Firm owners delay documenting their workflows because they think they have to be tech-savvy to do it.

However, people like Larisa Lopez, have shown how quick and easy it can be when you have the right system.

Having started her firm using spreadsheets and paper to-do lists, it didn’t take long for her to get to a point where adding one more client would not only hold her firm back but also threaten her mental health.

Today, Larisa has put her workflow challenges behind her, which has given her the mental clarity to grow her firm.

I’ve been able to document more of my workflows and processes, and I’ve been able to delegate my work to free up my time, and that delegation has been key for my sanity."

Larisa LopezThis article will help you understand the best practices for managing accounting workflows to enable your firm to become all that it can be.

First, what is Accounting Workflow?

An accounting workflow is a structured sequence of tasks designed to efficiently complete accounting activities within a firm, such as bookkeeping, financial reporting, tax preparation, and client invoicing.

It outlines the steps, responsibilities, and tools needed to complete an accounting process on time. It defines who does what, when, and how to encourage consistency and accountability.

What is Accounting Workflow Management?

Accounting workflow management is the process of defining, optimizing, and automating a workflow to eliminate bottlenecks and enable teams to complete tasks and collaborate as efficiently as possible.

Importance of Workflow Management in Accounting

a. Streamlined Processes

Workflow management organizes every activity in a process into actionable steps and automates repetitive tasks, such as approvals and data entry, to ensure timely and accurate client service.

b. Improves visibility across the firm

When tasks are organized into their logical flow, it is easy to see the status of the entire project. Apart from providing reliable updates to clients (which improves client trust), this enables firm owners and managers to eliminate bottlenecks before they become huge problems.

c. Easier team collaboration

Workflow management centralizes work and client information in one place for everyone to access when needed. When work is managed in accounting workflow software, your team members will have a single environment to ask questions and provide updates that guide task execution.

This keeps everyone on the same page, as opposed to email communication, which creates an information silo.

d. Prevents bottlenecks and missed deadlines

Workflow management displays every project in your firm, helping you spot and prevent bottlenecks ahead of time.

If you use workflow software, the workflow dashboard shows where additional client information will be needed. This will help you request the information ahead of time, so your team can find the necessary information when they are ready to do the work.

e. Faster onboarding for new staff

Workflow management streamlines the process of setting new team members up in your work systems. It also ensures new hires understand their roles and responsibilities as quickly as possible.

This empowers them to deliver value faster. It also saves your senior team members the time of showing someone around for an extended period.

We have one or two clients who pay what we call UEZ sales tax, or Urban Enterprise Zone. They pay half the rate of a typical sales tax client in New Jersey. I can say that because I alone had that information in my head, so I had to do those clients myself, because it's hard to explain.

But now with Financial Cents, I could put those specific notes into that client’s work, so that a new team member could join our firm today and they could see exactly what to do for that client, and they could do the UEZ sales tax because the steps are captured in each project.”"

f. Ensures client work is delivered on time

By assigning tasks to qualified and available team members and automating repetitive, time-consuming tasks, workflow management moves client work forward faster.

With workflow management software like Financial Cents, your team members will also be reminded about pending tasks to ensure clients receive their deliverables faster.

Examples Of Accounting Workflows

You can create a workflow for literally any of your accounting processes, but the most common include:

1. Accounting Client Onboarding Workflow to help your firm set the tone for client engagement.

A client onboarding workflow shows your team members the information to provide (and request) and the conversations to have with a client.

By listing your client onboarding tasks, such as gathering client information, administering client questionnaires, sending welcome emails, setting up communication channels, and introducing clients to the accounting processes (and tools) your firm uses, you will set a strong foundation for all interactions with the client during the engagement.

Here’s our client onboarding workflow sample to guide you:

Download Free Client Onboarding Template

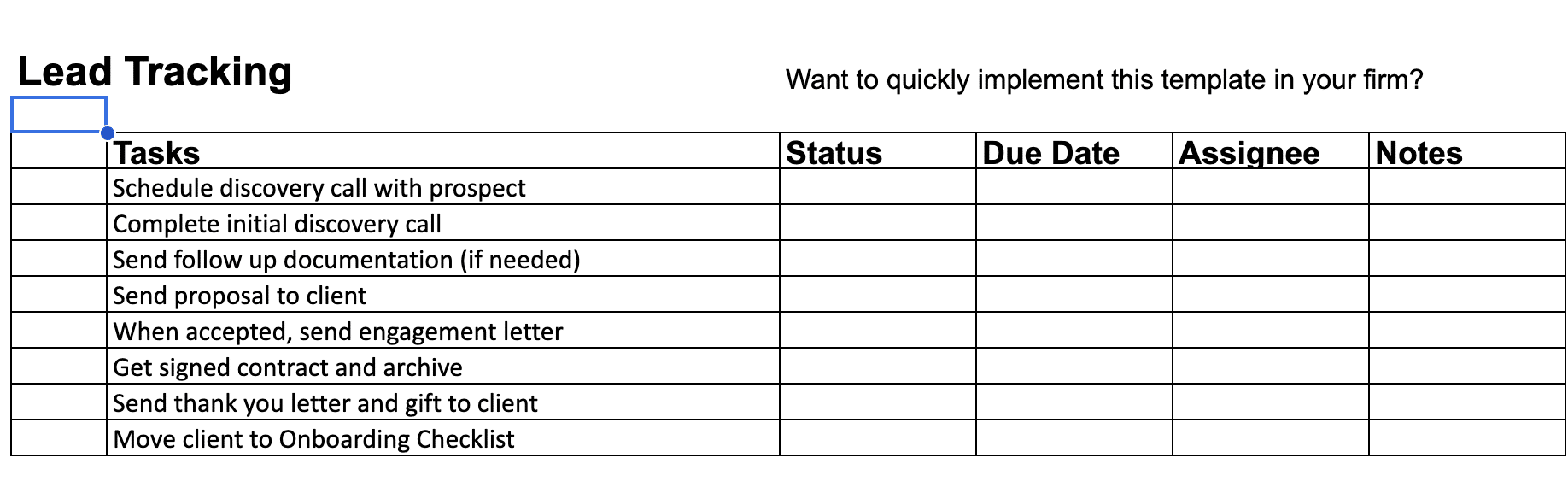

2. Marketing and Lead Tracking Workflow

This workflow centralizes the information of the people who have shown interest in working with you. It enables you to create (and assign) targeted steps that move them further along on their journey to becoming your clients.

This makes it easier to see where things stand, what is done in that process, and what’s next.

Download The Lead Tracking Workflow Template

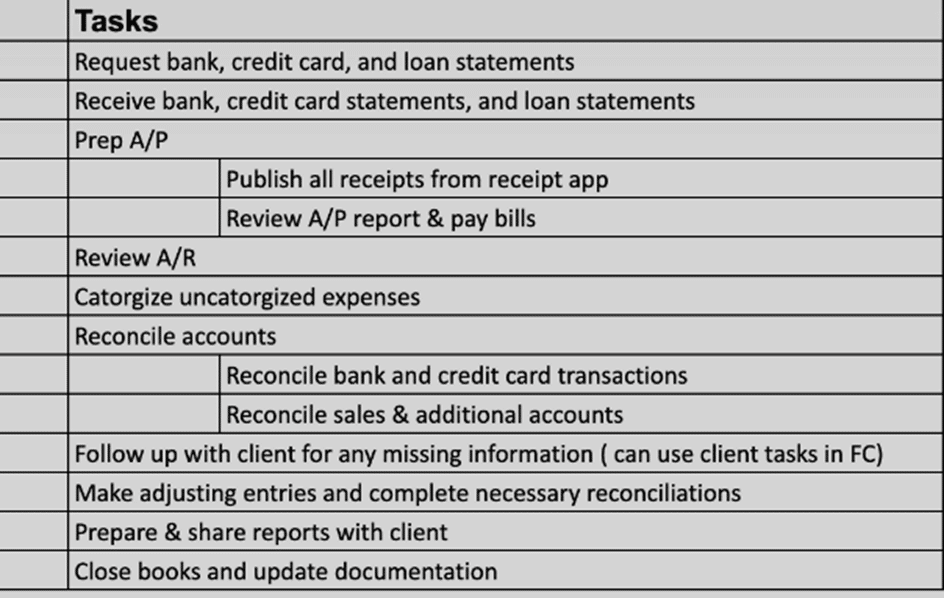

3. Task Management for Routine and Recurring Tasks

Managing tasks (whether routine or recurring) prevents a last-minute rush, which increases the risk of forgetting key steps.

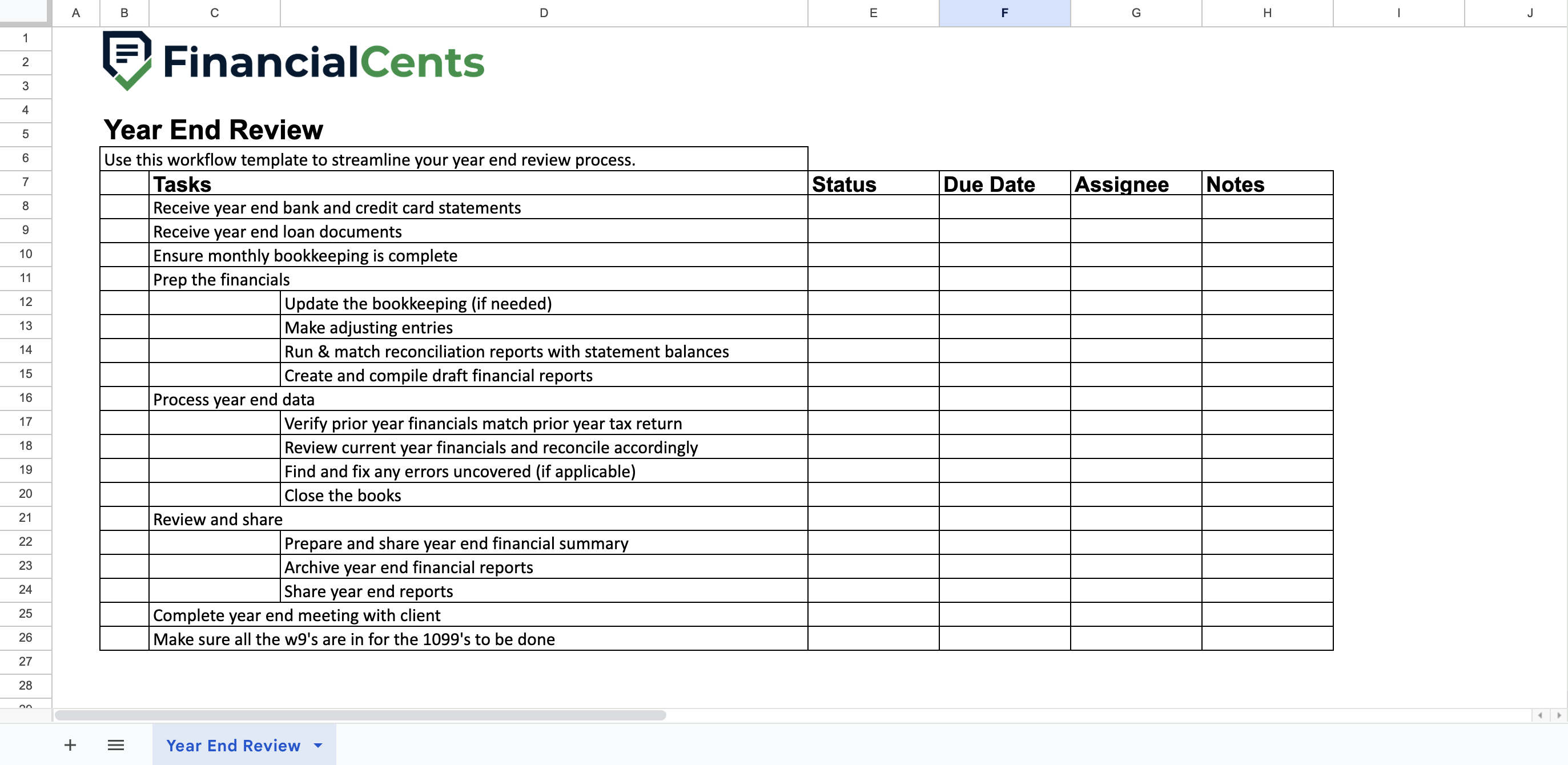

This workflow ensures that all recurring projects (from weekly bookkeeping to monthly bookkeeping, month-end close process, quarterly reviews, yearly reviews) are recreated at the set periods. This is the first step to enabling your team to complete them on schedule.

***PRO TIP:

Use an accounting workflow management software for a more streamlined and automated task management workflow.

We provide a sample of a year end workflow template below.

Use our over 60 workflow starter pack to get started.

4. Client Management Workflow

There is a tendency to neglect your existing clients in the bid to get more clients and grow your firm. The client management workflow establishes a system that ensures all customers are well cared for, increasing the chances of referrals.

This workflow should revolve around your client relationship management system. A good system should have spaces for their contact information, sensitive data, active projects, documents, and communication with the client.

In Financial Cents’ Accounting CRM solution, you can also see when a client was last contacted, how happy or sad they were with your service, and what your team members discussed with them.

5. Invoicing Clients

Late invoicing and unclear invoicing details are two of the reasons why clients pay late, and whenever this happens, your revenue is tied down for however long it takes the client to process it. This uncertainty is bad for your cash flow.

The Invoicing workflow can help to reduce it by ensuring the right person receives your invoices on time and with accurate information.

A reliable time tracking and billing system makes invoicing easier for accounting firms. It not only enables you to send invoices based on resources spent on a client’s work, but it also allows you to send recurring invoices and automate payment collection to save you the trouble of a manual and inefficient invoicing process.

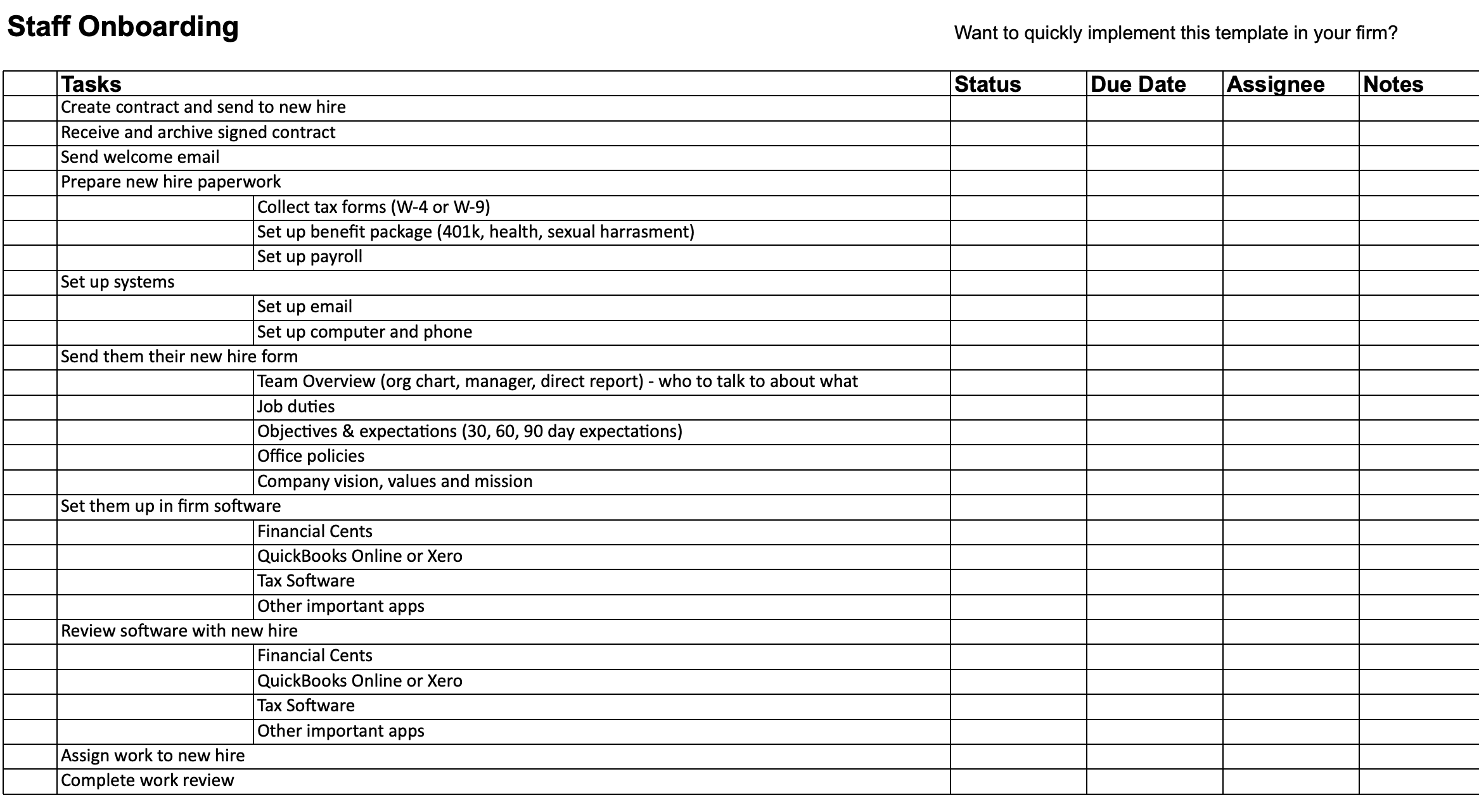

6. Staff Onboarding Workflow

A good onboarding process for new employees helps them integrate quickly into your firm’s culture, work systems, and processes. It shows them what to do, when, and who to reach out to if they encounter a challenge.

This is only effective when you have a documented process that shows whoever onboards a new hire what to do, when to do it, and how.

This will help new hires hit the ground running ASAP, which increases their chances of success and satisfaction, which will help your talent acquisition and retention strategy.

Here’s a sample staff onboarding checklist template:

Download our Free Staff Onboarding Checklist Template

Types Of Accounting Workflow Management

a. Sequential Workflow

A Sequential Workflow presents tasks in a step-by-step process, ensuring that tasks are completed in a linear order. The end of one task in a Sequential Workflow triggers the commencement of the next.

An example of tasks that benefit from this type of workflow is financial statements, which start with recognizing transactions, preparing journal entries, posting transactions in the general ledger, preparing a trial balance, making adjusting entries, and reviewing the adjusted trial balance before preparing financial statements.

The Sequential Workflow reduces the risk of forgetting a step in an accounting process, but prevents further work from being done when the previous step is delayed.

However, some accounting processes require the concurrent performance of several tasks to save time. That’s where the next workflow comes in handy.

b. State Workflow

Instead of following a linear progression of tasks, the State Workflow allows multiple tasks to be done simultaneously.

There are no dependencies, which means multiple tasks can be completed at once. This is why State Workflow can speed up execution. However, roles need to be clear to everyone to prevent team misalignment.

An example of this workflow is Financial Audit checklist, where multiple tasks can be done concurrently.

What Should Be in Your Accounting Workflow

- Process Checklist: All tasks necessary for completing the accounting workflow should be outlined to ensure no aspect falls through the cracks.

- Detailed Steps: This explains what is needed to complete the steps in a workflow, ensuring that anyone performing a task understands how to perform them to standard. This can include subtasks that further break down the tasks.

- Client Communication Touchpoints: This carries your clients along where and when necessary during the work. This includes stating when to ask clients for information, request approval, or simply provide updates.

- Review checkpoints: The stages where work has to be reviewed by senior team members to ensure quality control.

- Notes: Some tasks need the right context to guide the assignee. Notes allow you to provide this additional information and instructions to ensure satisfactory client work.

- Status: This shows where each work stands, giving firm owners and managers the data to make informed decisions about resource allocation or deadline adjustments.

- Due Date: The due date information communicates deadlines to enable your team to meet client and regulatory deliverables.

- Assignee: The assignee is the person responsible for each task in the project. Adding this information promotes accountability in the firm.

Best Practices for Implementing & Managing Accounting Workflow

1. Document Your Workflow (or audit current workflows if any)

When it comes to documenting your workflows, done can be better than perfect. But you can do it even better.

Kellie Parks, CPB, recommends building out your workflow checklists based on what you want them to achieve for you, your team, and your clients (instead of jumping straight to listing out the steps that make up a process).

This also applies to your existing processes. That’s because you’ll find a better way of doing things as time passes and your team grows. Beyond adjusting your old workflows to fit your new processes, ask yourself why you have them in the first place.

Tying your workflows to the desired outcomes adds a sense of purpose to your documentation efforts, driving home the importance of using the workflow checklists.

The outcome of Calmwater’s onboarding workflow is to bring a great fit client into our firm as a pleasing first experience with us, yet gather all of the documentation and information to begin working with them by a date that we have agreed upon."

Kellie Parks, CPB, Owner of Calmwaters Cloud AccountingNote: You can also document your workflows with video. Read this guide to see how.

2. Standardize Recurring Processes

Creating standard workflows for your recurring processes (such as bookkeeping, payroll, and account reconciliation) will save team members from second-guessing themselves. This is especially helpful during the busy season. They can see what needs to be done at each point of the process.

Since they can see what needs to be done at each point, every team member (old and new) can follow the same steps to achieve the same result, encouraging consistency across your firm.

3. Assign Clear Task Owners

Task assignment communicates a sense of ownership. Without it, some tasks might be left unattended because there’s no sense of ownership.

Task assignment also enhances accountability. It shows you who to hold responsible for project outcomes and who you should give more support to when a task is dragging.

To assign tasks effectively, monitor your capacity management dashboard to ensure more tasks are not assigned to an overwhelmed team member.

4. Set Realistic Deadlines

When assignees are not given sufficient time to complete their tasks, they’ll be under pressure to meet deadlines. This increases the odds of making avoidable mistakes and employee burnout.

To set realistic deadlines, look at your past projects to understand how long similar tasks took in the past and use the insights to inform your estimates for the current projects.

5. Use Workflow Management Software

Workflow management software centralizes your work resources, enabling you to track progress, store information, and collaborate with your team (and clients) for better work quality.

Without it, you’ll have to rely on paper documents and spreadsheets, which can get overwhelming to manage very quickly. Before long, you’ll be spending time working on what to work on.

6. Automate Where Possible

Automation improves your productivity and efficiency by reducing manual efforts, like data entry, client requests, and follow-up. This results in fewer errors and more time to complete tasks or high-value work that drives profits.

For example, Oscar Abraham, CPA, uses Financial Cents’ task dependency feature to automate work hand-off between assignees, which has solved the team’s long-term struggle with workflow coordination.

7. Create Visibility for the Entire Team

When everyone has visibility into the work they’re involved in, they can better plan their time for urgent tasks and prevent deadlines from taking them by surprise.

However, getting visibility is difficult without accounting workflow management software. With a tool like Financial Cents, the firm owner or manager has access to every project, while team members can view their assigned tasks for the day, week, month, etc.

8. Review and Optimize Regularly

Your workflows should not be set in stone. As compliance requirements and client needs evolve, revisit your workflow to ensure they are effective in the context of current practices and technology.

To achieve this, review your team’s turnaround time, error rates, and other metrics to see where improvement is needed.

You can also ask your team members where they’re having challenges and where they think an adjustment might be needed.

9. Ensure Data Security and Access Control

This is another critical benefit of accounting workflow software. Using paper workflow systems limits your ability to determine who can see what information.

Accounting workflow management software, like Financial Cents, enables you to determine which work or client information your team members can access.

Beyond that, the app is built with advanced security technology that keeps information from unauthorized persons in compliance with national and international security standards.

Some of its security features include:

- Data Encryption: This technology renders your data useless to people who do not have the passcode to decrypt it.

- Magic Link Technology: This not only enables passwordless access to your client portal but also uses a unique link that fraudsters cannot replicate.

- Multi-Factor Authentication: This requires multiple identity verifications before access is granted, making it difficult for your login information to be used without your knowledge.

- Transport Layer Security (TLS) System: protects your information from unauthorized access while it is in transit between computers and servers.

Why You Need Accounting Workflows

You do need accounting workflows to:

Delegate work effectively

Much has been said about delegating work to free up capacity for those things only you can—or need to—handle. But not enough about the nagging fear that your new employee might not deliver work to your standard.

Workflows can help you with that. By breaking processes down in their order of performance, it becomes easier for anyone to run with them and achieve the same results. And you can rest assured that things can run well without unnecessary hand-holding.

Provide Consistent Client Deliverables

Workflows help you break work down and equip employees to excel in areas they are not so familiar with since following documented accounting workflows lets them know what to do, when and how to do it.

This drives consistency across your team so your clients get the same quality of work every month no matter who on your team is doing the work.

Maintain Freedom and Flexibility

Most firm owners struggle with overtime work every week because the firm cannot run properly without them. This reduces your overall productivity, social life and increases the risk of burnout.

When you are able to easily delegate work and still ensure consistent client deliverables, your business will run well without you. It will also help you buy back time for a proper work-life balance, which will help you manage your firm better.

Accounting and bookkeeping firm owners reported that workflow automation enabled them to reduce the time spent on manual tasks by at least 50% in 2022, in this state of accounting workflow automation report.

Scale Your Firm with Ease

“The reward for work well done is more work (money)” says Will Wright.

Your firm is as good as the systems it runs on. If you don’t implement the proper systems your firm will struggle to grow.

Streamlining your accounting processes will make it much easier for you to double, triple, or even quadruple your firm without any growing pains.

What You Should Include in Your Accounting Workflow

Workflows come in all shapes and sizes, but an effective workflow needs the following elements to fly:

- Process Checklist: The actions your team takes to complete the tasks in the workflow.

- Detailed steps: The detailed process your team must follow to complete each step correctly in the checklist.

- Related information: the resources you need to complete a step in the workflow.

- Assignee: The person that is responsible for performing each step in the process.

You may be interested in:

7 Basic Accounting Workflow Templates (+ Free Diagrams & Flowchart)

Workflow Management Tips for New Firm Owners

After 20 years of accounting workflow management, Veronica Wasek, CPA, has seen the good, the bad, and the ugly workflow management practices.

She reflects on her earliest years of building a bookkeeping firm and helping other bookkeepers build theirs at 5MinuteBookkeeping. She draws on her experience to provide the workflow management tips that have helped grow her firm in the video below:

Manual Or Automated Accounting Workflow: Which is Better for You?

1. Manual Workflows

Manual workflows require you to set everything aside to create projects and coordinate the many moving parts of the accounting work using sticky notes and other paper-based systems.

From task assignment to document management, client follow-up, task tracking, reporting, and every other activity needed to take on a project all depend on your manual efforts. If you miss a step, everything that depends on it gets stuck.

You can start with manual workflows when you have few clients and team members, and cannot afford to pay for accounting workflow software.

That’s why firms create, optimize, and manage their workflows with software.

- How to Create Your First Manual Workflow Checklist

Creating your first manual workflow checklist is straightforward.

- Get a piece of paper or open a spreadsheet.

- Pick a project your team does frequently (monthly bookkeeping, for example).

- List out the steps that go into completing it (preferably in their order of performance).

- Review the steps and add the missing ones (if any)

This is how this process looks for a year-end process:

Once you’re done documenting the steps, assign the tasks to your team members and provide other details, such as due dates and notes.

2. Automated Workflows

Automated accounting workflows rely on software to create and manage your projects. You wouldn’t have to outline the tasks. The system can generate it for you, or in a worst-case scenario, make it easier and quicker to enter the tasks and create templates that can be duplicated to create client projects.

Why Do You Need Workflow Management Software in Your Firm?

Running an accounting firm is high pressure any time, any day. It’s worse without workflow management software.

That leaves you without a structured system for your projects, especially the repetitive kind. That means taking hours every month to figure things out by creating projects, assigning tasks, and tracking them in the dashboard.

As your client list grows, it becomes harder to do this every month. Information slips through the cracks, Important steps will be forgotten, and deadlines will be missed, which will damage your firm’s reputation.

Moments like these are what drove Larisa Lopez to search for Accounting Workflow Management Software.

Accounting workflow management software, not just any random workflow tool, addresses these challenges by providing a structured system of creating work, assigning responsibilities, tracking the work, and holding your team accountable.

With an accounting workflow tool, you’ll suddenly realize that there’s not much difference between managing 4 clients or 400 with the same 8-person team. With the right automation, all projects are recreated as and when due, collaboration is easy (and centralized), and capacity is managed in real time to prevent imbalances, which frees you up to nurture quality client relationships and grow your firm.

Read more about the many-sided benefits of accounting workflow management software in our review of the top 11 Best workflow options for 2025.

What Makes a Good Accounting Workflow Software?

-

Built Specifically for Accounting Firms

Most accounting firms start out managing their workflows with the most popular, generic tools on the market (think Asana, ClickUp, and Trello). But it doesn’t take long before they return to using an accounting-specific solution.

That is because accounting workflow needs are unique and only a purpose-built workflow software can accommodate the nuances of accounting workflows, such as year-end close, tax deadlines, and Uncategorized transactions.

Accounting-specific workflow software functions in a way accounting firms like to operate, making it feel like a natural extension of your practice rather than an app you have to force to fit your processes.

-

Task and Deadline Tracking

The accounting industry runs on deadlines, so every task is tracked to ensure all projects are completed on time.

With the Workflow Dashboard, you can see where projects and tasks stand and the cause of delay (if any). Similarly, the Due Date feature enables you to measure progress against deadlines.

Without these features, you’ll struggle with missed deadlines, financial penalties, and client turnover.

-

Client Management Capabilities

Accounting projects revolve around clients, so your ability to centralize client information and communication determines how quickly your team members find the resources they need to do work.

This also helps with client updates. By storing client information in a central location, you empower your team members to provide updates to clients when they call with a question, which improves client service.

-

Team Collaboration Tools

Accounting teams don’t work in isolation. Sometimes, a team member has spoken to a client and needs to record the interaction in the client’s profile. Another time, a junior accountant may prepare a tax return and need a senior staff member to review it.

In any case, team collaboration should provide a single place for all team members to share ideas and work together at all times.

Beyond these, Financial Cents’ team collaboration solution also allows team members to comment on projects and tag specific team members in comments, helping to build clarity and team alignment.

-

Automation and Reminders

Every reliable accounting workflow software automates tasks like recurring work, client tasks, and reminders. This saves you the time for recreating repetitive projects and chasing clients for additional information, respectively.

In Financial Cents, you also have due date reminders, which prevent missed deadlines by reminding your team members about upcoming deadlines.

-

Time Tracking and Billing Integration

While time tracking tracks the time your team spends on client work, the billing feature ensures you get paid on time. In Financial Cents, both features are in one place, helping you send invoices on time, receive payment faster, and keep your cash flow healthier.

Without these features, you need multiple third-party solutions, which require manual data entry and going between multiple apps at the expense of accuracy and productivity.

-

File Sharing and Document Storage

Your workflow software should support the secure exchange of files with your clients. If you use Financial Cents, you can share documents with your clients, but more importantly, clients can share documents with you by uploading them to the client portal with a few clicks.

All documents uploaded by the clients are automatically organized in their profiles inside Financial Cents. This makes it easy for your team members to access the documents they need for their tasks in one central place.

-

Reporting and Analytics

This is about measuring and improving your workflows for speed and profitability. The reporting feature shows you important metrics, like revenue generated by team members, clients, and projects.

With this information at your fingertips, you can find out what needs to improve for your firm to achieve its profitability potential.

-

User-Friendly Interface

Your team won’t use a workflow tool with a difficult user interface no matter how powerful it is. That is why poor usability is one of the primary reasons users abandon software products, resulting in a waste of money, time, and opportunity.

Your workflow management software should be easy to implement and use for daily task management and collaboration. Otherwise, your team will have to call customer support each time they need to change things.

-

Integrations

No single tool has it all. If your workflow tool is difficult to integrate with the other tools you use, your team will be forced to log into several disconnected apps every day.

They will also have to manually transfer data between the different apps, which will make completing projects unnecessarily difficult. This increases admin time and increases the chances of errors.

Integration allows you to use the relevant features of third-party software solutions without logging out of your workflow software. It saves time and helps your team’s ability to concentrate.

More resources for you:

Download – Our Library of Workflow Checklists

Read – How To Quickly Create Your Accounting Workflow Checklists

Listen – Learn How To Systemize Your Accounting Firm with Jessica Fox

Build your Accounting Workflows with Financial Cents

Financial Cents is not just a workflow management solution. It is an all-in-one accounting practice management software with a workflow solution that streamlines your processes, centralizes team collaboration, and enables you to track the status of client work to hit your deadlines.

Our features, which are grouped into two broad areas (Team Management and Client Management), will help your team find everything they need to get work done in one place, preventing the overwhelm that comes from using multiple tools, where one could have served.

They include:

TEAM MANAGEMENT FEATURES

- Workflow Management and To-Do List: shows the status of client work, who is working on what, and when projects are due. This keeps work from slipping through the cracks.

- Workflow Automation: automate manual tasks to enable your team to focus on what matters most.

- Team Collaboration: centralizes team conversations, emails, files, notes, etc. on the project, allowing everyone to access what they need to complete their work.

- Email Integration: brings all client emails into Financial Cents, giving you more control and visibility into your inbox.

- Capacity Management: displays your team’s workload distribution to ensure even task assignments and prevent burnout.

- Time Tracking: built-in time tracker that monitors resources invested in clients to enable adequate billing.

- Document Management: secure document management that eases storage and retrieval.

- Budget and Reporting: real-time insights that support timely and accurate decision-making.

CLIENT MANAGEMENT FEATURES

- Client Request: supported by a secure and passwordless client portal that allows you to request documents, share folders, and communicate with clients while enabling clients to track their billing, proposals, and more.

- E-Signature: secure E-signature request that saves you time and improves client experience and response time.

- Client CRM: organizes each client’s information (contact information, work, emails, communication, notes, documents, passwords) in the client profile.

- Bill and Payment: integrated billing and payment processing that lets you get paid where you’re doing the work.

- Proposal and Engagement Letters: an automated agreement, billing, and payment system that helps you convert clients faster.

- Uncategorized Transactions: ask clients about uncategorized transactions and automatically remind them until they provide the necessary information that allows you to categorize, approve, and update them in QuickBooks Online without leaving Financial Cents.

Centralize your workflow into Financial Cents’ all-in-one platform today.

One aspect that often gets overlooked is the importance of prioritizing tasks. It’s easy to get caught up in the day-to-day whirlwind of activities, but without a clear sense of what needs to be tackled first, we risk spending our time on less critical tasks. I find that techniques like the Eisenhower Matrix, which categorizes tasks into urgent/important, urgent/not important, not urgent/important, and not urgent/not important, can be incredibly helpful in maintaining focus.