The month-end close process enables accounting firms to review, verify, and adjust their clients’ data to make their financial statements more complete and accurate.

When done well, this service is a win-win for everyone. It enhances your clients’ decision-making and regulatory compliance, while improving client trust in your firm.

But many firms don’t do it well. Most firms lack standardized processes and struggle with time-consuming manual work, which leads to errors, missed deadlines, and threatens client relationships.

It’s no surprise that getting files and information from clients, visibility into month-end close projects, and ineffective internal processes account for more than 70% of the challenges accounting firms face in 2025.

This article shows why systematizing the month-end close process is the foundation for operational efficiency, consistent client service, and client retention for any firm.

What Is the Month-End Close Process?

The month-end close process is a sequence of tasks that provide an accurate view of your client’s financial health at the end of the month.

An efficient month-end close process enables your team to:

- Assign tasks and hold team members accountable for their tasks.

- Deliver accurate bookkeeping at scale.

- Meet up with your clients’ tax and reporting deadlines.

- Reduce the risk of errors that damage client trust.

- Upsell clients on your advisory services (such as forecasting, budgeting, or KPI analysis).

Why the Month-End Close Matters

The month-end close service is valuable to accounting firms because of its effect on client satisfaction and relationships.

Here are some of the benefits of an efficient month-end close process:

1. Ensures accurate financials

The month-end close allows you to update your client’s general ledger by verifying the accuracy of all financial transactions (income, expenses, assets, and liabilities) according to the relevant financial reporting standard (GAAP or IFRS).

This ensures that the financial statements as compilation report accounting generated from the general ledger paint a true picture of the company’s financial position.

2. Helps detect errors or fraud early

By reviewing, reconciling, and verifying financial data every month, you can catch and prevent errors that would have compounded and transformed into bigger (and more difficult) problems at the end of the year.

On that note, the month-end close process serves as a safeguard for identifying discrepancies, duplicate entries, or unauthorized transactions that could result in errors or fraud. When done well, the process positions your firm as a proactive and trusted adviser to your clients.

3. Prepares for quarterly or year-end close

Strong month-end closes simplify quarterly and year-end processes by providing up-to-date financial statements and reducing, if not eliminating, the need for extensive clean-up work. This lessens the stress and workload in reviewing several months of financial records.

This allows your team to focus on core year-end accounting tasks, like fixed asset rollforward, annual tax adjustments, and inventory write-downs, which improves the chances of delivering accurate work.

4. Provides up-to-date financial insights

Every time your team completes a month-end close, you give the client the most current financial data to manage costs, forecast cash flow, and maximize growth opportunities.

It positions clients to be proactive, instead of reacting to market forces, which can determine their ability to compete in their industries.

5. Strengthens client trust and internal accountability

The month-end closing process keeps your team accountable for their tasks, ensuring all month-end close projects are completed on time and to the required standard.

When you consistently provide up-to-date financial data to your clients, it becomes easy to trust your firm.

Pre-Close Preparations

Taking the following steps will prepare the ground for the month-end close process for a faster and more efficient team experience.

At this stage, you should:

I. Collect missing invoices or receipts

Gather outstanding invoices, receipts, expense reports, and any other important documents that are necessary to support the client’s close work.

When these are not available, the process will experience delays or transactions unreported, translating to a financial misstatement.

II. Communicate cut-off dates with internal teams or clients

Establishing a clear cut-off date for submitting transactions, receipts, and approvals with your clients helps them provide the files and information your team needs to meet regulatory and internal deadlines.

For your team, this helps them to adjust priorities and plan their time to ensure all transactions are recorded on time. That way, you prevent the last-minute rush and anxiety that increases the chances of errors.

III. Review preliminary reports for obvious red flags

It is also helpful to proactively review preliminary reports (such as Trial Balance, Balance Sheet, Income Statement/P&L) for errors, negative balances, and unusual balances using historical data in the accounting software.

Detecting errors at this stage makes it easier to reconcile them during the month-end close, so they don’t reflect in the final financial statements.

IV. Make sure all transactions are entered and categorized

Record all transaction data in their appropriate general ledger accounts to save time during the closing process. Whether data is pulled from bank feeds or recorded manually, verify source documents to ensure they are posted correctly.

If this is not done well, transactions will be misclassified, resulting in inaccurate financial reporting.

The Month-End Close Process: Step-by-step

The month-end close process works best when it is repeatable, given its monthly nature.

Here is the step-by-step process your team can use to deliver quality month-end services consistently.

a. Collect client information

Confirm that you have all the files needed that capture the client’s financial information, such as invoices, receipts, bank statements, payroll records, and sales reports.

An accounting workflow management software should make this easy. It centralizes all your documents in one place, making it easy to see what is outstanding. It also enables you to automate the collection of the missing pieces, reducing your manual work.

b. Make adjusting entries

With all of the client’s financial data now at your fingertips, it’s time to adjust for accruals, prepayments, depreciations, and revenues.

This ensures all transactions are recorded at the right time, in keeping with the accrual-based system of accounting.

C. Reconcile bank and credit card accounts

Compare credit card statements with the data in the general ledger to ensure transactions are captured correctly.

When done well, this will help you identify missing, duplicate, and miscategorized transactions. It also ensures separate personal and business expenses while ensuring expense reporting is well recorded.

d. Reconcile key balance sheet accounts, including loan accounts

Match lender statements with general ledger information to verify loan balances, interest accruals, and payment schedules to ensure liabilities and interest expenses are well accounted for.

e. Verify asset and liability accounts

Review fixed assets, AP, AR, depreciation schedules, deposits, prepaids, and every other liability account for alignment with source documents to communicate an accurate picture of the business in the balance sheet.

f. Confirm suspense-holding accounts

Check for transactions in clearing or suspense holding accounts for unclassified transactions. If any transaction remains in this account, investigate it and reclassify it.

g. Review equity accounts

Review equity accounts to be sure that owner’s equity, owner’s draws, retained earnings, and distributions are recorded correctly.

This step clarifies the ownership structure to determine control, profit sharing, and legal liability, ensuring multi-member entities abide by founders’ agreements.

h. Review uncategorized accounts

This step helps you to identify all transactions in miscellaneous or uncategorized accounts so you can collaborate with the client to clarify and recategorize them.

PRO TIP: Standardize your reclassification requests with the Financial Cents’ ReCats feature. It will auto-pull these transactions into your workflow tool, share them with the client, and publish them into QBO without leaving Financial Cents or chasing the clients to attend to them. See more about this here.

i. Verify appropriate balances

Check all account balances for consistency and reasonableness in the context of historical trends.

This step will test the integrity of the client’s financial data by showing whether liabilities and equity correspond or if any category experienced jumps or drops that are hard to explain.

j. Generate and archive financial statements

Upon confirming the integrity of the financial data in the previous step, proceed to prepare financial statements (balance sheet, cash flow statement, income statement, etc.), which represent the company’s financial position for the accounting period.

Once generated, archive the financial statement in a secure accounting document management system according to data retention policies.

k. Close books

This step locks the general ledger data for the accounting period to maintain the integrity of the financial records.

l. Notify client

An email or portal message informing the client that the books have been closed is in order at this stage.

Share the financial reports with clients and explain notable changes or variances addressed. You can also schedule a call to review your findings and make necessary recommendations.

With Financial Cents, you don’t even have to lift a finger here. The last task will trigger the auto-send feature to send your client an email you have previously drafted.

In the email, you can add a calendar invite to schedule a review meeting or a link to the document management system to view the financial statements.

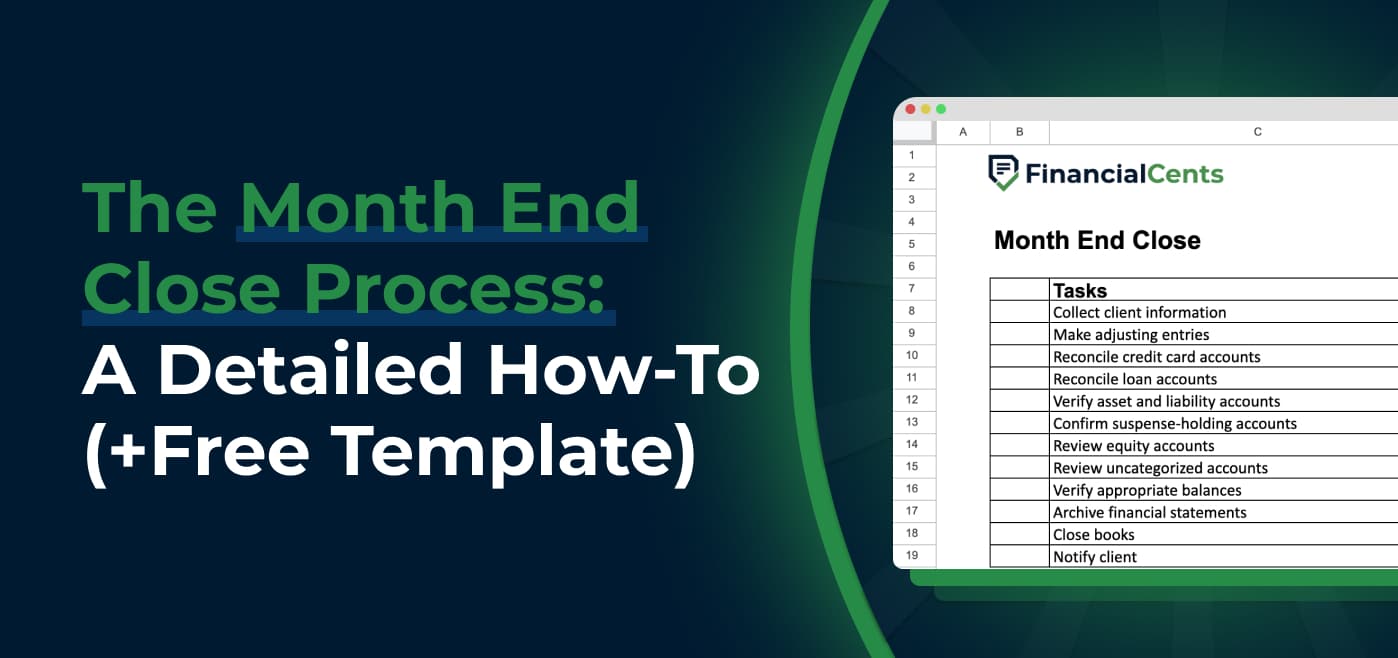

Free month-end process template

This free month-end close checklist template is designed to help you collect, review, and reconcile monthly transactions and financial activities quickly and thoroughly.

By customizing this template to standardize your month-end close process, you’ll be empowering your team to meet client deliverables confidently.

For more details on this template and to download other templates to standardize all your monthly accounting and bookkeeping processes, see the month end close checklist guide here.

Common Month-End Close Challenges

These are the challenges to avoid if you want to deliver timely, accurate, and valuable month-end close services at scale:

-

Missing documentation

Missing documents are common when there is no document management system to organize files. It could also result from an inefficient data collection system, which prevents clients from sharing documents conveniently.

At the very least, missing documentation results in delays, which will force your team to chase clients for information. This will cost your firm hours of billable work and make your team look disorganized and unprofessional.

That is why accounting firms implement client portals. With Financial Cents’ client portal, your clients have a single place to upload documents and ask questions when they are unclear about your requests.

Client portals provide teams with a central location to access all client documents, rather than storing them in multiple tools, which can make important documents fall through the cracks.

-

Manual spreadsheets and a lack of centralized tracking

A lot of the data entry work in the month-end close (as well as other accounting processes) can now be automated, but when your processes live in spreadsheets, your team will have to do almost everything manually.

As you can imagine, the risk of errors or omissions multiplies when manual input is needed across several clients.

There’s also a workflow visibility challenge when using disconnected spreadsheets, which affects your ability to monitor progress and assign tasks to hold team members accountable.

-

Communication breakdown between departments

Any breakdown in communication between your clients and your team is a potential cause of error or missed deadlines.

It is the primary reason that document submission delays and enquiries about uncategorized transactions are ignored, which reduces the chances of delivering timely, complete, and accurate month-end close reports.

-

Inconsistencies across clients or team members

The steps, order, and reporting format in the month-end process can vary from client to client and from one team member to another, and that can make your month-end closing process ineffective and unscalable.

If your team members use multiple different procedures for the process, you’ll need to train them on your specific method. Otherwise, your team will deliver inconsistent client experiences, which could negatively impact customer loyalty.

-

Rushed deadlines that cause errors

Whatever the cause of the delay might be (late documentation, complex transitions, or late reconciliation), it increases the pressure on your team.

Forced to do so much in such a short time, suspicious transactions can be overlooked and figures misstated, which will compromise the quality of work delivered. The resulting financial misstatements can damage client trust and affect your firm’s reputation.

Best Practices to Improve the Month-End Close

These best practices address the challenges above, transforming your month-end close into an efficient, reliable process that consistently delivers value to clients.

A. Use standardized templates or checklists

Checklist templates document the steps needed to perform each month-end close task, like data collection, reconciliation, and financial statements.

They keep your team members from missing any step in the process, especially during the busy season.

While you can adjust specifics to fit each client’s business size and industry, your master template should capture the same core steps for all clients.

Speaking of templates, feel free to customize our free month-end template to suit your workflow or download one from other accounting firm owners like you in the Financial Cents template library.

B. Assign ownership of each task

When the responsibility for a close task is unclear, the task belongs to everybody and nobody at the same time. In this case, multiple team members could work on it, and it could fall through the cracks altogether.

Accounting project management software solutions, like Financial Cents, make it easy to assign responsibilities to your team members. Combined with the capacity management feature, the Financial Cents Task Assignment feature shows which team member has the capacity for month-end close tasks.

This balances team workload and ensures all tasks can be completed on time. See how to hit client deadlines using project management software.

C. Set internal deadlines and reminders

When your team is juggling multiple clients, especially during the busy season, every task can feel urgent. The due date feature establishes a clear sense of priority in your firm.

Even better, an internal due date will help your team complete month-end close projects before the actual client deadline. This gives your team more room to implement any corrections.

Similarly, the due date reminders prevent month-end close work from falling behind schedule. It reminds your team members of all the month-end close tasks that are due.

The reminder features can also auto-notify clients to send any outstanding files or information that your team needs to complete their work, keeping your team and clients accountable to the cut-off dates you have set.

D. Create a central source of truth for documentation

Having a central source of truth for your documents and working papers saves time, keeps your team organized, and enables them to deliver the best work they can.

Otherwise, they will have to go back and forth between several tools, which kills productivity and frustrates their attention to detail.

A disorganized document system is also the number one cause of missing documents and version control issues. With a central document management system, you can see what has been altered, by whom, and when, which keeps you on top of the process.

E. Automate repetitive steps with accounting workflow software

Repetitive tasks consume the time and effort that could have been spent on review and analysis.

Automating them frees your team up to spend time on strategic and client advisory work.

For example, the client portal feature in accounting workflow software like Financial Cents enables you to streamline document sharing with your clients, communicate in context, and clarify uncategorized transactions in one place.

F. Track close progress for transparency

Workflow dashboards and progress reports provide real-time visibility into month-end close projects.

They show you where the month-end close projects stand, enabling you to identify and address workflow bottlenecks.

For example, if a team member’s task is delayed, you can investigate the causes to support them where necessary. The same applies to unresponsive clients.

Use Financial Cents to Streamline Your Close Process

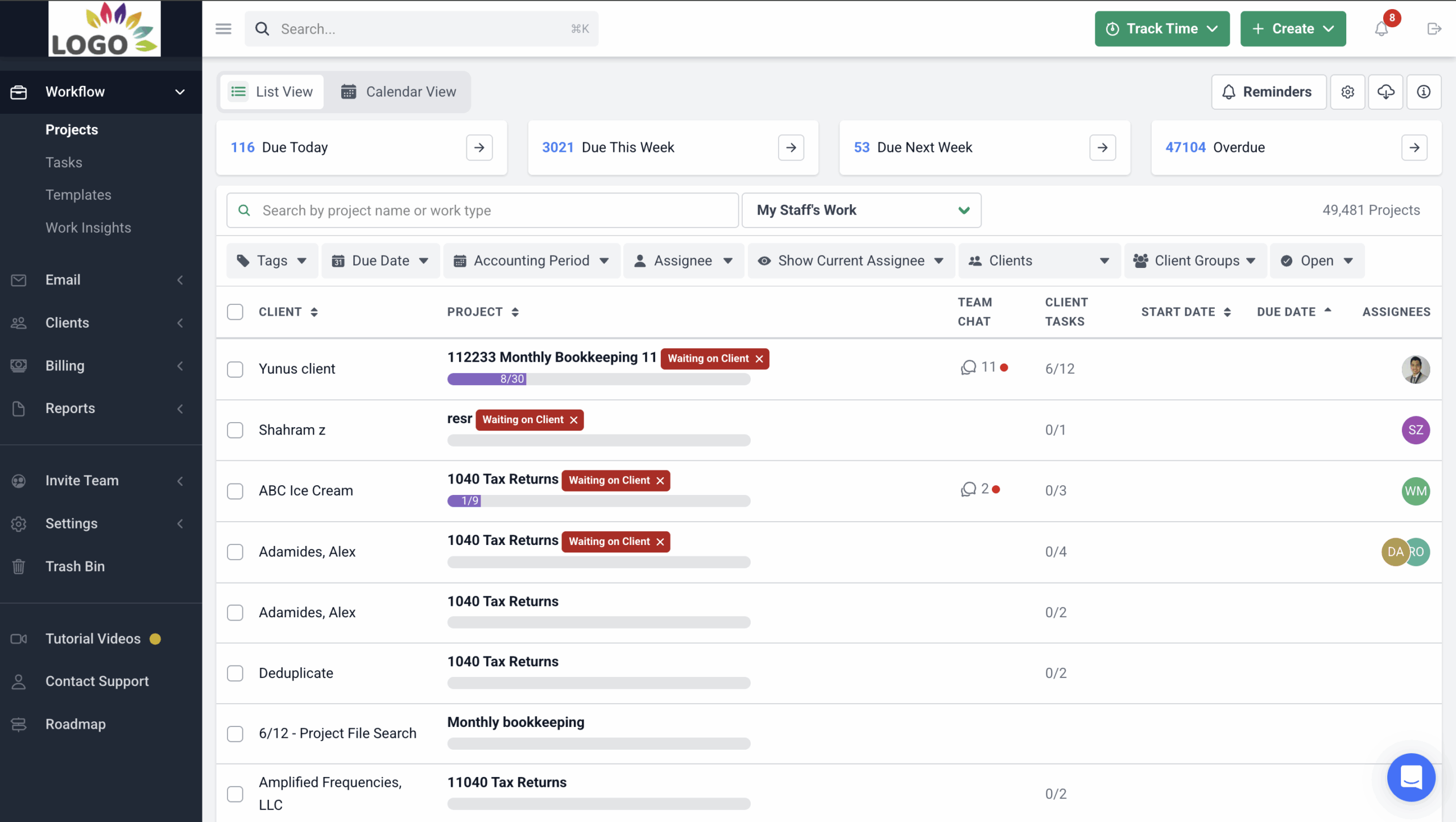

Financial Cents’ is a top all-in-one accounting practice management software organizes your client information, provides visibility into the status of month-end close projects, and centralizes team and client collaboration to deliver excellent client services as your firm grows.

Financial Cents’ month-end project-critical features:

-

Workflow Management and Automation

With the average accounting firm working on multiple month-end projects at a time, Financial Cents’ workflow management and automation solution helps them track it all to meet deadlines consistently using:

- Workflow Dashboard: All month-end projects are displayed on the dashboard with their basic information, including the client, assigned team member, due date, and progress bar.

- Workflow Filters: Provide visibility into month-end projects by letting you filter your dashboard for specific information, such as client, employee, or tag.

- Tasks and Subtasks: Allows you to break down month-end projects into smaller, more manageable parts.

- Dependencies: Notifies your team members when their tasks are ready to be worked on.

- Internal File-sharing: All project-related files and information are stored on the work to make everything your team needs to complete it readily available.

- Workflow Templates: Prebuilt month-end close (and other) templates that you can customize to fit your workflow.

-

Task Assignment

Every task in Financial Cents has an owner. If you don’t assign it to anyone, Financial Cents automatically assigns it to you. This ensures accountability across the board.

Its capacity management features make task assignment more effective:

- Capacity Dashboard: Displays your team workload and enables you to identify who is available for more work and who is at capacity.

- Task Reassignment: Financial Cents allows you to reallocate work from overworked team members to others who can take on more work.

- Workload Forecasting: Analyzes historical workload trends to predict workload surges, signalling the need to hire more staff to manage the upcoming workload.

-

Automate Recurring Tasks

Financial Cents automatically creates subsequent copies of your month-end close projects when the current one is completed or expired.

This keeps you from worrying about remembering (or setting time aside) to create them in the future.

-

Automate Client Requests

Financial Cents saves you the stress, delays, and embarrassment of missing or incomplete documentation by making it easy to collect and store client documents or information, like 50.5% of respondents in the 2025 State of Accounting Workflow Automation Report.

The automated client request features include:

- Client Task: Financial Cents sends your clients the list of files and information you need from them and enables them to share it with a button.

- Auto-reminders: Automatically nudge your clients about outstanding requests until they send them to you.

- Passwordless Portal: Provides a secure place for clients to share documents with you. It is easy to use, and your clients do not need passwords to access the portal, making it more convenient.

-

Document Storage

Financial Cents’ document management system allows you to securely store client documents for as long as you need to.

- Document and Folder Sharing: Allows you to share the financial statements you have generated with your clients.

- Document Organization: You can organize documents in folders into groups for easy retrieval.

- Search functionality: The Financial Cents DMS tool allows you to find specific documents using keywords.

- Real-time Notifications: You get alerted when a client or team member takes an action on a document.

-

Deadline Tracking

Financial Cents’ Due Date feature enables you to establish cut-off dates and task deadlines for your clients and team to communicate urgency and improve accountability.

You can manage due dates for your month-end close projects using:

- Due Date Reminders for Projects: Financial Cents sends your team members an email and an in-app notification about upcoming due dates to keep them ahead of schedule.

- Internal Due Dates: This due date helps your team to complete their projects ahead of time by increasing the urgency level of your tasks.

- Due date constraints on Templates: When you set up due date constraints on templates, all work created from the month-end templates automatically carries the due date you have set.

-

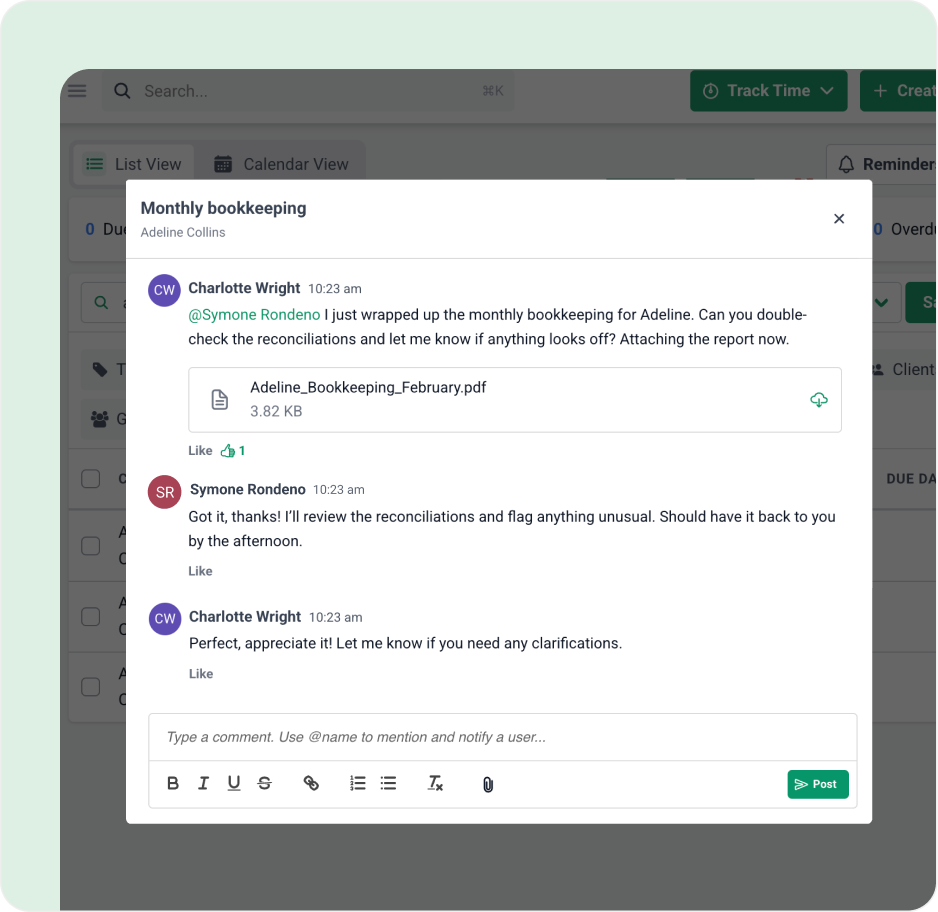

Team Collaboration

Financial Cents centralizes team collaboration to keep everyone on your team on the same page using:

- Team Chat: Centralizes your team’s project-related communication inside the project.

- Comments: Allow everyone assigned to the project to ask questions or provide clarity to other assignees.

- @Mention: Lets you tag your team members on work, email, and client information to ensure they don’t miss it.

- File-sharing: You can easily share documents and images with team members inside the app.

- Shared Inbox: Client emails are open to all assignees in a project to help them access the latest information about the client and project.

Make Your Month-End Close Process Scalable

Every firm owner wants to deliver quality month-end close service (at scale), but very few achieve that goal, and that is because firms don’t rise to the level of their goals; they fall to the level of the systems (in the words of James Clear).

Without the right structure, even the most knowledgeable and experienced teams will waste their time and creative energy chasing down documents, fixing last-minute mistakes, and rushing to meet deadlines, which results in errors, team burnout, and client dissatisfaction.

That’s why we have provided the free month-end close checklist above to make your process repeatable, predictable, and scalable.

But it doesn’t end there. All-in-one practice management tools like Financial Cents will enable you to automate manual tasks, set internal deadlines, and track all your month-end closes to meet deadlines confidently.

Centralize your client information, automate manual tasks, and track client month-end close processes with Financial Cents’ all-in-one practice management software. Click here to Start Your Free 14-day Trial.