Project management is the most valuable skill an accountant should have (besides technical accounting knowledge). Without it, firms become victims of their own successes.

Critical tasks get buried under a pile of emails, miscommunication between team members creates redundancies, and deadlines creep up unnoticed, all of which can damage client trust.

Effective accounting project management ensures that the firm owner, clients, and team members are aligned on what needs to be done, how it should be done, and how long it’ll take.

This article shows how accounting project management differs from general project management and how accountants can adapt general project management principles to the nature and flow of work in the accounting industry.

Why Accounting is Naturally Project-Driven

Everything was siloed before we implemented an accounting project management system.

We were trying to do so. We're doing capacity planning in one place, task management in another, and then ensuring everything gets checked off elsewhere. This fragmented information became too overwhelming to manage.

"

Accounting is naturally project-driven because virtually every task and client engagement has a defined start/end date, objective, and deliverables to be provided to clients.

That is why it is counterproductive to think of project management only in terms of the bigger and more complex engagements, like financial audits, year-end reviews, and ERP implementation. Project management applies in just the same way to the smaller, simpler tasks like staff onboarding and monthly bookkeeping, and AP/AR.

Examples of Projects in Accounting

A project in accounting is any piece of work that has a deadline, requires collaboration with team members or clients, regardless of its scope and frequency:

Here’s why the following example projects meet these criteria:

- Monthly Bookkeeping: Has a defined set of tasks (gathering client data, reconciling accounts, and preparing reports) to provide accurate financial records (objective) for compliance and decision making.

The timeframe is monthly, and the deliverables include financial statements that accurately depict the business.

- Payroll Processing: Tasks include calculating gross pay and making deductions, and generating pay slips. The objective is accurate payment and management of employee salaries and benefits in compliance with tax laws.

Payrolls are processed regularly (bi-weekly, monthly, etc.) with clear deadlines and deliverables that include timely payments and compliance reports.

- Financial Audit: Involves risk assessment, evidence evaluation, and opinion reporting. The objective is to determine the completeness, accuracy, transparency, and compliance of financial records with relevant regulations.

While financial audits may be quarterly or yearly, each engagement has a specific completion date, and the deliverables include the auditor’s report, management letter, and working papers.

- Client Onboarding: Requires laying a solid foundation for client service through onboarding questionnaires, service level agreements (SLA), kick-off meetings, and regular follow-ups to integrate new clients into your firm as seamlessly as possible.

Timely completion is crucial. Deliverables include a signed engagement letter and access to relevant software solutions.

- Financial Planning and Analysis: Involve tasks like data collection, financial modeling, and variance analysis with the objective of understanding historical results and forecasting future performance.

All FP&A engagements require strong time management due to strict deadlines, especially during financial reporting periods. Deliverables include financial model, budgets, forecasts, variance analysis report, etc.

The Two Major Project Management Challenges for Accountants

-

Projects are Recurring

Accounting projects are cyclical and repetitive. Bookkeeping is done monthly, tax returns are filed quarterly or annually, and payrolls are processed monthly.

That’s not all. These all have tight deadlines that do not permit errors or delays, requiring an efficient system to recreate projects (when due), assign tasks, collaborate, and track progress automatically.

The big roadblock we ran into when we used programs like Asana was that Asana and other programs like it didn't allow for recurring work. There were just one-off projects. If I assign my team member a recurring task, she would have to remember to reopen the task on the calendar every single time that she gets to the end of the current task. That was a difficult thing to have to deal with"

Tonya Schulte, Founder, The Profit ConstructorsTonya’s experience isn’t unique. Most Financial Cents users turned to the platform after wasting hours building manual workarounds to complete routine accounting tasks.

Click here to see why accounting, bookkeeping, and CPA firm owners are choosing Financial Cents over generic project, team, and client management solutions in 2025.

-

Workflows Depend on Clients

Accounting projects depend on how quickly clients provide the files, information, or approvals required for recording and managing finances.

Bank reconciliations, for example, are impossible when the client does not provide the bank statements and supporting documents (for uncategorized transactions) that need reconciling.

When clients don’t respond on time, workflows come to a standstill, which often increases the pressure on the accounting team to meet regulatory deadlines.

When accounting project management fails to account for these nuances, accounting expertise struggles to find expression, like a seed sown on rocky soil.

What is Project Management for Accountants?

In accounting, project management is the process of planning client engagements, creating projects, assigning the corresponding tasks, and tracking progress to ensure timely, accurate, and efficient completion.

Whether it is a one-off or repetitive engagement, what matters is that your team, process, and tools are aligned. This ensures that projects move smoothly through the stages to deliver consistent quality client service without overworking your team.

That requires:

- Clear definition of tasks and assignment of responsibilities.

- Documentation of standard operating procedures for work quality.

- Setting and tracking due dates for projects and tasks.

- Central tracking of progress to address bottlenecks in the workflow before they snowball.

- Effective client collaboration to collect necessary data and provide timely updates.

- An effective review process to ensure accuracy and compliance with relevant standards and regulations.

How Accounting Project Management Differs from General Project Management

The differences between accounting-specific and general project management software can be seen in their:

1. Dependence on Client Inputs

- General Project Management: Most projects can be done without client input. They rely on internal or third-party resources and data to deliver client services.

- Accounting Project Management: Workflow depends on the documents and information clients provide, so the ability to manage the client relationship (and responses) is a critical factor.

2. Specialized Tools and Expertise

- General Project Management: Uses project management tools designed for multiple industries.

- Accounting Project Management: Relies on project management platforms built for accounting workflows and regulatory compliance.

That is why the recurring project feature remains a decisive feature for accounting firms looking for project management software.

3. Time Sensitivity and Deadlines

- General Project Management: Deadlines vary by project and client preferences. Missing them often does not have regulatory implications. That is why they are more flexible.

- Accounting Project Management: Deadlines are non-negotiable and driven by regulatory requirements. Missed deadlines attract fines and penalties.

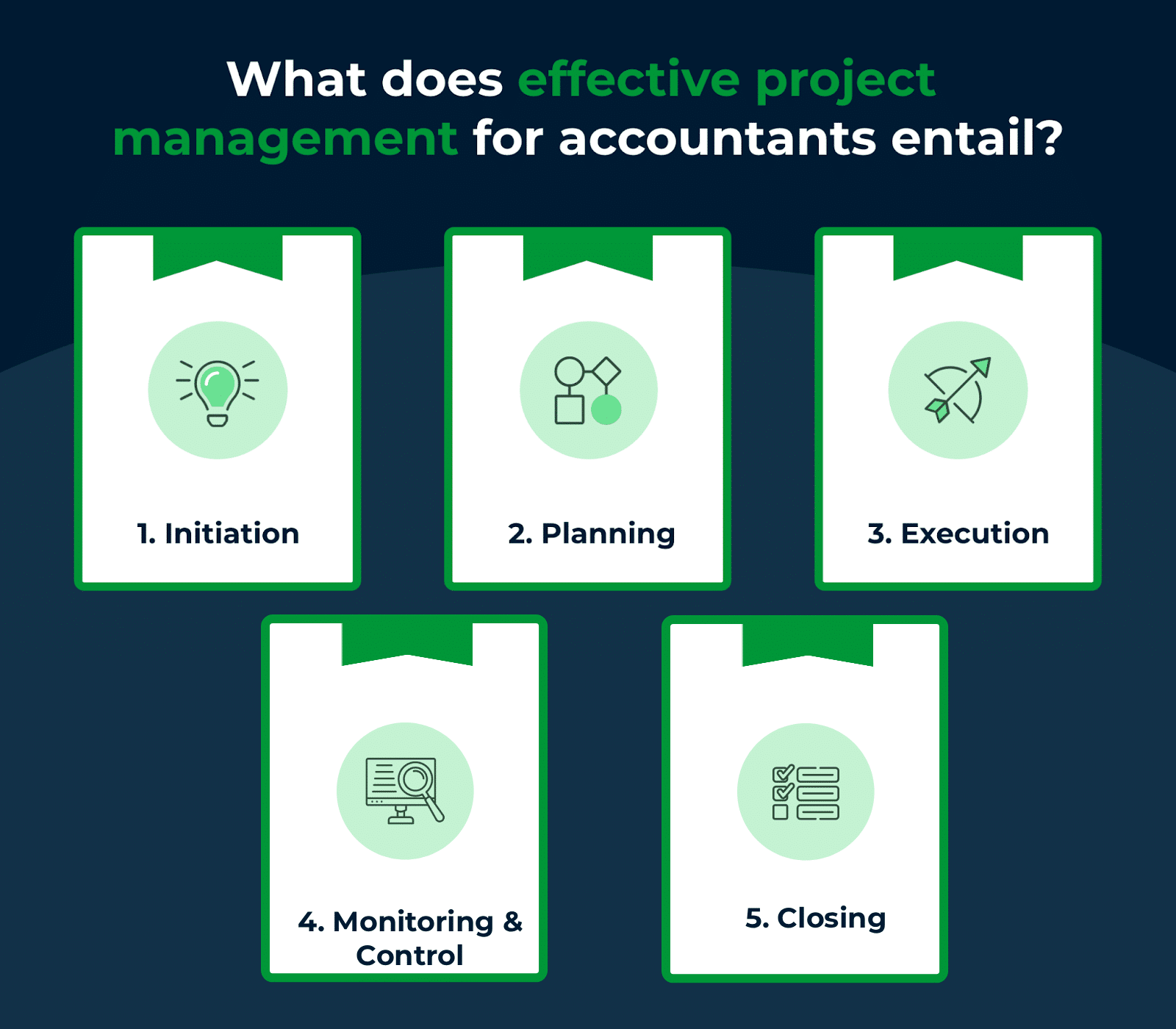

What Does Effective Project Management for Accountants Entail?

The PMBOK categorizes the project management process into five steps: initiation, planning, execution, controlling, and closing.

Structure is a critical aspect of accounting project management. It makes client service predictable, repeatable, and scalable.

Here’s how project management structures can be adapted to suit the unique workflow needs of the accounting industry.

Phase 1: Initiation (Client & Scope Clarity)

The first step in every client engagement is understanding project needs and aligning expectations.

Here, the client and the accountant agree on their roles and responsibilities to meet client deliverables. This includes the cost of the different levels of service.

The client also provides the accountant access to relevant tools while deadlines for the deliverables are set, laying the foundation for accountability.

Phase 2: Planning (Workflow Mapping)

Once the expectations are set and the project scope is defined, the next step is to map the workflow.

This involves:

- Breaking down the engagement into standardized steps or checklists.

- Identifying team roles according to required expertise.

- Defining internal and client-facing deadlines.

- Setting dependencies between tasks to establish the order of performance.

Dive deeper: Accounting Workflow Management guide.

Phase 3: Execution (Assignment & Tracking)

This is where tasks are assigned to team members who will use relevant tools to automate manual tasks and collaborate with teammates to process financial data.

You can monitor execution by tracking the tasks that have been completed and following up with team members to ensure accountability while addressing bottlenecks and other workflow challenges

Phase 4: Monitoring & Control (Managing Bottlenecks)

Accounting projects rarely move on a straight line, so preparing for bottlenecks is just a critical part of project management.

For example, when a client delays responses, a good monitoring system will notify you to follow up with the client quickly and efficiently.

Similarly, a team member may be assigned too many tasks, which will affect their accuracy and productivity. A good accounting project management software can show you the challenge’s cause, so you can reassign tasks to balance team capacity.

This is also the stage where senior team members review the work of the junior members to identify errors, address discrepancies, and ensure adherence to relevant standards.

Phase 5: Closing (Review & Analysis)

At this stage, the project is ready to be delivered to the client. Relevant documents are archived, and a post-project review is conducted to understand what went well and what didn’t.

These insights will be useful for refining the workflows to make subsequent projects more timely, accurate, and profitable.

Download the Accounting Project Management guide as a PDF. – Co-authored with Tonya Schulte.

Why Do Accountants Need to Gain Project Management Skills?

Project management skills enable firm owners and managers to set up systems that free their team up to spend their time and energy where it’s most needed at a time.

That empowers accounting teams to:

-

Delegate Work Effectively

Every accounting project is a sum of several tasks, many of which require specialized skills. That is why it is common to see multiple people handling different aspects of a client engagement.

Without project management skills, delegating tasks becomes an ad-hoc decision, which can cause firm owners and managers to assign tasks to unqualified team members.

By contrast, project management skills ensure that client engagements are broken down into manageable tasks and each task is assigned to team members with the skills and availability to complete it accurately and on schedule.

-

Ensure accuracy and compliance

When tasks are assigned to team members with the time, expertise, and sufficient information to complete them, errors are significantly reduced.

Similarly, project management emphasizes the use of standard operating procedures (SOPs), which ensure that all projects follow the same processes every time. This reduces errors and ensures consistency of project outcomes across all client engagements. That way, new team members can seamlessly deliver the same quality of work as senior team members.

Good project management skills also make room for quality control. It ensures that every stage of a project is reviewed for accuracy and compliance with relevant laws and regulations, keeping errors even lower.

Quality control is a big part of our workflow. This year, we brought on a quality control manager because we needed a way to assess whether the work our partner firm is doing is being done to the required standard."

Tonya Schulte, Founder, The Profit Constructors-

Meet deadlines consistently

Project management provides real-time visibility into the status of each client engagement. This makes it easy to see deadlines a mile away, enabling team members to take necessary steps to prevent missed deadlines.

By relying on automation, effective project management saves your team time on manual accounting tasks, such as data entry, client follow-up, and manual payroll calculations, freeing assignees up to complete more tasks on time.

-

Manage team capacity and resources more efficiently

Adequate project management skills enable teams to plan capacity against peak and slow periods.

The right project management tools display team members’ workload, showing who is overworking and who has more room for work. This helps firms to manage resources more effectively, including knowing when to hire more staff.

For example, Shannon Theis knows it’s time to hire more staff when her team members start working a certain number of hours a week.

-

Improve Client Communication and Transparency

Ineffective client communication and collaboration cause delays in accounting projects, and adequate project management knowledge helps accounting teams to centralize them to improve visibility and response time.

Project management skills also enable accounting teams to provide clients with regular updates about their engagements. This also reflects in the use of a project management software that automates client email updates when a task or section is completed.

-

Scale your firm with ease

With the structure and automation that good project management systems provide, client engagements become more predictable and repeatable, and that makes it easier to meet deliverables across a larger client base.

This also enables new or junior team members to take projects from start to finish, equipped with the SOPs and tools they need to meet all client deliverables. With that, firm owners can add more clients without worrying about their ability to meet their deliverables.

Recommended Resource:

Common Challenges Without Proper Project Management

The lack of a proper project management system defies technical accounting expertise to produce damaging outcomes for clients, such as:

I. Missed deadlines and compliance risks

You may not be able to move regulatory deadlines, but you can organize your workflows and processes to get the most work done in the shortest time possible.

But when you rely on spreadsheets and other manual project management systems, every client you add to your firm will multiply your manual work through data entry, task tracking, and client follow-up. With so much work done manually, the chances of missing deadlines are high.

The lack of a centralized dashboard deprives the team of visibility into upcoming deadlines, increasing the risk of violating compliance deadlines.

II. Overloaded staff and burnout

When firms don’t have a centralized view of team workloads, it’s harder to tell how much capacity team members have and when they need to hire more staff.

In that case, firm owners and managers can easily assign more tasks to people who are already at capacity, which is a recipe for employee burnout.

Before using Financial Cents, we weren't giving them the right resources because we didn't have enough forward-looking information in the project management system.

We would bring on a new client and assign it to team members, and we weren't doing a great job of holding the team members accountable. Part of the steps of holding someone accountable that we didn't know how to do well was asking them if they had enough time to do the task assigned to them."

III. Lack of visibility into projects

Managing client work across spreadsheets, calendars, emails, and sticky notes makes it difficult for firm owners and managers to see where projects stand. This puts firm owners and managers in a reactive mode.

We all know how important client updates are for transparency. When you can’t even tell what’s going on with a client engagement for yourself, it becomes harder to provide timely updates to a client, which can negatively affect their experience.

IV. Limited access to client information

Unless you have a proper project management system, your client information, communication, and documents will be scattered across email inboxes, shared drives, and personal folders.

In this setup, information silos will frustrate work quality, especially when a team member is out of the office. Others won’t be able to easily take it up from them, which will result in workflow delays, duplicate efforts, and an inability to meet client deliverables.

V. Poor client experience

When your team is constantly fighting with manual tasks and unintuitive systems, your clients will feel the effect.

Responses will be delayed, and financial insights for decision-making will be late. This can damage their trust in your firm and force them to take their business elsewhere.

VI. Inconsistent work quality

Without standardized workflows, each team member performs their tasks differently. This will, at best, produce varying client results, which will damage your brand identity.

It gets worse. The less experienced team members will likely deliver results that are riddled with errors that create material misstatements and result in regulatory penalties.

How to Implement Project Management in Your Accounting Firm

While building a scalable project management system requires project management software, there are other key aspects to that:

1. Audit & document your current workflow

Transforming your workflows begins with understanding how your client engagements are currently managed. This will show you where your team is having the biggest challenges to refine the process.

You can get ideas to refine your workflows from other accounting firm owners using the Financial Cents templates library.

If you’re documenting everything for the first time, start with your recurring projects and consult with your team members to understand where their biggest challenges lie.

2. Choose the right project management tool

Having documented your workflows, it’s time to choose a practice management software that functions the way your team members work.

This is where many firms make the mistake of choosing generic project management tools. While those can work, they will require more workarounds as your firm grows. Before long, you’ll have outgrown their features and functionalities and will need to switch to another project management tool.

As we grew, we recognized that I needed to know when Sally was reaching capacity. In Asana, I didn't have any way to look forward and see oh Sally does sales tax every single tenth of the month for this client and 12th of the month for that client, and I didn't have any way to plan capacity for Sally to know if she was actually going to have time on her calendar when looking ahead to bring in another client."

Tonya Schulte, Founder, The Profit ConstructorsAccounting industry-specific project management tools provide the features that accounting teams need and function the way accounting firms work.

Our review of the best accounting project management software should help you make the right choice for your team size, service offering, and budget.

3. Pilot with a small team

Unless you’re just starting your firm, it’s best to move your firm to your new project management tool gradually. Doing it at once might be too disruptive for your team members.

Add a few team members, service lines, and clients. When you see the changes that follow, you can use that knowledge gained to implement the system across the entire firm.

4. Set up and standardize templates

Once you have chosen a project management tool that suits your firm, it is time to create workflow templates using the standard operating procedures you documented in the first step.

By that we mean:

- Defining the task lists for each process.

- Identifying team roles.

- Setting a due date constraint (such as seven days after a project is created from the template.

- Automating the dependencies.

- Adding notes to provide more context (optional).

Templates make it easier to create recurring client projects, complete with due dates, assignees, and other details.

Some of the most successful accounting teams include accounting flowcharts to add a visual element to their workflows.

Flowcharts use symbols to represent the tasks in a workflow. This visual appeal builds clarity and makes it easier to coordinate team efforts.

5. Provide mandatory training for your team

While ease of use is critical in every project management tool, usability can feel different for different team members. That is why you can’t rely on your team members to figure out your project management system on their own.

Providing firm-wide training helps everyone understand the features and functionality of an accounting project management tool to the same extent, which is helpful for firm-wide adoption.

Done well, your project management software can become a natural part of your work culture. Otherwise, your team members might resort to the systems they are used to.

6. Monitor usage and optimize over time

The good thing about project management software is that you don’t have to figure everything out before you start seeing sufficient results.

But regardless of the benefits you see in the first month, quarter, or year of using a project management software, monitoring usage will help you to identify where changes are needed to ensure continuous improvement in your processes.

Critical metrics like task completion rates, client response times, and capacity management can give you the insights you need to refine your project management system for scale and profitability.

Standardizing Processes with Financial Cents

Project management is most effective when using a single, central system. The sheer ability to find everything needed to take a project from start to finish in one place, instead of jumping between tools, cuts your administrative workload in half.

Financial Cents takes these steps further by:

- Organizing accounting project, client, and team information to track project progress in real time.

- Automating routine tasks to speed up workflows and reduce human errors.

- Centralizing team and client collaboration to keep the files and information your staff and clients need always at their fingertips.

This saves accounting teams the stress of juggling spreadsheets, emails, and scattered task lists, enabling them to spend their time and resources on billable work.

Here are some of Financial Cents’ all-in-one accounting project management features and what they do:

- Workflow management & tracking: Provides firm-wide visibility into the status of client engagements in real time.

- Workflow Automation: Automates time-consuming routine tasks to free up time for tasks that generate revenue and require human judgment.

- Accounting CRM: Client information, projects, files, emails, chats, portal, login details for third-party apps, and everything you need to deliver client service and build strong client relationships are organized in the client profile.

- Accounting team Collaboration: Team conversations, relevant emails, files, and notes are organized on the work, showing everyone what they need to complete their tasks.

- Document Management: Document storage is built right into your workflow for quick retrieval. Financial Cents also allows you to reroute your documents to your preferred third-party document management system.

- Client Portal: Allows you to collect data, request, share folders, communicate, send proposals and engagement letters, and manage billing information and proposals in a secure and passwordless platform.

- Email Integration: All client emails are pulled into your accounting projects to improve visibility and responsiveness.

- Time tracking: Every second that team members spend on tasks (billable or not) is automatically captured while you’re doing the work.

- E-signature: Seamlessly collect e-signatures without requiring clients to print and scan documents.

- ReCats: Financial Cents pulls uncategorized transactions from QBO and enables you to collaborate with the clients and publish the categorized transactions to QBO, all inside the client’s profile.

- Capacity Management: A Team workload dashboard that enables firm owners and managers to manage team capacity to ensure workload balance and prevent burnout.

- Billing and Payments: Automates invoicing and payment collection to keep your firm profitable.

- Reporting: Real-time insights for making informed project management decisions. This includes seeing which clients or projects are behind schedule, workload by team members, and client responsiveness.

Use Financial Cents to Manage Your Accounting Projects Confidently

In an accounting profession defined by precision, deadlines, and client trust, centralizing your project resources in one place is half the job of effective project management.

Managing your team and clients and balancing multiple deadlines with your memory and disconnected systems will increase guesswork, manual tasks, and constant context switching that drains productive energy.

When these are stored in spreadsheets, sticky notes, and the firm owner’s memory, it’s only a matter of time (or the right number of clients) before team members start mixing up due dates, struggling to find the most up-to-date information, and second-guessing themselves.

With such challenges, inefficiencies will be the least of your challenges. Your best clients will take their businesses to firms with more organized systems, team members will pursue opportunities elsewhere, and the firm will become a shadow of itself — Not because there’s a lack of technical accounting skill, but because the work environment frustrates the application of that skill to financial citations.

That is why firm owners like Tonya Schulte turned to project management tools like Financial Cents before things got too bad.

One of the biggest reasons we choose an accounting-specific project management software is the recurring work feature. We tried a whole bunch of different solutions, but most of them were either calendar or list-based and could not handle recurrences. They didn't display the recurring work in a format that allowed us to know which deadline is going to come up on this day at this time, and that was super important to us."

Tonya Schulte, Founder, The Profit ConstructorsFinancial Cents was not only built for the recurring and client-dependent project management needs of the accounting industry, but it also provides all the features an accounting firm needs to manage its clients, processes, and team members in one place.

This gives users visibility into the status of client engagements, a secure location to store files and information, and one place to collaborate. Its advanced reporting features provide the real-time insights needed to understand what’s working and what isn’t, making you more proactive, rather than reactive.

Ready to see how Financial Cents can help your team manage projects more confidently? Book a free demo with one of our Products’ specialist.