9 Best Accounting Project Management Software for Small and Mid-sized Firms

Author: Financial Cents

In this article

Small and mid-sized accounting firms are not spared the hassles of managing the many moving parts of their firms despite having fewer resources.

Having the right tool is essential to master project management in accounting. While many of these firms have learned to leverage online tools to enhance their daily performance, only a few have found suitable accounting project management software to power their team’s efficiency and client communication.

You’ve probably tried several project management software that failed to meet your firm’s unique needs. We have curated this list of project management solutions for accounting firms to help you get the tool that fits your specific needs and significantly improves your firm’s productivity going forward. You can take a look at the importance of project management in accounting firms to help you while making a decision.

Our analysis prioritizes the qualities that matter most to small and mid-sized accounting firms—such as client task management, ease of use, team collaboration, price, and automation. We reckon that accounting project management tools that combines these qualities at a good price helps your team members do more in less time, strike a work-life balance, and stay motivated to do their best work.

(You may also be interested in: The Best Accounting Practice Management Software Options)

What is an Accounting Project Management Software?

An accounting project or task management software is a solution specifically designed to provide accounting firms, teams and solo accountants with necessary tools to effectively manage work, track and monitor the progress of work, delegate tasks, automate workflows and hit client deadlines with ease.

This includes enhancing workflow through improved visibility and automation, accounting workflow templates, time tracking, and improved collaboration for teams and clients. You can learn more about essential features an accounting project management software should have in this blog.

Should You Use Spreadsheets, a Generic Project Management Software or a Project Management Software for Accounting Firms?

Many accounting firms start out with either using a spreadsheet or a generic project management software to manage projects, tasks or their workflows. While some find them useful, many accountants have found them to be less productive for performing accounting tasks. They also take a lot of time to set them up to fit accounting or bookkeeping needs, thus making you spend more time tweaking and less time working on billable work for your clients.

To answer this we discussed with accounting firm owners, Gerry Anderson of Blue Canyon CPA and Wendy Kelley of Bookkeeping Simplified, at the 2023 WorkflowCon.

Benefits of an Accounting Project Management Software

-

Automate Your Workflow:

An accounting project management solution helps you simplify your projects by providing visibility into all tasks within your firm using a workflow dashboard. It allows you to track the progress of tasks, set up automated reminders, and ensure that processes run smoothly.

This enables you streamline operations, spend less time on manual tasks, and ensures you are not missing out on any client tasks. It helps you hit client deadlines easily. We discuss how to use a project management software to hit client deadlines in this blog.

-

Easily Track Time on Work Done:

With an accounting task management tool you can monitor how much time is spent on various client projects and charge accordingly. If it has an integration with QuickBooks Online, even better, you can export the time tracked to QuickBooks to create invoices and bill clients.

Through time tracking you can understand where your team’s time is spent, improve billing accuracy, and identify areas where employees may be wasting time and discover clients that may not be profitable.

-

Improved Collaboration:

The best accounting project management tools are equipped with team collaboration features that help to improve collaboration within your firm. Team members can communicate with themselves on projects by adding comments, using @mentions or the inbuilt chat. Your team can also share client notes to ensure no more misses out on any prior communication with a client.

This saves time and ensures that everyone is on the same page at all times, resulting in improved project outcomes and client satisfaction.

-

Effective Capacity Management:

An ideal project management tool for accounting enables you to manage your team’s capacity effectively. You can identify team members who might be overworked and redistribute tasks as needed.

A proper capacity management feature ensures that your staff aren’t overwhelmed with too much work, which may lead to reduced work quality and burnout.

-

Recurring Task Automation:

As an accounting firm owner, you are probably well aware that there are some routine tasks you perform for clients, which could be weekly, bi-weekly, monthly, quarterly or yearly, such as monthly bookkeeping, payroll etc. With a project management system streamlined for the accounting industry, you can automate recurring client tasks.

By automating recurring tasks, you save time, reduce planning efforts, and minimize the risk of missing deadlines for routine tasks.

-

Free Accounting Workflow Templates to Standardize Quality of Work:

Many project management solutions include pre-designed workflow templates that can be customized. However, they may not be what you need, because they weren’t created for accounting tasks, by using a project management tool specifically designed for accounting teams, you get access to workflow templates specifically created for accounting or bookkeeping related tasks, you can then customize it to fit your firm or client’s need.

A workflow template helps you create a standardized way for getting clients work done, regardless of who is handling the task, even if they are new hires.

-

Automate Client Requests:

Project management tools for accountants should assist in requesting and managing work-related information or documents from clients. You can set up automated reminders to prompt clients to submit the necessary information.

Client request management ensures that you receive required client documents and information on time, which may lead to delays in project completion and help improve client communication.

By leveraging an accounting project management system, your firm can benefit from increased efficiency, reduced manual work, improved client satisfaction, and better control over project timelines and workloads. These advantages ultimately contribute to a more successful and productive accounting practice. This is particularly useful when your project management software has an inbuilt CRM.

Based on these benefits, let’s look at the best accounting project management software and then you decide.

List of the 9 Top Project Management Tools for Small & Mid-sized Accounting Firms

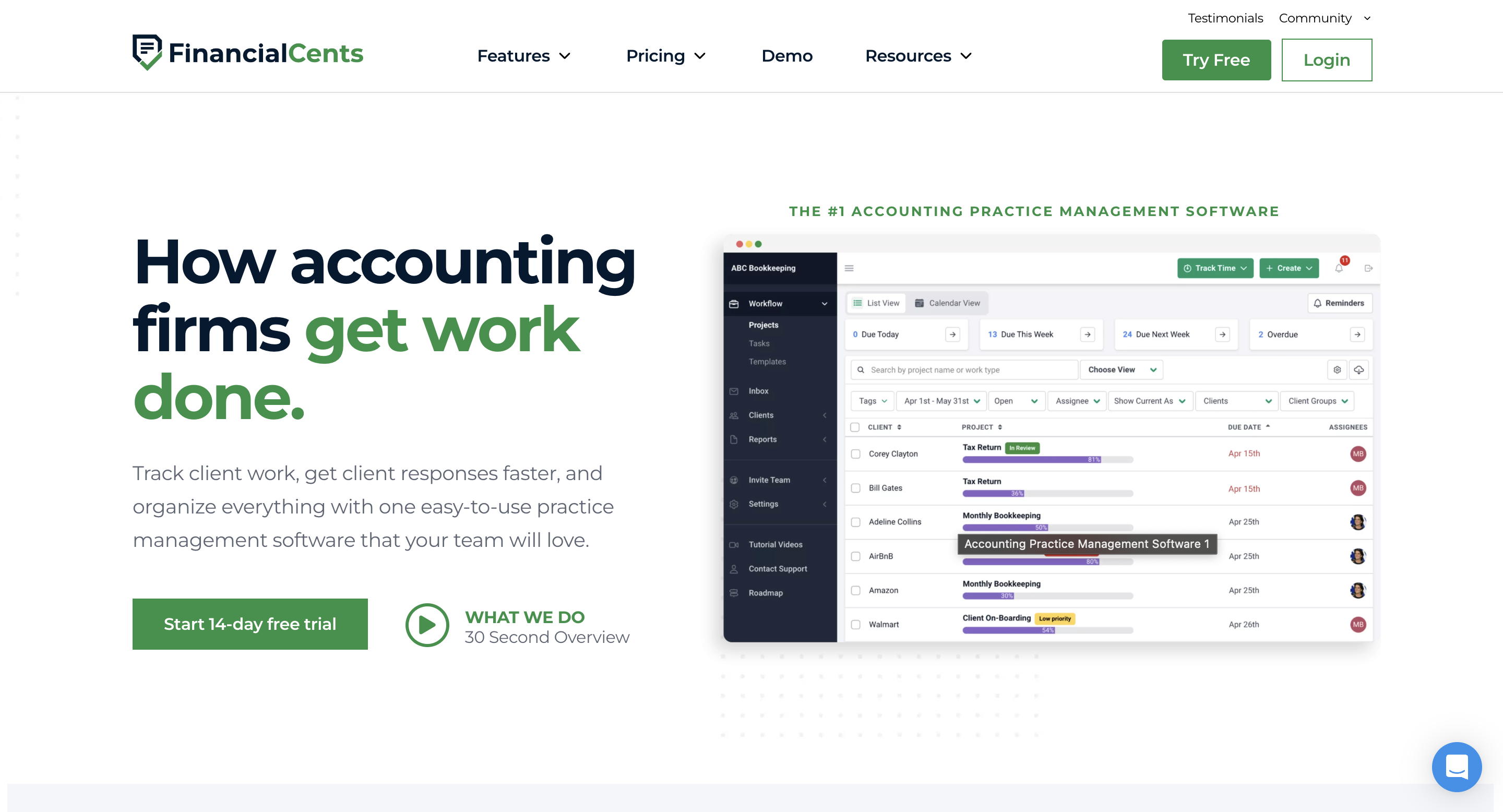

1. Financial Cents

Financial Cents is a project management software built specifically for small and mid-sized accounting firms. It enables you to track the status of client work using a workflow dashboard, create recurring checklists and collaborate with your team members online. Financial Cents also allows you to automate client requests and reminders to save your team the stress of chasing down your clients for information.

Financial Cents’ interface is easy-to-use. Users testify to the ease of managing their work, organizing important client information, managing your staff members workload, and tracking how much time employees spend on tasks, which helps small accounting firms identify over-budget work and inefficiencies.

Whether you’re a novice or an expert at creating accounting workflow checklists, Financial Cents’ workflow templates will make streamlining accounting workflows easy so as to ensure consistent client deliverables.

Financial Cents also integrates with Outlook and Gmail to help you better manage your cluttered inbox. When you integrate email with Financial Cents, it will give you a focused folder that just displays client-related emails to simplify your inbox and keep you focused.

You also have the ability to delegate ad hoc email requests from clients and tag important emails to work so your team can view them when doing client work.

That’s not all. Financial Cents’ free email templates help small accounting firms improve client communication, boosting service quality and client retention—even for mid-sized accounting firms.

Financial Cents also has an AI and ChatGPT integration for accountants and bookkeepers to help you create accounting workflow templates in seconds and also create email templates to enable you communicate with your clients professionally. You can learn more about the ChatGPT integration here.

Given Financial Cents’ ability to provide an easy to use yet robust accounting practice management software, it has become the preferred project management solution of choice for small and mid-sized accounting firms.

Financial Cents offers two plans: the annual plan of $39 per team member/month and the monthly plan of $49 per team member/month.

Financial Cents Accounting Project & Task Management Features

- Built and streamlined for accountants.

- Workflow automation.

- Easy to use and setup – Rated 4.9/5.0 for ease of use.

- Collaborate and communicate with team members with inbuilt chats, @mentions and more.

- Automate recurring tasks and projects

- Manage uncategorized transactions – ReCats

- ChatGPT and AI integration

- E-Signature to collect signatures from clients

- Capacity management to enable you distribute work across your firm evenly.

- Time tracking and billing to keep track of client work done.

- QuickBooks integration

- Automated client requests and reminders

- Email integration with Gmail and Outlook

- Zapier integration with 5,000+ Apps

- CRM feature to enable you manage client information and tasks.

- Document Management and integration with other DMS (Google Drive, Dropbox, OneDrive, SmartVault etc)

- Client Portal

- Over 50+ accounting workflow templates

- Facebook community group for users

Reviews

2. Karbon

Karbon is a work and communication platform for large accounting firms. It gives teams visibility across their team to see what might be obstructing their team member’s productivity. Like Financial Cents, Karbon gives you the ability to automate client tasks and reminders to make collecting data from your clients easy, so your team can proceed with work. Karbon uses Triage to optimize tasks and email for speed and efficiency to improve the project timeline.

Integrated with Office 365, Gmail, and Exchange, Karbon unifies all your team’s client communication with timelines, while giving your team the room to discuss any issue the client’s email has raised in the designated comments section (without the client seeing in-house discussions). This aligns your team’s voice and makes your firm’s client communication cohesive.

Karbon charges $59 per user/month for the Team Plan and $79 per user/month for the Business Plan, making it quite pricey for small and mid-sized accounting firms to enjoy.

Karbon Project Management Features

- Accounting project management tool.

- Client tasks automation

- Workflow automation

- Email integration

- Client communication features

- Workflow templates for accounting.

Reviews

Detailed overview: Financial Cents vs Karbon

3. Jetpack Workflow

Jetpack Workflow enables managers to build and manage their team’s projects as their firm grows. Whether you need to see all due projects, speak with your team about a task, or track progress, Jetpack Workflow makes all that possible.

Instead of wasting hours on non-billable client work, Jetpack Workflow allows your team to build and automate repetitive tasks and templates for several clients.

Its Labels feature allows your team to put tasks in proper perspective by indicating what could be holding their progress back (such as waiting on a client’s file, scope definition, or a second reviewer). So that your team is clear on what each project needs to progress.

Jetpack workflow costs $36 per user/month for its Organize plan and $39 per user/month for its Scale plan which includes capacity management and scheduling.

Jetpack Workflow Project & Task Management Features

- Accounting project management tool.

- Workflow automation

- Time tracking

- Work organization

- Tasks progress tracking

- Workflow templates for accounting.

Reviews

Detailed overview: Financial Cents vs Jetpack Workflow

4. Asana

Asana is the project management solution that works for teams across all industry and career verticals. Its collaborative work platform suits marketing, sales, IT, and dev-ops teams. Asana’s easy-to-use interface makes it a good fit for solo firms looking for a generic project management tool.

With Asana workflows, your team gets to add tasks to multiple projects in a way that editing tasks in one location automatically reflects in any other place it appears, keeping everyone on the same page on the task.

Asana also gives teams a rare capacity to visualize tasks by presenting all projects, tasks, and subtasks on one screen at the same time. This makes it easy to view tasks while seeing the project’s hierarchy simultaneously.

The in-task communication feature in Asana saves teams the trouble of leaving the window to communicate with collaborators through another feature or third-party messaging app, which can obstruct effective communication. All of this helps to execute projects quicker.

Apart from being too generic for an accounting project management, Asana does not track time and this is a big deal for small and mid-sized accounting firms. Asana requires the use of third-party software to track how much time your team is spending on projects.

Asana is free for teams of 15 members and below. But to access its workflow builder, multichannel reporting, and task templates, you will have to buy the premium plan for $10.99 per user/month and the business plan for $24.99 per user/month.

Asana Features

- Generic project management system. It’s not built for accountants.

- Track work.

- Collaboration

- Communicate with team members

- No time tracking

- Generic workflow templates

Reviews

Detailed overview: Financial Cents vs Asana

5. Canopy

Canopy is a practice management software that helps executives manage their accounting firm’s daily schedules and client relationships. Canopy helps teams stay organized with CRM, document management, time and billing, and workflow management. Built with practice management and post-filing tools, accountants can leverage Canopy to improve the quality of their results, especially during tax season.

Canopy is a practice management software that helps executives manage their accounting firm’s daily schedules and client relationships. Canopy helps teams stay organized with CRM, document management, time and billing, and workflow management. Built with practice management and post-filing tools, accountants can leverage Canopy to improve the quality of their results, especially during tax season.

If your client gets into trouble with the revenue authority, you can use Canopy to access IRS data that you need to help them. Canopy allows you to pull your client’s transcript from the IRS to understand your client’s compliance issues.

Canopy also boasts of great client communication tools like letter generator, client requests, and financial questionnaire that makes client tax resolution more efficient.

While Canopy is a reliable project management software for tax accountants, its can be pretty pricey for small and medium sized accounting firms. They offer a service-based pricing system. For example, their document management module costs $40 month/ per user. Their workflow package goes for $30 month/ per user. Their Time & Billing module costs $24 month/ per user. Their Transcripts & Notice service cost $33 month/ per user. Their Client management module costs $2.50 per client/ year.

Features

- Built for the accounting industry.

- Workflow templates for accounting.

- Robust client communication tools.

- In-built CRM

- Document management

- Time tracking.

Reviews

You may be interested in:

6. ClickUp

ClickUp is a cloud based project management software that allows firms to manage projects and create workflows that guide project implementation. ClickUp lets you present your projects in spaces, folders, lists, tasks, and subtasks, to which you can assign due dates and urgency levels so the assignee knows how much time they have to complete it.

With ClickUp, you can add your team members to share ideas and brainstorm on projects and tasks. The assignee can indicate “in progress,” “working on it,” or “done” to help both the assignor and assignee better understand each other, increasing visibility in your firm’s task management.

ClickUp can help you view budget expenses and understand what your team has used for what and what remains.

ClickUp’s dashboard can help your team list pending tasks, embed links and use conversation widgets to enhance team communication. You can create project, client, or brain dump dashboards and shuttle between them as much as you need during the project lifecycle.

ClickUp is quite complex for small accounting firms to wrap their heads around. Separating a project from lists and tasks is not simple, and this can lead to wasted hours and threatens the essence of using project management solution in the first place.

ClickUp’s free plan offers more features than many other project management system, but their prices range from $5 per user/month for the Unlimited plan to $12 and $19 per user/month for the Business plans.

ClickUp Features

- Generic project management tool.

- Work tracking.

- Budget tracking

- Team communication tool

- Generic workflow templates.

- Document management

- Time tracking.

Reviews

7. Trello

Trello is a project management system that gives teams the ability to create boards for the meetings, events, tasks, and files they need to get their work done or invite team members to collaborate where and when necessary. The ability to comment on Trello cards (each card is a task) Activity section, which allows teams to share ideas on the go, stands it out among several other project management tools in the market.

With Trello, you can easily set up, customize and automate workflows that help your team prevent delays and move your projects forward. The Trello View feature allows your team to visualize project performance against timelines. Tr

You can also adjust the start and due dates of projects or simply overview your project layout to make large projects easier to implement in smaller and more manageable chunks. Plus, you get the ability to spot bottlenecks and address them ahead of time to help your small or mid-sized accounting firm stay on top of its daily, weekly, or monthly work schedule.

Furthermore, its integration with third-party software like Figma, Jira, and Slack, allows your team to use Trello Power-ups to add more features that help your team work and communicate better on your Trello boards.

That being said, Trello boards can be confusing to create, manage and structure, which makes it a challenge for firms looking for simple project management solution for accountants. Because it is not designed necessarily for the accounting industry, most of its features are nearly immaterial to your core accounting practice needs.

It is free to organize anything on Trello, but to manage more work would cost your team between $5, $10, and $17.50 for their standard, premium, and enterprise plans respectively.

Trello Features

- Generic project management system.

- Trello cards

- Trello boards

- Workflow automation

- Integration with Figma, Jira, and Slack

- Generic workflow templates.

Reviews

8. Notion

Notion makes collaboration easy by keeping team notes, docs, and wikis organized in one place. Notion’s Meeting Notes feature makes it easy to carry your employees along. With detailed meeting notes made available to team members, this feature unifies your team efforts, making achieving your project objectives stress-free.

Notion makes collaboration easy by keeping team notes, docs, and wikis organized in one place. Notion’s Meeting Notes feature makes it easy to carry your employees along. With detailed meeting notes made available to team members, this feature unifies your team efforts, making achieving your project objectives stress-free.

The Table Database in Notion lets team members display clear and concise project information and draw the attention of other team members to project components to enrich your documentation. This ensures everyone on the team can keep track of projects.

Baked with a Kanban board, you can see and adjust your tasks and timelines and redistribute work among your team members when necessary.

Although it can be hard to get the hang of Notion’s array of features—like Habit Tracker, Roadmap, and Simple Budget, they can aid underperforming teams to make the most of their work.

Because Notion is not specifically for accounting firms it has a lot of features that firms will not use. This sometimes makes it overwhelming and difficult to use for firms with small team. However, solo firms have had success with Notion. Notion for teams is $10 monthly and $8 for annual billing.

Notion Project Management Features

- Meeting notes

- Table database

- Kanban board

- To-do list blocks

- Generic task management software

Reviews

9. Monday.com

Monday.com is a choice tool for several industries and roles including marketers, sales executives, HR, and software developers seeking to manage their work and keep their business tools unified in one place.

Monday.com is a choice tool for several industries and roles including marketers, sales executives, HR, and software developers seeking to manage their work and keep their business tools unified in one place.

Its platform lets team members see who is online to collaborate on a project in real-time. It also helps teams simplify decision-making processes and makes data available for any teammate who needs it. Monday.com uses a Kanban system to enable teams to prioritize and manage tasks efficiently.

What is goal-setting without the ability to visualize milestones and dependencies? Monday.com uses Gantt charts to help teams see their project components.

Monday.com works by allowing team members to open tickets (tasks), set timelines, track progress reports, and add other team members to attend to tasks that need attention. The “new,” “working” and “solved” feature on Monday.com helps teams focus their efforts on what is urgent. Visualize your workload in the dashboard and manage your team’s capacity with Monday.com views to keep projects within schedules.

Monday.com is free for individuals for up to two seats. To add more team members, you’ll be required to upgrade to the Basic Plan at $8 per user/month, Standard Plan at $10 per user/month, or Pro Plan at $16 per user/month).

Because it is built for teams across industries, Monday.com lacks the specific benefits that small accounting firms need to deliver better results.

Monday.com Features

- Generic project management solution.

- Kanban system

- Gantt charts for visiualization

- Progress tracking

- Tickets

Reviews

Final Thoughts

Any of these project management software can benefit your firm to a degree. But for small and mid-sized accounting firms looking to make the most of their resources, getting a cloud based tool built for your specific needs at a great price may be all you need to give your team an unfair advantage.

Financial Cents was built with the needs, challenges, and goals of accounting firms in mind and for that reason it is the best choice for small and medium sized accounting firms.

Wouldn’t you prefer an accounting task management software that sees work the way you do and constantly improves the product to help address your accounting firm challenges ahead of time?

If you sign up now, you’ll get two weeks to manage your work, team capacity, and client communication with Financial Cents FOR FREE.

Get 14 days to manage your work, team capacity, and client communication with Financial Cents FOR FREE.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

The 7 Best Karbon Alternatives to Consider in 2024

There is a suitable practice management tool for every accounting firm. When it is the right firm, Karbon provides most of the…

Apr 16, 2024

The Top 8 TaxDome Alternatives for Your Accounting Firm

Practice management software, like TaxDome, should help firm owners manage their projects, clients, and staff to improve client service and stay profitable.…

Apr 08, 2024