The key to optimizing any accounting firm for productivity lies in streamlined processes that ensure no staff member spends one more minute than necessary on tasks.

That is how firms save their employees’ time and mental energy to get more work done, generate more revenues, and grow the firm.

Streamlined processes mean:

- Automation (that buys back time from manual, repetitive work).

- Documented standard operating procedures (that enable you to delegate work effectively and keep work quality consistent no matter which staff member completes a project).

- Organized work and client information (that helps your team find everything they need for work in one easily accessible place).

- Visibility into employee workload (that keeps every staff member functioning at peak capacity).

A necessary condition for optimizing your firm for productivity is the ability to do all of these (and more) with the fewest tech tools possible. This is the essence of accounting practice management software—to organize, track, and manage your firm from one place, whether you are a team of one or 100.

Even if you are working by yourself, a practice management system will help organize you"

Nayo Carter-Gray, CEO 1st Step AccountingLet’s see how this plays out in a regular accounting or bookkeeping firm, using Financial Cents as an example.

The Importance of Accounting Practice Management Software in Your Firm

Most accounting firms struggle to harmonize their accounting tech stack because the app at the center of it all—the practice management software—Is not a good fit. But the right practice management software should empower your team to:

-

Improve Team Collaboration

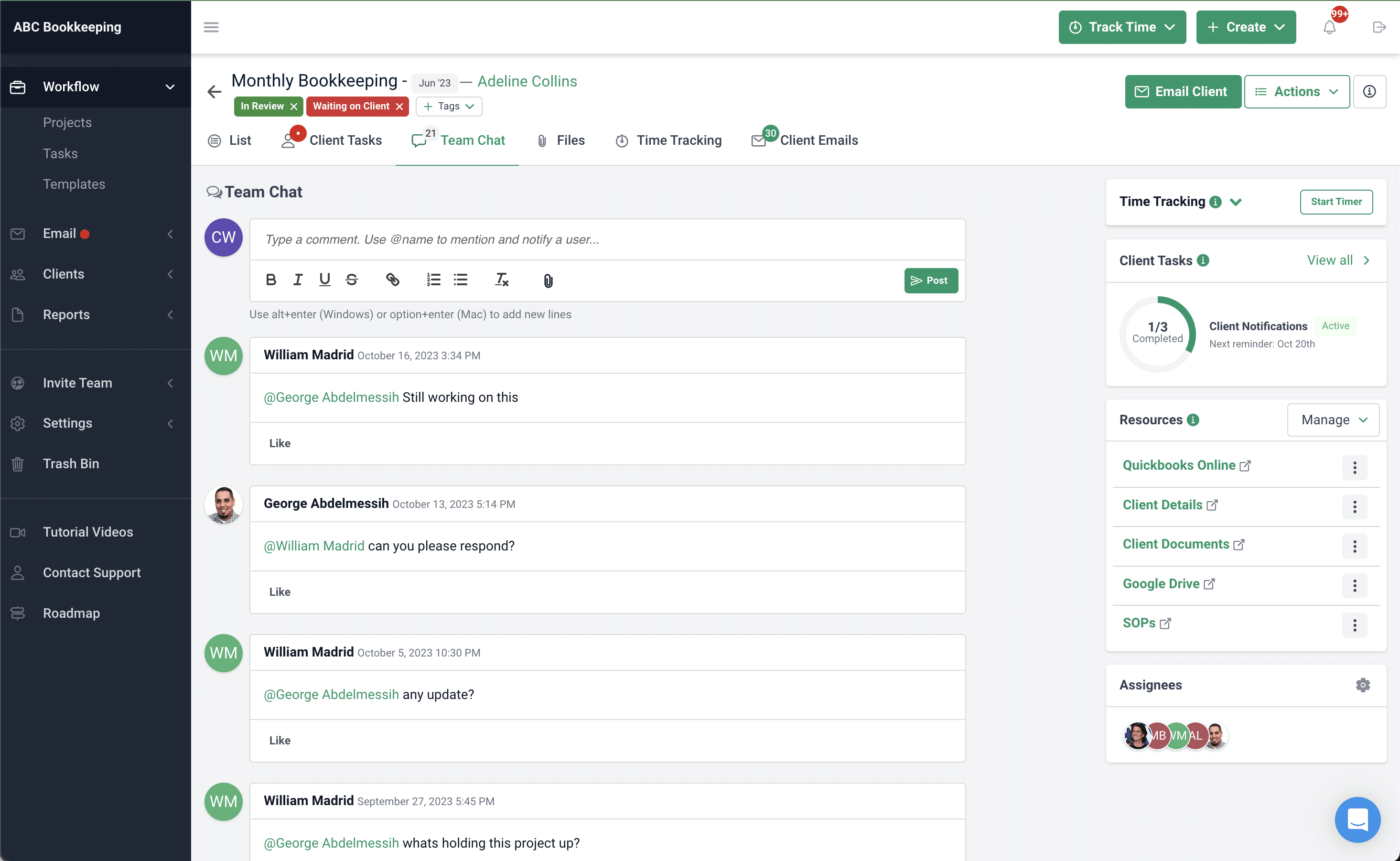

Accounting practice management software comes with easy-to-use communication and internal note features that enable your team to share files and information to keep everyone in the loop.

In Financial Cents, for example, team members can communicate within the project or inside the client’s profile, helping them to interact in context (right where the job is getting done).

For example;

Comments allow your team to request and provide information on a project while using the @mention to tag relevant team members and pull them into the conversation.

The files tab allows you to share the files your team needs to do the client’s work.

You should read: 25 Practice Management Tips for Accountants by Accountants.

-

Manage Everything from One Place

Workflow dashboards are a central part of accounting practice management software. These dashboards provide accounting firm owners with a firm-wide view of everything in the firm in one view.

From client projects to due dates, assignees, client database, tracked time, and staff workload, everything is one or two clicks away from you, which enables you to make time-sensitive decisions quickly.

With so much information at your fingertips, practice managers like Financial Cents helps you to make better strategic decisions by showing you where your team is wasting time, where your client project stands, and where there might be a bottleneck in your processes.

-

Keep Track of Client Communication

If you don’t have a practice management software (or if the one you use is not a good fit), your client communication will be too disorganized (across different Slack channels, Email inboxes, and SMS) to see client messages, receive client files on time, which will result in information slipping through the cracks.

Most accounting practice management software integrates with Email service providers to help you pull all client emails into a focus folder within the system. So, any email a client sends to any of your email addresses will appear in one folder in your accounting practice management software (where your team is getting work done).

For example, reading, replying, or archiving an email in Financial Cents reflects the same action in your Gmail or Outlook.

See other apps your practice management system should integrate with.

-

Never Miss a Client Deadline

By giving you the ability to organize and track everything (project, clients, and staff) in one place, track client communication (so no information slips through the cracks), and manage team communication (so no one is confused about their role, tasks and the procedures to get work done), your team is better able to work within time schedules to meet client deadlines.

Also, the due date feature in accounting practice management software shows your team which project is nearest its deadline to avoid prioritizing less urgent projects.

The time tracking feature also helps your team measure how long your projects take to complete, empowering your team to plan their time to meet client deliverables.

Then there is automation, which keeps your team from wasting hours on administrative tasks, freeing them up to focus on not just the work that brings revenue but work that moves the needle in the client timeline.

Optimizing Your Firm’s Productivity Using an Accounting Practice Management Software

1. Create Standardized Templates For Tasks

Since accounting firms are different in how they get work done. Even the most experienced accountants need to understand how you prefer to get things done when they join your firm. And workflow templates will help you make that transition seamless.

Templates help all staff (old and new) to achieve the same results by laying out the steps in your processes, one after the other.

Apart from saving your team several hours a month (because they do not always have to recreate the same type of work), templates prevent the confusion of guessing how to follow a process, which results in poor work quality.

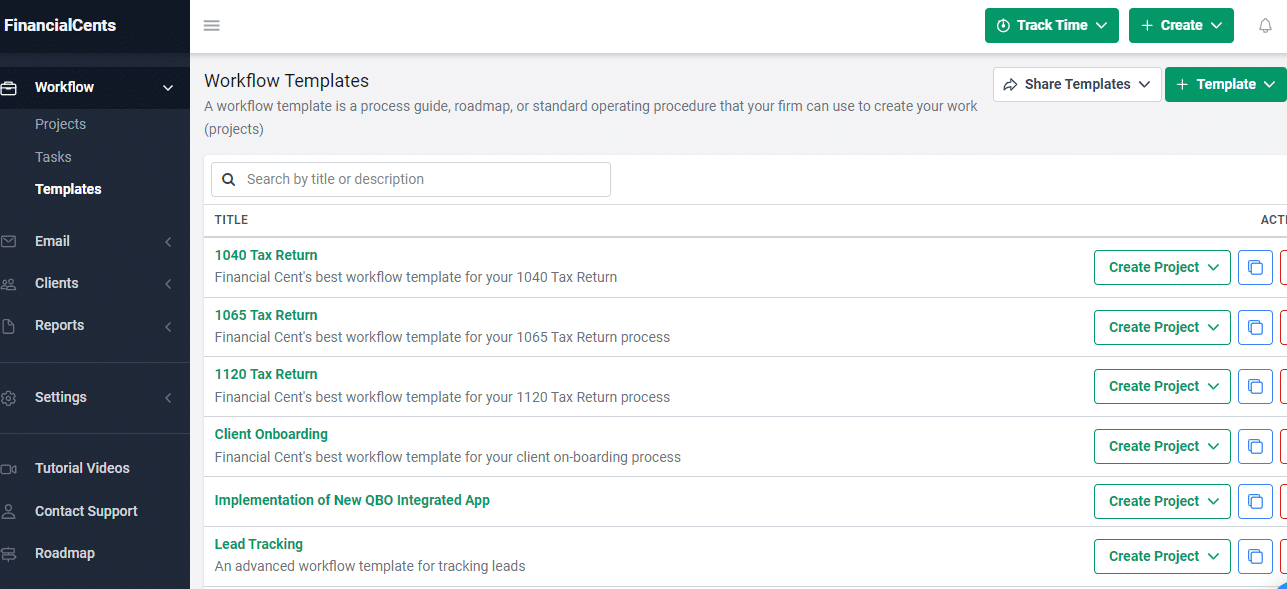

Any good accounting practice management software should enable you to create and store templates for future use.

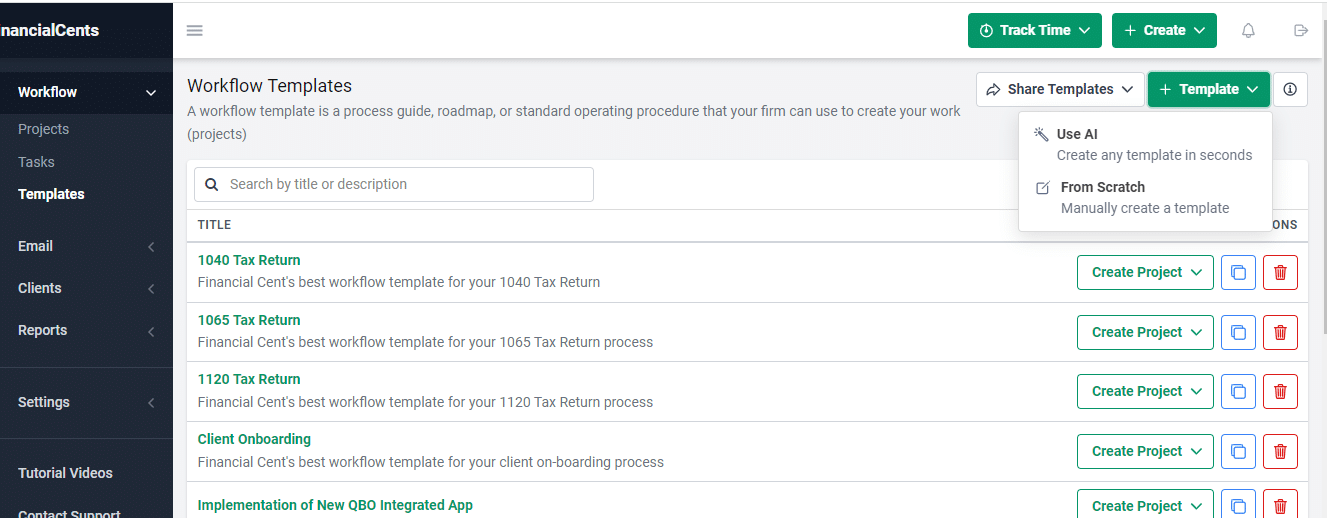

In Financial Cents, for example, you can use templates in three ways:

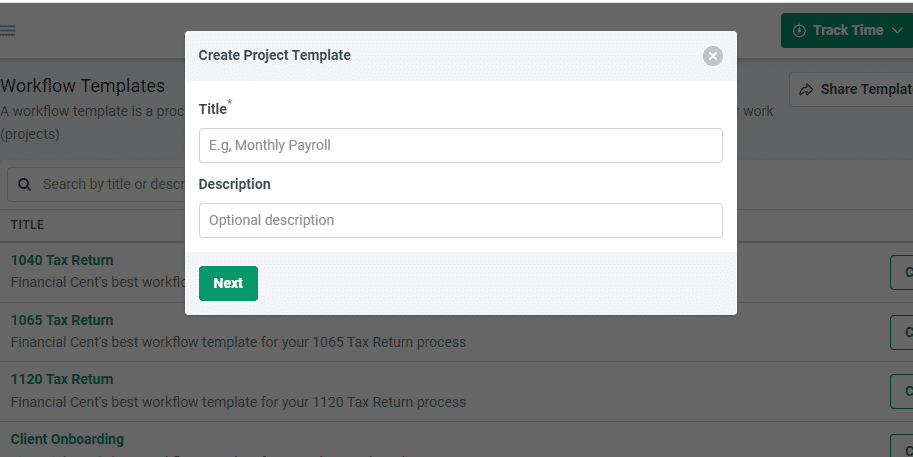

→ From Scratch

This enables you to build out your templates by yourself by:

- Selecting the Templates tab

- Entering the project name and description.

- Typing the steps directly into the system (you can also paste the process steps you have in other platforms like MSWord or Excel)

→ Customize Pre-Built Templates

creating your templates from scratch will eat into the time you’re trying to save. Financial Cents comes with a prebuilt pack of workflow templates that you can use immediately.

But then, your process will likely be slightly different than most firms, so you need to edit the steps to suit your unique procedure by adding and removing tasks and subtasks. You can move tasks up or down in your preferred order. You can also add descriptions to explain the tasks and subtasks.

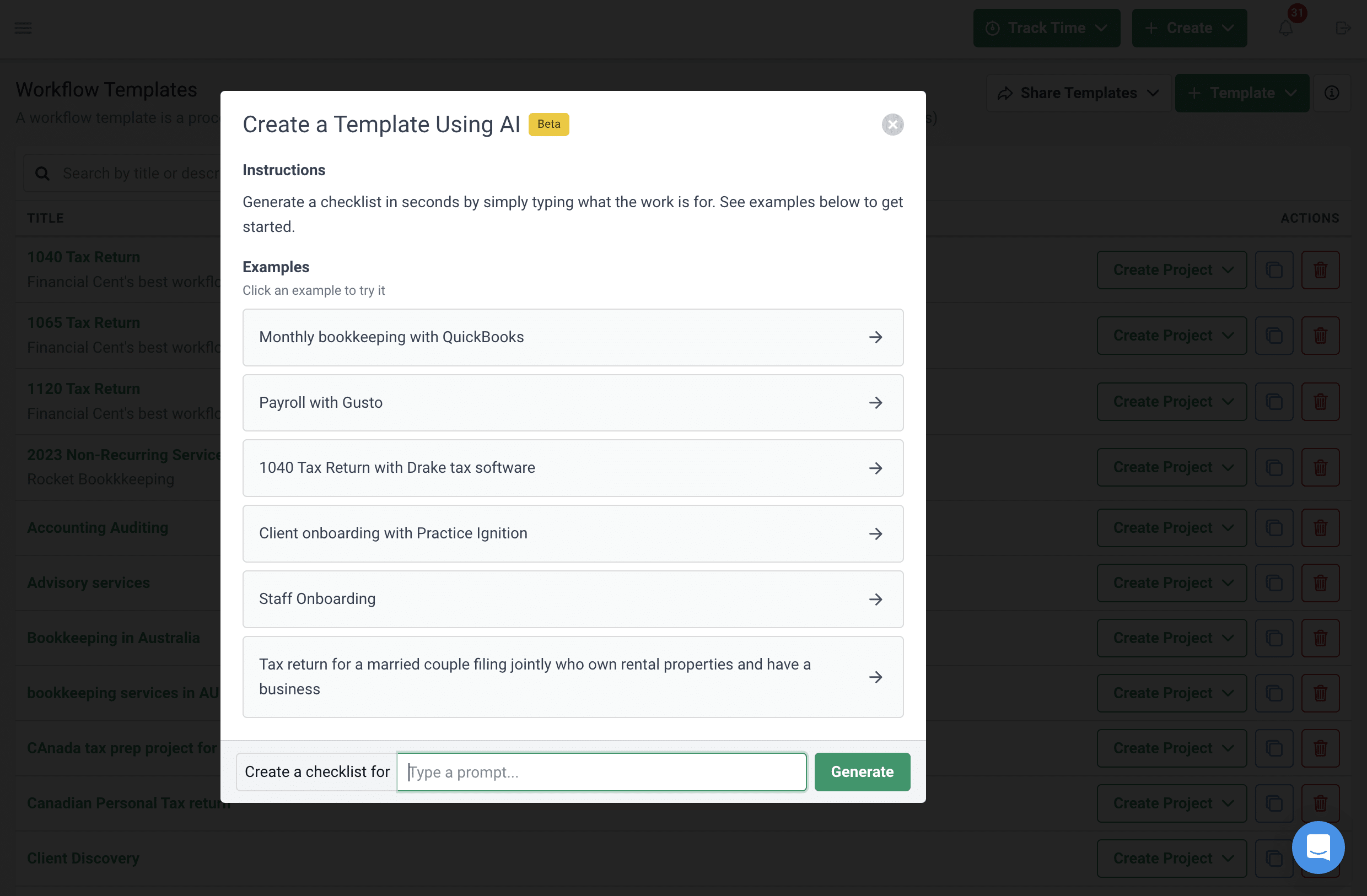

→ With AI

Financial Cents integration enables you to use ChatGPT to create workflow templates inside Financial Cents. (more on this in Number 5).

2. Delegate Tasks Effectively (By Using Capacity Management Feature to Avoid Burnouts)

Scaling your firm depends on how well you can delegate work. After all, most accounting firm owners can do all accounting tasks. As your client base increases, you’ll find that doing it all will keep you from seeing your firm’s big picture.

While delegation empowers you to work on the business, instead of getting lost in the daily activities of the business, you need to know how much work each of your team members already has. If you don’t, you might give more work to team members already doing too much.

That would result in lower quality work, missed deadlines, employee burnout, and employee turnover.

To prevent this, you need your practice manager’s capacity management feature to see your team members’ workload in one view. This enables you to know who can take on more work. You can take work from someone already working too many hours to those not working enough to keep the balance in your firm.

Kelly Porter, Director of Operations at Arrow Bookkeeping, uses Financial Cents capacity management reports to see how “full” her team members are.

I've been using the reporting tools to see how full somebody is. For instance, before I started using Financial Cents, I would create a spreadsheet and estimate each staff’s weekly tasks and how long everything would take."

Kelly Porter, Director of Operations, Arrow Bookkeeping3. Discover Profitable (and Not So Profitable) Clients Using Time Tracking

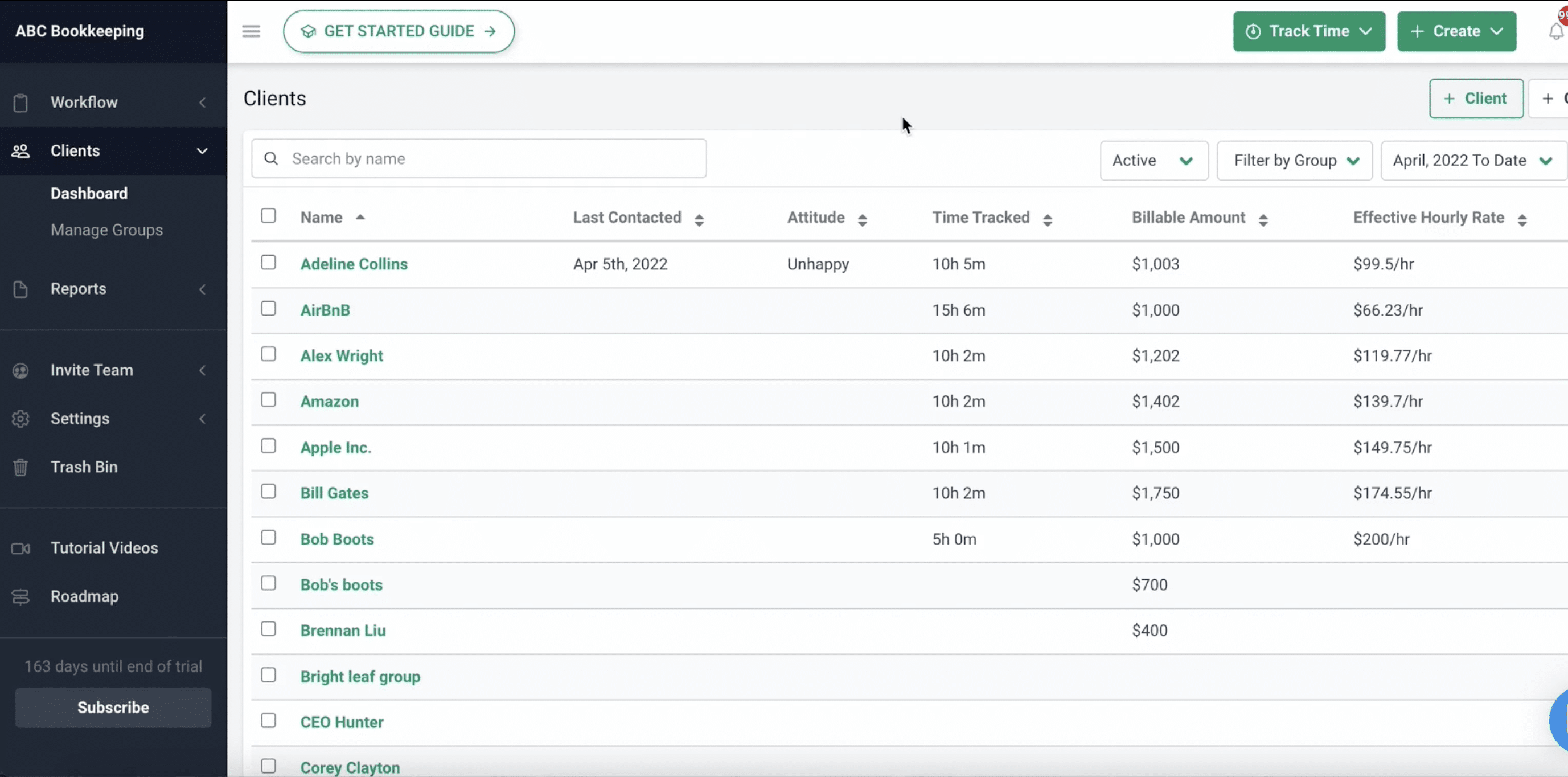

Productivity and efficiency won’t count if you don’t get enough financial returns on your time investment in your clients. So, positioning your firm to serve well-paying clients is a huge part of optimizing your firm.

Knowing which client is profitable (and which is not) begins with tracking the time your team spends on their work with the time tracking feature in your accounting practice management software. Knowing the number of hours your team spends on their work will help you determine whether you are charging enough to be profitable or just getting by (and where you can raise your rates to meet your revenue projections).

Financial Cents’ time tracking feature enables employees to record time as they work on client projects. This feature also allows you to set time budgets for your team to measure how much time they spend on tasks versus the time budgeted.

The start/stop timer enables you to track time by project or client. You can also log your timesheets manually.

Most importantly, the Effective Hourly Rate feature is an easy way to identify your profitable clients by seeing how much you earn per client versus how much time you invest in them.

The feature calculates how much you charge a client by the hours of work you do for the client to show you how much your hours are worth for the client.

If your effective hourly rate doesn’t reflect your time investment in a client, you can find ways to renegotiate their rates to make you more profitable.

You may be interested in:

Time Tracking for Accountants: How to Improve Client Billing and Revenue Management

4. Save Time by Automating Manual Tasks

There had to be a way to automate those accounting and bookkeeping tasks that take up several hours of accounting and bookkeeping work every week—workflow automation became the answer.

With an accounting workflow software, your team gets their time back to focus on the tasks that are best suited to humans instead of performing the same set of tasks every week,

For example, it helps your firm to:

The client task feature in accounting practice management software does not just shorten the time it takes your firm to get documents from clients (by automating reminders); it also conserves your team’s energy by freeing them up to work on other projects while waiting on a client’s documents.

Without it, they will have to set time aside to send follow-up emails to remind the client to send missing information.

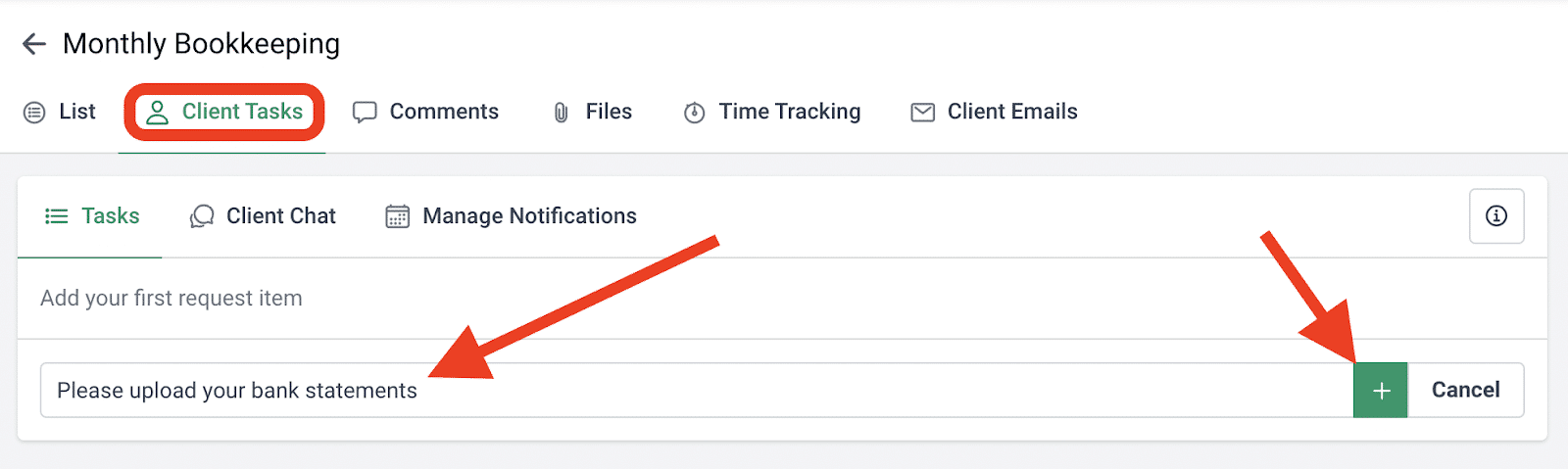

In Financial Cents, you can set up as many requests as you need. Here’s how to do it:

- Open the project for which you need the additional information.

- Click Client Task

- Type in the request.

- Click “+”

- Add the due date and description, and choose your preferred upload destination for the document.

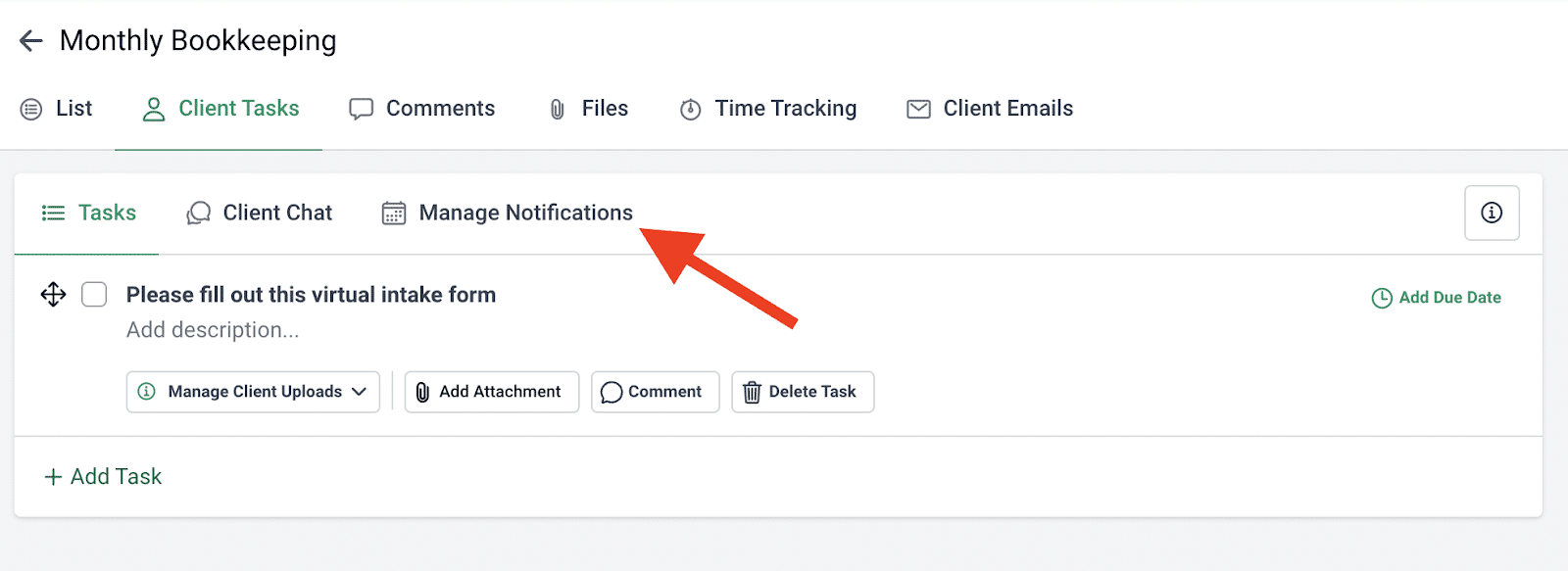

Then go ahead to automate the client reminders in these steps:

- Click Manage Notification.

- Select the date the request should start sending.

- Select the frequency of the reminders.

-

Automate Recurring Tasks

If you’re like most accounting firm owners, you have clients you do the same type of work for on a weekly, monthly, yearly (or custom schedule) basis. Creating these projects only when they are due will increase the time spent on administrative tasks. There is also the chance of forgetting it altogether, which could cause things to slip through the cracks.

An accounting practice management software prevents both scenarios. It enables you to create the work once and set it to recreate itself across its future dates automatically.

That means that whenever the project has passed its due date or is complete, the system automatically recreates the next copy of the project according to the frequency you set for it.

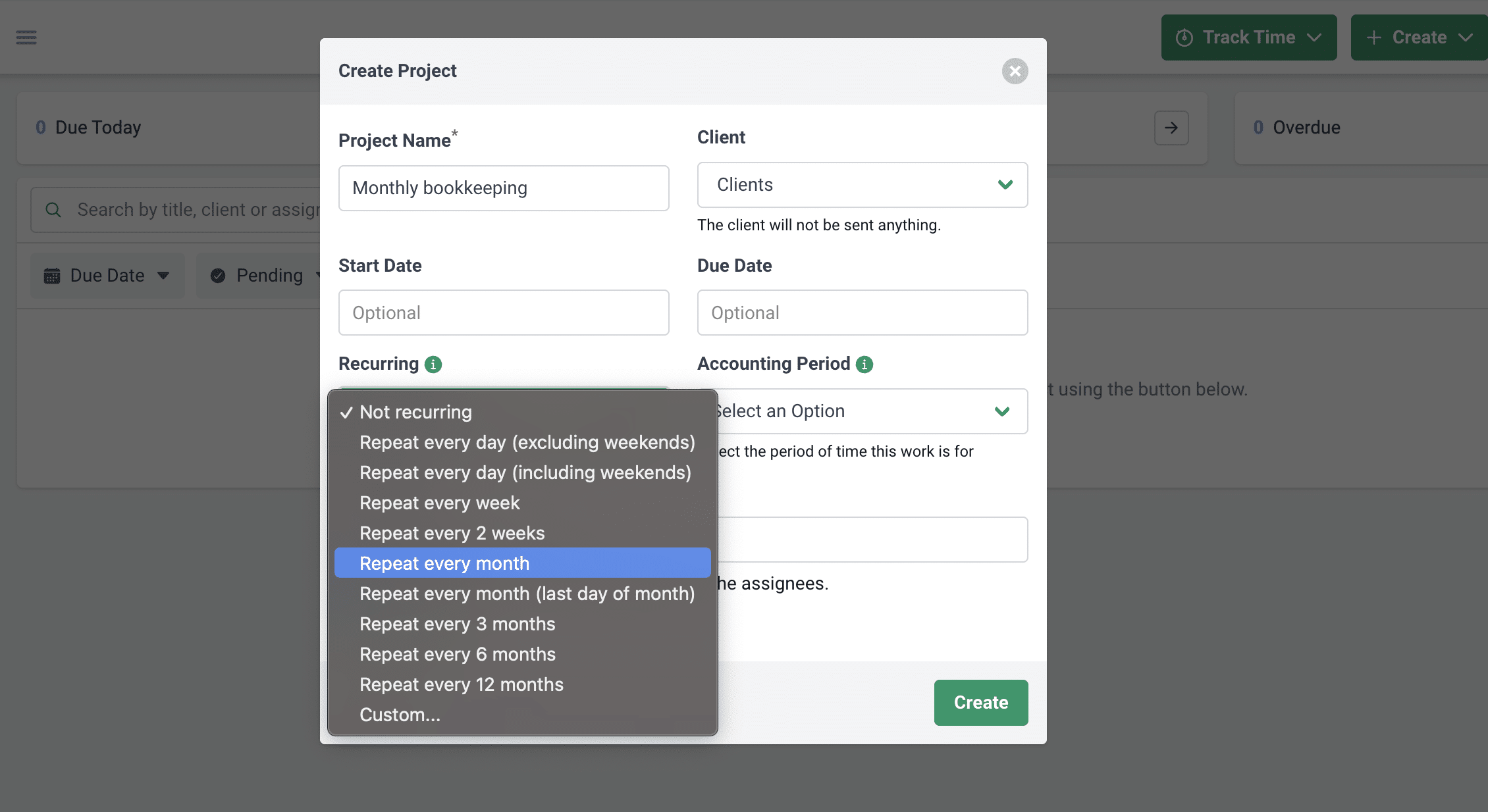

In Financial Cents, this feature is applicable when creating a project.

- Scroll to the Recurring section.

- Select the frequency (it could be default options like every week, month, or quarter).

- You can also use a custom option to repeat the work on a more complex schedule, like a third Monday every month or a particular day of the week.

- Fill in other project information and click Done.

-

Automate Dependencies

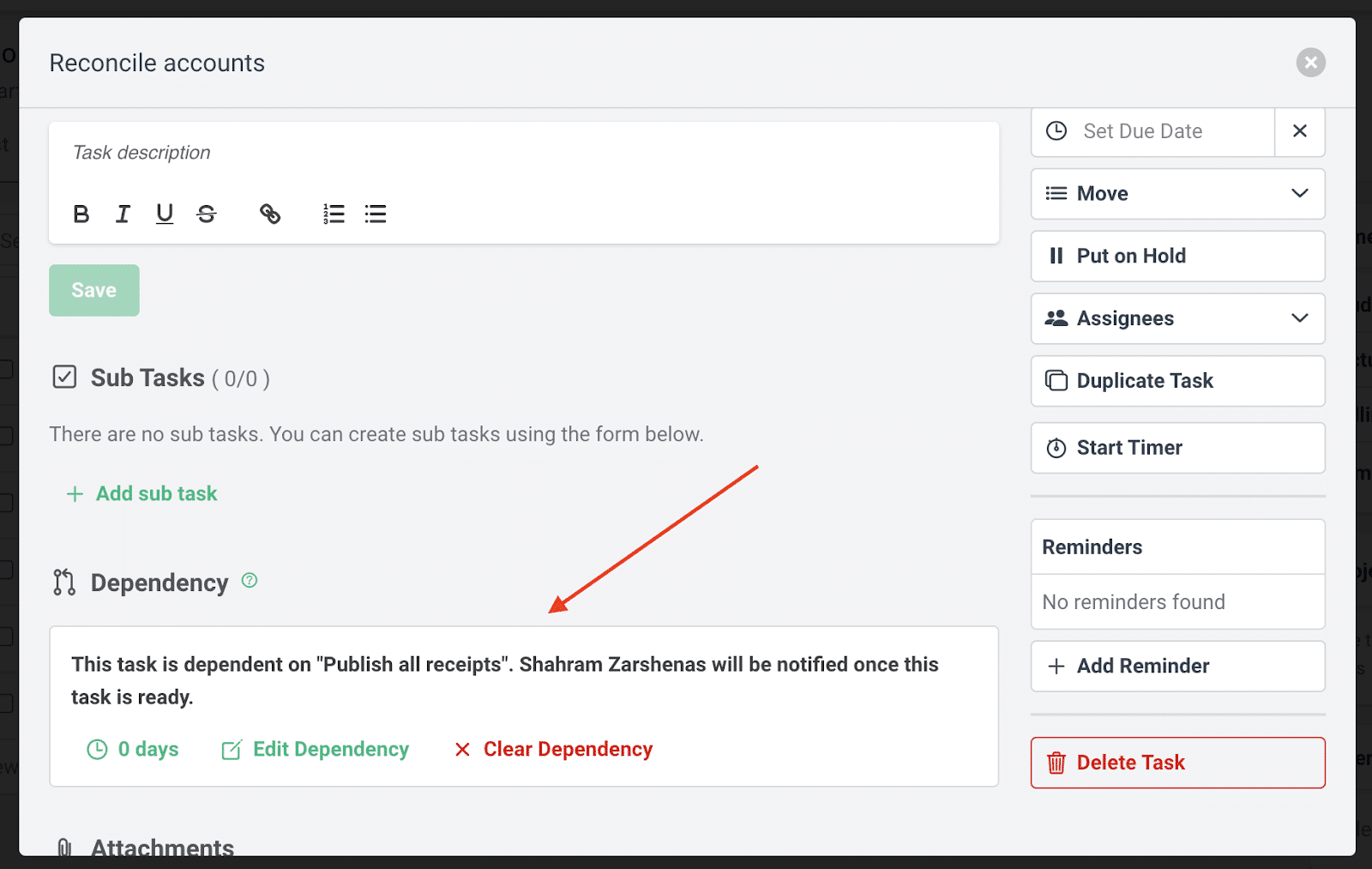

The dependency feature helps you to automatically notify your staff when their work is ready to begin.

Without the dependencies feature, your staff members will always struggle with understanding which of the numerous projects they have tasks in is most urgent. Naturally, they may go ahead to complete a task that could wait while a more urgent task misses its deadline.

The Financial Cents Dependency feature automates the process by decluttering your employees’ dashboard so they can see only the tasks they need to work on. The system also notifies the assignee when their tasks are due. This helps to prevent things from slipping through the cracks.

To set up task dependencies in Financial Cents, click on the task you want to make dependent on another and choose which task it should depend on.

5. Use AI to Create Workflow Checklists in Seconds

Creating workflow checklists to guide your team can be time-consuming. Thankfully, a few accounting practice management software enable you to create checklists for your workflows in seconds.

All you need to do is type the workflow template you want to create into the text box, and the system will populate your screen within seconds.

Here are the steps to setting up your workflow checklists in seconds:

- Click Templates

Click the green +Template button on the top right

- Select Use AI

- Type the project you want to create the template for (like Monthly Bookkeeping)

- The system will populate your screen with the steps needed to complete a monthly bookkeeping work.

I went even deeper with it. I said, 'Prepare a tax return for a married couple that has a rental property and a business that will need to pay an invoice before I upload documents to the client portal.' The checklist it gave me was awesome. I tweaked only three things."

Nayo Carter-Gray, CEO 1st Step AccountingYou will find this useful:

7 Quick Steps to Migrate to a New Accounting Practice Management Software

More Ways to Optimize Your Firm in Financial Cents

You can do much more in accounting practice management software to optimize your firm for maximum productivity. If you use Financial Cents, you also get the ability to:

-

Close Task Automatically:

You don’t have to spend extra seconds closing projects manually. Once the last task in a project is complete, the project automatically closes, saving you the mental energy of dealing with a cluttered dashboard or figuring out what needs to leave the workflow dashboard.

-

Find Information Faster Using Workflow Filters

Workflow Filters enable you to sift through your workflow dashboard to find specific information. You can filter your dashboard by any of the features in your workflow dashboard—client, due date, assignee, tag, client groups, Etc.

Financial Cents’ productivity optimization features are better experienced than explained. Try out all these features (and more) in our free trial.