Bookkeeping services such as payroll processing, bank reconciliation, and data entry are essential parts of an organization’s finance department. This much is clear.

But as Dr Seow Poh Sun, Associate Professor of Accounting (Education) at Singapore Management University points out:

The accounting profession is changing rapidly due to digitalization. Accountants need to develop business acumen and embrace innovations to stay future-ready as new business models evolve."

What this means is accountants must adapt and develop new skills to remain competitive or risk being left behind.

But to do this, firm owners have to contract these tedious, time-consuming bookkeeping tasks to third-party companies. This frees up time and resources to focus on providing higher-value services. For example strategic planning, financial forecast, and advisory services.

Little wonder outsourced bookkeeping is fast gaining prominence among accounting and CPA firms.

Tom O’Connor, Managing Member at Thomas A. O’Connor, CPA LLC corroborates this point. When asked which accounting tasks CPAs commonly outsource, here was his response:

Bookkeeping! I’m sure many want to concentrate on tax, management advisory, and financial planning. Better to outsource it than struggle with time management, meeting client’s requirements, and negotiating prices for the solutions offered"

Lower costs, expert help, and accurate financial records are other benefits of handing over your bookkeeping services to third-party firms.

However, this move is not without its risks.

How do you maintain the same work quality after outsourcing bookkeeping to avoid losing clients and damaging your firm’s reputation?

This is a common question most firm owners ponder before outsourcing their bookkeeping functions.

If you currently find yourself in a similar situation, this article is for you.

In it, we’ll discuss the essence of retaining work quality, some factors affecting the quality of work, and how to maintain the same standards in outsourced bookkeeping.

Want to know whether outsourcing bookkeeping is right for your accounting or CPA firm? We cover all you need to know about outsourced bookkeeping in this article.

Outsourced Bookkeeping: The Essence of Retaining Work Quality

High-quality bookkeeping services lay the foundation for a strong client relationship.

When customers are confident in the accuracy and timeliness of their financial records, they are more likely to continue engaging in your firm’s services and even refer friends, colleagues, or business partners.

And when you consider it’s five to 25 times more expensive to acquire new clients than to retain existing ones, providing quality work becomes a no-brainer.

However, this may get tricky when outsourcing your bookkeeping tasks to a third-party company. Clients can quickly detect when there’s a significant drop-off in the quality of their work.

So the question is, how do you retain the same work quality?

This boils down to finding an outsourcing partner that:

- Has sufficient expertise, experience, and positive customer reviews.

- Shares your firm’s values and commitment to delivering high-quality work.

- Adheres strictly to the processes and systems you put in place to ensure smooth collaboration.

Once a partner fits all these criteria, only then can you be rest assured of retaining clients, maintaining a solid reputation, and achieving sustainable business growth.

Factors Affecting Work Quality in Outsourced Bookkeeping

While outsourced bookkeeping has its benefits, there are factors that if left unchecked, could affect the quality of work produced. Let’s examine some of them.

Skills level of your outsourced partners

Imagine you contact a web design company to build a website for your firm. After signing the contract and paying the stipulated fees, the company outsources it to an intern.

The result? A poorly designed, dysfunctional website. We bet you’d ask them to redesign it or seek a refund.

This scenario describes what happens when you hand over your bookkeeping functions to an outsourcing company that lacks the necessary skills, expertise, and experience. As a result, your clients get low-quality work different from what they are used to.

Also, there could be mistakes in financial records, compromising the quality of work delivered to clients, risking regulatory compliance, and erasing the trust that clients place in your accounting firm.

As such, it’s important to partner with a competent and experienced bookkeeping firm with the same or better skill level than your firm.

Lack of Proper Communication Channels

Your clients have been enjoying world-class bookkeeping services for years. But a few weeks after you outsource it, they experience a massive drop in quality.

This doesn’t just happen out of the blue. Sometimes it’s due to miscommunication with your outsourced partners.

No matter how efficient they are, a lack of a proper communication channel leads to misunderstanding and increased turnaround time. In a Forbes Advisor survey, 49% of employed Americans said ineffective communication impacted productivity.

Furthermore, an inability to discuss changes or revisions on time could lead to delays in delivery, subpar work quality, and unsatisfied clients.

Therefore, it’s imperative to establish clear, reliable, and regular communication channels from the start to ensure smooth operations and high-quality results.

No Clear Standard Operating Procedures (SOPs)

Outsourcing bookkeeping tasks without establishing a clear process is like driving to a new destination without GPS. You might get there eventually, but the journey will be stressful and full of wrong turns.

Without clear SOPs, there could be mistakes, miscommunication, and lack of uniformity in handling financial tasks. All these make it a challenging outsourcing experience.

So, before engaging the services of an outsourcing company, create clear SOPs to ensure everyone is on the same page.

You Don’t Use the Same Accounting Tech Stack

Nothing is more frustrating than spending precious time going over work that your outsourced partner has completed. This defeats the whole purpose of outsourcing those tasks.

One major reason for this hurdle is the outsourcing partner not using the same tools as your company.

While it’s common for companies to have their preferred accounting tech stack, using different tools from yours could impact the work quality in several ways.

First, it may lead to compatibility issues when sharing data, potentially causing delays and creating room for errors. For example, using premium software like Quickbooks while the partner uses a lesser-known incompatible software could pose problems.

Secondly, if the outsourced partner is not familiar with your firm’s accounting tech stack, they may require additional time to learn and adapt to the new software. This could cause delays in turnaround time.

The solution? Agree on a uniform tech stack to foster smoother collaboration between both parties.

No Accounting Practice Management Software to Track Work

How do you keep tabs on your outsourced partner to ensure work is going as planned?

By tracking their progress.

But doing this physically, via emails or phone calls is stressful, time-consuming, and less effective.

That’s where accounting practice software comes in.

Accounting firms without one will struggle to track the status of tasks leading to delayed deliveries and poorly completed jobs.

Now that we understand the factors affecting work quality, let’s discuss how you can retain quality when outsourcing bookkeeping.

How to Retain Quality of Work for Outsourced Bookkeeping

Here are proven ways to retain work quality after handing your bookkeeping services to third-party companies.

Use Standard Operating Procedure (SOPs)

SOPs exist because they help to maintain consistency and quality across operations. When contracting out bookkeeping tasks, it’s essential to document your process of executing client work and share it with the partners.

This documentation should include detailed workflow templates, instructions, and best practices to ensure partners understand the required standards.

Doing this minimizes risks, reduces errors, and maintains the same quality standard that your clients expect.

In cases where the external team needs further understanding, you can provide training on the documented processes to improve their ability to deliver high-quality work.

Here are some tips for creating effective SOPs:

1. Set Well-Defined Objectives: Identify the goals you want to achieve and outline specific steps the outsourcing partner requires to complete them.

2. Establish Detailed Workflow Documentation: Provide step-by-step instructions for each bookkeeping task. You can incorporate visual aids, such as accounting workflow flowcharts or diagrams, to add clarity and make it easy for anyone to follow the process.

3. Standardize Processes: Standardize bookkeeping processes to ensure consistency and efficiency across different tasks. You can implement templates, checklists, and other standardized formats. Also, specify the tools and software they should use for bookkeeping tasks. Ensure the outsourcing team is proficient in using these tools to avoid challenges.

4. Define Roles and Responsibilities: Clearly outline the roles and responsibilities of your in-house and outsourcing team to foster a successful relationship.

Stephen King, CEO and president of GrowthForce, an outsourced accounting firm shared a similar opinion in this Forbes article:

When working with an outsourced partner, it's important to understand everyone's responsibilities and the role they play in the relationship. This helps ensure that the relationship goes smoothly and that the outsourcing partnership is successful."

5. Provide Training and Support: Provide adequate training sessions to ensure the outsourcing team is familiar with your process and expectations. You can do this through virtual meetings, webinars, and providing access to training materials. Encourage open communication for questions, suggestions, or feedback.

6. Contingency Plans: Include contingency plans for unexpected scenarios, such as system failures or data breaches. Having clear guidelines on how to handle such situations minimizes the risk of disruptions to the bookkeeping process.

7. Review and Update SOPs Regularly: Review and update SOPs often to reflect changes in accounting processes, software updates, and industry standards. It ensures the outsourcing team always works with the most current information.

You may be interested in

Time Tracking for Accountants: How to Improve Client Billing and Revenue Management.

Manage and Track Your Outsourced Partners with an Accounting Practice Management Software

Your outsourcing partner is, by extension, a part of your team. So, it’s only normal to keep tabs on the progress of bookkeeping tasks assigned to them. And as we mentioned earlier, doing so manually is stressful and time-consuming.

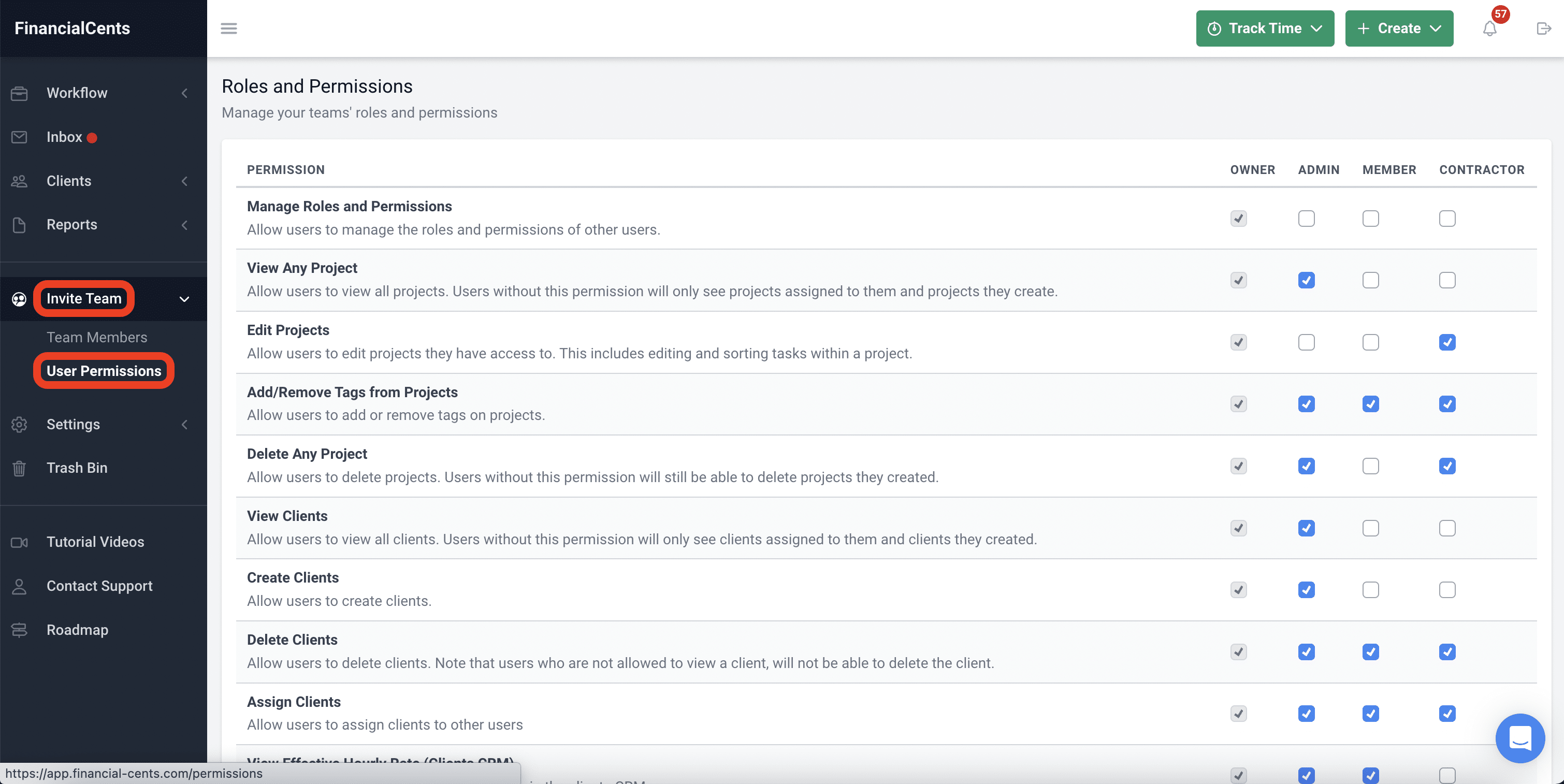

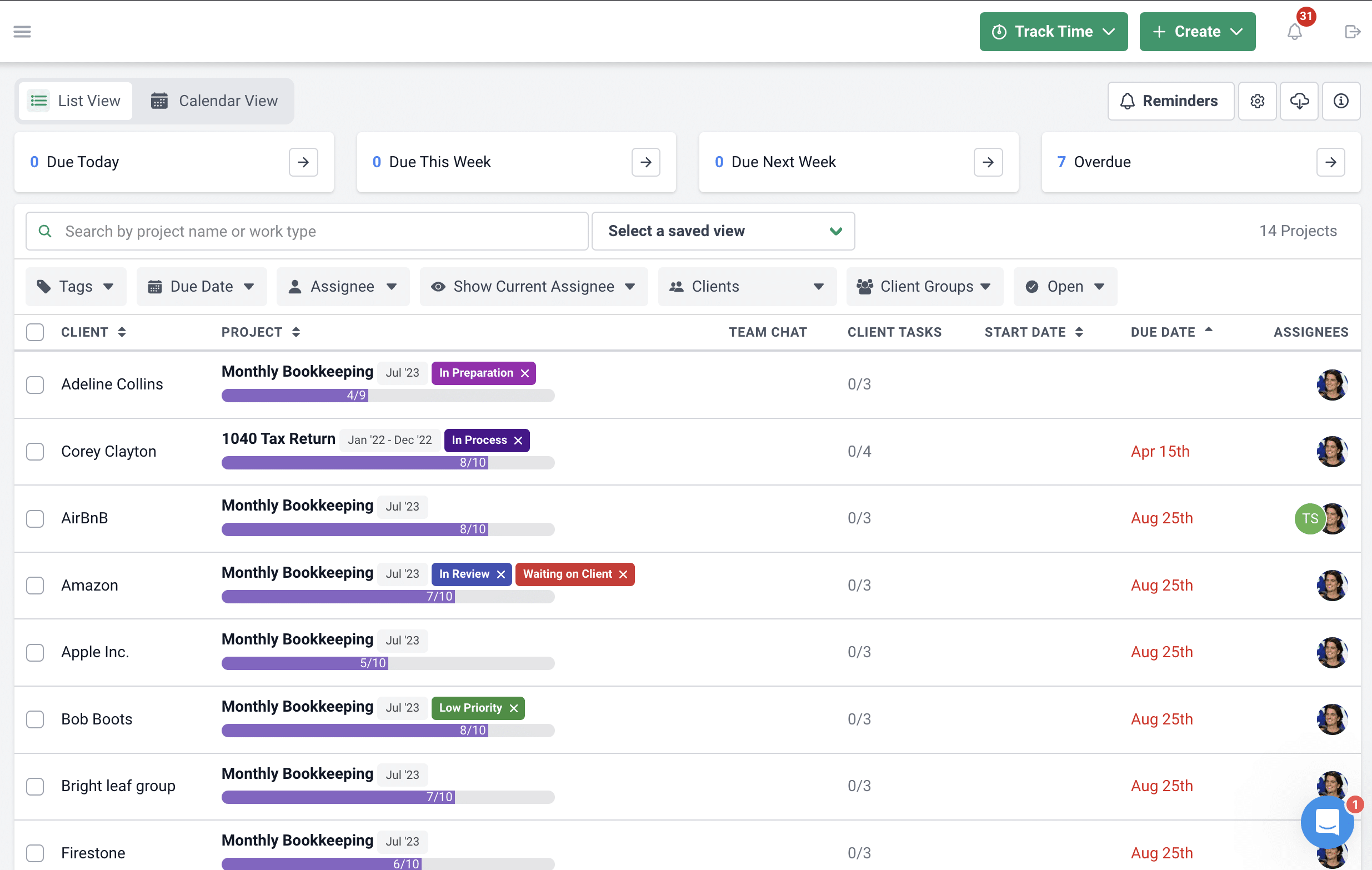

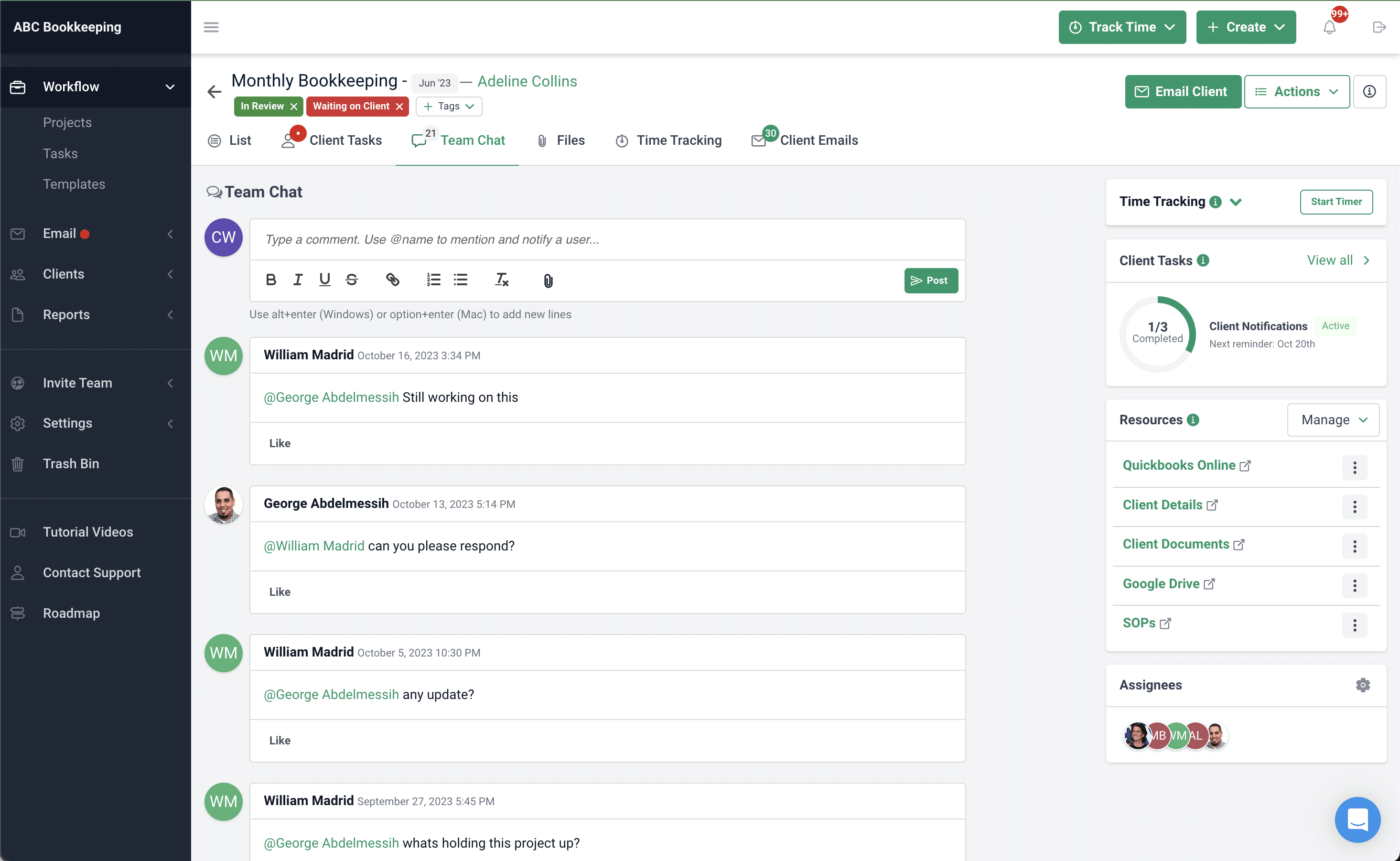

But not when you use an accounting practice management software like Financial Cents that makes it easy to track and manage your outsourcing partners. You can invite them as contractors to use the platform with you. This helps you keep track of everything and everyone.

Furthermore, competent accounting practice management software should contain essential features to streamline operations, enhance collaboration, and ensure efficiency in managing bookkeeping tasks.

Here are some key features to look out for in accounting practice management software:

1. Information Dashboard: The accounting software should have an interactive dashboard to view task status, deadlines, meeting notes, and other important information at a glance.

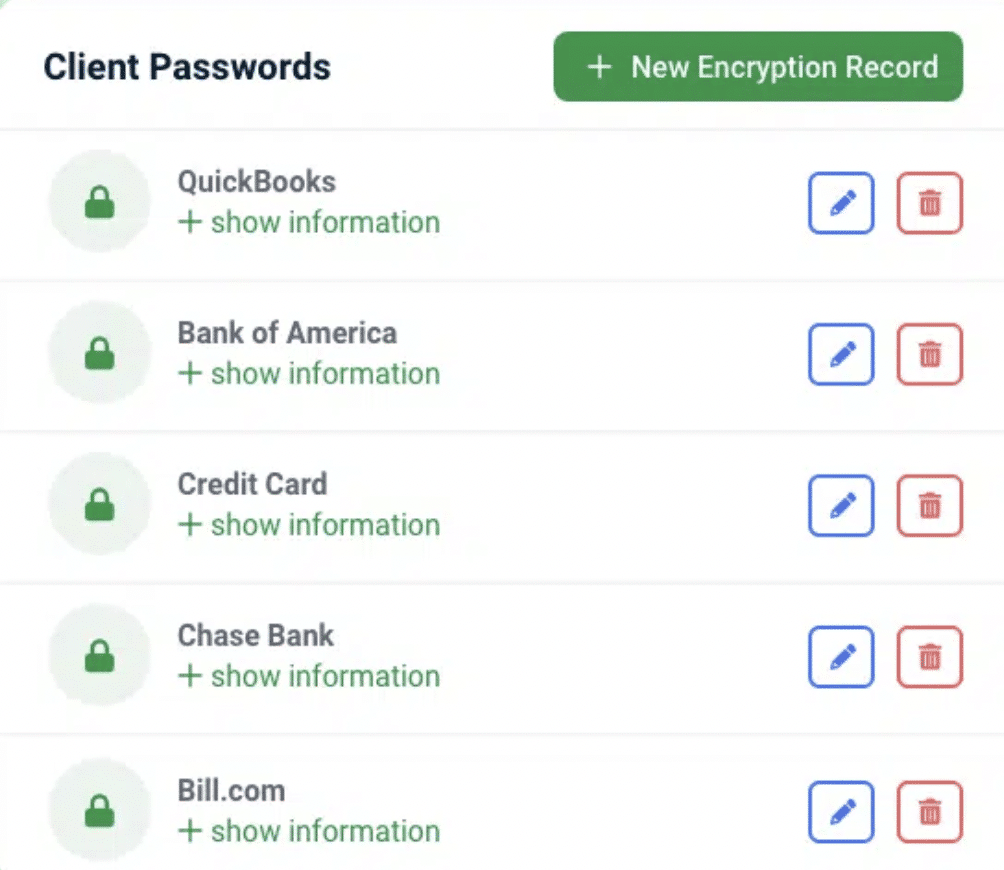

2. Secure File Storage: A well-secured accounting software prevents unauthorized file access and data breaches that could lead to financial losses, reputational damage, and legal consequences for your firm.

As such, you must consider security before adopting any accounting software. For instance, a platform like Financial Cents uses a decryption key to safeguard sensitive information like usernames, passwords, and credit card details in its vault.

3. Communication & Collaboration: Real-time collaboration and communication enable seamless interaction, file sharing, conflict resolution, and decision-making among team members. This makes it a must-have feature in robust accounting software.

Even if your partners prefer using email to communicate, software like Financial Cents makes it easy to sync your email. As such, you don’t have to switch apps to stay updated with the latest information.

4. Automated Data Collection: Another important feature a useful accounting software should have is the ability to collect data automatically. This reduces the back-and-forth between both teams and prevents unnecessary delays.

Ensure Their Accounting Tech Stack Meets Standard Quality

One benefit of contracting bookkeeping services to third-party companies is access to the latest technology you don’t have in-house. In fact, 64% of firm owners cite access to high-end technology and analytics as the reason for outsourcing.

So, it won’t make sense to outsource to a company with substandard tools.

As such, when evaluating potential outsourcing partners, it’s vital to assess their tech stack and ensure it meets a standard quality that aligns with your internal practices.

This can help streamline collaboration, accelerate information sharing, and minimize errors caused by software incompatibility.

Here are some tips to ensure their accounting tech stack meets standard quality:

- Request detailed information about the tools they use, including their compatibility with your internal systems.

- Arrange a demonstration to assess how their tech stack aligns with your processes. This may involve testing file sharing, collaboration, and potential integrations to ensure seamless compatibility and minimal errors.

- Seek recommendations or conduct thorough research on the outsourced partner’s tech stack to get valuable insights into its standard quality and alignment with your internal practices.

Have a Clear Communication Channel

The importance of communication to any business partnership’s success cannot be overemphasized.

Clear and effective communication is key to building trust, meeting deadlines, resolving issues, and fostering collaboration.

As such, it’s crucial to establish a clear channel with your outsourced partner where you can collaborate and communicate in real-time.

Here are some effective ways to establish a clear communication channel:

- Designated Platforms: Agree on a dedicated communication platform such as email, project management tools, or messaging apps to centralize and access all relevant communications.

- Defined Protocols: Establish clear guidelines for communication, response time, deadlines, and the appropriate use of communication channels.

- Regular Updates: Maintain regular communication schedules to provide updates on project status, share relevant information, and address urgent issues.

- Documented Communication: Keep a record of important communications to ensure accountability and provide a reference for future discussions.

- Feedback Mechanisms: Encourage open dialogue and feedback from all parties involved to address concerns, optimize processes, and enhance collaboration.

Perform Routine Quality Audits Quarterly

Performing quarterly audits is a great way to assess whether outsourced partners are adhering to established standards.

It allows you to identify any deficiencies, mitigate risks, and point out areas for improvement.

This proactive approach not only contributes to maintaining high-quality services but also fosters client trust in your firm’s commitment to delivering excellent services.

Use Financial Cents to Manage Your Partners, Retain Work Quality, and Grow Your Firm

High-quality work is the cornerstone of success for accounting and CPA firms.

Consistently delivering top-notch bookkeeping services ensures your firm retains clients, maintains its reputation, and positions itself for sustainable growth.

This makes it essential to do your due diligence before choosing an outsourced partner by:

- Researching their track record

- Checking customer reviews

- Gauging their response time

- Understanding their processes.

When you finally engage a partner, ensure you set clear processes, establish communication channels, and track bookkeeping tasks by using accounting software such as Financial Cents.

It’s an all-in-one solution that accounting and CPA firms use to assign and track client work, collaborate with team members, and hit deadlines.

Ready to see how it works?

Use Financial Cents Accounting Practice Management Software to manage your Outsourced Bookkeeping team.