workload.

Its core features include:

- A dashboard that gives a high-level overview of projects, allowing teams to track progress and make data-backed decisions.

- Workdoc organizes documents and enables team collaboration. The board integration feature allows users to embed documents into their workdoc.

- Its Integrations connect users with over 200 apps to sync data and automate tasks between them.

- Automation allows users to perform repetitive tasks (such as work creation, task assignment, and due date reminders) without human input.

Like firms in many other industries (such as IT, HR, software development, and construction), accounting and bookkeeping firms have found ways to use Monday.com’s project management features.

In this article, we look into how well Monday.com can work for accounting and bookkeeping firms.

Can Monday.com Work for Accounting Firms?

a. Improved project management and team collaboration

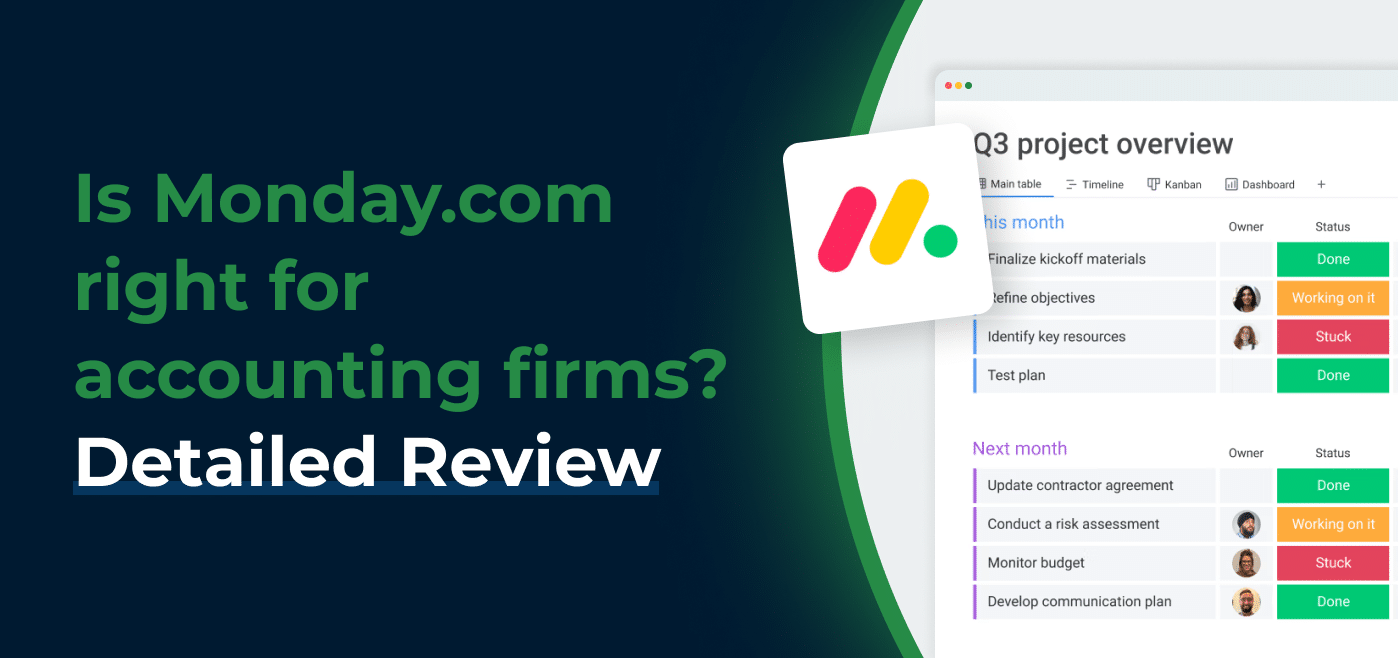

Monday.com improves project management with project planning, task assignment, dependencies, and milestones features.

Its status buttons show where each task stands. This enables teams to make timely decisions and ensures smoother project completion.

With a task assignment feature and customizable dashboard (that allows teams to access shared sources of files and information), Monday.com brings all emails into one place, keeping everyone on the same page at all times.

b. Streamlined workflows and task automation

Using sticky notes and spreadsheets can clutter your workspace with files, information, and tasks that are not urgent.

Monday.com enables users to create and assign tasks, set deadlines, and establish the order of performing those tasks (with its dependency feature). This streamlines workflows and allows teams to focus on what is most urgent.

Plus, Monday.com allows users to leverage a rules-based system to automate tasks like due dates and work status by stating what should be done when a condition is met. For example, “when the project budget is approved, notify the project owner.”

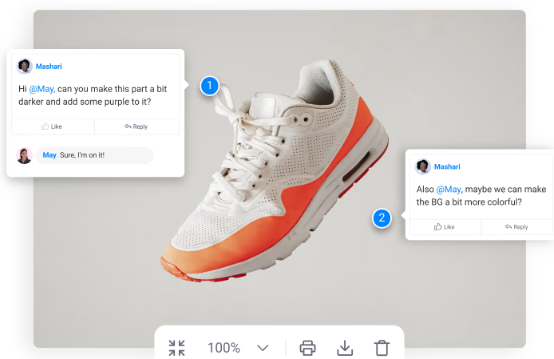

c. Enhanced communication and client visibility

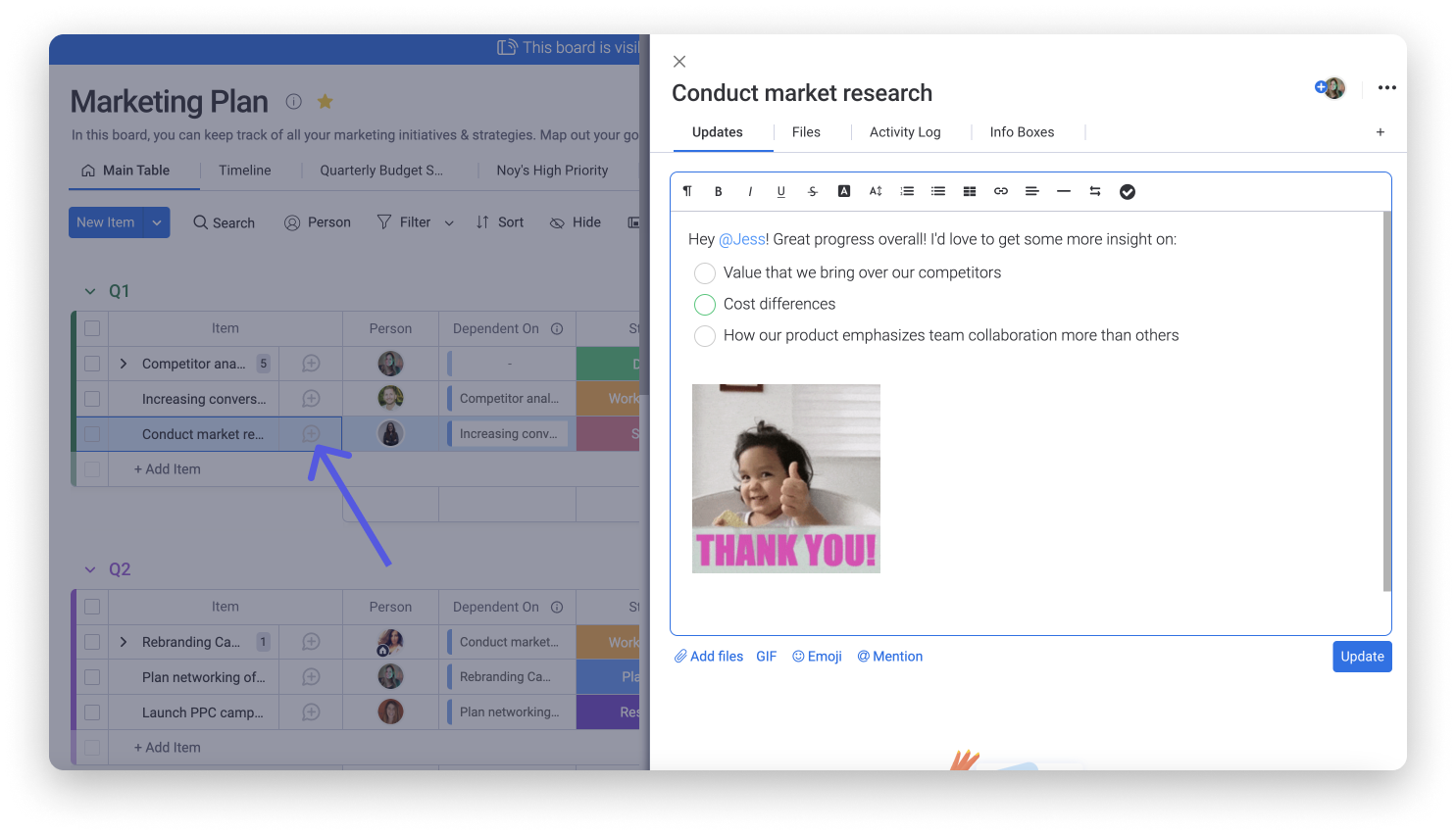

When it comes to project visibility, Monday’s dashboards do the job. They are one place for users to view completed and upcoming tasks in their schedules.

As for internal communication, the @mention button allows users to discuss a project, task, or client by tagging the people in a board, workspace, or item.

Limitations of Monday.com for Accounting and Bookkeeping Firms

a. It takes time to set it up and fit into accounting firms’ workflow needs

Setting up Monday.com for accountants requires a steep learning curve. Many tasks in the tool are too complex for beginners (and users who are not tech-savvy) to complete. It doesn’t help that Monday.com has so many features that it can get overwhelming to know where to start.

Although large accounting firms can overcome this by committing extra time and money to learn the product, smaller firms (with 2 to 30 staff) cannot afford to do that, which defeats the purpose of having project management software.

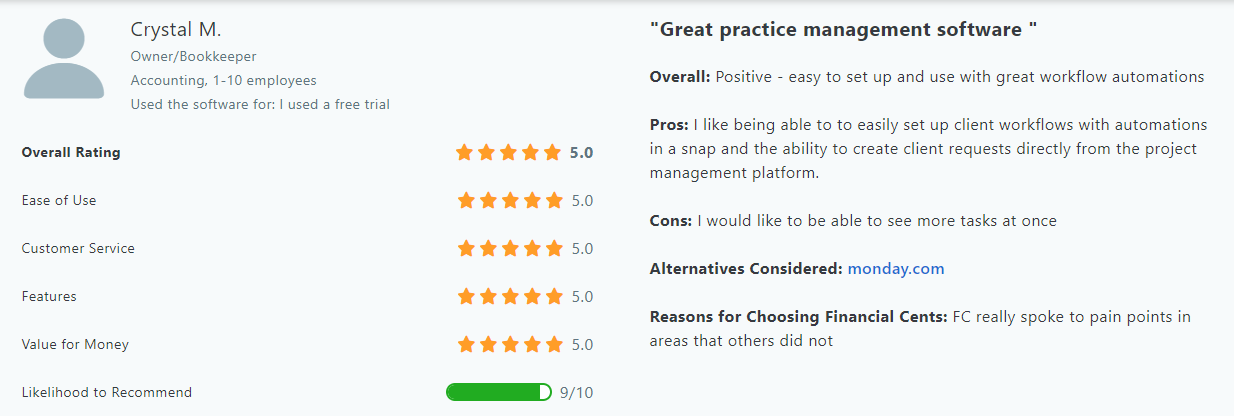

It was super complex to set up Monday.com. The onboarding team also did not fully understand our use cases and needs, so even though we paid them to set us up, we still needed to do everything ourselves."

Juliana, Head of Operations at a Staffing and Recruiting firmb. Workflow templates on Monday.com are too generic for accountants

Since it is a generic project management tool, Monday.com’s templates comprise tasks irrelevant to accounting firms.

Worse still, the templates are not easily customizable. They come with tasks and subtasks that take a long time to fit into your unique project needs.

Ultimately, you could spend the same hours customizing them as you would create them from scratch, which defeats the goal of using workflow templates.

c. Monday.com has no CRM features

Monday.com does not have a native module to store client information. This leaves accounting firms to store their clients’ contact details, logins, communication history, and custom information in multiple places. It’s also difficult to link projects to clients.

Storing client information, managing client communication, and tracking client work with different tools is time- and energy-consuming.

Read: Why Your Accounting Project Management Software Should Have CRM

d. Limited integration with Accounting Software

Of its 200+ integrations, very few are relevant to accounting firms. For example, no general ledger software solution makes it difficult to sync data between Monday.com and accounting programs like QuickBooks Online and Xero. .

Also, Monday’s integrations are so numerous that accounting professionals might spend hours testing which works for them. Finding the right tool for your processes could take hours, reducing your productivity and profitability.

e. Lacks Client Portal

Monday.com allows users to create boards with links that clients can access, but it does not have a client portal where clients can exchange information with their accountants.

Any workarounds for this depend on how much time you have to research and set it up. As your firm grows, you will need more time and energy to do so.

Plus, being a third-party integration could make such workarounds more vulnerable to data breaches, depending on the security of the API or third-party app.

Read: Key Features Your Accounting Client Portal Must Have

f. No automated client reminders

Since most accounting work requires periodic requests for information from clients, the ability to use automated reminders to prompt them to grant pending requests will save your firm hours of billable work each week.

Monday.com does not have a feature that helps with this—and understandably so. It was not built for the accounting industry alone.

g. Customer service isn’t specific to the Accounting and Bookkeeping Industry.

You will be asking for too much if you expect a product to effectively cater to the project management needs of multiple industries to the same extent.

Monday.com’s multi-industry appeal creates contrasting priorities, which prevents it from attending to the unique workflow needs of accounting professionals as much as it otherwise could.

In contrast, a tool that caters directly to the needs of the accounting industry means that everyone on the customer support team brings a perspective tailored to the workflow needs of accounting and bookkeeping professionals.

Best Monday.com Alternative to Consider

Using Monday.com for accounting processes will add a layer of complexity to your accounting workflows. Implementing it is not the most efficient use of your firm’s resources, especially when there are specialized tools for the accounting industry.

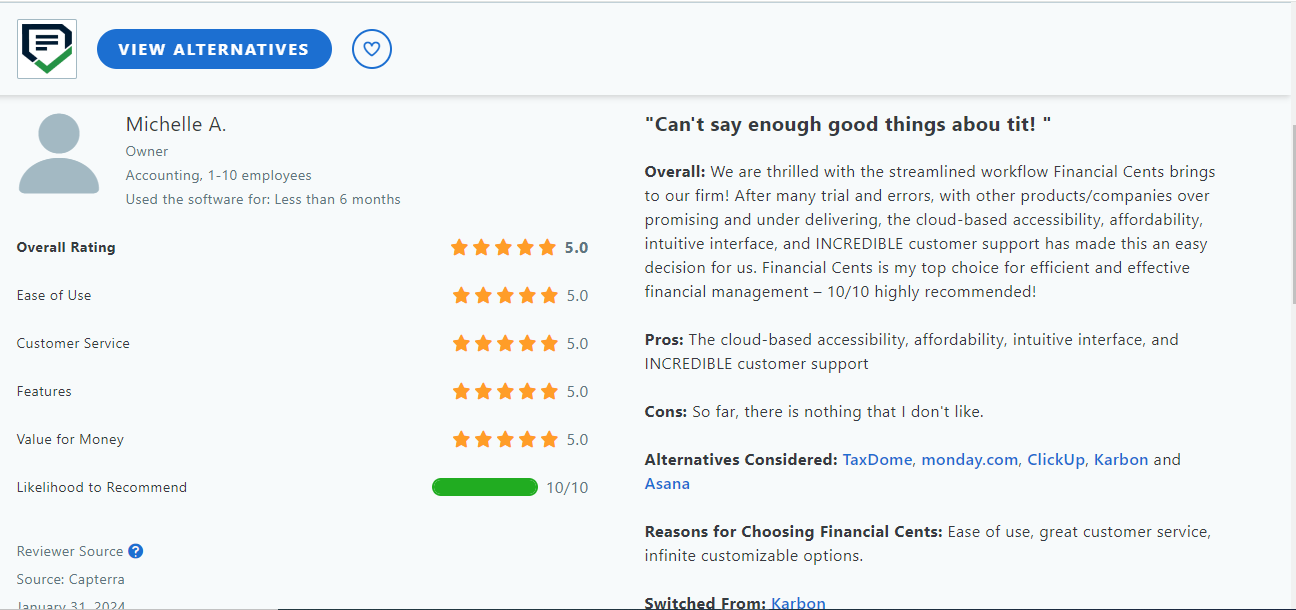

For example, Financial Cents provides accounting firms with a workflow and accounting practice management software that:

Tailored exclusively to the accounting industry, Financial Cents is/has:

a. Quick to Implement and Easy to Use to Drive Staff Adoption

Financial Cents takes an average of three (3) hours to set up. It has short videos to help your team make the most of all its features.

b. 50+ Accounting workflow templates to standardize your client work and reduce error

Financial Cents’ library of accounting workflow templates has helped firm owners like Michael to standardize their work quality. Helping firm owners document their standard operating procedures (SOPs) frees their brains to focus on strategic tasks.

Each Financial Cents template addresses specific accounting projects. So, you do not need to do much when customizing (just because one firm is different from the next) them to suit your unique processes. That way, your team members, especially the new ones, can complete work to your standard to reduce the need for rework.

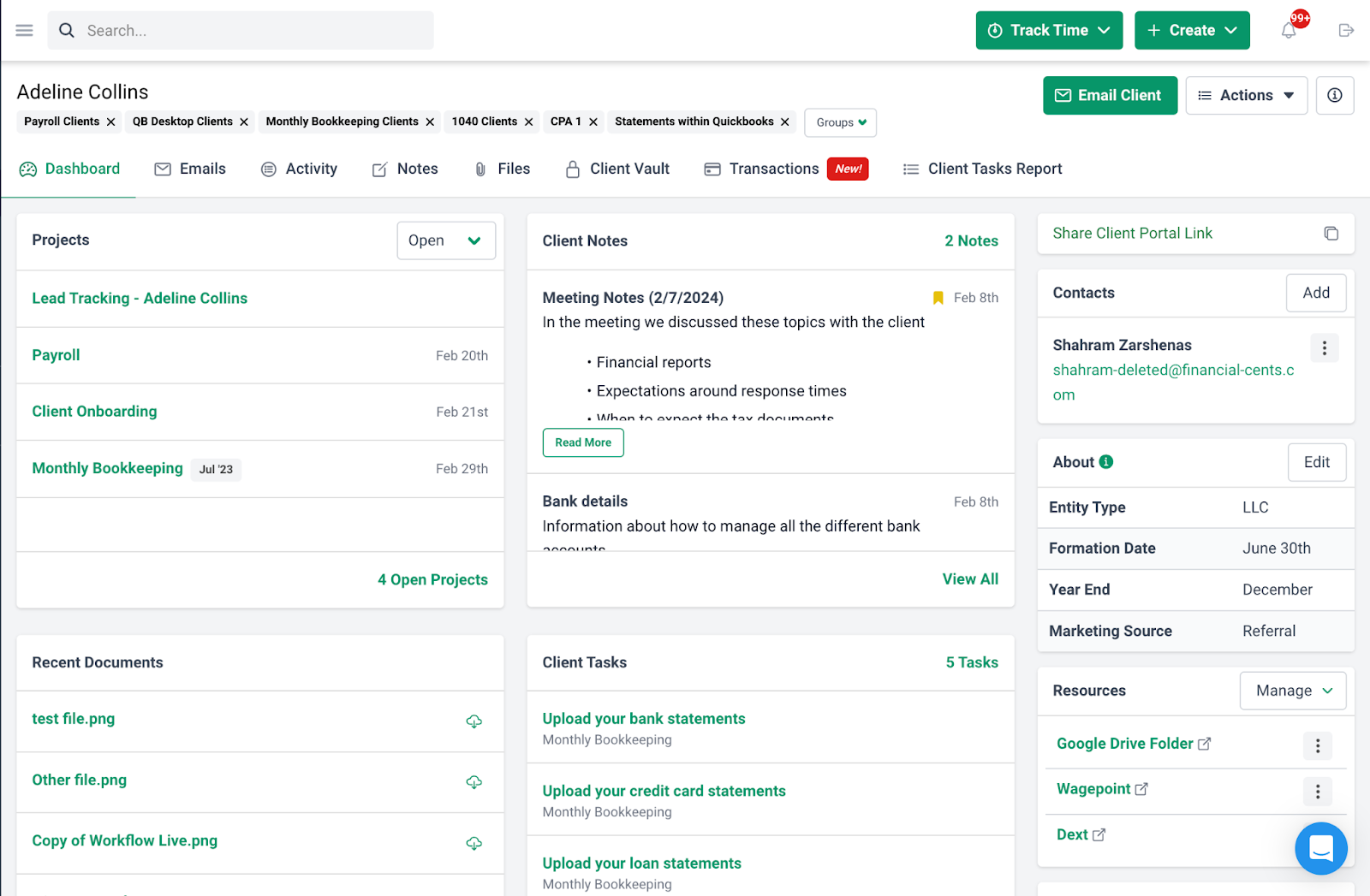

c. Accounting CRM to Store Client Information Where Their Work is Done

Financial Cents’ CRM feature is designed to help accounting and bookkeeping firms build quality relationships by finding information, tracking communications, and exchanging files with them.

Two examples of these features are:

- Client Emails: Financial Cents integrates with Gmail and Outlook to organize all your client emails into a focused folder for the client inside Financial Cents. This declutters your inbox and makes it easier to see client updates, delegate ad-hoc requests, and follow up with clients (where necessary) inside Financial Cents. This keeps things from falling through the cracks.

- Client Dashboard: this is where all your clients’ contact and sensitive information and files are stored. By storing all client information in one single place rather than using multiple apps., Financial Cents gives your team one place to find everything they need to complete each client’s projects.

Other examples include:

- Activity to track client interactions for improved client relationships.

- Client Notes for sharing client updates with your team.

- Files to organize a client’s documents into folders.

- Client Vault: a secure platform that stores sensitive client information using encryption technology.

- Transactions to categorize uncategorized transactions in QBO from inside Financial Cents.

- Custom Fields for client-specific information like entity type, Year-End, marketing source, and additional resources.

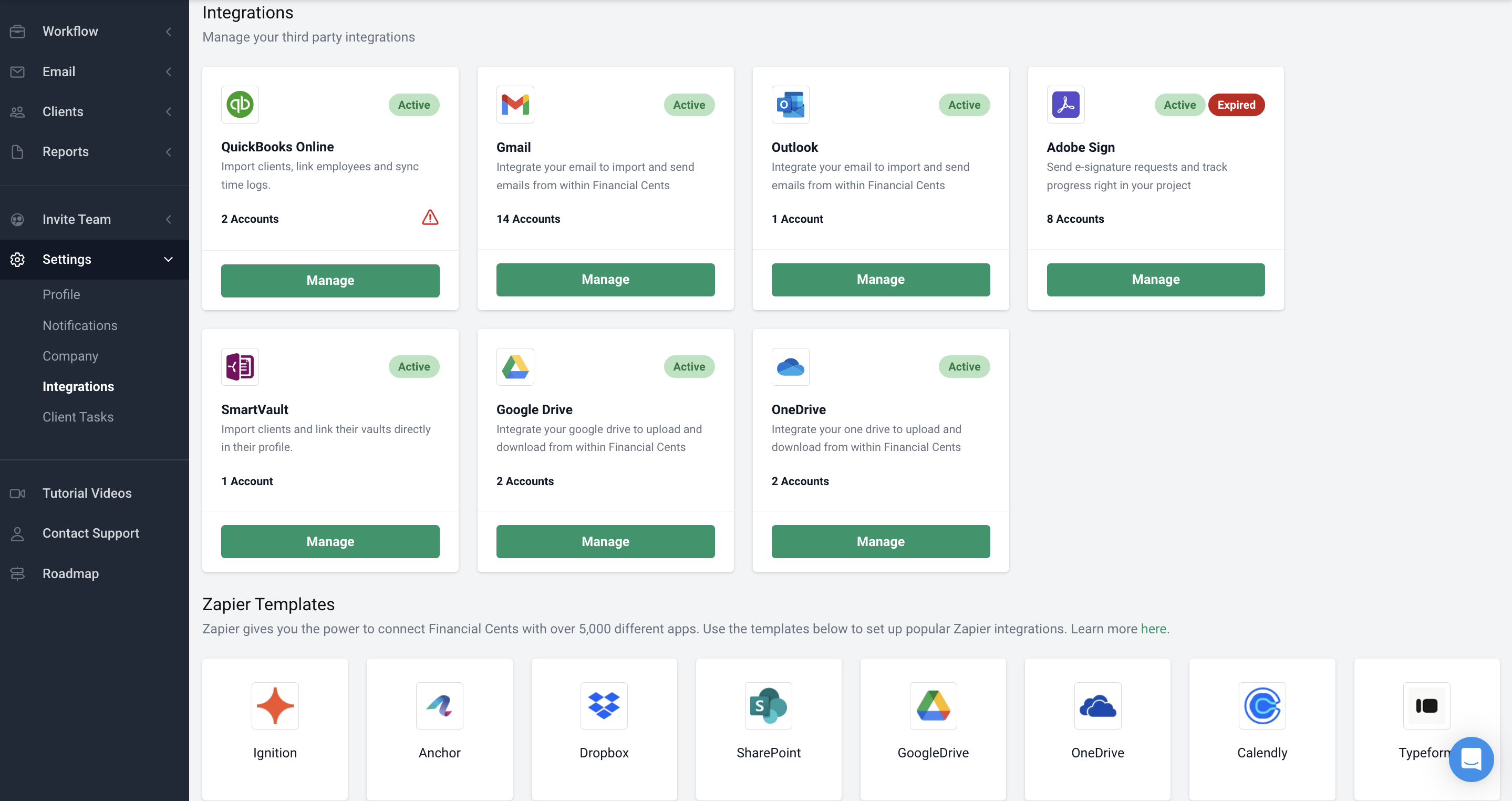

d. Integrations with accounting practice-critical apps

Financial Cents integrates with only the apps that are relevant to accounting and bookkeeping professionals, such as:

- QuickBooks Online to import clients, manage uncategorized transactions, and sync data between Financial Cents and QBO for accurate invoicing.

- Gmail & Outlook to stay on top of client communication inside Financial Cents.

- SmartVault to sync client data with your document management system.

- Adobe Sign to request client signatures on proposals, tax returns, and other documents inside Financial Cents).

- Zapier to integrate Financial Cents with thousands of accounting-relevant apps like Ignition, GoProposal, Anchor, Typeform, Google Form, DropBox, Google Drive, Etc.

e. Client portal for accounting and bookkeeping firms

Financial Cents’ client portal is a secure platform for accounting and bookkeeping firms to request documents and information, providing a collaborative platform that saves you the time and energy of chasing down clients.

The portal is password-less, making it easy for clients to access, see all pending requests, and upload the necessary documents in a few seconds, which increases the chances of receiving client documents files on time.

Not only can clients upload documents, but you can also share documents and collaborate with clients in the portal.

Similarly, the portal’s collaboration capability enables bookkeepers to categorize uncategorized transactions in QBO without leaving Financial Cents.

f. Automated reminders and workflows

Financial Cents Automated Reminders are designed to improve your client data collection.

In Financial Cents, you can set up client tasks (a list of the files and information you need from clients) and automate the reminders so that you never have to take time off work to follow up with your clients.

This feature allows you to choose the reminder frequency so that your client will be automatically notified by email or text (or both) until they send the file or information you need.

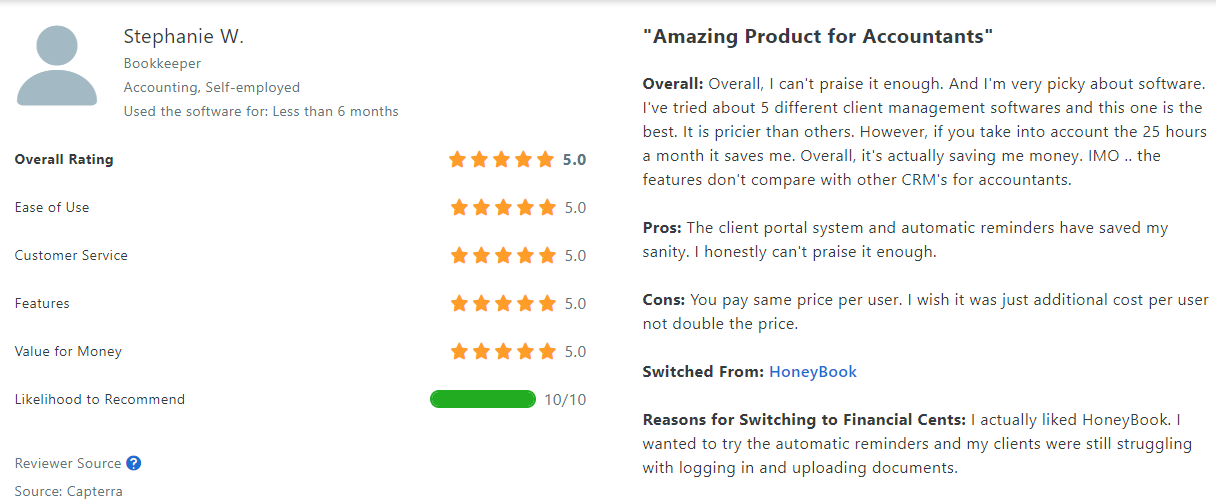

g. Customer support tailored to your needs

Financial Cents’ customer support representatives are trained to help users find solutions to their specific accounting workflow and practice management challenges.

Since they only cater to accounting and bookkeeping teams, the Financial Cents customer support team focuses on the complete spectrum of workflow challenges accounting professionals face, which makes them much more helpful.

Final Verdict: Is Monday.com for Accounting Firms A Good Fit?

Monday.com is so feature-rich and customizable that teams across all industries can find it useful; therein lies the problem.

Serving so many industries reduces its usefulness to an accounting industry that requires painstaking attention to detail.

Using Monday.com for accounting projects could drown your team in administrative work, cause things to slip through the cracks, and prevent you from helping your clients meet their financial reporting requirements.

In this study, Amanda Owens walks us through the problems she encountered while using Monday.com and how she solved them using Financial Cents.

Using Monday.com for Accounting Projects Falls Short in Critical Areas

The absence of client relationship management (CRM) and client portal features shows that Monday.com was not designed with the specific needs of accounting firms in mind.

Without these features, accounting firms struggle to receive and store up-to-date client information, which is necessary for the accuracy of accounting projects.

Using a project management solution built for the accounting industry is non-negotiable for building quality client relationships (without which your business cannot survive), delivering accurate work at scale, and increasing your firm’s revenue.

Use Financial Cents for your accounting firm’s project management.