The 9 Best Accounting Workflow Software Solutions

Author: Financial Cents

In this article

You’re self-sabotaging your firm if (in 2024) you still struggle with organizing your firm to:

- See who is working on what

- Onboard new staff to client work

- Find client information

- Make strategic decisions that will grow your firm in the long term.

It shows how much you need an accounting workflow software solution to set up systems and processes, organize everything, and handle admin tasks so that you can focus on getting work done and growing your firm. Else, while you work your fingers to the bone, 70% of firms like yours are leveraging accounting workflow automation to buy-back time to “work ON the business, not IN the business,” like Shahram Zarshenas (Financial Cents’ CEO) says.

(You may be interested in our review of the best accounting practice management software.)

Benefits of Using an Accounting Workflow Software in Your Firm

Accounting firms use workflow management solutions for several reasons, but these four are the most common

Work Tracking

Accounting workflow software gives firm owners visibility of the status of client work, meaning they can see how much work is getting done, where their teams are spending their time, and what might delay work These help firms complete more client work, add more clients, and earn more money. This is less likely if you use spreadsheets to manage your workflow.

Standardizing Processes with Workflow Templates

Stressing over repetitive, little tasks is a great way to reduce focus and productivity. But creating systems (with workflow software) that guide the implementation of processes helps the team to deliver consistent client work. An. accounting workflow software is usually embeded with a library of standard accounting workflow templates to help you get accounting tasks done, which you can customize to suit your firm/clients needs. You can also create your templates from scratch and save them.

If you prefer using flowcharts and diagrams, check out this 7 basic accounting workflow templates and diagrams.

Automate Recurring Tasks

Accounting tasks that you have to do on periodical basis such as monthly bookkeeping or payroll do not need to be manually set up at the start of each tasks. With an accounting workflow management tool, you can automatically set them to recur at the set period and get the work done. It also reduces the likelihood for you or your team members to forget.

Meeting Deadlines

Workflow software solutions enable firms to automate as many tasks as possible. This frees up more time to complete client work on time. In a recent recent survey by Financial Cents, accounting firm and bookkeeping firm owners stated that accounting workflow automation help cut the average duration spent on manual work from an average of 1-10 hours to 0-5 hours.

Staff Collaboration

The timely exchange of files and information helps firms to work efficiently and accurately is one thing. The data security that workflow software companies provide is another. Whether your priority is improving accuracy in your firm or keeping client data secure, workflow software makes running your firm many times easier.

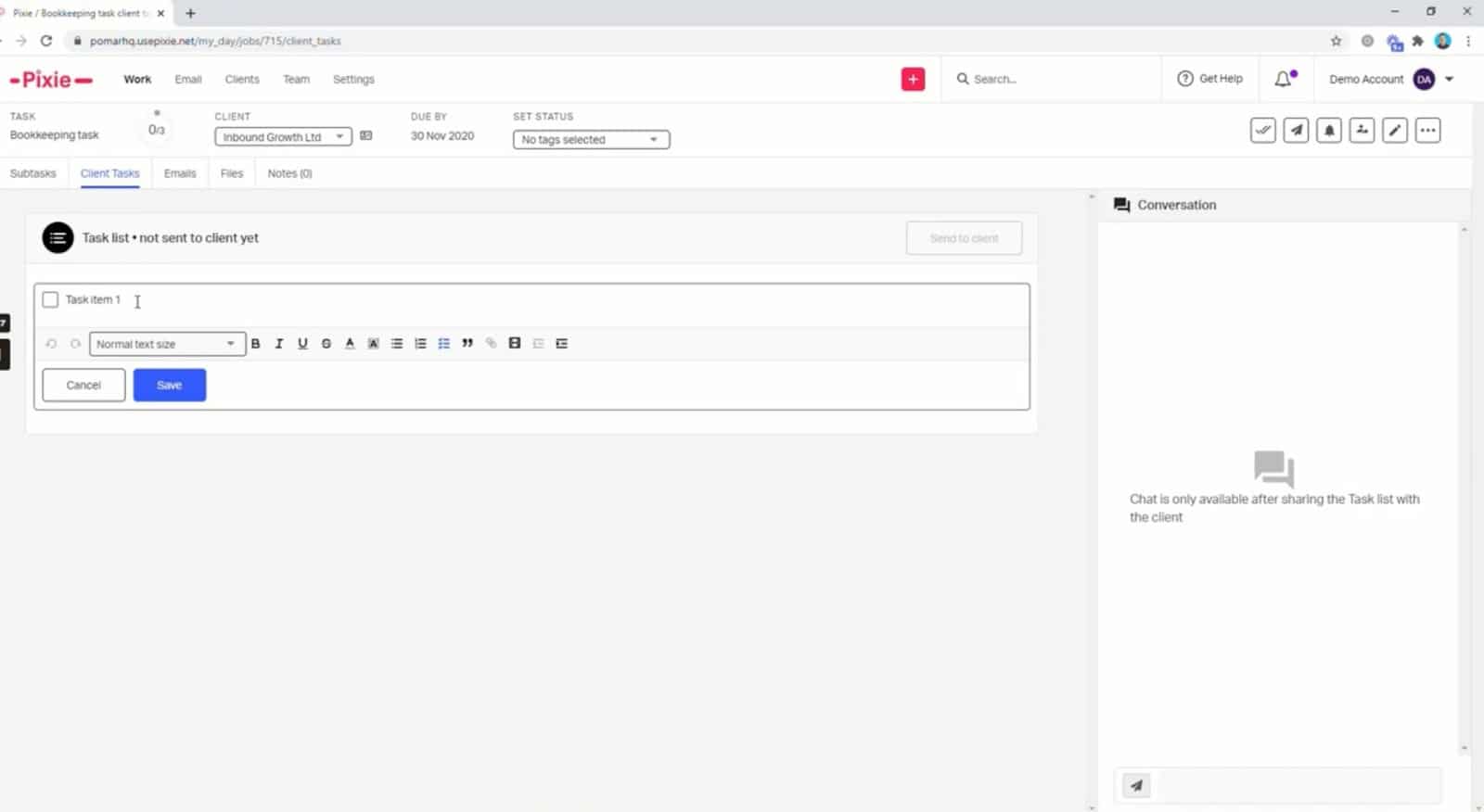

Collaboration with Clients

Using the client portal and communication features available in a workflow software you can receive documents from your clients and chat with them on specific tasks and projects. This ensures you receive documents from clients promptly and that you are on the same page.

3rd Party App Integrations

Using a good workflow management software for accounting firms provides you with the opportunity to connect with other apps in your accounting tech stack through integrations. Most accounting workflow software integrate with QuickBooks, ChatGPT, adobe signature, Zapier, email platforms such as Gmail and Outlook, document management systems, tax software and more. This helps to significantly reduce time spent on manual processes.

Just starting out your firm? Here’s how to know a workflow software that is right for your new accounting firm.

Important Questions to Ask Yourself When Selecting a Workflow Management Tool

When selecting an accounting workflow management solution, here are important factors and questions to ask yourself to ensure it’s a right fit for your firm. You do no want to be stuck with a software that doesn’t quite fit after spending time, money, energy, training your team member and in some cases migrating all your data and processes from a previous solution:

- Is it scalable? This is particularly important if your firm has growth plans or plans to scale, such as adding more team members, clients and the number of services you provide, let’s face it this is the goal for many accounting firms. You do not want to be stuck with a workflow software that doesn’t have the capabilities to grow with your firm.

- Is it easy to use and implement? You want to ensure that the workflow software you choose can be implemented with ease and doesn’t require a degree in “rocket science” to use. Check customer reviews for the software and be sure it has an high rating for “Ease of Use”. Confirm that the platform isn’t complex, some software platforms bloat their tools with features that users do not need.

- Can my clients use it? Part of the reasons why a workflow software is useful for accountants is the ability to request and receive documents from clients with ease. A good accounting workflow has client management features such as a client portal, client document management, client dashboard, inbuilt chat to communicate with clients, email integration, e-signature and more. These features ensure you don’t chase clients around to get work done and once you client is able to use it, you are good.

- Are demos and trainings provided? Be sure that they provide demos and confirm if trainings are provided during demos.

- Is there a free trial? Apart from demos, you may also want to try things out and test out the features, you can do this with a free trial.

- What are people saying about it? Check in with friends in your industry, ask for referrals from colleagues and most importantly check online reviews and ratings on platforms like Capterra or G2.

- Will it help my team work better and collaborate?

- Can I track work and monitor progress of work done?

- Does the pricing fit what we need?

- Is it right for my firm’s day to day activities?

You can use our guide for selecting a workflow software for accounting firms for more a detailed insight. If your firm is based in Canada, read this – A Guide for Selecting Accounting Workflow Software for Canadian Firms.

How to Get Started with Accounting Workflow Management in Your Firm

If you are just starting your accounting firm or intend to begin using accounting workflow software to manage tasks and projects in your firm, you may be confused about how to start. In this video, Kellie Parks, CPB, the founder of Calmwaters Cloud Accounting, explains where to begin with workflow management in your firm during our first annual WorkflowCon in 2023.

If you are familiar with workflow management, you can skip this video or check out these 6 practical tips to master accounting workflow management.

Features Of a Good Workflow Management Software for Accounting Firms

For any workflow management software to make sense for accountants, it must have these features:

- Workflow Dashboard

- Due Date and Deadline Tracking

- Task Assignment

- Recurring Projects

- Task Dependencies

- Workflow Templates

Workflow Dashboard

How we present information determines the success of project.

It is one thing to have the people and information you need to complete client work. It is another to find what you need to make time-sensitive decisions.

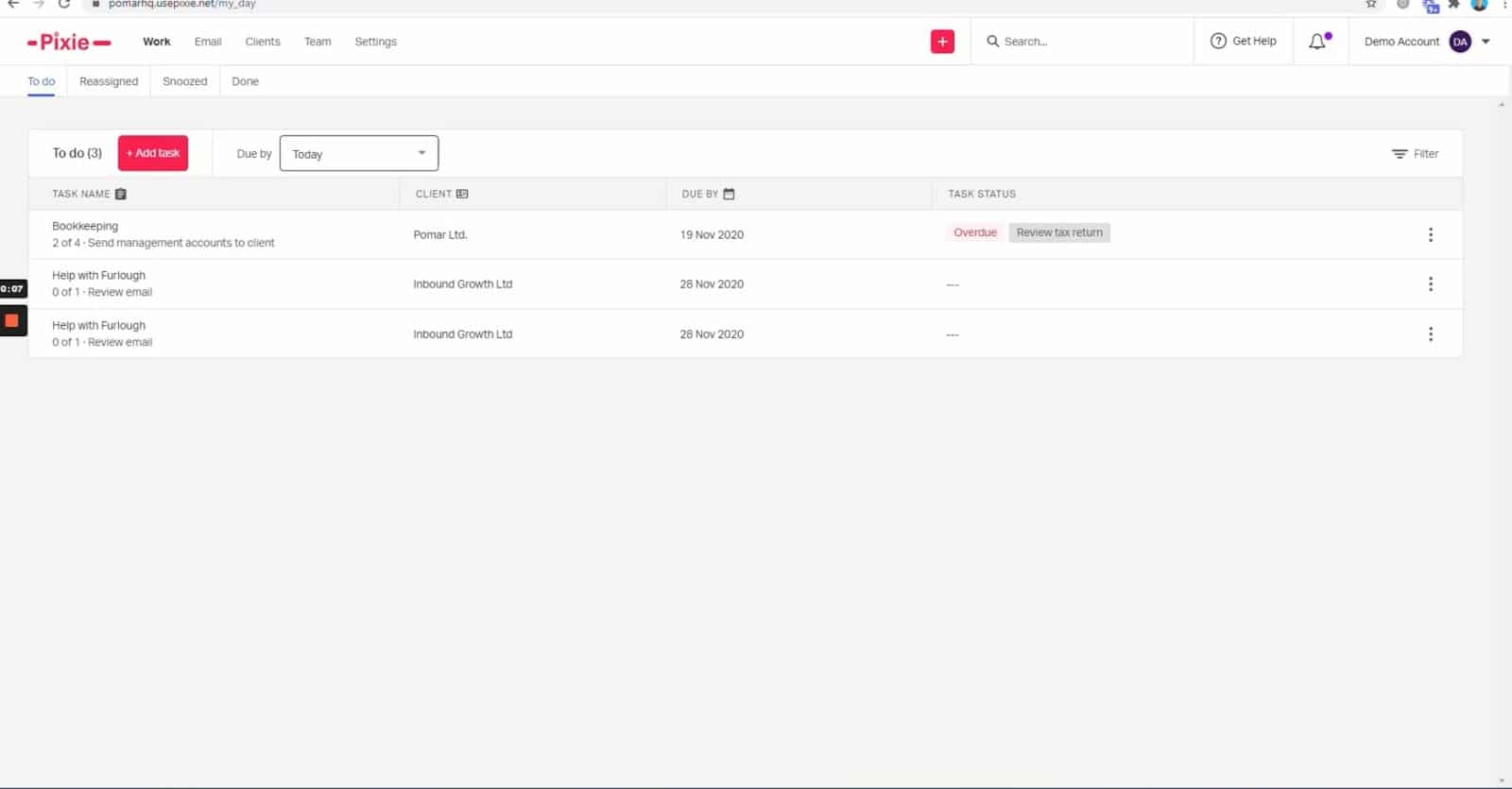

The workflow management dashboard is usually the first thing you see when you log into an accounting workflow software.

As the manager, your workflow dashboard should give you a bird’s eye view of your firm’s projects, due dates and assignees. Your Dashboard should be easy to navigate so everyone can focus on doing the work instead of wasting time trying to figure things out.

Due Date and Deadline Tracking

The average workflow software will show you the client work your firm has to do and when they are due.

And that’s because, in a compliance-heavy industry like accounting, missing deadlines can cost your clients a fortune.

You shouldn’t have to drill into each project to see their deadlines, you should be able to see them from your dashboard so you can meet deadlines and keep your clients happy.

You should also be able to filter your workflow dashboard to see only the work that is due at the moment to get your priorities right.

Learn more about due date tracking for accountants.

Task Assignment

In addition to due dates, your workflow software should let you assign work to your team. This helps you know who to hold accountable for project performance.

You should be able to filter your work by assignees so you see how much an employee is doing. This helps you to manage capacity to meet deadlines and prevent burnout.

Recurring Projects

Your workflow software should also allow you to easily create recurring projects for your most common, repeatable work. . This helps you save time and better plan work.

Task Dependencies

As the manager/owner, you should be able to see the sequence of tasks (and assignees) on client work that require multiple assignees.

This feature lets you see who’s on the queue to work on a client’s work and clarifies the assignees’ role in the work.

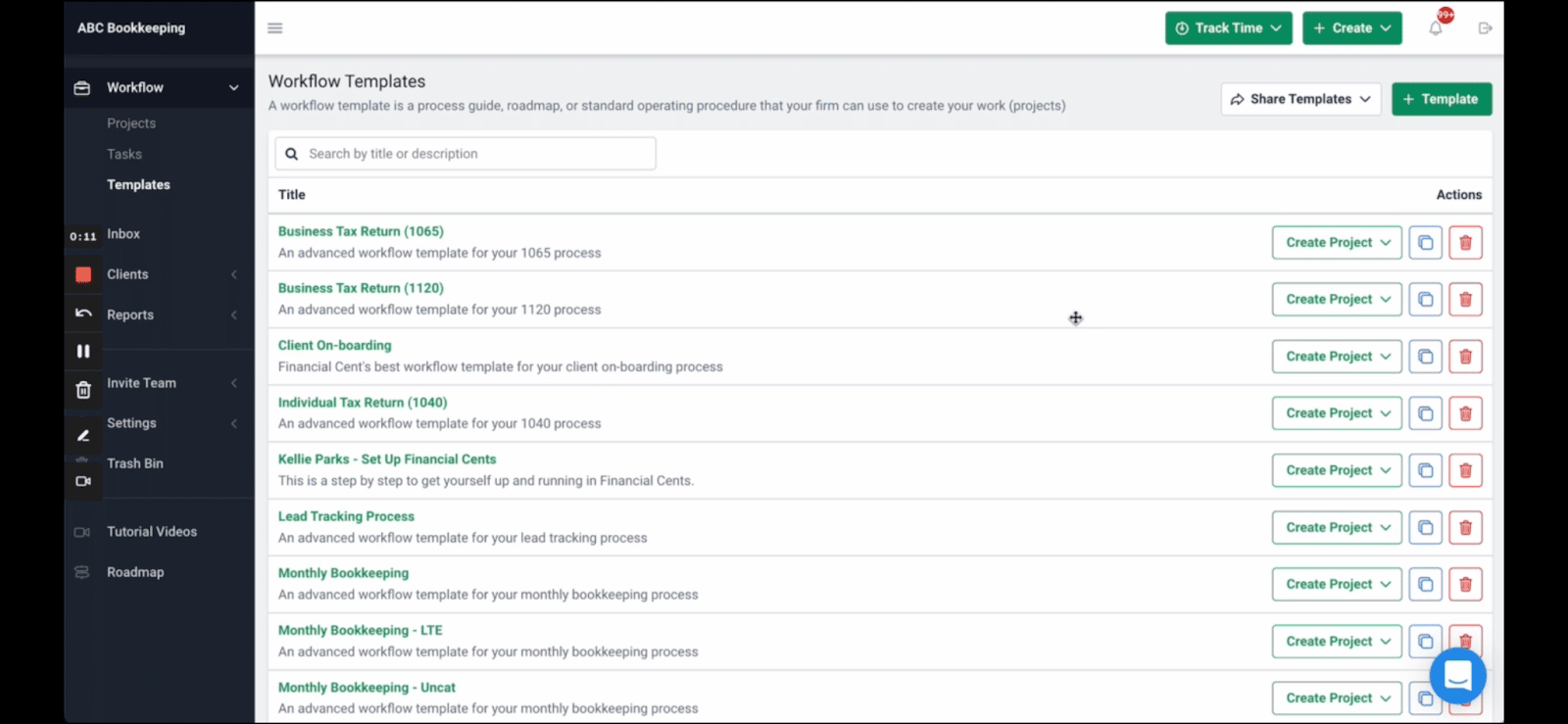

Workflow Templates

For those similar tasks you frequently perform, templates will save you the stress of starting them from scratch whenever you need to complete them.

A good workflow software will enable you to create templates by auto-filling them with the information that helps you kick-start the task.

Some workflow software solutions will even give you templates you can convert to projects or customize to fit your unique needs.

The more accounting-focused a workflow tool is, the less customizing its templates will need, which is why we are recommending accounting-specific workflow software options. If you have a spreadsheet or excel template that you use in your firm for workflow, you can also import or use them with a workflow tool. You can learn how to use spreadsheets with your accounting workflow management software here.

Here’s our review of nine(9) top accounting workflow software solutions to help you find the best fit for your firm and the goals you want to achieve. We have chosen these accounting workflow software solutions because they are built for the accounting industry, which makes their workflow features most relevant for accounting processes.

Read our detailed blog to help you determine the essential features to look out for in a workflow management software.

The 9 Best Workflow Software for Accounting Firms in 2024

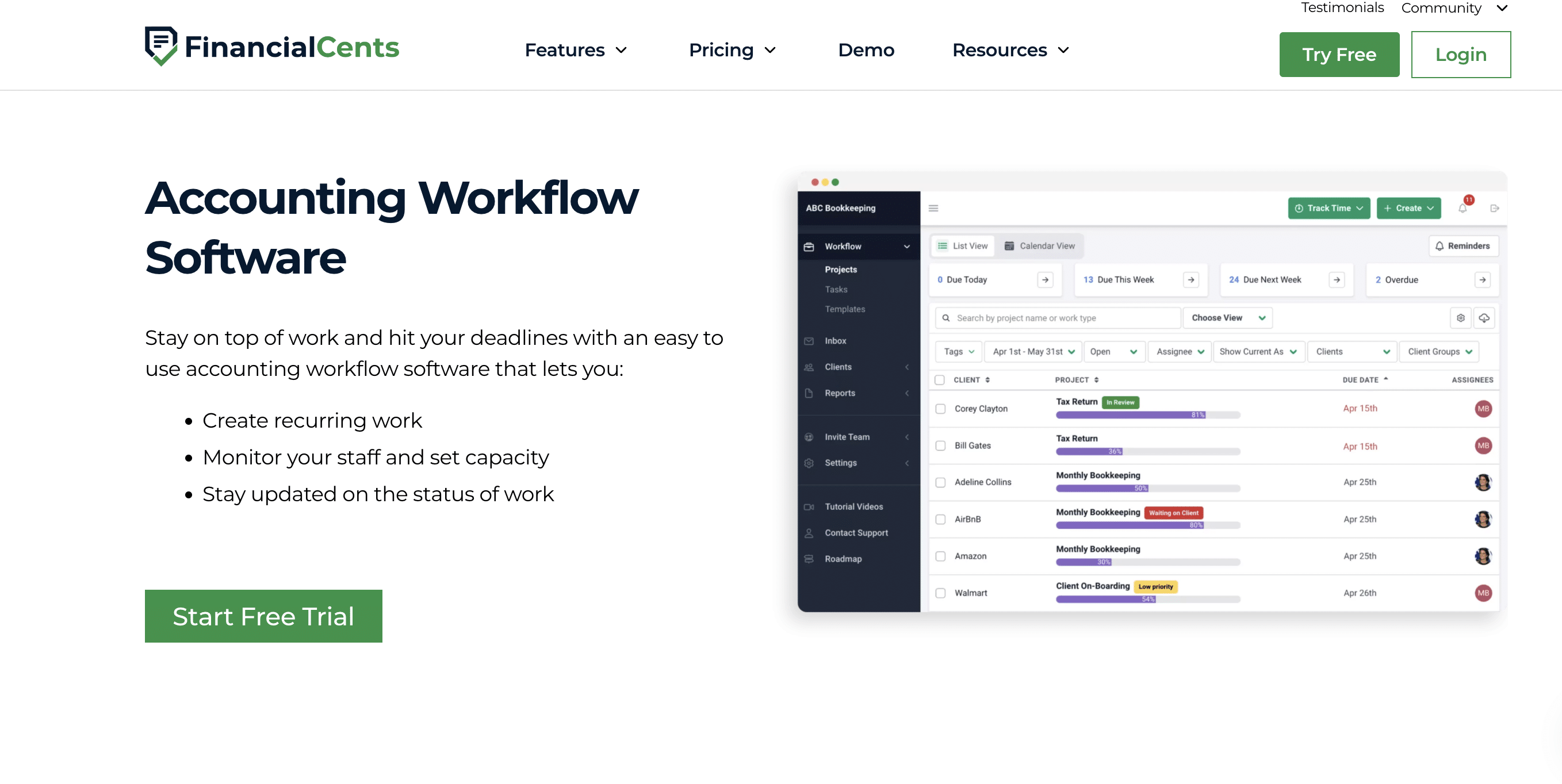

1. Financial Cents

Financial Cents is an easy-to-use accounting workflow management software.

Its simple design helps firms to streamline their work. It has all the features accountants need to complete work on schedule.

For the sake of this topic, we’ll see how it helps you stay on top of things through:

-

Work Tracking

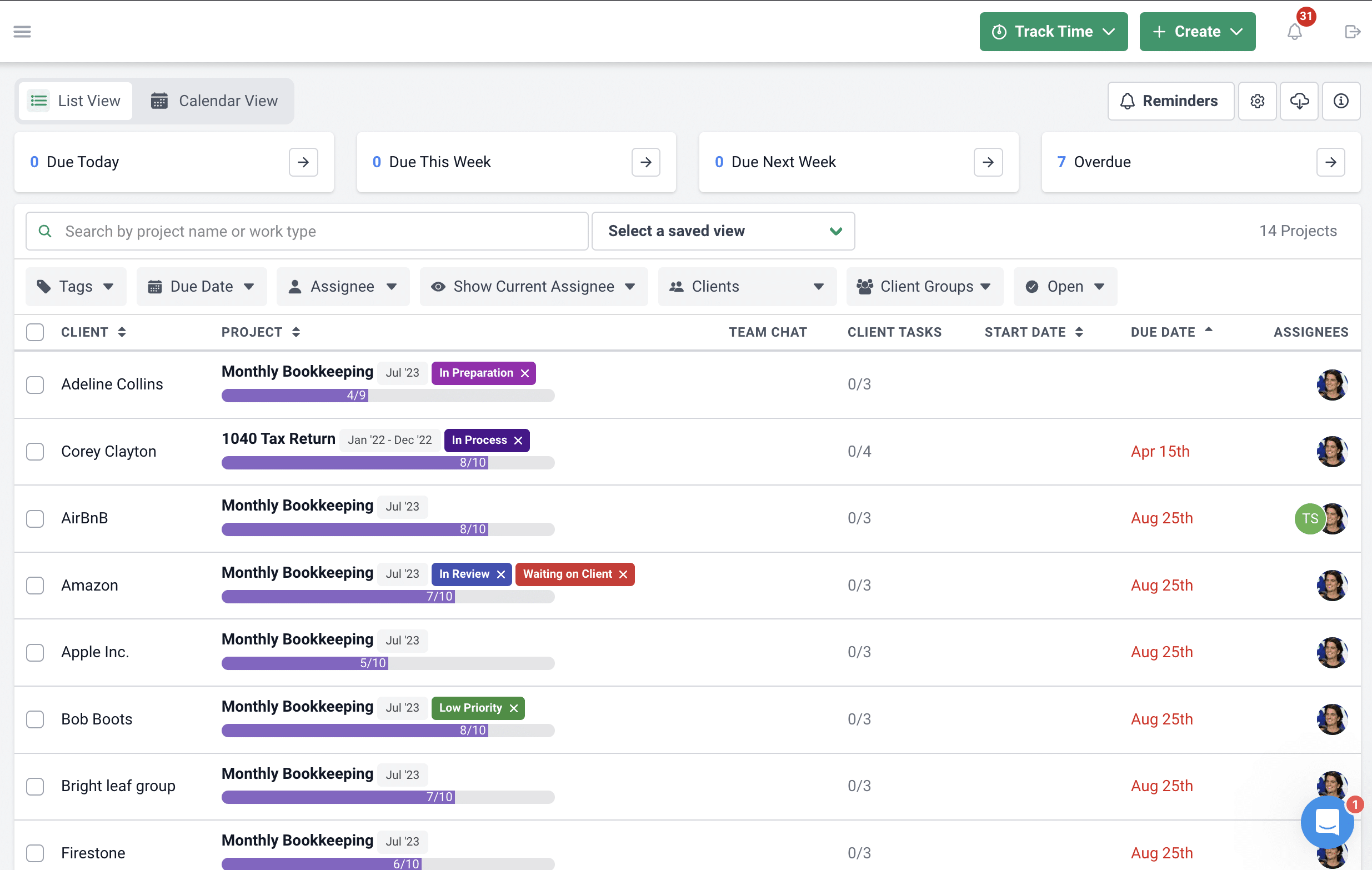

Tracking work in Financial Cents happens on your workflow dashboard.

The Workflow Dashboard is the first window you see when you log into your account. It shows you all the projects your firm has to work on from top to bottom. The progress level of each client’s work is color-coded so that the work status does not escape you.

As you can see, the dashboard shows you all client work and the:

- Team members assigned to the work.

- Start and due date.

- Progress status of the work.

You can drill into the dashboard for more details with:

- Workflow Filters that enable you to pick out information by typing the following terms in the search bar:

- Work type (like year-end or bookkeeping).

- Due date to see which work is nearest to their deadlines.

- Assignees (like John Doe or Jane Doe) to see how much work they have and how well they are doing.

- Client to see how much work your team is doing for them.

- Client Groups to see all the clients that need a type of work.

You can also combine search terms to get more detailed information at once. For example, you can enter “payroll due next week,” which combines the due date with the work type.

If you need to see a particular view regularly, you can save it for future access. And if you no longer need it, you can delete it with the Clear Filters button.

- Client Emails that can be converted to projects to keep you from forgetting them, which can cause client dissatisfaction.

-

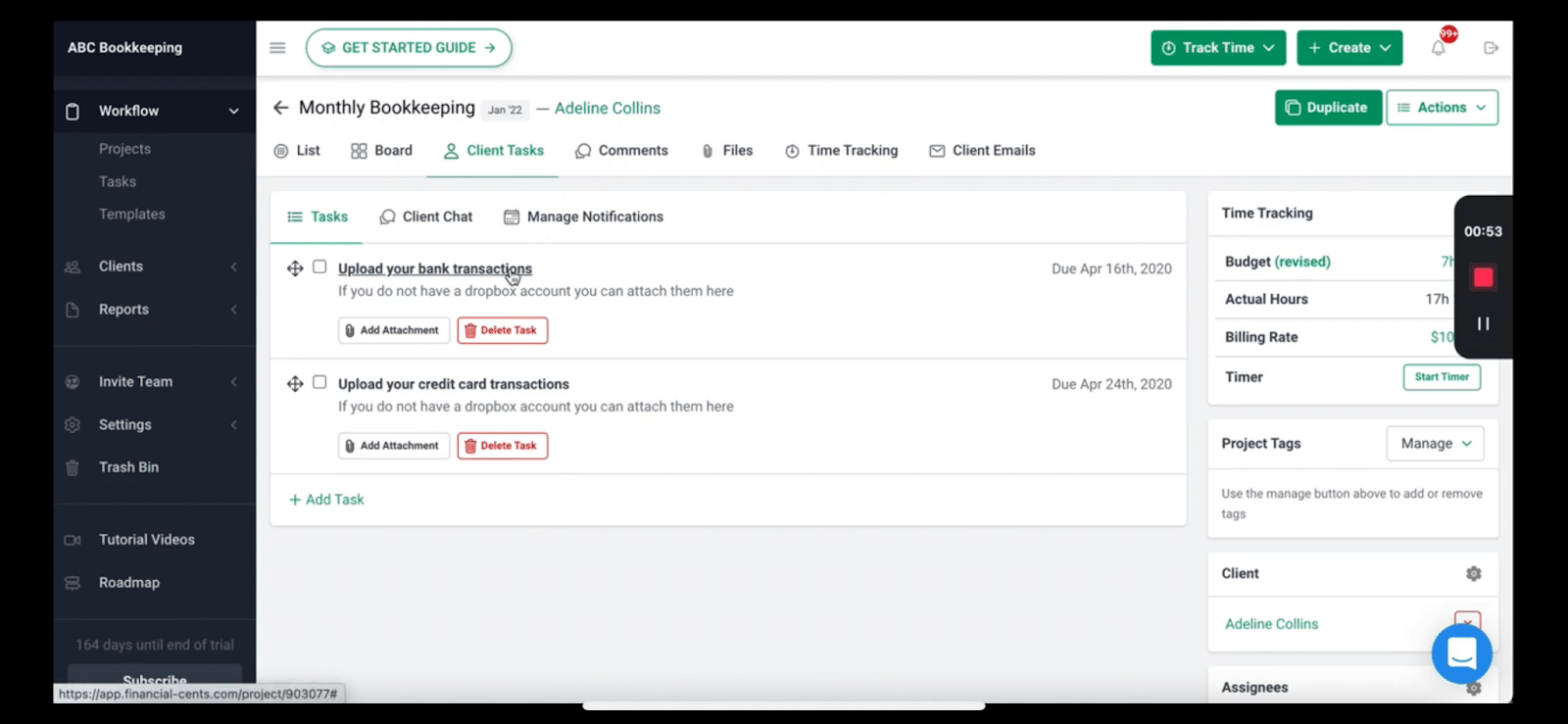

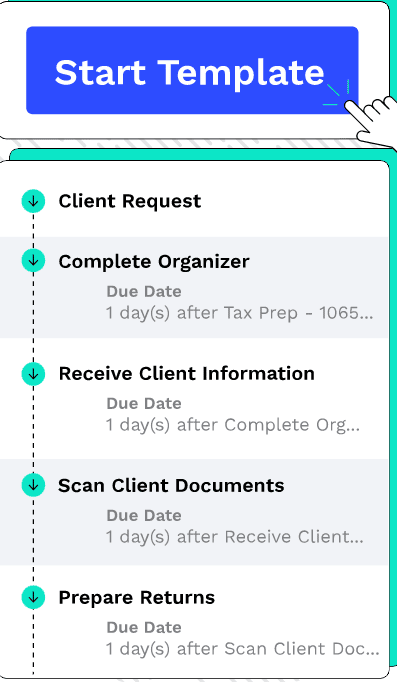

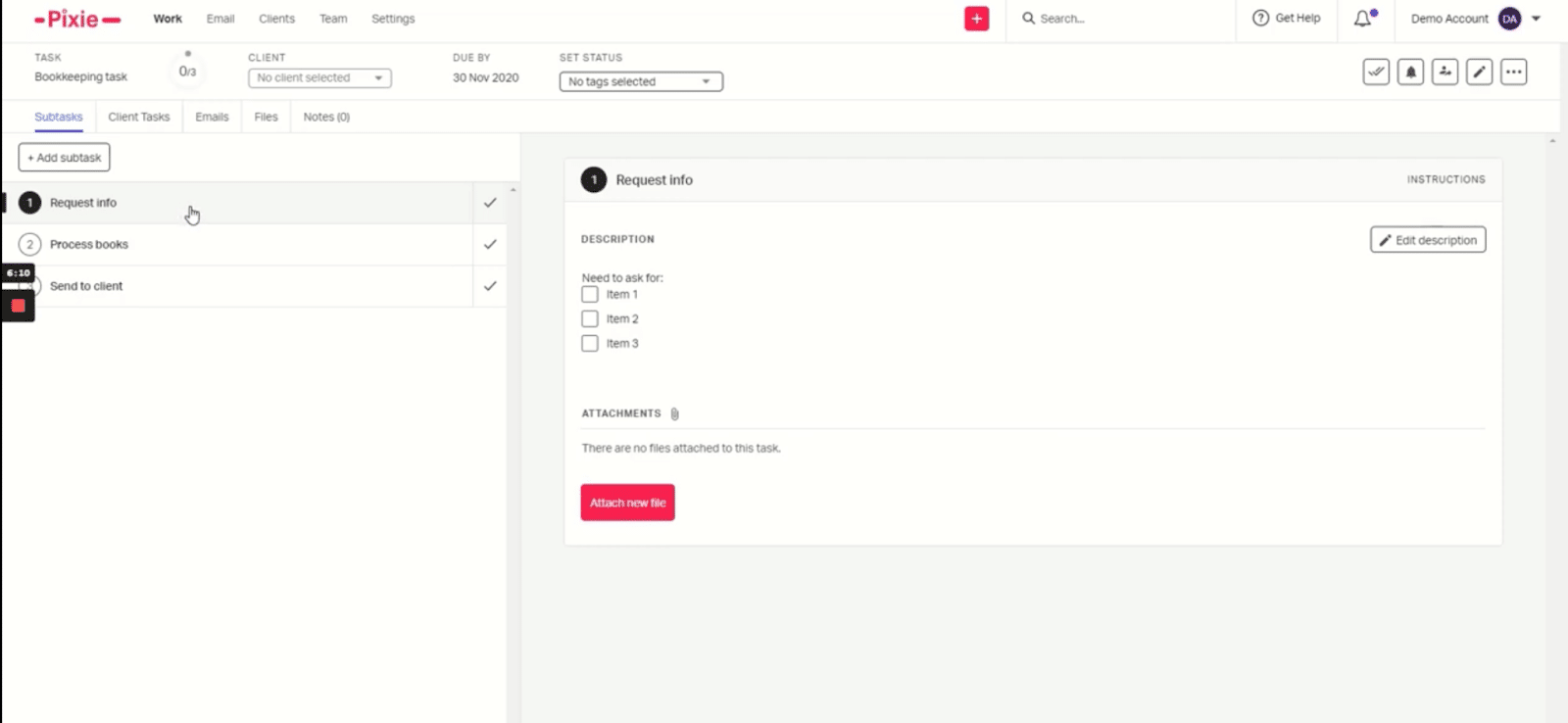

Standardizing Processes

Financial Cents believes that having standard processes will give your staff most of what they need to complete tasks—to the required standard.

To help you get more out of your team, Financial Cents offers:

- Automatic client data collection so that your employees do not have to reinvent the wheels each time they need to get files from your clients.

- Template checklists to give your team a head start on projects, streamline your procedures and keep your work quality consistent.

Financial Cents templates library has templates for most of what small and mid-size accounting firms need, including:

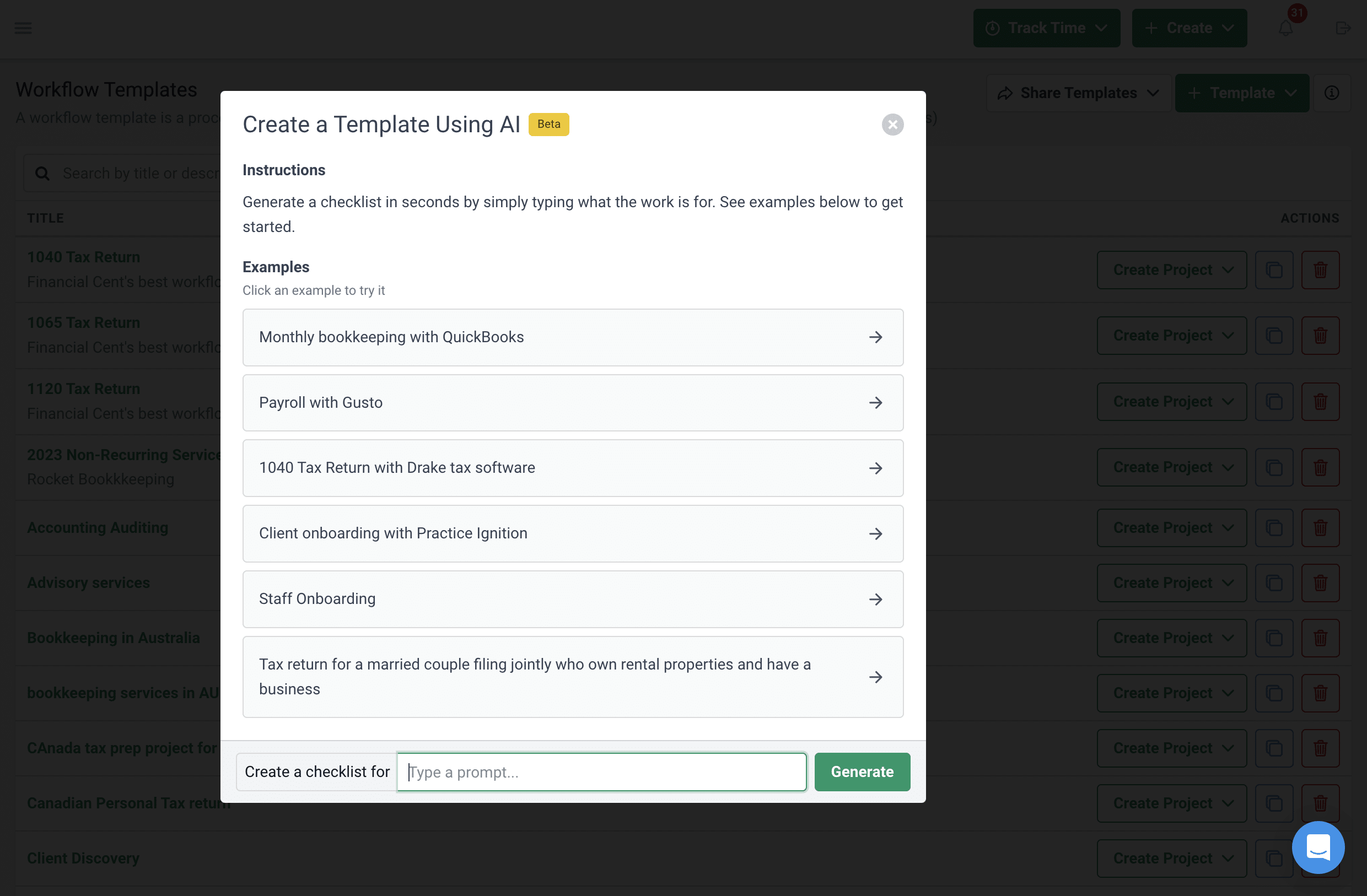

You can download the templates inside Financial Cents or customize them to suit your unique needs. You can also import your own templates into the software. We also recently added a feature to make accounting workflow automation easier with our AI and ChatGPT integration you can create accounting workflow templates in seconds.

- Recurrences to recreate a project for future dates to maintain the consistent scope of work across board.

- Dependencies automate task hand-off process between assignees. It also auto-notifies them when their task is due.

-

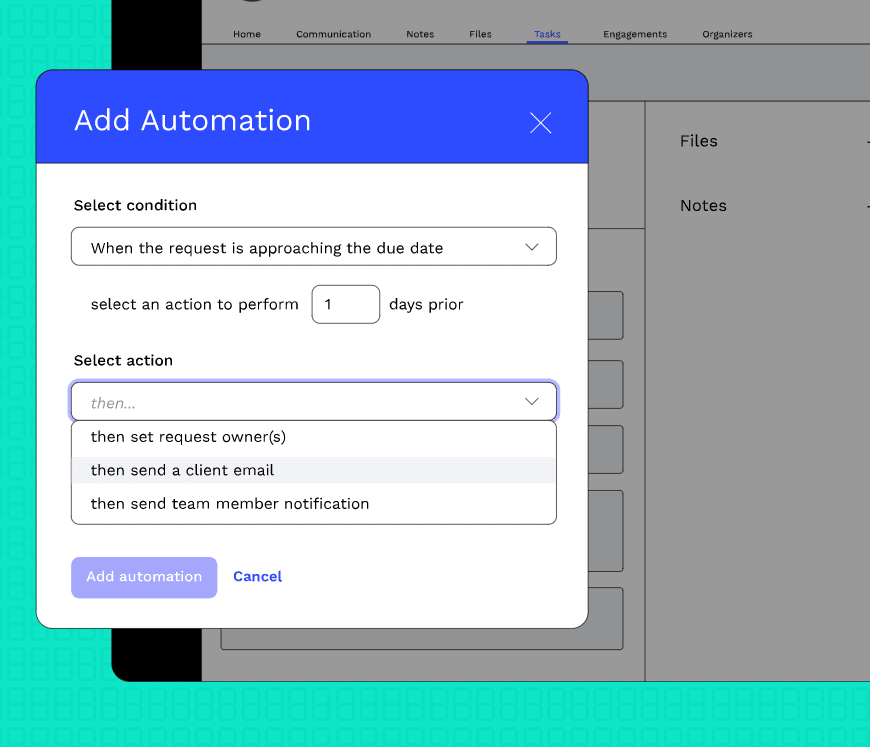

Meeting deadlines

To help you meet your deadlines, Financial Cents offers:

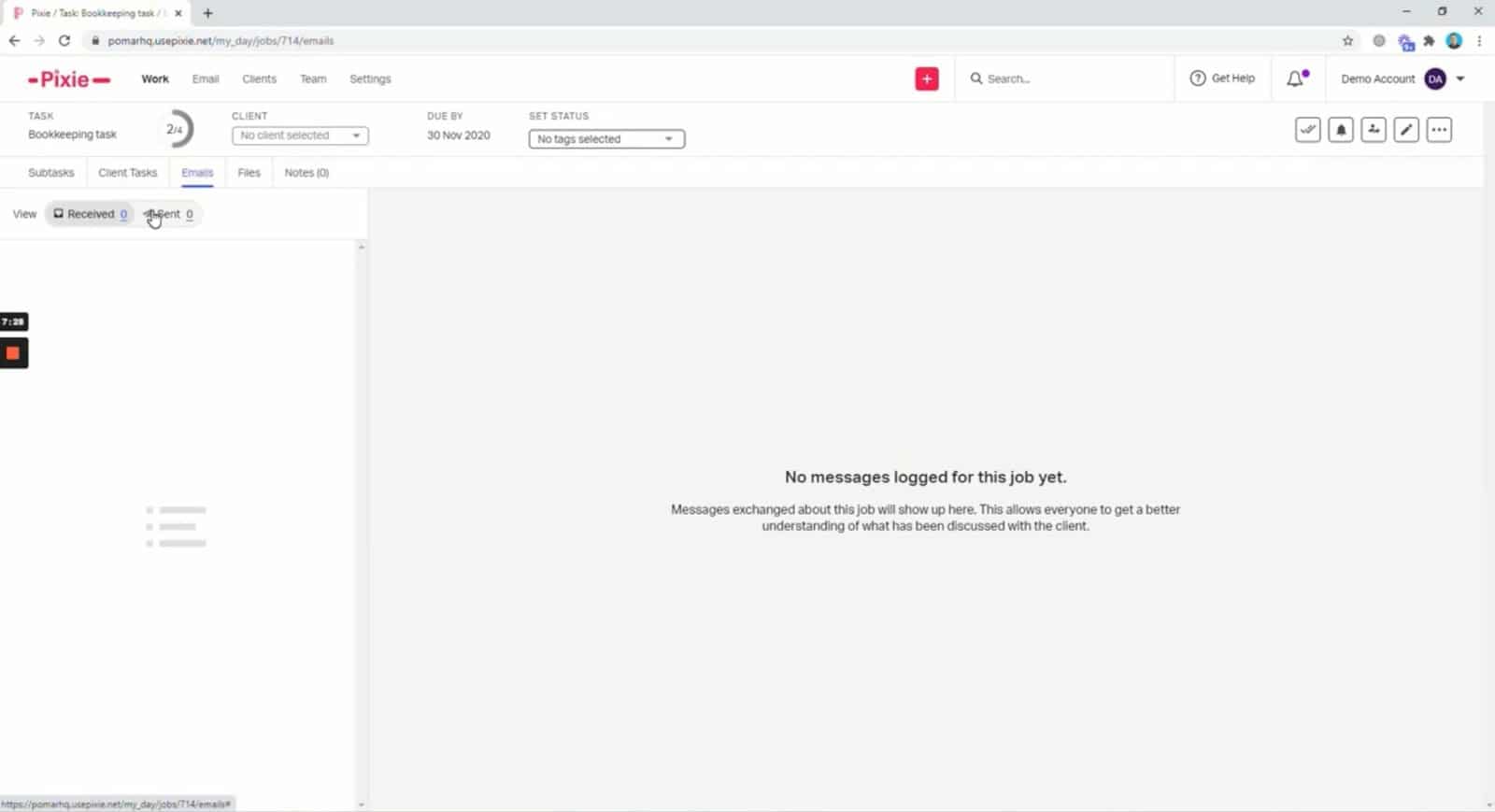

- Integrated Emails to keep conversations between your clients and anyone in your firm in one place. That is so that your team does not struggle with finding what anyone in the firm last said to a client.

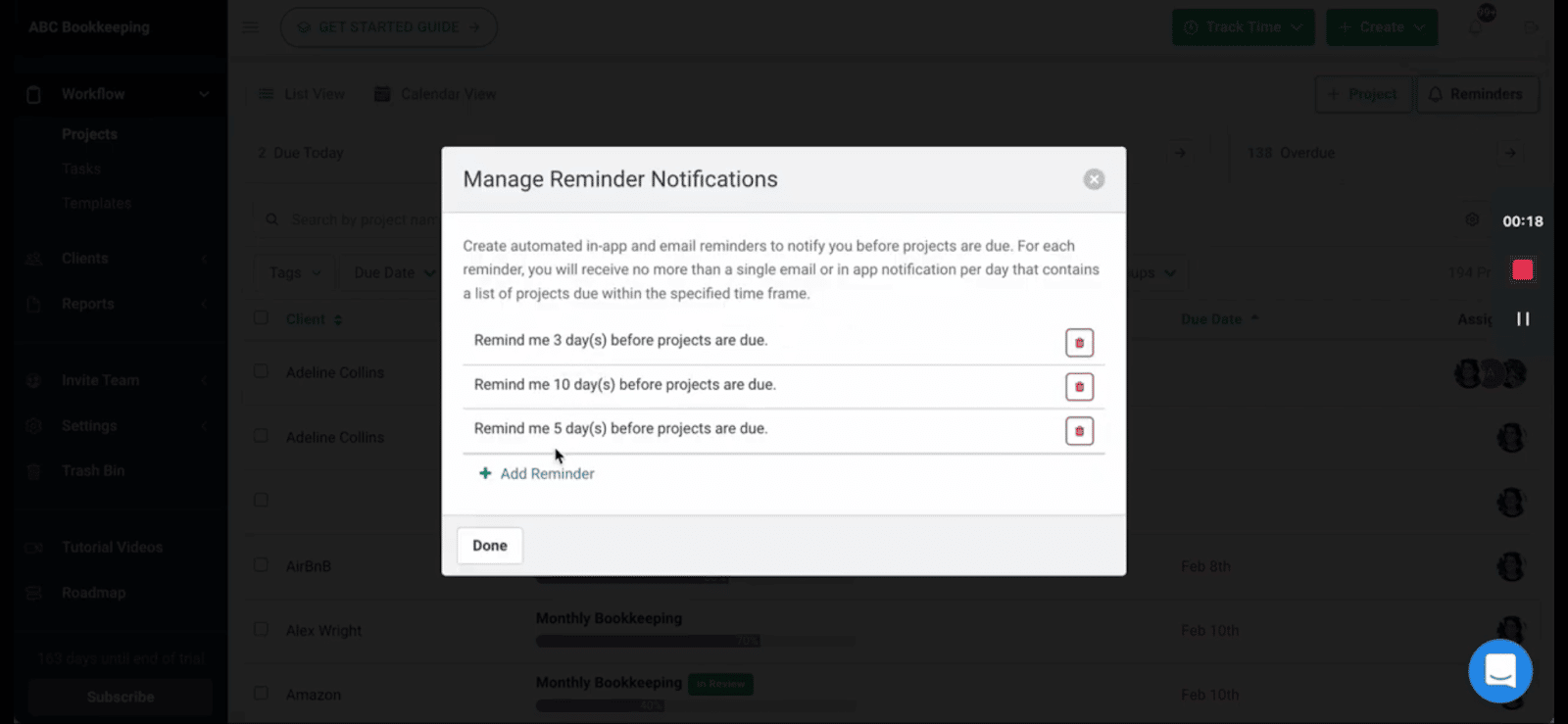

- Due Date Reminders to keep urgent client work at the top of your employees’ minds. Once you set this up, you will receive a reminder on the set date. You can apply this at both the task and project levels.

Everyone on your team will have to set this reminder up for themselves.

- Actual vs. Budgeted Time to measure how long a process lasts versus how much time was budgeted for it to help your resource planning. Apart from helping you to meet client deliverables, it also helps you to review your pricing strategy to stay profitable.

-

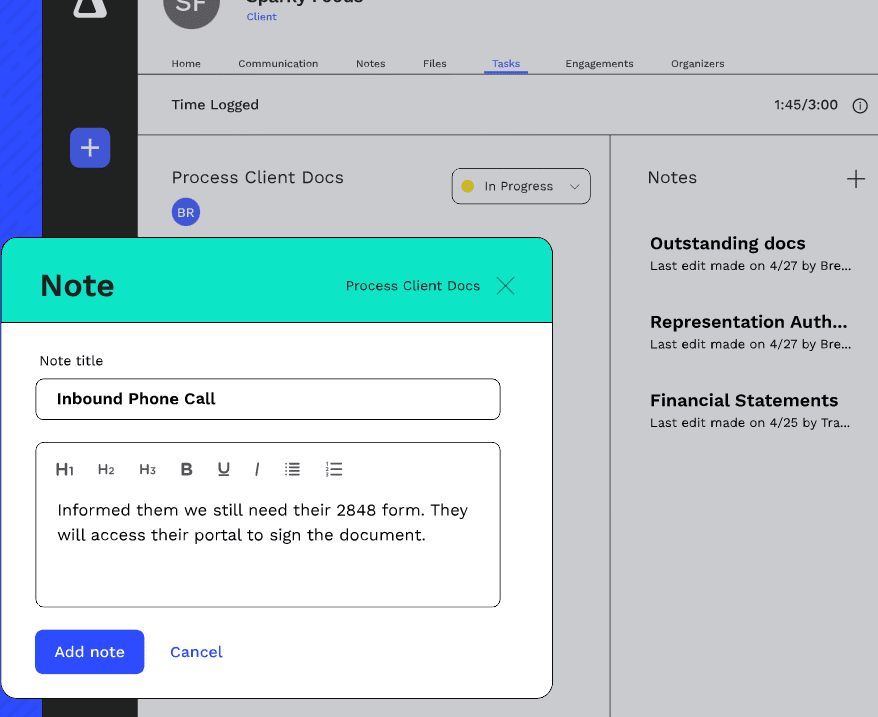

Staff Collaboration

Financial Cents brings your team to collaborate within the client work with:

- Client Notes: This feature allows your staff to add notes to a client’s work profile (to update other team members on any latest information on the work.

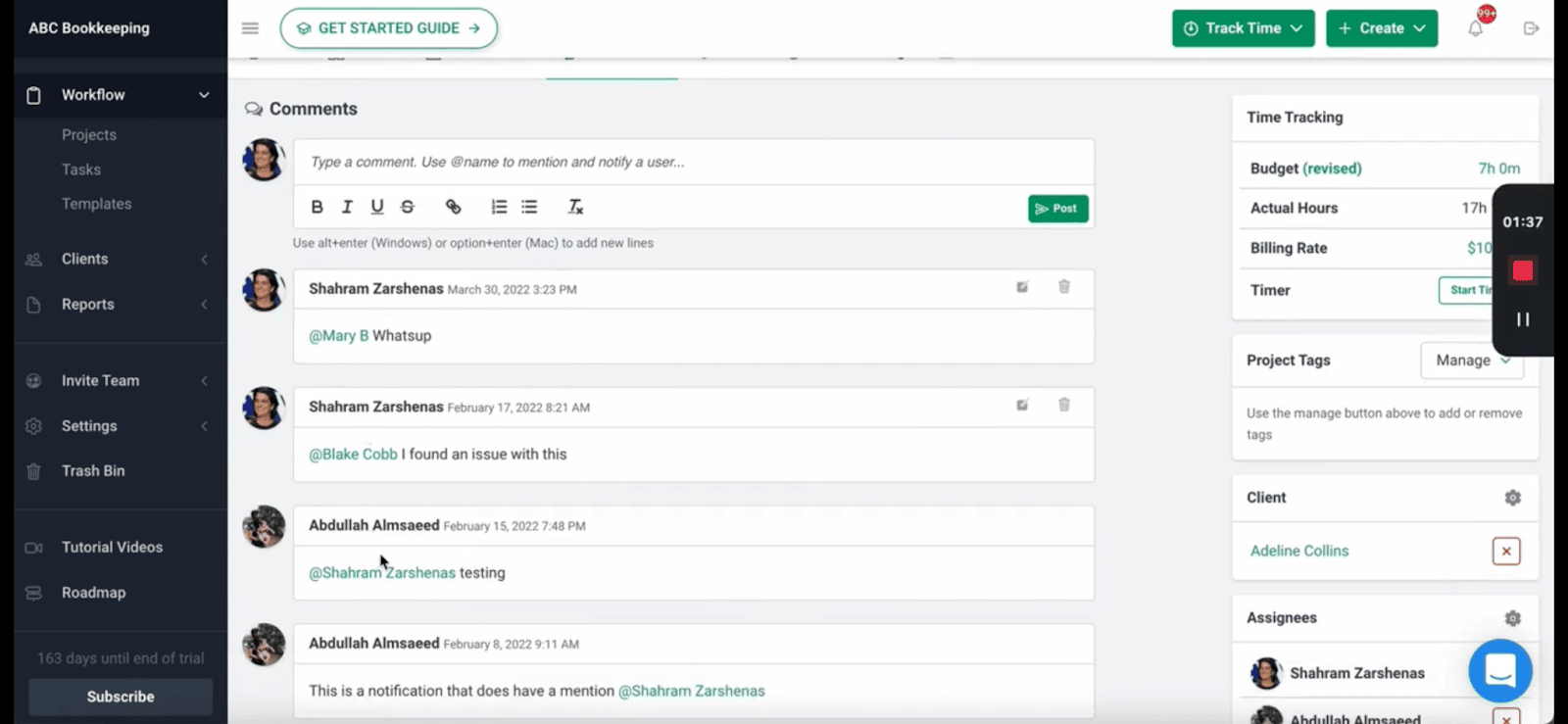

- Mention: your team members can mention one another when adding notes to a client’s work to pull their colleagues into the conversation.

- Comments: your staff can make comments against a task (to share more information or ask for clarity)

- File Sharing: your team can share the files they need between themselves by uploading them to the client’s work.

- Email Integration to pin client emails to relevant work for the assignees.

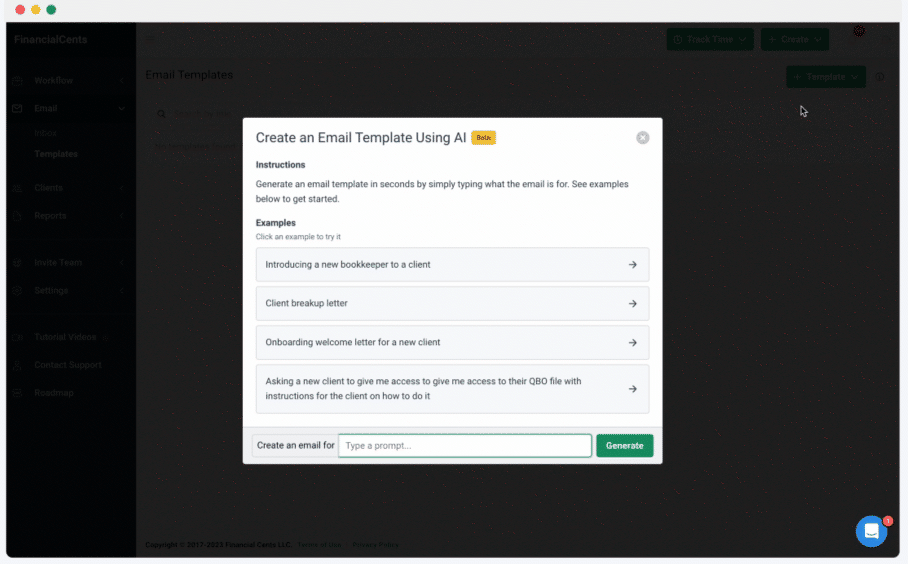

From Financial Cents, you can quickly compose client emails using our artificial intelligence (AI) and ChatGPT. This helps you save time spent on drafting client emails and improve client communication positively. Here’s an illustration of how it works below:

Free Trial and Price

You can start enjoying Financial Cents’ full features today. It is free for 14 days.

After the Free Trial period, you can start enjoying all Financial Cents’ features, including workflow automation, team collaboration, and client management for:

- $39/month per team member (billed yearly).

- $49/month per user (billed monthly).

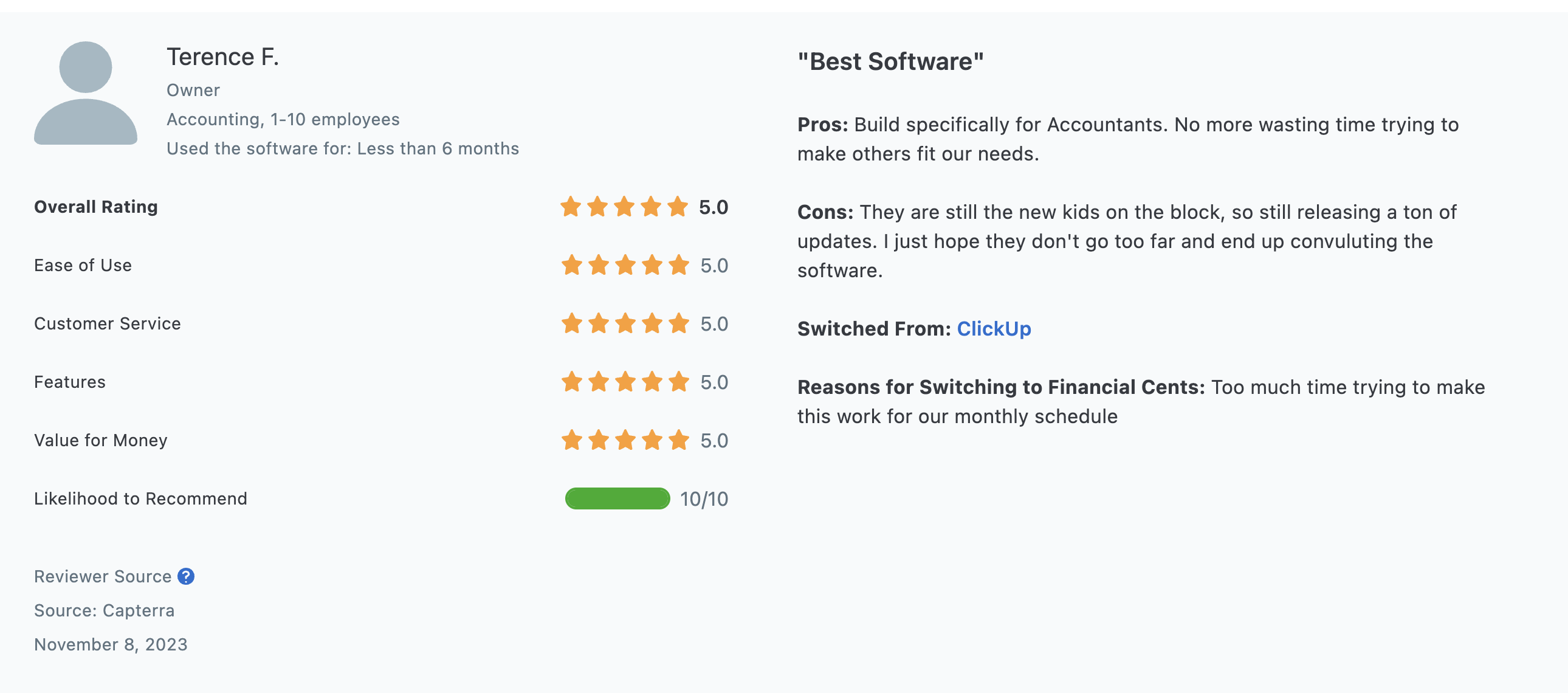

What Financial Cents Customers Say

I LOVE financial cents. I tried several different workflow apps before settling on this one, and ultimately I settled here. What sealed the deal was the integrated email and the ability to automatically sned reminders to clients to send me what I need. This took a huge mental load and saves me so much time, it is definitely worth the month cost. It is extremely easy to use, and getting to set my work load to see what I can take on is amazing. Can't recommend enough."

Theresa P.Some of Financial Cents Features

- Accounting workflow management automation

- Simple and easy to use. Financial Cents is rated 4.9/5.0 for ease of use.

- Collaborate and communicate with team members with inbuilt chats, @mentions

- Automate recurring tasks

- ChatGPT and AI integration

- E-Signature

- Capacity management

- Time tracking and billing

- QuickBooks integration

- Email integration with Gmail and Outlook

- Zapier integration with 5,000+ Apps

- Accounting CRM feature

- Project Management

- SmartVault Integration

- Document Management and integration with other DMS (Google Drive, Dropbox, OneDrive etc)

- Automated client requests and reminders

- Client Portal

- Over 50+ workflow templates

- Facebook community group for users

- Annual Workflow Conference

Cloud-based?

Yes.

Reviews from Clients

See how Alexis Sadler from Accounting Therapy use Financial Cents for their firm’s success.

2. Karbon

Karbon is a practice management tool that gives accounting teams visibility and control over their firms by bringing everything together in one place.

Karbon is designed largely for the needs of large accounting firms, which explains why it can feel overwhelming for small and mid-sized teams with limited resources to fully implement it.

Once you get a hang of it, you can use it to:

-

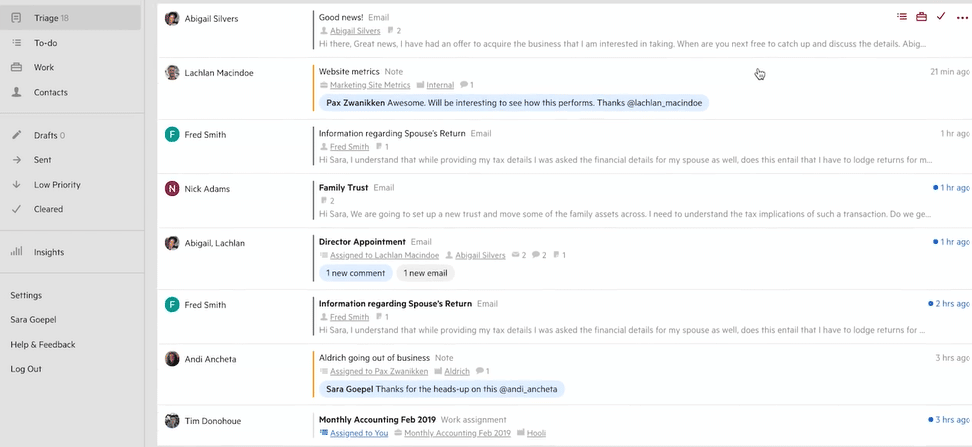

Tracking Work

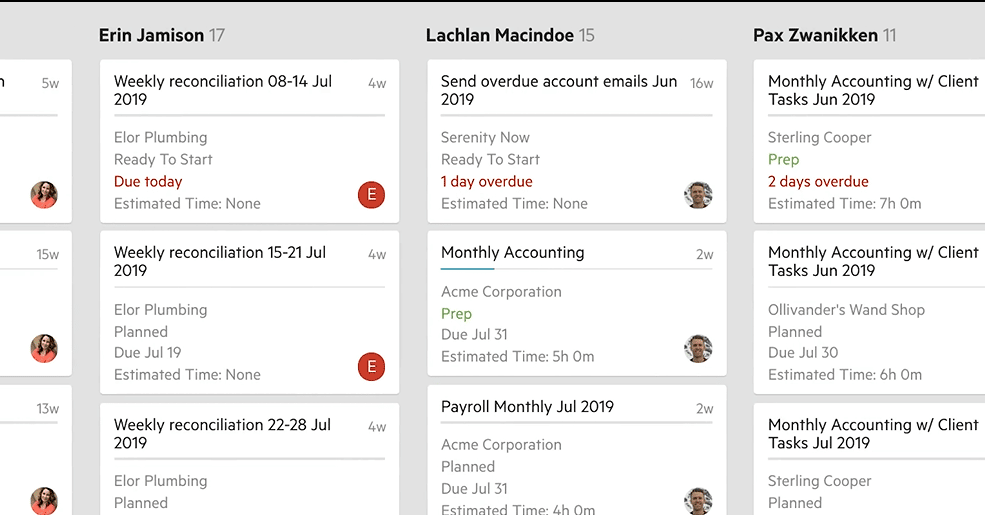

Karbon lets you monitor what goes on in your firm so that you can make sound strategic decisions for your firm. As an enterprise product, Karbon can be overwhelming, so you may need a fair bit of patience to maximize its dashboard features. They have an advanced training program that you can take to understand the dashboard features that include:

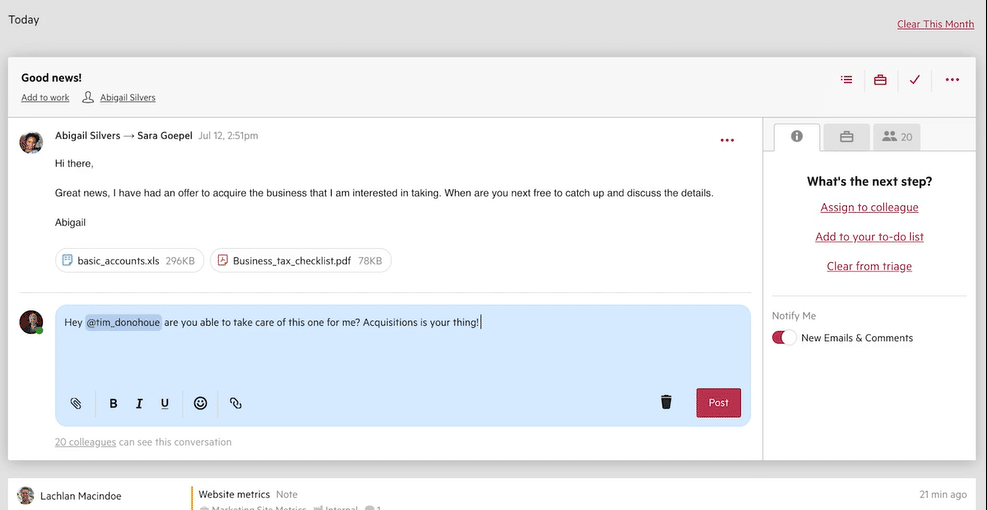

- Your triage view is the first thing you see when you log into Karbon. It is where all your work items, notifications, emails, and notes are stored. You can perform several functions here, including replying to comments, assigning work, or converting client email to a work item.

- A Kanban View that lets you see your work items in cards. Each card on the board represents a piece of work and contains the project’s start and due dates, progress bar, and assignee. You can click each work item to get more details about it.

- Employee Views: each of your employee’s views will be different because Karbon allows them to see only the tasks assigned to them. But being the manager, you can see everything and everyone in the firm.

- Filters allow you to sieve your workflow dashboard to find the specific information you need about client work. It could be by work type, due date, or client.

- Client Group is a feature that lets you pick out sets of clients with similar accounting or bookkeeping needs. You can save views, so you do not have to struggle to find them subsequently.

- Client Emails can be converted to work items before it gets lost somewhere.

-

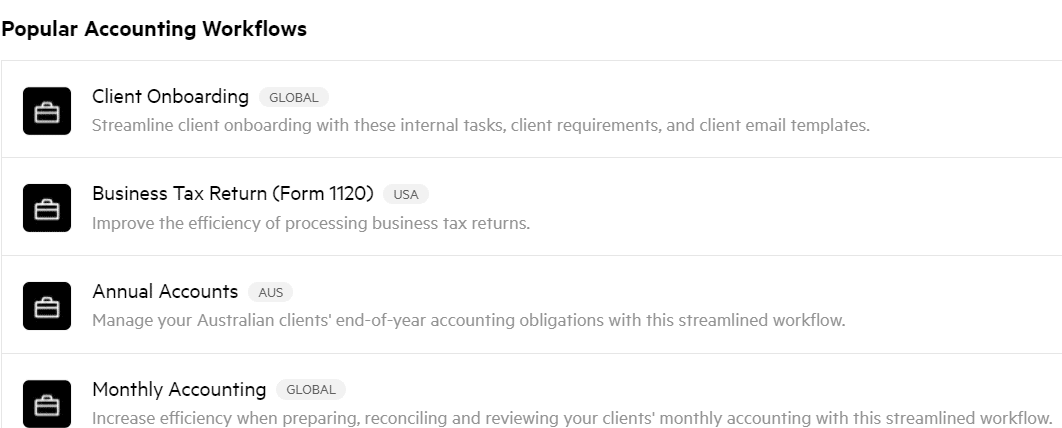

Standardizing Processes

Karbon believes that the less time you spend on administrative work, the better your chances of delivering quality services. So, it empowers you with

- Automate client data collection so your team can focus on other client work while the system auto-reminds the client for you. All your staff has to do here is set it in motion in just a few clicks.

- Once your clients receive the notification, they will know what they need to do, which improves their experience with your firm.

- Templates to standardize your procedures to maintain your work standard. All of which you can download for your accounting or bookkeeping use.

- Meeting Deadlines

Meeting deadlines in Karbon begins with knowing where all projects stand. From there, you can prioritize them according to their urgency.

With that out of the way, you can improve your chances of meeting client deadlines with:

- A dashboard that lets you adjust your team’s workload and reallocate resources to help them deliver on the most urgent work.

- In my Week View, each assignee can see what’s most urgent in their tasks list to complete them on schedule.

- Progress bar to track work items to see and address possible delays.

-

Staff Collaboration

Karbon lets your team collaborate right within the projects to prevent out-of-context communication.

Here are your communication tools in Karbon:

- Karbon Triage is your central communication hub. Everyone receives their notification in their triage dashboard, making it hard for them to miss relevant information.

- Email Integrated to your team, jobs, and clients to give you an automatic audit trail of internal and external communication.

- Notes allow you to share updates for your teammates inside the job.

- Mention your teammates to tag them in your comments, and the system will notify them in their triage view.

- Email Comments to share comments that bring your team up to speed via emails.

- Activity Timeline lets your team see what their colleagues are doing or saying to each other in your firm.

Free Trial and Price

Karbon offers a 7-day free trial period.

After the 7 days, you have three plans to choose from:

- Team at $59/month per user (billed annually) or $75/month per user (billed monthly).

- Business at $79/month, per user (billed annually) or $99/month per user (billed monthly)

- Enterprise that is subject to custom negotiations.

Features

- Client Portal

- Accounting Workflow management automation

- ChatGPT integration in beta stage

- CRM

- Kanban board work view

- Collaboration features

- Email integration

Cloud-based?

Yes.

Reviews from Clients

Read the comparison article: Financial Cents vs Karbon.

(You may be interested in our review of The 5 Best Accounting CRM Software)

3. Jetpack Workflow

Jetpack Workflow is a workflow management tool that lets accounting firms at any stage of growth organize their team and manage clients to prevent missing critical deadlines.

Its workflow management features enable you to:

-

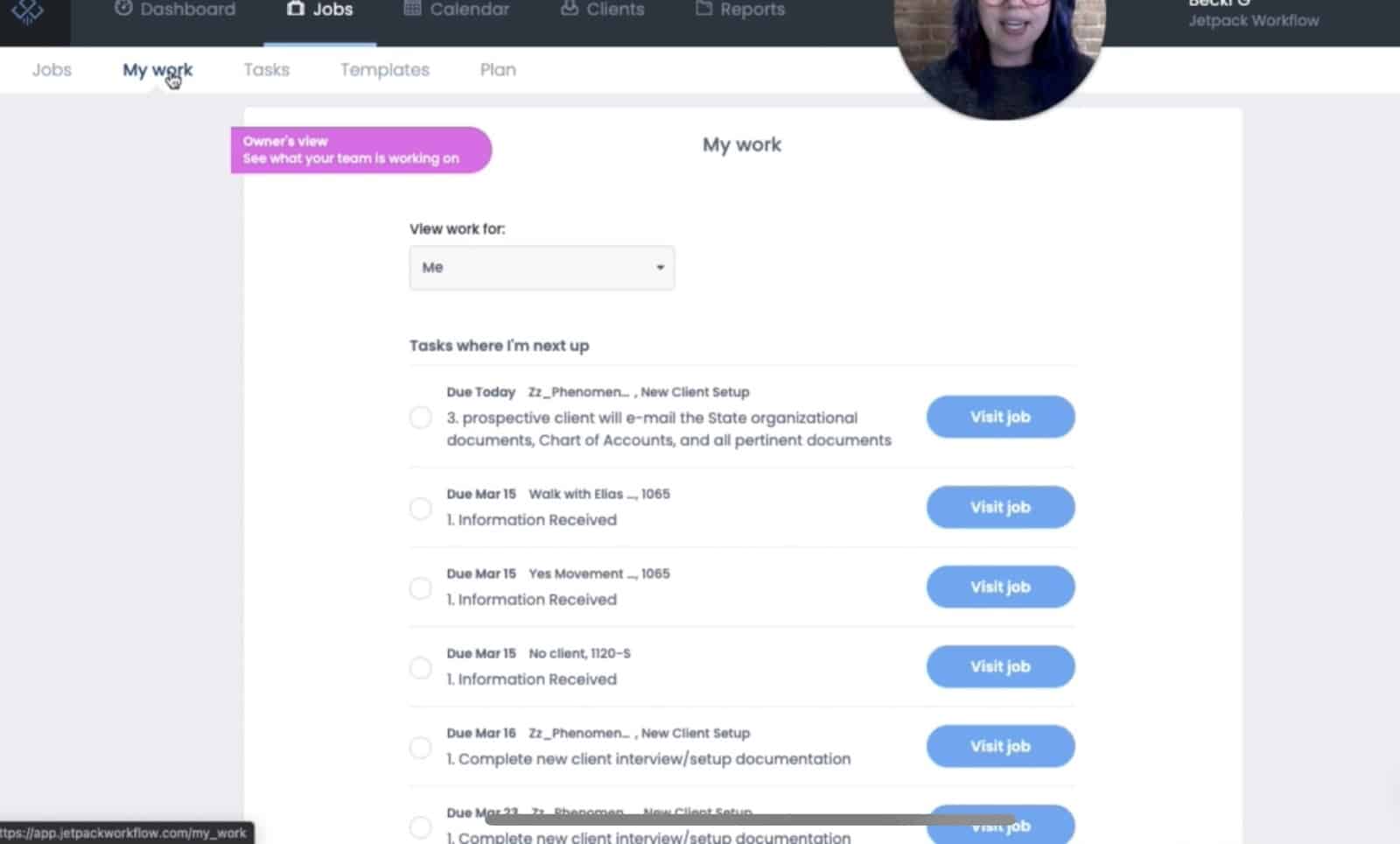

Track Work

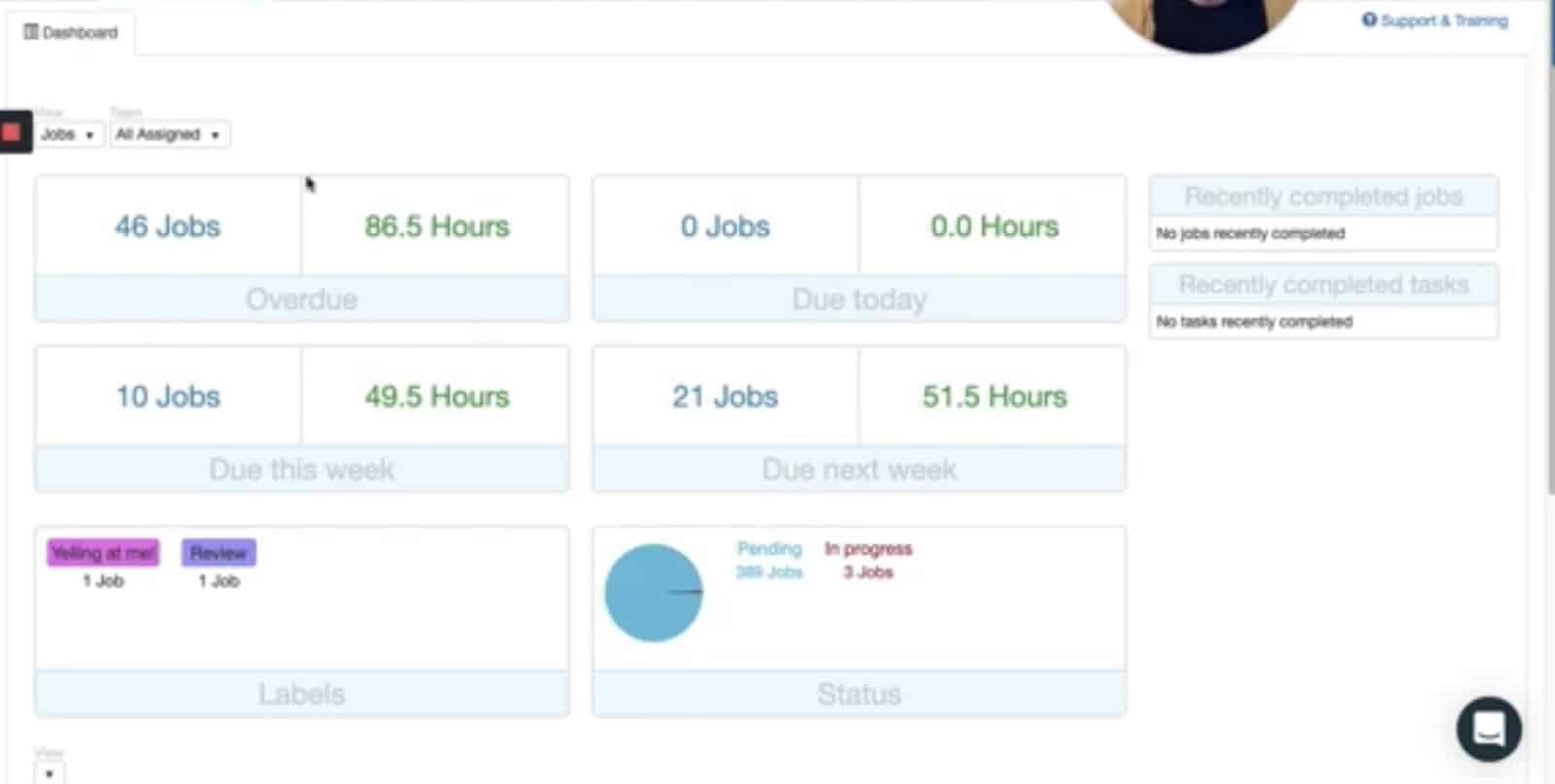

Like Financial Cents, the workflow dashboard is the first thing you see when you log in to Jetpack Workflow. It shows you all of your work in one place. Your projects are grouped into

- Firm Capacity: to see jobs that are due today, due this week, due next week, and overdue.

- Recently completed jobs and tasks to show you everything your firm has recently completed

- Labels and Status to see what’s waiting on, say, client information or payment. You can chose to label your jobs as you see fit. Meanwhile, Status lets you see jobs that are in progress.

- Team Capacity that lets you see how many hours your employees are working.

Together, these four sections help you know what work is getting done versus what is yet to begin to make accurate plans.

The dashboard shows your team members’ workload when you click on “Team” from the dropdown and select their names.

Jetpack Workflow offers three features to find what you’re looking for in your workflow dashboard:

- Filter—picking out the exact information you need. For example, you can filter all unassigned jobs and tasks (with your manager filter) to assign them.

- Sort to arrange jobs by their due dates to meet deadlines.

- Search to search for specific information from within your workflow dashboards.

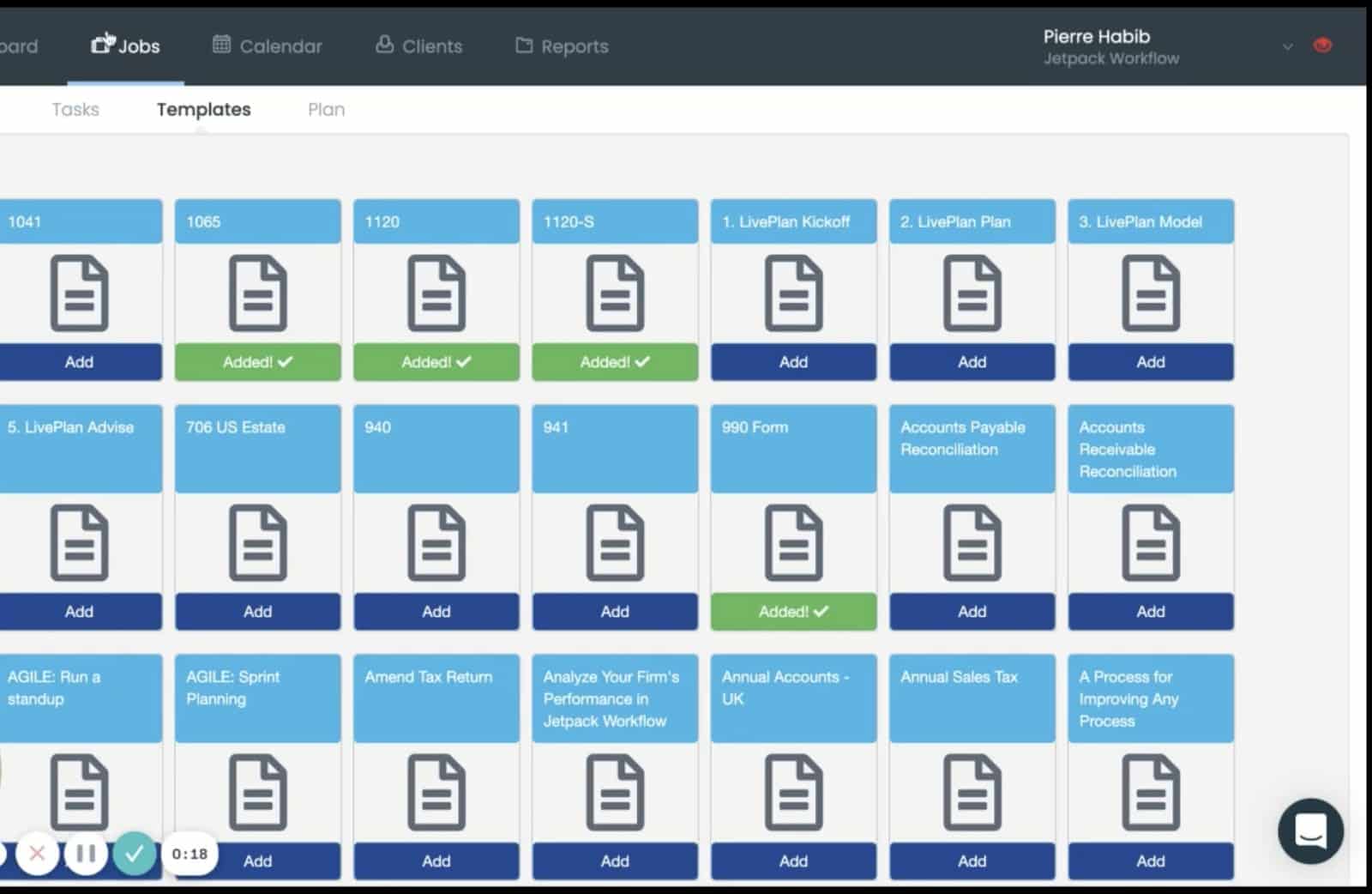

Standardizing Processes

Jetpack Workflows’ template library has over 50 workflow templates to make setting up client work easy.

The best part is that you can apply a template with just one click to save your team the stress (and possible errors) of creating from scratch. Or duplicate it for multiple clients.

Meeting Deadlines

Meeting deadlines in Jetpack gets easier with features like:

- My Work Tab: this allows your staff to start implementing jobs that are due without needing to scroll through jobs to see what you should be doing.

As the manager, you can see what’s in the queue for each of your staff members to hold them accountable or help them meet up with deadlines.

- Ability to Create Jobs from Email: you can quickly create jobs from your email inbox to improve your chances of meeting tight deadlines.

Staff Collaboration

Collaboration in Jetpack usually takes the form of:

- Email to staff: leave a note on the jobs tab and mention your colleague, and Jetpack will generate an automatic email to them.

- Mention: by typing @ in the notes section, you can add a colleague’s name, and Jetpack will notify them of your note.

Free Trial and Price

Jetpack offers a 14-day free trial, after which you’ll need to choose one of these plans:

- Organize at $36/month Per user (billed annually)

- Scale at $39/month Per user (billed annually)

Features:

- Basic accounting workflow management automation

- Templates library

- Task management

- Time tracking and budgets

- QuickBooks Online and Zapier integration

- No inbuilt CRM

- No client portal

- No AI or ChatGPT integration

Cloud-based:

Yes.

Reviews from Clients

Comparison: Financial Cents vs Jetpack Workflow: Which Should You Buy and Why?

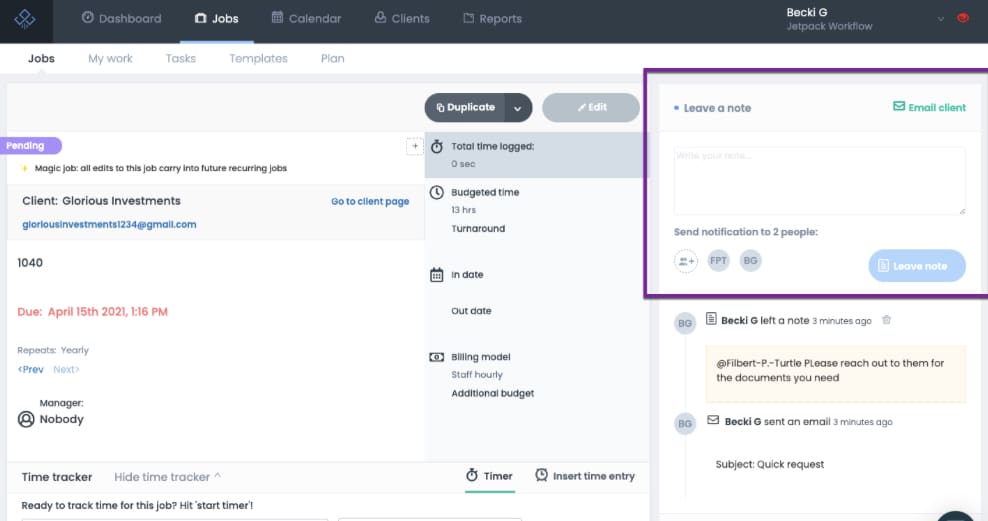

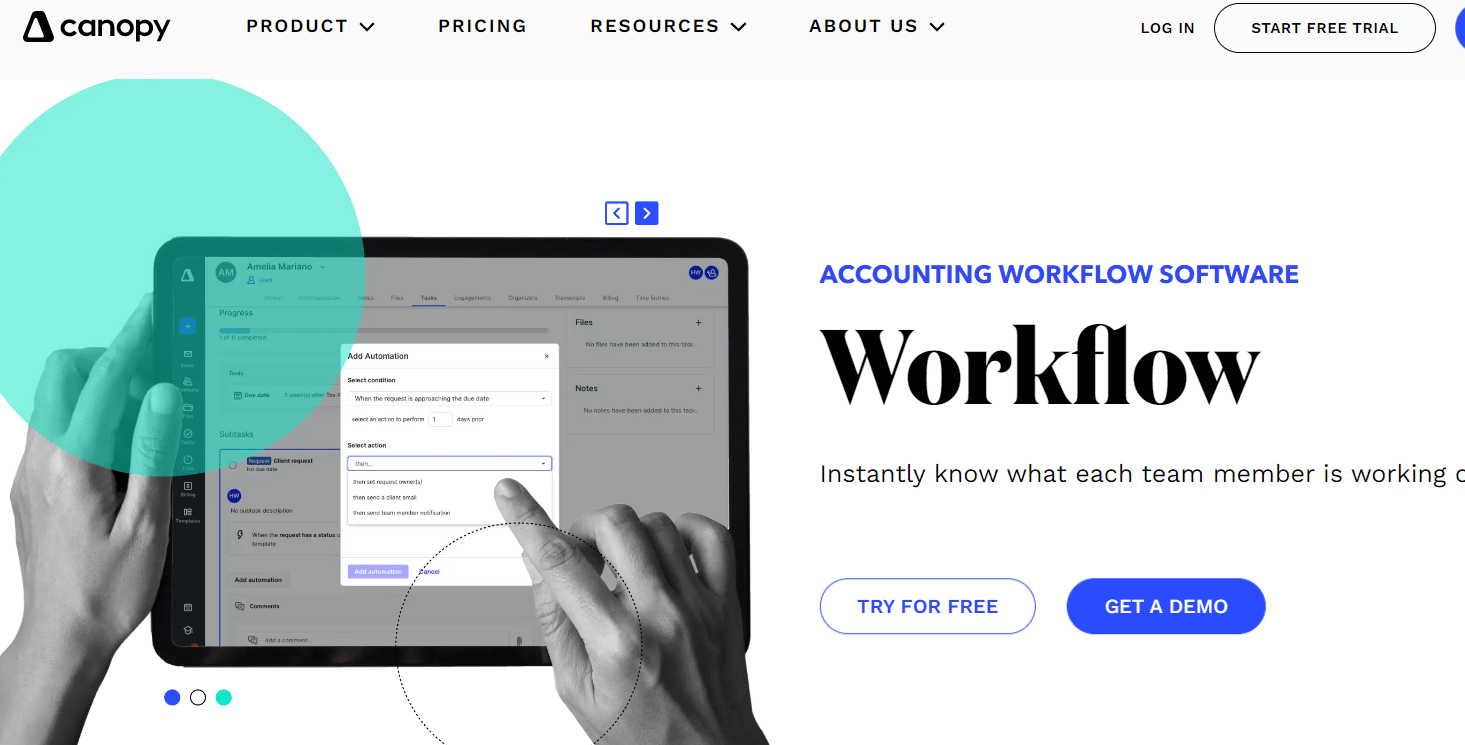

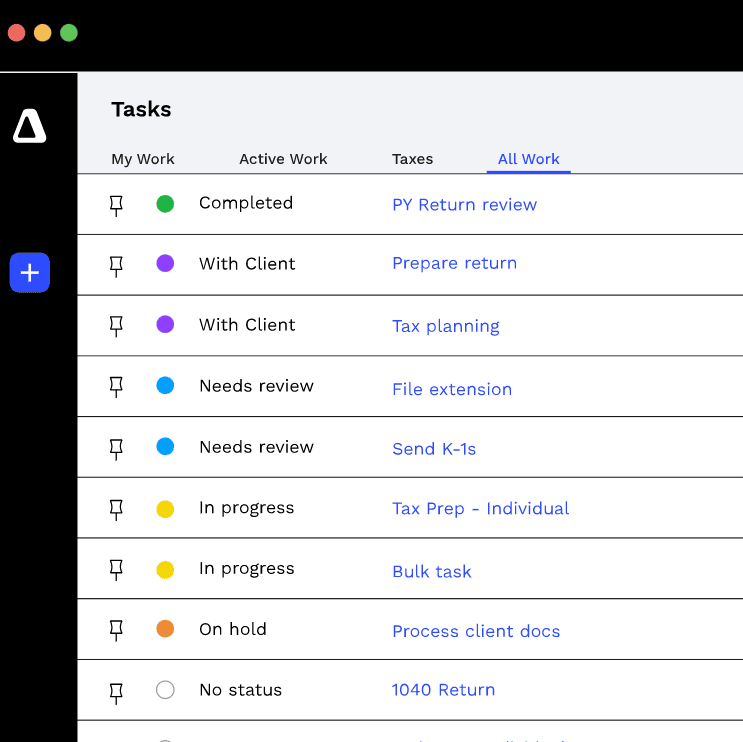

4. Canopy

Canopy is a workflow management software that lets you build your “mission-critical functions” around client management to give your staff and clients positive experiences.

For workflow management, it helps you with:

Work Tracking

Canopy’s dashboard gives you complete visibility over your firm to prevent work-related confusion with task assignments in your firm.

From its Global Preset tab, you can see all project information, including assigned team members, tasks, and the client the work is for. The goal is to give you a firm-wide view of everything so that you can manage your firm with confidence.

You can manipulate the dashboard to suit your specific needs with:

- Client Organizer helps you group clients together according to the services you provide to them.

- Filters: to declutter your screen with the only information you need. You can do this if you want to understand how much of a work type your firm has, how many projects you need to deliver to a client, or how many jobs a team member is doing.

- Saved Filters are your saved dashboard views for easy access to a set of information.

- There are also Custom Task Filters which allow you to combine existing filters to create a unique view of Canopy’s filters are not enough for you. You can also save these for future use.

Standardizing Processes

Standardizing your processes in Canopy means using

- Workflow templates: Canopy workflow templates help you perform tasks faster with templates, making it easier for your team to work more accurately.

Canopy’s templates, you can assign to team members, add due dates and automate it to repeat when the last due date is marked complete.

Meeting Deadlines

Canopy helps you save time by automating tasks to allow you to complete client work faster. But you’ll need to set up a set of conditions to meet to trigger corresponding actions in the workflow.

You can apply this automation to:

- Assignees to notify them of the tasks that have been created for them.

- Task Repeat to automatically recreate a task once it has been completed. You can preset the start and due date, assignees, and client.

- Due Date Reminder to auto-remind relevant teammates when their tasks approach the due date.

- Client Requests: automate the client chase process while your team focuses on work that moves the needle for your firm.

All of these are to keep your team up-to-date and efficient, which helps to focus on meeting client deliverables.

Staff Collaboration

Canopy’s Collaboration features include:

- Notes: Canopy allows you to communicate in context by leaving notes for your staff on the tasks.

- Notifications: Canopy sends anyone in your firm an email or in-app notification when there’s a task or an update for them.

- Task Activity History to help you see all changes made to a task over time.

Free Trial and Price

Canopy offers a 1-day free trial.

After that, you’ll have to pay for each of the features that you want to use.

For example, The Workflow is $30/month per user.

The Document Management feature costs $40/month per user. And so on.

Features

- Staff collaboration

- Accounting workflow management automation

- Document management

- Workflow templates

- Client requests

- ChatGPT beta

Cloud-based:

Yes.

Reviews from Clients

5. Pixie

Pixie is a workflow solution that lets you organize your processes to keep them “running like clockwork.” It is simple, easy to use, and saves you the stress of navigating a long list of tasks every day.

Pixie can help you meet client deliverables at scale.

Work Tracking

Tracking work is possible on Pixie because of its:

- Workflow Dashboard: It lets your team organize everything it needs to complete tasks in one place, so they do not have to jump between apps to access them. You can also add, edit and delete tasks as much as necessary to meet deadlines easily.

- Automatic To-do lists: Pixie’s to-do lists automatically recreates and prioritize to give your team a clearer view of what’s most urgent.

- Assignees Tab that helps you track which staff is scheduled to perform a task to hold them accountable for it.

- Reports show you the progress your team is making on tasks.

- Internal Target Dates: helps your team complete work before the client deadline.

Standardizing Processes

Pixie lets you create systems for your tasks by documenting your processes with checklists, instructions, and walkthrough videos.

- Task Templates: You can turn regular tasks into templates (with just one click) and set them to recur for future work. Pixie’s templates are based on the best practices of accounting firms like yours.

- Companies House Integration update client records automatically to make Pixie your team’s single source of truth–which makes work more accurate.

- Custom Workflows to set tasks to start on a day or date of the month you want.

Meeting Deadline:

Your team is better prepared to meet deadlines with Pixie’s

- Real-Time Updates that give you visibility over the progress of your tasks so you can address any bottleneck and avoid delays.

- Recurrences in Pixie enable you to automate your repeating to-do lists so your team can *focus on completing them.

Client data collection

To keep your team from chasing clients, and instead, create a checklist of tasks while they focus on meeting deadlines. You can also set up automatic email reminders to auto-remind clients on your behalf.

- Automated Emails save you the time for drafting emails from scratch. You can also automate the emails to send automatically.

Staff Collaboration:

To keep everyone on your team on the same page, Pixie offers

- Internal notifications: keep you from chasing your staff for information and updates on client work. It notifies you when an assignee has completed a task or received your messages, and vice-versa.

- Notes: Notes between you and your clients appear in the client’s record, enabling your team to find and work with them whenever they need to.

Free Trial and Price

Pixie charges a flat fee of $69/month for any number of users you have.

Features

- Accounting workflow management automation

- Collaboration features for team members

- Tasks templates

- Automatic email reminders for client tasks

Cloud-based?

Yes.

Reviews from Clients

Generic Workflow Software Accounting Firms can consider

The accounting workflow management tools discussed above are specifically built for the accounting industry (which we recommend). However, if you are considering using a generic workflow software (we do not recommend) in your accounting firm, here’s a list of the best generic workflow software you can consider.

Before you decide, see this review from a user who had used generic software before switching to Financial Cents – a workflow software for accounting firms.

6. Asana

Asana is a project management software that helps teams plan what to do, when, and how to do it.

MANAGING PROJECTS IN ASANA

- Views: Asana views lets teams manipulate their dashboards however they like: The List view helps to break projects into to-do lists and check them off as they complete them. The board view allows them to organize and track their work like sticky notes on the wall. You can also use the Timeline or Calendar view.

- Tasks and subtasks allow teams to break complex projects into more manageable parts.

- Sections allow you to group tasks by work type and stage of completion.

- Milestones help teams visualize project stages to measure progress.

- Dependencies allow teams to manage tasks that require other steps before completing them.

- The reporting feature allows teams to measure tasks and workload to see where they need adjusting.

- Recurrence: set the tasks your team frequently performs to repeat on future dates automatically.

TEAM COLLABORATION IN ASANA

Team collaboration is possible in Asana with:

- Task comments for team members to comment or ask questions directly on tasks to keep everyone on the same page.

- Tags: Team members can ensure teams get notified by tagging them with the mention button.

- Conversations: teams can discuss project progress, updates, and announcements to improve team motivation.

- Share files with your team on Asana by adding them to tasks.

INDUSTRY FIT

Asana is a work management tool for teams across all industries and has no industry-specific advantage for accountants.

Using time tracking to measure your effective hourly rate (or billable time) is not available in Asana unless you use the third-party integration system it provides.

Asana’s workflow templates will require time and technical efforts to customize them for accounting projects.

STAYING PRODUCTIVE WITH ASANA

Asana helps teams manage their projects by breaking them into sequences and stages. This keeps tasks streamlined and allows teams to focus on delivering quality work.

Asana’s board view allows team leaders to spot duplicate tasks and save hours of duplicating team members’ efforts.

Asana’s Milestone feature allows teams to measure where work lags and reallocate resources to meet the target.

Client Reviews

Read the comparison article: Financial Cents vs Asana which is better for accounting firms?.

7. ClickUp

ClickUp project management software is a generic workflow software that allows teams work and collaborate on projects from on a central platform.

WORK TRACKING

- Dashboard: With ClickUp dashboard you get a high-level view of all your firm’s work so you can create, manage work and ensure your team is accountable. ClickUp’s dashboard provides firm owners with the ability gain visibility into their accounting firm by by viewing the workload by assignees to measure team performance, and redistribute resources where necessary. You can also distribute work and manage task assignments.

- Task and Subtasks: This features enables teams to break projects into parts.

- The assignment allows team leads to assign tasks and add custom fields to make the necessary information available.

- Multiple Lists: Add tasks that span multiple projects and need a cross-functional team to implement to the Multiple Lists tab to reflect any change made to it from any location.

- Priorities allow your team members to know what is urgent and what can’t wait to enable your team complete the project in their order of urgency.

- Dependencies: You can set an order of performance for your firm’s tasks to ensure all conditions necessary for performing a task are met before starting the subsequent ones.

TEAM COLLABORATION

- ClickUp’s Chat view lets you communicate and share updates with your team.

- Sharing notes: you can add notes to project cards so that your team is up-to-date on projects.

- Tags: The tag feature allows you to mention them so they will receive a notification in their dashboard.

- ClickUp Docs: enables writing teams to work with documents like Google Docs. Write and edit with your preferred font size and styles and invite your team to work with you on projects.

INDUSTRY FIT

For one, ClickUp does not integrate with QuickBooks Online the way you expect of your accounting work management software.

You can only use QBO with ClickUp if you integrate it through Zapier. ClickUp cannot possibly serve everyone at the same level, so accountants should expect to forfeit some features if they go for generic software over niched ones.

For example, Take Financial Cents is focused on the accounting industry, making its features cover only what accountants and bookkeepers need.

STAYING PRODUCTIVE WITH CLICKUP

ClickUp makes teams more productive by letting them:

- Create schedules and track time against projects to prevent wasting time on projects.

- Create and assign subtasks (nested items) to team members to aid work delegation and the ability to hit deadlines.

Reviews from clients

8. MONDAY.COM

Monday.com is a work operating system that helps teams manage projects and collaborate.

MANAGING PROJECTS

- Views: monday.com gives teams several ways to view projects to reduce the time it takes to understand where each project stands. The views include Kanban boards, Gantt charts, calendars, and timelines.

- Workdocs allow team members to turn ideas into tasks on Monday.com boards. Like Google Docs, multiple team members can edit, share comments and move projects forward in the workdoc.

- Task List helps your team break complex ideas down into smaller parts.

TEAM COLLABORATION IN MONDAY.COM

- Monday.com’s workdoc helps remote teams collaborate by creating shared documents to write, edit, and brainstorm ideas.

- Live Comments help teams ask questions to help project clarity and alignment.

- Tag team members to draw their attention to updates or comments on their work.

- Forms allow you to create and share work requests with your team or clients.

INDUSTRY FIT

Monday.com is suited for small, large, and enterprise corporations in any industry. That explains why it does not integrate with tax software.

For example, you cannot find QuickBooks Online in Monday.com’s integration center. You have to create an account with Zapier to access QBO on Monday.com.

STAYING PRODUCTIVE WITH MONDAY.COM

- Monday.com has an automation and notification builder that helps teams automate manual processes and cut hours of repetitive work each week.

- Its dashboards help to simplify the view to understand where projects stand and ease decision-making.

Client Reviews

9. TRELLO

Trello is a visual project management software that allows teams to plan projects and track results.

MANAGING PROJECTS

- Views: views allow teams to see project data across teams and departments. There are four views: The Timeline view draws parallels between tasks. The Table view organizes projects in rows and columns. The Dashboard view makes spotting causes of delay and seeing insights easy. And the Calendar view to see upcoming deadlines easily and plan accordingly.

- Cards: cards are tasks and contain everything you need to complete a project in Trello. Add cards to your Trello boards and move them (from To-do to Doing and Done) around until your team completes the project.

- Checklists are within each project card.

- Members are teammates. Add them to project cards to assign them tasks and freely view their cards to see their capacity.

- Due Dates: you can add due dates to your projects and add reminders to keep all members accountable until the project is complete.

- Status Bar: the status bar helps you measure how far projects have gone at a glance.

- Custom fields: this allows you to add new field types and data to your boards to suit your firm’s specific needs.

TEAM COLLABORATION IN TRELLO

Adding members to Trello boards gives them access to everything that goes on on that board. They will receive notifications for:

- All comments by other members.

- Changes in project due dates and all.

- Members can share files on the board for others to use in projects.

INDUSTRY FIT

Unlike Financial Cents which focuses on the accounting industry, Trello’s features are more helpful for other industries—like marketing, engineers, and sales teams.

Using QBO with Trello requires integrating QBO through Zappier.

STAYING PRODUCTIVE WITH TRELLO

Trello’s views make knowing what to work on easy. By seeing everything on the dashboard, you know what is pending, who is working on what, and how the team can rally around completing it if there’s a delay.

Trello Butler gives you the automation power to create any command or set rules for your workflows to free you up to focus on growing your practice.

Client Reviews

Start Tackling Your Firm’s Accounting Workflow Issues Today

You can’t do meaningful accounting work for clients unless you can establish processes to manage work, client communication, and collaboration among your team.

The more of these features (we have discussed above) an accounting workflow management tool gives you, the better your ability to put manual tasks on autopilot, which helps you concentrate on making the most of the time-sensitive decisions that will help you keep impeccable books for clients and meet compliance requirements at scale.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

How to Move from Spreadsheets to a Workflow Management Software

Congratulations on your courage to switch from spreadsheets to a workflow management software. Managing your firm is about to be many times…

Oct 06, 2022 | 10 Mins read

Tax Preparation Workflow: A Comprehensive Automation Guide

Struggling with managing an increased workload during tax season? You need an efficient workflow. Here’s all you need to know about implementing…

Jan 08, 2024